Reports

Reports

Analyst Viewpoint

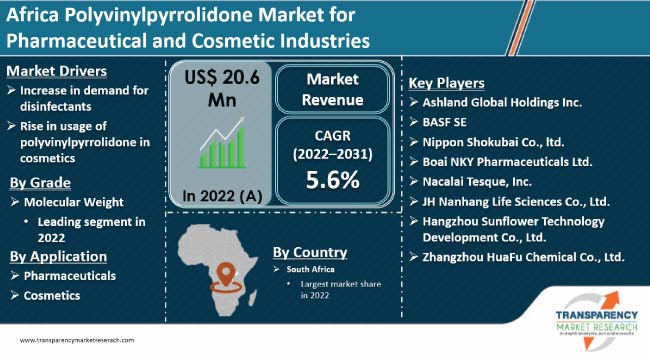

Increase in demand for disinfectants and rise in usage of polyvinylpyrrolidone in cosmetics are fueling the polyvinylpyrrolidone market for pharmaceutical and cosmetic industries size. Polyvinylpyrrolidone is gaining traction in cosmetics due to its exceptional film-forming properties. Rise in demand for sustainable and eco-friendly cosmetic products is driving the market trajectory in Africa.

The exceptional film-forming properties of polyvinylpyrrolidone increase its usage in cosmetics. Polyvinylpyrrolidone is compatible with various cosmetic ingredients. Vendors are forming distribution partnerships to strengthen their position in Africa. They are also acquiring other businesses to expand their expertise and strengthen their consumer business portfolio.

Polyvinylpyrrolidone (PVP) is widely used as an antiseptic and disinfectant in the pharmaceutical sector. It is employed as an antiseptic in pre- and post-operative skin cleansing, and prevention of infection in wounds and vaginal infections. Povidone iodine is used as a disinfectant in contact lenses, surgical instruments, endoscopes, catheters, and hand washes before surgery.

Incidences of Hospital Acquired Infections (HAIs) are increasing in developing countries, which is expected to spur the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries growth in the near future. Rise in the number of HAIs can be ascribed to the lack of sanitization and precautions. Utilization of disinfectants in hospitals reduces the risk of infections. Polyvinylpyrrolidone-based disinfectants are effective in these applications.

Surge in awareness about hygiene is boosting the demand for polyvinylpyrrolidone. Increase in geriatric population and growth in disposable income of the middle class are projected to augment the demand for antiseptics and disinfectants, thereby driving the Africa polyvinylpyrrolidone industry for pharmaceutical and cosmetic industries. Polyvinylpyrrolidone finds application in veterinary medicines as antiseptic surgical scrubs and solutions. This mild antiseptic is utilized for small and large animals.

One of the key drivers behind the increased adoption of PVP in cosmetics is its exceptional film-forming properties. PVP forms a transparent film when applied to the skin or hair, imparting a smooth and glossy texture. This unique characteristic makes it a preferred ingredient in cosmetic formulations such as hair styling products, where it enhances the hold and longevity of style while providing a natural look and feel.

PVP’s compatibility with a broad range of cosmetic ingredients contributes to its popularity in formulations such as mascaras, eyeliners, and brow gels. The polymer acts as a binder, aiding in the even distribution and adhesion of pigments and other components. This ensures that cosmetic products achieve the desired texture, color intensity, and wear resistance. PVP’s versatility extends to its role as a stabilizer in emulsion systems, contributing to the longevity and consistency of various cosmetic formulations. In products such as creams and lotions, PVP helps prevent phase separation and maintains the overall stability of the formulation, ensuring a smooth and homogeneous product.

Rise in demand for sustainable and eco-friendly cosmetic products is driving the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries landscape. As a water-soluble polymer, PVP offers an environmentally friendly alternative in comparison to some petroleum-derived ingredients. Manufacturers are increasingly incorporating PVP into formulations that align with the growing trend of green and sustainable beauty. Moreover, PVP’s water-solubility makes it easy to formulate with, allowing for the creation of cosmetic products that are easy to wash off, reducing the environmental impact associated with persistent cosmetic residues. Another significant factor contributing to the upsurge in PVP usage in cosmetics is its compatibility with a wide range of pH levels.

Cosmetic formulations often require stability across various pH conditions to ensure the product’s effectiveness and safety. PVP’s stability in both acidic and alkaline environments makes it an attractive choice for formulators working on diverse cosmetic products. This flexibility allows cosmetic manufacturers to create formulations that cater to different skin types and preferences without compromising the stability or performance of the end product. Increase in usage of PVP in cosmetics is driven by its exceptional film-forming properties, compatibility with various cosmetic ingredients, and adaptability to different pH levels. This, in turn, is fueling the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries revenue.

From enhancing the longevity of hairstyles to contributing to the stability of emulsion systems in skincare products, PVP’s versatility positions it as a valuable and multifunctional ingredient in the cosmetics sector. As consumer preferences evolve toward clean beauty and sustainability, PVP’s water-soluble nature further aligns with these trends, making it a sought-after polymer in the formulation of modern and eco-conscious cosmetic products.

According to the latest Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries trends, the low molecular weight grade segment held largest share in 2022. Low molecular weight PVP, characterized by shorter polymer chains, is positioned to dominate the market due to its versatile applications and advantageous properties. The pharmaceutical sector, in particular, stands to benefit significantly from the prevalence of low molecular weight PVP. Its lower viscosity and improved solubility make it an ideal excipient in pharmaceutical formulations, enhancing the ease of processing during manufacturing. This leads to increased formulation flexibility, allowing for efficient integration into tablets, capsules, and liquid formulations.

According to the latest Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries trends, the pharmaceuticals application segment held largest share in 2022. Growth of the segment can be ascribed to the unique properties of PVP, positioning it as a key ingredient in pharmaceutical formulations and fostering innovation in drug development. PVP, renowned for its exceptional binding and solubilizing properties, plays a crucial role in improving the bioavailability of various drugs.

PVP’s compatibility with a wide range of Active Pharmaceutical Ingredients (APIs) further solidifies its dominance in this segment, as it seamlessly integrates into various drug formulations, supporting the industry’s commitment to therapeutic advancements. Simultaneously, the cosmetic sector benefits from the dominance of the pharmaceutical segment in the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries.

According to the latest Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries analysis, South Africa held largest share in 2022. The dominance of South Africa is fueled by a combination of factors, ranging from a robust pharmaceutical sector to a growing cosmetics sector, positioning the country at the forefront of PVP applications in Africa.

The pharmaceutical sector plays a central role in propelling the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries dynamics of South Africa. The country boasts a well-established pharmaceutical sector characterized by research and development activities, fostering the demand for advanced excipients such as PVP. PVP’s versatile properties, including its role as a binder, solubilizer, and film-forming agent, align with the evolving needs of the pharmaceutical sector.

South Africa’s prowess in the cosmetic sector is further driving the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries statistics. The country’s cosmetics sector is experiencing a surge in demand for high-quality personal care products, aligning with global trends. PVP’s significance in cosmetic formulations, particularly in products, such as hair styling agents, skin creams, and sunscreens, places South Africa at the forefront of cosmetic innovation. The film-forming and stabilizing properties of PVP contribute to the development of aesthetically pleasing and functional cosmetic products.

The industry is highly consolidated, with a small number of large-scale vendors controlling majority of the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries share. Manufacturers are investing significantly in comprehensive research and development activities. Many players are collaborating strategically to accelerate product innovation and expand their business lines in regional and international markets.

Ashland Global Holdings., Inc., BASF SE, Nippon Shokubai Co., Ltd., Boai NKY Pharmaceuticals Ltd., Nacalai Tesque, Inc., JH Nanhang Life Sciences Co., Ltd., Hangzhou Sunflower Technology Development Co., Ltd., and Zhangzhou HuaFu Chemical Co., Ltd. are key entities operating in the market.

Each of these players has been profiled in the Africa polyvinylpyrrolidone market for pharmaceutical and cosmetic industries research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 20.6 Mn |

| Market Forecast Value in 2031 | US$ 33.6 Mn |

| Growth Rate (CAGR) | 5.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Tons | US$ Mn for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the Africa as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 20.6 Mn in 2022

It is projected to grow at a CAGR of 5.6% from 2023 to 2031

Increase in demand for disinfectants and rise in usage of polyvinylpyrrolidone in cosmetics

Low molecular weight was the largest grade segment in 2022

South Africa was the most lucrative country in 2022

Ashland Global Holdings., Inc., BASF SE, Nippon Shokubai Co., Ltd., Boai NKY Pharmaceuticals Ltd., Nacalai Tesque, Inc., JH Nanhang Life Sciences Co., Ltd., Hangzhou Sunflower Technology Development Co., Ltd., and Zhangzhou HuaFu Chemical Co., Ltd.

1. Executive Summary

1.1. Africa Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Analysis and Forecast, 2020-2031

2.6.1. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons)

2.6.2. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain

3.2. Impact on Demand– Pre & Post Crisis

4. Africa Production Output Analysis (Tons), 2022

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2020-2031

6.1. Price Trend Analysis by Grade

7. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Analysis and Forecast, by Grade, 2020–2031

7.1. Introduction and Definitions

7.2. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

7.2.1. Low Molecular Weight

7.2.1.1. K12

7.2.1.2. K17

7.2.2. Medium Molecular Weight

7.2.2.1. K25

7.2.2.2. K30

7.2.3. High Molecular Weight Polyurethane

7.2.3.1. K90

7.2.3.2. Others (including K60 and K120)

7.2.4. Crospovidone

7.2.5. Copovidone

7.2.6. Others

7.3. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Attractiveness, by Grade

8. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Analysis and Forecast, by Application, 2020–2031

8.1. Introduction and Definitions

8.2. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.2.1. Pharmaceuticals

8.2.1.1. Tablets

8.2.1.2. Liquid Suspension/Ointments

8.2.1.3. Injections

8.2.2. Cosmetics

8.2.2.1. Hair Fixative Polymers

8.2.2.2. Skin Care

8.2.2.3. Perfumes

8.2.2.4. Oral Care

8.3. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Attractiveness, by Application

9. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Analysis and Forecast, by Country, 2020–2031

9.1. Key Findings

9.2. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.2.1. Egypt

9.2.2. South Africa

9.2.3. Nigeria

9.2.4. Algeria

9.2.5. Morocco

9.2.6. Tunisia

9.2.7. Ethiopia

9.2.8. Rest of Africa

9.3. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Attractiveness, by Country

10. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.3. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

10.4.1. Egypt Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.2. Egypt Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.3. South Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.4. South Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.5. Nigeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.6. Nigeria. Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.7. Algeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.8. Algeria. Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.9. Morocco Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.10. Morocco Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.11. Tunisia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.12. Tunisia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.13. EthiopiaPolyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.14. Ethiopia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.15. Rest of Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.16. Rest of Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.5. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Attractiveness Analysis

11. Competition Landscape

11.1. Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Company Market Share Analysis, 2022

11.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.2.1. Ashland Global Holdings Inc.

11.2.1.1. Company Revenue

11.2.1.2. Business Overview

11.2.1.3. Product Segments

11.2.1.4. Geographic Footprint

11.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.2. BASF SE

11.2.2.1. Company Revenue

11.2.2.2. Business Overview

11.2.2.3. Product Segments

11.2.2.4. Geographic Footprint

11.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.3. Nippon Shokubai Co., Ltd.

11.2.3.1. Company Revenue

11.2.3.2. Business Overview

11.2.3.3. Product Segments

11.2.3.4. Geographic Footprint

11.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.4. Boai NKY Pharmaceuticals Ltd.

11.2.4.1. Company Revenue

11.2.4.2. Business Overview

11.2.4.3. Product Segments

11.2.4.4. Geographic Footprint

11.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.5. Nacalai Tesque, Inc.

11.2.5.1. Company Revenue

11.2.5.2. Business Overview

11.2.5.3. Product Segments

11.2.5.4. Geographic Footprint

11.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.6. JH Nanhang Life Sciences Co., Ltd.

11.2.6.1. Company Revenue

11.2.6.2. Business Overview

11.2.6.3. Product Segments

11.2.6.4. Geographic Footprint

11.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.7. Hangzhou Sunflower Technology Development Co., Ltd.

11.2.7.1. Company Revenue

11.2.7.2. Business Overview

11.2.7.3. Product Segments

11.2.7.4. Geographic Footprint

11.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.8. Zhangzhou HuaFu Chemical Co., Ltd.

11.2.8.1. Company Revenue

11.2.8.2. Business Overview

11.2.8.3. Product Segments

11.2.8.4. Geographic Footprint

11.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

11.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11.2.9. Others

11.2.9.1. Company Revenue

11.2.9.2. Business Overview

11.2.9.3. Product Segments

11.2.9.4. Geographic Footprint

11.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 2: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 3: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 4: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Region, 2020–2031

Table 6: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 8: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 9: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 10: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Country, 2020–2031

Table 12: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: Egypt Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 14: Egypt Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 15: Egypt Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 16: Egypt Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: South Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 18: South Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 19: South Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 20: South Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application 2020–2031

Table 27: Nigeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 28: Nigeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 29: Nigeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 30: Nigeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application 2020–2031

Table 31: Algeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 32: Algeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 33: Algeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 34: Algeria Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application 2020–2031

Table 35: Morocco Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 36: Morocco Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 37: Morocco Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 38: Morocco Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application 2020–2031

Table 39: Tunisia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 40: Tunisia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 41: Tunisia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 42: Tunisia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application 2020–2031

Table 47: Ethiopia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 48: Ethiopia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 49: Ethiopia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 50: Ethiopia Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application 2020–2031

Table 51: Rest of Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Grade, 2020–2031

Table 52: Rest of Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 53: Rest of Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume (Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 2: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Attractiveness, by Grade

Figure 3: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Attractiveness, by Application

Figure 5: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 6: Africa Polyvinylpyrrolidone Market for Pharmaceutical and Cosmetic Industries Attractiveness, by Country