Reports

Reports

The coating resins market has been showing consistency in growth due to the increased demand from the construction, automotive, packaging, and industrial sectors where coating resins are needed to preserve the surface and as part of a decorative layer. In paints and coatings, the coating resins form the adhesive component that gives the protective properties of bonding strength, adhesion, and environmental resistance against corrosion, ultraviolet radiation and chemicals. The rising urbanization and construction of renewed infrastructure in addition the rising use of lightweight materials in automotive and aviation industries are contributing to the movement toward advanced resin-based coats. Furthermore, the trend toward more environmentally-friendly and renewable resins is driving fabricators to produce water borne, UV curable and bio-based resins to comply with new environmental standards.

The major players are focusing on intensive R&D, strategic alliance, and product design to improve the performance qualities and lower VOC emissions. Upscaling of production facilities and tailoring of products volumes for customers are some of the aspects boosting the growth of the market as coating resins are becoming a critical agent in the current, advanced industrial, and consumer products.

The coating resins are used as the major film-forming agent in coating and paint formulas. These resins play a pivoting role in offering durability as well as enhancing the looks of the surfaces. Coating resins have undergone a wide adoption in industries with applications matching long-lifespan and high performance finishes across a broad array of industries.

Coating resins can find massive application in construction, automobile, packaging, marine, and industrial devices. They are the vital binder that binds pigments and additives, thereby enabling coatings to resist wear, corrosion, ultraviolet radiations, and chemicals. Diverse resin types in processes like water-borne, solvent-borne, powder coating, and UV-curable coatings enable it to regulatory requirements.

| Attribute | Detail |

|---|---|

| Coating Resins Market Drivers |

|

The automotive and transportation segment is also becoming one of the key drivers to the coating resins market mainly due to increased need for high-performance coatings with attributes that provide durability as well as visual appeal. Resins, in coating, play a vital role of providing excellent protective solutions to both the exterior and interior surfaces of a vehicle against the various environmental stressors including the UV radiations, corrosion, humidity, abrasion, and exposure to chemicals. Apart from protection, the resins improve the eye-appeal of vehicles as gloss, smoothness, and color stability are becoming more valuable among both premium and mass-market clients. As the lightweight automotive industries continue to accelerate towards its upturn, manufacturers are increasingly turning to the most advanced coating technology to boost fuel savings even as vehicle life cycle increases. ‘

The transportation sector includes automotive, aerospace, railway, and marine industries and is increasingly adopting environmentally-friendly resins pressure on volatile organic compounds (VOC) emissions. UV-curable resins are used where solvent-based products are being slowly phased out to achieve environmental sustainability but with no diminution of their performance. Further, new developments in scratch resistant, self-healing, anti-fouling coatings are opening up new opportunities in specialty transport uses of resins. Market leaders are also placing a strong emphasis on research and development to develop more adhesive resins, with shorter curing times and less negative effect on the environment.

The more visible impact sustainability and environmental stewardship has on the global economy has prompted the introduction of low-VOC (volatile organic compound) and eco-friendly coatings as a primary factor for growth in the coating resins market. Solvent-borne coatings have been historically effective, but the drawbacks include increased emissions of VOCs that result in air pollution, smog formation, and illness. Regulatory agencies around the world (in the US - EPA, in Europe - ECHA) are now setting even more stringent emission levels, prompting industries clean alternatives and indicating increased usage of water, UV curable, powder & bio resins. This trend has given manufacturers an opportunity to align their product portfolios meeting sustainable product standards and customer expectations.

Moving to sustainable resins is not just an environmental compliance issue but also a business strategic decision. End-users in the construction industry, automotive, packaging, and industrial. manufacturing industries are now focusing more on coating that has low carbon footprint but would not affect performance.

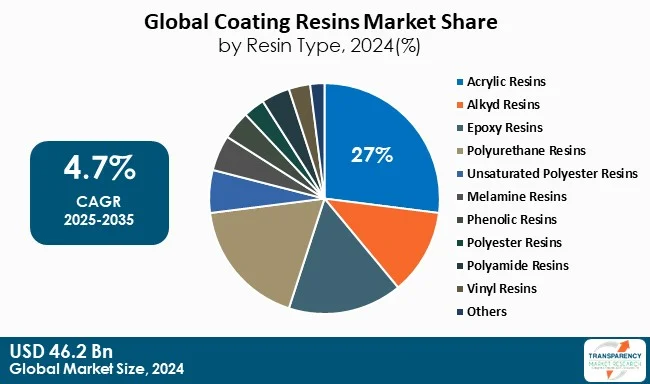

Acrylic resins dominate the coating resins market as they offer a good balance in terms of durability, UV, and weather resistance. As such, they are used in architectural, automobile, and industrial applications. They dry instantly, do not fade or break in strength much after exposure, and have good gloss retention, as well as work well with both solvent-based and water-based coatings. Moreover, the rise in demand for environment-friendly, low-VOC paints correlates with acrylic resins that fit with environmentally-friendly technologies.

| Attribute | Detail |

|---|---|

| Leading Region |

|

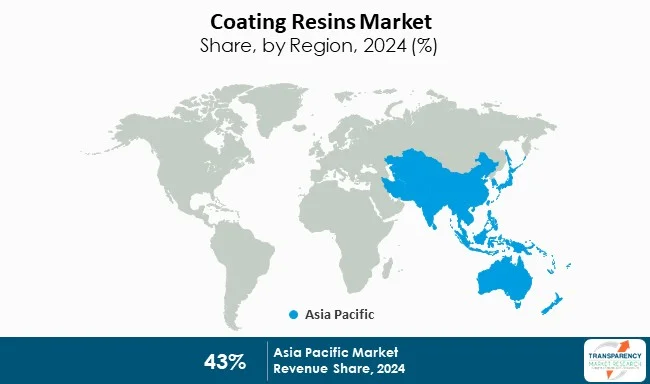

Asia-Pacific region leads in coating resins market due to urbanization and infrastructure Project, as well as high production of automotive in countries such as India and China. Growth of construction activities, and increasing demand for high-performance and eco-friendly coatings also promote growth. Additionally, lower manufacturing costs and government-backed industrial development encouraged many global players to set up their production facilities in this region, and boosting the region's market share even higher.

BASF SE, Arkema Group, Allnex Holdings S.a.r.l and Akzo Nobel N.v. are some of the major international players dealing with variability of coating resin solutions, especially acrylics, alkyd, epoxies, polyesters, and polyurethane resins. They offer portfolios that cover architectural, automotive, industrial, and packaging needs, thereby highlighting durability, weather resistance, sustainability. Eco-friendly low-VOC waterborne and UV-curable solutions are used to respond to the changing industry and regulatory requirements.

Additionally, LANXESS, Dow Inc., Royal DSM N.V., and Bayer AG play a major role in the consolidated coating resins market, with a competitive landscape governed by innovation and productivity.

In 2024, Arkema made a pioneering step forward by working with up to 40% post-consumer recycled PET in its powder coating resins, which, in total, will reduce product carbon footprints by as much as 20%. Arkema's innovation promotes circularity while maintaining a good performance on the part of the resin, and presents a new sustainable choice for industrial and architectural coating applications. It strengthens Arkema's role as a leader in low-waste, solvent-free coating innovations.

In 2024, Allnex launched energy-curable resins aimed at the textile and leather markets. The next-generation resins provide proper environmental benefits and superior performance for coatings on artificial leather and fabric. This is a strategic entry into the industrial area, allowing Allnex to apply its energy-cured technology in order to convert demand for sustainable and high-performance coating technologies.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 46.2 Bn |

| Market Forecast Value in 2035 | US$ 76.7 Bn |

| Growth Rate (CAGR) | 4.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Resin Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 46.2 Bn in 2024

The industry is expected to grow at a CAGR of 4.7% from 2025 to 2035

Expanding automotive and transportation coating applications and increasing preference for eco-friendly and low-VOC costings

Acrylic resins held the largest share under resin type segment in 2024

Asia Pacific was the most lucrative region of the coating resin market in 2024

BASF SE, LANXESS, Royal DSM N.V., Dow Inc., DIC Corporation, Bayer AG, AOC, Celanese Corporation, Arkema S.A., Solutia Inc., INEOS Group Holdings S.A., Huntsman International LLC., Evonik Industries AG.

Table 1 Global Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 2 Global Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 3 Global Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 4 Global Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 5 Global Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 6 Global Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 7 Global Market Volume (Tons) Forecast, by Category 2020 to 2035

Table 8 Global Market Value (US$ Bn) Forecast, by Category 2020 to 2035

Table 9 Global Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 10 Global Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 11 Global Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 12 Global Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 13 Global Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 14 Global Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 15 North America Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 16 North America Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 17 North America Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 18 North America Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 19 North America Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 20 North America Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 21 North America Market Volume (Tons) Forecast, by Category 2020 to 2035

Table 22 North America Market Value (US$ Bn) Forecast, by Category 2020 to 2035

Table 23 North America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 24 North America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25 North America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 26 North America Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 27 North America Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 28 North America Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 29 USA Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 30 USA Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 31 USA Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 32 USA Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 33 USA Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 34 USA Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 35 USA Market Volume (Tons) Forecast, by Category 2020 to 2035

Table 36 USA Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 37 USA Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 38 USA Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39 USA Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 40 USA Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 41 Canada Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 42 Canada Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 43 Canada Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 44 Canada Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 45 Canada Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 46 Canada Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 47 Canada Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 48 Canada Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 49 Canada Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 50 Canada Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51 Canada Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 52 Canada Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 53 Europe Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 54 Europe Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 55 Europe Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 56 Europe Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 57 Europe Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 58 Europe Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 59 Europe Market Volume (Tons) Forecast, by Category 2020 to 2035

Table 60 Europe Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 61 Europe Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 62 Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 63 Europe Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 64 Europe Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 65 Europe Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 66 Europe Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 67 Germany Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 68 Germany Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 69 Germany Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 70 Germany Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 71 Germany Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 72 Germany Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 73 Germany Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 74 Germany Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 75 Germany Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Germany Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Germany Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Germany Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 79 France Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 80 France Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 81 France Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 82 France Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 83 France Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 84 France Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 85 France Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 86 France Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 87 France Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 88 France Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 89 France Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 90 France Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 91 UK Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 92 UK Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 93 UK Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 94 UK Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 95 UK Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 96 UK Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 97 UK Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 98 UK Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 99 UK Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 UK Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101 UK Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 UK Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 103 Italy Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 104 Italy Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 105 Italy Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 106 Italy Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 107 Italy Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 108 Italy Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 109 Italy Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 110 Italy Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 111 Italy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 112 Italy Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 113 Italy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 114 Italy Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 115 Spain Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 116 Spain Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 117 Spain Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 118 Spain Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 119 Spain Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 120 Spain Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 121 Spain Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 122 Spain Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 123 Spain Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 124 Spain Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Spain Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 126 Spain Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 Russia & CIS Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 128 Russia & CIS Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 129 Russia & CIS Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 130 Russia & CIS Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 131 Russia & CIS Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 132 Russia & CIS Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 133 Russia & CIS Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 134 Russia & CIS Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 135 Russia & CIS Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 136 Russia & CIS Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 137 Russia & CIS Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Russia & CIS Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 139 Rest of Europe Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 140 Rest of Europe Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 141 Rest of Europe Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 142 Rest of Europe Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 143 Rest of Europe Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 144 Rest of Europe Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 145 Rest of Europe Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 146 Rest of Europe Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 147 Rest of Europe Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 148 Rest of Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 149 Rest of Europe Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Rest of Europe Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 151 Asia Pacific Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 152 Asia Pacific Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 153 Asia Pacific Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 154 Asia Pacific Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 155 Asia Pacific Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 156 Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 157 Asia Pacific Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 158 Asia Pacific Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 159 Asia Pacific Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 160 Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 161 Asia Pacific Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 162 Asia Pacific Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 163 Asia Pacific Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 164 Asia Pacific Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 165 China Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 166 China Market Value (US$ Bn) Forecast, by Resin Type 2020 to 2035

Table 167 China Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 168 China Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 169 China Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 170 China Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 171 China Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 172 China Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 173 China Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 174 China Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 175 China Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 176 China Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 177 Japan Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 178 Japan Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 179 Japan Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 180 Japan Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 181 Japan Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 182 Japan Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 183 Japan Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 184 Japan Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 185 Japan Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 186 Japan Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Japan Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 188 Japan Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 189 India Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 190 India Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 191 India Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 192 India Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 193 India Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 194 India Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 195 India Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 196 India Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 197 India Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 198 India Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 199 India Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 200 India Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 201 ASEAN Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 202 ASEAN Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 203 ASEAN Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 204 ASEAN Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 205 ASEAN Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 206 ASEAN Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 207 ASEAN Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 208 ASEAN Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 209 ASEAN Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 210 ASEAN Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 211 ASEAN Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 ASEAN Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Asia Pacific Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 214 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 215 Rest of Asia Pacific Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 216 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 217 Rest of Asia Pacific Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 218 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 219 Rest of Asia Pacific Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 220 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 221 Rest of Asia Pacific Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 222 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 223 Rest of Asia Pacific Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 224 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 225 Latin America Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 226 Latin America Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 227 Latin America Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 228 Latin America Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 229 Latin America Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 230 Latin America Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 231 Latin America Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 232 Latin America Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 233 Latin America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 234 Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 235 Latin America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 236 Latin America Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 237 Latin America Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 238 Latin America Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 239 Brazil Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 240 Brazil Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 241 Brazil Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 242 Brazil Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 243 Brazil Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 244 Brazil Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 245 Brazil Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 246 Brazil Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 247 Brazil Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 248 Brazil Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 249 Brazil Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 250 Brazil Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 251 Mexico Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 252 Mexico Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 253 Mexico Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 254 Mexico Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 255 Mexico Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 256 Mexico Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 257 Mexico Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 258 Mexico Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 259 Mexico Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 260 Mexico Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 Mexico Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 262 Mexico Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 263 Rest of Latin America Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 264 Rest of Latin America Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 265 Rest of Latin America Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 266 Rest of Latin America Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 267 Rest of Latin America Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 268 Rest of Latin America Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 269 Rest of Latin America Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 270 Rest of Latin America Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 271 Rest of Latin America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 272 Rest of Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 273 Rest of Latin America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 274 Rest of Latin America Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 275 Middle East & Africa Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 276 Middle East & Africa Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 277 Middle East & Africa Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 278 Middle East & Africa Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 279 Middle East & Africa Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 280 Middle East & Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 281 Middle East & Africa Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 282 Middle East & Africa Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 283 Middle East & Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 284 Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 285 Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 286 Middle East & Africa Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 287 Middle East & Africa Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 288 Middle East & Africa Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 289 GCC Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 290 GCC Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 291 GCC Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 292 GCC Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 293 GCC Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 294 GCC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 295 GCC Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 296 GCC Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 297 GCC Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 298 GCC Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 299 GCC Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 300 GCC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 301 South Africa Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 302 South Africa Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 303 South Africa Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 304 South Africa Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 305 South Africa Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 306 South Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 307 South Africa Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 308 South Africa Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 309 South Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 310 South Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 311 South Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 312 South Africa Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 313 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Resin Type, 2020 to 2035

Table 314 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Resin Type, 2020 to 2035

Table 315 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Substrate, 2020 to 2035

Table 316 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Substrate, 2020 to 2035

Table 317 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 318 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 319 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Category, 2020 to 2035

Table 320 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Category, 2020 to 2035

Table 321 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 322 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 323 Rest of Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 324 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Market Volume Share Analysis, by Resin Type, 2024, 2027, and 2035

Figure 2 Global Market Attractiveness, by Resin Type

Figure 3 Global Market Volume Share Analysis, by Substrate, 2024, 2027, and 2035

Figure 4 Global Market Attractiveness, by Substrate

Figure 5 Global Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 6 Global Market Attractiveness, by Technology

Figure 7 Global Market Volume Share Analysis, by Category, 2024, 2027, and 2035

Figure 8 Global Market Attractiveness, by Category

Figure 9 Global Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 10 Global Market Attractiveness, by Application

Figure 11 Global Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 12 Global Market Attractiveness, by End-use

Figure 13 Global Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 14 Global Market Attractiveness, by Region

Figure 15 North America Market Volume Share Analysis, by Resin Type, 2024, 2027, and 2035

Figure 16 North America Market Attractiveness, by Resin Type

Figure 17 North America Market Attractiveness, by Resin Type

Figure 18 North America Market Volume Share Analysis, by Substrate, 2024, 2027, and 2035

Figure 19 North America Market Attractiveness, by Substrate

Figure 20 North America Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 21 North America Market Attractiveness, by Technology

Figure 22 North America Market Volume Share Analysis, by Category, 2024, 2027, and 2035

Figure 23 North America Market Attractiveness, by Category

Figure 24 North America Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 25 North America Market Attractiveness, by Application

Figure 26 North America Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 27 North America Market Attractiveness, by End-use

Figure 28 North America Market Attractiveness, by Country and Sub-region

Figure 29 Europe Market Volume Share Analysis, by Resin Type, 2024, 2027, and 2035

Figure 30 Europe Market Attractiveness, by Resin Type

Figure 31 Europe Market Volume Share Analysis, by Substrate, 2024, 2027, and 2035

Figure 32 Europe Market Attractiveness, by Substrate

Figure 33 Europe Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 34 Europe Market Attractiveness, by Technology

Figure 35 Europe Market Volume Share Analysis, by Category, 2024, 2027, and 2035

Figure 36 Europe Market Attractiveness, by Category

Figure 37 Europe Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 38 Europe Market Attractiveness, by Application

Figure 39 Europe Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 40 Europe Market Attractiveness, by End-use

Figure 41 Europe Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 42 Europe Market Attractiveness, by Country and Sub-region

Figure 43 Asia Pacific Market Volume Share Analysis, by Resin Type, 2024, 2027, and 2035

Figure 44 Asia Pacific Market Attractiveness, by Resin Type

Figure 45 Asia Pacific Market Volume Share Analysis, by Substrate, 2024, 2027, and 2035

Figure 46 Asia Pacific Market Attractiveness, by Substrate

Figure 47 Asia Pacific Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 48 Asia Pacific Market Attractiveness, by Technology

Figure 49 Asia Pacific Market Volume Share Analysis, by Category, 2024, 2027, and 2035

Figure 50 Asia Pacific Market Attractiveness, by Category

Figure 51 Asia Pacific Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 52 Asia Pacific Market Attractiveness, by Application

Figure 53 Asia Pacific Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 54 Asia Pacific Market Attractiveness, by End-use

Figure 55 Asia Pacific Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 56 Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 57 Latin America Market Volume Share Analysis, by Resin Type, 2024, 2027, and 2035

Figure 58 Latin America Market Attractiveness, by Resin Type

Figure 59 Latin America Market Volume Share Analysis, by Substrate, 2024, 2027, and 2035

Figure 60 Latin America Market Attractiveness, by Substrate

Figure 61 Latin America Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 62 Latin America Market Attractiveness, by Technology

Figure 63 Latin America Market Volume Share Analysis, by Category, 2024, 2027, and 2035

Figure 64 Latin America Market Attractiveness, by Category

Figure 65 Latin America Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 66 Latin America Market Attractiveness, by Application

Figure 67 Latin America Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 68 Latin America Market Attractiveness, by End-use

Figure 69 Latin America Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 70 Latin America Market Attractiveness, by Country and Sub-region

Figure 71 Middle East & Africa Market Volume Share Analysis, by Resin Type, 2024, 2027, and 2035

Figure 72 Middle East & Africa Market Attractiveness, by Resin Type

Figure 73 Middle East & Africa Market Volume Share Analysis, by Substrate, 2024, 2027, and 2035

Figure 74 Middle East & Africa Market Attractiveness, by Substrate

Figure 75 Middle East & Africa Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 76 Middle East & Africa Market Attractiveness, by Technology

Figure 77 Middle East & Africa Market Volume Share Analysis, by Category, 2024, 2027, and 2035

Figure 78 Middle East & Africa Market Attractiveness, by Category

Figure 79 Middle East & Africa Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 80 Middle East & Africa Market Attractiveness, by Application

Figure 81 Middle East & Africa Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 82 Middle East & Africa Market Attractiveness, by End-use

Figure 83 Middle East & Africa Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 84 Middle East & Africa Market Attractiveness, by Country and Sub-region