Reports

Reports

Analysts’ Viewpoint on Agricultural Shredder Market Scenario

Shredding is one of the major activities in the agricultural industry. Increasing awareness regarding advanced technology in agricultural practices is a major factor driving the global agricultural shredder market. An agricultural shredder helps reduce manual labor and man-hours that can be used in other tasks. A shredder is ideal for disposing leaves and garden & agricultural waste such as thorns, small branches, flower stalks, and tree pruning. The ground waste mixed with grass, logs, and leaves creates a light compost that promotes soil improvement. Moreover, the best way to get rid of agricultural waste is to turn it into compost. This scientific method returns nutrients to the soil in a natural manner. Therefore, efforts must be focused on the efficient use of all waste. Shredding helps cut agricultural products into smaller components that can be used for other applications. Agricultural shredders or farm shredders can be both fixed and portable; fixed products are mostly used for small farming purposes, while portable shredders are generally used as attachments/implements of tractors and can cover more area. These are more efficient, which makes them a better choice for consumers.

A shredder is a two-axis cutting tool used to cut, roll, tear, and extrude materials. A shredder is also defined as a crushing machine used for crushing materials of different hardness for extrusion and bending. A shredder can shred and recycle waste sources such as waste rubber, plastics, and tires. Therefore, it is considered an ecological machine.

An agricultural shredder machine comprises a bearing structure, drive machine, cutting chamber, rotor, shredding chamber, and blades. Agricultural shredder machine blades and other components are attached to agro machinery, such as a tractor, or installed in a fixed manner for agriculture practices of cutting and shredding. Revenue of the agricultural shredder market is estimated to advance due to the increase in arable land across the globe.

Agriculture is a highly intensive industry in several parts of the world, producing various byproducts requiring different treatment technologies and management practices. Agricultural waste, which includes both organic and inorganic waste, is a general term used to describe the waste produced on a farm through various agricultural activities. This waste is projected to account for more than 30% of global agricultural productivity. Some of the agricultural waste is recycled into agricultural production as fertilizer, while a large amount of waste is unused and in numerous cases presents a disposal problem. Conventional agricultural waste includes garden waste; agricultural waste is landfilled to be decomposed in a specific place. Since waste is landfilled as such, it takes longer to degrade and causes environmental pollution. The design and development of agricultural waste shredder machines helps reduce agricultural waste and convert it into useful nutritious fertilizer.

Moreover, governments in several countries are emphasizing on implementation of new regulations that are estimated to help strengthen the shredder machinery market. Additionally, shredders usually do not produce waste, which is another advantage of this machine. Governments are taking initiatives to recycle waste produced in the agricultural industry for economic and environmental reasons. Agricultural shredders and cutters help reduce waste, and this increases the demand for agricultural shredders globally.

Agricultural automation, often associated with ‘smart farming’, is the technology that makes farms more efficient and automates the production cycle of crops and animals. A growing number of companies are working on robotic innovation, developing drones, autonomous tractors, harvesting robots, automated irrigation, and seeding robots. Although these technologies are fairly new, the industry is seeing more and more traditional farming companies incorporating farm automation into their processes. The main goal of agricultural automation technology is to cover simpler routine tasks. Emerging trends of the agricultural shredder machines market includes commonly used technologies such as automated harvesting (including shredders), autonomous tractors, seeding and weeding, and drones, besides tractor operated shredder machines.

Deere & Company is focusing on development of remote products that can reduce labor involvement and enhance the ability to check work progress more efficiently. The company has developed products applying robotics; its new product line is equipped with ActiveVision cameras that can help farmers look inside the combine's grain bin and observe the stubble to monitor the condition of the harvested grain down to the individual grain. Moreover, the company’s products combine proprietary artificial intelligence capabilities, computer vision, field machine-to-machine communication, and integrated sensors for connectivity and self-driving capabilities. These advanced technologies are expected to propel the demand for automatic agricultural shredders worldwide.

Increasing awareness about the importance of technology in agriculture practices is one of the major factors driving the agriculture shredder market globally. Use of farm equipment such as agricultural grass shredders, or agricultural compost shredders saves considerable time and manual labor, which in turn can be used for performing other tasks. Moreover, garden waste shredder manufacturers are getting government support, which is expected to modernize the agricultural sector and increase the demand for different types of shredders in the near future. Moreover, expansion of commercial and agricultural sectors in emerging countries is likely to create an opportunity for the agricultural shredder market during the forecast period.

Asia Pacific is expected to dominate the global agricultural shredder market during the forecast period owing to a growing agriculture sector in the region. Rapid growth of smart farming and modern technologies is a key trend boosting the prospects of the agricultural shredder market in the region. The market in Asia Pacific is followed by the market in North America. Europe has emerged as a highly lucrative market in recent years. Increasing investments in the agricultural sector across developing economies is also expected to have a significant impact on the agricultural shredder market.

The global agricultural shredder market is consolidated with a few large-scale vendors controlling majority share. Most of the firms are spending significantly on comprehensive research and development for fabrication of agriculture waste shredder machines. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. AGCO Corporation Bamford Excavators Limited, Alamo Group, Beri Udyog Private Limited, Bertolini, Bobcat Company, Changzhou Dongfeng Agricultural Machinery Group Co. Ltd., Daedong Industry Co. Ltd., Deere & Company, Iseki & Co., Ltd., Kubota Corporation, Landoll Company LLC, and Mahindra & Mahindra Limited are the prominent players operating in the market.

|

Attribute |

Detail |

|

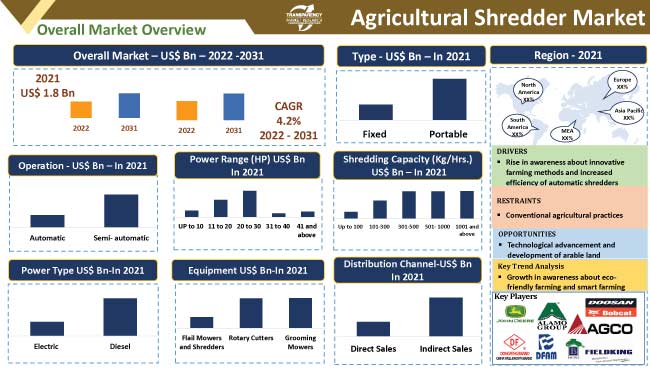

Market Size Value in 2021 |

US$ 1.8 Bn |

|

Market Forecast Value in 2031 |

US$ 2.8 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The agricultural shredder market stood at US$ 1.8 Bn in 2021.

The agricultural shredder market is estimated to expand at a CAGR of 4.2%.

Rise in awareness about innovative farming methods and increased efficiency of automatic shredders.

Portable type segment held largest share of the agricultural shredder market in 2021.

Asia Pacific is a more attractive region for vendors in the agricultural shredder market.

Agco Corporation, Bamford Excavators Limited, Alamo Group, Beri Udyog Private Limited, Bertolini, Bobcat Company, Changzhou Dongfeng Agricultural Machinery Group Co. Ltd., Daedong Industry Co. Ltd., Deere & Company, Iseki & Co., Ltd., Kubota Corporation, Landoll Company LLC, and Mahindra & Mahindra Limited.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Shredder Market

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. Covid-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technological Analysis

5.10. Global Agricultural Shredder Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Agricultural Shredder Market Analysis and Forecast, by Type

6.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Type, 2017 - 2031

6.1.1. Fixed

6.1.2. Portable

6.1.2.1. Self-driven

6.1.2.2. Attachments/Implements

6.2. Incremental Opportunity, by Type

7. Global Agricultural Shredder Market Analysis and Forecast, by Equipment

7.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Equipment, 2017 - 2031

7.1.1. Flail Mowers and Shredders

7.1.2. Rotary Cutters

7.1.3. Grooming Mowers

7.2. Incremental Opportunity, by Equipment

8. Global Agricultural Shredder Market Analysis and Forecast, by Operation

8.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Operation, 2017 - 2031

8.1.1. Automatic

8.1.2. Semi- automatic

8.2. Incremental Opportunity, by Operation

9. Global Agricultural Shredder Market Analysis and Forecast, by Power Type

9.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Type, 2017 - 2031

9.1.1. Electric

9.1.2. Diesel

9.2. Incremental Opportunity, by Power Type

10. Global Agricultural Shredder Market Analysis and Forecast, by Shredding Capacity (Kg/Hrs.)

10.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Shredding Capacity (Kg/Hrs.), 2017 - 2031

10.1.1. Up to 100

10.1.2. 101-300

10.1.3. 301-500

10.1.4. 501- 1000

10.1.5. 1001 and above

10.2. Incremental Opportunity, by Shredding Capacity (Kg/Hrs.)

11. Global Agricultural Shredder Market Analysis and Forecast, by Power Range

11.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Range, 2017 - 2031

11.1.1. Up to 10

11.1.2. 11 to 20

11.1.3. 20 to 30

11.1.4. 31 to 40

11.1.5. 41 and above

11.2. Incremental Opportunity, by Power Range

12. Global Agricultural Shredder Market Analysis and Forecast, by Distribution Channel

12.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

12.1.1. Direct

12.1.2. Indirect

12.2. Incremental Opportunity, by Distribution Channel

13. Global Agricultural Shredder Market Analysis and Forecast, by Region

13.1. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Region, 2017 - 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, by Region

14. North America Agricultural Shredder Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Type, 2017 - 2031

14.5.1. Fixed

14.5.2. Portable

14.5.2.1. Self-driven

14.5.2.2. Attachments/Implements

14.6. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Equipment, 2017 - 2031

14.6.1. Flail Mowers and Shredders

14.6.2. Rotary Cutters

14.6.3. Grooming Mowers

14.7. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Operation, 2017 - 2031

14.7.1. Automatic

14.7.2. Semi- automatic

14.8. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Type, 2017 - 2031

14.8.1. Electric

14.8.2. Diesel

14.9. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Shredding Capacity (Kg/Hrs.), 2017 - 2031

14.9.1. Up to 100

14.9.2. 101-300

14.9.3. 301-500

14.9.4. 501- 1000

14.9.5. 1001 and above

14.10. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Range, 2017 - 2031

14.10.1. UP to 10

14.10.2. 11 to 20

14.10.3. 20 to 30

14.10.4. 31 to 40

14.10.5. 41 and above

14.11. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

14.11.1. Direct

14.11.2. Indirect

14.12. Agricultural Shredder Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017 - 2031

14.12.1. U.S.

14.12.2. Canada

14.12.3. Rest of North America

14.13. Incremental Opportunity Analysis

15. Europe Agricultural Shredder Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Type, 2017 - 2031

15.5.1. Fixed

15.5.2. Portable

15.5.2.1. Self-Driven

15.5.2.2. Attachments/Implements

15.6. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Equipment, 2017 - 2031

15.6.1. Flail Mowers and Shredders

15.6.2. Rotary Cutters

15.6.3. Grooming Mowers

15.7. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Operation, 2017 - 2031

15.7.1. Automatic

15.7.2. Semi- automatic

15.8. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Type, 2017 - 2031

15.8.1. Electric

15.8.2. Diesel

15.9. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Shredding Capacity (Kg/Hrs.), 2017 - 2031

15.9.1. Up to 100

15.9.2. 101-300

15.9.3. 301-500

15.9.4. 501- 1000

15.9.5. 1001 and above

15.10. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Range, 2017 - 2031

15.10.1. UP to 10

15.10.2. 11 to 20

15.10.3. 20 to 30

15.10.4. 31 to 40

15.10.5. 41 and above

15.11. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

15.11.1. Direct

15.11.2. Indirect

15.12. Agricultural Shredder Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017 - 2031

15.12.1. U.K.

15.12.2. Germany

15.12.3. France

15.12.4. Rest of Europe

15.13. Incremental Opportunity Analysis

16. Asia Pacific Agricultural Shredder Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Brand Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Price

16.4. Key Trends Analysis

16.4.1. Demand Side Analysis

16.4.2. Supply Side Analysis

16.5. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Type, 2017 - 2031

16.5.1. Fixed

16.5.2. Portable

16.5.2.1. Self-driven

16.5.2.2. Attachments/Implements

16.6. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Equipment, 2017 - 2031

16.6.1. Flail Mowers and Shredders

16.6.2. Rotary Cutters

16.6.3. Grooming Mowers

16.7. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Operation, 2017 - 2031

16.7.1. Automatic

16.7.2. Semi- automatic

16.8. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Type, 2017 - 2031

16.8.1. Electric

16.8.2. Diesel

16.9. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Shredding Capacity (Kg/Hrs.), 2017 - 2031

16.9.1. Up to 100

16.9.2. 101-300

16.9.3. 301-500

16.9.4. 501- 1000

16.9.5. 1001 and above

16.10. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Range, 2017 - 2031

16.10.1. UP to 10

16.10.2. 11 to 20

16.10.3. 20 to 30

16.10.4. 31 to 40

16.10.5. 41 and above

16.11. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

16.11.1. Direct

16.11.2. Indirect

16.12. Agricultural Shredder Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017 - 2031

16.12.1. China

16.12.2. India

16.12.3. Japan

16.12.4. Rest of Asia Pacific

16.13. Incremental Opportunity Analysis

17. Middle East & Africa Agricultural Shredder Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Brand Analysis

17.3. Price Trend Analysis

17.3.1. Weighted Average Price

17.4. Key Trends Analysis

17.4.1. Demand Side Analysis

17.4.2. Supply Side Analysis

17.5. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Type, 2017 - 2031

17.5.1. Fixed

17.5.2. Portable

17.5.2.1. Self-driven

17.5.2.2. Attachments/Implements

17.6. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Equipment, 2017 - 2031

17.6.1. Flail Mowers and Shredders

17.6.2. Rotary Cutters

17.6.3. Grooming Mowers

17.7. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Operation, 2017 - 2031

17.7.1. Automatic

17.7.2. Semi- automatic

17.8. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Type, 2017 - 2031

17.8.1. Electric

17.8.2. Diesel

17.9. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Shredding Capacity (Kg/Hrs.), 2017 - 2031

17.9.1. Up to 100

17.9.2. 101-300

17.9.3. 301-500

17.9.4. 501- 1000

17.9.5. 1001 and above

17.10. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Range, 2017 - 2031

17.10.1. UP to 10

17.10.2. 11 to 20

17.10.3. 20 to 30

17.10.4. 31 to 40

17.10.5. 41 and above

17.11. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

17.11.1. Direct

17.11.2. Indirect

17.12. Agricultural Shredder Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017 - 2031

17.12.1. GCC

17.12.2. South Africa

17.12.3. Rest of Middle East & Africa

17.13. Incremental Opportunity Analysis

18. South America Agricultural Shredder Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Key Brand Analysis

18.3. Price Trend Analysis

18.3.1. Weighted Average Price

18.4. Key Trends Analysis

18.4.1. Demand Side Analysis

18.4.2. Supply Side Analysis

18.5. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Type, 2017 - 2031

18.5.1. Fixed

18.5.2. Portable

18.5.2.1. Self-driven

18.5.2.2. Attachments/Implements

18.6. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Equipment, 2017 - 2031

18.6.1. Flail Mowers and Shredders

18.6.2. Rotary Cutters

18.6.3. Grooming Mowers

18.7. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Operation, 2017 - 2031

18.7.1. Automatic

18.7.2. Semi- automatic

18.8. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Type, 2017 - 2031

18.8.1. Electric

18.8.2. Diesel

18.9. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Shredding Capacity (Kg/Hrs.), 2017 - 2031

18.9.1. Up to 100

18.9.2. 101-300

18.9.3. 301-500

18.9.4. 501- 1000

18.9.5. 1001 and above

18.10. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Power Range, 2017 - 2031

18.10.1. UP to 10

18.10.2. 11 to 20

18.10.3. 20 to 30

18.10.4. 31 to 40

18.10.5. 41 and above

18.11. Agricultural Shredder Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

18.11.1. Direct

18.11.2. Indirect

18.12. Agricultural Shredder Market Size (US$ Bn) (Bn Units), by Country & Sub-region, 2017 - 2031

18.12.1. Brazil

18.12.2. Rest of South America

18.13. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player – Competition Dashboard

19.2. Market Share Analysis % (2021)

19.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

19.3.1. AGCO Corporation Bamford Excavators Limited

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Revenue

19.3.1.4. Strategy & Business Overview

19.3.1.5. Go-To-Market Strategy

19.3.2. Alamo Group

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Revenue

19.3.2.4. Strategy & Business Overview

19.3.2.5. Go-To-Market Strategy

19.3.3. Beri Udyog Private Limited

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Revenue

19.3.3.4. Strategy & Business Overview

19.3.3.5. Go-To-Market Strategy

19.3.4. Bertolini

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Revenue

19.3.4.4. Strategy & Business Overview

19.3.4.5. Go-To-Market Strategy

19.3.5. Bobcat Company

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Revenue

19.3.5.4. Strategy & Business Overview

19.3.5.5. Go-To-Market Strategy

19.3.6. Changzhou Dongfeng Agricultural Machinery Group Co. Ltd.

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Revenue

19.3.6.4. Strategy & Business Overview

19.3.6.5. Go-To-Market Strategy

19.3.7. Daedong Industry Co. Ltd.

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Revenue

19.3.7.4. Strategy & Business Overview

19.3.7.5. Go-To-Market Strategy

19.3.8. Deere & Company

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Revenue

19.3.8.4. Strategy & Business Overview

19.3.8.5. Go-To-Market Strategy

19.3.9. Iseki & Co., Ltd.

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Revenue

19.3.9.4. Strategy & Business Overview

19.3.9.5. Go-To-Market Strategy

19.3.10. Kubota Corporation

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Revenue

19.3.10.4. Strategy & Business Overview

19.3.10.5. Go-To-Market Strategy

19.3.11. Landoll Company. LLC.

19.3.11.1. Company Overview

19.3.11.2. Sales Area/Geographical Presence

19.3.11.3. Revenue

19.3.11.4. Strategy & Business Overview

19.3.11.5. Go-To-Market Strategy

19.3.12. Mahindra & Mahindra Limited

19.3.12.1. Company Overview

19.3.12.2. Sales Area/Geographical Presence

19.3.12.3. Revenue

19.3.12.4. Strategy & Business Overview

19.3.12.5. Go-To-Market Strategy

19.3.13. Mondo Machine / Machinery World

19.3.13.1. Company Overview

19.3.13.2. Sales Area/Geographical Presence

19.3.13.3. Revenue

19.3.13.4. Strategy & Business Overview

19.3.13.5. Go-To-Market Strategy

20. Key Takeaways

20.1. Identification of Potential Market Spaces

20.1.1. Type

20.1.2. Operation

20.1.3. Power Type

20.1.4. Shredding Capacity (Kg/Hrs.)

20.1.5. Power Range (HP)

20.1.6. Distribution Channel

20.1.7. Region

20.2. Preferred Sales & Marketing Strategy

20.3. Prevailing Market Risks

List of Tables

Table 1: Global Agricultural Shredder Market Value (US$ Bn) Projection By Type 2017-2031

Table 2: Global Agricultural Shredder Market Volume (Thousand Units) Projection By Type 2017-2031

Table 3: Global Agricultural Shredder Market Value (US$ Bn) Projection By Operation 2017-2031

Table 4: Global Agricultural Shredder Market Volume (Thousand Units) Projection By Operation 2017-2031

Table 5: Global Agricultural Shredder Market Value (US$ Bn) Projection By Power Range (HP) 2017-2031

Table 6: Global Agricultural Shredder Market Volume (Thousand units) Projection By Power Range (HP) 2017-2031

Table 7: Global Agricultural Shredder Market Value (US$ Bn) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 8: Global Agricultural Shredder Market Volume (Thousand units) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 9: Global Agricultural Shredder Market Value (US$ Bn) Projection By Power Type 2017-2031

Table 10: Global Agricultural Shredder Market Volume (Thousand units) Projection By Power Type 2017-2031

Table 11: Global Agricultural Shredder Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 12: Global Agricultural Shredder Market Volume (Thousand units) Projection By Equipment 2017-2031

Table 13: Global Agricultural Shredder Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 14: Global Agricultural Shredder Market Volume (Thousand units) Projection By Distribution Channel 2017-2031

Table 15: Global Agricultural Shredder Market Value (US$ Bn) Projection By Region 2017-2031

Table 16: Global Agricultural Shredder Market Volume (Thousand units) Projection By Region 2017-2031

Table 17: North America Agricultural Shredder Market Value (US$ Bn) Projection By Type 2017-2031

Table 18: North America Agricultural Shredder Market Volume (Thousand units) Projection By Type 2017-2031

Table 19: North America Agricultural Shredder Market Value (US$ Bn) Projection By Operation 2017-2031

Table 20: North America Agricultural Shredder Market Volume (Thousand units) Projection By Operation 2017-2031

Table 21: North America Agricultural Shredder Market Value (US$ Bn) Projection By Power Range (HP) 2017-2031

Table 22: North America Agricultural Shredder Market Volume (Thousand units) Projection By Power Range (HP) 2017-2031

Table 23: North America Agricultural Shredder Market Value (US$ Bn) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 24: North America Agricultural Shredder Market Volume (Thousand units) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 25: North America Agricultural Shredder Market Value (US$ Bn) Projection By Power Type 2017-2031

Table 26: North America Agricultural Shredder Market Volume (Thousand units) Projection By Power Type 2017-2031

Table 27: North America Agricultural Shredder Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 28: North America Agricultural Shredder Market Volume (Thousand units) Projection By Equipment 2017-2031

Table 29: North America Agricultural Shredder Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 30: North America Agricultural Shredder Market Volume (Thousand units) Projection By Distribution Channel 2017-2031

Table 31: North America Agricultural Shredder Market Value (US$ Bn) Projection By Country 2017-2031

Table 32: North America Agricultural Shredder Market Volume (Thousand units) Projection By Country 2017-2031

Table 33: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Type 2017-2031

Table 34: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Type 2017-2031

Table 35: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Operation 2017-2031

Table 36: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Operation 2017-2031

Table 37: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Power Range (HP) 2017-2031

Table 38: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Power Range (HP) 2017-2031

Table 39: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 40: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 41: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Power Type 2017-2031

Table 42: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Power Type 2017-2031

Table 43: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 44: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Equipment 2017-2031

Table 45: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 46: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Distribution Channel 2017-2031

Table 47: Europe Agricultural Shredder Market Value (US$ Bn) Projection By Country 2017-2031

Table 48: Europe Agricultural Shredder Market Volume (Thousand units) Projection By Country 2017-2031

Table 49: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Type 2017-2031

Table 50: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Type 2017-2031

Table 51: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Operation 2017-2031

Table 52: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Operation 2017-2031

Table 53: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Power Range (HP) 2017-2031

Table 54: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Power Range (HP) 2017-2031

Table 55: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 56: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 57: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Power Type 2017-2031

Table 58: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Power Type 2017-2031

Table 59: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 60: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Equipment 2017-2031

Table 61: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 62: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Distribution Channel 2017-2031

Table 63: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection By Country 2017-2031

Table 64: Asia Pacific Agricultural Shredder Market Volume (Thousand units) Projection By Country 2017-2031

Table 65: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Type 2017-2031

Table 66: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Type 2017-2031

Table 67: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Operation 2017-2031

Table 68: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Operation 2017-2031

Table 69: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Power Range (HP) 2017-2031

Table 70: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Power Range (HP) 2017-2031

Table 71: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 72: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 73: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Power Type 2017-2031

Table 74: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Power Type 2017-2031

Table 75: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 76: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Equipment 2017-2031

Table 77: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 78: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Distribution Channel 2017-2031

Table 79: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection By Country 2017-2031

Table 80: Middle East & Africa Agricultural Shredder Market Volume (Thousand units) Projection By Country 2017-2031

Table 81: South America Agricultural Shredder Market Value (US$ Bn) Projection By Type 2017-2031

Table 82: South America Agricultural Shredder Market Volume (Thousand units) Projection By Type 2017-2031

Table 83: South America Agricultural Shredder Market Value (US$ Bn) Projection By Operation 2017-2031

Table 84: South America Agricultural Shredder Market Volume (Thousand units) Projection By Operation 2017-2031

Table 85: South America Agricultural Shredder Market Value (US$ Bn) Projection By Power Range (HP) 2017-2031

Table 86: South America Agricultural Shredder Market Volume (Thousand units) Projection By Power Range (HP) 2017-2031

Table 87: South America Agricultural Shredder Market Value (US$ Bn) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 88: South America Agricultural Shredder Market Volume (Thousand units) Projection By Shredding Capacity (Kg/Hrs.) 2017-2031

Table 89: South America Agricultural Shredder Market Value (US$ Bn) Projection By Power Type 2017-2031

Table 90: South America Agricultural Shredder Market Volume (Thousand units) Projection By Power Type 2017-2031

Table 91: South America Agricultural Shredder Market Value (US$ Bn) Projection By Equipment 2017-2031

Table 92: South America Agricultural Shredder Market Volume (Thousand units) Projection By Equipment 2017-2031

Table 93: South America Agricultural Shredder Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 94: South America Agricultural Shredder Market Volume (Thousand units) Projection By Distribution Channel 2017-2031

Table 95: South America Agricultural Shredder Market Value (US$ Bn) Projection By Country 2017-2031

Table 96: South America Agricultural Shredder Market Volume (Thousand units) Projection By Country 2017-2031

List of Figures

Figure 1: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 2: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 3: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Type 2022-2031

Figure 4: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Operation 2022-2031

Figure 5: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Operation 2022-2031

Figure 6: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Operation 2022-2031

Figure 7: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Power Range (HP) 2022-2031

Figure 8: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Range (HP) 2022-2031

Figure 9: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Range (HP) 2022-2031

Figure 10: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 11: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 12: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 13: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Power Type 2022-2031

Figure 14: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Type 2022-2031

Figure 15: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Type 2022-2031

Figure 16: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 17: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Equipment 2017-2031

Figure 18: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Equipment 2022-2031

Figure 19: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 20: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 21: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Distribution Channel 2022-2031

Figure 22: Global Agricultural Shredder Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 23: Global Agricultural Shredder Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 24: Global Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Region 2022-2031

Figure 25: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 26: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 27: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Type 2022-2031

Figure 28: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 29: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 30: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Operation 2022-2031

Figure 31: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Power Range (HP) 2017-2031

Figure 32: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Range (HP) 2017-2031

Figure 33: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Range (HP) 2022-2031

Figure 34: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Shredding Capacity (Kg/Hrs.) 2017-2031

Figure 35: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Shredding Capacity (Kg/Hrs.) 2017-2031

Figure 36: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 37: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Power Type 2017-2031

Figure 38: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Type 2017-2031

Figure 39: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Type 2022-2031

Figure 40: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 41: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Equipment 2017-2031

Figure 42: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Equipment 2022-2031

Figure 43: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 44: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 45: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Distribution Channel 2022-2031

Figure 46: North America Agricultural Shredder Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 47: North America Agricultural Shredder Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 48: North America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2022-2031

Figure 49: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 50: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 51: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Type 2022-2031

Figure 52: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 53: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 54: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Operation 2022-2031

Figure 55: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Power Range (HP) 2017-2031

Figure 56: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Range (HP) 2017-2031

Figure 57: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Range (HP) 2022-2031

Figure 58: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Shredding Capacity (Kg/Hrs.) 2017-2031

Figure 59: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Shredding Capacity (Kg/Hrs.) 2017-2031

Figure 60: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 61: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Power Type 2017-2031

Figure 62: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Type 2017-2031

Figure 63: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Type 2022-2031

Figure 64: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Equipment 2017-2031

Figure 65: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Equipment 2017-2031

Figure 66: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Equipment 2022-2031

Figure 67: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 68: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 69: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Distribution Channel 2022-2031

Figure 70: Europe Agricultural Shredder Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 71: Europe Agricultural Shredder Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 72: Europe Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2022-2031

Figure 73: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 74: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 75: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Type 2022-2031

Figure 76: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 77: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 78: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Operation 2022-2031

Figure 79: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Power Range (HP) 2017-2031

Figure 80: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Range (HP) 2017-2031

Figure 81: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Range (HP) 2022-2031

Figure 82: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Shredding Capacity (Kg/Hrs.) 2017-2031

Figure 83: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Shredding Capacity (Kg/Hrs.) 2017-2031

Figure 84: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 85: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Power Type 2022-2031

Figure 86: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Type 2022-2031

Figure 87: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Type 2022-2031

Figure 88: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Equipment 2022-2031

Figure 89: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Equipment 2022-2031

Figure 90: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Equipment 2022-2031

Figure 91: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Distribution Channel 2022-2031

Figure 92: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Distribution Channel 2022-2031

Figure 93: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Distribution Channel 2022-2031

Figure 94: Asia Pacific Agricultural Shredder Market Value (US$ Bn) Projection, By Country 2022-2031

Figure 95: Asia Pacific Agricultural Shredder Market Volume (Thousand Units) Projection, By Country 2022-2031

Figure 96: Asia Pacific Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2022-2031

Figure 97: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Type 2022-2031

Figure 98: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Type 2022-2031

Figure 99: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Type 2022-2031

Figure 100: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Operation 2022-2031

Figure 101: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Operation 2022-2031

Figure 102: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Operation 2022-2031

Figure 103: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Power Range (HP) 2022-2031

Figure 104: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Range (HP) 2022-2031

Figure 105: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Range (HP) 2022-2031

Figure 106: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 107: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 108: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 109: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Power Type 2022-2031

Figure 110: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Type 2022-2031

Figure 111: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Type 2022-2031

Figure 112: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Equipment 2022-2031

Figure 113: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Equipment 2022-2031

Figure 114: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Equipment 2022-2031

Figure 115: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Distribution Channel 2022-2031

Figure 116: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Distribution Channel 2022-2031

Figure 117: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Distribution Channel 2022-2031

Figure 118: Middle East & Africa Agricultural Shredder Market Value (US$ Bn) Projection, By Country 2022-2031

Figure 119: Middle East & Africa Agricultural Shredder Market Volume (Thousand Units) Projection, By Country 2022-2031

Figure 120: Middle East & Africa Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2022-2031

Figure 121: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Type 2022-2031

Figure 122: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Type 2022-2031

Figure 123: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Type 2022-2031

Figure 124: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Operation 2022-2031

Figure 125: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Operation 2022-2031

Figure 126: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Operation 2022-2031

Figure 127: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Power Range (HP) 2022-2031

Figure 128: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Range (HP) 2022-2031

Figure 129: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Range (HP) 2022-2031

Figure 130: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 131: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 132: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Shredding Capacity (Kg/Hrs.) 2022-2031

Figure 133: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Power Type 2022-2031

Figure 134: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Power Type 2022-2031

Figure 135: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Power Type 2022-2031

Figure 136: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Equipment 2022-2031

Figure 137: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Equipment 2022-2031

Figure 138: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Equipment 2022-2031

Figure 139: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Distribution Channel 2022-2031

Figure 140: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Distribution Channel 2022-2031

Figure 141: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Distribution Channel 2022-2031

Figure 142: South America Agricultural Shredder Market Value (US$ Bn) Projection, By Country 2022-2031

Figure 143: South America Agricultural Shredder Market Volume (Thousand Units) Projection, By Country 2022-2031

Figure 144: South America Agricultural Shredder Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2022-2031