Reports

Reports

The concept of self-administered blood collection is becoming increasingly mainstream in the wake of the COVID-19 pandemic. For instance, Tasso Inc.- a medical equipment manufacturer in Seattle, has been successful in acquiring a funding of US$ 17 Mn to innovate in a push-button blood sampling device that does not require any training. Thus, companies in the capillary and venous blood sampling devices market are taking cues from such innovations to increase the availability of home blood testing devices. As such, home-based capillary and venous blood sampling devices are being used by individuals to administer any chronic or infectious diseases, as the COVID-19 scare continues to surge worldwide. This is driving the capillary and venous blood sampling devices market.

With the help of telemedicine, individuals can conduct virtual clinical trials via self-administered blood collection devices.

Innovative sample handling and analytical technologies are being used in clinical studies in order to make diagnostic blood testing more accessible and convenient. Hence, companies in the capillary and venous blood sampling devices market are entering into strategic partnerships to improve clinical outcomes. For instance, the medical technology company, BD (Becton, Dickinson and Company), announced collaboration with transformative diagnostic blood testing company Babson Diagnostics to increase the availability of less expensive laboratory testing in a customer-friendly manner.

The development of innovative capillary and venous blood sampling devices is in the pipeline for med-tech companies. The goal is to increase the availability of laboratory-quality diagnostic testing through retail pharmacies. Hence, companies in the capillary and venous blood sampling devices market are increasing their R&D activities to innovate in small-volume blood collection devices that can be made available in urgent care centers and skilled nursing facilities.

Companies in the capillary and venous blood sampling devices market are developing disposable blood collection devices that use capillary action that help to draw blood from tiny channels. A fingerstick is among the list of popular disposable blood collection devices found to show good results in HIV (Human Immunodeficiency Virus) clinical trials. However, the potential variation between droplets of blood during HIV viral load tests acts as a restraining factor, thus affecting the sales of fingersticks. Hence, companies are overcoming these obstacles by focusing on technologies that collect microliters of capillary blood.

Seventh Sense Biosystems gained global recognition for its TAP device, which is a novel push-button blood collection device that uses a vacuum chamber to collect up to several microliters of capillary blood. Manufacturers in the capillary and venous blood sampling devices market are increasing efforts to develop devices with large volume capacities.

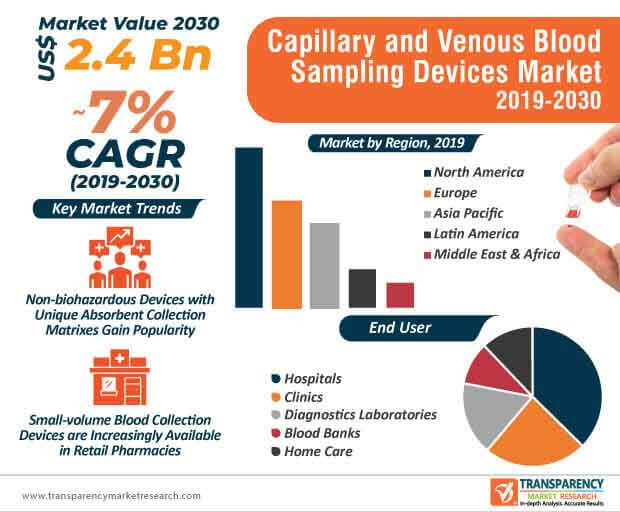

The demand for non-biohazard devices is surging in the diagnostic testing landscape. Hence, San Francisco-based med-tech company Spot On Sciences has introduced HemaSpot HF, which is an FDA-(Food & Drug Association) pending Class 2 Device, which, after the collection and transportation of blood microsamples becomes non-biohazardous after drying. Such innovations are bolstering the growth of the capillary and venous blood sampling devices market, which is estimated to reach a value of US$ 2.4 Bn by 2030.

Med-tech companies in the capillary and venous blood sampling devices market are increasing their research efforts to introduce unique absorbent collection matrixes in the cartridges of devices to prevent risks of bio-hazardous incidences. They are increasing focus in moisture-tight designs for capillary and venous blood sampling devices with tamper-evident latches so that the sample results remain uncompromised.

Self-management is becoming increasingly important in the healthcare sector, especially for chronic diabetic patients. Self-diagnosis and patient empowerment has led to decline in costs for both doctors as well as patients, whilst improving patient independence. As such, the growing number of diabetic patients worldwide has been a key driver for growth of the capillary and venous blood sampling devices market, which is predicted to expand at a healthy CAGR of ~7% during the forecast period. Thus, unfavorable health outcomes due to diabetes such as kidney impairment and peripheral neuropathy have increased the demand for blood draws in laboratory settings.

Regular doctor visits and frequent lab tests can be potentially inconvenient for diabetic patients. Hence, manufacturers in the capillary and venous blood sampling devices market are increasing their production capabilities to develop finger-prick devices that help patients to draw blood by themselves.

Microsampling is a prominent trend in the capillary and venous blood sampling devices market. Its minimally invasive attributes are catalyzing the demand for innovative capillary and venous blood sampling devices. Positive growth factors such as advancements in molecular detection techniques have further popularized microsampling. Thus, microsampling is becoming increasingly commonplace in point-of-care (POC) devices.

Companies in the capillary and venous blood sampling devices market are becoming increasingly aware about the limitations of conventional blood sampling approaches such as biomarker detection. Hence, manufacturers are turning toward microsampling techniques to improve patient quality of life. Since conventional blood collection techniques, such as phlebotomy involve the use of invasive needles and catheters, healthcare professionals have raised a demand for non-invasive techniques including microsampling. Though phlebotomy is considered as the gold standard for blood sampling, manufacturers are focusing on microsampling to reduce the cost and time-consuming efforts associated with phlebotomy capillary and venous blood sampling devices.

Analysts’ Viewpoint

Manufacturers in the capillary and venous blood sampling devices market are increasing their focus to develop COVID-19 rapid test kits that are suitable for qualitative detection of the novel coronavirus using finger-prick samples. Companies are increasing efforts to innovate in small volume blood collection devices that are being made available for retail pharmacies. However, conventional blood sampling techniques such as phlebotomy are potentially time-consuming and costly for healthcare facilities. Hence, companies should develop capillary blood microsampling systems to help overcome the obstacles of traditional blood sampling techniques. They should also gain proficiency in the development of non-biohazardous devices that deliver uncompromised results.

Capillary and venous blood sampling devices market is estimated to reach a value of US$ 2.4 Bn by 2030

Capillary and venous blood sampling devices market is projected to expand at a CAGR of ~7% from 2020 to 2030

Capillary and venous blood sampling devices market is driven by increase in prevalence of diabetes and availability of point-of-Care (PoC) diagnostics

The venous blood collection devices segment accounted for a prominent share of the global capillary and venous blood sampling devices market

Key players in the global capillary and venous blood sampling devices market include B. Braun Melsungen AG, Terumo Corporation, BD, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Capillary and Venous Blood Sampling Devices Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Market Dynamics

4.2.1. Drivers and Restraints Snapshot Analysis

4.2.2. Drivers

4.2.3. Restraints

4.2.4. Opportunities

4.3. Global Capillary and Venous Blood Sampling Devices Market Revenue Projection

4.4. Global Capillary and Venous Blood Sampling Devices Market Outlook

5. Market Outlook

5.1. Pricing Analysis

5.2. Capillary Blood Sampling : Overview

5.3. Global Point-of-Care vs. Centralized Laboratory Testing Market Overview

5.4. Market Footprint Analysis

5.5. COVID-19 Pandemic Impact on Global Capillary and Venous Blood Sampling Devices Industry

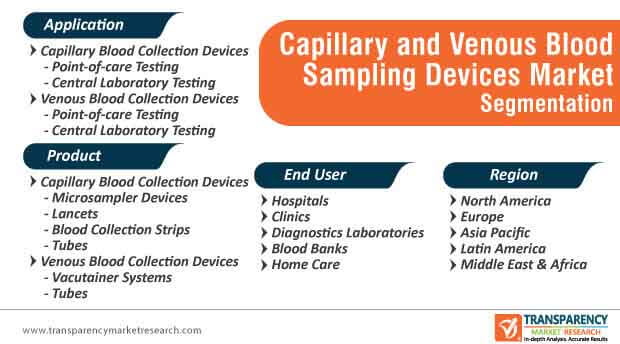

6. Global Capillary and Venous Blood Sampling Devices Market, by Product

6.1. Definition

6.2. Introduction

6.3. Global Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Product

6.4. Global Capillary and Venous Blood Sampling Devices Market Forecast, by Product

6.4.1. Capillary Blood Collection Devices

6.4.1.1. Microsampler Devices

6.4.1.2. Lancets

6.4.1.3. Blood Collection Strips

6.4.1.4. Tubes

6.4.2. Venous Blood Collection Devices

6.4.2.1. Vacutainer System

6.4.2.2. Tubes

6.5. Global Capillary and Venous Blood Sampling Devices Market Analysis, by Product

7. Global Capillary and Venous Blood Sampling Devices Market, by Application

7.1. Introduction

7.2. Global Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Application

7.3. Global Capillary and Venous Blood Sampling Devices Market Forecast, by Application

7.3.1. Capillary Blood Collection Devices

7.3.1.1. Point-of-care Testing

7.3.1.2. Central Laboratory Testing

7.3.2. Venous Blood Collection Devices

7.3.2.1. Point-of-care Testing

7.3.2.2. Central Laboratory Testing

7.4. Global Capillary and Venous Blood Sampling Devices Market Analysis, by Application

8. Global Capillary and Venous Blood Sampling Devices Market, by End-user

8.1. Definition

8.2. Introduction

8.3. Global Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by End-user

8.4. Global Capillary and Venous Blood Sampling Devices Market Forecast, by End-user

8.4.1. Hospitals

8.4.2. Clinics

8.4.3. Diagnostics Laboratories

8.4.4. Blood Banks

8.4.5. Home Care

8.5. Global Capillary and Venous Blood Sampling Devices Market Analysis, by End-user

9. Global Capillary and Venous Blood Sampling Devices Market Analysis, by Region

9.1. Global Capillary and Venous Blood Sampling Devices Market Snapshot, by Country

9.2. Global Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Region

9.3. Global Capillary and Venous Blood Sampling Devices Market Forecast, by Region

10. North America Capillary and Venous Blood Sampling Devices Market Analysis

10.1. North America Capillary and Venous Blood Sampling Devices Market Analysis

10.2. North America Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Country

10.3. North America Capillary and Venous Blood Sampling Devices Market Forecast, by Country

10.3.1. U.S.

10.3.2. Canada

10.4. North America Capillary and Venous Blood Sampling Devices Market Value Share & Attractiveness Analysis, by Product

10.5. North America Capillary and Venous Blood Sampling Devices Market Forecast, by Product

10.5.1. Capillary Blood Collection Devices

10.5.1.1. Microsampler Devices

10.5.1.2. Lancets

10.5.1.3. Blood Collection Strips

10.5.1.4. Tubes

10.5.2. Venous Blood Collection Devices

10.5.2.1. Vacutainer System

10.5.2.2. Tubes

10.6. North America Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Application

10.7. North America Capillary and Venous Blood Sampling Devices Market Forecast, by Application

10.7.1. Capillary Blood Collection Devices

10.7.1.1. Point-of-care Testing

10.7.1.2. Central Laboratory Testing

10.7.2. Venous Blood Collection Devices

10.7.2.1. Point-of-care Testing

10.7.2.2. Central Laboratory Testing

10.8. North America Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by End-user

10.9. North America Capillary and Venous Blood Sampling Devices Market Forecast, by End-user

10.9.1. Hospitals

10.9.2. Clinics

10.9.3. Diagnostics Laboratories

10.9.4. Blood Banks

10.9.5. Home Care

11. Europe Capillary and Venous Blood Sampling Devices Market Analysis

11.1. Europe Capillary and Venous Blood Sampling Devices Market Analysis

11.2. Europe Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Country/Sub-region

11.3. Europe Capillary and Venous Blood Sampling Devices Market Forecast, by Country/Sub-region

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

11.4. Europe Capillary and Venous Blood Sampling Devices Market Value Share & Attractiveness Analysis, by Product

11.5. Europe Capillary and Venous Blood Sampling Devices Market Forecast, by Product

11.5.1. Capillary Blood Collection Devices

11.5.1.1. Microsampler Devices

11.5.1.2. Lancets

11.5.1.3. Blood Collection Strips

11.5.1.4. Tubes

11.5.2. Venous Blood Collection Devices

11.5.2.1. Vacutainer System

11.5.2.2. Tubes

11.6. Europe Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Application

11.7. Europe Capillary and Venous Blood Sampling Devices Market Forecast, by Application

11.7.1. Capillary Blood Collection Devices

11.7.1.1. Point-of-care Testing

11.7.1.2. Central Laboratory Testing

11.7.2. Venous Blood Collection Devices

11.7.2.1. Point-of-care Testing

11.7.2.2. Central Laboratory Testing

11.8. Europe Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by End-user

11.9. Europe Capillary and Venous Blood Sampling Devices Market Forecast, by End-user

11.9.1. Hospitals

11.9.2. Clinics

11.9.3. Diagnostics Laboratories

11.9.4. Blood Banks

11.9.5. Home Care

12. Asia Pacific Capillary and Venous Blood Sampling Devices Market Analysis

12.1. Asia Pacific Capillary and Venous Blood Sampling Devices Market Analysis

12.2. Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Country/Sub-region

12.3. Asia Pacific Capillary and Venous Blood Sampling Devices Market Forecast, by Country/Sub-region

12.3.1. China

12.3.2. Japan

12.3.3. India

12.3.4. Australia & New Zealand

12.3.5. Rest of Asia Pacific

12.4. Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share & Attractiveness Analysis, by Product

12.5. Asia Pacific Capillary and Venous Blood Sampling Devices Market Forecast, by Product

12.5.1. Capillary Blood Collection Devices

12.5.1.1. Microsampler Devices

12.5.1.2. Lancets

12.5.1.3. Blood Collection Strips

12.5.1.4. Tubes

12.5.2. Venous Blood Collection Devices

12.5.2.1. Vacutainer System

12.5.2.2. Tubes

12.6. Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Application

12.7. Asia Pacific Capillary and Venous Blood Sampling Devices Market Forecast, by Application

12.7.1. Capillary Blood Collection Devices

12.7.1.1. Point-of-care Testing

12.7.1.2. Central Laboratory Testing

12.7.2. Venous Blood Collection Devices

12.7.2.1. Point-of-care Testing

12.7.2.2. Central Laboratory Testing

12.8. Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by End-user

12.9. Asia Pacific Capillary and Venous Blood Sampling Devices Market Forecast, by End-user

12.9.1. Hospitals

12.9.2. Clinics

12.9.3. Diagnostics Laboratories

12.9.4. Blood Banks

12.9.5. Home Care

13. Latin America Capillary and Venous Blood Sampling Devices Market Analysis

13.1. Latin America Capillary and Venous Blood Sampling Devices Market Analysis

13.2. Latin America Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Country/Sub-region

13.3. Latin America Capillary and Venous Blood Sampling Devices Market Forecast, by Country/Sub-region

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Rest of Latin America

13.4. Latin America Capillary and Venous Blood Sampling Devices Market Value Share & Attractiveness Analysis, by Product

13.5. Latin America Capillary and Venous Blood Sampling Devices Market Forecast, by Product

13.5.1. Capillary Blood Collection Devices

13.5.1.1. Microsampler Devices

13.5.1.2. Lancets

13.5.1.3. Blood Collection Strips

13.5.1.4. Tubes

13.5.2. Venous Blood Collection Devices

13.5.2.1. Vacutainer System

13.5.2.2. Tubes

13.6. Latin America Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Application

13.7. Latin America Capillary and Venous Blood Sampling Devices Market Forecast, by Application

13.7.1. Capillary Blood Collection Devices

13.7.1.1. Point-of-care Testing

13.7.1.2. Central Laboratory Testing

13.7.2. Venous Blood Collection Devices

13.7.2.1. Point-of-care Testing

13.7.2.2. Central Laboratory Testing

13.8. Latin America Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by End-user

13.9. Latin America Capillary and Venous Blood Sampling Devices Market Forecast, by End-user

13.9.1. Hospitals

13.9.2. Clinics

13.9.3. Diagnostics Laboratories

13.9.4. Blood Banks

13.9.5. Home Care

14. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Analysis

14.1. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Analysis

14.2. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Country

14.3. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Forecast, by Country/Sub-region

14.3.1. GCC Countries

14.3.2. South Africa

14.3.3. Rest of Middle East & Africa

14.4. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share & Attractiveness Analysis, by Product

14.5. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Forecast, by Product

14.5.1. Capillary Blood Collection Devices

14.5.1.1. Microsampler Devices

14.5.1.2. Lancets

14.5.1.3. Blood Collection Strips

14.5.1.4. Tubes

14.5.2. Venous Blood Collection Devices

14.5.2.1. Vacutainer System

14.5.2.2. Tubes

14.6. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by Application

14.7. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Forecast, by Application

14.7.1. Capillary Blood Collection Devices

14.7.1.1. Point-of-care Testing

14.7.1.2. Central Laboratory Testing

14.7.2. Venous Blood Collection Devices

14.7.2.1. Point-of-care Testing

14.7.2.2. Central Laboratory Testing

14.8. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share and Attractiveness Analysis, by End-user

14.9. Middle East & Africa Capillary and Venous Blood Sampling Devices Market Forecast, by End-user

14.9.1. Hospitals

14.9.2. Clinics

14.9.3. Diagnostics Laboratories

14.9.4. Blood Banks

14.9.5. Home Care

15. Competitive Landscape

15.1. Company Profile

15.1.1. B. Braun Melsungen AG.

15.1.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.1.2. Financial Overview

15.1.1.3. Product Portfolio

15.1.1.4. SWOT Analysis

15.1.1.5. Strategic Overview

15.1.2. Terumo Corporation

15.1.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.2.2. Financial Overview

15.1.2.3. Product Portfolio

15.1.2.4. SWOT Analysis

15.1.2.5. Strategic Overview

15.1.3. BD

15.1.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.3.2. Financial Overview

15.1.3.3. Product Portfolio

15.1.3.4. SWOT Analysis

15.1.3.5. Strategic Overview

15.1.4. Thermo Fisher Scientific, Inc.

15.1.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.4.2. Product Portfolio

15.1.4.3. SWOT Analysis

15.1.4.4. Strategic Overview

15.1.5. Bio-Rad Laboratories, Inc.

15.1.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.5.2. Financial Overview

15.1.5.3. Product Portfolio

15.1.5.4. SWOT Analysis

15.1.5.5. Strategic Overview

15.1.6. Ypsomed Holding AG

15.1.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.6.2. Financial Overview

15.1.6.3. Product Portfolio

15.1.6.4. SWOT Analysis

15.1.6.5. Strategic Overview

15.1.7. Owen Mumford Ltd.

15.1.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.7.2. Product Portfolio

15.1.7.3. SWOT Analysis

15.1.7.4. Strategic Overview

15.1.8. Greiner Bio-One International GmbH.

15.1.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.8.2. Financial Overview

15.1.8.3. Product Portfolio

15.1.8.4. SWOT Analysis

15.1.8.5. Strategic Overview

15.1.9. Sarstedt AG & Co. KG

15.1.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.9.2. Product Portfolio

15.1.9.3. SWOT Analysis

15.1.9.4. Strategic Overview

15.1.10. Cardinal Health

15.1.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.10.2. Financial Overview

15.1.10.3. Product Portfolio

15.1.10.4. SWOT Analysis

15.1.10.5. Strategic Overview

List of Tables

Table 01: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 02: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018–2030

Table 03: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018–2030

Table 04: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 05: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018–2030

Table 06: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018–2030

Table 07: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 08: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 09: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Country, 2018?2030

Table 10: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Product, 2018?2030

Table 11: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 12: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 13: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Application, 2018?2030

Table 14: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 15: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 16: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by End-user, 2018?2030

Table 17: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018?2030

Table 18: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Product, 2018?2030

Table 19: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 20: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 21: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Application, 2018?2030

Table 22: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 23: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 24: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by End-user, 2018?2030

Table 25: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 26: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Product, 2018?2030

Table 27: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 28: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 29: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Application, 2018?2030

Table 30: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 31: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 32: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by End-user, 2018?2030

Table 33: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 34: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Product, 2018?2030

Table 35: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 36: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 37: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Application, 2018?2030

Table 38: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 39: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 40: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by End-user, 2018?2030

Table 41: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 42: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Product, 2018?2030

Table 43: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 44: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 45: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Application, 2018?2030

Table 46: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Capillary Blood Collection Devices, 2018?2030

Table 47: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by Venous Blood Collection Devices, 2018?2030

Table 48: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, by End-user, 2018?2030

List of Figures

Figure 01: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Distribution, by Region, 2019 and 2030

Figure 02: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast, 2018–2030

Figure 03: Global Capillary and Venous Blood Sampling Devices Market Value Share, by Product, 2019

Figure 04: Global Capillary and Venous Blood Sampling Devices Market Value Share, by End-user, 2019

Figure 05: Global Capillary and Venous Blood Sampling Devices Market Value Share, by Application-Capillary Blood Sampling Devices, 2019

Figure 06: Global Capillary and Venous Blood Sampling Devices Market Value Share, by Region, 2019

Figure 07: Global Point-of-care Diagnostics Market Value (US$ Mn) Forecast, 2018–2030

Figure 08: Global Central Laboratory Diagnostic Market Value (US$ Mn) Forecast, 2018–2030

Figure 09: Global Capillary and Venous Blood Sampling Devices Market Value Share, by Product, 2019 and 2030

Figure 10: Global Capillary and Venous Blood Sampling Devices Market Attractiveness, by Product, 2020–2030

Figure 11: Global Capillary and Venous Blood Sampling Devices Market Value Share, by Capillary Blood Sampling, 2019 and 2030

Figure 12: Global Capillary and Venous Blood Sampling Devices Market Attractiveness, by Capillary Blood Sampling, 2020–2030

Figure 13: Global Capillary and Venous Blood Sampling Devices Market Value Share, by Venous Blood Sampling, 2019 and 2030

Figure 14: Global Capillary and Venous Blood Sampling Devices Market Attractiveness, by Venous Blood Sampling, 2020–2030

Figure 15: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Capillary Blood Collection Devices, 2018–2030

Figure 16: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Venous Blood Collection Devices, 2018–2030

Figure 17: Europe Capillary and Venous Blood Sampling Devices Market Value Share, by Application, 2019 and 2030

Figure 18: Europe Capillary and Venous Blood Sampling Devices Market Attractiveness, by Application, 2020–2030

Figure 19: Europe Capillary and Venous Blood Sampling Devices Market Value Share, by Capillary Blood Collection Sampling, 2019 and 2030

Figure 20: Europe Capillary and Venous Blood Sampling Devices Market Attractiveness, by Capillary Blood Collection Sampling, 2020–2030

Figure 21: Europe Capillary and Venous Blood Sampling Devices Market Value Share, by Venous Blood Collection Sampling, 2019 and 2030

Figure 22: Europe Capillary and Venous Blood Sampling Devices Market Attractiveness, by Venous Blood Collection Sampling, 2020–2030

Figure 23: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Capillary Blood Collection Devices, 2018–2030

Figure 24: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Venous Blood Collection Devices, 2018–2030

Figure 25: Global Capillary and Venous Blood Sampling Devices Market Value Share, by End-user, 2019 and 2030

Figure 26: Global Capillary and Venous Blood Sampling Devices Market Attractiveness, by End-user, 2020–2030

Figure 27: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2018–2030

Figure 28: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Clinics, 2018–2030

Figure 29: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Diagnostics Laboratories, 2018–2030

Figure 30: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Blood Banks, 2018–2030

Figure 31: Global Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Home Care, 2018-2030

Figure 32: Global Capillary and Venous Blood Sampling Devices Market Value Share, by Region, 2019 and 2030

Figure 33: Global Capillary and Venous Blood Sampling Devices Market Attractiveness, by Region, 2019–2030

Figure 34: North America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018?2030

Figure 35: North America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Country, 2019 and 2030

Figure 36: North America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Country, 2020–2030

Figure 37: North America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Product, 2019 and 2030

Figure 38: North America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Product, 2020–2030

Figure 39: North America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Application, 2019 and 2030

Figure 40: North America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 41: North America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by End-user, 2019 and 2030

Figure 42: North America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 43: Europe Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018?2030

Figure 44: Europe Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 45: Europe Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 46: Europe Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Product, 2019 and 2030

Figure 47: Europe Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Product, 2020–2030

Figure 48: Europe Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Application, 2019 and 2030

Figure 49: Europe Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 50: Europe Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by End-user, 2019 and 2030

Figure 51: Europe Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 52: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018?2030

Figure 53: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 54: Asia Pacific Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 55: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Product, 2019 and 2030

Figure 56: Asia Pacific Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Product, 2020–2030

Figure 57: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Application, 2019 and 2030

Figure 58: Asia Pacific Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 59: Asia Pacific Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by End-user, 2019 and 2030

Figure 60: Asia Pacific Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 61: Latin America Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018?2030

Figure 62: Latin America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 63: Latin America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 64: Latin America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Product, 2019 and 2030

Figure 65: Latin America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Product, 2020–2030

Figure 66: Latin America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Application, 2019 and 2030

Figure 67: Latin America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 68: Latin America Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by End-user, 2019 and 2030

Figure 69: Latin America Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 70: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018?2030

Figure 71: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 72: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 73: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Product, 2019 and 2030

Figure 74: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Product, 2020–2030

Figure 75: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by Application, 2019 and 2030

Figure 76: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 77: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Value Share Analysis, by End-user, 2019 and 2030

Figure 78: Middle East & Africa Capillary and Venous Blood Sampling Devices Market Attractiveness Analysis, by End-user, 2020–2030