Reports

Reports

Key players in the global radiofrequency ablation devices for pain management market are engaged in regulatory approvals, launch of new products, and acquisition & collaborative agreements with other companies. These strategies are likely to fuel the growth of the market. A few expansion strategies adopted by players operating in the global market are:

The report on the global radiofrequency ablation devices for pain management industry discussed individual strategies, followed by company profiles of manufacturers of ablation devices. The competitive landscape section has been included in the report to provide readers with a dashboard view and a company market share analysis of key players operating in the global market.

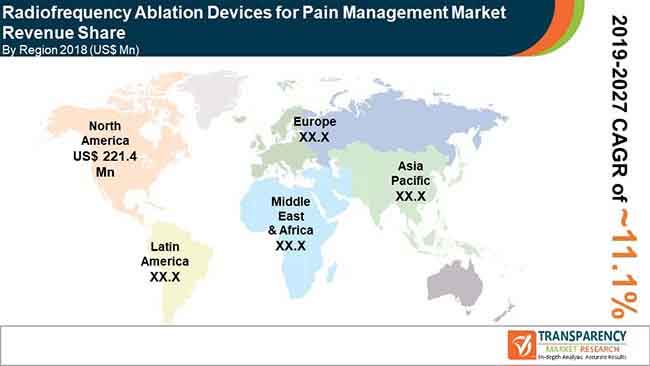

The market is anticipated to expand at a CAGR of 11.1% from 2019 to 2027

The market is driven by increase in prevalence of chronic pain, and rise in demand for minimally invasive procedures

North America accounted for a major share of the global radiofrequency ablation devices for pain management market

Key players in the global market include Boston Scientific Corporation, Diros Technology, Inc., Halyard Health, Inc., Abbott, Stryker Corporation

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: Global Radiofrequency Ablation Devices for Pain Management Market

Chapter 4. Market Overview

4.1. Introduction

4.1.1. Product Overview

4.1.2. Industry Evolution / Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Radiofrequency Ablation Devices for Pain Management Market- Capital Equipment Volume Forecast, By Region

4.4. Global Radiofrequency Ablation Devices for Pain Management Market Outlook

4.5. Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, 2017–2027

Chapter 5. Market Overview

5.1. Global Radiofrequency Ablation Devices for Pain Management Market- Capital Equipment Volume Forecast, By Region

5.2. Porter’s Five Force Analysis

5.3. Value Chain Analysis

5.4. Product Price Analysis

Chapter 6. Global Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecasts, By Product Type

6.1. Key Findings / Developments

6.2. Introduction & Definition

6.3. Market Value Forecast By Product, 2017–2027

6.3.1. RF Generators

6.3.2. Reusable Products

6.3.2.1. Probes

6.3.2.2. Electrodes

6.3.3. Disposable Products

6.3.3.1. Cannulas

6.3.3.2. Needles

6.3.3.3. Single-use Probes and Electrodes

6.4. Market Attractiveness By Product

Chapter 7. Global Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecasts, By End-user

7.1. Key Findings / Developments

7.2. Introduction & Definition

7.3. Market Value Forecast By End-user, 2017–2027

7.3.1. Specialty Clinics

7.3.2. Ambulatory Surgical Centers

7.3.3. Hospitals

7.3.3.1. 500+ Beds

7.3.3.2. 250-499 Beds

7.3.3.3. Less than 250 Beds

7.4. Market Attractiveness By End-user

Chapter 8. Global Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecasts, By Geography/Region

8.1. Geographical Representation

8.2. Market Value Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness By Region

8.4. Key Trends

Chapter 9. North America Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecast

9.1. Market Value Forecast By Country, 2017–2027

9.1.1. U.S.

9.1.2. Canada

9.2. Market Value Forecast By Product, 2017–2027

9.3. Market Value Forecast By End-user, 2017–2027

9.4. Market Attractiveness Analysis

9.4.1. By Country

9.4.2. By Product

9.4.3. By End-user

Chapter 10. Europe Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecast

10.1. Market Value Forecast By Country , 2017–2027

10.1.1. Germany

10.1.2. France

10.1.3. U.K.

10.1.4. Spain

10.1.5. Italy

10.1.6. Rest of Europe

10.2. Market Value Forecast By Product, 2017–2027

10.3. Market Value Forecast By End-user, 2017–2027

10.4. Market Attractiveness Analysis

10.4.1. By Country

10.4.2. By Product

10.4.3. By End-user

Chapter 11. Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecast

11.1. Market Value Forecast By Country , 2017–2027

11.1.1. China

11.1.2. Japan

11.1.3. India

11.1.4. Australia & New Zealand

11.1.5. Rest of APAC

11.2. Market Value Forecast By Product, 2017–2027

11.3. Market Value Forecast By End-user, 2017–2027

11.4. Market Attractiveness Analysis

11.4.1. By Country

11.4.2. By Product

11.4.3. By End-user

Chapter 12. Latin America Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecast

12.1. Market Value Forecast By Country, 2017–2027

12.1.1. Brazil

12.1.2. Mexico

12.1.3. Rest of LATAM

12.2. Market Value Forecast By Product, 2017–2027

12.3. Market Value Forecast By End-user, 2017–2027

12.4. Market Attractiveness Analysis

12.4.1. By Country

12.4.2. By Product

12.4.3. By End-user

Chapter 13. Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Analysis and Forecast

13.1. Market Value Forecast By Country , 2017–2027

13.1.1. GCC Countries

13.1.2. South Africa

13.1.3. Israel

13.1.4. Rest of MEA

13.2. Market Value Forecast By Product, 2017–2027

13.3. Market Value Forecast By End-user, 2017–2027

13.4. Market Attractiveness Analysis

13.4.1. By Country

13.4.2. By Product

13.4.3. By End-user

Chapter 14. Competition Landscape

14.1. Competition Matrix

14.1.1. Boston Scientific Corporation

14.1.2. Abbottt

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.2.1. Boston Scientific Corporation

14.2.1.1. Company Details

14.2.1.2. Company Description

14.2.1.3. Business Overview

14.2.1.4. SWOT Analysis

14.2.1.5. Financial Analysis

14.2.1.6. Strategic Overview

14.2.2. Diros Technology, Inc.

14.2.2.1. Company Details

14.2.2.2. Company Description

14.2.2.3. Business Overview

14.2.2.4. SWOT Analysis

14.2.2.5. Strategic Overview

14.2.3. Halyard Health, Inc. (Avanos Medical, Inc.)

14.2.3.1. Company Details

14.2.3.2. Company Description

14.2.3.3. Business Overview

14.2.3.4. SWOT Analysis

14.2.3.5. Strategic Overview

14.2.4. Abbott

14.2.4.1. Company Details

14.2.4.2. Company Description

14.2.4.3. Business Overview

14.2.4.4. SWOT Analysis

14.2.4.5. Strategic Overview

14.2.5. Stryker Corporation

14.2.5.1. Company Details

14.2.5.2. Company Description

14.2.5.3. Business Overview

14.2.5.4. SWOT Analysis

14.2.5.5. Financial Analysis

14.2.5.6. Strategic Overview

14.2.6. Olympus Corporation

14.2.6.1. Company Details

14.2.6.2. Company Description

14.2.6.3. Business Overview

14.2.6.4. SWOT Analysis

14.2.6.5. Financial Analysis

14.2.6.6. Strategic Overview

14.2.7. Merit Medical Systems

14.2.7.1. Company Details

14.2.7.2. Company Description

14.2.7.3. Business Overview

14.2.7.4. SWOT Analysis

14.2.7.5. Financial Analysis

14.2.7.6. Strategic Overview

14.2.8. Medtronic plc

14.2.8.1. Company Details

14.2.8.2. Company Description

14.2.8.3. Business Overview

14.2.8.4. SWOT Analysis

14.2.8.5. Financial Analysis

14.2.8.6. Strategic Overview

14.2.9. AngioDynamics, Inc.

14.2.9.1. Company Details

14.2.9.2. Company Description

14.2.9.3. Business Overview

14.2.9.4. SWOT Analysis

14.2.9.5. Strategic Overview

List of Tables

Table 01: Global Radiofrequency Ablation Devices for Pain Management- RF Generator (Capital Equipment) Volume (Units) Forecast, By Region, 2017–2027

Table 02: Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 03: Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Reusable Product Type, 2017–2027

Table 04: Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast,

Table 05: Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 06: Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End Users-Hospitals, 2017–2027

Table 07: Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Region, 2017–2027

Table 08: North America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast by Country, 2017–2027

Table 09: North America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 10: North America Radiofrequency Ablation Devices for Pain Management Reusable Market Size (US$ Mn) Forecast, by Reusable Product Type, 2017–2027

Table 11: North America Radiofrequency Ablation Devices for Pain Management Disposable Market Size (US$ Mn) Forecast, by Disposable Product Type, 2017–2027

Table 12: North America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast,

Table 13: North America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast,

Table 14: Europe Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table 15: Europe Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 16: Europe Radiofrequency Ablation Devices for Pain Management Reusable Market Size (US$ Mn) Forecast, by Reusable Product Type, 2017–2027

Table 17: Europe Radiofrequency Ablation Devices for Pain Management Disposable Market Size (US$ Mn) Forecast, by Disposable Product Type, 2017–2027

Table 18: Europe Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 19: Europe Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user-Hospitals, 2017–2027

Table 20: Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table 21: Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 22: Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 23: Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 24: Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 25: Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user-Hospitals, 2017–2027

Table 26: Latin America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table 27: Latin America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 28: Latin America Radiofrequency Ablation Devices for Pain Management Reusable Market Size (US$ Mn) Forecast, by Reusable Product Type, 2017–2027

Table 29: Latin America Radiofrequency Ablation Devices for Pain Management Disposable Market Size (US$ Mn) Forecast, by Disposable Product Type, 2017–2027

Table 30: Latin America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 31: Latin America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 32: Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table 33: Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 34: Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Reusable Product Type, 2017–2027

Table 35: Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by Disposable Product Type, 2017–2027

Table 36: Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-users, 2017–2027

Table 37: Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, by End-user, 2017–2027

List of Figure

Figure 01: Global Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, 2017–2027

Figure 02: Global Radiofrequency Ablation Devices for Pain Management Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 03: Global Radiofrequency Ablation Devices for Pain Management- RF Generators Market Revenue (US$ Mn), 2017–2027

Figure 04: Global Radiofrequency Ablation Devices for Pain Management - Reusable Products Market Revenue (US$ Mn), 2017–2027

Figure 05: Global Radiofrequency Ablation Devices for Pain Management - Disposable Products Market Revenue (US$ Mn), 2017–2027

Figure 06: Global Radiofrequency Ablation Devices for Pain Management - Probes Market Revenue (US$ Mn), 2017–2027

Figure 07: Global Radiofrequency Ablation Devices for Pain Management - Electrodes Market Revenue (US$ Mn), 2017–2027

Figure 08: Global Radiofrequency Ablation Devices for Pain Management - Cannulas Market Revenue (US$ Mn), 2017–2027

Figure 09: Global Radiofrequency Ablation Devices for Pain Management - Needles Market Revenue (US$ Mn), 2017–2027

Figure 10: Global Radiofrequency Ablation Devices for Pain Management Market - Single-use Probes and Electrodes Revenue (US$ Mn), 2017–2027

Figure 11: Global Radiofrequency Ablation Devices for Pain Management Market Attractiveness Analysis, by Product Type, 2017–2027

Figure 12: Global Radiofrequency Ablation Devices for Pain Management Market Value Share Analysis, by End-user, 2018 and 2027

Figure 13: Global Hospitals Market Revenue (US$ Mn), 2017–2027

Figure 14: Global ASCs Market Revenue (US$ Mn), 2017–2027

Figure 15: Global Clinics Market Revenue (US$ Mn), 2017–2027

Figure 16: Global Hospitals with 500+ Beds Market

Figure 17: Global Hospitals with 250-499 Beds

Figure 18: Global Hospitals with less than 250 Beds Market Revenue (US$ Mn, 2017–2027

Figure 19: Global Radiofrequency Ablation Devices for Pain Management Market Attractiveness Analysis, by End-user, 2019–2027

Figure 20: Global Radiofrequency Ablation Devices for Pain Management Market Value Share Analysis, by Region, 2018 and 2027

Figure 21: Global Radiofrequency Ablation Devices for Pain Management Market Attractiveness Analysis, by Region, 2017–2027

Figure 22: North America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, 2017–2027

Figure 23: North America Market Attractiveness Analysis,

Figure 24: North America Market Value Share Analysis, by Country, 2018 and 2027

Figure 25: North America Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 26: North America Market Value Share Analysis, by End-user, 2018 and 2027

Figure 27: North America Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 28: North America Market Attractiveness Analysis, by End-user, 2019–2027

Figure 29: Europe Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, 2017–2027

Figure 30: Europe Market Attractiveness Analysis, by Country, 2019-2027

Figure 31: Europe Market Value Share Analysis, by Country,

Figure 32: Europe Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 33: Europe Market Value Share Analysis, by End-user, 2018 and 2027

Figure 34: Europe Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 35: Europe Market Attractiveness Analysis, by End-user, 2019–2027

Figure 36: Asia Pacific Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, 2017–2027

Figure 37: Asia Pacific Market Attractiveness Analysis, by Country 2019-2027

Figure 38: Asia Pacific Market Value Share Analysis, by Country, 2018 and 2027

Figure 39: Asia Pacific Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 40: Asia Pacific Market Value Share Analysis, by End-user, 2018 and 2027

Figure 41: Asia Pacific Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 42: Asia Pacific Market Attractiveness Analysis, by End-user, 2019–2027

Figure 43: Latin America Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, 2017–2027

Figure 44: Latin America Market Attractiveness Analysis,

Figure 45: Latin America Market Value Share Analysis, by Country, 2018 and 2027

Figure 46: Latin America Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 47: Latin America Market Value Share Analysis, by End-user, 2018 and 2027

Figure 48: Latin America Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 49: Latin America Market Attractiveness Analysis, by End-user, 2019–2027

Figure 50: Middle East & Africa Radiofrequency Ablation Devices for Pain Management Market Size (US$ Mn) Forecast, 2017–2027

Figure 51: Middle East & Africa Market Attractiveness Analysis, by Country, 2019–2027

Figure 52: Middle East & Africa Market Value Share Analysis,

Figure 53: Middle East & Africa Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 54: Middle East & Africa Market Value Share Analysis, by End-users, 2018 and 2027

Figure 55: Middle East & Africa Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 56: Middle East & Africa Market Attractiveness Analysis, by End-user, 2019–2027

Figure 57: Global Radiofrequency Ablation Devices for Pain Management Market Share Analysis, By Company, 2018

Figure 58: Boston Scientific Corporation Breakdown of Net Sales, by Geography 2018

Figure 59: Boston Scientific Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 60: Halyard Health, Inc. Breakdown of Net Sales, by Region, 2018

Figure 61: Halyard Health, Inc. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

Figure 62: St. Jude Medical, Inc. Breakdown of Net Sales, by Region, 2018

Figure 63: St. Jude Medical, Inc. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

Figure 64: Stryker Corporation Breakdown of Net Sales, by Region 2018

Figure 65: Stryker Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018