Reports

Reports

Analysts’ Viewpoint on Fuel Card Market Scenario

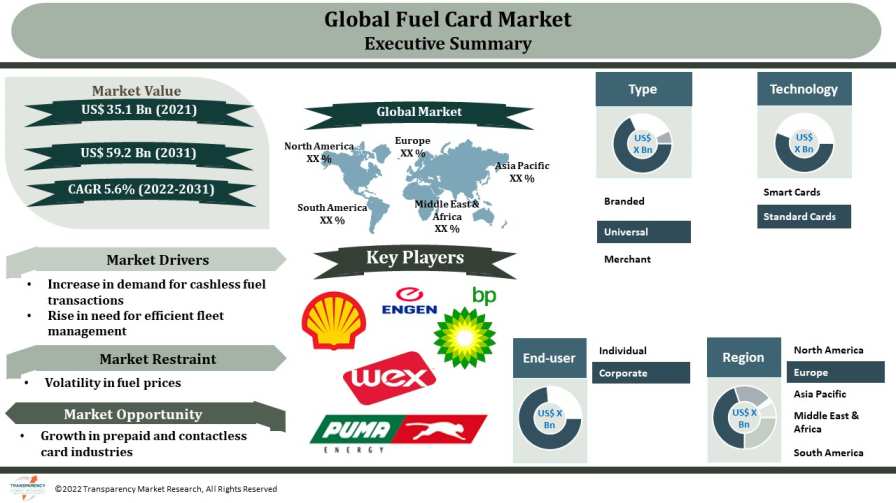

Increase in demand for cashless fuel transactions and widespread adoption of new technologies are driving the global fuel card market.

Rise in adoption of contactless and prepaid cards; and advancements in fuel card services are projected to offer lucrative opportunities to the global market during the forecast period. Fuel cards are convenient to use and offer various benefits to consumers. Smart cards let consumers and fleet owners make quick payments without the hassle of paying in cash.

Key players operating in the global fuel card market are focusing on R&D in advanced technologies such as telematics interfaces, mobile applications, tokenization, and cardholder verification methods to enhance their market share. They are also emphasizing on re-examining payment and system processes according to changing customer preferences.

Fuel card, also known as fleet card, is a mode of cashless payment commonly used for gasoline, diesel, and other fuels at gas stations. Fuel cards and fleet management are gaining traction among customers and fleet owners, as they offer significant cost savings and boost fleet management.

Fuel card companies are simplifying the work of fleet owners by offering them reward points, merchant fuel cards, discounts, and other lucrative incentives. The number of cars has increased as a result of ride-hailing and sharing apps. This trend has placed an added responsibility on owners to manage their fleets cost-effectively.

Contactless and prepaid technologies are comparatively new. According to a study, Canada, Sweden, the U.K., France, and the U.S. are the top five cashless economies in the world. Rapid urbanization and industrialization in developing countries such as China, India, Mexico, South Africa, and Brazil is offering promising opportunities for players in the market. According to SABRIC (The South African Banking Risk Information Center), contactless payment cards are a very secure option akin to traditional cards.

Adoption of fleet management software is rising in transportation and logistics sectors. Key players are making efforts to elevate the personalized experience of customers using analytics. They are adopting the omnichannel experience approach to make customer experience more seamless. This approach is complemented with online channels to make customer acquisition easier, time saving, and cost efficient.

Players in the fuel card market are developing mobile applications to enhance customer service. These apps help customers locate the nearest fuel station.

Volatility in fuel prices is likely to be one of the major restraints of the market. It is difficult to plan and budget fuel expenses, as fuel prices continue to fluctuate. Fuel prices vary between countries. These issues are likely to adversely impact the growth of the market. Measures such as switching to more fuel-efficient vehicles, eliminating idle time, reducing fleet size, and timely maintenance can help decrease fuel consumption. However, managing the budget considering the volatility in fuel prices remains a serious challenge.

In terms of type, the global fuel card market has been segmented into branded, universal, and merchant. The universal segment dominated the market in 2021. The segment is expected to maintain its dominance during the forecast period. Universal fuel cards provide optimized fuel data management service with broad station access. The cards are used exclusively for fuel payments. Universal cards cost lower than other cards.

Merchant and branded segments are also expected to grow significantly during the forecast period. Merchant cards are the best fuel cards for small businesses. Various fuel companies such as Shell, BP, and ExxonMobil offer branded fuel cards. These companies are gradually opting for third-party cards to increase their customer base.

Based on technology, the global fuel card market has been classified into smart cards and standard cards. The standard cards segment held the largest share of 83% of the global fuel card market in 2021. Standard fuel cards offer various benefits such as discounts on fuel expenditure and utility bills.

The smart cards segment is also expected to grow significantly during the forecast period. Demand for smart cards is increasing consistently due to the rise in preference for hassle-free payments among customers. Companies are also providing various value-added services in smart cards.

Europe accounted for the prominent share of the global fuel card market in 2021. Companies in the region are adopting advanced features that benefit consumers. Expansion of the corporate sector coupled with the large number of fleet management companies across Europe is augmenting the corporate end-user segment in the region.

The market in Asia Pacific is driven by the rise in adoption of prepaid and contactless technologies in the region. India and China are the fastest-growing economies, where demand for fuel cards is expected to surge in the next few years.

The global fuel card market is consolidated, with large presence of global players. Market players are offering the best fuel cards to enhance their market share. Strategies followed by key players in the market include business expansion through mergers and acquisitions, product launches, collaborations, and alliances. Shell Group, BP plc., Total Fuel Card, WEX Inc., Caltex, Puma Energy, Engen Petroleum Ltd, Absa Bank Limited, Standard Bank, and First National Bank (FNB) are prominent entities operating in this market.

Each of these players has been profiled in the global fuel card market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 35.1 Bn |

|

Market Forecast Value in 2031 |

US$ 59.2 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, ecosystem analysis, and price trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 35.1 Bn in 2021

The market is estimated to grow at a CAGR of 5.6% during 2022-2031

Increase in demand for cashless fuel transactions and rise in need for efficient fleet management

The universal segment accounted for maximum share of the market in 2021

Europe held the largest share of the global fuel card market in 2021

Shell Group, BP plc., Total Fuel Card, WEX Inc., Caltex, Puma Energy, Engen Petroleum Ltd., Absa Bank Limited, Standard Bank, and First National Bank (FNB)

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Supply Side

5.2.2. Demand Side

5.3. Key Market Indicators

5.3.1. Advanced and Connected Fleets Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Ecosystem Analysis

5.6. Industry SWOT Analysis

5.7. Covid-19 Impact Analysis

5.8. Technological Overview

5.9. Global Fuel Card Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Million Units)

6. Global Fuel Card Market Analysis and Forecast, by Type

6.1. Fuel Card Market (US$ Mn and Million Units), by Type, 2017 - 2031

6.1.1. Branded

6.1.2. Universal

6.1.3. Merchant

6.2. Incremental Opportunity, by Type

7. Global Fuel Card Market Analysis and Forecast, by Technology

7.1. Fuel Card Market (US$ Mn and Million Units), by Technology, 2017 - 2031

7.1.1. Smart Cards

7.1.2. Standard Cards

7.2. Incremental Opportunity, by Technology

8. Global Fuel Card Market Analysis and Forecast, by End-User

8.1. Fuel Card Market (US$ Mn and Million Units), by End-User, 2017 - 2031

8.1.1. Individual

8.1.2. Corporate

8.2. Incremental Opportunity, by End-user

9. Global Fuel Card Market Analysis and Forecast, by Region

9.1. Fuel Card Market (US$ Mn and Million Units), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Fuel Card Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Key Trend Analysis

10.4. Price Trend Analysis

10.4.1. Weighted Average Selling Price (US$)

10.5. Fuel Card Market (US$ Mn and Million Units), by Type, 2017 - 2031

10.5.1. Branded

10.5.2. Universal

10.5.3. Merchant

10.6. Fuel Card Market (US$ Mn and Million Units), by Technology, 2017 - 2031

10.6.1. Smart Cards

10.6.2. Standard Cards

10.7. Fuel Card Market (US$ Mn and Million Units), by End-user, 2017 - 2031

10.7.1. Individual

10.7.2. Corporate

10.8. Fuel Card Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

10.8.1. U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Fuel Card Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trend Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Fuel Card Market (US$ Mn and Million Units), by Type, 2017 - 2031

11.5.1. Branded

11.5.2. Universal

11.5.3. Merchant

11.6. Fuel Card Market (US$ Mn and Million Units), by Technology, 2017 - 2031

11.6.1. Smart Cards

11.6.2. Standard Cards

11.7. Fuel Card Market (US$ Mn and Million Units), by End-user, 2017 - 2031

11.7.1. Individual

11.7.2. Corporate

11.8. Fuel Card Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

11.8.1. U.K.

11.8.2. Germany

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Fuel Card Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trend Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Fuel Card Market (US$ Mn and Million Units), by Type, 2017 - 2031

12.5.1. Branded

12.5.2. Universal

12.5.3. Merchant

12.6. Fuel Card Market (US$ Mn and Million Units), by Technology, 2017 - 2031

12.6.1. Smart Cards

12.6.2. Standard Cards

12.7. Fuel Card Market (US$ Mn and Million Units), by End-user, 2017 - 2031

12.7.1. Individual

12.7.2. Corporate

12.8. Fuel Card Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Fuel Card Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trend Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Fuel Card Market (US$ Mn and Million Units), by Type, 2017 - 2031

13.5.1. Branded

13.5.2. Universal

13.5.3. Merchant

13.6. Fuel Card Market (US$ Mn and Million Units), by Technology, 2017 - 2031

13.6.1. Smart Cards

13.6.2. Standard Cards

13.7. Fuel Card Market (US$ Mn and Million Units), by End-user, 2017 - 2031

13.7.1. Individual

13.7.2. Corporate

13.8. Fuel Card Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Fuel Card Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trend Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Fuel Card Market (US$ Mn and Million Units), by Type, 2017 - 2031

14.5.1. Branded

14.5.2. Universal

14.5.3. Merchant

14.6. Fuel Card Market (US$ Mn and Million Units), by Technology, 2017 - 2031

14.6.1. Smart Cards

14.6.2. Standard Cards

14.7. Fuel Card Market (US$ Mn and Million Units), by End-user, 2017 - 2031

14.7.1. Individual

14.7.2. Corporate

14.8. Fuel Card Market (US$ Mn and Million Units) Forecast, By Country & Sub-region, 2017 - 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Revenue Share Analysis (%), (2021)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Absa Bank Limited

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. BP plc.

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. Caltex

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. Engen Petroleum Ltd

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. First National Bank (FNB)

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Puma Energy

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Shell Group

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. Standard Bank

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. Total Fuel Card

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. WEX Inc.

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Type

16.1.2. By Technology

16.1.3. By End-user

16.1.4. By Region

16.2. Prevailing Market Risks

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Table 2: Global Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Table 3: Global Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Table 4: Global Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Table 5: Global Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Table 6: Global Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Table 7: Global Fuel Card Market Volume (Million Units), by Region, 2017 - 2031

Table 8: Global Fuel Card Market Value (US$ Mn), by Region, 2017 - 2031

Table 9: North America Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Table 10: North America Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Table 11: North America Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Table 12: North America Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Table 13: North America Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Table 14: North America Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Table 15: North America Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Table 16: North America Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Table 17: Europe Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Table 18: Europe Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Table 19: Europe Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Table 20: Europe Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Table 21: Europe Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Table 22: Europe Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Table 23: Europe Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Table 24: Europe Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Table 25: Asia Pacific Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Table 26: Asia Pacific Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Table 27: Asia Pacific Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Table 28: Asia Pacific Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Table 29: Asia Pacific Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Table 30: Asia Pacific Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Table 31: Asia Pacific Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Table 32: Asia Pacific Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Table 33: Middle East & Africa Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Table 34: Middle East & Africa Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Table 35: Middle East & Africa Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Table 36: Middle East & Africa Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Table 37: Middle East & Africa Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Table 38: Middle East & Africa Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Table 39: Middle East & Africa Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Table 40: Middle East & Africa Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Table 41: South America Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Table 42: South America Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Table 43: South America Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Table 44: South America Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Table 45: South America Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Table 46: South America Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Table 47: South America Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Table 48: South America Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

List of Figures

Figure 1: Global Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Figure 2: Global Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Figure 3: Global Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2022 - 2031

Figure 4: Global Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Figure 5: Global Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Figure 6: Global Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2022 - 2031

Figure 7: Global Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Figure 8: Global Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Figure 9: Global Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2022 - 2031

Figure 10: Global Fuel Card Market Volume (Million Units), by Region, 2017 - 2031

Figure 11: Global Fuel Card Market Value (US$ Mn), by Region, 2017 - 2031

Figure 12: Global Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2022 - 2031

Figure 13: North America Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Figure 14: North America Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Figure 15: North America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2022 - 2031

Figure 16: North America Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Figure 17: North America Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Figure 18: North America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2022 - 2031

Figure 19: North America Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Figure 20: North America Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Figure 21: North America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2022 - 2031

Figure 22: North America Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Figure 23: North America Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Figure 24: North America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 25: Europe Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Figure 26: Europe Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Figure 27: Europe Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2022 - 2031

Figure 28: Europe Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Figure 29: Europe Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Figure 30: Europe Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2022 - 2031

Figure 31: Europe Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Figure 32: Europe Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Figure 33: Europe Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2022 - 2031

Figure 34: Europe Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Figure 35: Europe Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Figure 36: Europe Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 37: Asia Pacific Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Figure 38: Asia Pacific Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Figure 39: Asia Pacific Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2022 - 2031

Figure 40: Asia Pacific Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Figure 41: Asia Pacific Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Figure 42: Asia Pacific Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2022 - 2031

Figure 43: Asia Pacific Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Figure 44: Asia Pacific Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Figure 45: Asia Pacific Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2022 - 2031

Figure 46: Asia Pacific Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Figure 47: Asia Pacific Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Figure 48: Asia Pacific Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 49: Middle East & Africa Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Figure 50: Middle East & Africa Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Figure 51: Middle East & Africa Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2022 - 2031

Figure 52: Middle East & Africa Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Figure 53: Middle East & Africa Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Figure 54: Middle East & Africa Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2022 - 2031

Figure 55: Middle East & Africa Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Figure 56: Middle East & Africa Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Figure 57: Middle East & Africa Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2022 - 2031

Figure 58: Middle East & Africa Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Figure 59: Middle East & Africa Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Figure 60: Middle East & Africa Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031

Figure 61: South America Fuel Card Market Volume (Million Units), by Type, 2017 - 2031

Figure 62: South America Fuel Card Market Value (US$ Mn), by Type, 2017 - 2031

Figure 63: South America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2022 - 2031

Figure 64: South America Fuel Card Market Volume (Million Units), by Technology, 2017 - 2031

Figure 65: South America Fuel Card Market Value (US$ Mn), by Technology, 2017 - 2031

Figure 66: South America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Technology, 2022 - 2031

Figure 67: South America Fuel Card Market Volume (Million Units), by End-user, 2017 - 2031

Figure 68: South America Fuel Card Market Value (US$ Mn), by End-user, 2017 - 2031

Figure 69: South America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2022 - 2031

Figure 70: South America Fuel Card Market Volume (Million Units), by Country, 2017 - 2031

Figure 71: South America Fuel Card Market Value (US$ Mn), by Country, 2017 - 2031

Figure 72: South America Fuel Card Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2022 - 2031