Reports

Reports

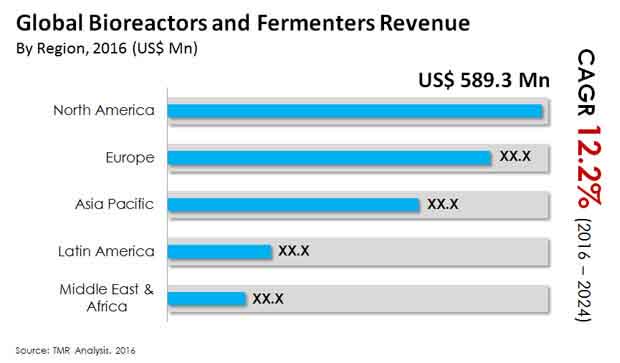

The global bioreactors and fermenters market is estimated to expand at a CAGR of 12.2% during the forecast period, 2016-2024. Thus, the market is estimated to gain a valuation of US$ 4,461.0 Mn by 2024.

Bioreactors and fermenters are widely utilized in the creation of appropriate environment for the microorganisms’ growth. Furthermore, these devices are also useful in driving biochemically active substances created by such organisms. Fermenters find application in the development and maintenance of fungal or bacterial cells in a controlled atmosphere. Bioreactors are the bigger versions of fermenters that are extensively used in the biopharmaceutical industry for the production of biologics including recombinant proteins, vaccines, and monoclonal antibodies.

A research report by Transparency Market Research (TMR) gives in-depth analysis of many crucial factors impacting the growth of the bioreactors and fermenters market. Thus, readers gain complete assessment on growth drivers, restraints, challenges, trends, and expansion opportunities in the market for bioreactors and fermenters.

Analysts of the study by TMR have performed the segmentation of the global bioreactors and fermenters market based on many important parameters such as product type, process, end-user, and region. In terms of product type, the market is classified into single-use bioreactors and multiple-use bioreactors. Moreover, the market is divided into continuous, fed batch, and batch on the basis of process.

Due to many factors such as unhealthy eating habits and sedentary lifestyles, there is rise in the number of health issues across the globe. This situation has resulted into increasing the requirement for personalized medicines, biologics, and drugs for orphan diseases, which is creating sales prospects in the global bioreactors and fermenters market. Moreover, the market is being driven by increase in demand for bioreactors and fermenters by varied end-users such as CROs, academic & research institutes, and biopharmaceutical companies.

Various key regions supporting the growth of the global bioreactors and fermenters industry are North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among all, Europe and North America are prominent regions holding 62% share of the global market for bioreactors and fermenters.

Some of the key factors making North America a dominating region include increasing use of single-use disposable bioreactors and rise in the adoption of advanced technologies in the bio-processing systems. Moreover, the regional market is prognosticated to experience higher growth prospects on the back of existence of many well-entrenched bioprocessing equipment producers and biopharmaceutical enterprises in the region.

Asia Pacific is estimated to provide lucrative prospects in the bioreactors and fermenters market owing to many factors such as presence of several emerging economies in the region. Moreover, increase in investments by international level biopharmaceutical enterprises and contract manufacturers is likely to bode well with the regional market growth in the years to come.

The global bioreactors and fermenters market is fragmented in nature. Presence of many well-established companies represents intense level of competition in the market. Thus to sustain in this competition, enterprises are utilizing strategies such as collaborations and acquisitions.

Many players in the bioreactors and fermenters industry are increasing investments in R&D projects, which are focused on the introduction of break-through features in their existing products. Besides, several companies are focused on the launch of next-gen products. Such efforts are likely to generate promising business prospects in the bioreactors and fermenters market in the upcoming years.

Some of the key players operating in the global bioreactors and fermenters market include Applikon Biotechnology B.V., Finesse Solutions, Inc., Danaher Corporation, PBS Biotech, Inc., Eppendorf AG, Sartorius AG, GE Healthcare, ZETA Holding GmbH, PIERRE GUERIN TECHNOLOGIES, Solaris Biotechnology srl, Merck KGaA, and Thermo Fisher Scientific Inc.

Bioreactors and fermenters market is estimated to gain a valuation of US$ 4,461.0 Mn by 2024

Bioreactors and fermenters market is estimated to expand at a CAGR of 12.2% during the forecast period, 2016-2024

Bioreactors and fermenters market is driven by increased prevalence of chronic diseases

Asia Pacific is estimated to provide lucrative prospects in the bioreactors and fermenters market owing to many factors such as presence of several emerging economies in the region

Key players operating in the global bioreactors and fermenters market include Applikon Biotechnology B.V., Finesse Solutions, Inc., Danaher Corporation, PBS Biotech, Inc., Eppendorf AG, Sartorius AG, GE Healthcare

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Bioreactors and Fermenters Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Global Bioreactors and Fermenters Market Analysis and Forecasts, 2016–2024

4.4.1. Market Volume Projections

4.5. Bioreactors and Fermenters Market - Global Supply Demand Scenario

4.6. Porter’s Five Force Analysis

4.7. Value Chain Analysis

4.7.1. List of active market participants

4.8. Market Outlook

5. Global Bioreactors and Fermenters Market Analysis and Forecasts, By Product

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value Forecast By Product

5.4.1. Single-use bioreactors

5.4.2. Multi-use bioreactors

5.5. Market Attractiveness By Product

6. Global Bioreactors and Fermenters Market Analysis and Forecasts, By Process

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Value Forecast By Process

6.4.1. Fed batch

6.4.2. Continuous

6.4.3. Batch

6.5. Market Attractiveness By Process

7. Global Bioreactors and Fermenters Market Analysis and Forecasts, By End-User

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Value Forecast By End-User

7.4.1. Biopharmaceutical companies

7.4.2. CROs

7.4.3. Academic & Research Institutes

7.5. Market Attractiveness By End-User

8. Global Bioreactors and Fermenters Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Value Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East and Africa

8.3. Market Attractiveness By Country/Region

9. North America Bioreactors and Fermenters Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Key Trends

9.2. Market Value Forecast By Product

9.2.1. Single-use bioreactors

9.2.2. Multi-use bioreactors

9.3. Market Value Forecast By Process

9.3.1. Fed batch

9.3.2. Continuous

9.3.3. Batch

9.4. Market Value Forecast By End-User

9.4.1. Biopharmaceutical companies

9.4.2. CROs

9.4.3. Academic & Research Institutes

9.5. Market Value Forecast By Country

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

10. Europe Bioreactors and Fermenters Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.1.2. Key Trends

10.2. Market Value Forecast By Product

10.2.1. Single-use bioreactors

10.2.2. Multi-use bioreactors

10.3. Market Value Forecast By Process

10.3.1. Fed batch

10.3.2. Continuous

10.3.3. Batch

10.4. Market Value Forecast By End-User , 2014–2024

10.4.1. Biopharmaceutical companies

10.4.2. CROs

10.4.3. Academic & Research Institutes

10.5. Market Value Forecast By Country , 2014–2024

10.5.1. Germany

10.5.2. France

10.5.3. U.K.

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

11. Asia Pacific Bioreactors and Fermenters Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Key Trends

11.2. Market Value Forecast By Product

11.2.1. Single-use bioreactors

11.2.2. Multi-use bioreactors

11.3. Market Value Forecast By Process

11.3.1. Fed batch

11.3.2. Continuous

11.3.3. Batch

11.4. Market Value Forecast By End-User

11.4.1. Biopharmaceutical companies

11.4.2. CROs

11.4.3. Academic & Research Institutes

11.5. Market Value Forecast By Country

11.5.1. Japan

11.5.2. China

11.5.3. India

11.5.4. Australia

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

12. Latin America Bioreactors and Fermenters Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.1.2. Key Trends

12.2. Market Value Forecast By Product

12.2.1. Single-use bioreactors

12.2.2. Multi-use bioreactors

12.3. Market Value Forecast By Process

12.3.1. Fed batch

12.3.2. Continuous

12.3.3. Batch

12.4. Market Value Forecast By End-User

12.4.1. Biopharmaceutical companies

12.4.2. CROs

12.4.3. Academic & Research Institutes

12.5. Market Value Forecast By Country

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

13. Middle East and Africa Bioreactors and Fermenters Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.1.2. Key Trends

13.2. Market Value Forecast By Product

13.2.1. Single-use bioreactors

13.2.2. Multi-use bioreactors

13.3. Market Value Forecast By Process

13.3.1. Fed batch

13.3.2. Continuous

13.3.3. Batch

13.4. Market Value Forecast By End-User

13.4.1. Biopharmaceutical companies

13.4.2. CROs

13.4.3. Academic & Research Institutes

13.5. Market Value Forecast By Country

13.5.1. Saudi Arabia

13.5.2. South Africa

13.5.3. Rest of MEA

13.6. Market Attractiveness Analysis

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2015)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. Applikon Biotechnology B.V.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Business Overview

14.3.1.3. Product Portfolio

14.3.1.4. Financial Overview

14.3.1.5. SWOT Analysis

14.3.1.6. Strategic overview

14.3.2. Danaher Corporation

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Business Overview

14.3.2.3. Product Portfolio

14.3.2.4. Financial Overview

14.3.2.5. SWOT Analysis

14.3.2.6. Strategic overview

14.3.3. Eppendorf AG

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Business Overview

14.3.3.3. Product Portfolio

14.3.3.4. Financial Overview

14.3.3.5. SWOT Analysis

14.3.3.6. Strategic overview

14.3.4. Finesse Solutions, Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Business Overview

14.3.4.3. Product Portfolio

14.3.4.4. Financial Overview

14.3.4.5. SWOT Analysis

14.3.4.6. Strategic overview

14.3.5. GE Healthcare

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Business Overview

14.3.5.3. Product Portfolio

14.3.5.4. Financial Overview

14.3.5.5. SWOT Analysis

14.3.5.6. Strategic overview

14.3.6. Merck KGaA

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Business Overview

14.3.6.3. Product Portfolio

14.3.6.4. Financial Overview

14.3.6.5. SWOT Analysis

14.3.6.6. Strategic overview

14.3.7. PBS Biotech, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Business Overview

14.3.7.3. Product Portfolio

14.3.7.4. Financial Overview

14.3.7.5. SWOT Analysis

14.3.7.6. Strategic overview

14.3.8. PIERRE GUERIN TECHNOLOGIES

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Business Overview

14.3.8.3. Product Portfolio

14.3.8.4. Financial Overview

14.3.8.5. SWOT Analysis

14.3.8.6. Strategic overview

14.3.9. Sartorius AG

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Business Overview

14.3.9.3. Product Portfolio

14.3.9.4. Financial Overview

14.3.9.5. SWOT Analysis

14.3.9.6. Strategic overview

14.3.10. SOLARIS BIOTECHNOLOGY srl

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Business Overview

14.3.10.3. Product Portfolio

14.3.10.4. Financial Overview

14.3.10.5. SWOT Analysis

14.3.10.6. Strategic overview

14.3.11. Thermo Fisher Scientific Inc

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Business Overview

14.3.11.3. Product Portfolio

14.3.11.4. Financial Overview

14.3.11.5. SWOT Analysis

14.3.11.6. Strategic overview

14.3.12. ZETA Holding GmbH

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Business Overview

14.3.12.3. Product Portfolio

14.3.12.4. Financial Overview

14.3.12.5. SWOT Analysis

14.3.12.6. Strategic overview

List of Tables

Table 01: Global Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Product Type, 2016–2024

Table 02: Global Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Process Type, 2016–2024

Table 03: Global Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by End user, 2016–2024

Table 04: Global Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Region, 2016–2024

Table 05: North America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Product, 2016–2024

Table 06: North America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Process, 2016–2024

Table 07: North America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by End user, 2016–2024

Table 08: North America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 09: Europe Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Product, 2016–2024

Table 10: Europe Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Process, 2016–2024

Table 11: Europe Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by End user, 2016–2024

Table 12: Europe Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 13: Asia Pacific Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Product, 2016–2024

Table 14: Asia Pacific Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Process, 2016–2024

Table 15: Asia Pacific Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by End user, 2016–2024

Table 16: Asia Pacific Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 17: Latin America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Product, 2016–2024

Table 18: Latin America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Process, 2016–2024

Table 19: Latin America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by End user, 2016–2024

Table 20: Latin America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 21: Middle East and Africa Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Product, 2016–2024

Table 22: Middle East and Africa Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Process, 2016–2024

Table 23: Middle East and Africa Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by End user, 2016–2024

Table 24: Middle East and Africa Bioreactors and Fermenters Market Size (US$ Mn) Forecast, by Country, 2016–2024

List of Figures

Figure 01: Global Bioreactors and Fermenters Market Size (US$ Mn) Forecast, 2016–2024

Figure 02: Global Bioreactors and Fermenters Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 03: Global Single-use Bioreactors Market Revenue (US$ Mn), 2015-2024

Figure 04: Global Multiple-use Bioreactors Market Revenue, US$ Mn, 2015–2024

Figure 05: Bioreactors and Fermenters Market Attractiveness Analysis By Product Type

Figure 06: Global Bioreactors and Fermenters Market Value Share Analysis By Process Type, 2016 and 2024

Figure 07: Fed batch Bioreactors Market Revenue, US$ Mn, 2014–2024

Figure 08: Global Continuous Process Bioreactors Market Revenue, US$ Mn, 2014–2024

Figure 09: Global Batch Process Bioreactors Market Revenue, US$ Mn, 2014–2024

Figure 10: Global Bioreactors and Fermenters Market Attractiveness Analysis, By Process Type

Figure 11: Global Bioreactors and Fermenters Market Value Share Analysis By End users, 2016 and 2024

Figure 12: Global Biopharmaceutical companies Market Revenue (US$ Mn), 2016–2024

Figure 13: Global CROs Market Revenue (US$ Mn), 2016–2024

Figure 14: Global Academic & Research Institutes Market Revenue (US$ Mn), 2016–2024

Figure 15: Bioreactors and Fermenters Market Attractiveness Analysis, by End user

Figure 16: Global Bioreactors and Fermenters Market Analysis By Region, 2016 and 2024

Figure 17: Global Bioreactors and Fermenters Market Attractiveness Analysis, By Region Type

Figure 18: North America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, 2016–2024

Figure 19: North America Market Attractiveness Analysis By Country

Figure 20: North America Bioreactors and Fermenters Market Value Share Analysis By Product Type, 2016 and 2024

Figure 21: North America Bioreactors and Fermenters Market Value Share Analysis By Process Type, 2016 and 2024

Figure 22: North America Bioreactors and Fermenters Market Value Share Analysis By End User Type, 2016 and 2024

Figure 23: North America Market Value Share Analysis By Country, 2016 and 2024

Figure 24: North America Market Attractiveness Analysis, by Product

Figure 25: North America Market Attractiveness Analysis, by Process

Figure 26: North America Market Attractiveness Analysis, by End User

Figure 27: Europe Bioreactors and Fermenters Market Size (US$ Mn) Forecast, 2016–2024

Figure 28: Europe Market Attractiveness Analysis, by Country

Figure 29: Europe Market Value Share Analysis By Product Type, 2016 and 2024

Figure 30: Europe Market Value Share Analysis By Process Type, 2016 and 2024

Figure 31: Europe Bioreactors and Fermenters Market Value Share Analysis By End User Type, 2016 and 2024

Figure 32: Europe Market Value Share Analysis, by Country, 2016 and 2024

Figure 33: Europe Market Attractiveness Analysis, by Product

Figure 34: Europe Market Attractiveness Analysis, by Process

Figure 35: Europe Market Attractiveness Analysis, by End User

Figure 36: Asia Pacific Bioreactors and Fermenters Market Size (US$ Mn) Forecast, 2016–2024

Figure 37: Asia Pacific Market Attractiveness Analysis, by Country

Figure 38: Asia Pacific Market Value Share Analysis By Product Type, 2016 and 2024

Figure 39: Asia Pacific Market Value Share Analysis By Process Type, 2016 and 2024

Figure 40: Asia Pacific Bioreactors and Fermenters Market Value Share Analysis By End User Type, 2016 and 2024

Figure 41: Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

Figure 42: Asia Pacific Market Attractiveness Analysis, by Product

Figure 43: Asia Pacific Market Attractiveness Analysis, by Process

Figure 44: Asia Pacific Market Attractiveness Analysis, by End User

Figure 45: Latin America Bioreactors and Fermenters Market Size (US$ Mn) Forecast, 2016–2024

Figure 46: Latin America Market Attractiveness Analysis, by Country

Figure 47: Latin America Market Value Share Analysis By Product Type, 2016 and 2024

Figure 48: Latin America Market Value Share Analysis By Process Type, 2016 and 2024

Figure 49: Latin America Bioreactors and Fermenters Market Value Share Analysis By End User Type, 2016 and 2024

Figure 50: Latin America Market Value Share Analysis, by Country, 2016 and 2024

Figure 51: Latin America Market Attractiveness Analysis, by Product

Figure 52: Latin America Market Attractiveness Analysis, by Process

Figure 53: Latin America Market Attractiveness Analysis, by End User

Figure 54: Middle East and Africa Bioreactors and Fermenters Market Size (US$ Mn) Forecast, 2016–2024

Figure 55: Middle East and Africa Market Attractiveness Analysis, by Country

Figure 56: Middle East and Africa Market Value Share Analysis By Product Type, 2016 and 2024

Figure 57: Middle East and Africa Market Value Share Analysis By Process Type, 2016 and 2024

Figure 58: Middle East and Africa Bioreactors and Fermenters Market Value Share Analysis By End User Type, 2016 and 2024

Figure 59: Middle East and Africa Market Value Share Analysis, by Country, 2016 and 2024

Figure 60: Middle East and Africa Market Attractiveness Analysis, by Product

Figure 61: Middle East and Africa Market Attractiveness Analysis, by Process

Figure 62: Middle East and Africa Market Attractiveness Analysis, by End User

Figure 63: Global Bioreactors and Fermenters Market Share Analysis By Company (2015)