Reports

Reports

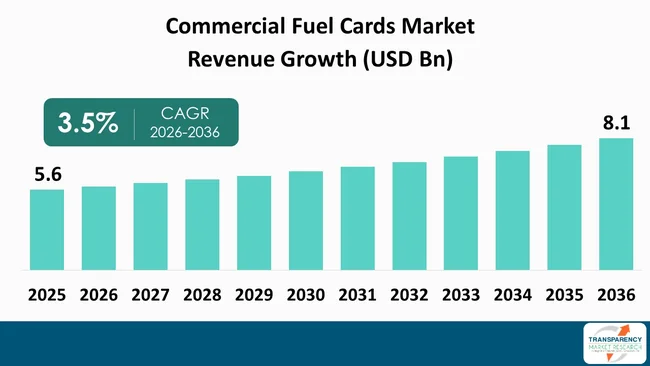

Canada commercial fuel cards market size was valued at US$ 5.6 Bn in 2025 and is projected to reach US$ 8.1 Bn by 2036, expanding at a CAGR of 3.5% from 2026 to 2036. The market growth is driven by the growth in transportation and logistics activities and demand for enhanced fleet tracking and visibility.

The Canadian market for commercial fuel cards functions as a complete system consisting of dedicated payment systems and expense management tools that assist businesses operating commercial vehicle fleets throughout Canada. The market serves various end-user groups that include logistics companies transportation firms, construction companies, utility providers, government organizations, rental car businesses, and small to medium-sized businesses that operate commercial vehicles.

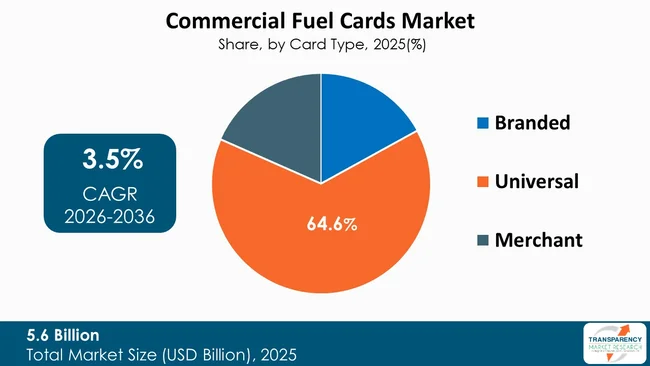

Fuel card solutions are designed for accommodating different fleet sizes, fuel types, and operational needs including fleets that operate between Canada and the United States. Organizations can utilize these solutions for centralized billing, transaction tracking, spending management, and reporting functions that enable better financial control and operational efficiency. The market contains universal fuel cards that control about 64.6% of total market share due to provision of fuel access to drivers at various fueling stations and fuel stations that operate multiple fuel brands.

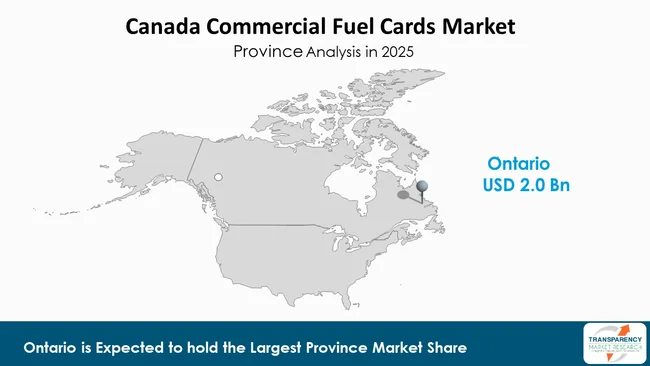

Ontario serves as the leading province in Canada for commercial fuel card usage with its market share of 35.3% due to its strong economic foundation, extensive transportation network, and high levels of commercial fleet activity. The market enables Canadian businesses to run their fleets efficiently while maintaining transparent costs and making decisions based on data throughout the commercial transportation and mobility systems in Canada.

The commercial fuel cards market refers to the structured ecosystem of payment solutions designed specifically for businesses to manage, monitor, and optimize fuel-related expenses across commercial vehicle fleets operating within Canada. The fuel cards serve as cashless payment tools that fuel retailers, financial institutions, and fleet service providers to enable companies to acquire fuel and vehicle services from authorized fueling stations across the country.

The market serves a wide range of end-users that include logistics and transportation companies, construction firms, utilities, government agencies, rental car operators, and small- and medium-sized enterprises that operate commercial vehicles.

The market offers products that meet the needs of various fleet sizes, different types of fuels, and requirements for cross-border operations for fleets that travel between Canada and the United States. The market helps commercial vehicle operators achieve better financial management and operational efficiency as rising fuel prices, stronger cost control measures, and greater use of digital fleet management tools demand better cost management.

Fuel card solutions see increased adoption as businesses must fulfill regulatory requirements that involve fuel tax reporting, emissions tracking, and compliance documentation. Canada commercial fuel cards market functions as an essential component that enables businesses to operate their fleets efficiently while maintaining financial control and making decisions based on data throughout the commercial transportation and mobility sectors in Canada.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing freight movement and vehicle operations expansion in Canada’s transportation and logistics operations results in higher demand for commercial fuel cards, which enables fleet operators to manage their fuel costs through efficient fuel purchasing processes. The 2024 annual report from Transport Canada reveals that Canada’s transportation and warehousing operations generated approximately US$ 96.5 Bn in economic value during 2024, which represented 4.3 % of national GDP while creating nearly one million employment opportunities.

The substantial contribution from the trucking industry includes both - interprovincial freight movement and border delivery operations together with their extensive logistics networks that include warehousing facilities, distribution points, and local delivery operations.

Government statistics from Statistics Canada show that Canadian rail freight operations moved 377.1 million tons of goods in 2024. The freight volumes increased slightly when compared to the previous year, which showed strong cargo movement through key transportation routes. Rail freight operations do not utilize road fuel directly but they create a transportation requirement for trucks and local delivery vehicles that need to recharge their fuel tanks. The government data presents evidence of a transportation system that operated at high capacity during the entire year of 2024, which resulted in multiple fueling stations distributed throughout various regions.

Businesses that experience fleet expansions and increased fuel expenses can benefit from commercial fuel cards, which provide businesses with centralized payment methods, instant tracking capabilities, expenditure limitations, and unified billing to enhance their ability to monitor expenses and track their entire logistics operations.

Canada commercial fuel cards market has been driven by the need for better fleet tracking systems as commercial fleets continue to expand while their operations become increasingly difficult to control. Statistics Canada reported that Canada had 26.8 million registered road motor vehicles during 2024, which showed an ongoing growth of the national vehicle fleet that included many commercial and fleet-operated vehicles. The total vehicle registration numbers increased by the same rate as medium and heavy-duty vehicle registrations made up a significant portion of commercial trucks and transport vehicles.

The increasing number of vehicles forces companies to face greater difficulties in tracking their fuel consumption and vehicle operation and driver performance throughout their widely distributed fleets. Companies need digital solutions that provide centralized visibility as their manual tracking systems become less accurate when their fleets grow larger. Operators use enhanced fleet tracking to watch vehicle refueling moments and locations and to link fuel consumption data with their specific vehicles or drivers while they detect unusual fuel usage patterns which show either inefficiencies or misuse.

Real-time transaction data generated through commercial fuel cards enables fleet management systems to create data-driven decision-making processes that operate at their full potential. The organization achieves cost management through expanded operational transparency that delivers exact vehicle operation records together with mileage data and fuel consumption information that organizations require to conduct auditing and internal management procedures.

Fleet managers face growing challenges because their organizations need to develop improved routing solutions which will reduce vehicle downtime while using operational data resources to enhance their fleet performance. Organizations need commercial fuel card systems because they require fleet visibility which these systems provide through their dual function as payment methods and vital data sources for modern fleet management systems.

Universal fuel cards lead Canada commercial fuel cards market, accounting for approximately 64.6 % of total market share due to their broad acceptance, operational flexibility, and suitability for diverse fleet requirements.

Universal cards enable fleets to optimize routes on the basis of operational efficiency in place of fuel station availability, reducing detours, downtime, and unnecessary fuel consumption. The universal cards maintain their leading position as they work with all types of vehicle fleets that operate through multiple business models. Multiple fuel retailers provide large logistics companies, mixed-use fleets, and third-party transport operators with consolidated billing, which enables them to manage expenses more easily while maintaining better cash-flow forecasting.

Universal fuel cards establish operational links with fleet management systems and telematics systems and accounting systems, which permit fuel stations to generate complete reporting and analytical data. The system provides better insight into fuel usage patterns while it detects operational waste and unauthorized fuel consumption.

The ability to bundle ancillary services such as vehicle maintenance tolls and parking under a single payment platform further enhances their value proposition. Canadian fleet operators select universal fuel cards as their preferred solution as these cards deliver wider coverage and greater operational efficiency and unrestricted usage capabilities in comparison with branded or merchant-specific cards.

| Attribute | Detail |

|---|---|

| Leading Province |

|

Ontario controls 35.3% of Canada commercial fuel cards market as its economic power, dense transportation systems, and high commercial fleet operations make it their leading market. The most populated province in Canada and its primary economic center, Ontario, operates a large number of freight operations and service vehicles and corporate fleets that need structured solutions for managing their fuel expenses.

The province functions as an essential transportation route that connects central Canada to the United States. It enables ongoing cross-border and interprovincial trucking operations that result in higher fuel usage and more frequent business transactions.

Ontario maintains its position as the leading province in Canada as it maintains extensive operations for warehousing, manufacturing, retail distribution, and last-mile delivery services throughout the Greater Toronto Area, Hamilton, Peel, and York regions.

Its advanced financial and digital infrastructure enables businesses to connect fuel cards with their accounting systems, ERP systems, and fleet management software. Ontario's economic strength, its extensive logistics operations, its high concentration of commercial fleets, and its developed business infrastructure combine to establish the province as the primary market in Canada.

The Canadian commercial fuel card market is bound to experience substantial expansion as businesses are starting to use alternative fuel sources and electric vehicle charging stations. Fleet operators require integrated systems that provide payment solutions and energy management tools to manage multiple fuel types used in their operations. Commercial fuel card providers can develop into all-encompassing mobility payment systems as they enable customers to pay for electric vehicle charging biofuels and alternative energy sources together with traditional fuel purchases.

The complexity of EV charging cost management increases when businesses install EVs in their fleets to achieve sustainability goals while minimizing future operational expenses. Fuel card programs that enable EV charging payment integration work as tools for fleet managers who want to monitor energy use while distributing costs per driver and vehicle for their energy use.

The expansion of this program improves customer loyalty through its development of fuel card programs, which will meet future requirements of changing fleet management methods. The market needs hybrid solution providers who can supply their service to both - combustion engine and electric fleet operations during the period of transition between these two technologies.

The development of alternative fuel and electrification solutions enables commercial fuel cards to function as permanent fleet energy management systems, which create multiple revenue sources while maintaining their importance in Canadian transportation and sustainability developments.

AtoB, BVD Group, Canadian Tire, Coast, Corpay, Inc., Fillip Fleet Inc., Gulf, Imperial Oil through its Esso and Mobil fuel card programs powered by WEX Inc., Motive Technologies, Inc., Parkland Fuel Corporation, Pilot Travel Centers LLC, RoadFlex, Shell International B.V., Suncor Energy Inc. (Petro-Canada brand) are some of the leading companies operating in Canada commercial fuel cards market.

Each of these companies has been profiled in Canada commercial fuel cards market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 5.6 Bn |

| Market Forecast Value in 2036 | US$ 8.1 Bn |

| Growth Rate (CAGR 2026 to 2036) | 3.5% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Card Type

|

| Province Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

Canada commercial fuel cards market was valued at US$ 5.6 Bn in 2025

Canada commercial fuel cards industry is projected to reach at US$ 8.1 Bn by the end of 2036

Growth in transportation & logistics activities and demand for enhanced fleet tracking and visibility are some of the driving factors for this market

The CAGR is anticipated to be 3.5% from 2026 to 2036

AtoB, BVD Group, Canadian Tire, Coast, Corpay, Inc., Fillip Fleet Inc., Gulf, Imperial Oil through its Esso and Mobil fuel card programs powered by WEX Inc., Motive Technologies, Inc., Parkland Fuel Corporation, Pilot Travel Centers LLC, RoadFlex, Shell International B.V., Suncor Energy Inc. (Petro-Canada brand), and the other key players

Table 01: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Table 02: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Card Type 2021 to 2036

Table 03: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Table 04: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Table 05: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Table 06: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Vehicle Type 2021 to 2036

Table 07: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 08: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 09: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Province 2021 to 2036

Table 10: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Province 2021 to 2036

Figure 01: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Figure 02: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Card Type 2021 to 2036

Figure 03: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Card Type 2026 to 2036

Figure 04: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Figure 05: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Figure 06: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Category 2026 to 2036

Figure 07: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Figure 08: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Vehicle Type 2021 to 2036

Figure 09: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Vehicle Type 2026 to 2036

Figure 10: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 11: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 12: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 13: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Province 2021 to 2036

Figure 14: Canada Commercial Fuel Cards Market Volume (Thousand Units) Projection, By Province 2021 to 2036

Figure 15: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Province 2026 to 2036