Reports

Reports

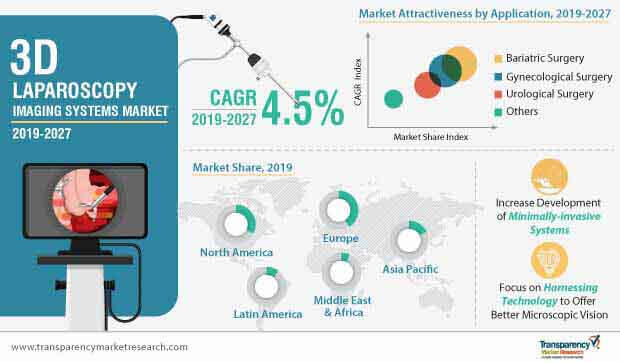

A recent Transparency Market Research (TMR) study examined the potential of the 3D laparoscopy imaging systems market, spanning 5 key regions, and documented high-to-low impact trends and notable developments. As per the findings, the 3D laparoscopy imaging systems market is on track to record a valuation of ~ US$ 4 billion by 2027, representing a real shift of medical personnel from using 2D laparoscopy imaging systems.

The question is no longer confined as to how quickly 3D laparoscopy imaging systems will overtake 2D systems; it is how 3D will lead and grab opportunities from invasive surgeries and aid surgeons bundle a patient-centric offering. As patients leading demanding lifestyles tend to prefer minimally-invasive procedures, manufacturers will enjoy better penetration of 3D laparoscopy imaging systems.

Growth of the market will also gain momentum owing to the rising number of bariatric surgeries being performed. As surgeons require a stereoscopic vision of anatomy for an accurate dissection prior to the surgery, the application scope of 3D laparoscopy imaging systems is likely to expand in bariatric surgeries. However, amidst the steady growth of the industry, challenges from technologically-driven 3D laparoscopy imaging systems flag the affordability issue, which is likely to crop up, especially in the developing countries.

To put this in perspective, 'high cost' can limit the growth of the landscape, and it will become a deciding factor for the shift from 2D to 3D laparoscopy imaging systems. Overall, the industry will progress at a compound annual growth rate of 4.5 percent during the forecast period of 2019-2027.

As the healthcare industry harnesses the power of technology to develop patient-centric treatment options, 3D laparoscopy imaging systems will dim the market value of 2D systems. 3D laparoscopy imaging systems offer enhanced operative vision with a binocular-depth perception that is absent in 2D laparoscopy imaging systems. Growth in the number of surgeries using advanced laparoscopy imaging systems is further increasing the reliance of surgeons on these units, given their better performance and lower error rates.

Beside surgeons, 3D laparoscopic procedures also gain the favorability of patients. Patients show a high proclivity for minimally-invasive procedures, given their emphasis on less blood loss, smaller scars, reduced pain, better recovery times, and shorter stay, which is likely to uptake the demand for 3D laparoscopy imaging systems during the forecast period.

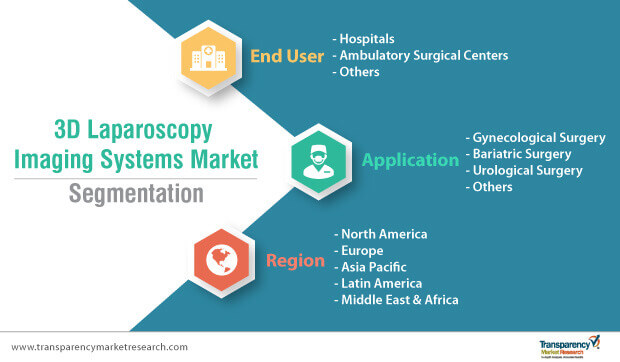

Unsurprisingly, hospitals hold a leading stance in the 3D laparoscopy imaging systems market, on account of discretionary spending by government bodies in the form of grants for innovation in medical devices and establishment of new hospitals. The adoption of 3D laparoscopy imaging systems at a CAGR of ~ 5% in hospitals during the forecast period represents the traditional preference for inpatient settings; however, as ambulatory surgical centers and clinics bank big on minimal wait times, easy scheduling, affordability, and better recovery times, outpatient settings are likely to grow in terms of popularity, in the future, for various surgeries.

The deployment of 3D laparoscopy imaging systems will remain high for bariatric surgeries, which is gaining popularity among the obese and diabetic populace. Bariatric surgeries remain a key revenue pocket for the 3D laparoscopy imaging systems market, currently holding a share of ~ 33 percent, and increasing its revenue share at an exponential rate.

New dimensions to 3D laparoscopy imaging systems are likely to emerge from gynecological surgeries, as gynecologists seek extended range of motion and improved hand-eye coordination. Currently, gynecological surgeries account for ~ 29 percent of the global sales of 3D laparoscopy imaging systems, and this segment is likely to grow at a CAGR of ~ 5 percent during the forecast period, as patients are drawn towards technologically-advanced healthcare procedures for better outcomes.

As the healthcare industry looks at the technology that blurs the boundary separating near-accurate and accurate surgeries, the rise of robotic systems will play a central role. A high level of dexterity with improved movement as compared to a human hand or wrist has been the key distinguishing proposition for robotic systems, thereby paling the popularity of 3D laparoscopy imaging systems.

Should market players worry about this?

The answer is - No. Though robotic systems are deemed efficient with a low risk of infection and blood loss, 3D laparoscopy imaging systems tend to outperform these systems in selected procedures, such as mitral valve repair and keyhole surgeries. Robotic procedures require more operative time as compared to 3D laparoscopy imaging systems. For instance, robotic procedures take around 224 minutes for a mitral valve repair surgery, while the same can be performed using laparoscopic systems in 180 minutes, with lesser blood transfusion. In addition, market players can renew the interest of surgeons in 3D laparoscopy imaging systems by employing a price-competitive strategy to regain the paling strength of the market, as the price of robotic systems is on the higher side.

High demand, strong portfolio, solid R&D spending, and positive legislative environment account for the high-value growth of the European 3D laparoscopy imaging systems market. Germany - being the leading medical device market in Europe in terms of revenue, holds enormous potential, with an anticipated value of ~ US$ 400 million by 2027.

The incorporation of new technologies and investments towards increasing production capacity will remain the common thread across manufacturing capabilities across the country. For example, a German player, KARL STORZ SE & Co. KG, announced the introduction of hyperspectral imaging in its range of products, in June 2019. Another player, B. Braun Melsungen AG, inaugurated 5 new medical production facilities in Penang, Malaysia, well-equipped with advanced technology and production infrastructure to manufacture medical devices for pharmaceutical solutions, infusion therapy, and surgical instruments.

With a promising future, the 3D laparoscopy imaging systems market does hold underlying possibilities and opportunities for prominent and new entrants to outscore the performance of established players. Manufacturers should look at the expansion of their product portfolio, coupled with focus on broadening their exposure in developing countries by recruiting direct sales force professionals. Investments made toward the integration of advanced technologies for the development of minimally-invasive devices will remain well-appreciated by surgeons and patients. Building partnerships with hospitals and ambulatory surgery centers will help manufacturers gain a revenue influx in the long-term, and help sustain their position in the 3D laparoscopy imaging systems market.

Global 3D Laparoscopy Imaging Systems Market: Overview

3D laparoscopic imaging systems have stereoscopic vision, where depth perception is achieved by different unique images received by each eye. Recent improvements in stereoscopic projection technology using passive polarizing displays have significantly improved novice surgeon performance during the acquisition of minimally-invasive surgical skills.

Strategic Acquisitions and Partnerships Drive 3D Laparoscopy Imaging Systems Market

Technological Advances in Surgical Visualization to Propel 3D Laparoscopy Imaging Systems Market

Rise in Scope of 3D Laparoscopy in Bariatric Surgery

North America a Prominent 3D Laparoscopy Imaging Systems Market

Companies Mentioned in the 3D Laparoscopy Imaging Systems Report

The report provides profiles of the leading players operating in the global 3D laparoscopy imaging systems market. Some of the key players operating in the global 3D laparoscopy imaging systems market include -

3D laparoscopy imaging systems market is projected to reach ~ US$ 4 Bn by 2027

3D laparoscopy imaging systems market to expand at a CAGR of 4.5% from 2019 to 2027

3D laparoscopy imaging systems market is driven by rise in the prevalence of chronic diseases

The bariatric surgery segment accounted for the largest share of the global 3D laparoscopy imaging systems market

Key players in the global 3D laparoscopy imaging systems market include Olympus Corporation, KARL STORZ SE & Co. KG, B. Braun Melsungen AG, CONMED Corporation, Visionsense

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global 3D Laparoscopy Imaging System

4. Market Overview

4.1. Market Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global 3D Laparoscopy Imaging System Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. Technological Advancements

5.2. Key Mergers & Acquisitions

5.3. Pricing Analysis: By Region and Brands

5.4. 3D Laparoscopy Imaging System Market Volume (2018)

6. Global 3D Laparoscopy Imaging System Analysis and Forecast, by Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Application, 2017–2027

6.3.1. Gynecological Surgery

6.3.2. Bariatric Surgery

6.3.3. Urological Surgery

6.3.4. Others

6.4. Market Attractiveness, by Application

7. Global 3D Laparoscopy Imaging System Analysis and Forecast, by End User

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End User, 2017–2027

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Others

7.4. Market Attractiveness, by End User

8. Global 3D Laparoscopy Imaging System Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Country/Region

9. North America 3D Laparoscopy Imaging System Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Application, 2017–2027

9.2.1. Gynecological Surgery

9.2.2. Bariatric Surgery

9.2.3. Urological Surgery

9.2.4. Others

9.3. Market Value Forecast, by End User, 2017–2027

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2027

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Application

9.5.2. By End User

9.5.3. By Country

10. Europe 3D Laparoscopy Imaging System Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Application, 2017–2027

10.2.1. Gynecological Surgery

10.2.2. Bariatric Surgery

10.2.3. Urological Surgery

10.2.4. Others

10.3. Market Value Forecast, by End User, 2017–2027

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2027

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Application

10.5.2. By End User

10.5.3. By Country/Sub-region

11. Asia Pacific 3D Laparoscopy Imaging System Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Application, 2017–2027

11.2.1. Gynecological Surgery

11.2.2. Bariatric Surgery

11.2.3. Urological Surgery

11.2.4. Others

11.3. Market Value Forecast, by End User, 2017–2027

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2027

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Application

11.5.2. By End User

11.5.3. By Country/Sub-region

12. Latin America 3D Laparoscopy Imaging System Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Application, 2017–2027

12.2.1. Gynecological Surgery

12.2.2. Bariatric Surgery

12.2.3. Urological Surgery

12.2.4. Others

12.3. Market Value Forecast, by End User, 2017–2027

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2027

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Application

12.5.2. By End User

12.5.3. By Country/Sub-region

13. Middle East & Africa 3D Laparoscopy Imaging System Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Application, 2017–2027

13.2.1. Gynecological Surgery

13.2.2. Bariatric Surgery

13.2.3. Urological Surgery

13.2.4. Others

13.3. Market Value Forecast, by End User, 2017–2027

13.3.1. Hospitals

13.3.2. Ambulatory Surgical Centers

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2027

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Israel

13.4.4. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Application

13.5.2. By End User

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Company Profiles

14.1.1. Olympus Corporation

14.1.1.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.1.2. Financial Overview

14.1.1.3. SWOT Analysis

14.1.1.4. Strategic Overview

14.1.2. Sometech, Inc.

14.1.2.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.2.2. Financial Overview

14.1.2.3. SWOT Analysis

14.1.2.4. Strategic Overview

14.1.3. KARL STORZ SE & Co. KG

14.1.3.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.3.2. Financial Overview

14.1.3.3. SWOT Analysis

14.1.3.4. Strategic Overview

14.1.4. B. Braun Melsungen AG

14.1.4.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.4.2. Financial Overview

14.1.4.3. SWOT Analysis

14.1.4.4. Strategic Overview

14.1.5. CONMED Corporation

14.1.5.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.5.2. Financial Overview

14.1.5.3. SWOT Analysis

14.1.5.4. Strategic Overview

14.1.6. Visionsense

14.1.6.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.6.2. Financial Overview

14.1.6.3. SWOT Analysis

14.1.6.4. Strategic Overview

14.1.7. Richard Wolf GmbH

14.1.7.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.7.2. Financial Overview

14.1.7.3. SWOT Analysis

14.1.7.4. Strategic Overview

14.1.8. Fujifilm Holdings Corporation

14.1.8.1. Company Overview (Headquarters, Business Segments, Employee Strength)

14.1.8.2. Financial Overview

14.1.8.3. SWOT Analysis

14.1.8.4. Strategic Overview

List of Tables

Table 01: Global 3D Laparoscopy Imaging System Market Volume (2018), by Major Players

Table 02: North America 3D Laparoscopy Imaging System Market Volume (2018), by Major Players

Table 03: Europe 3D Laparoscopy Imaging System Market Volume (2018), by Major Players

Table 04: Asia Pacific 3D Laparoscopy Imaging System Market Volume (2018), by Major Players

Table 05: Latin America 3D Laparoscopy Imaging System Market Volume (2018), by Major Players

Table 06: Middle East & Africa (MEA) 3D Laparoscopy Imaging System Market Volume (2018), by Major Players

Table 08: Global 3D Laparoscopy Imaging Systems Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 09: Global 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 10: Global 3D Laparoscopy Imaging Systems Market value (US$ Mn) Forecast, by Region, 2017–2027

Table 11: North America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 12: North America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 13: North America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 14: Europe 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 15: Europe 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 16: Europe 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 17: Asia Pacific 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 18: Asia Pacific 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 19: Asia Pacific 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 20: Latin America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 21: Latin America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 22: Latin America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 23: Middle East & Africa 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Middle East & Africa 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 25: Middle East & Africa 3D Laparoscopy Imaging Systems Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 26: Products Offered Olympus Corporation

Table 27: Products Offered - Sometech, Inc.

Table 28: Products Offered - KARL STORZ SE & Co. KG

Table 29: Products Offered - B. Braun Melsungen AG

Table 30: Product Offerings - CONMED Corporation

Table 31: Product Offerings - Visionsense

Table 32: Products Offered - Richard Wolf GmbH

Table 33: Products Offered - Fujifilm Holdings Corporation

List of Figures

Figure 01: Global 3D Laparoscopy Imaging Systems Market Size (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global 3D Laparoscopy Imaging Systems Market Revenue Projection (US$ Mn), 2017–2027

Figure 03: Global 3D Laparoscopy Imaging Systems Market Value Share, by Application, 2018

Figure 04: Global 3D Laparoscopy Imaging Systems Market Value Share, by End User, 2018

Figure 05: Global 3D Laparoscopy Imaging Systems Market Value Share, by Region, 2018

Figure 06: North America Pricing Analysis (1/5)

Figure 07: Europe Pricing Analysis (2/5)

Figure 08: Asia Pacific Pricing Analysis (3/5)

Figure 09: Latin America Pricing Analysis (4/5)

Figure 10: Middle East & Africa Pricing Analysis (5/5)

Figure 11: Global 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Application, 2018 and 2027

Figure 12: Global 3D Laparoscopy Imaging Systems Market Revenue (US$ Mn) Forecast, by Bariatric Surgery, 2017–2027

Figure 13: Global 3D Laparoscopy Imaging Systems Market Revenue (US$ Mn), by Gynecological Surgery, 2017–2027

Figure 14: Global 3D Laparoscopy Imaging Systems Market Revenue (US$ Mn) Forecast, by Urological Surgery, 2017–2027

Figure 15: Global 3D Laparoscopy Imaging Systems Market Revenue (US$ Mn), by Others, 2017–2027

Figure 16: Global 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by Application, 2019–2027

Figure 17: Global 3D Laparoscopy Imaging Systems Market Value Share, by End User, 2017 and 2026

Figure 18: Global 3D Laparoscopy Imaging Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 19: Global 3D Laparoscopy Imaging Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgery Centers, 2017–2027

Figure 20: Global 3D Laparoscopy Imaging Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 21: Global 3D Laparoscopy Imaging Systems Market Attractiveness, by End User, 2019–2027

Figure 22: Global 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Region, 2018 and 2027

Figure 23: Global 3D Laparoscopy Imaging Systems Market Attractiveness, by Region, 2019-2027

Figure 24: North America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 25: North America 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by Country, 2019–2027

Figure 26: North America 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Country, 2018 and 2027

Figure 27: North America 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Application, 2018 and 2027

Figure 28: North America 3D Laparoscopy Imaging Systems Market Value Share Analysis, by End User, 2018 and 2027

Figure 29: North America 3D Laparoscopy Imaging Systems Market Attractiveness, by Application, 2019?2027

Figure 30: North America 3D Laparoscopy Imaging Systems Market Attractiveness, by End User, 2019?2027

Figure 31: Europe 3D Laparoscopy Imaging Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 32: Europe 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 33: Europe 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 34: Europe 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Application, 2018 and 2027

Figure 35: Europe 3D Laparoscopy Imaging Systems Market Value Share Analysis, by End User, 2018 and 2027

Figure 36: Europe 3D Laparoscopy Imaging Systems Market Attractiveness, by Application, 2019?2027

Figure 37: Europe 3D Laparoscopy Imaging Systems Market Attractiveness, by End User, 2019?2027

Figure 38: Asia Pacific 3D Laparoscopy Imaging Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 39: Asia Pacific 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 40: Asia Pacific 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 41: Asia Pacific 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Application, 2018 and 2027

Figure 42: Asia Pacific 3D Laparoscopy Imaging Systems Market Value Share Analysis, by End User, 2018 and 2027

Figure 43: Asia Pacific 3D Laparoscopy Imaging Systems Market Attractiveness, by Application, 2019?2027

Figure 44: Asia Pacific 3D Laparoscopy Imaging Systems Market Attractiveness, by End User, 2019?2027

Figure 45: Latin America 3D Laparoscopy Imaging Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 46: Latin America 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 47: Latin America 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 48: Latin America 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Application, 2018 and 2027

Figure 49: Latin America 3D Laparoscopy Imaging Systems Market Value Share Analysis, by End User, 2018 and 2027

Figure 50: Latin America 3D Laparoscopy Imaging Systems Market Attractiveness, by Application, 2019?2027

Figure 51: Latin America 3D Laparoscopy Imaging Systems Market Attractiveness, by End User, 2019?2027

Figure 52: Middle East & Africa 3D Laparoscopy Imaging Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 53: Middle East & Africa 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 54: Middle East & Africa 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 55: Middle East & Africa 3D Laparoscopy Imaging Systems Market Value Share Analysis, by Application, 2018 and 2027

Figure 56: Middle East & Africa 3D Laparoscopy Imaging Systems Market Value Share Analysis, by End User, 2018 and 2027

Figure 57: Middle East & Africa 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by Application, 2019?2027

Figure 58: Middle East & Africa 3D Laparoscopy Imaging Systems Market Attractiveness Analysis, by End User, 2019?2027

Figure 59: Olympus Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 60: Olympus Corporation R&D Expenses (US$ Mn), 2016–2019

Figure 61: Olympus Corporation Breakdown of Net Sales, by Region, 2019

Figure 62: Olympus Corporation Breakdown of Net Sales, by Medical Business Segment, 2019

Figure 63: B. Braun Melsungen AG Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 64: B. Braun Melsungen AG R&D Expenses (US$ Mn) 2016–2018

Figure 65: B. Braun Melsungen AG Breakdown of Net Sales, by Region/Country, 2018

Figure 66: B. Braun Melsungen AG Breakdown of Net Sales, by Business Division, 2018

Figure 67: CONMED Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 68: CONMED Corporation R&D Expenses (US$ Mn), 2016–2018

Figure 69: CONMED Corporation Breakdown of Net Sales, by Region/Country, 2018

Figure 71: Fujifilm Holdings Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 70: CONMED Corporation Breakdown of Net Sales, by Business Division, 2018

Figure 72: Fujifilm Holdings Corporation R&D Expenses (US$ Mn), 2016–2019

Figure 73: Fujifilm Holdings Corporation Breakdown of Net Sales, by Operating Segment, 2019

Figure 74: Fujifilm Holdings Corporation Breakdown of Net Sales, by Region, 2019