Reports

Reports

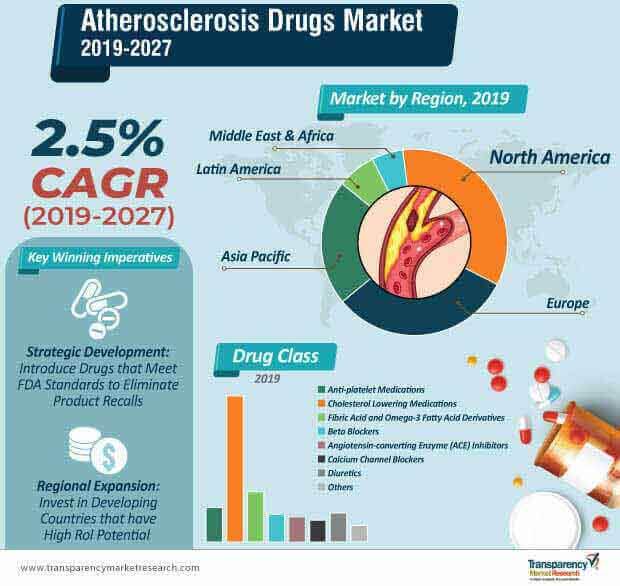

Despite the prevalence of diabetes and cholesterol among a wide patient pool, the atherosclerosis drugs market will move at a sluggish CAGR of 2.5% during the forecast period, finds a recently published report by Transparency Market Research (TMR).

This market growth is attributable to the high consumption of cholesterol-lowering drugs by patients to reduce blockages in arteries. A sedentary, yet, demanding lifestyle instigates consumers to opt for quick dietary choices, which will catalyze revenue streams to the atherosclerosis drugs landscape.

To add to that, government initiatives at a global level have played a crucial role in improving the quality of healthcare services and infrastructure, which has been encouraging pharmaceutical companies to develop effective drugs for the treatment of various diseases. The effectiveness of drugs coupled with their easy availability through streamlined distribution channels has been complementing the sales of atherosclerosis drugs. Analyzing the current and the future growth scope, the TMR study opines that, the atherosclerosis drugs market will register a value tantamount to ~US$ 57.4 Bn by 2027.

In March 2019, the U.S. Food and Drug Administration approved a novel generic drug of Diovan to bridge the high demand and low supply gap of this critical drug, on account of multiple recalls of valsartan products manufactured by several brands. After two months, Zydus Cadila announced that it has received approval for Chlorthalidone, a generic version of Thalitone produced by Pfizer.

These and many companies have scrambled towards the development of generic drugs to offer the near-same benefits of branded drugs at a low cost. The rapid rise in the penetration of generic drugs in parallel to increasing awareness among consumers about the cost benefits of these drugs is likely to curb the growth potential of the atherosclerosis drugs market.

Also, heart strokes and cardiovascular dysfunction are the symptoms associated with atherosclerosis conditions, which could lead to sudden death. On account of the severity of these symptoms, the survival rate is low among patients, which reduces the diagnosis percentage of atherosclerosis.

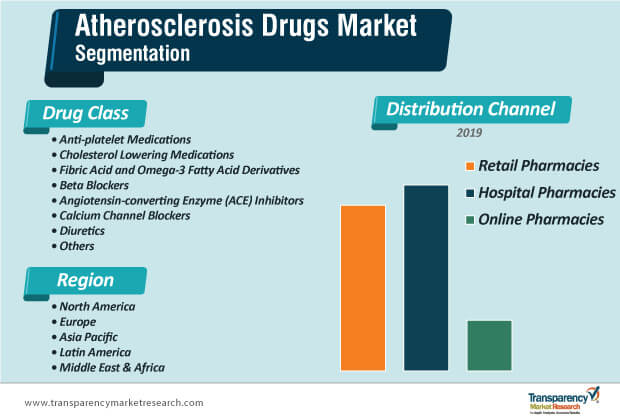

According to the statistical data of the TMR study, retail pharmacies will grow as the key point-of-sales channel for atherosclerosis drugs, as they are established at even the remotest of locations, thereby making it convenient for consumers to present prescriptions and purchase drugs. In addition, retail pharmacists offer a more consultative role regarding the route of administration and possible side effects of drugs. Retail pharmacies have the presence of several brands, which makes them a suitable purchase point for patients. However, hospital pharmacists operate in a more clinic-oriented manner by having significant contact with doctors and nurses, and they manage their inventories with only specific brands.

By 2027, players in the atherosclerosis drugs market can look at sales through retail pharmacies to a value tantamount to ~US$ 24 Bn.

Analysts’ Take on Atherosclerosis Drugs Market

Analyzing the impact of the drivers and restraints influencing the future of the atherosclerosis drugs market, analysts of the TMR study anticipate slow, yet, steady growth during the forecast period. While favorable government policies and impressive strides of the healthcare industry are projected to foster the leaps of the North American atherosclerosis drugs market, Asia Pacific will grow at an accelerated pace during the forecast period.

An investment made towards the development of novel drugs with a keen eye on their effectiveness will help in developing a weighted product portfolio. In addition, the convergence of e-Commerce and the healthcare sector will create high sales opportunities through online pharmacies for players operating in the atherosclerosis drugs market during the forecast period.

Atherosclerosis Drugs Market: Overview

Increase in Prevalence of Atherosclerosis & Cardiovascular Diseases and Awareness About Cardiovascular Diseases: Key Drivers

Atherosclerosis Drugs Market: Development of New Treatments

Availability of Generic Drugs Hampers Atherosclerosis Drugs Market

Global Atherosclerosis Drugs Market: Competition Landscape

Global Atherosclerosis Drugs Market: Key Developments

Key players in the global atherosclerosis drugs market are engaged in the development of new products and approvals, mergers & acquisitions, and collaborations. Major developments by key players are likely to fuel the expansion of the global atherosclerosis drugs market. Some of the growth strategies adopted by players in the atherosclerosis drugs market as follows:

In January 2017, Novartis AG signed a collaborative deal with its subsidiary, Akcea Therapeutics and Ionis Pharmaceuticals, for cardiovascular products

The global atherosclerosis drugs market was worth US$ 45.7 Bn and is projected to reach a value of US$ 57.4 Bn by the end of 2027

Atherosclerosis drugs market is anticipated to grow at a CAGR of 2.5% during the forecast period

North America and Western Europe accounted for a major share of the global atherosclerosis drugs market

Atherosclerosis drugs market is driven by rising prevalence of atherosclerosis and cardiovascular disease, and development of new treatments are anticipated to drive the global market

Key players in the global atherosclerosis drugs market include GlaxoSmithKline Plc, Sanofi, F. Hoffmann-La Roche Ltd, Bayer AG, Novartis AG, Merck & Co., Inc. (Merck Sharp & Dohme Corp), Janssen Pharmaceuticals, Inc. (Johnson & Johnson), Mylan N.V., Amgen Inc., Pfizer, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Atherosclerosis Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.1.1. Increase in Prevalence of Atherosclerosis & Cardiovascular Diseases

4.3.1.2. Development of New Treatments

4.3.1.3. Rising Awareness about Cardiovascular Diseases

4.3.2. Restraints

4.3.2.1. Availability of Generic Products

4.3.2.2. Low Diagnostic Rate

4.3.3. Opportunities

4.4. Global Atherosclerosis Drugs Market Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. Clinical Trial Pipeline Analysis

5.2. Disease Prevalence & Incidence Rate globally with key countries

5.3. Brand Analysis

6. Global Atherosclerosis Drugs Market Analysis and Forecast, By Drug Class

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

6.2.1. Anti-platelet Medications

6.2.2. Cholesterol Lowering Medications

6.2.3. Fibric Acid and Omega-3 Fatty Acid Derivatives

6.2.4. Beta Blockers

6.2.5. Angiotensin-Converting Enzyme (ACE) Inhibitors

6.2.6. Calcium Channel Blockers

6.2.7. Diuretics

6.2.8. Others

6.3. Global Atherosclerosis Drugs Market Attractiveness, by Drug Class

7. Global Atherosclerosis Drugs Market Analysis and Forecast, By Distribution Channel

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

7.2.1. Retail Pharmacies

7.2.2. Hospital Pharmacies

7.2.3. Online Pharmacies

7.3. Global Atherosclerosis Drugs Market Attractiveness, by Distribution Channel

8. Global Atherosclerosis Drugs Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Atherosclerosis Drugs Market Attractiveness, by region

9. North America Atherosclerosis Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

9.2.1. Anti-platelet Medications

9.2.2. Cholesterol Lowering Medications

9.2.3. Fibric Acid and Omega-3 Fatty Acid Derivatives

9.2.4. Beta Blockers

9.2.5. Angiotensin-Converting Enzyme (ACE) Inhibitors

9.2.6. Calcium Channel Blockers

9.2.7. Diuretics

9.2.8. Others

9.3. North America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

9.3.1. Retail Pharmacies

9.3.2. Hospital Pharmacies

9.3.3. Online Pharmacies

9.4. North America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

9.4.1. U.S.

9.4.2. Canada

9.5. North America Atherosclerosis Drugs Market Attractiveness

9.5.1. By Drug Type

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Atherosclerosis Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

10.2.1. Anti-platelet Medications

10.2.2. Cholesterol Lowering Medications

10.2.3. Fibric Acid and Omega-3 Fatty Acid Derivatives

10.2.4. Beta Blockers

10.2.5. Angiotensin-Converting Enzyme (ACE) Inhibitors

10.2.6. Calcium Channel Blockers

10.2.7. Diuretics

10.2.8. Others

10.3. Europe Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

10.3.1. Retail Pharmacies

10.3.2. Hospital Pharmacies

10.3.3. Online Pharmacies

10.4. Europe Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country Sub/region, 2017–2027

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Europe Atherosclerosis Drugs Market Attractiveness

10.5.1. By Drug Type

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Atherosclerosis Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

11.2.1. Anti-platelet Medications

11.2.2. Cholesterol lowering medications

11.2.3. Fibric Acid and Omega-3 Fatty Acid Derivatives

11.2.4. Beta blockers

11.2.5. Angiotensin-Converting Enzyme (ACE) Inhibitors

11.2.6. Calcium Channel Blockers

11.2.7. Diuretics

11.2.8. Others

11.3. Asia Pacific Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

11.3.1. Retail Pharmacies

11.3.2. Hospital Pharmacies

11.3.3. Online Pharmacies

11.4. Asia Pacific Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Atherosclerosis Drugs Market Attractiveness

11.5.1. By Drug Type

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Atherosclerosis Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

12.2.1. Anti-platelet Medications

12.2.2. Cholesterol Lowering Medications

12.2.3. Fibric Acid and Omega-3 Fatty Acid Derivatives

12.2.4. Beta blockers

12.2.5. Angiotensin-Converting Enzyme (ACE) Inhibitors

12.2.6. Calcium Channel Blockers

12.2.7. Diuretics

12.2.8. Others

12.3. Latin America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

12.3.1. Retail Pharmacies

12.3.2. Hospital Pharmacies

12.3.3. Online Pharmacies

12.4. Latin America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Atherosclerosis Drugs Market Attractiveness

12.5.1. By Drug Type

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Atherosclerosis Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

13.2.1. Anti-platelet medications

13.2.2. Cholesterol Lowering Medications

13.2.3. Fibric Acid and Omega-3 Fatty Acid Derivatives

13.2.4. Beta blockers

13.2.5. Angiotensin-Converting Enzyme (ACE) Inhibitors

13.2.6. Calcium Channel Blockers

13.2.7. Diuretics

13.2.8. Others

13.3. Middle East & Africa Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

13.3.1. Retail Pharmacies

13.3.2. Hospital Pharmacies

13.3.3. Online Pharmacies

13.4. Middle East & Africa Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

13.4.1. GCC

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Middle East & Africa Atherosclerosis Drugs Market Attractiveness

13.5.1. By Drug Type

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Key Company’s Market Ranking Analysis

14.3. Company Profiles

14.3.1. GlaxoSmithKline Plc

14.3.1.1. Company Overview

14.3.1.2. Company Financials

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. Sanofi

14.3.2.1. Company Overview

14.3.2.2. Company Financials

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Hoffmann-La Roche Ltd

14.3.3.1. Company Overview

14.3.3.2. Company Financials

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. Bayer AG

14.3.4.1. Company Overview

14.3.4.2. Company Financials

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. Novartis AG

14.3.5.1. Company Overview

14.3.5.2. Company Financials

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. Merck & Co., Inc. (Merck Sharp & Dohme Corp)

14.3.6.1. Company Overview

14.3.6.2. Company Financials

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. Janssen Pharmaceuticals, Inc. (Johnson & Johnson)

14.3.7.1. Company Overview

14.3.7.2. Company Financials

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

14.3.8. Mylan N.V.

14.3.8.1. Company Overview

14.3.8.2. Company Financials

14.3.8.3. Growth Strategies

14.3.8.4. SWOT Analysis

14.3.9. Amgen Inc.

14.3.9.1. Company Overview

14.3.9.2. Company Financials

14.3.9.3. Growth Strategies

14.3.9.4. SWOT Analysis

14.3.10. Pfizer, Inc.

14.3.10.1. Company Overview

14.3.10.2. Company Financials

14.3.10.3. Growth Strategies

14.3.10.4. SWOT Analysis

List of Tables

Table 01: Atherosclerosis Pipeline Analysis

Table 02: Atherosclerosis Pipeline Analysis

Table 03: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 04: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 05: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class 2017–2027

Table 07: North America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 08: North America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

Table 09: Europe Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 10: Europe Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 11: Europe Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Asia Pacific Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 13: Asia Pacific Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 14: Asia Pacific Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 15: Latin America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class 2017–2027

Table 16: Latin America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 17: Latin America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country / Sub-region, 2017–2027

Table 18: Middle East & Africa Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 19: Middle East & Africa Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 20: Middle East & Africa Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Atherosclerosis Drugs Market Revenue (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Atherosclerosis Drugs Market Revenue (US$ Mn), by Drug Class, 2018

Figure 03: Global Atherosclerosis Drugs Market Revenue Share Analysis, by Drug Class, 2018

Figure 04: Market Overview

Figure 05: Global Atherosclerosis Drugs Market Revenue Share, by Drug Class, 2018

Figure 06: Global Atherosclerosis Drugs Market Revenue Share, by Distribution Channel, 2018

Figure 07: Global Atherosclerosis Drugs Market Revenue Share, by Region, 2018

Figure 08: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 09: Global Atherosclerosis Drugs Market Revenue Share Analysis, by Drug Class, 2018 and 2027

Figure 10: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Anti-platelet Medications, 2017–2027

Figure 11: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Cholesterol Lowering Medications, 2017–2027

Figure 12: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Fibric Acid and Omega-3 Fatty Acid Derivatives, 2017–2027

Figure 13: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Beta Blockers, 2017–2027

Figure 14: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Angiotensin-converting Enzyme (ACE) Inhibitors, 2017–2027

Figure 15: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Calcium Channel Blockers, 2017–2027

Figure 16: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Diuretics, 2017–2027

Figure 17: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2027

Figure 18: Global Atherosclerosis Drugs Market Attractiveness Analysis, by Drug Class, 2018–2027

Figure 19: Global Atherosclerosis Drugs Market Revenue Share Analysis, by Distribution Channel, 2018 and 2027

Figure 20: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth(%) Projection, by Retail Pharmacies, 2017–2027

Figure 21: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospital Pharmacies, 2017–2027

Figure 22: Global Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Online Pharmacies, 2017–2027

Figure 23: Global Atherosclerosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 24: Global Atherosclerosis Drugs Market Revenue Share Analysis, by Region, 2018 and 2027

Figure 25: Global Atherosclerosis Drugs Market Attractiveness Analysis, by Region, 2019–2027

Figure 26: North America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 27: North America Atherosclerosis Drugs Market Revenue Share Analysis, by Drug Class, 2018 and 2027

Figure 28: North America Atherosclerosis Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 29: North America Atherosclerosis Drugs Market Revenue Share Analysis, by Distribution Channel, 2018 and 2027

Figure 30: North America Atherosclerosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2019 -2027

Figure 31: North America Atherosclerosis Drugs Market Revenue Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 32: North America Atherosclerosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 33: Europe Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 34: Europe Atherosclerosis Drugs Market Revenue Share Analysis, by Drug Class, 2018 and 2027

Figure 35: Europe Atherosclerosis Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 36: Europe Atherosclerosis Drugs Market Revenue Share Analysis, by Distribution Channel, 2018 and 2027

Figure 37: Europe Atherosclerosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 38: Europe Atherosclerosis Drugs Market Revenue Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 39: Europe Atherosclerosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 40: Asia Pacific Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 41: Asia Pacific Atherosclerosis Drugs Market Revenue Share Analysis, by Drug Class, 2018 and 2027

Figure 42: Asia Pacific Atherosclerosis Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 43: Asia Pacific Atherosclerosis Drugs Market Revenue Share Analysis, by Distribution Channel, 2018 and 2027

Figure 44: Asia Pacific Atherosclerosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2019 -2027

Figure 45: Asia Pacific Atherosclerosis Drugs Market Revenue Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 46: Asia Pacific Atherosclerosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 47: Latin America Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 48: Latin America Atherosclerosis Drugs Market Revenue Share Analysis, by Drug Class, 2018 and 2027

Figure 49: Latin America Atherosclerosis Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 50: Latin America Atherosclerosis Drugs Market Revenue Share Analysis, by Distribution Channel, 2018 and 2027

Figure 51: Latin America Atherosclerosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2019 -2027

Figure 52: Latin America Atherosclerosis Drugs Market Revenue Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 53: Latin America Atherosclerosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 54: Middle East & Africa Atherosclerosis Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 55: Middle East & Africa Atherosclerosis Drugs Market Revenue Share Analysis, by Drug Class, 2018 and 2027

Figure 56: Middle East & Africa Atherosclerosis Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 57: Middle East & Africa Atherosclerosis Drugs Market Revenue Share Analysis, by Distribution Channel, 2018 and 2027

Figure 58: Middle East & Africa Atherosclerosis Drugs Market Attractiveness Analysis, by Distribution Channel, 2019 -2027

Figure 59: Middle East & Africa Atherosclerosis Drugs Market Revenue Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 60: Middle East & Africa Atherosclerosis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 61: Market Position Analysis, 2018, by Tier and Size of the Company

Figure 62: GlaxoSmithKline plc (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 63: GlaxoSmithKline plc Breakdown of Net Sales (%), by Region/Country, 2018

Figure 64: GlaxoSmithKline plc Revenue Breakdown of Net Sales (%), by Business segment, 2018

Figure 65: GlaxoSmithKline plc R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 66: Sanofi (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 65: GlaxoSmithKline plc R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 68: Sanofi Revenue Breakdown of Net Sales (%), by Pharmaceutical Business segment, 2018

Figure 69: Sanofi R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 70: F. Hoffmann-La Roche Ltd Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 71: F. Hoffmann-La Roche Ltd Breakdown of Net Sales (%), by Region, 2018

Figure 72: F. Hoffmann-La Roche Ltd Breakdown of Net Sales (%), by Pharmaceutical Division, 2018

Figure 73: F. Hoffmann-La Roche Ltd R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 74: Bayer AG, Pharmaceutical Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 75: Bayer AG Breakdown of Net Sales (%), by Region, 2018

Figure 76: Bayer AG Revenue Breakdown of Net Sales (%), by Business segment, 2018

Figure 77: Bayer AG, pharmaceutical segment R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 78: Novartis AG Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 79: Novartis AG Breakdown of Net Sales (%) of Innovative Medicines Business Segment, by Region/Country, 2018

Figure 80: Novartis AG Revenue Breakdown of Net Sales (%), by Innovative Medicines Segment, 2018

Figure 81: Novartis AG R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 82: Merck & Co., Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 83: Merck & Co., Inc. Breakdown of Net Sales (%), by Region/Country, 2018

Figure 84: Merck & Co., Inc. Revenue Breakdown of Net Sales (%), by Segment, 2018

Figure 85: Merck & Co., Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 86: Johnson & Johnson Pharmaceutical Segment Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 87: Johnson & Johnson Breakdown of Net Sales (%), of Pharmaceutical Segment by Region/Country, 2018

Figure 88: Johnson & Johnson Revenue Breakdown of Net Sales (%), by Pharmaceutical Segment, 2018

Figure 89: Johnson & Johnson, Pharmaceutical Segment R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 90: Mylan N.V. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 91: Mylan N.V. R&D Expenses (US$ Mn), 2017–2018

Figure 92: Mylan N.V. Breakdown of Net Sales, by Region, 2018

Figure 93: Amgen, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 94: Amgen, Inc. Breakdown of Net Sales (%), by Region/Country, 2017

Figure 95: Amgen Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), by Segment 2014–2017

Figure 96: Pfizer, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 97: Pfizer, Inc. Breakdown of Net Sales, by Geography, 2018

Figure 98: Pfizer, Inc. Breakdown of Net Sales, by Business Segment (%), 2018

Figure 99: Pfizer, Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018