Reports

Reports

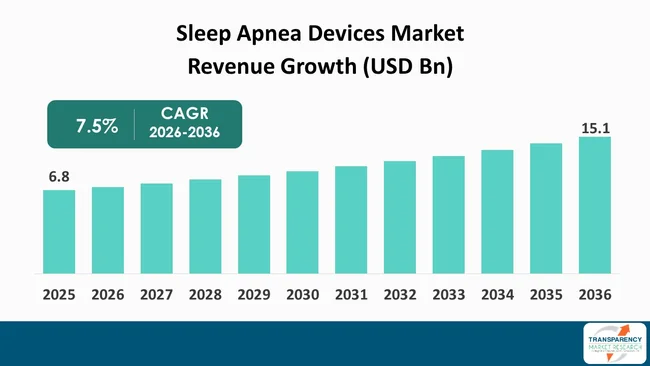

The global sleep apnea devices market size was valued at US$ 6.8 Bn in 2025 and is projected to reach US$ 15.1 Bn by 2036, expanding at a CAGR of 7.5% from 2026 to 2036.

The global market is witnessing steady growth and is expected to expand significantly over the forecast period, driven by increasing awareness, diagnosis rates, and adoption of therapeutic devices such as CPAP and oral appliances. A major market driver is the rising prevalence of obstructive sleep apnea (OSA), supported by growing obesity rates, aging populations, and improving access to sleep disorder diagnostics worldwide.

The global sleep apnea devices market represents a growing part of the medical devices field which develops new technologies through increasing sleep disorder diagnosis and the rising demand for home monitoring and treatment options. The market experiences growth because more people develop obstructive sleep apnea (OSA) which results from rising obesity rates and sedentary behavior and the increasing number of elderly people. The market faces several major obstacles. First, people stop using CPAP therapy due to discomfort. Second, high cost of these devices in developing region and limited awareness and access to sleep disorder treatment in emerging economies. The organization faces obstacles which can be transformed into business possibilities through technological development of compact devices which are simple to use and through the telehealth system and remote patient monitoring system which help patients stay compliant with treatment and manage their diseases over time. The healthcare infrastructure development which emerging regions receive will create new economic growth opportunities. The market shows three main trends which involve home sleep apnea testing (HSAT) becoming more common and digital connectivity being added to devices and patients choosing mask-less or minimally invasive therapies which enhance their comfort and portability needs.

Sleep apnea devices are medical devices used to diagnose and treat sleep apnea, a sleep disorder in which breathing repeatedly stops and starts during sleep. These devices include diagnostic systems such as polysomnography and home sleep testing devices, and therapeutic devices such as CPAP, BiPAP, adaptive servo-ventilation (ASV) systems, oral appliances, and masks, which help keep the airway open and ensure continuous airflow for effective breathing during sleep.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The sleep apnea devices market will experience significant growth as obstructive sleep apnea (OSA) becomes more common due to rising obesity rates and increasing sedentary behavior and the global population needs. OSA develops in obese people because their excess neck and upper airway fat blocks their breathing pathways which leads to sleep apnea. The number of people who have sleep-related breathing disorders keeps growing because the global obesity epidemic increases from unhealthy eating habits and low physical activity and urban living conditions. OSA becomes more common in older people because their upper airway muscle strength declines and their rate of cardiovascular diseases and diabetes and hypertension develops which are common sleep apnea risk factors. Office work sedentary lifestyles and stress together with limited exercise create conditions that lead to weight gain and reduced sleep quality which makes people more likely to develop OSA. Patients are seeking diagnosis and treatment because awareness about untreated sleep apnea leads to heart disease and stroke and daytime fatigue as serious health problems. The demand for diagnostic and therapeutic devices has increased which includes CPAP and BiPAP and home sleep testing systems because these devices directly contribute to the global Sleep Apnea Devices Market growth.

The sleep apnea devices market will experience substantial growth due to upcoming technological breakthroughs in diagnostic and therapeutic devices that will produce portable and connected and user-friendly CPAP and home sleep testing systems. The continuous process of developing new device designs has resulted in CPAP and BiPAP systems that operate with smaller and lighter and more comfortable components which enable patients to use the machines more frequently and maintain their treatment schedule. Healthcare providers can now monitor patient usage and treatment results through modern devices which feature smart capabilities that include wireless connectivity and mobile applications and cloud-based data tracking. This not only enhances clinical decision-making but also supports personalized treatment plans and remote patient management.

The increasing usage of home sleep apnea testing (HSAT) systems is changing how professionals diagnose sleep apnea because it provides patients with both affordable and convenient and easy-to-use testing options which serve as substitutes for standard in-lab polysomnography. Patients can use portable diagnostic devices to conduct tests in their own homes because these devices shorten the time needed for testing and decrease the costs for diagnosis while providing better comfort to patients. The combination of artificial intelligence with advanced sensor technology enables diagnostic systems to achieve enhanced performance when identifying sleep-related breathing disorders. Manufacturers are developing new products that include user-friendly and digitally-enabled healthcare solutions because patients want these types of products which will result in increasing market share and sustained market expansion for sleep apnea devices throughout the world.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

Untapped growth potential in emerging markets across Asia-Pacific, Latin America, and the Middle East, driven by improving healthcare infrastructure and rising awareness, represents a significant opportunity for the Sleep Apnea Devices Market. The populations of these regions undergo rapid urban development while their residents adopt modern lifestyles which produce higher obesity and chronic disease rates that lead to obstructive sleep apnea (OSA) development. The combination of government and private healthcare investment in new hospitals and sleep clinics and diagnostic facilities will enable more people to receive sleep disorder assessment and treatment.

Public health initiatives and digital platforms and physician education programs are increasing awareness about sleep-related health issues. The demand for early diagnosis and effective treatment will grow because people are becoming aware that untreated sleep apnea leads to serious medical conditions like cardiovascular diseases and diabetes and productivity loss. Manufacturers can find significant opportunities in emerging markets because they can develop affordable and portable devices which meet the needs of users who require simple products. The increasing use of telemedicine and home diagnostic methods in these areas will help solve existing infrastructure problems while increasing the number of patients who can access medical services. The combination of these factors will establish emerging economies as essential growth engines for the worldwide Sleep Apnea Devices Market.

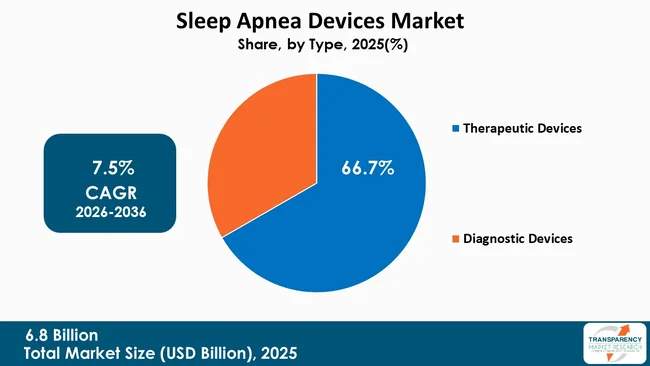

Therapeutic devices is dominant product category in sleep apnea devices industry as these devices serve essential functions in treating and managing sleep apnea for extended periods. Doctors prescribe these devices as the primary treatment option for patients who have been diagnosed with obstructive sleep apnea (OSA). Among them, CPAP devices hold a particularly strong position, as they are considered the gold standard for moderate to severe OSA treatment and are recommended by healthcare professionals across clinical settings.

Therapeutic devices exist as the leading product category because increasing patient diagnoses create ongoing demands for therapy which helps treat their symptoms while stopping cardiovascular diseases and hypertension and daytime sleepiness. The daily usage of therapeutic devices throughout their entire operational life results in more frequent replacements and ongoing accessory needs for items like masks and tubing which differ from diagnostic devices that only assess patients at the start. The introduction of modern technology has created therapeutic devices which function at lower noise levels and smaller sizes while maintaining simple operation for users to achieve better patient satisfaction and treatment compliance. The continuous requirement for long-term treatment solutions together with device upgrades creates strong market demand for therapeutic devices which dominate the Sleep Apnea Devices Market

| Attribute | Detail |

|---|---|

| Leading Region |

|

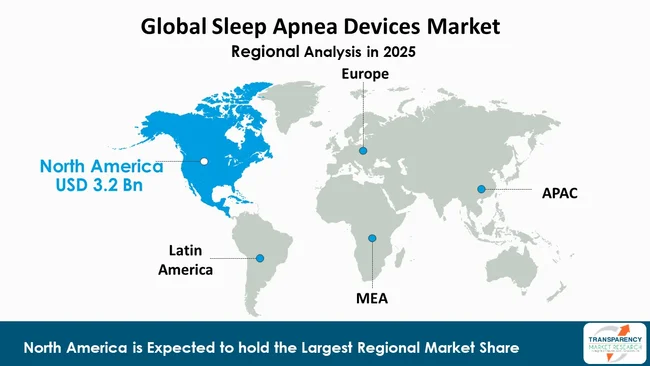

North America is the dominating region in the sleep apnea devices market, accounting for a considerable 46.5% market share due to more sleep apnea cases and established healthcare facilities. The United States particular region shows high rates of obstructive sleep apnea (OSA), driven by increasing obesity levels, sedentary lifestyles, and aging population. This has created a strong market need for devices that diagnose and treat sleep apnea including CPAP and BiPAP machines and home sleep testing devices.

North America maintains its market leadership as patients and healthcare professionals show high awareness of sleep disorders, which allows for early diagnosis. The region offers complete access to sleep clinics that use modern diagnostic equipment and employ qualified professionals for early diagnosis and treatment.

The presence of favorable reimbursement systems and insurance coverage for sleep apnea diagnosis and treatment encourages higher adoption of therapy devices. The market experiences growth through the combination of the major market players and their ongoing product development as manufacturers invest in research to create new technological solutions that improve patient treatment. The rise of telemedicine and remote patient monitoring in North America improves sleep care access, which strengthens the region's sleep apnea devices market dominance.

Resmed, Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited., Sleeptight Ltd, Somnotec, BMC Medical Co., Ltd., Natus, SOMNOmedics AG, Compumedics Limited, ZOLL Itamar, Nihon Kohden Corporation, Nox Medical, Nyxoah SA., Inspire Medical Systems Europe GmbH and Other Prominent Players are the key players governing the global Sleep Apnea Devices Market.

Each of these players has been profiled in the sleep apnea devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$- 6.8 Bn |

| Forecast Value in 2036 | More than US$ 15.1 Bn |

| CAGR | 7.5% |

| Forecast Period | 2026 2036 |

| Historical Data Available for | 2020 2024 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.8 Bn in 2025

It is projected to cross US$ 15.1 Bn by the end of 2036

Rising prevalence of obstructive sleep apnea (OSA) due to increasing obesity rates, sedentary lifestyles, and aging populations globally and Technological advancements in diagnostic and therapeutic devices, including portable, connected, and user-friendly CPAP and home sleep testing systems

It is anticipated to grow at a CAGR 7.5% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Resmed., Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited., Sleeptight Ltd, Somnotec, BMC Medical Co., Ltd., Natus, SOMNOmedics AG, Compumedics Limited , ZOLL Itamar, Nihon Kohden Corporation, Nox Medical, Nyxoah SA., Inspire Medical Systems Europe GmbH, and other prominent players

h

Table 01: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 02: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 03: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 04: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 05: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 06: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 07: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 08: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 09: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 10: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 11: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 12: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 13: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 14: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 15: U.S. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 16: U.S. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 17: U.S. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 18: U.S. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 19: U.S. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 20: U.S. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 21: Canada Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 22: Canada Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 23: Canada Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 24: Canada Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 25: Canada Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 26: Canada Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 27: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 28: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 29: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 30: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 31: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 32: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 33: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 34: Germany Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 35: Germany Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 36: Germany Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 37: Germany Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 38: Germany Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 39: Germany Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 40: U.K. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 41: U.K. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 42: U.K. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 43: U.K. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 44: U.K. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 45: U.K. Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 46: France Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 47: France Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 48: France Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 49: France Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 50: France Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 51: France Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 52: Italy Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 53: Italy Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 54: Italy Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 55: Italy Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 56: Italy Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 57: Italy Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 58: Spain Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 59: Spain Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 60: Spain Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 61: Spain Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 62: Spain Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 63: Spain Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 64: The Netherlands Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 65: The Netherlands Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 66: The Netherlands Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 67: The Netherlands Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 68: The Netherlands Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 69: The Netherlands Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 70: Rest of Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 71: Rest of Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 72: Rest of Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 73: Rest of Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 74: Rest of Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 75: Rest of Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 76: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 77: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 78: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 79: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 80: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 81: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 82: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 83: China Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 84: China Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 85: China Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 86: China Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 87: China Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 88: China Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 89: Japan Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 90: Japan Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 91: Japan Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 92: Japan Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 93: Japan Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 94: Japan Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 95: India Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 96: India Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 97: India Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 98: India Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 99: India Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 100: India Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 101: South Korea Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 102: South Korea Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 103: South Korea Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 104: South Korea Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 105: South Korea Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 106: South Korea Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 107: Australia Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 108: Australia Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 109: Australia Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 110: Australia Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 111: Australia Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 112: Australia Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 113: ASEAN Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 114: ASEAN Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 115: ASEAN Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 116: ASEAN Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 117: ASEAN Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 118: ASEAN Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 119: Rest of Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 120: Rest of Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 121: Rest of Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 122: Rest of Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 123: Rest of Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 124: Rest of Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 125: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 126: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 127: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 128: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 129: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 130: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 131: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 132: Brazil Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 133: Brazil Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 134: Brazil Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 135: Brazil Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 136: Brazil Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 137: Brazil Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 138: Mexico Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 139: Mexico Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 140: Mexico Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 141: Mexico Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 142: Mexico Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 143: Mexico Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 144: Argentina Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 145: Argentina Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 146: Argentina Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 147: Argentina Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 148: Argentina Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 149: Argentina Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 150: Rest of Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 151: Rest of Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 152: Rest of Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 153: Rest of Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 154: Rest of Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 155: Rest of Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 156: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 157: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 158: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 159: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 160: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 161: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 162: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 163: GCC Countries Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 164: GCC Countries Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 165: GCC Countries Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 166: GCC Countries Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 167: GCC Countries Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 168: GCC Countries Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 169: South Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 170: South Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 171: South Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 172: South Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 173: South Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 174: South Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 175: Rest of Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 176: Rest of Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Therapeutic Devices, 2021 to 2036

Table 177: Rest of Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Positive Pressure Devices, 2021 to 2036

Table 178: Rest of Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Oral Appliances, 2021 to 2036

Table 179: Rest of Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 180: Rest of Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Figure 01: Global Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 03: Global Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 04: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Therapeutic Devices, 2021 to 2036

Figure 05: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Diagnostic Devices, 2021 to 2036

Figure 06: Global Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 07: Global Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 08: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Pediatric, 2021 to 2036

Figure 09: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Adult, 2021 to 2036

Figure 10: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Geriatric , 2021 to 2036

Figure 11: Global Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 12: Global Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 13: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Hospitals, 2021 to 2036

Figure 14: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Specialty Clinics, 2021 to 2036

Figure 15: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Homecare Settings/Individuals, 2021 to 2036

Figure 16: Global Sleep Apnea Devices Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 17: Global Sleep Apnea Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 18: Global Sleep Apnea Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 19: North America Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 20: North America Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 21: North America Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 22: North America Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 23: North America Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 24: North America Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 25: North America Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 26: North America Sleep Apnea Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 27: North America Sleep Apnea Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 28: U.S. Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 29: U.S. Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 30: U.S. Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 31: U.S. Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 32: U.S. Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 33: U.S. Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 34: U.S. Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 35: Canada Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 36: Canada Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 37: Canada Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 38: Canada Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 39: Canada Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 40: Canada Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 41: Canada Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 42: Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 43: Europe Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 44: Europe Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 45: Europe Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 46: Europe Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 47: Europe Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 48: Europe Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 49: Europe Sleep Apnea Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 50: Europe Sleep Apnea Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 51: Germany Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 52: Germany Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 53: Germany Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 54: Germany Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 55: Germany Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 56: Germany Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 57: Germany Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 58: U.K. Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 59: U.K. Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 60: U.K. Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 61: U.K. Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 62: U.K. Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 63: U.K. Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 64: U.K. Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 65: France Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 66: France Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 67: France Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 68: France Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 69: France Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 70: France Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 71: France Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 72: Italy Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 73: Italy Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 74: Italy Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 75: Italy Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 76: Italy Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 77: Italy Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 78: Italy Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 79: Spain Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 80: Spain Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 81: Spain Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 82: Spain Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 83: Spain Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 84: Spain Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 85: Spain Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 86: The Netherlands Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 87: The Netherlands Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 88: The Netherlands Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 89: The Netherlands Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 90: The Netherlands Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 91: The Netherlands Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 92: The Netherlands Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 93: Rest of Europe Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 94: Rest of Europe Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 95: Rest of Europe Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 96: Rest of Europe Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 97: Rest of Europe Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 98: Rest of Europe Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 99: Rest of Europe Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 100: Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 101: Asia Pacific Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 102: Asia Pacific Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 103: Asia Pacific Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 104: Asia Pacific Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 105: Asia Pacific Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 106: Asia Pacific Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 107: Asia Pacific Sleep Apnea Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 108: Asia Pacific Sleep Apnea Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 109: China Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 110: China Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 111: China Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 112: China Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 113: China Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 114: China Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 115: China Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 116: Japan Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 117: Japan Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 118: Japan Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 119: Japan Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 120: Japan Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 121: Japan Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 122: Japan Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 123: India Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 124: India Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 125: India Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 126: India Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 127: India Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 128: India Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 129: India Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 130: South Korea Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 131: South Korea Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 132: South Korea Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 133: South Korea Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 134: South Korea Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 135: South Korea Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 136: South Korea Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 137: Australia Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 138: Australia Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 139: Australia Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 140: Australia Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 141: Australia Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 142: Australia Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 143: Australia Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 144: ASEAN Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 145: ASEAN Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 146: ASEAN Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 147: ASEAN Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 148: ASEAN Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 149: ASEAN Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 150: ASEAN Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 151: Rest of Asia Pacific Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 152: Rest of Asia Pacific Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 153: Rest of Asia Pacific Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 154: Rest of Asia Pacific Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 155: Rest of Asia Pacific Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 156: Rest of Asia Pacific Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 157: Rest of Asia Pacific Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 158: Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 159: Latin America Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 160: Latin America Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 161: Latin America Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 162: Latin America Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 163: Latin America Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 164: Latin America Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 165: Latin America Sleep Apnea Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 166: Latin America Sleep Apnea Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 167: Brazil Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 168: Brazil Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 169: Brazil Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 170: Brazil Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 171: Brazil Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 172: Brazil Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 173: Brazil Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 174: Mexico Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 175: Mexico Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 176: Mexico Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 177: Mexico Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 178: Mexico Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 179: Mexico Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 180: Mexico Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 181: Argentina Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 182: Argentina Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 183: Argentina Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 184: Argentina Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 185: Argentina Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 186: Argentina Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 187: Argentina Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 188: Rest of Latin America Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 189: Rest of Latin America Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 190: Rest of Latin America Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 191: Rest of Latin America Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 192: Rest of Latin America Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 193: Rest of Latin America Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 194: Rest of Latin America Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 195: Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 196: Middle East and Africa Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 197: Middle East and Africa Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 198: Middle East and Africa Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 199: Middle East and Africa Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 200: Middle East and Africa Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 201: Middle East and Africa Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 202: Middle East and Africa Sleep Apnea Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 203: Middle East and Africa Sleep Apnea Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 204: GCC Countries Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 205: GCC Countries Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 206: GCC Countries Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 207: GCC Countries Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 208: GCC Countries Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 209: GCC Countries Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 210: GCC Countries Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 211: South Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 212: South Africa Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 213: South Africa Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 214: South Africa Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 215: South Africa Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 216: South Africa Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 217: South Africa Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 218: Rest of Middle East and Africa Sleep Apnea Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 219: Rest of Middle East and Africa Sleep Apnea Devices Market Value Share Analysis, by Type, 2025 and 2036

Figure 220: Rest of Middle East and Africa Sleep Apnea Devices Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 221: Rest of Middle East and Africa Sleep Apnea Devices Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 222: Rest of Middle East and Africa Sleep Apnea Devices Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 223: Rest of Middle East and Africa Sleep Apnea Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 224: Rest of Middle East and Africa Sleep Apnea Devices Market Attractiveness Analysis, by End-user, 2026 to 2036