Reports

Reports

Analysts’ Viewpoint

Automotive manufacturers have developed various types of automotive embedded systems and safety systems that are expected to help prevent accidents. These integrated safety systems help in crash avoidance and reduction of the severity of the crash.

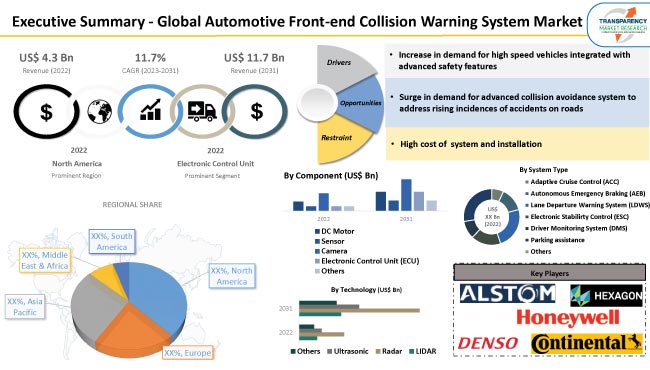

Rise in the demand for vehicles that are incorporated with enhanced safety features and change in consumer living standards are projected to boost the automotive front-end collision warning system market growth in the next few years.

Several government authorities across the globe, including those in North America, Europe, and Asia Pacific, are working toward mandating the integration of advance safety features in both passenger and commercial vehicles. This is expected to propel the automotive front-end collision warning system industry growth in the coming years.

The automotive front-end collision warning system is integrated within the control system and has the capability to reduce the loss of control and prevent rollover crashes. Moreover, rising demand for high-speed vehicles is driving the need to adopt advanced technologies, such as automotive front-end collision warning system, in order to enhance consumer safety.

The automotive front-end collision warning system is a safety feature that uses radar, lasers, or cameras to scan the road ahead and detect the distance between two successive cars as well as their relative speed.

The ability of the automotive front-end collision avoidance warning system to reduce injury crashes by 40% and fatal crashes by 30% offers significant business growth opportunity for vendors of automotive embedded systems.

Rise in investment for integration of safety features in vehicles and implementation of regulations for enhancement in safety and vehicle emission are driving the automotive front-end collision warning system market dynamics.

Growing awareness about safety among vehicle owners and users is boosting the adoption of self-driving and sophisticated safety systems in vehicles. Moreover, focus of government bodies on the enactment of new laws and regulations regarding collision warning system is anticipated to significantly drive the automotive front-end collision warning system market demand.

For instance, UN ECE regulation 152 provides the requirements for the approval for an AEBS designed to avoid collision either with cars or pedestrians. The regulation states to design a system that would minimize the generation of collision warning signals and to avoid advanced emergency braking.

Rising demand for high-speed vehicles is driving the need to adopt advanced technologies, such as collision mitigation technology coupled with the use of advanced components such as sensors, radars, and cameras, in order to satisfy consumer interest without compromising on safety.

Implementation of these systems detects a potential crash, alerts the driver, and takes corrective action without the need for driver interference.

Increase in concerns about occupant safety and awareness programs by traffic administrations across the globe are anticipated to positively impact the automotive front-end collision warning system market forecast during the forecast period. These systems has a superior advantage in commercial vehicles, as these vehicles carrying heavy loads are difficult to stop, as compared to passenger vehicles.

Moreover, according to the U.S. National Transportation Safety Board, the adoption of these systems, such as collision avoidance system and autonomous emergency braking system in highway vehicles, would significantly lower the number of accidents and reduce accidental injuries and loss of lives.

Intercontinental trucking activities are highly popular in North America and Europe, which in turn is expected to drive the adoption of automotive front-end collision warning system in these regions.

The e-commerce industry has been witnessed exponential growth due to rise in online shopping and rapid increase in the number of Internet users. This rise in e-commerce activities has aggressively supported the use of commercial vehicles, which in turn is anticipated to fuel the automotive embedded system market in 2023.

Moreover, rapid economic development in nations in Asia Pacific, including China, India, Japan, and ASEAN Countries, is boosting the sales of commercial vehicles, thereby fueling the demand for commercial vehicles in the region. This, in turn, is expected to boost the demand for automotive forward collision warning system for automotive.

Demand for radar technology-based front-end collision warning system is anticipated to grow at a significant CAGR due to its ability to measure the distance from the other vehicle or any hurdle in the way. This radar-based safety system is designed to warn, assist, and alert the driver in order to avoid imminent collisions and minimize the risk of accidents.

Growing demand for active safety systems in automotive, such Advance Driver Assistance System (ADAS), is a key factor that is estimated to augment the adoption of radars in automotive front collision warning system during the forecast period.

According to the region-wise global automotive front-end collision warning system market analysis, North America is anticipated to hold a notable automotive front-end collision warning system market share due increase in concerns about safety and the presence of advanced technologies across the countries in the region.

The Asia Pacific market is expected to grow at a prominent CAGR in the next few years due to the presence of expanding economies, such as China and India, in the region. Moreover, Asia Pacific is the largest automobile market coupled with several other factors such as rising consumer purchasing power that significantly supports the demand for automobiles in the region. These factors are estimated to significantly boost the adoption of automotive front-end collision warning systems during the forecast years.

The global automotive Front-end Collision warning system business is controlled by established companies. However, key players are consolidating their market position by strategies such as partnership, merger, & acquisitions with major automobile manufacturers coupled with enhancements in product offerings.

Some of the key manufacturers in the automotive front-end collision warning system industry across the globe are Alstom, Autoliv, Becker Mining Systems, Continental AG, Delphi Technologies, Denso Corporation, General Electric, Hexagon AB, Honeywell International, Magna International Inc., Mobileye N.V., Robert Bosch GmbH, Siemens, Wabtec Corporation, and ZF Friedrichshafen (TRW).

The automotive front-end collision warning system market report scope includes profiles of key players who have been analyzed on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 4.3 Bn |

|

Market Forecast Value in 2031 |

US$ 11.7 Bn |

|

Growth Rate (CAGR) |

11.7% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market is valued at US$ 4.3 Bn in 2022

The market is expected to expand at a CAGR of 11.7% by 2031

The automotive front end collision warning system business would be worth US$ 11.7 Bn in 2031

Increase in demand for high speed vehicles integrated with advanced safety features and rise in e-commerce with surge in trucking activities

Based on vehicle type, the passenger car segment accounted for majority share in 2022

North America was a highly lucrative region for vendors in 2022

Mobileye N.V., Autoliv, Robert Bosch GmbH, Magna International Inc., Delphi Technologies, ZF Friedrichshafen (TRW), Siemens, Continental AG, General Electric, Honeywell International, Hexagon AB, Becker Mining Systems, Alstom, Wabtec Corporation, and Denso Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Automotive Front-end Collision Warning System Market

4. Global Automotive Front-end Collision Warning System Market, by Component

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Component

4.2.1. DC Motor

4.2.2. Sensor

4.2.3. Camera

4.2.4. Electronic Control Unit (ECU)

4.2.5. Others

5. Global Automotive Front-end Collision Warning System Market, by System Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by System Type

5.2.1. Adaptive Cruise Control (ACC)

5.2.2. Autonomous Emergency Braking (AEB)

5.2.3. Lane Departure Warning System (LDWS)

5.2.4. Electronic Stability Control (ESC)

5.2.5. Driver Monitoring System (DMS)

5.2.6. Parking assistance

5.2.7. Others

6. Global Automotive Front-end Collision Warning System Market, by Technology

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Technology

6.2.1. LIDAR

6.2.2. Radar

6.2.3. Ultrasonic

6.2.4. Others

7. Global Automotive Front-end Collision Warning System Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Vehicle Type

7.2.1. Passenger Cars

7.2.1.1. Hatchback

7.2.1.2. Sedan

7.2.1.3. Utility Vehicles

7.2.2. Light Commercial Vehicles

7.2.3. Heavy Duty Trucks

7.2.4. Buses and Coaches

8. Global Automotive Front-end Collision Warning System Market, by Propulsion

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Propulsion

8.2.1. IC Engine

8.2.1.1. Gasoline

8.2.1.2. Diesel

8.2.2. Electric

8.2.2.1. Battery Electric Vehicle (BEV)

8.2.2.2. Hybrid Electric Vehicle (HEV)

8.2.2.3. Plug-In Hybrid Electric Vehicle (PHEV)

9. Global Automotive Front-end Collision Warning System Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Front-end Collision Warning System Market

10.1. Market Snapshot

10.2. North America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Component

10.2.1. DC Motor

10.2.2. Sensor

10.2.3. Camera

10.2.4. Electronic Control Unit (ECU)

10.2.5. Others

10.3. North America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by System Type

10.3.1. Adaptive Cruise Control (ACC)

10.3.2. Autonomous Emergency Braking (AEB)

10.3.3. Lane Departure Warning System (LDWS)

10.3.4. Electronic Stability Control (ESC)

10.3.5. Driver Monitoring System (DMS)

10.3.6. Parking assistance

10.3.7. Others

10.4. North America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Technology

10.4.1. LIDAR

10.4.2. Radar

10.4.3. Ultrasonic

10.4.4. Others

10.5. North America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Vehicle Type

10.5.1. Passenger Cars

10.5.1.1. Hatchback

10.5.1.2. Sedan

10.5.1.3. Utility Vehicles

10.5.2. Light Commercial Vehicles

10.5.3. Heavy Duty Trucks

10.5.4. Buses and Coaches

10.6. North America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Propulsion

10.6.1. IC Engine

10.6.1.1. Gasoline

10.6.1.2. Diesel

10.6.2. Electric

10.6.2.1. Battery Electric Vehicle (BEV)

10.6.2.2. Hybrid Electric Vehicle (HEV)

10.6.2.3. Plug-In Hybrid Electric Vehicle (PHEV)

10.7. North America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Country

10.7.1. U. S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Automotive Front-end Collision Warning System Market

11.1. Market Snapshot

11.2. Europe Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Component

11.2.1. DC Motor

11.2.2. Sensor

11.2.3. Camera

11.2.4. Electronic Control Unit (ECU)

11.2.5. Others

11.3. Europe Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by System Type

11.3.1. Adaptive Cruise Control (ACC)

11.3.2. Autonomous Emergency Braking (AEB)

11.3.3. Lane Departure Warning System (LDWS)

11.3.4. Electronic Stability Control (ESC)

11.3.5. Driver Monitoring System (DMS)

11.3.6. Parking assistance

11.3.7. Others

11.4. Europe Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Technology

11.4.1. LIDAR

11.4.2. Radar

11.4.3. Ultrasonic

11.4.4. Others

11.5. Europe Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Vehicle Type

11.5.1. Passenger Cars

11.5.1.1. Hatchback

11.5.1.2. Sedan

11.5.1.3. Utility Vehicles

11.5.2. Light Commercial Vehicles

11.5.3. Heavy Duty Trucks

11.5.4. Buses and Coaches

11.6. Europe Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Propulsion

11.6.1. IC Engine

11.6.1.1. Gasoline

11.6.1.2. Diesel

11.6.2. Electric

11.6.2.1. Battery Electric Vehicle (BEV)

11.6.2.2. Hybrid Electric Vehicle (HEV)

11.6.2.3. Plug-In Hybrid Electric Vehicle (PHEV)

11.7. Europe Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Country

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Automotive Front-end Collision Warning System Market

12.1. Market Snapshot

12.2. Asia Pacific Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Component

12.2.1. DC Motor

12.2.2. Sensor

12.2.3. Camera

12.2.4. Electronic Control Unit (ECU)

12.2.5. Others

12.3. Asia Pacific Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by System Type

12.3.1. Adaptive Cruise Control (ACC)

12.3.2. Autonomous Emergency Braking (AEB)

12.3.3. Lane Departure Warning System (LDWS)

12.3.4. Electronic Stability Control (ESC)

12.3.5. Driver Monitoring System (DMS)

12.3.6. Parking assistance

12.3.7. Others

12.4. Asia Pacific Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Technology

12.4.1. LIDAR

12.4.2. Radar

12.4.3. Ultrasonic

12.4.4. Others

12.5. Asia Pacific Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Vehicle Type

12.5.1. Passenger Cars

12.5.1.1. Hatchback

12.5.1.2. Sedan

12.5.1.3. Utility Vehicles

12.5.2. Light Commercial Vehicles

12.5.3. Heavy Duty Trucks

12.5.4. Buses and Coaches

12.6. Asia Pacific Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Propulsion

12.6.1. IC Engine

12.6.1.1. Gasoline

12.6.1.2. Diesel

12.6.2. Electric

12.6.2.1. Battery Electric Vehicle (BEV)

12.6.2.2. Hybrid Electric Vehicle (HEV)

12.6.2.3. Plug-In Hybrid Electric Vehicle (PHEV)

12.7. Asia Pacific Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Country

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Front-end Collision Warning System Market

13.1. Market Snapshot

13.2. Middle East & Africa Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Component

13.2.1. DC Motor

13.2.2. Sensor

13.2.3. Camera

13.2.4. Electronic Control Unit (ECU)

13.2.5. Others

13.3. Middle East & Africa Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by System Type

13.3.1. Adaptive Cruise Control (ACC)

13.3.2. Autonomous Emergency Braking (AEB)

13.3.3. Lane Departure Warning System (LDWS)

13.3.4. Electronic Stability Control (ESC)

13.3.5. Driver Monitoring System (DMS)

13.3.6. Parking assistance

13.3.7. Others

13.4. Middle East & Africa Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Technology

13.4.1. LIDAR

13.4.2. Radar

13.4.3. Ultrasonic

13.4.4. Others

13.5. Middle East & Africa Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Vehicle Type

13.5.1. Passenger Cars

13.5.1.1. Hatchback

13.5.1.2. Sedan

13.5.1.3. Utility Vehicles

13.5.2. Light Commercial Vehicles

13.5.3. Heavy Duty Trucks

13.5.4. Buses and Coaches

13.6. Middle East & Africa Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Propulsion

13.6.1. IC Engine

13.6.1.1. Gasoline

13.6.1.2. Diesel

13.6.2. Electric

13.6.2.1. Battery Electric Vehicle (BEV)

13.6.2.2. Hybrid Electric Vehicle (HEV)

13.6.2.3. Plug-In Hybrid Electric Vehicle (PHEV)

13.7. Middle East & Africa Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Country

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Automotive Front-end Collision Warning System Market

14.1. Market Snapshot

14.2. South America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Component

14.2.1. DC Motor

14.2.2. Sensor

14.2.3. Camera

14.2.4. Electronic Control Unit (ECU)

14.2.5. Others

14.3. South America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by System Type

14.3.1. Adaptive Cruise Control (ACC)

14.3.2. Autonomous Emergency Braking (AEB)

14.3.3. Lane Departure Warning System (LDWS)

14.3.4. Electronic Stability Control (ESC)

14.3.5. Driver Monitoring System (DMS)

14.3.6. Parking assistance

14.3.7. Others

14.4. South America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Technology

14.4.1. LIDAR

14.4.2. Radar

14.4.3. Ultrasonic

14.4.4. Others

14.5. South America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Vehicle Type

14.5.1. Passenger Cars

14.5.1.1. Hatchback

14.5.1.2. Sedan

14.5.1.3. Utility Vehicles

14.5.2. Light Commercial Vehicles

14.5.3. Heavy Duty Trucks

14.5.4. Buses and Coaches

14.6. South America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Propulsion

14.6.1. IC Engine

14.6.1.1. Gasoline

14.6.1.2. Diesel

14.6.2. Electric

14.6.2.1. Battery Electric Vehicle (BEV)

14.6.2.2. Hybrid Electric Vehicle (HEV)

14.6.2.3. Plug-In Hybrid Electric Vehicle (PHEV)

14.7. South America Automotive Front-end Collision Warning System Market Size & Forecast, 2017-2031, by Country

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Alstom

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Autoliv

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Becker Mining Systems

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Continental AG

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Delphi Technologies

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Denso Corporation

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. General Electric

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Hexagon AB

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Honeywell International

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Magna International Inc.

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Mobileye N.V

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Robert Bosch GmbH

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Siemens

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Wabtec Corporation

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. ZF Friedrichshafen (TRW)

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Other Key Players

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

List of Tables

Table 1: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Table 2: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 3: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Table 4: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Table 5: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Table 6: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 7: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 10: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 11: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Table 14: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 15: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Table 16: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Table 17: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Table 18: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 19: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 20: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 21: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 22: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 23: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Table 26: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 27: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Table 28: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Table 29: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Table 30: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 31: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 33: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 34: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 35: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Table 38: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 39: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Table 40: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Table 41: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Table 42: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 43: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 45: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 46: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 47: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Table 50: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 51: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Table 52: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Table 53: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Table 54: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 55: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 58: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 59: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Table 62: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 63: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Table 64: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Table 65: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Table 66: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 67: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 68: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 69: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 70: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 71: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 2: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 3: Global Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Figure 5: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Figure 6: Global Automotive Front-end Collision Warning System Market, Incremental Opportunity, by System Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 8: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 9: Global Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 14: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 15: Global Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 16: Global Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 20: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 21: North America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Figure 23: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Figure 24: North America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by System Type, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 26: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 27: North America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: North America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 31: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 32: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 33: North America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 34: North America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 38: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 39: Europe Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Figure 41: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Figure 42: Europe Automotive Front-end Collision Warning System Market, Incremental Opportunity, by System Type, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 44: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 45: Europe Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 46: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 49: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 50: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 51: Europe Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 52: Europe Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 56: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 57: Asia Pacific Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Figure 59: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Figure 60: Asia Pacific Automotive Front-end Collision Warning System Market, Incremental Opportunity, by System Type, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 62: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 63: Asia Pacific Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 68: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 69: Asia Pacific Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 74: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 75: Middle East & Africa Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Figure 77: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Figure 78: Middle East & Africa Automotive Front-end Collision Warning System Market, Incremental Opportunity, by System Type, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 80: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 81: Middle East & Africa Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 86: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 87: Middle East & Africa Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Component, 2017-2031

Figure 92: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 93: South America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 94: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by System Type, 2017-2031

Figure 95: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by System Type, 2017-2031

Figure 96: South America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by System Type, Value (US$ Bn), 2023-2031

Figure 97: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 98: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 99: South America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 100: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 101: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 103: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 104: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 105: South America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 106: South America Automotive Front-end Collision Warning System Market Volume (Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Front-end Collision Warning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Front-end Collision Warning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031