Reports

Reports

Analysts’ Viewpoint

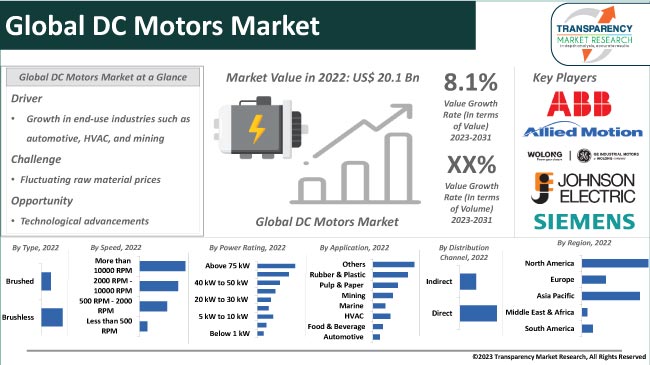

Growth in end-use industries, such as automotive, HVAC, and mining, and rise in governmental support to use energy-efficient motors are fueling the DC motors market demand. Moreover, increase in adoption of mechanization and automation across several industries is contributing to the market dynamics. Surge in demand for consumer appliances and industrial machinery is driving the DC motors market progress.

Leading manufacturers of DC motors are focusing on introduction of different types of motors in order to stay ahead of the competition. Technological advancements help manufacturers to develop energy-efficient products such as electric forklift DC motors, DC series motors, electromagnetic motors, and high torque DC motors. Increase in R&D capabilities of companies is creating growth opportunities for market participants. However, fluctuating raw material prices and increase in technical issues are expected to hamper the DC motors market value in the near future.

A DC (direct current) motor is a type of electric machine that converts electrical energy into mechanical energy. Brushed and brushless are the common DC motor types. These motors can vary in size and power based on their usage. Small DC motors are utilized in numerous domestic appliances. Applications of DC motors are rising across the globe due to expansion of end-use industries.

Key players operating in the global DC motors business are working on revolutionizing the DC motor to solve the sustainability challenge. For instance, MAXON, a leading DC motor manufacturing company, developed RE motors. These energy-efficient DC motors are equipped with powerful permanent magnets. A coreless motor is present at the center of RE motors.

Industrialization across the globe has accelerated the growth of various sectors such as HVAC, automobile, packaging, and mining. DC motors are used in various end-use industries such as oil & gas, pulp & paper, rubber & plastic, and industrial automation. These end-use industries are witnessing exponential growth, which is a prominent factor contributing to the market growth.

Demand for heating, ventilation, and air conditioning is increasing as a result of growing urbanization and rise in personal income of consumers in emerging economies. According to International Energy Agency (IEA), around two-thirds of the world’s households could have an air conditioner by 2050. China, India, and Indonesia would account for half the total.

Rise in demand for electric vehicles and high fuel prices are also augmenting the demand for DC motors in the automotive sector. Increase in efforts to reduce carbon emissions across the globe is also accelerating the sale of DC motors for vehicles.

Furthermore, the mining sector relies heavily on industrial DC motors, such as electric forklift DC motors, due to their benefits such as lower noise levels, enhanced safety, improved performance, and efficiency. DC motors are also being increasingly employed for underground coal mining activities. Therefore, growth in end-use industries is fueling the adoption of DC motors on a global scale.

Regional and local governments are adopting measures to use energy-saving equipment to reduce electricity wastage. Increase in awareness about the benefits of energy-efficient DC motors is contributing to the market growth.

Energy consumption is expected to increase significantly by 2030, potentially impacting the environment. Countries in the European Union, the U.S., and China are implementing regulatory plans to use advanced rather than outdated propulsion technology in order to improve energy-efficiency requirements.

Energy-efficient motors are incorporated with design improvements specifically to increase operating efficiency over motors of standard design. One such motor is the brushless DC motor. Several government bodies are supporting the use of technologically advanced brushless DC motors that incorporate both DC and AC motor features. They are operated through a permanent magnet rotor and an electronic controller to switch the current in the motor's windings. These motors don't have brushes. They use electronic switching to control the current, which significantly eliminates energy loss.

DC motors are widely used in various sectors where mechanical energy is needed. Therefore, rise in demand for energy-efficient DC motors is likely to fuel market statistics during the forecast period.

According to DC motors market analysis, Asia Pacific is projected to dominate the global industry during the forecast period. It held major share of the global market in 2022 due to rapid urbanization, growth in end-use industries, and increase in national and local policies and programs to incorporate energy-saving DC machines.

DC motors industry growth in Asia Pacific is attributable to the presence of several major manufacturers in the region. These manufacturers are implementing innovative marketing strategies as per the changing government policies for DC motors. DC motor manufacturers in Asia Pacific employing newest technologies to gain revenue benefits.

The DC motors market size in North America is anticipated to grow at a considerable pace in the near future, owing to the rise in application of these motors in the automotive industry. DC electric motors are widely used in the industrial automation sector in the region.

The global landscape is fragmented, with the presence of a few players controlling majority of the DC motors market share. According to the latest DC motors market research report analysis, prominent companies are spending a significant amount on comprehensive R&D to manufacture innovative products. Expansion of product portfolios and mergers & acquisitions are the main strategies adopted by key players.

ABB Group, Allied Motion Technologies Inc., General Electric, Hyundai Electric & Energy Systems Co. Ltd., Johnson Electric, Nidec Corporation, Regal Beloit Corporation, Robert Bosch GmbH, Siemens AG, and Toshiba Corporation are the key DC motors market leaders operating worldwide. These players are engaged in following the market trends to avail lucrative revenue opportunities.

Key players have been profiled in the DC motors market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 20.1 Bn |

|

Market Forecast Value in 2031 |

US$ 49.3 Bn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 20.1 Bn in 2022

It is projected to advance at a CAGR of 8.1% from 2023 to 2031

Growth in end-use industries such as automotive, HVAC, and mining and rise in government support to use energy-efficient motors

The brushless type segment accounted for significant share in 2022

Demand for DC motors is likely to be high in Asia Pacific during the forecast period

ABB Group, Allied Motion Technologies Inc., General Electric, Hyundai Electric & Energy Systems Co. Ltd., Johnson Electric, Nidec Corporation, Regal Beloit Corporation, Robert Bosch GmbH, Siemens AG, and Toshiba Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Regional Snapshot

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technological Overview Analysis

5.9. Regulatory Framework

5.10. Global DC Motors Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Bn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global DC Motors Market Analysis and Forecast, by Type

6.1. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

6.1.1. Brushless

6.1.2. Brushed

6.2. Incremental Opportunity, by Type

7. Global DC Motors Market Analysis and Forecast, by Speed

7.1. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Speed, 2017 - 2031

7.1.1. Less than 500 RPM

7.1.2. 500 RPM - 2000 RPM

7.1.3. 2000 RPM - 10000 RPM

7.1.4. More than 10000 RPM

7.2. Incremental Opportunity, by Speed

8. Global DC Motors Market Analysis and Forecast, by Power Rating

8.1. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Power Rating, 2017 - 2031

8.1.1. Below 1 kW

8.1.2. 1 kW to 5 kW

8.1.3. 5 kW to 10 kW

8.1.4. 10 kW to 20kW

8.1.5. 20 kW to 30 kW

8.1.6. 30 kW to 40 kW

8.1.7. 40 kW to 50 kW

8.1.8. 50 kW to 75 kW

8.1.9. Above 75 kW

8.2. Incremental Opportunity, by Power Rating

9. Global DC Motors Market Analysis and Forecast, by Application

9.1. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Application, 2017 - 2031

9.1.1. Automotive

9.1.2. Food & Beverage

9.1.3. HVAC

9.1.4. Marine

9.1.5. Mining

9.1.6. Pulp & Paper

9.1.7. Rubber & Plastic

9.1.8. Others

9.2. Incremental Opportunity, by Application

10. Global DC Motors Market Analysis and Forecast, by Distribution Channel

10.1. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

10.1.1. Direct

10.1.2. Indirect

10.2. Incremental Opportunity, by Distribution Channel

11. Global DC Motors Market Analysis and Forecast, by Region

11.1. DC Motors Market (US$ Bn and Thousand Units), Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America DC Motors Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side

12.3.2. Supply Side

12.4. Key Supplier Analysis

12.5. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

12.5.1. Brushless

12.5.2. Brushed

12.6. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Speed, 2017 - 2031

12.6.1. Less than 500 RPM

12.6.2. 500 RPM - 2000 RPM

12.6.3. 2000 RPM - 10000 RPM

12.6.4. More than 10000 RPM

12.7. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Power Rating, 2017 - 2031

12.7.1. Below 1 kW

12.7.2. 1 kW to 5 kW

12.7.3. 5 kW to 10 kW

12.7.4. 10 kW to 20kW

12.7.5. 20 kW to 30 kW

12.7.6. 30 kW to 40 kW

12.7.7. 40 kW to 50 kW

12.7.8. 50 kW to 75 kW

12.7.9. Above 75 kW

12.8. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Application, 2017 - 2031

12.8.1. Automotive

12.8.2. Food & Beverage

12.8.3. HVAC

12.8.4. Marine

12.8.5. Mining

12.8.6. Pulp & Paper

12.8.7. Rubber & Plastic

12.8.8. Others

12.9. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

12.9.1. Direct

12.9.2. Indirect

12.10. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe DC Motors Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Key Supplier Analysis

13.5. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

13.5.1. Brushless

13.5.2. Brushed

13.6. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Speed, 2017 - 2031

13.6.1. Less than 500 RPM

13.6.2. 500 RPM - 2000 RPM

13.6.3. 2000 RPM - 10000 RPM

13.6.4. More than 10000 RPM

13.7. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Power Rating, 2017 - 2031

13.7.1. Below 1 kW

13.7.2. 1 kW to 5 kW

13.7.3. 5 kW to 10 kW

13.7.4. 10 kW to 20kW

13.7.5. 20 kW to 30 kW

13.7.6. 30 kW to 40 kW

13.7.7. 40 kW to 50 kW

13.7.8. 50 kW to 75 kW

13.7.9. Above 75 kW

13.8. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Application, 2017 - 2031

13.8.1. Automotive

13.8.2. Food & Beverage

13.8.3. HVAC

13.8.4. Marine

13.8.5. Mining

13.8.6. Pulp & Paper

13.8.7. Rubber & Plastic

13.8.8. Others

13.9. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.9.1. Direct

13.9.2. Indirect

13.10. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

13.10.1. U.K

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific DC Motors Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trends Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Key Supplier Analysis

14.5. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

14.5.1. Brushless

14.5.2. Brushed

14.6. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Speed, 2017 - 2031

14.6.1. Less than 500 RPM

14.6.2. 500 RPM - 2000 RPM

14.6.3. 2000 RPM - 10000 RPM

14.6.4. More than 10000 RPM

14.7. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Power Rating, 2017 - 2031

14.7.1. Below 1 kW

14.7.2. 1 kW to 5 kW

14.7.3. 5 kW to 10 kW

14.7.4. 10 kW to 20kW

14.7.5. 20 kW to 30 kW

14.7.6. 30 kW to 40 kW

14.7.7. 40 kW to 50 kW

14.7.8. 50 kW to 75 kW

14.7.9. Above 75 kW

14.8. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Application, 2017 - 2031

14.8.1. Automotive

14.8.2. Food & Beverage

14.8.3. HVAC

14.8.4. Marine

14.8.5. Mining

14.8.6. Pulp & Paper

14.8.7. Rubber & Plastic

14.8.8. Others

14.9. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.9.1. Direct

14.9.2. Indirect

14.10. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa DC Motors Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Trends Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Key Supplier Analysis

15.5. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

15.5.1. Brushless

15.5.2. Brushed

15.6. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Speed, 2017 - 2031

15.6.1. Less than 500 RPM

15.6.2. 500 RPM - 2000 RPM

15.6.3. 2000 RPM - 10000 RPM

15.6.4. More than 10000 RPM

15.7. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Power Rating, 2017 - 2031

15.7.1. Below 1 kW

15.7.2. 1 kW to 5 kW

15.7.3. 5 kW to 10 kW

15.7.4. 10 kW to 20kW

15.7.5. 20 kW to 30 kW

15.7.6. 30 kW to 40 kW

15.7.7. 40 kW to 50 kW

15.7.8. 50 kW to 75 kW

15.7.9. Above 75 kW

15.8. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Application, 2017 - 2031

15.8.1. Automotive

15.8.2. Food & Beverage

15.8.3. HVAC

15.8.4. Marine

15.8.5. Mining

15.8.6. Pulp & Paper

15.8.7. Rubber & Plastic

15.8.8. Others

15.9. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

15.9.1. Direct

15.9.2. Indirect

15.10. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America DC Motors Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Key Trends Analysis

16.3.1. Demand Side

16.3.2. Supply Side

16.4. Key Supplier Analysis

16.5. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

16.5.1. Brushless

16.5.2. Brushed

16.6. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Speed, 2017 - 2031

16.6.1. Less than 500 RPM

16.6.2. 500 RPM - 2000 RPM

16.6.3. 2000 RPM - 10000 RPM

16.6.4. More than 10000 RPM

16.7. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Power Rating, 2017 - 2031

16.7.1. Below 1 kW

16.7.2. 1 kW to 5 kW

16.7.3. 5 kW to 10 kW

16.7.4. 10 kW to 20kW

16.7.5. 20 kW to 30 kW

16.7.6. 30 kW to 40 kW

16.7.7. 40 kW to 50 kW

16.7.8. 50 kW to 75 kW

16.7.9. Above 75 kW

16.8. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Application, 2017 - 2031

16.8.1. Automotive

16.8.2. Food & Beverage

16.8.3. HVAC

16.8.4. Marine

16.8.5. Mining

16.8.6. Pulp & Paper

16.8.7. Rubber & Plastic

16.8.8. Others

16.9. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

16.9.1. Direct

16.9.2. Indirect

16.10. DC Motors Market (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Revenue Share Analysis (%), By Company, (2022)

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. ABB Group

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. Allied Motion Technologies Inc.

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. General Electric

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Hyundai Electric & Energy Systems Co. Ltd.

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. Johnson Electric

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Nidec Corporation

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Regal Beloit Corporation

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Robert Bosch GmbH

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Siemens AG

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. Toshiba Corporation

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

17.3.11. Others

17.3.11.1. Company Overview

17.3.11.2. Sales Area/Geographical Presence

17.3.11.3. Revenue

17.3.11.4. Strategy & Business Overview

18. Go to Market Strategy

18.1. Identification of Potential Market Spaces

18.1.1. Type

18.1.2. Speed

18.1.3. Power Rating

18.1.4. Application

18.1.5. Distribution Channel

18.1.6. Region

18.2. Prevailing Market Risks

List of Tables

Table 1: Global DC Motors Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global DC Motors Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Table 4: Global DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Table 5: Global DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Table 6: Global DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Table 7: Global DC Motors Market Value (US$ Bn), by Application, 2017-2031

Table 8: Global DC Motors Market Volume (Thousand Units), by Application 2017-2031

Table 9: Global DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 10: Global DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 11: Global DC Motors Market Value (US$ Bn), by Region, 2017-2031

Table 12: Global DC Motors Market Volume (Thousand Units), by Region 2017-2031

Table 13: North America DC Motors Market Value (US$ Bn), by Type, 2017-2031

Table 14: North America DC Motors Market Volume (Thousand Units), by Type 2017-2031

Table 15: North America DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Table 16: North America DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Table 17: North America DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Table 18: North America DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Table 19: North America DC Motors Market Value (US$ Bn), by Application, 2017-2031

Table 20: North America DC Motors Market Volume (Thousand Units), by Application 2017-2031

Table 21: North America DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 22: North America DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: North America DC Motors Market Value (US$ Bn), by Region, 2017-2031

Table 24: North America DC Motors Market Volume (Thousand Units), by Region 2017-2031

Table 25: Europe DC Motors Market Value (US$ Bn), by Type, 2017-2031

Table 26: Europe DC Motors Market Volume (Thousand Units), by Type 2017-2031

Table 27: Europe DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Table 28: Europe DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Table 29: Europe DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Table 30: Europe DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Table 31: Europe DC Motors Market Value (US$ Bn), by Application, 2017-2031

Table 32: Europe DC Motors Market Volume (Thousand Units), by Application 2017-2031

Table 33: Europe DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 34: Europe DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 35: Europe DC Motors Market Value (US$ Bn), by Region, 2017-2031

Table 36: Europe DC Motors Market Volume (Thousand Units), by Region 2017-2031

Table 37: Asia Pacific DC Motors Market Value (US$ Bn), by Type, 2017-2031

Table 38: Asia Pacific DC Motors Market Volume (Thousand Units), by Type 2017-2031

Table 39: Asia Pacific DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Table 40: Asia Pacific DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Table 41: Asia Pacific DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Table 42: Asia Pacific DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Table 43: Asia Pacific DC Motors Market Value (US$ Bn), by Application, 2017-2031

Table 44: Asia Pacific DC Motors Market Volume (Thousand Units), by Application 2017-2031

Table 45: Asia Pacific DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 46: Asia Pacific DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: Asia Pacific DC Motors Market Value (US$ Bn), by Region, 2017-2031

Table 48: Asia Pacific DC Motors Market Volume (Thousand Units), by Region 2017-2031

Table 49: Middle East & Africa DC Motors Market Value (US$ Bn), by Type, 2017-2031

Table 50: Middle East & Africa DC Motors Market Volume (Thousand Units), by Type 2017-2031

Table 51: Middle East & Africa DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Table 52: Middle East & Africa DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Table 53: Middle East & Africa DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Table 54: Middle East & Africa DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Table 55: Middle East & Africa DC Motors Market Value (US$ Bn), by Application, 2017-2031

Table 56: Middle East & Africa DC Motors Market Volume (Thousand Units), by Application 2017-2031

Table 57: Middle East & Africa DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: Middle East & Africa DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: Middle East & Africa DC Motors Market Value (US$ Bn), by Region, 2017-2031

Table 60: Middle East & Africa DC Motors Market Volume (Thousand Units), by Region 2017-2031

Table 61: South America DC Motors Market Value (US$ Bn), by Type, 2017-2031

Table 62: South America DC Motors Market Volume (Thousand Units), by Type 2017-2031

Table 63: South America DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Table 64: South America DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Table 65: South America DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Table 66: South America DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Table 67: South America DC Motors Market Value (US$ Bn), by Application, 2017-2031

Table 68: South America DC Motors Market Volume (Thousand Units), by Application 2017-2031

Table 69: South America DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 70: South America DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 71: South America DC Motors Market Value (US$ Bn), by Region, 2017-2031

Table 72: South America DC Motors Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global DC Motors Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global DC Motors Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Figure 5: Global DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Figure 6: Global DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 7: Global DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 8: Global DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 9: Global DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2023-2031

Figure 10: Global DC Motors Market Value (US$ Bn), by Application, 2017-2031

Figure 11: Global DC Motors Market Volume (Thousand Units), by Application 2017-2031

Figure 12: Global DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 13: Global DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 14: Global DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 15: Global DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 16: Global DC Motors Market Value (US$ Bn), by Region, 2017-2031

Figure 17: Global DC Motors Market Volume (Thousand Units), by Region 2017-2031

Figure 18: Global DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 19: North America DC Motors Market Value (US$ Bn), by Type, 2017-2031

Figure 20: North America DC Motors Market Volume (Thousand Units), by Type 2017-2031

Figure 21: North America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 22: North America DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Figure 23: North America DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Figure 24: North America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 25: North America DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 26: North America DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 27: North America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2023-2031

Figure 28: North America DC Motors Market Value (US$ Bn), by Application, 2017-2031

Figure 29: North America DC Motors Market Volume (Thousand Units), by Application 2017-2031

Figure 30: North America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 31: North America DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 32: North America DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: North America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 34: North America DC Motors Market Value (US$ Bn), by Region, 2017-2031

Figure 35: North America DC Motors Market Volume (Thousand Units), by Region 2017-2031

Figure 36: North America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Europe DC Motors Market Value (US$ Bn), by Type, 2017-2031

Figure 38: Europe DC Motors Market Volume (Thousand Units), by Type 2017-2031

Figure 39: Europe DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 40: Europe DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Figure 41: Europe DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Figure 42: Europe DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 43: Europe DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 44: Europe DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 45: Europe DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2023-2031

Figure 46: Europe DC Motors Market Value (US$ Bn), by Application, 2017-2031

Figure 47: Europe DC Motors Market Volume (Thousand Units), by Application 2017-2031

Figure 48: Europe DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 49: Europe DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 50: Europe DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 51: Europe DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 52: Europe DC Motors Market Value (US$ Bn), by Region, 2017-2031

Figure 53: Europe DC Motors Market Volume (Thousand Units), by Region 2017-2031

Figure 54: Europe DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 55: Asia Pacific DC Motors Market Value (US$ Bn), by Type, 2017-2031

Figure 56: Asia Pacific DC Motors Market Volume (Thousand Units), by Type 2017-2031

Figure 57: Asia Pacific DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 58: Asia Pacific DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Figure 59: Asia Pacific DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Figure 60: Asia Pacific DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 61: Asia Pacific DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 62: Asia Pacific DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 63: Asia Pacific DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2023-2031

Figure 64: Asia Pacific DC Motors Market Value (US$ Bn), by Application, 2017-2031

Figure 65: Asia Pacific DC Motors Market Volume (Thousand Units), by Application 2017-2031

Figure 66: Asia Pacific DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 67: Asia Pacific DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 68: Asia Pacific DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: Asia Pacific DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 70: Asia Pacific DC Motors Market Value (US$ Bn), by Region, 2017-2031

Figure 71: Asia Pacific DC Motors Market Volume (Thousand Units), by Region 2017-2031

Figure 72: Asia Pacific DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 73: Middle East & Africa DC Motors Market Value (US$ Bn), by Type, 2017-2031

Figure 74: Middle East & Africa DC Motors Market Volume (Thousand Units), by Type 2017-2031

Figure 75: Middle East & Africa DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 76: Middle East & Africa DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Figure 77: Middle East & Africa DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Figure 78: Middle East & Africa DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 79: Middle East & Africa DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 80: Middle East & Africa DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 81: Middle East & Africa DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2023-2031

Figure 82: Middle East & Africa DC Motors Market Value (US$ Bn), by Application, 2017-2031

Figure 83: Middle East & Africa DC Motors Market Volume (Thousand Units), by Application 2017-2031

Figure 84: Middle East & Africa DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 85: Middle East & Africa DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: Middle East & Africa DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: Middle East & Africa DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: Middle East & Africa DC Motors Market Value (US$ Bn), by Region, 2017-2031

Figure 89: Middle East & Africa DC Motors Market Volume (Thousand Units), by Region 2017-2031

Figure 90: Middle East & Africa DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 91: South America DC Motors Market Value (US$ Bn), by Type, 2017-2031

Figure 92: South America DC Motors Market Volume (Thousand Units), by Type 2017-2031

Figure 93: South America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 94: South America DC Motors Market Value (US$ Bn), by Speed, 2017-2031

Figure 95: South America DC Motors Market Volume (Thousand Units), by Speed 2017-2031

Figure 96: South America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 97: South America DC Motors Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 98: South America DC Motors Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 99: South America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2023-2031

Figure 100: South America DC Motors Market Value (US$ Bn), by Application, 2017-2031

Figure 101: South America DC Motors Market Volume (Thousand Units), by Application 2017-2031

Figure 102: South America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 103: South America DC Motors Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 104: South America DC Motors Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 105: South America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 106: South America DC Motors Market Value (US$ Bn), by Region, 2017-2031

Figure 107: South America DC Motors Market Volume (Thousand Units), by Region 2017-2031

Figure 108: South America DC Motors Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031