Reports

Reports

Analysts’ Viewpoint on Market Scenario

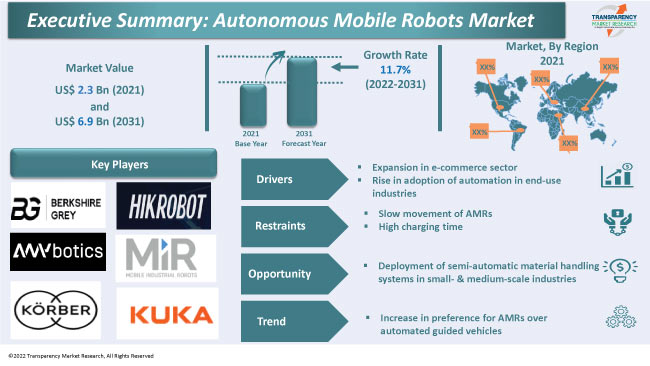

Rise in a labor shortage in end-use industries and expansion in the FMCG sector are driving the autonomous mobile robots market size. Autonomous Mobile Robots (AMRs) offer improved efficiency and productivity with reduced errors, re-works, and risk rates. Expansion in the e-commerce sector is expected to augment market progress during the forecast period.

High penetration of technologies such as mechatronics, Industry 4.0, Industry 5.0, AI, cloud computing, big data analytics, blockchain, and IoT is offering lucrative growth opportunities for vendors in the industry. Vendors are focused on launching AI-enabled and high payload capacity products to expand their customer base and broaden their autonomous mobile robots market share.

Autonomous mobile robot (AMR) is a machine that can avoid obstacles and autonomously navigate through its environment. The robot does not require any intervention from an operator. Automated mobile robots rely on a grid of sophisticated sensors to interpret and move through their surroundings. These sensors enable AMRs to perform various tasks more effectively and efficiently.

AMRs can navigate through fixed obstructions such as buildings, racks, and workstations. They can also move through variable obstacles such as people, lift trucks, and debris. Industrial mobile robots are widely employed in various sectors such as food & beverage, beauty & personal care, pharmaceuticals, chemicals, and automotive. Self-maintenance, autonomous navigation, and AI-based decision-making are prominent features of these robots.

The e-commerce sector has witnessed rapid growth in the last few years. This can be ascribed to various factors such as high penetration of internet, rise in adoption of smartphones, and the emergence of the COVID-19 pandemic.

According to United Nations Conference on Trade and Development, the share of internet users who shopped online more than doubled in the UAE, from 27% in 2019 to 63% in 2020. In Bahrain, the share tripled, reaching 45% in 2020. In Uzbekistan, it rose from 4% in 2018 to 11% in 2020. Thailand had a relatively high uptake prior to the pandemic and witnessed a 16% increase, i.e., more than half of internet users (56%) shopped online in 2020. Among developed countries, greatest increase was witnessed in Greece (up by 18%), Ireland, Hungary, and Romania (each by 15%).

Consumers are increasingly preferring one-day doorstep delivery, which has prompted e-commerce companies to accelerate their operations and boost their productivity. This is likely to fuel autonomous mobile robots market development during the forecast period.

Rapid growth in the e-commerce sector put tremendous pressure on distribution and fulfillment operations. Majority of retailers are actively seeking solutions to battle rapidly escalating fulfillment complexities. They are also looking for new tools to manage challenges such as labor management, order processing and tracking, and warehouse and distribution costs. Thus, stakeholders involved in warehousing and material handling operations are investing significantly in redesigning their operational layouts. This is anticipated to propel the autonomous mobile robots market expansion in the near future.

Insufficient workforce to handle e-commerce volumes and the lack of available floor space limit operational efficiencies. Difficulties in adapting inventory workflow on the warehouse floor also lead to various issues in operations in the e-commerce sector.

Fulfillment volumes can grow up to three times their normal rates during peak demand cycles that last two to three weeks in a year. This, in turn, poses noteworthy staffing challenges for distribution centers. E-commerce providers are increasingly utilizing AMRs to overcome these challenges. AMRs streamline processes, reduce operational costs, and maximize the return on capital investments. These benefits boost demand for AMRs in the e-commerce sector, thereby driving market statistics.

Traditional automated guided vehicles (AGVs) were the only option for the automation of internal transportation activities such as storage, picking, and sorting. AGVs are fixed installations where there is a need for repetitive, consistent material deliveries. These vehicles also require high initial investment, while provide a delayed ROI.

Major companies in warehouse management are focused on shortening the throughput (work time) of each process in the production line and during labeling, quality check, and inspections to enhance their productivity. They are also emphasizing on the reduction in transportation time.

Warehouse autonomous robots are more sophisticated, flexible, and more cost-effective as compared to AGVs. AGVs and AMRs both move materials from one place to another. However, these similarities cease majorly in automotive, consumer products, and personal care industries. These benefits of AMRs over AGVs contribute to the autonomous mobile robots market growth in the near future.

Various companies in the end-use industries are investing significantly in AMR startups. In 2021, ABB acquired ASTI Mobile Robotics Group, an autonomous mobile robot manufacturer. The acquisition expanded ABB’s robotics and automation offering, making it the only company to offer a complete portfolio for the next generation of flexible automation. In September 2020, Jungheinrich AG, a forklift manufacturer, invested US$ 24.5 Mn in Magazino GmbH, a Germany-based AMR maker.

According to the latest autonomous mobile robots market forecast, North America is expected to hold prominent share during the forecast period. Rise in adoption of automation in retail and non-durable goods businesses is driving market revenue in the region. Increase in penetration of IoT and 5G and surge in usage of Industry 4.0 & 5.0 are also boosting demand for AMRs in North America.

The industry in Europe and Asia Pacific is driven by the expansion in FMCG and automotive sectors. Rise in consumption of packed food products, apparel, and footwear is also fueling market value in these regions. The industry in Middle East & Africa and South America is anticipated to grow at a medium pace during the forecast period.

The industry is fragmented, with a large number of players catering to global demands. The autonomous mobile robots market report profiles major vendors based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Addverb Technologies Limited, AMS, Inc., ANYbotics AG, Berkshire Grey, Continental AG, ECA Group, Fetch Robotics, Inc., Gridbots Technologies Private Limited, Hikrobot Technology Co., Ltd., Intel Corporation, Kollmorgen, Körber AG, KuKa AG, Locus Robotics, Mobile Industrial Robots A/S, OMRON Corporation, Peer Robotics, Shanghai Quicktron Intelligent Technology Co., Ltd., Teradyne Inc., Tetrahedron Manufacturing Services, Universal Robots, and Youibot Robotics Co., Ltd. are key entities operating in the industry.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.3 Bn |

|

Market Forecast Value in 2031 |

US$ 6.9 Bn |

|

Growth Rate (CAGR) |

11.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis and COVID-19 Impact Analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 2.3 Bn in 2021

It is expected to advance at a CAGR of 11.7% from 2022 to 2031

It is likely to reach 6.9 Bn by the end of 2031

Expansion in e-commerce sector and rise in adoption of automation in end-use industries

North America is more lucrative for vendors

Addverb Technologies Limited, AMS, Inc., ANYbotics AG, Berkshire Grey, Continental AG, ECA Group, Fetch Robotics, Inc., Gridbots Technologies Private Limited, Hikrobot Technology Co., Ltd., Intel Corporation, Kollmorgen, Körber AG, KuKa AG, Locus Robotics, Mobile Industrial Robots A/S, OMRON Corporation, Peer Robotics, Shanghai Quicktron Intelligent Technology Co., Ltd., Teradyne Inc., Tetrahedron Manufacturing Services, Universal Robots, and Youibot Robotics Co., Ltd.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumptions and Acronyms

2. Executive Summary

2.1. Global Autonomous Mobile Robots Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicators Assessment

4.1. Parent Industry Overview – Global Autonomous Industrial Vehicles Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Load Capacity Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Autonomous Mobile Robots Market Analysis, by Offering

5.1. Global Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Offering, 2017–2031

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. Market Attractiveness Analysis, by Offering

6. Global Autonomous Mobile Robots Market Analysis, by Type

6.1. Global Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

6.1.1. Conveyor

6.1.2. Lifting

6.1.3. Automatic Trolley

6.1.4. Multifunctional

6.1.5. Others

6.2. Market Attractiveness Analysis, by Type

7. Global Autonomous Mobile Robots Market Analysis, by Load Capacity

7.1. Global Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Load Capacity, 2017–2031

7.1.1. Up to 500 Kg

7.1.2. 500 Kg - 1000 Kg

7.1.3. 1000 Kg - 2000 Kg

7.1.4. Above 2000 Kg

7.2. Market Attractiveness Analysis, by Load Capacity

8. Global Autonomous Mobile Robots Market Analysis, by Application

8.1. Global Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

8.1.1. Cardboard Boxes

8.1.2. Trays

8.1.3. Kegs

8.1.4. Buckets

8.1.5. Bags

8.1.6. Crates

8.1.7. Foil Bundles

8.1.8. Others

8.2. Market Attractiveness Analysis, by Application

9. Global Autonomous Mobile Robots Market Analysis, by End-use Industry

9.1. Global Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.1.1. Food & Beverage

9.1.2. Beauty & Personal Care

9.1.3. Pharmaceutical

9.1.4. Chemical

9.1.5. Automotive

9.1.6. Others

9.2. Market Attractiveness Analysis, by End-use Industry

10. Global Autonomous Mobile Robots Market Analysis and Forecast, by Region

10.1. Global Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, by Region

11. North America Autonomous Mobile Robots Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Offering, 2017–2031

11.3.1. Hardware

11.3.2. Software

11.3.3. Services

11.4. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.4.1. Conveyor

11.4.2. Lifting

11.4.3. Automatic Trolley

11.4.4. Multifunctional

11.4.5. Others

11.5. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Load Capacity, 2017–2031

11.5.1. Up to 500 Kg

11.5.2. 500 Kg - 1000 Kg

11.5.3. 1000 Kg - 2000 Kg

11.5.4. Above 2000 Kg

11.6. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.6.1. Cardboard Boxes

11.6.2. Trays

11.6.3. Kegs

11.6.4. Buckets

11.6.5. Bags

11.6.6. Crates

11.6.7. Foil Bundles

11.6.8. Others

11.7. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.7.1. Food & Beverage

11.7.2. Beauty & Personal Care

11.7.3. Pharmaceutical

11.7.4. Chemical

11.7.5. Automotive

11.7.6. Others

11.8. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Offering

11.9.2. By Type

11.9.3. By Load Capacity

11.9.4. By Application

11.9.5. By End-use Industry

11.9.6. By Country/Sub-region

12. Europe Autonomous Mobile Robots Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Offering, 2017–2031

12.3.1. Hardware

12.3.2. Software

12.3.3. Services

12.4. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.4.1. Conveyor

12.4.2. Lifting

12.4.3. Automatic Trolley

12.4.4. Multifunctional

12.4.5. Others

12.5. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Load Capacity, 2017–2031

12.5.1. Up to 500 Kg

12.5.2. 500 Kg - 1000 Kg

12.5.3. 1000 Kg - 2000 Kg

12.5.4. Above 2000 Kg

12.6. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.6.1. Cardboard Boxes

12.6.2. Trays

12.6.3. Kegs

12.6.4. Buckets

12.6.5. Bags

12.6.6. Crates

12.6.7. Foil Bundles

12.6.8. Others

12.7. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.7.1. Food & Beverage

12.7.2. Beauty & Personal Care

12.7.3. Pharmaceutical

12.7.4. Chemical

12.7.5. Automotive

12.7.6. Others

12.8. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Offering

12.9.2. By Type

12.9.3. By Load Capacity

12.9.4. By Application

12.9.5. By End-use Industry

12.9.6. By Country/Sub-region

13. Asia Pacific Autonomous Mobile Robots Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Offering, 2017–2031

13.3.1. Hardware

13.3.2. Software

13.3.3. Services

13.4. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

13.4.1. Conveyor

13.4.2. Lifting

13.4.3. Automatic Trolley

13.4.4. Multifunctional

13.4.5. Others

13.5. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Load Capacity, 2017–2031

13.5.1. Up to 500 Kg

13.5.2. 500 Kg - 1000 Kg

13.5.3. 1000 Kg - 2000 Kg

13.5.4. Above 2000 Kg

13.6. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.6.1. Cardboard Boxes

13.6.2. Trays

13.6.3. Kegs

13.6.4. Buckets

13.6.5. Bags

13.6.6. Crates

13.6.7. Foil Bundles

13.6.8. Others

13.7. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.7.1. Food & Beverage

13.7.2. Beauty & Personal Care

13.7.3. Pharmaceutical

13.7.4. Chemical

13.7.5. Automotive

13.7.6. Others

13.8. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. South Korea

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Offering

13.9.2. By Type

13.9.3. By Load Capacity

13.9.4. By Application

13.9.5. By End-use Industry

13.9.6. By Country/Sub-region

14. Middle East & Africa Autonomous Mobile Robots Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Offering, 2017–2031

14.3.1. Hardware

14.3.2. Software

14.3.3. Services

14.4. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

14.4.1. Conveyor

14.4.2. Lifting

14.4.3. Automatic Trolley

14.4.4. Multifunctional

14.4.5. Others

14.5. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Load Capacity, 2017–2031

14.5.1. Up to 500 Kg

14.5.2. 500 Kg - 1000 Kg

14.5.3. 1000 Kg - 2000 Kg

14.5.4. Above 2000 Kg

14.6. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

14.6.1. Cardboard Boxes

14.6.2. Trays

14.6.3. Kegs

14.6.4. Buckets

14.6.5. Bags

14.6.6. Crates

14.6.7. Foil Bundles

14.6.8. Others

14.7. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

14.7.1. Food & Beverage

14.7.2. Beauty & Personal Care

14.7.3. Pharmaceutical

14.7.4. Chemical

14.7.5. Automotive

14.7.6. Others

14.8. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Offering

14.9.2. By Type

14.9.3. By Load Capacity

14.9.4. By Application

14.9.5. By End-use Industry

14.9.6. By Country/Sub-region

15. South America Autonomous Mobile Robots Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Offering, 2017–2031

15.3.1. Hardware

15.3.2. Software

15.3.3. Services

15.4. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

15.4.1. Conveyor

15.4.2. Lifting

15.4.3. Automatic Trolley

15.4.4. Multifunctional

15.4.5. Others

15.5. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Load Capacity, 2017–2031

15.5.1. Up to 500 Kg

15.5.2. 500 Kg - 1000 Kg

15.5.3. 1000 Kg - 2000 Kg

15.5.4. Above 2000 Kg

15.6. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

15.6.1. Cardboard Boxes

15.6.2. Trays

15.6.3. Kegs

15.6.4. Buckets

15.6.5. Bags

15.6.6. Crates

15.6.7. Foil Bundles

15.6.8. Others

15.7. Autonomous Mobile Robots Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

15.7.1. Food & Beverage

15.7.2. Beauty & Personal Care

15.7.3. Pharmaceutical

15.7.4. Chemical

15.7.5. Automotive

15.7.6. Others

15.8. Autonomous Mobile Robots Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Offering

15.9.2. By Type

15.9.3. By Load Capacity

15.9.4. By Application

15.9.5. By End-use Industry

15.9.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Autonomous Mobile Robots Market Competition Matrix - a Dashboard View

16.1.1. Global Autonomous Mobile Robots Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Addverb Technologies Limited

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. AMS, Inc.

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. ANYbotics AG

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Berkshire Grey

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Continental AG

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. ECA Group

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. Fetch Robotics, Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Gridbots Technologies Private Limited

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Hikrobot Technology Co., Ltd.

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Intel Corporation

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Kollmorgen

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Körber AG

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. KuKa AG

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

17.14. Locus Robotics

17.14.1. Overview

17.14.2. Product Portfolio

17.14.3. Sales Footprint

17.14.4. Key Subsidiaries or Distributors

17.14.5. Strategy and Recent Developments

17.14.6. Key Financials

17.15. Mobile Industrial Robots A/S

17.15.1. Overview

17.15.2. Product Portfolio

17.15.3. Sales Footprint

17.15.4. Key Subsidiaries or Distributors

17.15.5. Strategy and Recent Developments

17.15.6. Key Financials

17.16. OMRON Corporation

17.16.1. Overview

17.16.2. Product Portfolio

17.16.3. Sales Footprint

17.16.4. Key Subsidiaries or Distributors

17.16.5. Strategy and Recent Developments

17.16.6. Key Financials

17.17. Peer Robotics

17.17.1. Overview

17.17.2. Product Portfolio

17.17.3. Sales Footprint

17.17.4. Key Subsidiaries or Distributors

17.17.5. Strategy and Recent Developments

17.17.6. Key Financials

17.18. Shanghai Quicktron Intelligent Technology Co., Ltd.

17.18.1. Overview

17.18.2. Product Portfolio

17.18.3. Sales Footprint

17.18.4. Key Subsidiaries or Distributors

17.18.5. Strategy and Recent Developments

17.18.6. Key Financials

17.19. Teradyne Inc.

17.19.1. Overview

17.19.2. Product Portfolio

17.19.3. Sales Footprint

17.19.4. Key Subsidiaries or Distributors

17.19.5. Strategy and Recent Developments

17.19.6. Key Financials

17.20. Tetrahedron Manufacturing Services

17.20.1. Overview

17.20.2. Product Portfolio

17.20.3. Sales Footprint

17.20.4. Key Subsidiaries or Distributors

17.20.5. Strategy and Recent Developments

17.20.6. Key Financials

17.21. Universal Robots

17.21.1. Overview

17.21.2. Product Portfolio

17.21.3. Sales Footprint

17.21.4. Key Subsidiaries or Distributors

17.21.5. Strategy and Recent Developments

17.21.6. Key Financials

17.22. Youibot Robotics Co., Ltd.

17.22.1. Overview

17.22.2. Product Portfolio

17.22.3. Sales Footprint

17.22.4. Key Subsidiaries or Distributors

17.22.5. Strategy and Recent Developments

17.22.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Offering

18.1.2. By Type

18.1.3. By Load Capacity

18.1.4. By Application

18.1.5. By End-use Industry

18.1.6. By Country/Sub-region

List of Tables

Table 01: Global Autonomous Mobile Robots Market Size & Forecast, by Offering, Value (US$ Mn), 2017–2031

Table 02: Global Autonomous Mobile Robots Market Size & Forecast, by Offering, Volume (Million Units), 2017–2031

Table 03: Global Autonomous Mobile Robots Market Size & Forecast, by Type, Value (US$ Mn), 2017–2031

Table 04: Global Autonomous Mobile Robots Market Size & Forecast, by Type, Volume (Million Units), 2017–2031

Table 05: Global Autonomous Mobile Robots Market Size & Forecast, by Capacity, Value (US$ Mn), 2017–2031

Table 06: Global Autonomous Mobile Robots Market Size & Forecast, by Capacity, Volume (Million Units), 2017–2031

Table 07: Global Autonomous Mobile Robots Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 08: Global Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 09: Global Autonomous Mobile Robots Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 10: North America Autonomous Mobile Robots Market Size & Forecast, by Offering, Value (US$ Mn), 2017–2031

Table 11: North America Autonomous Mobile Robots Market Size & Forecast, by Offering, Volume (Million Units), 2017–2031

Table 12: North America Autonomous Mobile Robots Market Size & Forecast, by Type, Value (US$ Mn), 2017–2031

Table 13: North America Autonomous Mobile Robots Market Size & Forecast, by Type, Volume (Million Units), 2017–2031

Table 14: North America Autonomous Mobile Robots Market Size & Forecast, by Capacity, Value (US$ Mn), 2017–2031

Table 15: North America Autonomous Mobile Robots Market Size & Forecast, by Capacity, Volume (Million Units), 2017–2031

Table 16: North America Autonomous Mobile Robots Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 17: North America Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 18: North America Autonomous Mobile Robots Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 19: Europe Autonomous Mobile Robots Market Size & Forecast, by Offering, Value (US$ Mn), 2017–2031

Table 20: Europe Autonomous Mobile Robots Market Size & Forecast, by Offering, Volume (Million Units), 2017–2031

Table 21: Europe Autonomous Mobile Robots Market Size & Forecast, by Type, Value (US$ Mn), 2017–2031

Table 22: Europe Autonomous Mobile Robots Market Size & Forecast, by Type, Volume (Million Units), 2017–2031

Table 23: Europe Autonomous Mobile Robots Market Size & Forecast, by Capacity, Value (US$ Mn), 2017–2031

Table 24: Europe Autonomous Mobile Robots Market Size & Forecast, by Capacity, Volume (Million Units), 2017–2031

Table 25: Europe Autonomous Mobile Robots Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 26: Europe Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 27: Europe Autonomous Mobile Robots Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 28: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Offering, Value (US$ Mn), 2017–2031

Table 29: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Offering, Volume (Million Units), 2017–2031

Table 30: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Type, Value (US$ Mn), 2017–2031

Table 31: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Type, Volume (Million Units), 2017–2031

Table 32: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Capacity, Value (US$ Mn), 2017–2031

Table 33: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Capacity, Volume (Million Units), 2017–2031

Table 34: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 35: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 36: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 37: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Offering, Value (US$ Mn), 2017–2031

Table 38: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Offering, Volume (Million Units), 2017–2031

Table 39: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Type, Value (US$ Mn), 2017–2031

Table 40: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Type, Volume (Million Units), 2017–2031

Table 41: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Capacity, Value (US$ Mn), 2017–2031

Table 42: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Capacity, Volume (Million Units), 2017–2031

Table 43: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 44: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 45: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 46: South America Autonomous Mobile Robots Market Size & Forecast, by Offering, Value (US$ Mn), 2017–2031

Table 47: South America Autonomous Mobile Robots Market Size & Forecast, by Offering, Volume (Million Units), 2017–2031

Table 48: South America Autonomous Mobile Robots Market Size & Forecast, by Type, Value (US$ Mn), 2017–2031

Table 49: South America Autonomous Mobile Robots Market Size & Forecast, by Type, Volume (Million Units), 2017–2031

Table 50: South America Autonomous Mobile Robots Market Size & Forecast, by Capacity, Value (US$ Mn), 2017–2031

Table 51: South America Autonomous Mobile Robots Market Size & Forecast, by Capacity, Volume (Million Units), 2017–2031

Table 52: South America Autonomous Mobile Robots Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 53: South America Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 54: South America Autonomous Mobile Robots Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

List of Figures

Figure 01: Global Autonomous Mobile Robots Market, Value (US$ Mn), 2017-2031

Figure 02: Global Autonomous Mobile Robots Market, Volume (Million Units), 2017-2031

Figure 03: Global Autonomous Mobile Robots Market Size & Forecast, by Offering, Revenue (US$ Mn), 2017-2031

Figure 04: Global Autonomous Mobile Robots Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 05: Global Autonomous Mobile Robots Market Share Analysis, by Offering, 2022 and 2031

Figure 06: Global Autonomous Mobile Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 07: Global Autonomous Mobile Robots Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 08: Global Autonomous Mobile Robots Market Share Analysis, by Type, 2022 and 2031

Figure 09: Global Autonomous Mobile Robots Market Size & Forecast, by Load Capacity, Revenue (US$ Mn), 2017-2031

Figure 10: Global Autonomous Mobile Robots Market Attractiveness, By Load Capacity, Value (US$ Mn), 2022-2031

Figure 11: Global Autonomous Mobile Robots Market Share Analysis, by Load Capacity, 2022 and 2031

Figure 12: Global Autonomous Mobile Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 13: Global Autonomous Mobile Robots Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 14: Global Autonomous Mobile Robots Market Share Analysis, by Application, 2022 and 2031

Figure 15: Global Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 16: Global Autonomous Mobile Robots Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 17: Global Autonomous Mobile Robots Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 18: Global Autonomous Mobile Robots Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 19: Global Autonomous Mobile Robots Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 20: Global Autonomous Mobile Robots Market Share Analysis, by Region, 2021 and 2031

Figure 21: North America Autonomous Mobile Robots Market, Value (US$ Mn), 2017-2031

Figure 22: North America Autonomous Mobile Robots Market, Volume (Million Units), 2017-2031

Figure 23: North America Autonomous Mobile Robots Market Size & Forecast, by Offering, Revenue (US$ Mn), 2017-2031

Figure 24: North America Autonomous Mobile Robots Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 25: North America Autonomous Mobile Robots Market Share Analysis, by Offering, 2022 and 2031

Figure 26: North America Autonomous Mobile Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 27: North America Autonomous Mobile Robots Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 28: North America Autonomous Mobile Robots Market Share Analysis, by Type, 2022 and 2031

Figure 29: North America Autonomous Mobile Robots Market Size & Forecast, by Load Capacity, Revenue (US$ Mn), 2017-2031

Figure 30: North America Autonomous Mobile Robots Market Attractiveness, By Load Capacity, Value (US$ Mn), 2022-2031

Figure 31: North America Autonomous Mobile Robots Market Share Analysis, by Load Capacity, 2022 and 2031

Figure 32: North America Autonomous Mobile Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 33: North America Autonomous Mobile Robots Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 34: North America Autonomous Mobile Robots Market Share Analysis, by Application, 2022 and 2031

Figure 35: North America Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 36: North America Autonomous Mobile Robots Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 37: North America Autonomous Mobile Robots Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 38: North America Autonomous Mobile Robots Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 39: North America Autonomous Mobile Robots Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 40: North America Autonomous Mobile Robots Market Share Analysis, by Region, 2021 and 2031

Figure 41: Europe Autonomous Mobile Robots Market, Value (US$ Mn), 2017-2031

Figure 42: Europe Autonomous Mobile Robots Market, Volume (Million Units), 2017-2031

Figure 43: Europe Autonomous Mobile Robots Market Size & Forecast, by Offering, Revenue (US$ Mn), 2017-2031

Figure 44: Europe Autonomous Mobile Robots Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 45: Europe Autonomous Mobile Robots Market Share Analysis, by Offering, 2022 and 2031

Figure 46: Europe Autonomous Mobile Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 47: Europe Autonomous Mobile Robots Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 48: Europe Autonomous Mobile Robots Market Share Analysis, by Type, 2022 and 2031

Figure 49: Europe Autonomous Mobile Robots Market Size & Forecast, by Load Capacity, Revenue (US$ Mn), 2017-2031

Figure 50: Europe Autonomous Mobile Robots Market Attractiveness, By Load Capacity, Value (US$ Mn), 2022-2031

Figure 51: Europe Autonomous Mobile Robots Market Share Analysis, by Load Capacity, 2022 and 2031

Figure 52: Europe Autonomous Mobile Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 53: Europe Autonomous Mobile Robots Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 54: Europe Autonomous Mobile Robots Market Share Analysis, by Application, 2022 and 2031

Figure 55: Europe Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 56: Europe Autonomous Mobile Robots Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 57: Europe Autonomous Mobile Robots Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 58: Europe Autonomous Mobile Robots Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 59: Europe Autonomous Mobile Robots Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 60: Europe Autonomous Mobile Robots Market Share Analysis, by Region, 2021 and 2031

Figure 61: Asia Pacific Autonomous Mobile Robots Market, Value (US$ Mn), 2017-2031

Figure 62: Asia Pacific Autonomous Mobile Robots Market, Volume (Million Units), 2017-2031

Figure 63: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Offering, Revenue (US$ Mn), 2017-2031

Figure 64: Asia Pacific Autonomous Mobile Robots Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 65: Asia Pacific Autonomous Mobile Robots Market Share Analysis, by Offering, 2022 and 2031

Figure 66: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 67: Asia Pacific Autonomous Mobile Robots Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 68: Asia Pacific Autonomous Mobile Robots Market Share Analysis, by Type, 2022 and 2031

Figure 69: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Load Capacity, Revenue (US$ Mn), 2017-2031

Figure 70: Asia Pacific Autonomous Mobile Robots Market Attractiveness, By Load Capacity, Value (US$ Mn), 2022-2031

Figure 71: Asia Pacific Autonomous Mobile Robots Market Share Analysis, by Load Capacity, 2022 and 2031

Figure 72: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 73: Asia Pacific Autonomous Mobile Robots Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 74: Asia Pacific Autonomous Mobile Robots Market Share Analysis, by Application, 2022 and 2031

Figure 75: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 76: Asia Pacific Autonomous Mobile Robots Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 77: Asia Pacific Autonomous Mobile Robots Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 78: Asia Pacific Autonomous Mobile Robots Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 79: Asia Pacific Autonomous Mobile Robots Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 80: Asia Pacific Autonomous Mobile Robots Market Share Analysis, by Region, 2021 and 2031

Figure 81: Middle East & Africa Autonomous Mobile Robots Market, Value (US$ Mn), 2017-2031

Figure 82: Middle East & Africa Autonomous Mobile Robots Market, Volume (Million Units), 2017-2031

Figure 83: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Offering, Revenue (US$ Mn), 2017-2031

Figure 84: Middle East & Africa Autonomous Mobile Robots Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 85: Middle East & Africa Autonomous Mobile Robots Market Share Analysis, by Offering, 2022 and 2031

Figure 86: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 87: Middle East & Africa Autonomous Mobile Robots Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 88: Middle East & Africa Autonomous Mobile Robots Market Share Analysis, by Type, 2022 and 2031

Figure 89: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Load Capacity, Revenue (US$ Mn), 2017-2031

Figure 90: Middle East & Africa Autonomous Mobile Robots Market Attractiveness, By Load Capacity, Value (US$ Mn), 2022-2031

Figure 91: Middle East & Africa Autonomous Mobile Robots Market Share Analysis, by Load Capacity, 2022 and 2031

Figure 92: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 93: Middle East & Africa Autonomous Mobile Robots Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 94: Middle East & Africa Autonomous Mobile Robots Market Share Analysis, by Application, 2022 and 2031

Figure 95: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 96: Middle East & Africa Autonomous Mobile Robots Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 97: Middle East & Africa Autonomous Mobile Robots Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 98: Middle East & Africa Autonomous Mobile Robots Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 99: Middle East & Africa Autonomous Mobile Robots Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 100: Middle East & Africa Autonomous Mobile Robots Market Share Analysis, by Region, 2021 and 2031

Figure 101: South America Autonomous Mobile Robots Market, Value (US$ Mn), 2017-2031

Figure 102: South America Autonomous Mobile Robots Market, Volume (Million Units), 2017-2031

Figure 103: South America Autonomous Mobile Robots Market Size & Forecast, by Offering, Revenue (US$ Mn), 2017-2031

Figure 104: South America Autonomous Mobile Robots Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 105: South America Autonomous Mobile Robots Market Share Analysis, by Offering, 2022 and 2031

Figure 106: South America Autonomous Mobile Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 107: South America Autonomous Mobile Robots Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 108: South America Autonomous Mobile Robots Market Share Analysis, by Type, 2022 and 2031

Figure 109: South America Autonomous Mobile Robots Market Size & Forecast, by Load Capacity, Revenue (US$ Mn), 2017-2031

Figure 110: South America Autonomous Mobile Robots Market Attractiveness, By Load Capacity, Value (US$ Mn), 2022-2031

Figure 111: South America Autonomous Mobile Robots Market Share Analysis, by Load Capacity, 2022 and 2031

Figure 112: South America Autonomous Mobile Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 113: South America Autonomous Mobile Robots Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 114: South America Autonomous Mobile Robots Market Share Analysis, by Application, 2022 and 2031

Figure 115: South America Autonomous Mobile Robots Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 116: South America Autonomous Mobile Robots Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 117: South America Autonomous Mobile Robots Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 118: South America Autonomous Mobile Robots Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 119: South America Autonomous Mobile Robots Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 120: South America Autonomous Mobile Robots Market Share Analysis, by Region, 2021 and 2031