Reports

Reports

Analysts’ Viewpoint

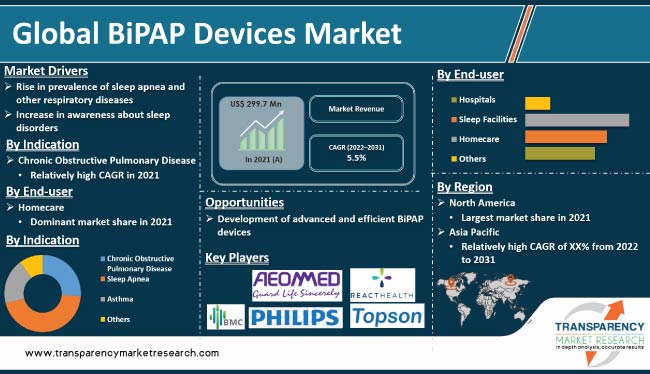

BiPAP device, also known as bi-level positive airway pressure device, is a type of ventilator used in the treatment of sleep apnea and other respiratory disorders. Rise in prevalence of sleep disorders and respiratory diseases is expected to propel the BiPAP devices market size during the forecast period. Increase in awareness about sleep disorders is expected to augment market expansion in the near future.

Auto-adjusting BiPAP are gaining traction, as these help overcome the issues associated with normal BiPAP device. R&D of new technologies is likely to offer lucrative opportunities for vendors in the industry. Key players have adopted various strategies, such as partnerships, collaborations, and new product launches, to increase market share.

BiPAP (bi-level positive airway pressure) device is used in the treatment of sleep apnea and other respiratory disorders. The device provides two types of pressure: expiratory positive airway pressure (EPAP) and inspiratory positive airway pressure (IPAP). The machine mimics patient's natural breathing pattern, enabling them to breathe normally and preventing breathing gaps.

The device is lightweight and portable, and masks for the device are available in various sizes. BiPAP therapy is used to treat sleep apnea, COPD, and other respiratory conditions.

Sleep apnea is a disorder that affects a person's breathing during sleep. It could cause a number of health issues, such as high blood pressure, heart disease, and stroke. BiPAP machine can help prevent the airway from collapsing and enable the user to breathe more easily, making it a popular treatment option for sleep apnea. According to the World Health Organization, sleep apnea is a significant public health concern, affecting around 100 million people globally in 2021.

Rise in awareness about the negative effects of sleep disorders on overall health is another driver of the market. People are becoming more conscious of the importance of good sleep, and are seeking treatment for their sleep disorders, which has led to increase in demand for BiPAP oxygen machines. This, in turn, is likely to bolster BiPAP devices market growth in the next few years.

Rise in awareness about sleep disorders is a major driver of the BiPAP devices industry. People are becoming more aware of the negative effect of sleep disorders on overall health and well-being. Therefore, they are seeking treatment for sleep disorders, which is increasing the demand for BiPAP devices.

Internet has made it easy for people to access information about sleep disorders and to find resources for treatment, which has helped increase awareness about the issue. Government and non-government organizations play a vital role in creating awareness about the importance of good sleep and the hazards of sleep disorders such as sleep apnea. This is encouraging people to seek treatment for their sleep disorders, which in turn is propelling demand for BiPAP devices.

In terms of indication, the sleep apnea segment held the largest BiPAP devices market share in 2021. Increase in prevalence of sleep disorders is likely to drive the segment in the near future. Sleep apnea is a sleep disorder characterized by repetitive interruptions in breathing during sleep.

The market for devices and treatments for sleep apnea is expected to witness significant growth in the next few years, driven by rise in prevalence of sleep apnea and other sleep-related disorders and surge in awareness about the negative effect of untreated sleep disorders.

Technological advancements in sleep apnea devices are driving market development. Manufacturers are introducing new, more advanced, and portable devices, which are designed to improve patient comfort and convenience. For instance, wireless and battery-powered devices are now available, which enable patients to use the devices while traveling or away from an outlet.

Rise in Prevalence of Sleep Apnea among Adults

Based on age group, the adult segment is likely to account for significant share of the global BiPAP devices market during the forecast period. Rise in prevalence of sleep apnea in adults is a major driver of the industry. According to the American Academy of Sleep Medicine, an estimated 22 million people in the U.S. have sleep apnea, and around 84% of them are adults.

North America held the largest share of around 45.0% of global BiPAP devices market demand in 2021. The region is expected to be a highly lucrative market during the forecast period. North America's dominance is ascribed to rise in prevalence of sleep apnea, COPD, asthma, and other respiratory diseases. The U.S. dominated the market in the region in 2031 owing to factors such as presence of leading players and increase in research & development activities.

Asia Pacific is projected to be the fastest growing market for BiPAP devices during the forecast period. This is ascribed to surge in incidence rate of sleep disorders and increase in population.

The global BiPAP devices market is fragmented, with the presence of large number of players. Most of the companies are investing significantly in research & development activities, primarily to develop innovative tests.

Expansion of product portfolio and merger & acquisition are the key strategies adopted by the key players in the global market. Beijing Aeonmed Co., Ltd., BMC Medical Co., Ltd., Drive DeVilbiss Healthcare, Hebei Topson Medical Technology Co., Ltd., Koninklijke Philips N.V, Lowenstein Medical Technology GmbH, React Health, Oventus Medical, ResMed Corp, SEFAM, and Somnetics International, Inc. are the prominent BiPAP devices market players.

Key players has been profiled in the BiPAP devices market report based on parameters such as company overview, strategies, product portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 299.7 Mn |

|

Forecast (Value) in 2031 |

More than US$ 511.6 Mn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 299.7 Mn in 2021.

It is projected to reach more than US$ 511.6 Mn by 2031.

The CAGR is anticipated to be 5.5% from 2022 to 2031.

Rise in prevalence of sleep apnea & other respiratory diseases and increase in awareness about sleep disorders.

North America is likely to account for significant share during the forecast period.

Beijing Aeonmed Co., Ltd., BMC Medical Co., Ltd., Drive DeVilbiss Healthcare, Hebei Topson Medical Technology Co., Ltd., Koninklijke Philips N.V, Lowenstein Medical Technology GmbH, Oventus Medical, React Health, ResMed Corp, SEFAM, and Somnetics International, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global BiPAP Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global BiPAP Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. Top 3 Players Operating in the Market Space

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global BiPAP Devices Market Analysis and Forecast, by Indication

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Indication, 2017–2031

6.3.1. Chronic Obstructive Pulmonary Disease

6.3.2. Sleep Apnea

6.3.3. Asthma

6.3.4. Others

6.4. Market Attractiveness Analysis, by Indication

7. Global BiPAP Devices Market Analysis and Forecast, by Age Group

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Age Group, 2017–2031

7.3.1. Adult

7.3.2. Pediatric

7.4. Market Attractiveness Analysis, by Age Group

8. Global BiPAP Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Sleep Facilities

8.3.3. Homecare

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global BiPAP Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America BiPAP Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Indication, 2017–2031

10.2.1. Chronic Obstructive Pulmonary Disease

10.2.2. Sleep Apnea

10.2.3. Asthma

10.2.4. Others

10.3. Market Value Forecast, by Age Group, 2017–2031

10.3.1. Adult

10.3.2. Pediatric

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Sleep Facilities

10.4.3. Homecare

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Indication

10.6.2. By Age Group

10.6.3. By End-user

10.6.4. By Country

11. Europe BiPAP Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Indication, 2017–2031

11.2.1. Chronic Obstructive Pulmonary Disease

11.2.2. Sleep Apnea

11.2.3. Asthma

11.2.4. Others

11.3. Market Value Forecast, by Age Group, 2017–2031

11.3.1. Adult

11.3.2. Pediatric

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Sleep Facilities

11.4.3. Homecare

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Indication

11.6.2. By Age Group

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific BiPAP Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Indication, 2017–2031

12.2.1. Chronic Obstructive Pulmonary Disease

12.2.2. Sleep Apnea

12.2.3. Asthma

12.2.4. Others

12.3. Market Value Forecast, by Age Group, 2017–2031

12.3.1. Adult

12.3.2. Pediatric

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Sleep Facilities

12.4.3. Homecare

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Indication

12.6.2. By Age Group

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America BiPAP Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Indication, 2017–2031

13.2.1. Chronic Obstructive Pulmonary Disease

13.2.2. Sleep Apnea

13.2.3. Asthma

13.2.4. Others

13.3. Market Value Forecast, by Age Group, 2017–2031

13.3.1. Adult

13.3.2. Pediatric

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Sleep Facilities

13.4.3. Homecare

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Indication

13.6.2. By Age Group

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa BiPAP Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Indication, 2017–2031

14.2.1. Chronic Obstructive Pulmonary Disease

14.2.2. Sleep Apnea

14.2.3. Asthma

14.2.4. Others

14.3. Market Value Forecast, by Age Group, 2017–2031

14.3.1. Adult

14.3.2. Pediatric

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Sleep Facilities

14.4.3. Homecare

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Indication

14.6.2. By Age Group

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Beijing Aeonmed Co., Ltd.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Indication Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. BMC Medical Co., Ltd.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Indication Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Drive DeVilbiss Healthcare

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Indication Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Hebei Topson Medical Technology Co., Ltd.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Indication Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Koninklijke Philips N.V.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Indication Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.6. Löwenstein Medical Technology GmbH

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Indication Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.7. React Health

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Indication Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.8. ResMed Corp.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Indication Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.9. SEFAM

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Indication Portfolio

15.3.9.3. Financial Overview

15.3.10. Somnetics International, Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Indication Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.11. Oventus Medical

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Indication Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

List of Tables

Table 01: Global BiPAP Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 02: Global BiPAP Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 03: Global BiPAP Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global BiPAP Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America BiPAP Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America BiPAP Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 07: North America BiPAP Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 08: North America BiPAP Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe BiPAP Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe BiPAP Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 11: Europe BiPAP Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 12: Europe BiPAP Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific BiPAP Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific BiPAP Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: Asia Pacific BiPAP Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 16: Asia Pacific BiPAP Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America BiPAP Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America BiPAP Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 19: Latin America BiPAP Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 20: Latin America BiPAP Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa BiPAP Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa BiPAP Devices Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 23: Middle East & Africa BiPAP Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 24: Middle East & Africa BiPAP Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global BiPAP Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global BiPAP Devices Market Value Share, by Indication (2021)

Figure 03: Global BiPAP Devices Market Value Share, by End-user (2021)

Figure 04: Global BiPAP Devices Market Value Share, by Age Group (2021)

Figure 05: Global BiPAP Devices Market Value Share, by Region (2021)

Figure 06: Global BiPAP Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 07: Global BiPAP Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 08: Global BiPAP Devices Market Value Share Analysis, by Age Group, 2021 and 2031

Figure 09: Global BiPAP Devices Market Attractiveness Analysis, by Age Group, 2022–2031

Figure 10: Global BiPAP Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 11: Global BiPAP Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 12: Global BiPAP Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 13: Global BiPAP Devices Market Attractiveness Analysis, by Region, 2022-2031

Figure 14: North America BiPAP Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 15: North America BiPAP Devices Market Value Share (%), by Country, 2021 and 2031

Figure 16: North America BiPAP Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 17: North America BiPAP Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 18: North America BiPAP Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 19: North America BiPAP Devices Market Value Share Analysis, by Age Group, 2021 and 2031

Figure 20: North America BiPAP Devices Market Attractiveness Analysis, by Age Group, 2022–2031

Figure 21: North America BiPAP Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 22: North America BiPAP Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 23: Europe BiPAP Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 24: Europe BiPAP Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 25: Europe BiPAP Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 26: Europe BiPAP Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 27: Europe BiPAP Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 28: Europe BiPAP Devices Market Value Share Analysis, by Age Group, 2021 and 2031

Figure 29: Europe BiPAP Devices Market Attractiveness Analysis, by Age Group, 2022–2031

Figure 30: Europe BiPAP Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 31: Europe BiPAP Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 32: Asia Pacific BiPAP Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 33: Asia Pacific BiPAP Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 34: Asia Pacific BiPAP Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 35: Asia Pacific BiPAP Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 36: Asia Pacific BiPAP Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 37: Asia Pacific BiPAP Devices Market Value Share Analysis, by Age Group, 2021 and 2031

Figure 38: Asia Pacific BiPAP Devices Market Attractiveness Analysis, by Age Group, 2022–2031

Figure 39: Asia Pacific BiPAP Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 40: Asia Pacific BiPAP Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 41: Latin America BiPAP Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 42: Latin America BiPAP Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 43: Latin America BiPAP Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 44: Latin America BiPAP Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 45: Latin America BiPAP Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 46: Latin America BiPAP Devices Market Value Share Analysis, by Age Group, 2021 and 2031

Figure 47: Latin America BiPAP Devices Market Attractiveness Analysis, by Age Group, 2022–2031

Figure 48: Latin America BiPAP Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 49: Latin America BiPAP Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 50: Middle East & Africa BiPAP Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 51: Middle East & Africa BiPAP Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 52: Middle East & Africa BiPAP Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 53: Middle East & Africa BiPAP Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 54: Middle East & Africa BiPAP Devices Market Attractiveness Analysis, by Indication, 2022–2031

Figure 55: Middle East & Africa BiPAP Devices Market Value Share Analysis, by Age Group, 2021 and 2031

Figure 56: Middle East & Africa BiPAP Devices Market Attractiveness Analysis, by Age Group, 2022–2031

Figure 57: Middle East & Africa BiPAP Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 58: Middle East & Africa BiPAP Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 59: Global BiPAP Devices Market Share Analysis, by Company, 2021