Reports

Reports

Analysts’ Viewpoint on Market Scenario

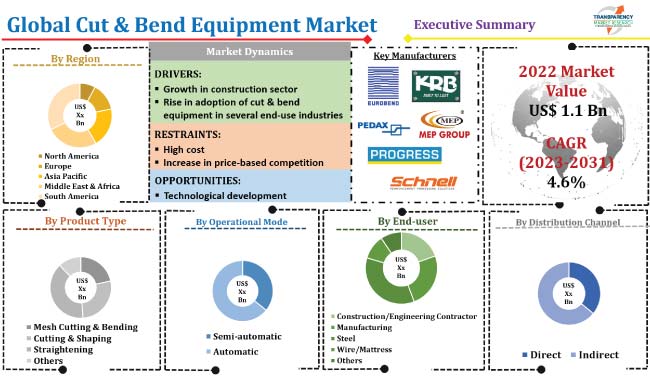

Growth in the construction industry along with infrastructural development across the globe is expected to fuel the market demand for cut & bend equipment during the forecast period. Automatic cutting & shaping machines are widely used in the construction sector. These machines offer advantages such as cost reduction, minimum labor requirement, automated working, etc. Additionally, urbanization in emerging economies, technological development, and rise in collaboration activities among leading players are creating lucrative cut & bend equipment business opportunities.

Increase in automation trends in several industries including manufacturing, steel, and oil, & gas, etc., is fueling market expansion. Key manufacturers in the market are focusing on the development of products based on advanced technologies such as laser cutting and plasma cutting. Rise in demand for automated bar bending machines in the building & construction sector is likely to boost the cut & bend equipment market in the next few years.

Cut & bend equipment are solutions used in the fabrication industry and also used for optimization of steel reinforcement bars in the manufacturing industry. These machines have numerous applications in the construction industry, and are available in different shapes and sizes. These equipment are used to manage inventories, and significantly reduce costs associated with labor.

Demand for cutting & bending equipment is growing due to the development of the global construction industry. According to a report by Oxford Economics, global construction output is expected to grow 85.0% to reach a value of US$ 15.5 trillion by 2030. Growth of the global construction industry is likely to boost the demand for construction materials in the next few years. Steel bars and coils are among the basic materials required for concrete reinforcement and the adoption of these material is increasing across the globe. Therefore, cutting & bending equipment manufacturers are expected to witness lucrative opportunities in the near future. Increase in adoption of cutting-edge technologies and automation processes in these equipment help reduce processing time and intensify productivity.

Rapid adoption of cut & bend equipment in several end-use industries including manufacturing, steel, oil & gas, welding lines, and wire/mattress, is a key factor expected to fuel market progress during the forecast period. Modern automatic cutting & bending machines are efficient and provide more precise operations. Industries are extensively utilizing these machines to increase productivity and reduce costs. Growth in manufacturing industries such as automotive, aerospace, and electrical & electronics, and increase in adoption of cut & bend equipment in these industries are expected to fuel cut & bend equipment market growth during the forecast period.

Some of the major types of cut & bend equipment are mesh cutting & bending, cutting & shaping, straightening, and others. The cutting & bending segment is further divided into stirrups and bar shaping. Cutting & shaping machines are increasingly being adopted in the manufacturing sector. Several automotive and electronics industries are moving toward automated machines. Therefore, the cutting & bending segment is projected to dominate the global market in the near future.

Stirrup machines are expected to gain significant traction during the forecast period. These machines are more efficient than conventional stirrup machines. Growth in sheet metal fabrication business is expected to boost the sale of stirrup machines during the forecast period.

Automatic cut & bend equipment are gaining popularity among end-users due to their convenience and efficiency. These equipment are convenient to use, as they offer advantages such as less manual intervention and faster processing (cutting, bending). Other benefits include reduced manpower requirement, lesser scrap generated, and higher production. However, automatic equipment are expensive as compared to semi-automatic ones. Moreover, automatic machines are bulkier due to in-built components involved for automatic functions.

Asia Pacific is expected to hold the largest share of the global cut & bend equipment market during the forecast period, owing to the increase in construction activities in the region. Industrial product manufacturers are focusing on products based on advanced technology due to the rapid adoption of the industrial Internet of Things (IIoT) in the region. The Asia Pacific cut & bend equipment market size is anticipated to grow during the forecast period, owing to the rise in initiatives by several governments to improve infrastructure in emerging economies in the region. Infrastructural development activities are rapidly growing in China. This is positively impacting the market value for cut & bend equipment in Asia Pacific.

In the consolidated global cut & bend equipment market, a few large-scale market players are controlling a significant share. Cut & bend equipment manufacturers are spending their capital on extensive R&D activities. Key players in the global cut & bend equipment market are expanding their product portfolio by implementing various strategies such as mergers and acquisitions and new product launches.

Eurobend S.A., KRB Machinery, M.E.P. Macchine Elettroniche Piegatrici S.p.A., Progress Holding AG, Progress Investment Management, Schnell Spa, PEDAX GmbH, Sona Construction Technologies Pvt. Ltd, TJK Machinery (Tianjin) Co, Ltd, and Toyo Kensetsu Kohki Co. Ltd. are some of the major cut & bend equipment manufacturing companies operating across the globe.

Key players have been profiled in the global cut & bend equipment market research report based on parameters such as financial overview, recent developments, product portfolio, business segments, company overview, and business strategies.

|

Attribute |

Detail |

|

Market Value in 2021 |

US$ 1.1 Bn |

|

Market Forecast Value in 2031 |

US$ 1.6 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.1 Bn in 2022.

The CAGR is likely to be 4.6% during 2023-2031.

Growth in construction sector and increase in demand for cut & bend equipment in several end-use industries.

The automatic operational mode segment accounted for maximum share in 2022.

Asia Pacific is likely to be the most lucrative region in the near future.

Eurobend S.A., KRB Machinery, M.E.P. Macchine Elettroniche Piegatrici S.p.A., Progress Holding AG, Progress Investment Management, Schnell Spa, PEDAX GmbH, Sona Construction Technologies Pvt. Ltd, TJK Machinery (Tianjin) Co, Ltd, and Toyo Kensetsu Kohki CO., LTD.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Technological Roadmap

5.8. Regulatory Framework

5.9. Global Cut & Bend Equipment Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Cut & Bend Equipment Market Analysis and Forecast, by Product Type

6.1. Global Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Product Type, 2017 - 2031

6.1.1. Mesh Cutting & Bending

6.1.2. Cutting & Shaping

6.1.2.1. Stirrups

6.1.2.2. Bar Shaping

6.1.3. Straightening

6.1.4. Others

6.2. Incremental Opportunity, by Product Type

7. Global Cut & Bend Equipment Market Analysis and Forecast, by Operational Mode

7.1. Global Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Operational Mode, 2017 - 2031

7.1.1. Semi-automatic

7.1.2. Automatic

7.2. Incremental Opportunity, by Operational Mode

8. Global Cut & Bend Equipment Market Analysis and Forecast, by End-user

8.1. Global Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by End-user, 2017 - 2031

8.1.1. Construction/Engineering Contractor

8.1.2. Manufacturing

8.1.3. Steel

8.1.4. Wire/Mattress

8.1.5. Others

8.2. Incremental Opportunity, by End-user

9. Global Cut & Bend Equipment Market Analysis and Forecast, by Distribution Channel

9.1. Global Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, by Distribution Channel

10. Global Cut & Bend Equipment Market Analysis and Forecast, Region

10.1. Global Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Cut & Bend Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side Analysis

11.4.2. Supply Side Analysis

11.5. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Product Type, 2017 - 2031

11.5.1. Mesh Cutting & Bending

11.5.2. Cutting & Shaping

11.5.2.1. Stirrups

11.5.2.2. Bar Shaping

11.5.3. Straightening

11.5.4. Others

11.6. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Operational Mode, 2017 - 2031

11.6.1. Semi-automatic

11.6.2. Automatic

11.7. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by End-user, 2017 - 2031

11.7.1. Construction/Engineering Contractor

11.7.2. Manufacturing

11.7.3. Steel

11.7.4. Wire/Mattress

11.7.5. Others

11.8. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

11.9. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

11.9.1. The U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Cut & Bend Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Product Type, 2017 - 2031

12.5.1. Mesh Cutting & Bending

12.5.2. Cutting & Shaping

12.5.2.1. Stirrups

12.5.2.2. Bar Shaping

12.5.3. Straightening

12.5.4. Others

12.6. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Operational Mode, 2017 - 2031

12.6.1. Semi-automatic

12.6.2. Automatic

12.7. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by End-user, 2017 - 2031

12.7.1. Construction/Engineering Contractor

12.7.2. Manufacturing

12.7.3. Steel

12.7.4. Wire/Mattress

12.7.5. Others

12.8. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

12.9.1. EU-27

12.9.2. UK

12.9.3. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Cut & Bend Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side Analysis

13.4.2. Supply Side Analysis

13.5. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Product Type, 2017 - 2031

13.5.1. Mesh Cutting & Bending

13.5.2. Cutting & Shaping

13.5.2.1. Stirrups

13.5.2.2. Bar Shaping

13.5.3. Straightening

13.5.4. Others

13.6. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Operational Mode, 2017 - 2031

13.6.1. Semi-automatic

13.6.2. Automatic

13.7. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by End-user, 2017 - 2031

13.7.1. Construction/Engineering Contractor

13.7.2. Manufacturing

13.7.3. Steel

13.7.4. Wire/Mattress

13.7.5. Others

13.8. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

13.8.1. Direct

13.8.2. Indirect

13.9. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Cut & Bend Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Product Type, 2017 - 2031

14.5.1. Mesh Cutting & Bending

14.5.2. Cutting & Shaping

14.5.2.1. Stirrups

14.5.2.2. Bar Shaping

14.5.3. Straightening

14.5.4. Others

14.6. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Operational Mode, 2017 - 2031

14.6.1. Semi-automatic

14.6.2. Automatic

14.7. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by End-user, 2017 - 2031

14.7.1. Construction/Engineering Contractor

14.7.2. Manufacturing

14.7.3. Steel

14.7.4. Wire/Mattress

14.7.5. Others

14.8. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Cut & Bend Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Product Type, 2017 - 2031

15.5.1. Mesh Cutting & Bending

15.5.2. Cutting & Shaping

15.5.2.1. Stirrups

15.5.2.2. Bar Shaping

15.5.3. Straightening

15.5.4. Others

15.6. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Operational Mode, 2017 - 2031

15.6.1. Semi-automatic

15.6.2. Automatic

15.7. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by End-user, 2017 - 2031

15.7.1. Construction/Engineering Contractor

15.7.2. Manufacturing

15.7.3. Steel

15.7.4. Wire/Mattress

15.7.5. Others

15.8. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

15.8.1. Direct

15.8.2. Indirect

15.9. Cut & Bend Equipment Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2021

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. Eurobend S.A.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. KRB Machinery

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. M.E.P. Macchine Elettroniche Piegatrici S.p.A.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. Progress Holding AG

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. Progress Investment Management

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. Schnell Spa

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. PEDAX GmbH

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Sona Construction Technologies Pvt. Ltd

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. TJK Machinery (Tianjin) Co, Ltd

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Toyo Kensetsu Kohki Co., Ltd.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Operational Mode

17.1.3. End-user

17.1.4. Distribution Channel

17.1.5. Geography

17.2. Understanding the Buying Process of the Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Table 2: Global Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Table 3: Global Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Table 4: Global Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Table 5: Global Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Table 6: Global Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Table 7: Global Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Table 9: Global Cut & Bend Equipment Market, by Region, Thousand Units, 2017-2031

Table 10: Global Cut & Bend Equipment Market, by Region, US$ Bn, 2017-2031

Table 11: North America Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Table 12: North America Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Table 13: North America Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Table 14: North America Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Table 15: North America Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Table 16: North America Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Table 17: North America Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Table 19: North America Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Table 20: North America Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Table 21: Europe Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Table 22: Europe Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Table 23: Europe Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Table 24: Europe Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Table 25: Europe Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Table 26: Europe Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Table 27: Europe Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Table 28: Europe Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Table 29: Europe Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Table 30: Europe Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Table 31: Asia Pacific Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Table 32: Asia Pacific Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Table 33: Asia Pacific Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Table 34: Asia Pacific Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Table 35: Asia Pacific Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Table 36: Asia Pacific Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Table 37: Asia Pacific Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Table 38: Asia Pacific Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Table 39: Asia Pacific Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Table 40: Asia Pacific Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Table 41: Middle East & Africa Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Table 42: Middle East & Africa Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Table 43: Middle East & Africa Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Table 44: Middle East & Africa Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Table 45: Middle East & Africa Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Table 46: Middle East & Africa Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Table 47: Middle East & Africa Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Table 48: Middle East & Africa Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Table 49: Middle East & Africa Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Table 50: Middle East & Africa Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Table 51: South America Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Table 52: South America Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Table 53: South America Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Table 54: South America Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Table 55: South America Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Table 56: South America Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Table 57: South America Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Table 58: South America Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Table 59: South America Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Table 60: South America Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Figure 2: Global Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Figure 3: Global Cut & Bend Equipment Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 4: Global Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Figure 5: Global Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Figure 6: Global Cut & Bend Equipment Market Incremental Opportunity, by Operational Mode, US$ Bn, 2017-2031

Figure 7: Global Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Figure 8: Global Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Figure 9: Global Cut & Bend Equipment Market Incremental Opportunity, by End-user, US$ Bn, 2017-2031

Figure 10: Global Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 12: Global Cut & Bend Equipment Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 13: Global Cut & Bend Equipment Market, by Region, Thousand Units, 2017-2031

Figure 14: Global Cut & Bend Equipment Market, by Region, US$ Bn, 2017-2031

Figure 15: Global Cut & Bend Equipment Market Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 16: North America Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Figure 17: North America Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Figure 18: North America Cut & Bend Equipment Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 19: North America Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Figure 20: North America Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Figure 21: North America Cut & Bend Equipment Market Incremental Opportunity, by Operational Mode, US$ Bn, 2017-2031

Figure 22: North America Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Figure 23: North America Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Figure 24: North America Cut & Bend Equipment Market Incremental Opportunity, by End-user, US$ Bn, 2017-2031

Figure 25: North America Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 27: North America Cut & Bend Equipment Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 28: North America Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Figure 29: North America Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Figure 30: North America Cut & Bend Equipment Market Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 31: Europe Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Figure 32: Europe Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Figure 33: Europe Cut & Bend Equipment Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 34: Europe Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Figure 35: Europe Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Figure 36: Europe Cut & Bend Equipment Market Incremental Opportunity, by Operational Mode, US$ Bn, 2017-2031

Figure 37: Europe Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Figure 38: Europe Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Figure 39: Europe Cut & Bend Equipment Market Incremental Opportunity, by End-user, US$ Bn, 2017-2031

Figure 40: Europe Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 41: Europe Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 42: Europe Cut & Bend Equipment Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 43: Europe Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Figure 44: Europe Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Figure 45: Europe Cut & Bend Equipment Market Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 46: Asia Pacific Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Figure 47: Asia Pacific Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Figure 48: Asia Pacific Cut & Bend Equipment Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 49: Asia Pacific Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Figure 50: Asia Pacific Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Figure 51: Asia Pacific Cut & Bend Equipment Market Incremental Opportunity, by Operational Mode, US$ Bn, 2017-2031

Figure 52: Asia Pacific Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Figure 53: Asia Pacific Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Figure 54: Asia Pacific Cut & Bend Equipment Market Incremental Opportunity, by End-user, US$ Bn, 2017-2031

Figure 55: Asia Pacific Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Asia Pacific Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 57: Asia Pacific Cut & Bend Equipment Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 58: Asia Pacific Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Figure 59: Asia Pacific Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Figure 60: Asia Pacific Cut & Bend Equipment Market Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 61: Middle East & Africa Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Figure 62: Middle East & Africa Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Figure 63: Middle East & Africa Cut & Bend Equipment Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 64: Middle East & Africa Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Figure 65: Middle East & Africa Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Figure 66: Middle East & Africa Cut & Bend Equipment Market Incremental Opportunity, by Operational Mode, US$ Bn, 2017-2031

Figure 67: Middle East & Africa Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Figure 68: Middle East & Africa Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Figure 69: Middle East & Africa Cut & Bend Equipment Market Incremental Opportunity, by End-user, US$ Bn, 2017-2031

Figure 70: Middle East & Africa Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 71: Middle East & Africa Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 72: Middle East & Africa Cut & Bend Equipment Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 73: Middle East & Africa Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Figure 75: Middle East & Africa Cut & Bend Equipment Market Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 76: South America Cut & Bend Equipment Market, by Product Type, Thousand Units, 2017-2031

Figure 77: South America Cut & Bend Equipment Market, by Product Type, US$ Bn, 2017-2031

Figure 78: South America Cut & Bend Equipment Market Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 79: South America Cut & Bend Equipment Market, by Operational Mode, Thousand Units, 2017-2031

Figure 80: South America Cut & Bend Equipment Market, by Operational Mode, US$ Bn, 2017-2031

Figure 81: South America Cut & Bend Equipment Market Incremental Opportunity, by Operational Mode, US$ Bn, 2017-2031

Figure 82: South America Cut & Bend Equipment Market, by End-user, Thousand Units, 2017-2031

Figure 83: South America Cut & Bend Equipment Market, by End-user, US$ Bn, 2017-2031

Figure 84: South America Cut & Bend Equipment Market Incremental Opportunity, by End-user, US$ Bn, 2017-2031

Figure 85: South America Cut & Bend Equipment Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 86: South America Cut & Bend Equipment Market, by Distribution Channel, US$ Bn, 2017-2031

Figure 87: South America Cut & Bend Equipment Market Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 88: South America Cut & Bend Equipment Market, by Country, Thousand Units, 2017-2031

Figure 89: South America Cut & Bend Equipment Market, by Country, US$ Bn, 2017-2031

Figure 90: South America Cut & Bend Equipment Market Incremental Opportunity, by Country, US$ Bn, 2017-2031