Reports

Reports

The DC drive market is witnessing steadiness. It is driven by industrial automation, demand for energy efficiency, and modernization of infrastructure. Traditionally used in applications requiring high torque and variable speed like mining, metal processing, and transportation, DC drives are expanding into new applications such as EV infrastructure, smart lighting, and water treatment.

Analysts highlight that the Asia-Pacific region remains the fastest-growing region due to rapid industrialization of India and China. There is also a strong shift toward smart DC drives that include Internet of Things (IoT) connectivity, predictive maintenance, and energy feedback capabilities. The global market is also into competition with AC drives, especially in applications where robustness and low maintenance are key concerns. The overall market does face some greater challenges for small and mid-sized enterprises as the upfront cost and overall integration complexity do restrict smaller businesses toward adoption of DC drives into their applications.

In order to remain competitive in a fast-paced environment, manufacturers of DC drives must innovate faster in digital integration like embedded diagnostics, remote monitoring, and additional Internet of Things (IoT) features and improve their local service base to support installation and lifecycle maintenance.

The market for DC drives, which are devices that regulate and control direct current (DC) for the purpose of controlling motors, LEDs, and the other electronic systems, is growing to meet the increasing need for energy-efficient and digitally integrated power control solutions. These drives are essential to regulate precise speed, torque, and direction in applications that demand variable loads and a high starting torque, such as elevators, cranes, electric vehicles, and industrial automation.

The transition from electrification and automation to Industry 4.0 in various industries is driving the adoption of new DC drives, particularly the fast growing economies of Asia-Pacific that prioritize capital investments to accelerate industrialization and infrastructure development.

Key companies in this area include ABB, Siemens, Rockwell Automation, Schneider Electric, etc. Overall, the DC drive market stays a relatively stable segment within the overall motor control and automation market with growth opportunity focused primarily within updates, niche applications, and integration with digital control platform products. There are significant growth opportunities in the low- to medium-voltage segment from a market standpoint. Compact, modular, and regenerative drive systems are becoming trendier in this space.

| Attribute | Detail |

|---|---|

| DC Drives Market Drivers |

|

The global market for DC drives is growing rapidly due to changes in consumer behavior. DC drives are used in traction motors, power steering, and battery management systems in electric vehicles and hybrid cars. All DC motor drives regulate the motors by controlling voltage, current and/or speed to achieve smooth acceleration, energy efficiency and torque response. Advanced DC motor drives offer variable speed control and regenerative braking, thereby enabling recovering and reusing kinetic energy during deceleration, which can improve range and overall vehicle efficiency.

Also, most modern EVs utilize electric power steering (EPS) systems act as an alternative to traditional hydraulic systems. The EPS unit of an EV utilizes DC motor drives to adjust the small motors to assist the driver in steering the vehicle.

Many legacy systems provide obsolete technologies like contactors, simple drives, or analog forms of control. In contrast, new motor controllers offer digital accuracy, data in real time, and easy integration into the current smart manufacturing systems (i.e., Industry 4.0). Many industries, especially the ones established with heavy-duty applications such as metals, mining, and pulp and paper, have substantial investments in their existing DC motor technology.

Key players and automakers can make step-by-step investment and strategic collaboration rather than relying on one one-time investment. Also, new drives’ generations have embedded capabilities for remote connection and self-diagnostics that enable remote support and condition monitoring services. Hence, the rise of DC drives, which are retrofitting aging systems, significantly fuels expansion in the global DC drives market. Many industrial plants continue to employ older DC motor systems, often as more advanced systems, especially within manufacturing, textile, and heavy engineering, where applications are inherent and deeply embedded.

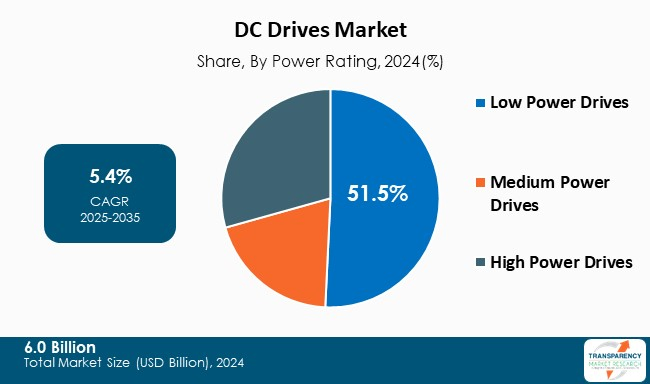

Growing revenue from the global DC drives industry can be attributed to the dominance of the low-voltage segment. The reasons for its dominance are versatility, cost, and widespread industry applicability. Low-voltage (typically <600V) DC drives are extensively used across a wide array of light- to medium-duty applications such as conveyors, pumps, HVAC systems, and small industrial machinery for a myriad of sectors that serve as the backbone for both - developed and developing economies. Low-voltage DC drives typically provide precise speed and torque control while being easier to install than medium- and high-voltage drives, and at lower initial costs. Modern low-voltage DC drives now incorporate features like IoT connectivity, remote diagnostics, and regenerative braking. Retrofitting and modernizing old industrial infrastructures—and especially in Asia Pacific, Latin America, and some parts of Europe—are steadily contributing to the low-voltage segment market share as most legacy systems operate at low voltage.

They are advantageous because they are easier to install, cheaper, more energy efficient, and can be easily used with modern automation systems. As industries continue to emphasize energy efficiency and flexibility in motor control, there will continue to be a strong demand for low-voltage DC drives, thus they will remain dominant in the overall market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific holds the largest share in the global DC drives market, thanks to the well-developed automotive infrastructure, governments’ support, and the key players like ABB Ltd, Schneider Electric SE, Parker Hannifin Corp, and Maxon Motor. In India, Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) program is supporting adoption of electric vehicles while providing additional incentives to customers and manufacturers to produce electric vehicles.

Also, the urban population demands upgraded automation with real-time monitoring, IoTs, and efficient motor control systems that drives the market growth of DC Driver in this region.

Hence, Asia Pacific region include developing economies like china, India, japan, south Korea that demands for advanced technology and upgradation.

Key players operating in the DC drives market are investing in innovation, strategic partnerships, and technological advancements. They focus on improving imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

ABB Ltd, Rockwell Automation, Siemens AG, Schneider Electric SE, Parker Hannifin Corp, STMicroelectronics, Analog Devices, NXP Semiconductors, Eaton, Maxon Motor, Mitsubishi Electric, ROHM Semiconductor co. ltd are the key players in global Market.

Each of these players has been profiled in the DC drives market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

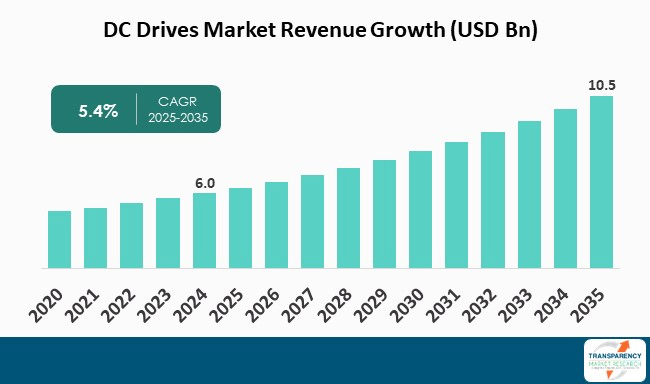

| Size in 2024 | US$ 6.0 Bn |

| Forecast Value in 2035 | US$ 10.5 Bn |

| CAGR | 5.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| DC Drives Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Voltage Rating

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The DC drives market was valued at US$ 6.0 Bn in 2024

The DC drives market is projected to reach US$ 10.5 Bn by the end of 2035

Increasing adoption of electric and hybrid vehicles, and retrofitting legacy systems with advanced DC drives are some of the factors driving the DC Drives market.

The CAGR is anticipated to be 5.4%from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

ABB Ltd, Rockwell Automation, Siemens AG, Schneider Electric SE, Parker Hannifin Corp, STMicroelectronics, Analog Devices, NXP Semiconductors, Eaton, Maxon Motor, Mitsubishi Electric, and ROHM Semiconductor Co. Ltd. among others

Table 01: Global DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 02: Global DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 03: Global DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 04: Global DC Drives Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 05: North America DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 06: North America DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 07: North America DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 08: North America DC Drives Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 09: U.S. DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 10: U.S. DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 11: U.S. DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 12: Canada DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 13: Canada DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 14: Canada DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Europe DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 16: Europe DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 17: Europe DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 18: Europe DC Drives Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 19: Germany DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 20: Germany DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 21: Germany DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 22: U.K. DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 23: U.K. DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 24: U.K. DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 25: France DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 26: France DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 27: France DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: Italy DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 29: Italy DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 30: Italy DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 31: Spain DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 32: Spain DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 33: Spain DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 34: Switzerland DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 35: Switzerland DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 36: Switzerland DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 37: The Netherlands DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 38: The Netherlands DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 39: The Netherlands DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Rest of Europe DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 41: Rest of Europe DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 42: Rest of Europe DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 43: Asia Pacific DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 44: Asia Pacific DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 45: Asia Pacific DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 46: Asia Pacific DC Drives Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 47: China DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 48: China DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 49: China DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 50: Japan DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 51: Japan DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 52: Japan DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 53: India DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 54: India DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 55: India DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 56: South Korea DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 57: South Korea DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 58: South Korea DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 59: Australia and New Zealand DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 60: Australia and New Zealand DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 61: Australia and New Zealand DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 62: Rest of Asia Pacific DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 63: Rest of Asia Pacific DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 64: Rest of Asia Pacific DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 65: Latin America DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 66: Latin America DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 67: Latin America DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 68: Latin America DC Drives Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 69: Brazil DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 70: Brazil DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 71: Brazil DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 72: Mexico DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 73: Mexico DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 74: Mexico DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 75: Argentina DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 76: Argentina DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 77: Argentina DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 78: Rest of Latin America DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 79: Rest of Latin America DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 80: Rest of Latin America DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 81: Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 82: Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 83: Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 84: Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 85: GCC Countries DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 86: GCC Countries DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 87: GCC Countries DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 88: South Africa DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 89: South Africa DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 90: South Africa DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 91: Rest of Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, by Voltage Rating, 2020 to 2035

Table 92: Rest of Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, by Power Rating, 2020 to 2035

Table 93: Rest of Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 03: Global DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 04: Global DC Drives Market Revenue (US$ Bn), by Low Voltage (up to 48V), 2020 to 2035

Figure 05: Global DC Drives Market Revenue (US$ Bn), by Medium Voltage (48V to 400V), 2020 to 2035

Figure 06: Global DC Drives Market Revenue (US$ Bn), by High Voltage (above 400V), 2020 to 2035

Figure 07: Global DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 08: Global DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 09: Global DC Drives Market Revenue (US$ Bn), by Low Power Drives, 2020 to 2035

Figure 10: Global DC Drives Market Revenue (US$ Bn), by Medium Power Drives, 2020 to 2035

Figure 11: Global DC Drives Market Revenue (US$ Bn), by High Power Drives, 2020 to 2035

Figure 12: Global DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 13: Global DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 14: Global DC Drives Market Revenue (US$ Bn), by Oil & Gas, 2020 to 2035

Figure 15: Global DC Drives Market Revenue (US$ Bn), by Power Generation, 2020 to 2035

Figure 16: Global DC Drives Market Revenue (US$ Bn), by Food & Beverages, 2020 to 2035

Figure 17: Global DC Drives Market Revenue (US$ Bn), by Chemicals & Petrochemicals, 2020 to 2035

Figure 18: Global DC Drives Market Revenue (US$ Bn), by Metal & Mining, 2020 to 2035

Figure 19: Global DC Drives Market Revenue (US$ Bn), by Building Automation, 2020 to 2035

Figure 20: Global DC Drives Market Revenue (US$ Bn), by Water & Wastewater, 2020 to 2035

Figure 21: Global DC Drives Market Revenue (US$ Bn), by Other Industries, 2020 to 2035

Figure 22: Global DC Drives Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 23: Global DC Drives Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 24: North America DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 25: North America DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 26: North America DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 27: North America DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 28: North America DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 29: North America DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 30: North America DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 31: North America DC Drives Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 32: North America DC Drives Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 33: U.S. DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: U.S. DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 35: U.S. DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 36: U.S. DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 37: U.S. DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 38: U.S. DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 39: U.S. DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 40: Canada DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Canada DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 42: Canada DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 43: Canada DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 44: Canada DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 45: Canada DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 46: Canada DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 47: Europe DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Europe DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 49: Europe DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 50: Europe DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 51: Europe DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 52: Europe DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 53: Europe DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 54: Europe DC Drives Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Europe DC Drives Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Germany DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Germany DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 58: Germany DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 59: Germany DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 60: Germany DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 61: Germany DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 62: Germany DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 63: U.K. DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 64: U.K. DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 65: U.K. DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 66: U.K. DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 67: U.K. DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 68: U.K. DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 69: U.K. DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 70: France DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: France DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 72: France DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 73: France DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 74: France DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 75: France DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 76: France DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 77: Italy DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 78: Italy DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 79: Italy DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 80: Italy DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 81: Italy DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 82: Italy DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 83: Italy DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 84: Spain DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 85: Spain DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 86: Spain DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 87: Spain DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 88: Spain DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 89: Spain DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 90: Spain DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 91: Switzerland DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 92: Switzerland DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 93: Switzerland DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 94: Switzerland DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 95: Switzerland DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 96: Switzerland DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 97: Switzerland DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 98: The Netherlands DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 99: The Netherlands DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 100: The Netherlands DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 101: The Netherlands DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 102: The Netherlands DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 103: The Netherlands DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 104: The Netherlands DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 105: Rest of Europe DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 106: Rest of Europe DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 107: Rest of Europe DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 108: Rest of Europe DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 109: Rest of Europe DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 110: Rest of Europe DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 111: Rest of Europe DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 112: Asia Pacific DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 113: Asia Pacific DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 114: Asia Pacific DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 115: Asia Pacific DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 116: Asia Pacific DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 117: Asia Pacific DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 118: Asia Pacific DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 119: Asia Pacific DC Drives Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 120: Asia Pacific DC Drives Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 121: China DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 122: China DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 123: China DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 124: China DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 125: China DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 126: China DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 127: China DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 128: Japan DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 129: Japan DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 130: Japan DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 131: Japan DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 132: Japan DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 133: Japan DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 134: Japan DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 135: India DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 136: India DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 137: India DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 138: India DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 139: India DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 140: India DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 141: India DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 142: South Korea DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 143: South Korea DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 144: South Korea DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 145: South Korea DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 146: South Korea DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 147: South Korea DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 148: South Korea DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 149: Australia and New Zealand DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 150: Australia and New Zealand DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 151: Australia and New Zealand DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 152: Australia and New Zealand DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 153: Australia and New Zealand DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 154: Australia and New Zealand DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 155: Australia and New Zealand DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 156: Rest of Asia Pacific DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 157: Rest of Asia Pacific DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 158: Rest of Asia Pacific DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 159: Rest of Asia Pacific DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 160: Rest of Asia Pacific DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 161: Rest of Asia Pacific DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 162: Rest of Asia Pacific DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 163: Latin America DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 164: Latin America DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 165: Latin America DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 166: Latin America DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 167: Latin America DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 168: Latin America DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 169: Latin America DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 170: Latin America DC Drives Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 171: Latin America DC Drives Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 172: Brazil DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 173: Brazil DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 174: Brazil DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 175: Brazil DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 176: Brazil DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 177: Brazil DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 178: Brazil DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 179: Mexico DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 180: Mexico DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 181: Mexico DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 182: Mexico DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 183: Mexico DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 184: Mexico DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 185: Mexico DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 186: Argentina DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 187: Argentina DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 188: Argentina DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 189: Argentina DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 190: Argentina DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 191: Argentina DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 192: Argentina DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 193: Rest of Latin America DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 194: Rest of Latin America DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 195: Rest of Latin America DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 196: Rest of Latin America DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 197: Rest of Latin America DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 198: Rest of Latin America DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 199: Rest of Latin America DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 200: Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 201: Middle East and Africa DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 202: Middle East and Africa DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 203: Middle East and Africa DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 204: Middle East and Africa DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 205: Middle East and Africa DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 206: Middle East and Africa DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 207: Middle East and Africa DC Drives Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 208: Middle East and Africa DC Drives Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 209: GCC Countries DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 210: GCC Countries DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 211: GCC Countries DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 212: GCC Countries DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 213: GCC Countries DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 214: GCC Countries DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 215: GCC Countries DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 216: South Africa DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 217: South Africa DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 218: South Africa DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 219: South Africa DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 220: South Africa DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 221: South Africa DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 222: South Africa DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 223: Rest of Middle East and Africa DC Drives Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 224: Rest of Middle East and Africa DC Drives Market Value Share Analysis, by Voltage Rating, 2024 and 2035

Figure 225: Rest of Middle East and Africa DC Drives Market Attractiveness Analysis, by Voltage Rating, 2025 to 2035

Figure 226: Rest of Middle East and Africa DC Drives Market Value Share Analysis, by Power Rating, 2024 and 2035

Figure 227: Rest of Middle East and Africa DC Drives Market Attractiveness Analysis, by Power Rating, 2025 to 2035

Figure 228: Rest of Middle East and Africa DC Drives Market Value Share Analysis, by End-user, 2024 and 2035

Figure 229: Rest of Middle East and Africa DC Drives Market Attractiveness Analysis, by End-user, 2025 to 2035