Reports

Reports

Analysts’ Viewpoint

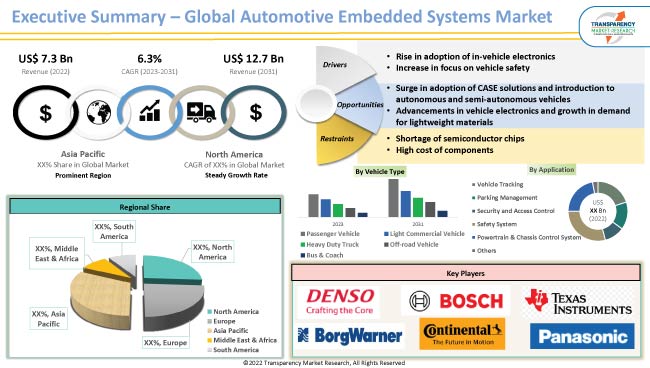

Automotive embedded systems are designed to make driving safer, more efficient, and more comfortable. The global automotive embedded electronics market size is anticipated to grow at a significant pace in the near future owing to rise in adoption of traffic management and prediction systems in large cities across the world.

Growth in need for advanced safety and infotainment features and accessories in vehicles is boosting the demand for automotive embedded systems. Furthermore, manufacturers are collaborating with OEMs to combat escalating per-vehicle hardware and software costs, create economies of scale, repurpose software across platforms, and reduce E/E architecture.

The automotive embedded system consists of an electronic or computer system capable of controlling and accessing the data in electronics-based systems. This system comprises a single-chip microcontroller such as cortex, ARM, and also microprocessors, FPGAs, DSPs, and ASICs.

Embedded systems are an integral part of automotive safety systems such as anti-lock braking systems, traction control, electronic stability control, and automatic four-wheel drive system. Embedded system hardware includes microcontrollers or microprocessors, integrated circuits, and central processing units. Embedded software systems are based on operating systems such as Linux, Windows, and Java.

Mobility 4.0 is gaining traction in the automotive sector due to the emergence of CASE (Connected, Autonomous, Shared, and Electric) technologies, changes in customer behaviors, and increase in focus on sustainability.

Embedded systems play a crucial role in providing the necessary functionality for automotive electronic components to work together seamlessly. For instance, anti-lock braking systems, airbag control systems, and traction control systems all rely on embedded systems to monitor and control various aspects of the vehicle's performance. Thus, surge in usage of in-vehicle electronics is projected to spur the automotive embedded systems market growth in the near future.

Expansion of the automotive sector in growing economies, such as China, India, and Brazil, is also boosting the demand for automotive embedded systems. Additionally, intense competition among automakers due to various factors, including innovation and development lead times, fuel economy, safety, reliability, product quality and features, and sustainable pricing, is augmenting the automotive embedded systems market expansion.

Automakers are integrating Artificial Intelligence (AI) in various vehicle systems to increase vehicle safety and comfort. This includes gesture input systems and next-generation cockpits. Next-generation vehicles are gaining traction among consumers with surge in disposable income and rise in focus on vehicle safety. Thus, OEMs are incorporating cutting-edge technologies that offer various levels of autonomy and improve driver and passenger convenience in their vehicles. This is projected to boost the automotive embedded systems market development in the next few years.

According to the latest automotive embedded systems market analysis, the passenger vehicle segment is anticipated to account for largest share from 2023 to 2031. Growth of the segment can be ascribed to rise in government initiatives to promote the use of advanced electronics in passenger cars in order to mitigate environment pollution. Increase in usage of ADAS is also fueling the segment.

According to the latest automotive embedded systems market trends, the safety system application segment is projected to dominate the industry during the forecast period. Growth in adoption of ADAS, such as adaptive cruise control, airbag system, traction control system, and anti-lock braking system, is driving the segment.

According to the latest automotive embedded systems market forecast, Asia Pacific is predicted to hold largest share from 2023 to 2031. Surge in usage of in-vehicle electronics and presence of major automakers in countries, such as China, Japan, South Korea, and India, are augmenting market statistics in the region.

Increase in implementation of advanced automotive technologies, such as wireless connectivity, multi-modal inputs, Driver Monitoring System (DMS), Human-Machine Interface (HMI) communication, and smart cabin monitoring, is also fueling the demand for automotive embedded systems in Asia Pacific.

Robert Bosch GmbH, DENSO Corporation, Panasonic Corporation, Texas Instruments, Mitsubishi Electric Corporation, Continental AG, Infineon Technologies, NXP Semiconductors, Johnson Electric, HARMAN International, BorgWarner Inc., Hella GmbH & Co. KgaA, Toshiba Corporation, ZF Friedrichshafen AG, STMicroelectronics, IBM Corporation, Fujitsu, VIA Technologies Inc., Intel Corporation, and Microchip Technology Inc. are key entities operating in this industry.

Key players have been profiled in the automotive embedded systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Vendors are standardizing their embedded systems to reduce development costs and increase efficiency. Standardization also enables manufacturers to leverage economies of scale and reduce the cost of production. They are also collaborating with other technology companies and semiconductor manufacturers to develop advanced products and increase their automotive embedded systems market share.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 7.3 Bn |

|

Market Forecast Value in 2031 |

US$ 12.7 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 7.3 Bn in 2022.

It is projected to grow at a CAGR of 6.3% from 2023 to 2031.

It is projected to reach US$ 12.7 Bn by the end of 2031.

Rise in adoption of in-vehicle electronics and increase in focus on vehicle safety.

The passenger vehicle segment is expected to account for largest share from 2023 to 2031 .

Asia Pacific is likely to be the most lucrative region for vendors during the forecast period.

Robert Bosch GmbH, DENSO Corporation, Panasonic Corporation, Texas Instruments, Mitsubishi Electric Corporation, Continental AG, Infineon Technologies, NXP Semiconductors, Johnson Electric, HARMAN International, BorgWarner Inc., Hella GmbH & Co. KgaA, Toshiba Corporation, ZF Friedrichshafen AG, STMicroelectronics, IBM Corporation, Fujitsu, VIA Technologies Inc., Intel Corporation, and Microchip Technology Inc.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Demand & Supply Side Trends

1.3. TMR Analysis and Recommendations

1.4. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Macro-economic Factors

2.3.1. GDP & GDP Growth Rate

2.3.2. Component Value Added Growth

2.4. Forecast Factors - Relevance & Impact

2.4.1. Global Automotive Embedded System Market Growth

2.4.2. Edge Computing Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

3. Key Trend Analysis

4. Industry Ecosystem Analysis

4.1. Value Chain Analysis

4.1.1. Component Manufacturer

4.1.2. System Suppliers

4.1.3. Tier 1 Players

4.1.4. 0.5 Tier Players/ Technology Providers

4.2. Vendor Matrix

4.3. Gross Margin Analysis

5. Global Automotive Embedded Systems Demand (in Value in US$ Bn) Analysis and Forecast, 2017-2031

5.1. Current and Future Market Value (US$ Bn) Projections, 2017-2031

5.1.1. Y-o-Y Growth Trend Analysis

5.1.2. Absolute $ Opportunity Analysis

6. Pricing Analysis

6.1. Cost Structure Analysis

6.2. Profit Margin Analysis

7. Global Automotive Embedded Systems Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

7.2.1. Passenger Vehicle

7.2.1.1. Hatchback

7.2.1.2. Sedan

7.2.1.3. Utility Vehicle

7.2.2. Light Commercial Vehicle

7.2.3. Heavy Duty Truck

7.2.4. Off-road Vehicle

7.2.4.1. Agriculture Vehicle

7.2.4.2. Industrial Vehicle

7.2.5. Bus & Coach

8. Global Automotive Embedded Systems Market, by Component

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

8.2.1. Sensors

8.2.2. Microcontrollers

8.2.3. ECUs

8.2.4. Transreceivers

8.2.5. Integrated Circuits

8.2.6. Timers

8.2.7. Others

9. Global Automotive Embedded Systems Market, by Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

9.2.1. Embedded Hardware

9.2.2. Embedded Software

10. Global Automotive Embedded Systems Market, by Propulsion

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

10.2.1. IC Engine

10.2.1.1. Gasoline

10.2.1.2. Diesel

10.2.2. Electric

10.2.2.1. Battery Electric Vehicle

10.2.2.2. Plug-in Hybrid Electric Vehicle

11. Global Automotive Embedded Systems Market, by Application

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

11.2.1. Vehicle Tracking

11.2.2. Parking Management

11.2.3. Security and Access Control

11.2.4. Safety System

11.2.4.1. Adaptive Cruise Control

11.2.4.2. Airbag System

11.2.4.3. Traction Control System

11.2.4.4. Anti-lock Braking System

11.2.4.5. Others

11.2.5. Powertrain & Chassis Control System

11.2.6. Others

12. Global Automotive Embedded Systems Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Automotive Embedded Systems Market

13.1. Market Snapshot

13.2. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

13.2.1. Passenger Vehicle

13.2.1.1. Hatchback

13.2.1.2. Sedan

13.2.1.3. Utility Vehicle

13.2.2. Light Commercial Vehicle

13.2.3. Heavy Duty Truck

13.2.4. Off-road Vehicle

13.2.4.1. Agriculture Vehicle

13.2.4.2. Industrial Vehicle

13.2.5. Bus & Coach

13.3. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

13.3.1. Sensors

13.3.2. Microcontrollers

13.3.3. ECUs

13.3.4. Transreceivers

13.3.5. Integrated Circuits

13.3.6. Timers

13.3.7. Others

13.4. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

13.4.1. Embedded Hardware

13.4.2. Embedded Software

13.5. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

13.5.1. IC Engine

13.5.1.1. Gasoline

13.5.1.2. Diesel

13.5.2. Electric

13.5.2.1. Battery Electric Vehicle

13.5.2.2. Plug-in Hybrid Electric Vehicle

13.6. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

13.6.1. Vehicle Tracking

13.6.2. Parking Management

13.6.3. Security and Access Control

13.6.4. Safety System

13.6.4.1. Adaptive Cruise Control

13.6.4.2. Airbag System

13.6.4.3. Traction Control System

13.6.4.4. Anti-lock Braking System

13.6.4.5. Others

13.6.5. Powertrain & Chassis Control System

13.6.6. Others

13.7. Key Country Analysis – North America Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031

13.7.1. U. S.

13.7.2. Canada

13.7.3. Mexico

14. Europe Automotive Embedded Systems Market

14.1. Market Snapshot

14.2. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

14.2.1. Passenger Vehicle

14.2.1.1. Hatchback

14.2.1.2. Sedan

14.2.1.3. Utility Vehicle

14.2.2. Light Commercial Vehicle

14.2.3. Heavy Duty Truck

14.2.4. Off-road Vehicle

14.2.4.1. Agriculture Vehicle

14.2.4.2. Industrial Vehicle

14.2.5. Bus & Coach

14.3. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

14.3.1. Sensors

14.3.2. Microcontrollers

14.3.3. ECUs

14.3.4. Transreceivers

14.3.5. Integrated Circuits

14.3.6. Timers

14.3.7. Others

14.4. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

14.4.1. Embedded Hardware

14.4.2. Embedded Software

14.5. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

14.5.1. IC Engine

14.5.1.1. Gasoline

14.5.1.2. Diesel

14.5.2. Electric

14.5.2.1. Battery Electric Vehicle

14.5.2.2. Plug-in Hybrid Electric Vehicle

14.6. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

14.6.1. Vehicle Tracking

14.6.2. Parking Management

14.6.3. Security and Access Control

14.6.4. Safety System

14.6.4.1. Adaptive Cruise Control

14.6.4.2. Airbag System

14.6.4.3. Traction Control System

14.6.4.4. Anti-lock Braking System

14.6.4.5. Others

14.6.5. Powertrain & Chassis Control System

14.6.6. Others

14.7. Key Country Analysis – Europe Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031

14.7.1. Germany

14.7.2. U.K.

14.7.3. France

14.7.4. Italy

14.7.5. Spain

14.7.6. Nordic Countries

14.7.7. Russia & CIS

14.7.8. Rest of Europe

15. Asia Pacific Automotive Embedded Systems Market

15.1. Market Snapshot

15.2. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

15.2.1. Passenger Vehicle

15.2.1.1. Hatchback

15.2.1.2. Sedan

15.2.1.3. Utility Vehicle

15.2.2. Light Commercial Vehicle

15.2.3. Heavy Duty Truck

15.2.4. Off-road Vehicle

15.2.4.1. Agriculture Vehicle

15.2.4.2. Industrial Vehicle

15.2.5. Bus & Coach

15.3. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

15.3.1. Sensors

15.3.2. Microcontrollers

15.3.3. ECUs

15.3.4. Transreceivers

15.3.5. Integrated Circuits

15.3.6. Timers

15.3.7. Others

15.4. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

15.4.1. Embedded Hardware

15.4.2. Embedded Software

15.5. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

15.5.1. IC Engine

15.5.1.1. Gasoline

15.5.1.2. Diesel

15.5.2. Electric

15.5.2.1. Battery Electric Vehicle

15.5.2.2. Plug-in Hybrid Electric Vehicle

15.6. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

15.6.1. Vehicle Tracking

15.6.2. Parking Management

15.6.3. Security and Access Control

15.6.4. Safety System

15.6.4.1. Adaptive Cruise Control

15.6.4.2. Airbag System

15.6.4.3. Traction Control System

15.6.4.4. Anti-lock Braking System

15.6.4.5. Others

15.6.5. Powertrain & Chassis Control System

15.6.6. Others

15.7. Key Country Analysis – Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031

15.7.1. China

15.7.2. India

15.7.3. Japan

15.7.4. ASEAN Countries

15.7.5. South Korea

15.7.6. ANZ

15.7.7. Rest of Asia Pacific

16. Middle East & Africa Automotive Embedded Systems Market

16.1. Market Snapshot

16.2. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

16.2.1. Passenger Vehicle

16.2.1.1. Hatchback

16.2.1.2. Sedan

16.2.1.3. Utility Vehicle

16.2.2. Light Commercial Vehicle

16.2.3. Heavy Duty Truck

16.2.4. Off-road Vehicle

16.2.4.1. Agriculture Vehicle

16.2.4.2. Industrial Vehicle

16.2.5. Bus & Coach

16.3. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

16.3.1. Sensors

16.3.2. Microcontrollers

16.3.3. ECUs

16.3.4. Transreceivers

16.3.5. Integrated Circuits

16.3.6. Timers

16.3.7. Others

16.4. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

16.4.1. Embedded Hardware

16.4.2. Embedded Software

16.5. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

16.5.1. IC Engine

16.5.1.1. Gasoline

16.5.1.2. Diesel

16.5.2. Electric

16.5.2.1. Battery Electric Vehicle

16.5.2.2. Plug-in Hybrid Electric Vehicle

16.6. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

16.6.1. Vehicle Tracking

16.6.2. Parking Management

16.6.3. Security and Access Control

16.6.4. Safety System

16.6.4.1. Adaptive Cruise Control

16.6.4.2. Airbag System

16.6.4.3. Traction Control System

16.6.4.4. Anti-lock Braking System

16.6.4.5. Others

16.6.5. Powertrain & Chassis Control System

16.6.6. Others

16.7. Key Country Analysis – Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031

16.7.1. GCC

16.7.2. South Africa

16.7.3. Turkey

16.7.4. Rest of Middle East & Africa

17. South America Automotive Embedded Systems Market

17.1. Market Snapshot

17.2. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

17.2.1. Passenger Vehicle

17.2.1.1. Hatchback

17.2.1.2. Sedan

17.2.1.3. Utility Vehicle

17.2.2. Light Commercial Vehicle

17.2.3. Heavy Duty Truck

17.2.4. Off-road Vehicle

17.2.4.1. Agriculture Vehicle

17.2.4.2. Industrial Vehicle

17.2.5. Bus & Coach

17.3. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

17.3.1. Sensors

17.3.2. Microcontrollers

17.3.3. ECUs

17.3.4. Transreceivers

17.3.5. Integrated Circuits

17.3.6. Timers

17.3.7. Others

17.4. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

17.4.1. Embedded Hardware

17.4.2. Embedded Software

17.5. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

17.5.1. IC Engine

17.5.1.1. Gasoline

17.5.1.2. Diesel

17.5.2. Electric

17.5.2.1. Battery Electric Vehicle

17.5.2.2. Plug-in Hybrid Electric Vehicle

17.6. Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

17.6.1. Vehicle Tracking

17.6.2. Parking Management

17.6.3. Security and Access Control

17.6.4. Safety System

17.6.4.1. Adaptive Cruise Control

17.6.4.2. Airbag System

17.6.4.3. Traction Control System

17.6.4.4. Anti-lock Braking System

17.6.4.5. Others

17.6.5. Powertrain & Chassis Control System

17.6.6. Others

17.7. Key Country Analysis – South America Automotive Embedded Systems Market Value (US$ Bn) Analysis & Forecast, 2017-2031

17.7.1. Brazil

17.7.2. Argentina

17.7.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2022

18.2. Key Strategy Analysis

18.2.1. Strategic Overview - Expansion, M&A, Partnership

18.2.2. Product & Marketing Strategy

18.3. Type Analysis for Each Player

18.3.1. Sensors

18.3.2. Microcontrollers

18.3.3. ECUs

18.3.4. Others

18.4. Company Analysis for Each Player(Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

19. Company Profile/ Key Players

19.1. Robert Bosch GmbH

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.1.11. Executive Bios

19.2. DENSO Corporation

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.2.11. Executive Bios

19.3. Panasonic Corporation

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.3.11. Executive Bios

19.4. Texas Instruments

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.4.11. Executive Bios

19.5. Mitsubishi Electric Corporation

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.5.11. Executive Bios

19.6. Continental AG

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.6.11. Executive Bios

19.7. Infineon Technologies

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.7.11. Executive Bios

19.8. NXP Semiconductors

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.8.11. Executive Bios

19.9. Johnson Electric

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.9.11. Executive Bios

19.10. HARMAN International

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.10.11. Executive Bios

19.11. BorgWarner Inc.

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.11.11. Executive Bios

19.12. Hella GmbH & Co. KgaA

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.12.11. Executive Bios

19.13. Toshiba Corporation

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.13.11. Executive Bios

19.14. ZF Friedrichshafen AG

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.14.11. Executive Bios

19.15. STMicroelectronics

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.15.11. Executive Bios

19.16. IBM Corporation

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.16.11. Executive Bios

19.17. Fujitsu

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.17.11. Executive Bios

19.18. VIA Technologies Inc.

19.18.1. Company Overview

19.18.2. Company Footprints

19.18.3. Production Locations

19.18.4. Product Portfolio

19.18.5. Competitors & Customers

19.18.6. Subsidiaries & Parent Organization

19.18.7. Recent Developments

19.18.8. Financial Analysis

19.18.9. Profitability

19.18.10. Revenue Share

19.18.11. Executive Bios

19.19. Intel Corporation

19.19.1. Company Overview

19.19.2. Company Footprints

19.19.3. Production Locations

19.19.4. Product Portfolio

19.19.5. Competitors & Customers

19.19.6. Subsidiaries & Parent Organization

19.19.7. Recent Developments

19.19.8. Financial Analysis

19.19.9. Profitability

19.19.10. Revenue Share

19.19.11. Executive Bios

19.20. Microchip Technology Inc.

19.20.1. Company Overview

19.20.2. Company Footprints

19.20.3. Production Locations

19.20.4. Product Portfolio

19.20.5. Competitors & Customers

19.20.6. Subsidiaries & Parent Organization

19.20.7. Recent Developments

19.20.8. Financial Analysis

19.20.9. Profitability

19.20.10. Revenue Share

19.20.11. Executive Bios

19.21. Others

19.21.1. Company Overview

19.21.2. Company Footprints

19.21.3. Production Locations

19.21.4. Product Portfolio

19.21.5. Competitors & Customers

19.21.6. Subsidiaries & Parent Organization

19.21.7. Recent Developments

19.21.8. Financial Analysis

19.21.9. Profitability

19.21.10. Revenue Share

19.21.11. Executive Bios

List of Tables

Table 1: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 3: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 4: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 5: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 6: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 7: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 8: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 9: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 10: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 11: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 14: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 15: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 16: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 17: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 18: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 19: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 20: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 21: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 23: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 26: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 27: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 28: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 29: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 30: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 31: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 32: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 33: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 34: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 35: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 39: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 40: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 41: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 42: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 43: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 44: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 45: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 46: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 47: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 50: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 51: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 52: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 53: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 54: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 55: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 56: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 57: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 58: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 59: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 62: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 63: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 64: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 65: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 66: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 67: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 68: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 69: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 70: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 71: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 3: Global Automotive Embedded Systems Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 5: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 6: Global Automotive Embedded Systems Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 8: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 9: Global Automotive Embedded Systems Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 11: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 12: Global Automotive Embedded Systems Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 14: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 15: Global Automotive Embedded Systems Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 16: Global Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Embedded Systems Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 21: North America Automotive Embedded Systems Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 23: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 24: North America Automotive Embedded Systems Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 26: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 27: North America Automotive Embedded Systems Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 29: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 30: North America Automotive Embedded Systems Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 31: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 32: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: North America Automotive Embedded Systems Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 34: North America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Embedded Systems Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: Europe Automotive Embedded Systems Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 41: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 42: Europe Automotive Embedded Systems Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 44: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 45: Europe Automotive Embedded Systems Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 46: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 47: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 48: Europe Automotive Embedded Systems Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 49: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 50: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: Europe Automotive Embedded Systems Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 52: Europe Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Embedded Systems Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific Automotive Embedded Systems Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 59: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 60: Asia Pacific Automotive Embedded Systems Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 62: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 63: Asia Pacific Automotive Embedded Systems Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 65: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 66: Asia Pacific Automotive Embedded Systems Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 68: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: Asia Pacific Automotive Embedded Systems Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Embedded Systems Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 74: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 75: Middle East & Africa Automotive Embedded Systems Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 77: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 78: Middle East & Africa Automotive Embedded Systems Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 80: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 81: Middle East & Africa Automotive Embedded Systems Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 83: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 84: Middle East & Africa Automotive Embedded Systems Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 86: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 87: Middle East & Africa Automotive Embedded Systems Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Embedded Systems Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 92: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 93: South America Automotive Embedded Systems Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 94: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 95: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 96: South America Automotive Embedded Systems Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 97: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 98: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 99: South America Automotive Embedded Systems Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 100: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 101: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 102: South America Automotive Embedded Systems Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 103: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 104: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 105: South America Automotive Embedded Systems Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 106: South America Automotive Embedded Systems Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Embedded Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Embedded Systems Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031