Analysts’ Viewpoint on Market Scenario

Wearable technology has taken a quantum leap by linking our senses to sensors, thereby opening up countless potential across multiple market sectors. Simplicity of use and versatility of wearable technologies in healthcare are key factors driving their popularity.

People are using wearable technology to efficiently monitor their vital signs. Those who are sensitive to slight glucose level fluctuations and require continuous glucose monitoring can benefit from therapeutic devices such as Pancreum's Vigil and Omnipod.

Rise in prevalence of chronic pain has boosted the demand for wearable medical devices such as transcutaneous electrical nerve stimulation (TENS) and pulsed electromagnetic field treatment (PEMF).

The wearable medical devices industry has been witnessing an increase in demand for respiratory monitors, multi-parameter monitoring solutions, and point-of-care monitoring products such as pulse oximeters and blood pressure monitors during the COVID period.

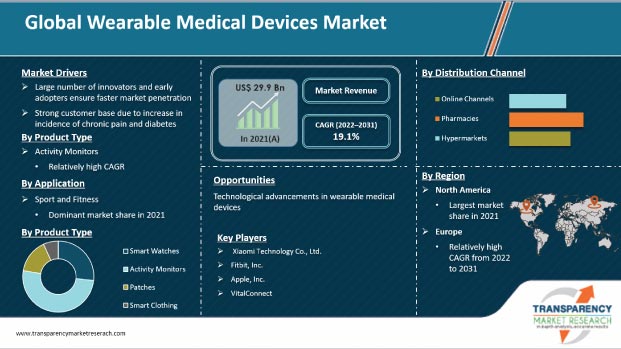

The global wearable medical devices market is expected to grow at a rapid pace between 2022 and 2031 due to the expansion of the healthcare sector, government efforts, increase in number of healthcare companies, rise in product approvals, and surge in patient population.

Wearable medical devices companies are striving to improve the usability and accessibility of their products. These wearable health monitoring devices provide crucial information about user health and are designed in such a way that a layperson can easily comprehend the data.

Request a sample to get extensive insights into the Wearable Medical Devices Market

Wearable technology is popular. Majority of the people who purchase such items are innovators and early adopters. The global wearable medical devices market is projected to be driven by a significant population of innovators and early adopters in developed countries, and increase in the number of persons in this category in emerging economies. Surge in number of sports and fitness enthusiasts seeking new ways to track their health is also anticipated to propel the global market. A sizable proportion of the population in the U.S. and Canada are early adopters. Hence, market penetration of wearable medical gadgets is likely to be faster in North America.

Surge in chronic pain cases is augmenting the demand for wearable medical devices such as transcutaneous electrical nerve stimulation (TENS) and pulsed electromagnetic field treatment (PEMF) devices.

Diabetes is affecting an increasing number of individuals because of improper diet, sedentary lifestyle, and obesity. This can result in life-threatening conditions such as renal failure, heart disease, and stroke. Hence, health of such persons must be checked on a regular basis. This is driving the demand for glucose monitors. Diabetic people are also at risk of dying prematurely from cardiovascular issues. This necessitates the development of wearable devices capable of continuous cardiovascular monitoring at home and in clinics.

Request a custom report on Wearable Medical Devices Market

In terms of product, the global wearable devices market has been classified into smart watches, activity monitors, patches, and smart clothing. The activity monitors segment accounted for a large share of the global market in 2021. The segment is expected to grow at a high CAGR from 2022 to 2031.

Activity monitors have grown in popularity as a result of the integration of technologies such as Bluetooth and Wi-Fi with diagnostic equipment. This allows these gadgets to communicate health information to computers or smartphones, enabling medical professionals to evaluate data more quickly.

Based on device, the global wearable medical devices market has been bifurcated into diagnostic & monitoring devices and therapeutic devices. The diagnostic & monitoring devices segment has been split into vital signs monitoring devices, glucose monitoring devices, sleep monitoring devices, fetal monitoring & obstetric devices, and neuromonitoring devices. The therapeutic devices segment has been segregated into pain management devices, rehabilitation devices, and insulin pumps.

The diagnostic & monitoring devices segment held significant share of the global market in 2021. Increase in health awareness and rise in prevalence of disorders such as diabetes and hypertension are expected to augment the diagnostic & monitoring devices segment during the forecast period. However, high cost, data security challenges, and unfavorable reimbursement policies are likely to restrain the segment in the next few years.

In terms of application, the global wearable medical devices market has been divided into sports & fitness, home health care, and remote patient monitoring.

The sports & fitness segment held major share of the global market during the forecast period. Sports and fitness equipment exhibit significant market penetration. These wearable gadgets can communicate with other devices, such as smartphones, laptops, and PCs, through Bluetooth and Wi-Fi, allowing for personalized settings and thorough performance monitoring.

Based on distribution channel, the global wearable medical devices market has been divided into online channels, pharmacies, and hypermarkets.

The pharmacies segment accounted for major market share in 2021. Increase in number of pharmacy stores and people's preference for physical buying over Internet shopping are likely to augment the segment during the forecast period.

North America is projected to be a highly lucrative region of the global market during the forecast period. High rate of acceptance of sophisticated goods, significant reimbursement coverage, and entry of new players with unique technologies are attributed to the region's large market share. Moreover, high incidence of chronic illnesses imposes a major economic burden and increases the need for inexpensive treatment in the U.S. This is driving the demand for wearable medical devices in the region.

The market in Europe is anticipated to grow at a rapid pace during the forecast period. Wearable medical technology pioneers can also be found in Nordic countries such as Finland, Sweden, and Iceland. Suunto, established in Finland, is a major participant in the heart rate monitor segment.

Asia Pacific is likely to be an emerging market for wearable medical devices during the forecast period due to the increase in government investment in health care and technical improvements in wearable medical devices. Surge in geriatric population and rise in awareness about wearable medical devices are also projected to augment the market in the region during the forecast period.

The global market is fragmented, with the presence of large number of small players. Key players operating in the global wearable medical devices market include Xiaomi Technology Co., Ltd., Samsung Electronics Co. Ltd., Fitbit, Inc., Garmin Corporation, Apple, Inc., Huawei Technologies Co., Ltd., Polar Electro, OMRON Corporation, Activinsights Ltd., and VitalConnect. Prominent players are adopting growth strategies such as new product development, product launches, product approval, agreement, partnerships, and mergers.

Each of these players has been profiled in the wearable medical devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 29.9 Bn |

|

Market Forecast Value in 2031 |

More than US$ 183.8 Bn |

|

Growth Rate (CAGR) 2022-2031 |

19.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 29.9 Bn in 2021.

It is projected to reach more than US$ 183.8 Bn by 2031.

The global market grew at a CAGR of 24.9% from 2017 to 2021

It market is anticipated to grow at a CAGR of 19.1% from 2022 to 2031.

Diagnostic & monitoring devices was the leading segment that held over 65% share of the global market in 2021.

North America is expected to account for the major share of the market during the forecast period.

Xiaomi Technology Co., Ltd., Samsung Electronics Co. Ltd., Fitbit, Inc., Garmin Corporation, Apple, Inc., Huawei Technologies Co., Ltd., Polar Electro, OMRON Corporation, Activinsights Ltd., and VitalConnect.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Wearable Medical Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Wearable Medical Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Technological Advancements

5.3. Disease Prevalence & Incidence Rate globally with key countries

5.4. Covid-19 Impact Analysis

6. Global Wearable Medical Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Smart Watches

6.3.2. Activity Monitors

6.3.3. Patches

6.3.4. Smart Clothing

6.4. Market Attractiveness Analysis, by Product Type

7. Global Wearable Medical Devices Market Analysis and Forecast, by Device

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Device, 2017–2031

7.3.1. Diagnostic & Monitoring Devices

7.3.1.1. Vital Signs Monitoring Devices

7.3.1.2. Glucose Monitoring Devices

7.3.1.3. Sleep Monitoring Devices

7.3.1.4. Fetal Monitoring & Obstetric Devices

7.3.1.5. Neuromonitoring Devices

7.3.2. Therapeutic Devices

7.3.2.1. Pain Management Devices

7.3.2.2. Rehabilitation Devices

7.3.2.3. Insulin Pumps

7.4. Market Attractiveness Analysis, by Device

8. Global Wearable Medical Devices Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Sports & Fitness

8.3.2. Home Health Care

8.3.3. Remote Patient Monitoring

8.4. Market Attractiveness Analysis, by Application

9. Global Wearable Medical Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Wearable Medical Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Smart Watches

10.2.2. Activity Monitors

10.2.3. Patches

10.2.4. Smart Clothing

10.3. Market Value Forecast, by Device, 2017–2031

10.3.1. Diagnostic & Monitoring Devices

10.3.1.1. Vital Signs Monitoring Devices

10.3.1.2. Glucose Monitoring Devices

10.3.1.3. Sleep Monitoring Devices

10.3.1.4. Fetal Monitoring & Obstetric Devices

10.3.1.5. Neuromonitoring Devices

10.3.2. Therapeutic Devices

10.3.2.1. Pain Management Devices

10.3.2.2. Rehabilitation Devices

10.3.2.3. Insulin Pumps

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Sports & Fitness

10.4.2. Home Health Care

10.4.3. Remote Patient Monitoring

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Device

10.6.3. By Application

10.6.4. By Country

11. Europe Wearable Medical Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Smart Watches

11.2.2. Activity Monitors

11.2.3. Patches

11.2.4. Smart Clothing

11.3. Market Value Forecast, by Device, 2017–2031

11.3.1. Diagnostic & Monitoring Devices

11.3.1.1. Vital Signs Monitoring Devices

11.3.1.2. Glucose Monitoring Devices

11.3.1.3. Sleep Monitoring Devices

11.3.1.4. Fetal Monitoring & Obstetric Devices

11.3.1.5. Neuromonitoring Devices

11.3.2. Therapeutic Devices

11.3.2.1. Pain Management Devices

11.3.2.2. Rehabilitation Devices

11.3.2.3. Insulin Pumps

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Sports & Fitness

11.4.2. Home Health Care

11.4.3. Remote Patient Monitoring

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Device

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Wearable Medical Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Smart Watches

12.2.2. Activity Monitors

12.2.3. Patches

12.2.4. Smart Clothing

12.3. Market Value Forecast, by Device, 2017–2031

12.3.1. Diagnostic & Monitoring Devices

12.3.1.1. Vital Signs Monitoring Devices

12.3.1.2. Glucose Monitoring Devices

12.3.1.3. Sleep Monitoring Devices

12.3.1.4. Fetal Monitoring & Obstetric Devices

12.3.1.5. Neuromonitoring Devices

12.3.2. Therapeutic Devices

12.3.2.1. Pain Management Devices

12.3.2.2. Rehabilitation Devices

12.3.2.3. Insulin Pumps

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Sports & Fitness

12.4.2. Home Health Care

12.4.3. Remote Patient Monitoring

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Device

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Wearable Medical Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Smart Watches

13.2.2. Activity Monitors

13.2.3. Patches

13.2.4. Smart Clothing

13.3. Market Value Forecast, by Device, 2017–2031

13.3.1. Diagnostic & Monitoring Devices

13.3.1.1. Vital Signs Monitoring Devices

13.3.1.2. Glucose Monitoring Devices

13.3.1.3. Sleep Monitoring Devices

13.3.1.4. Fetal Monitoring & Obstetric Devices

13.3.1.5. Neuromonitoring Devices

13.3.2. Therapeutic Devices

13.3.2.1. Pain Management Devices

13.3.2.2. Rehabilitation Devices

13.3.2.3. Insulin Pumps

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Sports & Fitness

13.4.2. Home Health Care

13.4.3. Remote Patient Monitoring

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Device

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Wearable Medical Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Smart Watches

14.2.2. Activity Monitors

14.2.3. Patches

14.2.4. Smart Clothing

14.3. Market Value Forecast, by Device, 2017–2031

14.3.1. Diagnostic & Monitoring Devices

14.3.1.1. Vital Signs Monitoring Devices

14.3.1.2. Glucose Monitoring Devices

14.3.1.3. Sleep Monitoring Devices

14.3.1.4. Fetal Monitoring & Obstetric Devices

14.3.1.5. Neuromonitoring Devices

14.3.2. Therapeutic Devices

14.3.2.1. Pain Management Devices

14.3.2.2. Rehabilitation Devices

14.3.2.3. Insulin Pumps

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Sports & Fitness

14.4.2. Home Health Care

14.4.3. Remote Patient Monitoring

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Device

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Activinsights Ltd.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Apple, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. BioTelemetry, Inc.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Fitbit, Inc.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Garmin Corporation

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Huawei Technologies Co., Ltd.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. OMRON Corporation

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Polar Electro

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. VitalConnect

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Xiaomi Technology Co.

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables:

Table 01: Global Wearable Medical Devices Market Value (US$ Mn) Forecast, by Device, 2017–2031

Table 02: Global Wearable Medical Devices Market Value (US$ Mn) Forecast, by Diagnostic & Monitoring Devices, 2017–2031

Table 03: Global Wearable Medical Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 04: Global Wearable Medical Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Wearable Medical Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: Global Wearable Medical Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Device, 2017–2031

Table 09: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Diagnostic & Monitoring Devices, 2017–2031

Table 10: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Therapeutic Devices, 2017–2031

Table 11: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 12: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 13: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 14: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 15: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, by Device, 2017–2031

Table 16: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, by Diagnostic & Monitoring Devices, 2017–2031

Table 17: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, by Therapeutic Devices, 2017–2031

Table 18: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, by Device, 2017–2031

Table 23: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, by Diagnostic & Monitoring Devices, 2017–2031

Table 24: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, by Therapeutic Devices, 2017–2031

Table 25: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 26: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 27: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 28: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 29: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Device, 2017–2031

Table 30: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Diagnostic & Monitoring Devices, 2017–2031

Table 31: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Therapeutic Devices, 2017–2031

Table 32: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 33: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 34: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 35: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 36: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, by Device, 2017–2031

Table 37: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, by Diagnostic & Monitoring Devices, 2017–2031

Table 38: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, by Therapeutic Devices, 2017–2031

Table 39: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 40: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 41: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 02: Global Wearable Medical Devices Market Value Share (%), by Device, 2017 and 2031

Figure 03: Global Wearable Medical Devices Market Attractiveness Analysis, by Device, 2022–2031

Figure 04: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Diagnostic & Monitoring Devices, 2017–2031

Figure 05: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Therapeutic Devices, 2017–2031

Figure 06: Global Wearable Medical Devices Market Value Share (%), by Product Type, 2017 and 2031

Figure 07: Global Wearable Medical Devices Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 08: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Smart Watches, 2017–2031

Figure 09: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Activity Monitors, 2017–2031

Figure 10: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Patches, 2017–2031

Figure 11: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Smart Clothing, 2017–2031

Figure 12: Global Wearable Medical Devices Market Value Share (%), by Application, 2017 and 2031

Figure 13: Global Wearable Medical Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 14: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Sports & Fitness, 2017–2031

Figure 15: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Home Healthcare, 2017–2031

Figure 16: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Remote Patient Monitoring, 2017–2031

Figure 17: Global Wearable Medical Devices Market Value Share (%), by Distribution Channel, 2017 and 2031

Figure 18: Global Wearable Medical Devices Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 19: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Online Channels, 2017–2031

Figure 20: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Pharmacies, 2017–2031

Figure 21: Global Wearable Medical Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hypermarkets, 2017–2031

Figure 22: Global Wearable Medical Devices Market Value Share (%), by Region, 2017 and 2031

Figure 23: Global Wearable Medical Devices Market Attractiveness Analysis, by Region, 2022–2031

Figure 24: North America Wearable Medical Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: North America Wearable Medical Devices Market Value Share (%), by Country, 2017 and 2031

Figure 26: North America Wearable Medical Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 27: North America Wearable Medical Devices Market Value Share (%), by Device, 2017 and 2031

Figure 28: North America Wearable Medical Devices Market Attractiveness Analysis, by Device, 2022–2031

Figure 29: North America Wearable Medical Devices Market Value Share (%), by Product Type, 2017 and 2031

Figure 30: North America Wearable Medical Devices Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 31: North America Wearable Medical Devices Market Value Share (%), by Application, 2017 and 2031

Figure 32: North America Wearable Medical Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 33: North America Wearable Medical Devices Market Value Share (%), by Distribution Channel, 2017 and 2031

Figure 34: North America Wearable Medical Devices Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 35: Europe Wearable Medical Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 36: Europe Wearable Medical Devices Market Value Share (%), by Country/Sub-region, 2017 and 2031

Figure 37: Europe Wearable Medical Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 38: Europe Wearable Medical Devices Market Value Share (%), by Device, 2017 and 2031

Figure 39: Europe Wearable Medical Devices Market Attractiveness Analysis, by Device, 2022–2031

Figure 40: Europe Wearable Medical Devices Market Value Share (%), by Product Type, 2017 and 2031

Figure 41: Europe Wearable Medical Devices Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 42: Europe Wearable Medical Devices Market Value Share (%), by Application, 2017 and 2031

Figure 43: Europe Wearable Medical Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 44: Europe Wearable Medical Devices Market Value Share (%), by Distribution Channel, 2017 and 2031

Figure 45: Europe Wearable Medical Devices Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 46: Asia Pacific Wearable Medical Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Asia Pacific Wearable Medical Devices Market Value Share (%), by Country/Sub-region, 2017 and 2031

Figure 48: Asia Pacific Wearable Medical Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 49: Asia Pacific Wearable Medical Devices Market Value Share (%), by Device, 2017 and 2031

Figure 50: Asia Pacific Wearable Medical Devices Market Attractiveness Analysis, by Device, 2022–2031

Figure 51: Asia Pacific Wearable Medical Devices Market Value Share (%), by Product Type, 2017 and 2031

Figure 52: Asia Pacific Wearable Medical Devices Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 53: Asia Pacific Wearable Medical Devices Market Value Share (%), by Application, 2017 and 2031

Figure 54: Asia Pacific Wearable Medical Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 55: Asia Pacific Wearable Medical Devices Market Value Share (%), by Distribution Channel, 2017 and 2031

Figure 56: Asia Pacific Wearable Medical Devices Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 57: Latin America Wearable Medical Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 58: Latin America Wearable Medical Devices Market Value Share (%), by Country/Sub-region, 2017 and 2031

Figure 59: Latin America Wearable Medical Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 60: Latin America Wearable Medical Devices Market Value Share (%), by Device, 2017 and 2031

Figure 61: Latin America Wearable Medical Devices Market Attractiveness Analysis, by Device, 2022–2031

Figure 62: Latin America Wearable Medical Devices Market Value Share (%), by Product Type, 2017 and 2031

Figure 63: Latin America Wearable Medical Devices Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 64: Latin America Wearable Medical Devices Market Value Share (%), by Application, 2017 and 2031

Figure 65: Latin America Wearable Medical Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 66: Latin America Wearable Medical Devices Market Value Share (%), by Distribution Channel, 2017 and 2031

Figure 67: Latin America Wearable Medical Devices Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 68: Middle East & Africa Wearable Medical Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 69: Middle East & Africa Wearable Medical Devices Market Value Share (%), by Country/Sub-region, 2017 and 2031

Figure 70: Middle East & Africa Wearable Medical Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 71: Middle East & Africa Wearable Medical Devices Market Value Share (%), by Device, 2017 and 2031

Figure 72: Middle East & Africa Wearable Medical Devices Market Attractiveness Analysis, by Device, 2022–2031

Figure 73: Middle East & Africa Wearable Medical Devices Market Value Share (%), by Product Type, 2017 and 2031

Figure 74: Middle East & Africa Wearable Medical Devices Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 75: Middle East & Africa Wearable Medical Devices Market Value Share (%), by Application, 2017 and 2031

Figure 76: Middle East & Africa Wearable Medical Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 77: Middle East & Africa Wearable Medical Devices Market Value Share (%), by Distribution Channel, 2017 and 2031

Figure 78: Middle East & Africa Wearable Medical Devices Market Attractiveness Analysis, by Distribution Channel, 2021–2031