Reports

Reports

The worldwide Automated Guided Vehicle (AGV) market is experiencing significant growth due to advancements in technology, increasing needs for automation, and higher labor costs. Key growth drivers include the increase in online retail, which has raised the bar for fast and efficient solutions to warehouse, distribution, and logistics.

Furthermore, the momentum generated from increased demands for improved processing efficiency and safety will accentuate the growth of the AGV market. The growth of technology-enabled automation such as Artificial Intelligence (AI), Internet of Things (IoT), and intelligent navigation systems are key enablers of the expansion of AGV capabilities for improved flexibility and efficiency.

With demand for AGVs expected to rise, it is vital for companies to innovate and provide customized solutions in their AGV solution portfolio. The focal point for technology companies will be continually investing in research and development activities to build sophisticated energy efficiency AGVs, which utilize AI as part of their navigation systems and technology

Key players are beginning to offer customizable solutions to meet the needs for different types of industries and operational environments. Companies are integrating AGVs with the existing automation and enterprise resource planning (ERP) systems for providing seamless operation.

Automated guided vehicle (AGV) is a type of mobile robot that transports materials using sensors and navigation systems to move goods in a predefined environment, such as a factory or warehouse. AGVs are primarily designed to take over repetitive physical work and provide efficiency along with accident prevention from human error. An AGV can autonomously transport goods between geographic points along a specific route, as indicated by some environmental cue, for example, moving goods from a storage location to a production line or along a multistep process in manufacturing.

AGVs use an external guidance system such as magnetic tape, lasers or vision cameras to move along fixed paths without a human operator. The use of AGVs increases efficiency and safety in industrial environments while automating the repetitive activity of moving materials and pallets in order to maintain a continuous flow of materials.

AGVs are constructed in different shapes and sizes for different applications and different industries. In a warehouse application, for example, a tow AGV could pull a train of carts that are loaded with goods. In a facility manufacturing pharmaceuticals or similar, a much smaller, more precise AGV could carry a fragile package or laboratory samples. Each of these AGVs will be equipped with technology that is best-suited to the task required, which can include heavy lifting, precision maneuvering, or interaction with an automated storage system. The diversity of AGVs allows almost any industry to adopt AGVs, to improve efficiency and safety of operations.

| Attribute | Detail |

|---|---|

| Automated Guided Vehicle (AGV) Market Drivers |

|

The rising demand for automation across numerous sectors is an important contributor to the advancement of the global automated guided vehicle (AGV) market, since it alleviates a host of operational difficulties and enhances efficiency. More industries such as manufacturing, logistics, and automotive are utilizing AGVs to optimize material handling and transportation.

AGVs allow goods and materials to be moved with little human contact, shortening the production line cycle and reducing human error and operational noise. By automating repetitive and labor-intensive operations, AGVs improve productivity by allowing human capital to be deployed against strategic value-added activities.

In manufacturing, AGVs are crucial to automating the movements of components and finished goods along assembly lines. AGVs maintain an even flow of material amongst production steps, and mitigate downtime and ensure a steady flow of components to the other areas of production. For example, in an automotive manufacturing space, AGVs may be used to move engine components and assemblies from one step in the production process to another. This allows for an improved assembly line method while potentially decreasing lead time. The overall impact of using AGVs within manufacturing not only improves an overall efficiency.

The increase in labor costs and workforce issues is a major factor contributing to the growth of the global automated guided vehicle (AGV) market. As labor costs rise across different industries, businesses are looking for solutions to help alleviate some of the operational costs associated with human labor, and AGVs offer a more affordable alternative to hiring new employees to improve operations.

AGVs are a good solution for companies looking to reduce their reliance on human employees when it comes to tasks that are repetitive or require physical effort, such as moving materials within a manufacturing facility or distributing goods to a fulfillment center. As organizations carry less human labor, they can lessen the effects of wage sustainability, thereby reducing their operational costs, which will help keep business alive or solve some of the issues companies have with all-time-rising operational costs due to competition in the market, extending their profitability further.

Some workforce challenges are making AGVs even more attractive and compel organizations to invest in AGVs sooner rather than later. For many industries, finding workers and, especially retaining those skilled workers in a labor force that has greater than most industries' or the mean/average turnover and/or lack of skilled labor to perform tasks that AGVs can do, such as material handling and logistics operations, is tough.

Workforce stabilization with AGVs helps alleviate these worker shortages as they are performing a significant laborious tasks that needed to be performed by labeled human labor and organizations trying to reduce their dependability on a stable workforce. That same stabilization occurs when organizations regularly recruit qualified labor, train employees, and face employee absence due to an operational issue management process, which is frequently affected by employee absentia or turnover.

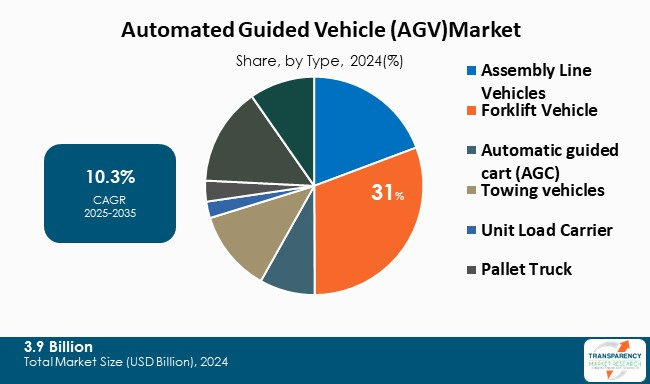

Forklift vehicle segment is dominating the global automated guided vehicle market due to its unrivaled versatility, efficiency, and suitability for modern material handling needs. Automated forklift AGVs are particularly good at complex activities such as pallet stacking, vertical storage, and remote inventory management. Conventional AGVs aren’t able to carry out these tasks. Automated forklifts can also transport, store, and move loads through multiple shelf heights - useful if space is constrained or when working in high-density warehouses.

Furthermore, forklift AGVs are now employing state-of-the-art technologies including laser guidance, vision, and SLAM navigation to accommodate operating in changing warehouse layouts. Forklift AGVs can work in dynamic settings and are capable of completing as many tasks as the average staff. This shows how forklift vehicle segment is dominating the automated guided vehicle market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

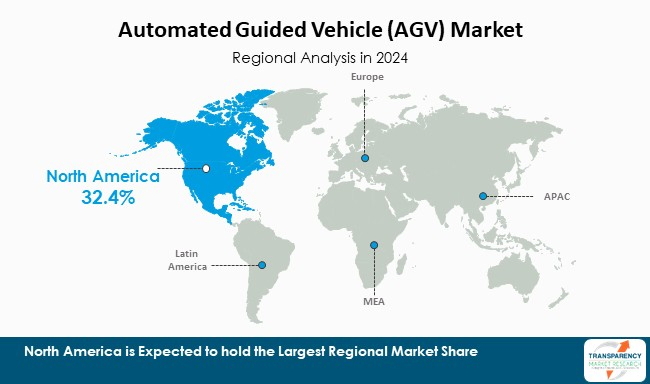

North America is at the forefront of the global automated guided vehicle (AGV) market, buoyed by a well-established automation supply chain, technological advancement, and excellent stakeholder awareness. The demand for online retail has, in turn, increased demand for automated warehouse and logistic solutions. The region has a terrific emphasis on safety, sustainability, and digital transformation, which presents significant advantages for leading the AGV market. In fact, it is expected that the region will maintain its leadership role in the AGB market on a global level in the future.

Key players operating in the automated guided vehicle (AGV) market are investing in innovation, strategic partnerships, and technological advancements. They focus on improving imaging clarity, and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

Addverb Technologies, Aichi Machine Industry Co., Ltd, China SME Group Co., Ltd, DAIFUKU GROUP, Egemin Automation Inc., GreyOrange, GRIDBOTS, JBT Corporation, KOLEC, Konecranes, KUKA AG, Murata Machinery, Ltd., Oceaneering International, Inc., SHENZHEN, MIRCOLOMAY TECHNOLOGY CO., LTD, TOYOTA INDUSTRIES CORPORATION are the key players in automated guided vehicle (AGV) market.

Each of these players has been profiled in the automated guided vehicle (AGV) market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

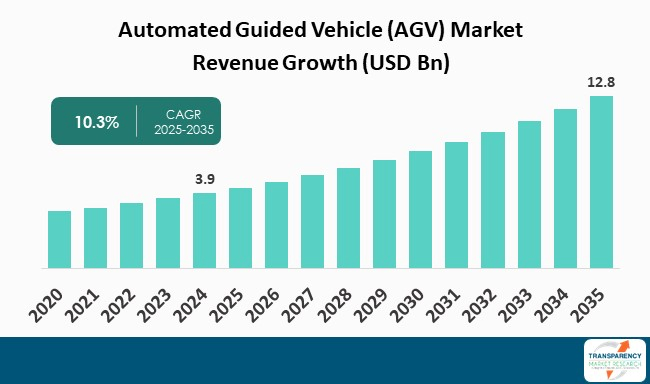

| Size in 2024 | US$ 3.9 Bn |

| Forecast Value in 2035 | US$ 12.8 Bn |

| CAGR | 10.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Automated Guided Vehicle (AGV) Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The automated guided vehicle (AGV) market was valued at US$ 3.9 Bn in 2024

The automated guided vehicle (AGV) market is projected to reach US$ 12.8 Bn by the end of 2035

Increased automation in industries and rising labor costs and workforce challenges are some of the driving factors of automated guided vehicle (AGV) market.

The CAGR is anticipated to be 10.3% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Addverb Technologies, Aichi Machine Industry Co., Ltd, China SME Group Co., Ltd, DAIFUKU GROUP, Egemin Automation Inc., GreyOrange, GRIDBOTS, JBT Corporation, KOLEC, Konecranes, KUKA AG, Murata Machinery, Ltd., Oceaneering International, Inc., SHENZHEN, MIRCOLOMAY TECHNOLOGY CO., LTD, and TOYOTA INDUSTRIES CORPORATION among others.

Table 01: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 02: Global Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 03: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 04: Global Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 05: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 06: Global Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 07: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 08: Global Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 09: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 10: Global Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery Type, 2020 to 2035

Table 11: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery Capacity, 2020 to 2035

Table 12: Global Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery Capacity, 2020 to 2035

Table 13: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 14: Global Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 15: North America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 16: North America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 17: North America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 18: North America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 19: North America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 20: North America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 21: North America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 22: North America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 23: North America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 24: North America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 25: North America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Automotive, 2020 to 2035

Table 26: North America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Automotive, 2020 to 2035

Table 27: U.S. Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 28: U.S. Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 29: U.S. Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 30: U.S. Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 31: U.S. Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 32: U.S. Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 33: U.S. Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 34: U.S. Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 35: Canada Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 36: Canada Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 37: Canada Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 38: Canada Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 39: Canada Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 40: Canada Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 41: Canada Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 42: Canada Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 43: Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 44: Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 45: Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 46: Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 47: Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 48: Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 49: Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 50: Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 51: Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 52: Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 53: Germany Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 54: Germany Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 55: Germany Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 56: Germany Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 57: Germany Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 58: Germany Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 59: Germany Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 60: Germany Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 61: U.K Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 62: U.K Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 63: U.K Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 64: U.K Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 65: U.K Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 66: U.K Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 67: U.K Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 68: U.K Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 69: France Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 70: France Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 71: France Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 72: France Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 73: France Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 74: France Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 75: France Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 76: France Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 77: Italy Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 78: Italy Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 79: Italy Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 80: Italy Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 81: Italy Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 82: Italy Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 83: Italy Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 84: Italy Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 85: Spain Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 86: Spain Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 87: Spain Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 88: Spain Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 89: Spain Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 90: Spain Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 91: Spain Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 92: Spain Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 93: Switzerland Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 94: Switzerland Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 95: Switzerland Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 96: Switzerland Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 97: Switzerland Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 98: Switzerland Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 99: Switzerland Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 100: Switzerland Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 101: The Netherlands Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 102: The Netherlands Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 103: The Netherlands Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 104: The Netherlands Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 105: The Netherlands Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 106: The Netherlands Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 107: The Netherlands Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 108: The Netherlands Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 109: Rest of Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 110: Rest of Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 111: Rest of Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 112: Rest of Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 113: Rest of Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 114: Rest of Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 115: Rest of Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 116: Rest of Europe Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 117: Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 118: Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 119: Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 120: Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 121: Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 122: Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 123: Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 124: Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 125: Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 126: Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 127: China Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 128: China Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 129: China Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 130: China Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 131: China Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 132: China Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 133: China Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 134: China Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 135: India Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 136: India Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 137: India Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 138: India Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 139: India Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 140: India Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 141: India Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 142: India Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 143: Japan Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 144: Japan Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 145: Japan Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 146: Japan Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 147: Japan Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 148: Japan Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 149: Japan Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 150: Japan Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 151: South Korea Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 152: South Korea Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 153: South Korea Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 154: South Korea Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 155: South Korea Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 156: South Korea Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 157: South Korea Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 158: South Korea Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 159: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 160: Australia and New Zealand Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 161: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 162: Australia and New Zealand Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 163: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 164: Australia and New Zealand Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 165: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 166: Australia and New Zealand Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 167: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 168: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 169: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 170: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 171: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 172: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 173: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 174: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 175: Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 176: Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 177: Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 178: Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 179: Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 180: Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 181: Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 182: Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 183: Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 184: Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 185: Brazil Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 186: Brazil Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 187: Brazil Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 188: Brazil Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 189: Brazil Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 190: Brazil Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 191: Brazil Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 192: Brazil Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 193: Mexico Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 194: Mexico Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 195: Mexico Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 196: Mexico Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 197: Mexico Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 198: Mexico Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 199: Mexico Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 200: Mexico Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 201: Argentina Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 202: Argentina Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 203: Argentina Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 204: Argentina Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 205: Argentina Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 206: Argentina Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 207: Argentina Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 208: Argentina Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 209: Rest of Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 210: Rest of Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 211: Rest of Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 212: Rest of Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 213: Rest of Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 214: Rest of Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 215: Rest of Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 216: Rest of Latin America Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 217: Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 218: Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 219: Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 220: Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 221: Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 222: Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 223: Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 224: Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 225: Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 226: Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 227: GCC Countries Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 228: GCC Countries Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 229: GCC Countries Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 230: GCC Countries Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 231: GCC Countries Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 232: GCC Countries Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 233: GCC Countries Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 234: GCC Countries Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 235: South Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 236: South Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 237: South Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 238: South Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 239: South Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 240: South Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 241: South Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 242: South Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Table 243: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 244: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 245: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 246: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 247: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by Battery, 2020 to 2035

Table 248: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by Battery, 2020 to 2035

Table 249: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, by End Use Industry, 2020 to 2035

Table 250: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Volume (Units) Forecast, by End Use Industry, 2020 to 2035

Figure 01: Global Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 03: Global Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 04: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Forklift Vehicle, 2020 to 2035

Figure 05: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Assembly Line Vehicles, 2020 to 2035

Figure 06: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Automatic guided cart (AGC), 2020 to 2035

Figure 07: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Towing vehicles, 2020 to 2035

Figure 08: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Unit Load Carrier, 2020 to 2035

Figure 09: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Pallet Truck, 2020 to 2035

Figure 10: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Autonomous Mobile Robots, 2020 to 2035

Figure 11: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 12: Global Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 13: Global Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 14: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Laser Guidance, 2020 to 2035

Figure 15: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Vision Guidance, 2020 to 2035

Figure 16: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Magnetic Guidance, 2020 to 2035

Figure 17: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Inductive Guidance, 2020 to 2035

Figure 18: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Optical Tape Guidance, 2020 to 2035

Figure 19: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 21: Global Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 22: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Battery Type, 2020 to 2035

Figure 23: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Battery Capacity, 2020 to 2035

Figure 24: Global Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 25: Global Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 26: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Retail/ Wholesale, 2020 to 2035

Figure 27: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Food/ Pharma, 2020 to 2035

Figure 28: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Transport/ Logistics, 2020 to 2035

Figure 29: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Manufacturing, 2020 to 2035

Figure 30: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 31: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Ports/ Terminals, 2020 to 2035

Figure 32: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Mining & Construction, 2020 to 2035

Figure 33: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Chemical/ Energy, 2020 to 2035

Figure 34: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Forestry/ Wood, 2020 to 2035

Figure 35: Global Automated Guided Vehicle (AGV) Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 36: Global Automated Guided Vehicle (AGV) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Global Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: North America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: North America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 40: North America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 41: North America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 42: North America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 43: North America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 44: North America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 45: North America Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 46: North America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 47: North America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 48: North America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 49: U.S. Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: U.S. Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 51: U.S. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 52: U.S. Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 53: U.S. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 54: U.S. Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 55: U.S. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 56: U.S. Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 57: U.S. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 58: Canada Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Canada Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 60: Canada Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 61: Canada Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 62: Canada Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 63: Canada Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 64: Canada Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 65: Canada Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 66: Canada Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 67: Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 69: Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 70: Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 71: Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 72: Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 73: Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 74: Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 75: Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 76: Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 77: Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 78: Germany Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 79: Germany Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 80: Germany Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 81: Germany Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 82: Germany Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 83: Germany Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 84: Germany Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 85: Germany Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 86: Germany Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 87: U.K. Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 88: U.K. Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 89: U.K. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 90: U.K. Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 91: U.K. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 92: U.K. Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 93: U.K. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 94: U.K. Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 95: U.K. Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 96: France Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 97: France Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 98: France Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 99: France Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 100: France Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 101: France Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 102: France Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 103: France Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 104: France Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 105: Italy Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 106: Italy Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 107: Italy Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 108: Italy Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 109: Italy Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 110: Italy Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 111: Italy Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 112: Italy Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 113: Italy Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 114: Spain Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 115: Spain Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 116: Spain Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 117: Spain Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 118: Spain Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 119: Spain Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 120: Spain Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 121: Spain Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 122: Spain Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 123: Switzerland Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 124: Switzerland Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 125: Switzerland Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 126: Switzerland Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 127: Switzerland Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 128: Switzerland Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 129: Switzerland Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 130: Switzerland Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 131: Switzerland Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 132: The Netherlands Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 133: The Netherlands Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 134: The Netherlands Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 135: The Netherlands Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 136: The Netherlands Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 137: The Netherlands Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 138: The Netherlands Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 139: The Netherlands Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 140: The Netherlands Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 141: Rest of Europe Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 142: Rest of Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 143: Rest of Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 144: Rest of Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 145: Rest of Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 146: Rest of Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 147: Rest of Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 148: Rest of Europe Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 149: Rest of Europe Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 150: Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 151: Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 152: Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 153: Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 154: Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 155: Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 156: Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 157: Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 158: Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 159: Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 160: Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 161: China Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 162: China Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 163: China Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 164: China Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 165: China Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 166: China Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 167: China Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 168: China Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 169: China Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 170: Japan Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 171: Japan Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 172: Japan Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 173: Japan Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 174: Japan Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 175: Japan Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 176: Japan Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 177: Japan Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 178: Japan Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 179: India Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 180: India Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 181: India Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 182: India Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 183: India Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 184: India Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 185: India Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 186: India Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 187: India Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 188: South Korea Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 189: South Korea Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 190: South Korea Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 191: South Korea Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 192: South Korea Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 193: South Korea Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 194: South Korea Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 195: South Korea Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 196: South Korea Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 197: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 198: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 199: Australia and New Zealand Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 200: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 201: Australia and New Zealand Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 202: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 203: Australia and New Zealand Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 204: Australia and New Zealand Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 205: Australia and New Zealand Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 206: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 207: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 208: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 209: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 210: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 211: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 212: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 213: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 214: Rest of Asia Pacific Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 215: Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 217: Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 218: Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 219: Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 220: Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 221: Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 222: Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 223: Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 224: Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 225: Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 226: Brazil Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 227: Brazil Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 228: Brazil Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 229: Brazil Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 230: Brazil Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 231: Brazil Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 232: Brazil Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 233: Brazil Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 234: Brazil Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 235: Mexico Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 236: Mexico Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 237: Mexico Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 238: Mexico Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 239: Mexico Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 240: Mexico Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 241: Mexico Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 242: Mexico Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 243: Mexico Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 244: Argentina Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 245: Argentina Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 246: Argentina Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 247: Argentina Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 248: Argentina Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 249: Argentina Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 250: Argentina Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 251: Argentina Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 252: Argentina Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 253: Rest of Latin America Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 254: Rest of Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 255: Rest of Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 256: Rest of Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 257: Rest of Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 258: Rest of Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 259: Rest of Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 260: Rest of Latin America Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 261: Rest of Latin America Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 262: Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 263: Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 264: Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 265: Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 266: Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 267: Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 268: Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 269: Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 270: Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 271: Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 272: Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 273: GCC Countries Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 274: GCC Countries Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 275: GCC Countries Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 276: GCC Countries Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 277: GCC Countries Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 278: GCC Countries Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 279: GCC Countries Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 280: GCC Countries Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 281: GCC Countries Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 282: South Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 283: South Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 284: South Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 285: South Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 286: South Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 287: South Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 288: South Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 289: South Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 290: South Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035

Figure 291: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 292: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Type, 2024 and 2035

Figure 293: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 294: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Technology, 2024 and 2035

Figure 295: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 296: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by Battery, 2024 and 2035

Figure 297: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by Battery, 2025 to 2035

Figure 298: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Value Share Analysis, by End Use Industry, 2024 and 2035

Figure 299: Rest of Middle East and Africa Automated Guided Vehicle (AGV) Market Attractiveness Analysis, by End Use Industry, 2025 to 2035