Reports

Reports

Analysts’ Viewpoint

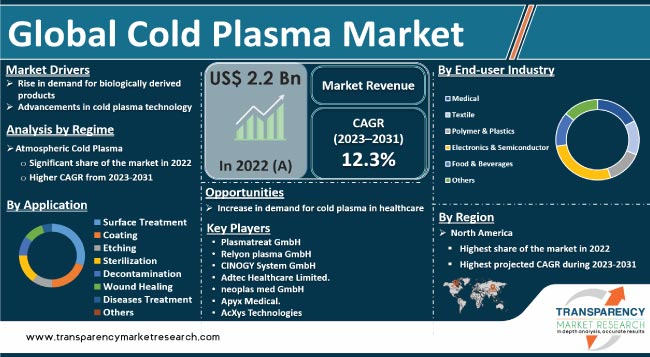

Increase in demand for environmentally-friendly processing options in various industries is driving the global cold plasma market. Cold plasma does not use harmful chemicals or produce toxic waste, making it a safer and more sustainable alternative to traditional chemical processing methods. Demand for high-quality and high-performance materials is rising in industries such as electronics, automotive, and medical devices. Furthermore, presence of key players, increase in investment in research & development, and adoption of new technologies in various industries are contributing to the growth of the global cold plasma market size.

Technological advances and rise in demand for environmentally-friendly and high-quality processing options offer lucrative opportunities to market players. Companies are focusing on development of new and improved cold plasma sources and control techniques for more precise and efficient processing.

Cold plasma technology has been gaining significant attention in the past few years due to its ability to provide precise and efficient processing without damaging the underlying material.

The technology involves the use of non-thermal, low-temperature plasma to modify surfaces, clean materials, and sterilize surfaces in various industries such as electronics, automotive, medical devices, food processing, and packaging.

Increase in demand for high performance materials and environmentally-friendly processing options are likely to propel the global cold plasma market demand. Researchers and companies have been developing new types of cold plasma sources and systems that are more efficient, stable, and precise, leading to new applications and driving demand in various industries.

Growth of the healthcare industry is driving the global market. Demand for cold plasma technology in the healthcare industry is increasing due to its non-invasive, safe, and effective applications in various medical fields. Cold plasma technology has shown promising results in wound healing, cancer treatment, sterilization, and dental applications.

Cold plasma in increasingly used for wound healing in the healthcare industry. The technology is utilized for the treatment of chronic wounds, burns, and other skin injuries, which is expected to drive demand for cold plasma in the wound care market.

Rise in prevalence of cancer is also driving demand for cold plasma technology in cancer treatment. According to the World Health Organization, cancer is the second leading cause of death globally, and an estimated 21.4 million new cancer cases and 9.9 million cancer deaths will be reported worldwide in 2030. Cold plasma technology has shown promising results in inducing apoptosis in cancer cells while sparing healthy cells, which makes it a promising tool for cancer treatment.

Overall, surge in demand for cold plasma technology in the healthcare industry is projected to bolster the global cold plasma market growth in the next few years.

Development of new and improved cold plasma systems with better efficiency, higher processing speeds, and lower costs is attracting more customers and driving demand.

Researchers are developing new plasma sources that are more efficient, longer lasting, and more stable than previous sources. These new sources are also more adaptable to different applications and can be used in a wide range of industries.

Plasma jets is another area of advancement is the market. Plasma jets are being used in various applications such as surface treatment, sterilization, and wound healing. Development of new plasma jets with better performance and higher efficiency is driving usage of cold plasma in these industries.

Advancements in the control of plasma are also fueling the global cold plasma market development. The ability to control plasma properties such as temperature, density, and composition is critical to the success of several cold plasma applications. Researchers are developing new techniques for controlling plasma, which is leading to more precise and efficient processing.

Development of new materials for cold plasma processing is also underway. Researchers are developing new materials that can withstand the harsh conditions of plasma processing and can be used in a range of applications.

Overall, advancements in cold plasma technology are driving the global cold plasma market value.

In terms of regime, the atmospheric cold plasma segment accounted for the largest global cold plasma market share in 2022. Atmospheric cold plasma can be generated at room temperature and atmospheric pressure, which makes it more practical for use in a range of applications. This is in contrast to other types of cold plasma, such as low-pressure plasma, which require special equipment and controlled environments to generate.

Atmospheric cold plasma also has several unique properties that make it attractive for use in various applications. It can be used to generate reactive oxygen and nitrogen species, which can be used for sterilization, surface treatment, and wound healing. Atmospheric cold plasma can also be used to generate ionized gas that can be used for materials processing.

Another advantage of atmospheric cold plasma is that it is safe and environmentally-friendly. Unlike traditional chemical processes, atmospheric cold plasma does not require the use of harmful chemicals, making it a safer and more sustainable alternative.

Based on application, the surface treatment segment dominated the global market in 2022. Surface treatment involves modification of the surface characteristics of a material, such as improving adhesion, wettability, and surface energy. Cold plasma is an attractive technology for surface treatment due to its ability to provide precise and efficient processing without damaging the underlying material.

Cold plasma can also be used to modify the surface properties of a range of materials, including plastics, metals, and ceramics. It can be used to modify the surface chemistry of these materials, which can improve adhesion and bonding properties. For example, cold plasma can be used to modify the surface of a polymer to improve its adhesion to a metal substrate.

Cold plasma can be used to selectively modify the surface properties of a material without affecting the bulk properties.

In terms of end-user industry, the electronics & semiconductor industries segment is expected to account for the largest share of the global cold plasma during the forecast period.

The electronics & semiconductor industries place high value on clean and environmentally-friendly processing options. Cold plasma does not use harmful chemicals or produce toxic waste, making it a safer and more sustainable alternative to traditional chemical processing methods. This is particularly important for companies in the electronics and semiconductor industries, which are under increasing pressure to reduce environmental footprint.

Large market share of the electronic and semiconductor industries segment is ascribed to the critical role that cold plasma technology plays in the manufacturing of electronic and semiconductor devices. Increase in preference for high-quality and high-performance electronic and semiconductor devices is projected to fuel demand for cold plasma technology in the next few years.

As per cold plasma market trends, North America held major share of the industry in 2022. This is ascribed to technological advancements, increasing investments in research & development, and presence of key players in the region.

The market in North America is also driven by rise in demand for clean and environmentally-friendly processing options in various industries. Furthermore, presence of key players in the cold plasma market in the region also contributed to significant market share of the region.

Asia Pacific has witnessed increasing investment in research & development in the past few years, particularly in the healthcare and electronics industries. This has led to the development of new medical devices and electronic components based on cold plasma technology. Growth of these industries has further driven the demand for cold plasma technology in Asia Pacific.

Europe is home to several leading research institutions and universities, which have been driving advancements in cold plasma technology. These institutions are focused on developing new and improved cold plasma sources and control techniques, which have led to more precise and efficient processing.

The European Union has been providing funding for research and development in cold plasma technology, which has further driven innovation in the region. The healthcare industry is also a significant end-user of cold plasma technology in Europe. Cold plasma has been shown to be effective in killing bacteria and viruses, making it an attractive option for sterilization and wound healing applications. Rise in need for high-quality and safe healthcare products and services is likely to bolster demand for cold plasma technology in the region.

The global market is fragmented, with the presence of large number of players. Plasmatreat GmbH, Relyon plasma GmbH, CINOGY System GmbH, Adtec Healthcare Limited, neoplas med GmbH, Apyx Medical, AcXys Technologies, Leaflife Technology, Nova Plasma Ltd., and Henniker Plasma Treatment are the prominent players in the market.

Each of the prominent players has been profiled in the cold plasma market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 2.2 Bn |

|

Forecast (Value) in 2031 |

More than US$ 6.2 Bn |

|

Growth Rate (CAGR) |

12.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

It was valued at US$ 2.2 Bn in 2022

It is projected to reach more than US$ 6.2 Bn by 2031

It is anticipated to grow at a CAGR of 12.3% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

Plasmatreat GmbH, Relyon plasma GmbH, CINOGY System GmbH, Adtec Healthcare Limited, neoplas med GmbH, Apyx Medical, AcXys Technologies, Leaflife Technology, Nova Plasma Ltd. and Henniker Plasma Treatment.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cold Plasma Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cold Plasma Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Overview: Emerging Trends in Cold Plasma Technology

5.3. Regulatory Scenario by Region/globally

5.4. Covid-19 Impact Analysis

6. Global Cold Plasma Market Analysis and Forecast, by Regime

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Regime, 2017-2031

6.3.1. Atmospheric Cold Plasma

6.3.2. Low-pressure Cold Plasma

6.4. Market Attractiveness Analysis, by Regime

7. Global Cold Plasma Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Surface Treatment

7.3.2. Coating

7.3.3. Etching

7.3.4. Sterilization

7.3.5. Decontamination

7.3.6. Wound Healing

7.3.7. Diseases Treatment

7.3.8. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Cold Plasma Market Analysis and Forecast, by End-user Industry

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user Industry, 2017-2031

8.3.1. Medical

8.3.2. Textile

8.3.3. Polymer & Plastics

8.3.4. Electronics & Semiconductor

8.3.5. Food & Beverages

8.3.6. Others

8.4. Market Attractiveness Analysis, by End-user Industry

9. Global Cold Plasma Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Cold Plasma Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Regime, 2017-2031

10.2.1. Atmospheric Cold Plasma

10.2.2. Low-pressure Cold Plasma

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Surface Treatment

10.3.2. Coating

10.3.3. Etching

10.3.4. Sterilization

10.3.5. Decontamination

10.3.6. Wound Healing

10.3.7. Diseases Treatment

10.3.8. Others

10.4. Market Value Forecast, by End-user Industry, 2017-2031

10.4.1. Medical

10.4.2. Textile

10.4.3. Polymer & Plastics

10.4.4. Electronics & Semiconductor

10.4.5. Food & Beverages

10.4.6. Others

10.5. Market Value Forecast, by Country/Sub-region, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Regime

10.6.2. By Application

10.6.3. By End-user Industry

10.6.4. By Country/Sub-region

11. Europe Cold Plasma Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Regime, 2017-2031

11.2.1. Atmospheric Cold Plasma

11.2.2. Low-pressure Cold Plasma

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Surface Treatment

11.3.2. Coating

11.3.3. Etching

11.3.4. Sterilization

11.3.5. Decontamination

11.3.6. Wound Healing

11.3.7. Diseases Treatment

11.3.8. Others

11.4. Market Value Forecast, by End-user Industry, 2017-2031

11.4.1. Medical

11.4.2. Textile

11.4.3. Polymer & Plastics

11.4.4. Electronics & Semiconductor

11.4.5. Food & Beverages

11.4.6. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Regime

11.6.2. By Application

11.6.3. By End-user Industry

11.6.4. By Country/Sub-region

12. Asia Pacific Cold Plasma Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Regime, 2017-2031

12.2.1. Atmospheric Cold Plasma

12.2.2. Low-pressure Cold Plasma

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Surface Treatment

12.3.2. Coating

12.3.3. Etching

12.3.4. Sterilization

12.3.5. Decontamination

12.3.6. Wound Healing

12.3.7. Diseases Treatment

12.3.8. Others

12.4. Market Value Forecast, by End-user Industry, 2017-2031

12.4.1. Medical

12.4.2. Textile

12.4.3. Polymer & Plastics

12.4.4. Electronics & Semiconductor

12.4.5. Food & Beverages

12.4.6. Others

12.5. Market Value Forecast, by Country/sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of APAC

12.6. Market Attractiveness Analysis

12.6.1. By Regime

12.6.2. By Application

12.6.3. By End-user Industry

12.6.4. By Country/Sub-region

13. Latin America Cold Plasma Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Regime, 2017-2031

13.2.1. Atmospheric Cold Plasma

13.2.2. Low-pressure Cold Plasma

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Surface Treatment

13.3.2. Coating

13.3.3. Etching

13.3.4. Sterilization

13.3.5. Decontamination

13.3.6. Wound Healing

13.3.7. Diseases Treatment

13.3.8. Others

13.4. Market Value Forecast, by End-user Industry, 2017-2031

13.4.1. Medical

13.4.2. Textile

13.4.3. Polymer & Plastics

13.4.4. Electronics & Semiconductor

13.4.5. Food & Beverages

13.4.6. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Regime

13.6.2. By Application

13.6.3. By End-user Industry

13.6.4. By Country/Sub-region

14. Middle East & Africa Cold Plasma Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Regime, 2017-2031

14.2.1. Atmospheric Cold Plasma

14.2.2. Low-pressure Cold Plasma

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Surface Treatment

14.3.2. Coating

14.3.3. Etching

14.3.4. Sterilization

14.3.5. Decontamination

14.3.6. Wound Healing

14.3.7. Diseases Treatment

14.3.8. Others

14.4. Market Value Forecast, by End-user Industry, 2017-2031

14.4.1. Medical

14.4.2. Textile

14.4.3. Polymer & Plastics

14.4.4. Electronics & Semiconductor

14.4.5. Food & Beverages

14.4.6. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle Eat & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Regime

14.6.2. By Application

14.6.3. By End-user Industry

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Plasmatreat GmbH

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Relyon plasma GmbH

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. CINOGY System GmbH

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Adtec Healthcare Limited.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. neoplas med GmbH

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Apyx Medical.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. AcXys Technologies

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Leaflife Technology

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Nova Plasma Ltd.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Henniker Plasma Treatment

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables

Table 01: Global Cold Plasma Market Size (US$ Mn) Forecast, by Regime, 2017-2031

Table 02: Global Cold Plasma Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 03: Global Cold Plasma Market Size (US$ Mn) Forecast, by End-user Industry, 2017-2031

Table 04: Global Cold Plasma Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Cold Plasma Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Cold Plasma Market Size (US$ Mn) Forecast, by Regime, 2017-2031

Table 07: North America Cold Plasma Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 08: North America Cold Plasma Market Size (US$ Mn) Forecast, by End-user Industry, 2017-2031

Table 09: Europe Cold Plasma Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Cold Plasma Market Size (US$ Mn) Forecast, by Regime, 2017-2031

Table 11: Europe Cold Plasma Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 12: Europe Cold Plasma Market Size (US$ Mn) Forecast, by End-user Industry, 2017-2031

Table 13: Asia Pacific Cold Plasma Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Cold Plasma Market Size (US$ Mn) Forecast, by Regime, 2017-2031

Table 15: Asia Pacific Cold Plasma Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 16: Asia Pacific Cold Plasma Market Size (US$ Mn) Forecast, by End-user Industry, 2017-2031

Table 17: Latin America Cold Plasma Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Cold Plasma Market Size (US$ Mn) Forecast, by Regime, 2017-2031

Table 19: Latin America Cold Plasma Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 20: Latin America Cold Plasma Market Size (US$ Mn) Forecast, by End-user Industry, 2017-2031

Table 21: Middle East and Africa Cold Plasma Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East and Africa Cold Plasma Market Size (US$ Mn) Forecast, by Regime, 2017-2031

Table 23: Middle East and Africa Cold Plasma Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Middle East and Africa Cold Plasma Market Size (US$ Mn) Forecast, by End-user Industry, 2017-2031

List of Figures

Figure 01: Global Cold Plasma Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Cold Plasma Market Value Share, by Regime, 2022

Figure 03: Global Cold Plasma Market Value Share, by Application, 2022

Figure 04: Global Cold Plasma Market Value Share, by End-user Industry, 2022

Figure 05: Global Cold Plasma Market Value Share Analysis, by Regime, 2022 and 2031

Figure 06: Global Cold Plasma Market Revenue (US$ Mn), by Atmospheric Cold Plasma, 2017-2031

Figure 07: Global Cold Plasma Market Revenue (US$ Mn), by Low-pressure Cold Plasma, 2017-2031

Figure 08: Global Cold Plasma Market Attractiveness Analysis, by Regime, 2023-2031

Figure 09: Global Cold Plasma Market Value Share Analysis, by Application, 2022 and 2031

Figure 10: Global Cold Plasma Market Revenue (US$ Mn), by Surface Treatment, 2017-2031

Figure 11: Global Cold Plasma Market Revenue (US$ Mn), by Coating, 2017-2031

Figure 12: Global Cold Plasma Market Revenue (US$ Mn), by Etching, 2017-2031

Figure 13: Global Cold Plasma Market Revenue (US$ Mn), by Sterilization, 2017-2031

Figure 14: Global Cold Plasma Market Revenue (US$ Mn), by Decontamination, 2017-2031

Figure 15: Global Cold Plasma Market Revenue (US$ Mn), by Wound Healing, 2017-2031

Figure 16: Global Cold Plasma Market Revenue (US$ Mn), by Diseases Treatment, 2017-2031

Figure 17: Global Cold Plasma Market Revenue (US$ Mn), by Others, 2017-2031

Figure 18: Global Cold Plasma Market Attractiveness Analysis, by Application, 2023-2031

Figure 19: Global Cold Plasma Market Value Share Analysis, by End-user Industry,, 2022 and 2031

Figure 20: Global Cold Plasma Market Revenue (US$ Mn), by Medical, 2017-2031

Figure 21: Global Cold Plasma Market Revenue (US$ Mn), by Textile, 2017-2031

Figure 22: Global Cold Plasma Market Revenue (US$ Mn), by Polymer & Plastics, 2017-2031

Figure 23: Global Cold Plasma Market Revenue (US$ Mn), by Electronics & Semiconductor, 2017-2031

Figure 24: Global Cold Plasma Market Revenue (US$ Mn), by Food & Beverages, 2017-2031

Figure 25: Global Cold Plasma Market Revenue (US$ Mn), by Others, 2017-2031

Figure 26: Global Cold Plasma Market Attractiveness Analysis, by End-user Industry, 2023-2031

Figure 27: Global Cold Plasma Market Value Share Analysis, by Region, 2022 and 2031

Figure 28: Global Cold Plasma Market Attractiveness Analysis, by Region, 2023-2031

Figure 29: North America Cold Plasma Market Value (US$ Mn) Forecast, 2017-2031

Figure 30: North America Cold Plasma Market Value Share Analysis, by Country, 2022 and 2031

Figure 31: North America Cold Plasma Market Attractiveness Analysis, by Country, 2023-2031

Figure 32: North America Cold Plasma Market Value Share Analysis, by Regime, 2022 and 2031

Figure 33: North America Cold Plasma Market Attractiveness Analysis, by Regime, 2023-2031

Figure 34: North America Cold Plasma Market Value Share Analysis, by Application, 2022 and 2031

Figure 35: North America Cold Plasma Market Attractiveness Analysis, by Application, 2023-2031

Figure 36: North America Cold Plasma Market Value Share Analysis, by End-user Industry,, 2022 and 2031

Figure 37: North America Cold Plasma Market Attractiveness Analysis, by End-user Industry,, 2023-2031

Figure 38: Europe Cold Plasma Market Value (US$ Mn) Forecast, 2017-2031

Figure 39: Europe Cold Plasma Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 40: Europe Cold Plasma Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 41: Europe Cold Plasma Market Value Share Analysis, by Regime, 2022 and 2031

Figure 42: Europe Cold Plasma Market Attractiveness Analysis, by Regime, 2023-2031

Figure 43: Europe Cold Plasma Market Value Share Analysis, by Application, 2022 and 2031

Figure 44: Europe Cold Plasma Market Attractiveness Analysis, by Application, 2023-2031

Figure 45: Europe Cold Plasma Market Value Share Analysis, by End-user Industry, 2022 and 2031

Figure 46: Europe Cold Plasma Market Attractiveness Analysis, by End-user Industry, 2023-2031

Figure 47: Asia Pacific Cold Plasma Market Value (US$ Mn) Forecast, 2017-2031

Figure 48: Asia Pacific Cold Plasma Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 49: Asia Pacific Cold Plasma Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 50: Asia Pacific Cold Plasma Market Value Share Analysis, by Regime, 2022 and 2031

Figure 51: Asia Pacific Cold Plasma Market Attractiveness Analysis, by Regime, 2023-2031

Figure 52: Asia Pacific Cold Plasma Market Value Share Analysis, by Application, 2022 and 2031

Figure 53: Asia Pacific Cold Plasma Market Attractiveness Analysis, by Application, 2023-2031

Figure 54: Asia Pacific Cold Plasma Market Value Share Analysis, by End-user Industry,, 2022 and 2031

Figure 55: Asia Pacific Cold Plasma Market Attractiveness Analysis, by End-user Industry,, 2023-2031

Figure 56: Latin America Cold Plasma Market Value (US$ Mn) Forecast, 2017-2031

Figure 57: Latin America Cold Plasma Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 58: Latin America Cold Plasma Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 59: Latin America Cold Plasma Market Value Share Analysis, by Regime, 2022 and 2031

Figure 60: Latin America Cold Plasma Market Attractiveness Analysis, by Regime, 2023-2031

Figure 61: Latin America Cold Plasma Market Value Share Analysis, by Application, 2022 and 2031

Figure 62: Latin America Cold Plasma Market Attractiveness Analysis, by Application, 2023-2031

Figure 63: Latin America Cold Plasma Market Value Share Analysis, by End-user Industry,, 2022 and 2031

Figure 64: Latin America Cold Plasma Market Attractiveness Analysis, by End-user Industry,, 2023-2031

Figure 65: Middle East and Africa Cold Plasma Market Value (US$ Mn) Forecast, 2017-2031

Figure 66: Middle East and Africa Cold Plasma Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 67: Middle East and Africa Cold Plasma Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 68: Middle East and Africa Cold Plasma Market Value Share Analysis, by Regime, 2022 and 2031

Figure 69: Middle East and Africa Cold Plasma Market Attractiveness Analysis, by Regime, 2023-2031

Figure 70: Middle East and Africa Cold Plasma Market Value Share Analysis, by Application, 2022 and 2031

Figure 71: Middle East and Africa Cold Plasma Market Attractiveness Analysis, by Application, 2023-2031

Figure 72: Middle East and Africa Cold Plasma Market Value Share Analysis, by End-user Industry,, 2022 and 2031

Figure 73: Middle East and Africa Cold Plasma Market Attractiveness Analysis, by End-user Industry, 2023-2031

Figure 74: Company Share Analysis