Analysts’ Viewpoint on Thermoplastic Elastomers Market Scenario

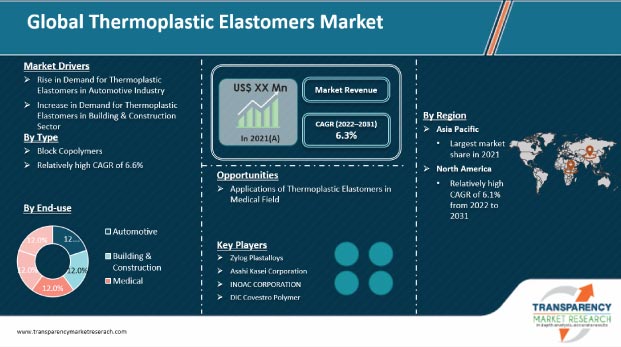

Companies operating in the thermoplastic elastomers market are emphasizing on the adoption of new types of thermoplastic elastomers, such as block copolymers and blends. Various industries are focusing on eco-friendly and bio-based thermoplastic elastomers, which have superior physical attributes & characteristics such as resistance to chemicals, UV radiation, and oxidation. They also provide soft touch to materials. Increase in preference for high performance and lightweight passenger cars has been driving plastics innovation in automotive manufacturing. This has led to a rise in usage of thermoplastics in the automotive sector. Most manufacturers of thermoplastic elastomers with global presence have integrated operations. Exit barriers are high in the market due to significant investments in machinery and technology.

Thermoplastic elastomers possess properties of plastics and elastomers. They can be extruded and molded when required. They can also return to their original shape. Thermoplastic elastomers are manufactured through three methods: extrusion, injection compression, and blow molding. Thermoplastic elastomers offer a wide range of performance attributes such as heat and oil resistance, improved adhesion, tear resistance, surface appearance, and low permeability.

Request a sample to get extensive insights into the Thermoplastic Elastomers Market

The demand for thermoplastic elastomers is rising in building and construction application. Thermoplastic elastomers are used in plumbing fixers, siding, flooring, insulation, panels, doors, windows, glazing, bathroom units, gratings, railings, and a wide variety of structural and decorative applications. Thermoplastic elastomers are efficient and cost effective alternatives to competitive materials such as silicone, natural rubber, latex, and PVC compounds in the building & construction sector.

Moreover, the use of thermoplastic polyolefins (TPOs) is rising in building and construction applications. TPOs have become prominent in new flame retardant roofing applications. Roofing membranes manufactured using TPOs combine attributes of EPDM and PVC, which are flexible single-ply membranes. TPOs provide long term weathering resistance, cold temperature flexibility, tear resistance, puncture resistance, chemical resistance, and heat seaming capability. Compared to their counterparts such as PVC and EPDM, thermoplastic elastomers are eco-friendlier. Shift toward green buildings and rise in environmental concerns are driving the demand for thermoplastic elastomers in the building and construction sector.

The automotive end-use industry segment dominated the global thermoplastic elastomers market with 54.9% share in 2021. Furthermore, the segment is expected to grow at a notable CAGR of 6.8% during the forecast period. Automotive manufacturers rely on thermoplastic elastomers due to their beneficial properties such as weather resistance, oil and grease resistance, abrasion resistance, and vibration damping. Typical applications of thermoplastic elastomers in a car include control elements, air bags, anti-slip mats, window trims, cowl panels, spoilers, seals, and air duct components. Thermoplastic elastomers offer many advantages to car manufacturers. They provide a smooth touch to gear sticks and steering wheels. Thermoplastic elastomers are light in weight and offer improved fuel efficiency to the vehicle. Increase in spending by consumers on luxury cars with esthetic features and high quality automotive parts is likely to fuel the demand for thermoplastic elastomers.

Styrenic block copolymers are used in bumpers, seats, and window encapsulations. Thermoplastic polyurethane is highly used in caster wheels, owing to its high elasticity, shear strength, and abrasion resistance. Thermoplastic olefins are tough and scratch resistant; and are largely used in bumpers and interior headliners in car ceiling.

Rise in middle class population and increase in disposable income of the people in emerging economies are the key factors driving the global automotive industry. Asia Pacific is a key manufacturer of automotive vehicles. The presence of prominent auto manufacturers such as Toyota, Mitsubishi, and Nissan; and increase in sale of fuel efficient cars in developing countries such as China and India are likely to propel the demand for thermoplastic elastomers in Asia Pacific.

Request a custom report on Thermoplastic Elastomers Market

In terms of type, the global thermoplastic elastomers market has been classified into block copolymers, blends, and others. The block copolymers segment accounted for a key share of 52.9% of the global market in 2021. The segment is estimated to expand at a CAGR of 6.8% during the forecast period. Block copolymers are the class of thermoplastic elastomers that include TPS (styrenic block copolymers), TPU (thermoplastic polyurethane), TPE (thermoplastic copolyesters), and TPA (thermoplastic polyamides). Block copolymers consist of two polymers: methyl methacrylate and bipolymer. Styrenic block copolymer is a combination of polystyrene and butadiene or poly isoprene. Similarly, thermoplastic polyurethane contains polyester or polyether linked with polyurethane. It also possesses long chain diols. Thermoplastic copolyester includes polybutylene terephthalate and poly tetra methylene ether. Thermoplastic polyamide contains polyetherimide with polyether polyol.

In terms of volume, Asia Pacific held 48.9% share of the global thermoplastic elastomers market in 2021. The high demand for thermoplastic elastomers in Asia Pacific can be ascribed to the rise in demand for these elastomers in automotive and building & construction industries.

In terms of volume, North America and Europe were also prominent regions of the global thermoplastic elastomers market, with 21.8% and 18.20% share, respectively, in 2021. The usage of thermoplastic elastomers in HVAC and automotive industries is expected to rise in North America and Europe in the near future. Growth of other end-use industries such as medical is also projected to drive the market in these regions at a moderate pace. The demand for transparent and sustainable thermoplastic elastomers is also high in the building & construction industry in North America.

The global thermoplastic elastomers market comprises several small and large-scale manufacturers and suppliers who control majority of the share. Most of the firms are adopting new technologies and strategies with comprehensive research and development, primarily to increase flexibility and streamline manufacturing operations. Diversification of product portfolios and mergers & acquisitions are key strategies adopted by market players.

Zylog Plastalloys, INOAC CORPORATION, Covestro AG, Huizhou LCY Elastomers Corp, LG Chem Ltd., Kolon Plastics Inc., BASF SE, and Covestro AG are the prominent entities operating in the market.

Each of these players has been profiled in the thermoplastic elastomers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 20.6 Bn |

|

Market Forecast Value in 2031 |

US$ 38 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 20.6 Bn in 2021

The market is expected to grow at a CAGR of 6.3% from 2022 to 2031

Increase in demand for thermoplastic elastomers in building & construction sector and rise in demand for thermoplastic elastomers in automotive industry

Block copolymers was the largest type segment that held 52.9% share in 2021

Asia Pacific was the most lucrative region of the thermoplastic elastomers market in 2021

Zylog Plastalloys, Asahi Kasei Corporation, INOAC CORPORATION, DIC Covestro Polymer, and Huizhou LCY Elastomers Corp., among others

1. Executive Summary

1.1. Thermoplastic Elastomers Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Key Manufacturers

2.6.2. List of Suppliers/ Distributors

2.6.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2021

5. Price Trend Analysis

6. Global Thermoplastic Elastomers Market Analysis and Forecast, by Type, 2020–2031

6.1. Introduction and Definitions

6.2. Global Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

6.2.1. Block Copolymers

6.2.1.1. TPS

6.2.1.2. TPU

6.2.1.3. TPE

6.2.1.4. TPA

6.2.2. Blends

6.2.2.1. TPO

6.2.2.2. TPV

6.2.3. Others

6.3. Global Thermoplastic Elastomers Market Attractiveness, by Type

7. Global Thermoplastic Elastomers Market Analysis and Forecast, by End-use Industry, 2020–2031

7.1. Introduction and Definitions

7.2. Global Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

7.2.1. Automotive

7.2.1.1. Wires & Cables

7.2.1.2. Under-hood Bonnet

7.2.1.3. Exteriors (Door Trims and Seals)

7.2.1.4. Others

7.2.2. Building & Construction

7.2.2.1. Seals & Gaskets

7.2.2.2. Expansion Joints

7.2.2.3. Others

7.2.3. Medical

7.2.3.1. Tubing

7.2.3.2. Catheters

7.2.3.3. Grips

7.2.3.4. Others

7.2.4. Consumer Goods

7.2.4.1. Power Tools Handles

7.2.4.2. Sporting goods & toys

7.2.4.3. Others

7.2.5. Others

7.3. Global Thermoplastic Elastomers Market Attractiveness, by End-use Industry

8. Global Thermoplastic Elastomers Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global Thermoplastic Elastomers Market Attractiveness, by Region

9. North America Thermoplastic Elastomers Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.3. North America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

9.4. North America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.4.1. U.S. Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.2. U.S. Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

9.4.3. Canada Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.4. Canada Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

9.5. North America Thermoplastic Elastomers Market Attractiveness Analysis

10. Europe Thermoplastic Elastomers Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.3. Europe Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4. Europe Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

10.4.1. Germany Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2020–2031

10.4.2. Germany Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4.3. Austria Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.4. Austria Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4.5. U.K. Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.6. U.K. Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4.7. Russia & CIS Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.8. Russia & CIS Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4.9. Rest of Europe Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.10. Rest of Europe Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.5. Europe Thermoplastic Elastomers Market Attractiveness Analysis

11. Asia Pacific Thermoplastic Elastomers Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type

11.3. Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4. Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

11.4.1. China Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.2. China Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.3. Japan Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.4. Japan Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.5. India Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.6. India Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.7. South Korea Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.8. South Korea Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.9. ASEAN Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.10. ASEAN Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.11. Rest of Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.12. Rest of Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.5. Asia Pacific Thermoplastic Elastomers Market Attractiveness Analysis

12. Latin America Thermoplastic Elastomers Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.3. Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4. Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

12.4.1. Brazil Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.2. Brazil Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.3. Mexico Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.4. Mexico Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.5. Rest of Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.6. Rest of Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5. Latin America Thermoplastic Elastomers Market Attractiveness Analysis

13. Middle East & Africa Thermoplastic Elastomers Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.3. Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4. Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

13.4.1. GCC Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.2. GCC Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4.3. South Africa Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.4. South Africa Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4.5. Rest of Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.6. Rest of Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.5. Middle East & Africa Thermoplastic Elastomers Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Ink Company Market Share Analysis, 2021

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Zylog Plastalloys

14.2.1.1. Company Description

14.2.1.2. Business Overview

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.2. Asahi Kasei Corporation

14.2.2.1. Company Description

14.2.2.2. Business Overview

14.2.2.3. Financial Overview

14.2.2.4. Strategic Overview

14.2.3. INOAC CORPORATION

14.2.3.1. Company Description

14.2.3.2. Business Overview

14.2.3.3. Financial Overview

14.2.3.4. Strategic Overview

14.2.4. DIC Covestro Polymer

14.2.4.1. Company Description

14.2.4.2. Business Overview

14.2.4.3. Financial Overview

14.2.4.4. Strategic Overview

14.2.5. Huizhou LCY Elastomers Corp

14.2.5.1. Company Description

14.2.5.2. Business Overview

14.2.5.3. Financial Overview

14.2.5.4. Strategic Overview

14.2.6. LG Chem Ltd.

14.2.6.1. Company Description

14.2.6.2. Business Overview

14.2.6.3. Financial Overview

14.2.6.4. Strategic Overview

14.2.7. Kolon Plastics Inc

14.2.7.1. Company Description

14.2.7.2. Business Overview

14.2.7.3. Financial Overview

14.2.7.4. Strategic Overview

14.2.8. BASF SE

14.2.8.1. Company Description

14.2.8.2. Business Overview

14.2.8.3. Financial Overview

14.2.8.4. Strategic Overview

14.2.9. Covestro AG

14.2.9.1. Company Description

14.2.9.2. Business Overview

14.2.9.3. Financial Overview

14.2.9.4. Strategic Overview

14.2.10. KRAIBURG

14.2.10.1. Company Description

14.2.10.2. Business Overview

14.2.10.3. Financial Overview

14.2.10.4. Strategic Overview

14.2.11. Taro Plast S.p.a

14.2.11.1. Company Description

14.2.11.2. Business Overview

14.2.11.3. Financial Overview

14.2.11.4. Strategic Overview

14.2.12. SIBUR

14.2.12.1. Company Description

14.2.12.2. Business Overview

14.2.12.3. Financial Overview

14.2.12.4. Strategic Overview

14.2.13. Arkema Group

14.2.13.1. Company Description

14.2.13.2. Business Overview

14.2.13.3. Financial Overview

14.2.13.4. Strategic Overview

14.2.14. Exxon Mobil Corporation

14.2.14.1. Company Description

14.2.14.2. Business Overview

14.2.14.3. Financial Overview

14.2.14.4. Strategic Overview

14.2.15. PolyOne Corporation

14.2.15.1. Company Description

14.2.15.2. Business Overview

14.2.15.3. Financial Overview

14.2.15.4. Strategic Overview

14.2.16. DowDuPont Inc..

14.2.16.1. Company Description

14.2.16.2. Business Overview

14.2.16.3. Financial Overview

14.2.16.4. Strategic Overview

14.2.17. Huntsman Corporation

14.2.17.1. Company Description

14.2.17.2. Business Overview

14.2.17.3. Financial Overview

14.2.17.4. Strategic Overview

14.2.18. KRATON CORPORATION

14.2.18.1. Company Description

14.2.18.2. Business Overview

14.2.18.3. Financial Overview

14.2.18.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 01: Global Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 02: Global Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 03: Global Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 04: Global Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 05: Global Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 06: Thermoplastic Elastomers Market, Value (US$ Mn) Forecast, by Region, 2020–2031

Table 07: North America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 08: North America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 09: North America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 10: North America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 11: North America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 12: North America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 13: U.S. Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 14: U.S. Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 15: U.S. Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 16: U.S. Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: Canada Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 18: Canada Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 19: Canada Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 20: Canada Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: Europe Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 22: Europe Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 23: Europe Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 24: Europe Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 25: Europe Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 26: Europe Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Germany Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 28: Germany Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 29: Germany Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 30: Germany Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: U.K. Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 32: U.K. Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 33: U.K. Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 34: U.K. Thermoplastic Elastomers Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Austria Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 36: Austria Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 37: Austria Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 38: Austrias Thermoplastic Elastomers Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Russia Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 40: Russia Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 41: Russia Thermoplastic Elastomers Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 42: Russia & CIS Thermoplastic Elastomers Market Value (Kilo Tons) Forecast, by Type, 2020–2031

Table 43: Russia & CIS Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 44: Russia & CIS Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 45: Russia & CIS Thermoplastic Elastomers Market Volume (US$ Mn) Forecast, by Application, 2020–2031

Table 46: Rest of Europe Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 47: Rest of Europe Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 48: Rest of Europe Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 49: Rest of Europe Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 50: Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 51: Asia Pacific Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Country/ Sub-Region and Sub-region, 2020–2031

Table 52: Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 53: Asia Pacific Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 54: Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 55: Asia Pacific Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 56: China Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 57: China Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 58: China Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 59: China Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 60: India Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 61: India Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 62: India Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 63: Japan Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 64: Japan Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 65: Japan Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 66: Japan Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: South Korea Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 68: South Korea Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 69: South Korea Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 70: South Korea Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 71: Rest of Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 72: Rest of Asia Pacific Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 73: Rest of Asia Pacific Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 74: Rest of Asia Pacific Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 75: Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Country/Sub-Region, 2020–2031

Table 76: Middle East & Africa Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2020–2031

Table 77: Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 78: Middle East & Africa Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 79: Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 80: Middle East & Africa Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 81: GCC Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 82: GCC Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 83: GCC Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 84: GCC Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: South Africa Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 86: South Africa Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 87: South Africa Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 88: South Africa Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 89: Rest of Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 90: Rest of Middle East & Africa Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 91: Rest of Middle East & Africa Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 92: Rest of Middle East & Africa Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 93: Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Country/ Sub-Region, 2020–2031

Table 94: Latin America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Country/ Sub-Region , 2020–2031

Table 95: Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 96: Latin America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 97: Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 98: Latin America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 99: Brazil Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 100: Brazil Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 101: Brazil Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 102: Brazil Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 103: Mexico Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 104: Mexico Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 105: Mexico Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 106: Mexico Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 107: Rest of Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 108: Rest of Latin America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 109: Rest of Latin America Thermoplastic Elastomers Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 110: Rest of Latin America Thermoplastic Elastomers Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 01: Global Thermoplastic Elastomers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2021, 2025, and 2031

Figure 02: Price Comparison Analysis, by Type (US$/Tons), 2017

Figure 03: Global Thermoplastic Elastomers Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 04: Global Thermoplastic Elastomers Market Attractiveness Analysis, by Type

Figure 05: Global Thermoplastic Elastomers Market Value Share Analysis, by End-use Industry, 2021, 2025, and 2031

Figure 06: Global Thermoplastic Elastomers Market Attractiveness Analysis, by End-use Industry

Figure 07: Global Thermoplastic Elastomers Market Value Share Analysis by Region, 2021, 2025, and 2031

Figure 08: Global Thermoplastic Elastomers Market Attractiveness Analysis, by Region

Figure 09: North America Thermoplastic Elastomers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2021, 2025, and 2031

Figure 10: North America Thermoplastic Elastomers Market Attractiveness Analysis, by Country

Figure 11: North America Thermoplastic Elastomers Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 12: North America Thermoplastic Elastomers Market Attractiveness Analysis, by Type

Figure 13: North America Thermoplastic Elastomers Market Value Share Analysis, by End-use Industry, 2021, 2025, and 2031

Figure 14: North America Thermoplastic Elastomers Market Attractiveness Analysis, by End-use Industry

Figure 15: North America Thermoplastic Elastomers Market Value Share Analysis, by Country, 2021, 2025, and 2031

Figure 16: Europe Thermoplastic Elastomers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2021, 2025, and 2031

Figure 17: Europe Thermoplastic Elastomers Market Attractiveness Analysis, by Country

Figure 18: Europe Thermoplastic Elastomers Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 19: Europe Thermoplastic Elastomers Market Attractiveness Analysis, by Type

Figure 20: Europe Thermoplastic Elastomers Market Value Share Analysis, by End-use Industry, 2021, 2025, and 2031

Figure 21: Europe Thermoplastic Elastomers Market Attractiveness Analysis, by End-use Industry

Figure 22: Europe Thermoplastic Elastomers Market Value Share Analysis, by Country, 2021, 2025, and 2031

Figure 23: Asia Pacific Thermoplastic Elastomers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2021, 2025, and 2031

Figure 24: Asia Pacific Thermoplastic Elastomers Market Attractiveness Analysis, by Country

Figure 25: Asia Pacific Thermoplastic Elastomers Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 26: Asia Pacific Thermoplastic Elastomers Market Attractiveness Analysis, by Type

Figure 27: Asia Pacific Thermoplastic Elastomers Market Value Share Analysis, by End-use Industry, 2021, 2025, and 2031

Figure 28: Asia Pacific Thermoplastic Elastomers Market Attractiveness Analysis, by End-use Industry

Figure 29: Asia Pacific Thermoplastic Elastomers Market Value Share Analysis, by Country, 2021, 2025, and 2031

Figure 30: Latin America Thermoplastic Elastomers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2021, 2025, and 2031

Figure 31: Latin America Thermoplastic Elastomers Market Attractiveness Analysis, by Country

Figure 32: Latin America Thermoplastic Elastomers Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 33: Latin America Thermoplastic Elastomers Market Attractiveness Analysis, by Type

Figure 34: Latin America Thermoplastic Elastomers Market Value Share Analysis, by End-use Industry, 2021, 2025, and 2031

Figure 35: Latin America Thermoplastic Elastomers Market Attractiveness Analysis, by End-use Industry

Figure 36: Latin America Thermoplastic Elastomers Market Value Share Analysis, by Country, 2021, 2025, and 2031

Figure 37: Middle East & Africa Thermoplastic Elastomers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2021, 2025, and 2031

Figure 38: Middle East & Africa Thermoplastic Elastomers Market Attractiveness Analysis, by Country

Figure 39: Middle East & Africa Thermoplastic Elastomers Market Value Share Analysis, by Type, 2021, 2025, and 2031

Figure 40: Middle East & Africa Thermoplastic Elastomers Market Attractiveness Analysis, by Type

Figure 41: Middle East & Africa Thermoplastic Elastomers Market Value Share Analysis, by End-use Industry, 2021, 2025, and 2031

Figure 42: Middle East & Africa Thermoplastic Elastomers Market Attractiveness Analysis, by End-use Industry

Figure 43: Middle East & Africa Thermoplastic Elastomers Market Value Share Analysis, by Country, 2021, 2025, and 2031

Figure 44: Thermoplastic Elastomers Market Share Analysis, by Company (2021)