Reports

Reports

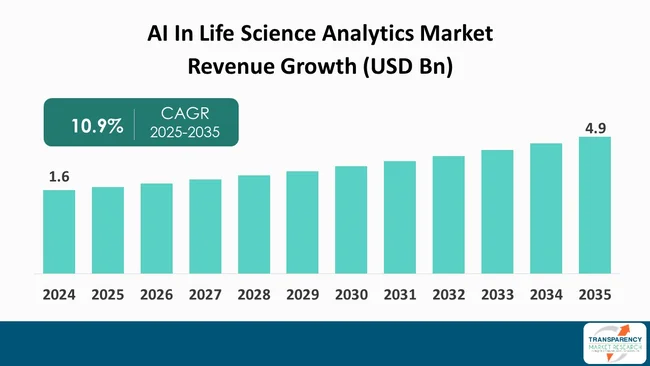

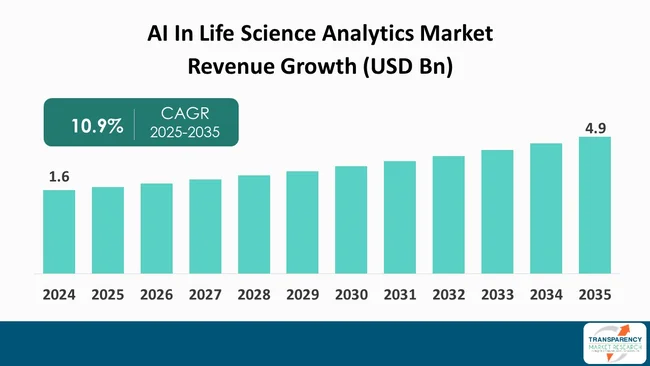

The global AI in life science analytics market size was valued at US$ 1.6 Bn in 2024 and is projected to reach US$ 4.9 Bn by 2035, expanding at a CAGR of 10.9% from 2025 to 2035. The main factors leading to this expansion are the fast implementation of AI and big data analytics in genomics, proteomics, and drug-discovery workflows; rising expenditure on precision and personalized medicine, which needs valuable insights from large, heterogeneous datasets; and increasing need for real-world evidence and advanced analytics to enhance clinical trials and regulatory submissions.

The global AI in life science analytics market is bound to witness rapid growth over years due to the rapid digital transformation of the pharma, biotech, and healthcare sectors. It is expected that the integration of AI in life science analytics will significantly impact the way companies decipher complex biological and clinical data, with the whole process being much faster and more accurate results being generated.

AI-powered analytics platforms are expected to be the major enablers of the life science sector in the near future as companies are putting more efforts to improve drug discovery efficiency, optimize clinical trials, and enhance patient outcomes through data-driven insights. Additionally, the market growth will be fueled by the increasing focus on personalized medicine as well as the numerous collaborations between technology providers and life science companies.

Moreover, the next developments of machine learning algorithms and cloud-based analytical tools are expected to significantly simplify data processing and predictive modeling in the life sciences. In general, analysts consider the market to be moving in a powerful upward direction, with AI-powered analytics being able to create new opportunities, improve efficiency, and give a competitive advantage to the entire global life sciences ecosystem.

The AI in life science analytics market is one of the fastest-growing segments of the healthcare and biotechnology industries. It is a field where AI technologies are progressively employed to get insightful data from complicated and large biological data. The market refers to the use of advanced analytics, machine learning, and predictive modeling in various areas of life sciences such as drug discovery, genomics, clinical research, and patient care management.

With Al, data analysis is automated and pattern recognition is enhanced. Researchers and organizations can thus innovate at a faster pace, increase precision, and at the same time, take well-informed decisions all along the product development lifecycle. The massive amounts of healthcare and biological data, in addition to the demand for quick, data-based solutions, are the main reasons for the worldwide life sciences industry to get extensively involved in Al-powered analytics.

However, the merging of Al with cloud computing, big data platforms, and real-world evidence systems is going to the next level of the scalability and the speed of the analytical processes. Consequently, the Al in life science analytics market is on its way to be the main instrument that will radically change the face of the research, help to operationalize the workflows efficiently, and be the source of the subsequent revolutionary wave of precision medicine and healthcare delivery.

For instance, the World Health Organization (WHO), in collaboration with key partners and supporters, launched version 2.0 of the Epidemic Intelligence from Open Sources (EIOS) system, used globally for the early detection of public health threats. It helps public health teams detect and respond to potential threats daily by analyzing large volumes of publicly available information in near real time.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The traditional pharmaceutical drug discovery and development process is being completely transformed by artificial intelligence with its time and cost savings of the process. By the use of sophisticated algorithms and machine learning models, Al has the capacity to sift through huge datasets-such as genomic data, molecular structures, or clinical trial results in order to pinpoint the most effective therapeutic compounds with an improved accuracy level.

With this data-driven approach, researchers can foresee drug-target interactions, refine molecular structures, and select candidates that have the highest chances of success. By implementing Al in operations that are usually time-consuming and are thus done only in limited amounts, such as screening, validation and optimization, the early stages of drug discovery are not only rapidly advanced but also the whole development pipeline becomes more efficient, which is the ultimate goal of the pharmaceutical industry.

For instance, in the U.S., the ARPA-H (Advanced Research Projects Agency for Health) under DHHS (Department of Health and Human Services) has mentioned that it had inaugurated its MATRIX venture, a bold Al-powered repurposing of drugs program aimed at rare and neglected diseases. The project is using advanced machine-learning models to pinpoint new uses of drugs in a way that is faster than the usual R&D route, thereby indicating that the federal government is increasingly putting money into Al-powered healthcare innovation.

The rising occurrence of complicated and chronic diseases such as cancer, neurological disorders, and autoimmune illnesses is going to be one of the primary reasons that will generate a demand for new pharmaceuticals. As the treatments for these diseases usually involve complex biological mechanisms and large datasets from genomics, proteomics, and clinical research, traditional research methods alone are already inadequate.

Al is addressing problems that human beings put forward is by increasing efficiency in data analysis with such huge data sets and giving precise drug targets and also suggesting exact patient responses. Hence, it is contributing to the rapid progression of medicine in general and targeted therapy in particular, and thus, Al has become necessary for survival in humanity's fight against the most difficult diseases of the world.

Additionally, the incorporation of Al-powered analytics opens up possibilities for scientists to simulate the progression of diseases and the results of treatments, thus, lessening the need for a long and arduous trial-and-error process. With healthcare systems and pharma companies increasingly concentrating on precision medicine, the use of Al in fighting intricate illnesses is anticipated not only to extend dramatically but also to change the speed and the effectiveness of drug development in the 21st century fundamentally.

For instance, in the UK, the Department for Science, Innovation and Technology (DSIT) revealed that it would spend £82.6 Mn in February 2025 on a major funding initiative for supporting Al-driven projects that aim to provide cancer care and drug discovery. This move is a vital component of the UK government's extensive plan of strengthening the country's position as a front-runner in health tech and precision medicine.

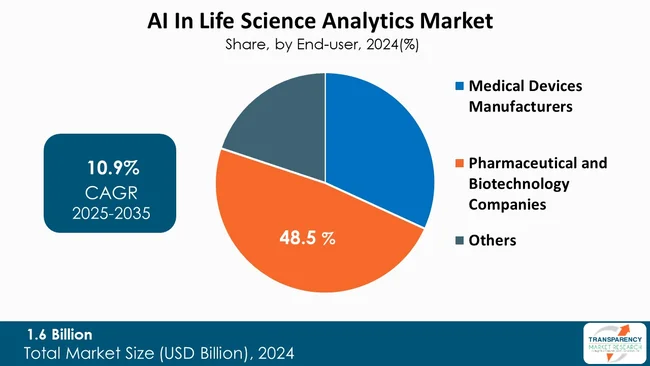

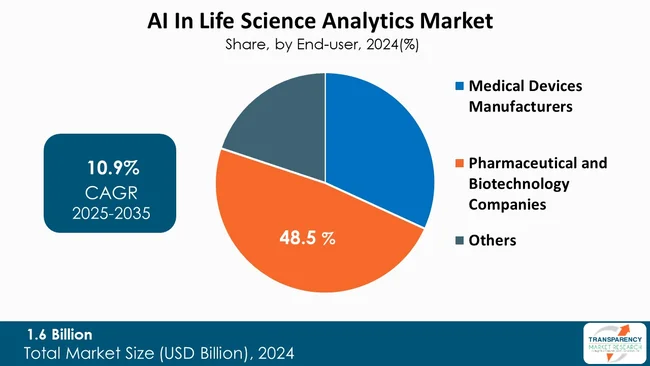

Pharmaceutical and Biotechnology Companies represent the largest end-user segment of the AI in life science analytics market with 48.5% share. In their quest for innovation and market leadership, these organizations produce tons of clinical, research, and operational data, thus, they have become the first and most significant users of AI-powered analytics.

Their

The global AI in life science analytics market size was valued at US$ 1.6 Bn in 2024 and is projected to reach US$ 4.9 Bn by 2035, expanding at a CAGR of 10.9% from 2025 to 2035. The main factors leading to this expansion are the fast implementation of AI and big data analytics in genomics, proteomics, and drug-discovery workflows; rising expenditure on precision and personalized medicine, which needs valuable insights from large, heterogeneous datasets; and increasing need for real-world evidence and advanced analytics to enhance clinical trials and regulatory submissions.

The global AI in life science analytics market is bound to witness rapid growth over years due to the rapid digital transformation of the pharma, biotech, and healthcare sectors. It is expected that the integration of AI in life science analytics will significantly impact the way companies decipher complex biological and clinical data, with the whole process being much faster and more accurate results being generated.

AI-powered analytics platforms are expected to be the major enablers of the life science sector in the near future as companies are putting more efforts to improve drug discovery efficiency, optimize clinical trials, and enhance patient outcomes through data-driven insights. Additionally, the market growth will be fueled by the increasing focus on personalized medicine as well as the numerous collaborations between technology providers and life science companies.

Moreover, the next developments of machine learning algorithms and cloud-based analytical tools are expected to significantly simplify data processing and predictive modeling in the life sciences. In general, analysts consider the market to be moving in a powerful upward direction, with AI-powered analytics being able to create new opportunities, improve efficiency, and give a competitive advantage to the entire global life sciences ecosystem.

The AI in life science analytics market is one of the fastest-growing segments of the healthcare and biotechnology industries. It is a field where AI technologies are progressively employed to get insightful data from complicated and large biological data. The market refers to the use of advanced analytics, machine learning, and predictive modeling in various areas of life sciences such as drug discovery, genomics, clinical research, and patient care management.

With Al, data analysis is automated and pattern recognition is enhanced. Researchers and organizations can thus innovate at a faster pace, increase precision, and at the same time, take well-informed decisions all along the product development lifecycle. The massive amounts of healthcare and biological data, in addition to the demand for quick, data-based solutions, are the main reasons for the worldwide life sciences industry to get extensively involved in Al-powered analytics.

However, the merging of Al with cloud computing, big data platforms, and real-world evidence systems is going to the next level of the scalability and the speed of the analytical processes. Consequently, the Al in life science analytics market is on its way to be the main instrument that will radically change the face of the research, help to operationalize the workflows efficiently, and be the source of the subsequent revolutionary wave of precision medicine and healthcare delivery.

For instance, the World Health Organization (WHO), in collaboration with key partners and supporters, launched version 2.0 of the Epidemic Intelligence from Open Sources (EIOS) system, used globally for the early detection of public health threats. It helps public health teams detect and respond to potential threats daily by analyzing large volumes of publicly available information in near real time.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The traditional pharmaceutical drug discovery and development process is being completely transformed by artificial intelligence with its time and cost savings of the process. By the use of sophisticated algorithms and machine learning models, Al has the capacity to sift through huge datasets-such as genomic data, molecular structures, or clinical trial results in order to pinpoint the most effective therapeutic compounds with an improved accuracy level.

With this data-driven approach, researchers can foresee drug-target interactions, refine molecular structures, and select candidates that have the highest chances of success. By implementing Al in operations that are usually time-consuming and are thus done only in limited amounts, such as screening, validation and optimization, the early stages of drug discovery are not only rapidly advanced but also the whole development pipeline becomes more efficient, which is the ultimate goal of the pharmaceutical industry.

For instance, in the U.S., the ARPA-H (Advanced Research Projects Agency for Health) under DHHS (Department of Health and Human Services) has mentioned that it had inaugurated its MATRIX venture, a bold Al-powered repurposing of drugs program aimed at rare and neglected diseases. The project is using advanced machine-learning models to pinpoint new uses of drugs in a way that is faster than the usual R&D route, thereby indicating that the federal government is increasingly putting money into Al-powered healthcare innovation.

The rising occurrence of complicated and chronic diseases such as cancer, neurological disorders, and autoimmune illnesses is going to be one of the primary reasons that will generate a demand for new pharmaceuticals. As the treatments for these diseases usually involve complex biological mechanisms and large datasets from genomics, proteomics, and clinical research, traditional research methods alone are already inadequate.

Al is addressing problems that human beings put forward is by increasing efficiency in data analysis with such huge data sets and giving precise drug targets and also suggesting exact patient responses. Hence, it is contributing to the rapid progression of medicine in general and targeted therapy in particular, and thus, Al has become necessary for survival in humanity's fight against the most difficult diseases of the world.

Additionally, the incorporation of Al-powered analytics opens up possibilities for scientists to simulate the progression of diseases and the results of treatments, thus, lessening the need for a long and arduous trial-and-error process. With healthcare systems and pharma companies increasingly concentrating on precision medicine, the use of Al in fighting intricate illnesses is anticipated not only to extend dramatically but also to change the speed and the effectiveness of drug development in the 21st century fundamentally.

For instance, in the UK, the Department for Science, Innovation and Technology (DSIT) revealed that it would spend £82.6 Mn in February 2025 on a major funding initiative for supporting Al-driven projects that aim to provide cancer care and drug discovery. This move is a vital component of the UK government's extensive plan of strengthening the country's position as a front-runner in health tech and precision medicine.

Pharmaceutical and Biotechnology Companies represent the largest end-user segment of the AI in life science analytics market with 48.5% share. In their quest for innovation and market leadership, these organizations produce tons of clinical, research, and operational data, thus, they have become the first and most significant users of AI-powered analytics.

Their imperative to speed up drug discovery, make trials more efficient, and improve decision-making has put them in a position where they are the first to use advanced analytical tools extensively. Consequently, this segment is ahead of medical device manufacturers in terms of market leadership.

Their leadership is largely powered by a higher investment capacity and a very strong emphasis on digital transformation across R&D and commercial functions. Consequently, pharma and biotech companies remain the main drivers of AI implementation in the entire life sciences ecosystem.

| Attribute | Detail |

|---|---|

| Leading Region |

|

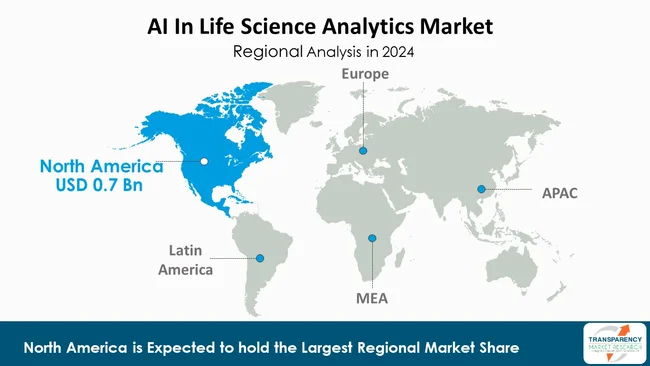

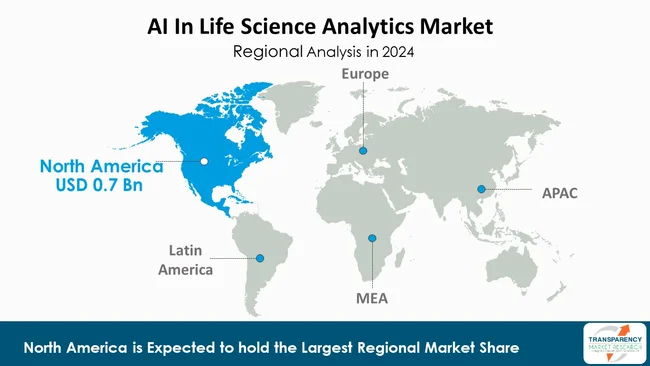

The major part of the global Al in life science analytics market is held by North America, which is anticipated to be the most influential region during the forecast period with 47.2% market share. The regions dominance in the market can mainly be credited to the wide and deep applications of high-tech, mature healthcare, and pharmaceutical industries, as well as the hefty investments in the research and development pertaining to artificial intelligence. Specifically, the U.S. is responsible for the major part due to the widespread use of innovative gene delivery methods, large-scale financing for genomics and personalized medicine, and an increasing number of clinical trials for gene and cell therapies.

Moreover, a strong regulatory system and a series of beneficial government programs, along with quite a few collaborations between the academic world, the industry, and the public sector have made the continent a leader in this field for a long time already. In fact, the region is able to quickly innovate and broadly deploy Al-based analytics throughout the life sciences ecosystem due to the extensive data integration and computational analysis that are supported by a large number of cloud service providers and advanced digital infrastructure.

For instance, OTTAWA, to solidify the Greater Toronto Area's leadership in advanced life science analytics, Innovation, Science and Economic Development Canada (ISED), made the announcement on March 7, 2025 that the Al Compute Access Fund will be launched to support SMEs with a grant of up to CA $ 300 Mn to gain access to a high-performance computing capacity.

Indegene, Lexalytics, Databricks, SAS Institute Inc., IQVIA, IBM, Sorcero, Inc., Axtria, Medidata, Sisense Ltd., Tempus AI, Inc., Oracle, Accenture, Parexel International (MA) Corporation, Microsoft, and others are some of the leading manufacturers operating in the global AI in Life Science Analytics Market.

Each of these companies has been profiled in the AI in life science analytics market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.6 Bn |

| Forecast Value in 2035 | More than US$ 4.9 Bn |

| CAGR | 10.9 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| AI in Life Science Analytics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

imperative to speed up drug discovery, make trials more efficient, and improve decision-making has put them in a position where they are the first to use advanced analytical tools extensively. Consequently, this segment is ahead of medical device manufacturers in terms of market leadership.

Their leadership is largely powered by a higher investment capacity and a very strong emphasis on digital transformation across R&D and commercial functions. Consequently, pharma and biotech companies remain the main drivers of AI implementation in the entire life sciences ecosystem.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The major part of the global Al in life science analytics market is held by North America, which is anticipated to be the most influential region during the forecast period with 47.2% market share. The regions dominance in the market can mainly be credited to the wide and deep applications of high-tech, mature healthcare, and pharmaceutical industries, as well as the hefty investments in the research and development pertaining to artificial intelligence. Specifically, the U.S. is responsible for the major part due to the widespread use of innovative gene delivery methods, large-scale financing for genomics and personalized medicine, and an increasing number of clinical trials for gene and cell therapies.

Moreover, a strong regulatory system and a series of beneficial government programs, along with quite a few collaborations between the academic world, the industry, and the public sector have made the continent a leader in this field for a long time already. In fact, the region is able to quickly innovate and broadly deploy Al-based analytics throughout the life sciences ecosystem due to the extensive data integration and computational analysis that are supported by a large number of cloud service providers and advanced digital infrastructure.

For instance, OTTAWA, to solidify the Greater Toronto Area's leadership in advanced life science analytics, Innovation, Science and Economic Development Canada (ISED), made the announcement on March 7, 2025 that the Al Compute Access Fund will be launched to support SMEs with a grant of up to CA $ 300 Mn to gain access to a high-performance computing capacity.

Indegene, Lexalytics, Databricks, SAS Institute Inc., IQVIA, IBM, Sorcero, Inc., Axtria, Medidata, Sisense Ltd., Tempus AI, Inc., Oracle, Accenture, Parexel International (MA) Corporation, Microsoft, and others are some of the leading manufacturers operating in the global AI in Life Science Analytics Market.

Each of these companies has been profiled in the AI in life science analytics market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.6 Bn |

| Forecast Value in 2035 | More than US$ 4.9 Bn |

| CAGR | 10.9 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| AI in Life Science Analytics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global AI in life science analytics market was valued at US$ 1.6 Bn in 2024

The global AI in life science analytics industry is projected to reach more than US$ 4.9 Bn by the end of 2035

Drug discovery and development and demand for treating complex diseases are some of the factors driving the expansion of AI in life science analytics market.

The CAGR is anticipated to be 10.9 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Indegene, Lexalytics, Databricks, SAS Institute Inc., IQVIA, IBM, Sorcero, Inc., Axtria, Medidata, Sisense Ltd., Tempus AI, Inc., Oracle, Accenture, Parexel International (MA) Corporation, Microsoft and other prominent players.

Table 01: Global AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 02: Global AI in Life Science Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 03: Global AI in Life Science Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global AI in Life Science Analytics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global AI in Life Science Analytics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 08: North America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 09: North America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 10: North America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: Europe AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 13: Europe AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 14: Europe AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15: Europe AI in Life Science Analytics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 18: Asia Pacific AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 19: Asia Pacific AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Asia Pacific AI in Life Science Analytics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 21: Latin America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 23: Latin America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 24: Latin America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25: Latin America AI in Life Science Analytics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 26: Middle East and Africa AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 28: Middle East and Africa AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 29: Middle East and Africa AI in Life Science Analytics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 30: Middle East and Africa AI in Life Science Analytics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global AI in Life Science Analytics Market Value Share Analysis, by Component, 2024 and 2035

Figure 02: Global AI in Life Science Analytics Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 03: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 04: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 05: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 06: Global AI in Life Science Analytics Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 07: Global AI in Life Science Analytics Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 08: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Cloud, 2020 to 2035

Figure 09: Global AI in Life Science Analytics Market Revenue (US$ Bn), by On Premise, 2020 to 2035

Figure 10: Global AI in Life Science Analytics Market Value Share Analysis, by Application, 2024 and 2035

Figure 11: Global AI in Life Science Analytics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 12: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Research and Development, 2020 to 2035

Figure 13: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Supply Chain Analytics, 2020 to 2035

Figure 14: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global AI in Life Science Analytics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 16: Global AI in Life Science Analytics Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 17: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Medical Devices Manufacturers, 2025 to 2035

Figure 18: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 19: Global AI in Life Science Analytics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global AI in Life Science Analytics Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global AI in Life Science Analytics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America AI in Life Science Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America AI in Life Science Analytics Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America AI in Life Science Analytics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America AI in Life Science Analytics Market Value Share Analysis, by Component, 2024 and 2035

Figure 26: North America AI in Life Science Analytics Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 27: North America AI in Life Science Analytics Value Share Analysis, by Deployment, 2025 to 2035

Figure 28: North America AI in Life Science Analytics Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 29: North America AI in Life Science Analytics Market Value Share Analysis, by Application, 2025 to 2035

Figure 30: North America AI in Life Science Analytics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 31: North America AI in Life Science Analytics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 32: North America AI in Life Science Analytics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 33: Europe AI in Life Science Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe AI in Life Science Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 35: Europe AI in Life Science Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 36: Europe AI in Life Science Analytics Market Value Share Analysis, by Component, 2024 and 2035

Figure 37: Europe AI in Life Science Analytics Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 38: Europe AI in Life Science Analytics Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 39: Europe AI in Life Science Analytics Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 40: Europe AI in Life Science Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: Europe AI in Life Science Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 42: Europe AI in Life Science Analytics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 43: Europe AI in Life Science Analytics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 44: Asia Pacific AI in Life Science Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific AI in Life Science Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Asia Pacific AI in Life Science Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Asia Pacific AI in Life Science Analytics Market Value Share Analysis, by Component, 2024 and 2035

Figure 48: Asia Pacific AI in Life Science Analytics Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 49: Asia Pacific AI in Life Science Analytics Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 50: Asia Pacific AI in Life Science Analytics Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 51: Asia Pacific AI in Life Science Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Asia Pacific AI in Life Science Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Asia Pacific AI in Life Science Analytics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 54: Asia Pacific AI in Life Science Analytics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 55: Latin America AI in Life Science Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Latin America AI in Life Science Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Latin America AI in Life Science Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 58: Latin America AI in Life Science Analytics Market Value Share Analysis, by Component, 2024 and 2035

Figure 59: Latin America AI in Life Science Analytics Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 60: Latin America AI in Life Science Analytics Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 61: Latin America AI in Life Science Analytics Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 62: Latin America AI in Life Science Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Latin America AI in Life Science Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Latin America AI in Life Science Analytics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 65: Latin America AI in Life Science Analytics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 66: Middle East and Africa AI in Life Science Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Middle East and Africa AI in Life Science Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 68: Middle East and Africa AI in Life Science Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 69: Middle East and Africa AI in Life Science Analytics Market Value Share Analysis, by Component, 2024 and 2035

Figure 70: Middle East and Africa AI in Life Science Analytics Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 71: Middle East and Africa AI in Life Science Analytics Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 72: Middle East and Africa AI in Life Science Analytics Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 73: Middle East and Africa AI in Life Science Analytics Market Value Share Analysis, by Application, 2024 and 2035

Figure 74: Middle East and Africa AI in Life Science Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: Middle East and Africa AI in Life Science Analytics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 76: Middle East and Africa AI in Life Science Analytics Market Attractiveness Analysis, by End-user, 2025 to 2035