Reports

Reports

Analysts’ Viewpoint on Market Scenario

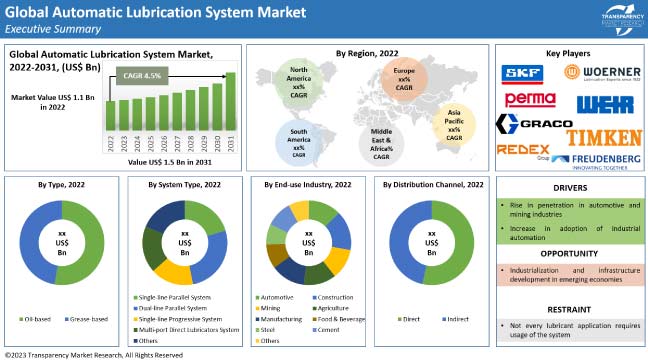

Increase in industrialization and rapid growth of automotive and mining activities, which led to revolutionized manufacturing, are driving the global automatic lubrication system industry. Surge in adoption of automatic lubrication systems (ALSs) in manufacturing industries in order to achieve equipment efficiency and service life as well as precise and consistent lubricant delivery further fuels the demand for automatic lubricating systems.

Key players are focusing on emerging automatic lubrication system market trends by offering remote monitoring and control of systems with customized and application-specific solutions. Such products are designed to meet specific industry and application requirements, which is resulting in increased automatic lubrication system market demand. Furthermore, players are spending significantly on comprehensive R&D activities, primarily to develop innovative lubrication system products.

An automatic lubrication system (ALS) is a device used to deliver precise amounts of lubricants to machinery or equipment at regular intervals without requiring manual intervention. The system is precise and eliminates the cycle of over-lubrication and under-lubrication. Automatic oil lubrication systems are widely used in various industries, such as automotive, construction, mining, agriculture, and manufacturing, to ensure proper lubrication, minimize downtime, and extend the service life of critical components.

An automatic lubrication system provides safety of workers by eliminating the need for manual lubrication in potentially hazardous or hard-to-access areas and reduces the risk of accidents and injuries associated with manual lubrication processes, making them a favored choice in the industry. This is estimated to boost the automatic lubrication system market share.

Automatic oil lubrication systems are extensively used in the automotive industry. It provides efficient and reliable lubrication to ensure smooth operation and longevity of various components and systems within vehicles, such as engines, transmissions, chassis, and bearings. ALSs ensure improved performance and increases vehicle complexity. These factors are anticipated to play a positive role in driving the automatic lubrication system market growth.

ALSs are considered a valuable element for heavy machinery and equipment used in mining operations. They provide continuous lubrication to machinery, such as excavators, loaders, haul trucks, and crushers, which are subject to extreme operating conditions. This reduces downtime, increases equipment availability, and improves overall productivity in mining operations. Hence, the rise in demand for the product in the mining industry is likely to lead to significant automatic lubrication system market developments.

Rise in adoption of industrial automation has led to high usage of ALSs for industrial applications, as manufacturers are seeking to improve equipment efficiency and service life. This has propelled the demand for industrial automation equipment, such as robots, packaging systems, mixers and agitators, compressors, and conveyor machines, which increasingly need lubrication for their operations.

As a result of the growing demand for lubrication in industrial automation, the market is anticipated to experience significant growth.

In terms of system type, multi-port direct lubricators system is gaining traction in the market, as it is designed to supply lubricant directly to multiple points in a machine or mechanical system simultaneously. Multi-port lubricators ensure consistent and accurate lubricant delivery, improving equipment performance and extending its service life, leading to their high preference in the global industry.

Multi-port ALSs also enhance efficiency, reduce downtime, and minimize the risk of inadequate lubrication at critical points, as they provide lubrication to multiple points from a centralized lubrication system.

Asia Pacific holds major share of the global automatic lubrication system market, driven by rapid industrialization, leading to the growth of various sectors, such as manufacturing, construction, and mining. Hence, the growth of these industries is escalating the usage of multiple types of machineries, which increasingly require lubrication. This is anticipated to drive the market growth.

According to the automatic lubrication system market research, North America and Europe are projected to witness increasing growth in the next few years. This is likely to be majorly driven by thriving growth of industries, such as automotive, aerospace, and consumer goods manufacturing, in these regions.

Detailed profiles of automatic lubrication system manufacturers are provided to evaluate their financials, key product offerings, recent developments, and strategies.

A large number of manufacturers are becoming aware of the automatic lubrication system benefits, which is leading to a surge in investments in this product. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by market players.

Prominent companies operating in the global industry are AB SKF, Eugen Woerner GmbH & Co. KG, Freudenberg & Co. KG, Graco Inc., Omarx Technologies, Perma-tec GmbH & Co. KG, Redex Group, Summa Holdings, Inc., The Weir Group PLC, and Timken Company.

Key players have been profiled in the global automatic lubrication system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 1.1 Bn |

|

Market Forecast Value in 2031 |

US$ 1.5 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 1.1 Bn

It is estimated to reach US$ 1.5 Bn by 2031

It is likely to grow at a CAGR of 4.5% from 2023 to 2031

Rise in penetration in automotive and mining industries, and increase in adoption of industrial automation

Multi-port direct lubricators is the dominant system type

Asia Pacific is a highly attractive region for vendors

AB SKF, Eugen Woerner GmbH & Co. KG, Freudenberg & Co. KG, Graco Inc., Omarx Technologies, Perma-tec GmbH & Co. KG, Redex Group, Summa Holdings, Inc., The Weir Group PLC, and Timken Company

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Lubrication System Industry

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Technological Overview Analysis

5.9. Trade Analysis (HS Code: 8479)

5.10. Regulatory Framework

5.11. Global Automatic Lubrication System Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Value Projections (US$ Mn)

5.11.2. Market Volume Projections (Thousand Units)

6. Global Automatic Lubrication System Market Analysis and Forecast, By Type

6.1. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Oil-based

6.1.2. Grease-based

6.2. Incremental Opportunity, By Type

7. Global Automatic Lubrication System Market Analysis and Forecast, By System Type

7.1. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By System Type, 2017 - 2031

7.1.1. Single-line Parallel System

7.1.2. Dual-line Parallel System

7.1.3. Single-line Progressive System

7.1.4. Multi-port Direct Lubricators System

7.1.5. Others

7.2. Incremental Opportunity, By System Type

8. Global Automatic Lubrication System Market Analysis and Forecast, End-use Industry

8.1. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

8.1.1. Automotive

8.1.2. Construction

8.1.3. Mining

8.1.4. Agriculture

8.1.5. Manufacturing

8.1.6. Food & Beverage

8.1.7. Steel

8.1.8. Cement

8.1.9. Others

8.2. Incremental Opportunity, By End-use Industry

9. Global Automatic Lubrication System Market Analysis and Forecast, By Distribution Channel

9.1. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, By Distribution Channel

10. Global Automatic Lubrication System Market Analysis and Forecast, By Region

10.1. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Automatic Lubrication System Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Pricing (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

11.5.1. Oil-based

11.5.2. Grease-based

11.6. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By System Type, 2017 - 2031

11.6.1. Single-line Parallel System

11.6.2. Dual-line Parallel System

11.6.3. Single-line Progressive System

11.6.4. Multi-port Direct Lubricators System

11.6.5. Others

11.7. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

11.7.1. Automotive

11.7.2. Construction

11.7.3. Mining

11.7.4. Agriculture

11.7.5. Manufacturing

11.7.6. Food & Beverage

11.7.7. Steel

11.7.8. Cement

11.7.9. Others

11.8. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

11.9. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Country/Sub Region, 2017 - 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Automatic Lubrication System Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Pricing (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

12.5.1. Oil-based

12.5.2. Grease-based

12.6. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By System Type, 2017 - 2031

12.6.1. Single-line Parallel System

12.6.2. Dual-line Parallel System

12.6.3. Single-line Progressive System

12.6.4. Multi-port Direct Lubricators System

12.6.5. Others

12.7. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

12.7.1. Automotive

12.7.2. Construction

12.7.3. Mining

12.7.4. Agriculture

12.7.5. Manufacturing

12.7.6. Food & Beverage

12.7.7. Steel

12.7.8. Cement

12.7.9. Others

12.8. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Country/Sub Region, 2017 - 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Automatic Lubrication System Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Pricing (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

13.5.1. Oil-based

13.5.2. Grease-based

13.6. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By System Type, 2017 - 2031

13.6.1. Single-line Parallel System

13.6.2. Dual-line Parallel System

13.6.3. Single-line Progressive System

13.6.4. Multi-port Direct Lubricators System

13.6.5. Others

13.7. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

13.7.1. Automotive

13.7.2. Construction

13.7.3. Mining

13.7.4. Agriculture

13.7.5. Manufacturing

13.7.6. Food & Beverage

13.7.7. Steel

13.7.8. Cement

13.7.9. Others

13.8. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.8.1. Direct

13.8.2. Indirect

13.9. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Country/Sub Region, 2017 - 2031

13.9.1. India

13.9.2. China

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Automatic Lubrication System Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Pricing (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

14.5.1. Oil-based

14.5.2. Grease-based

14.6. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By System Type, 2017 - 2031

14.6.1. Single-line Parallel System

14.6.2. Dual-line Parallel System

14.6.3. Single-line Progressive System

14.6.4. Multi-port Direct Lubricators System

14.6.5. Others

14.7. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

14.7.1. Automotive

14.7.2. Construction

14.7.3. Mining

14.7.4. Agriculture

14.7.5. Manufacturing

14.7.6. Food & Beverage

14.7.7. Steel

14.7.8. Cement

14.7.9. Others

14.8. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Country/Sub Region, 2017 - 2031

14.9.1. GCC

14.9.2. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Automatic Lubrication System Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Pricing (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

15.5.1. Oil-based

15.5.2. Grease-based

15.6. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By System Type, 2017 - 2031

15.6.1. Single-line Parallel System

15.6.2. Dual-line Parallel System

15.6.3. Single-line Progressive System

15.6.4. Multi-port Direct Lubricators System

15.6.5. Others

15.7. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

15.7.1. Automotive

15.7.2. Construction

15.7.3. Mining

15.7.4. Agriculture

15.7.5. Manufacturing

15.7.6. Food & Beverage

15.7.7. Steel

15.7.8. Cement

15.7.9. Others

15.8. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.8.1. Direct

15.8.2. Indirect

15.9. Automatic Lubrication System Market Size (US$ Mn and Thousand Units) Forecast, By Country/Sub Region, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. AB SKF

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Eugen Woerner GmbH & Co. KG

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Freudenberg & Co. KG

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Graco Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Omarx Technologies

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Perma-tec GmbH & Co. KG

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Redex Group

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Summa Holdings, Inc.

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. The Weir Group PLC

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Timken Company

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Go To Marketing Strategy

17.1. Identification of Potential Market Spaces

17.2. Prevailing Market Risks

17.3. Understanding the Buying Process of Customers

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Table 2: Global Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Table 3: Global Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Table 4: Global Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Table 5: Global Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Table 6: Global Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Table 7: Global Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Table 8: Global Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 9: Global Automatic Lubrication System Market Volume (Thousand Units) Share, by Region, 2017 - 2031

Table 10: Global Automatic Lubrication System Market Value (US$ Mn) Share, by Region, 2017 - 2031

Table 11: North America Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Table 12: North America Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Table 13: North America Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Table 14: North America Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Table 15: North America Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Table 16: North America Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Table 17: North America Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 18: North America Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Table 19: North America Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Table 20: Europe Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Table 21: Europe Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Table 22: Europe Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Table 23: Europe Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Table 24: Europe Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Table 25: Europe Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Table 26: Europe Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Table 27: Europe Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 28: Europe Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Table 29: Europe Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Table 30: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Table 31: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Table 32: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Table 33: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Table 34: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Table 35: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Table 36: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Table 37: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 38: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Table 39: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Table 40: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Table 41: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Table 42: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Table 43: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Table 44: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Table 45: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Table 46: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Table 47: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 48: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Table 49: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Table 50: South America Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Table 51: South America Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Table 52: South America Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Table 53: South America Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Table 54: South America Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Table 55: South America Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Table 56: South America Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Table 57: South America Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Table 58: South America Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Table 59: South America Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

List of Figures

Figure 1: Global Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Figure 2: Global Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Figure 3: Global Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Type, 2017 - 2031

Figure 4: Global Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Figure 5: Global Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Figure 6: Global Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by System Type, 2017 - 2031

Figure 7: Global Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Figure 8: Global Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Figure 9: Global Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by End-use Industry, 2017 - 2031

Figure 10: Global Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Figure 11: Global Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 12: Global Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 13: Global Automatic Lubrication System Market Volume (Thousand Units) Share, by Region, 2017 - 2031

Figure 14: Global Automatic Lubrication System Market Value (US$ Mn) Share, by Region, 2017 - 2031

Figure 15: Global Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Region, 2017 - 2031

Figure 16: North America Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Figure 17: North America Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Figure 18: North America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Type, 2017 - 2031

Figure 19: North America Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Figure 20: North America Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Figure 21: North America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by System Type, 2017 - 2031

Figure 22: North America Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Figure 23: North America Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Figure 24: North America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by End-use Industry, 2017 - 2031

Figure 25: North America Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Figure 26: North America Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 27: North America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 28: North America Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Figure 29: North America Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 30: North America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 31: Europe Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Figure 32: Europe Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Figure 33: Europe Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Type, 2017 - 2031

Figure 34: Europe Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Figure 35: Europe Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Figure 36: Europe Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by System Type, 2017 - 2031

Figure 37: Europe Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Figure 38: Europe Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Figure 39: Europe Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by End-use Industry, 2017 - 2031

Figure 40: Europe Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Figure 41: Europe Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 42: Europe Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 43: Europe Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Figure 44: Europe Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 45: Europe Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 46: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Figure 47: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Figure 48: Asia Pacific Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Type, 2017 - 2031

Figure 49: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Figure 50: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Figure 51: Asia Pacific Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by System Type, 2017 - 2031

Figure 52: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Figure 53: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Figure 54: Asia Pacific Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by End-use Industry, 2017 - 2031

Figure 55: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Figure 56: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 57: Asia Pacific Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 58: Asia Pacific Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Figure 59: Asia Pacific Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 60: Asia Pacific Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 61: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Figure 62: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Figure 63: Middle East & Africa Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Type, 2017 - 2031

Figure 64: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Figure 65: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Figure 66: Middle East & Africa Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by System Type, 2017 - 2031

Figure 67: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Figure 68: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Figure 69: Middle East & Africa Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by End-use Industry, 2017 - 2031

Figure 70: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Figure 71: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 72: Middle East & Africa Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 73: Middle East & Africa Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Figure 74: Middle East & Africa Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 75: Middle East & Africa Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 76: South America Automatic Lubrication System Market Volume (Thousand Units), by Type, 2017 - 2031

Figure 77: South America Automatic Lubrication System Market Value (US$ Mn), by Type, 2017 - 2031

Figure 78: South America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Type, 2017 - 2031

Figure 79: South America Automatic Lubrication System Market Volume (Thousand Units), by System Type, 2017 - 2031

Figure 80: South America Automatic Lubrication System Market Value (US$ Mn), by System Type, 2017 - 2031

Figure 81: South America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by System Type, 2017 - 2031

Figure 82: South America Automatic Lubrication System Market Volume (Thousand Units), by End-use Industry, 2017 - 2031

Figure 83: South America Automatic Lubrication System Market Value (US$ Mn), by End-use Industry, 2017 - 2031

Figure 84: South America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by End-use Industry, 2017 - 2031

Figure 85: South America Automatic Lubrication System Market Volume (Thousand Units), by Distribution Channel, 2017 - 2031

Figure 86: South America Automatic Lubrication System Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 87: South America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 88: South America Automatic Lubrication System Market Volume (Thousand Units), by Country/Sub Region, 2017 - 2031

Figure 89: South America Automatic Lubrication System Market Value (US$ Mn), by Country/Sub Region, 2017 - 2031

Figure 90: South America Automatic Lubrication System Market Incremental Opportunity (US$ Mn), by Country/Sub Region, 2017 - 2031