German-engineered Emma mattresses are acquiring prominence in Indian hospital care settings due to rampant growth in the COVID-19 (coronavirus) cases. Thus, companies in the global pressure relief devices market should take a step forward to make a difference amidst the fallout of the pandemic and provide financial support to healthcare facilities in resource-deprived organizations. As such, pressure relief device manufacturers are capitalizing on revenue opportunities, since most COVID-19 patients are bedridden.

Non-governmental organizations (NGOs) are taking a step forward to facilitate hospitals with foam-based mattresses to prevent pressure injuries in COVID-19 patients. These NGOs are also supplying essentials such as medicines, clothing, and personal protective equipment (PPE) to care providers. Thus, pressure relief device manufacturers should collaborate with NGOs to supply hospitals with therapeutic beds and pressure relief mattresses to improve outcomes in patients, and increase their share of the pressure relief devices market.

To know the scope of our report Get a Sample on Pressure Relief Devices Market

Therapeutic foam mattresses are amongst some of the most popular pressure relief devices that are creating stable revenue streams for manufacturers. Online portals are reviewing the best foam-based mattresses, which help to boost the credibility credentials of manufacturers in the pressure relief devices market. This is due to mattresses being one of the integral factors providing comfort and support to patients who are bedridden for prolonged periods in hospitals and rehabilitation centers. As such, the COVID-19 pandemic has also been a key driver to fuel the demand for pressure relief devices and other products in order to support patients while in bed.

The demand for pressure ulcer care hospital bed mattresses is surging in the pressure relief devices market. This explains why the market is projected to advance at a high CAGR during the assessment period. Thus, companies are tapping into incremental opportunities via online sales to increase the uptake of therapeutic foam mattresses.

Automated beds are making into the list of high-tech devices used for the prevention of pressure ulcers in patients with moving disability, as bed sores are one of the most unnoticed medical problems in patients with moving disabilities. These sores are analyzed with multimodal sensors and with the help of 3D (3 Dimensional) imaging to determine the best pressure relief devices for patients. However, bed sores cannot be healed at once, which poses as a challenge for healthcare professionals. Hence, companies in the pressure relief devices market are creating awareness in care providers to timely change the posture of the patient to improve patient quality of life.

Get a glimpse of the in-depth analysis through our Report Brochure

Companies in the pressure relief devices market are innovating in automated beds with pressurized tubes that inflate with very low displacement. Thus, moving or turning the patient is the key to prevent incidences of bed sores in patients.

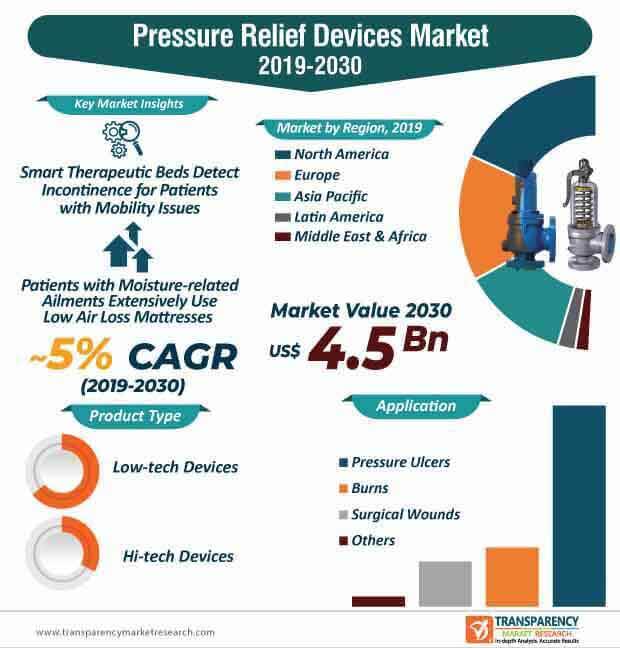

Air fluidized therapy beds are a novel introduction in the pressure relief devices market. Hillrom-a company driven for patient-centered care, is increasing its marketing efforts to publicize their Envella® Air Fluidized Therapy (AFT) Bed, which helps to speed up wound healing. Such innovations are contributing toward the exponential revenue growth of the market, which is predicted to reach a value of US$ 4.54 Bn by the end of 2030.

Patients with complex wounds need elevated care. Hence, companies in the pressure relief devices market are increasing their R&D capabilities to drive innovations in air fluidized therapy beds, which help to enhance outcomes in high-acuity wound cases. Accelerating pressure injury healing is one of the key advantages of air fluidized therapy beds.

Low air loss mattresses are growing popular among patients with moisture-related ailments. For instance, patients who sweat excessively or are subject to maceration increasingly prefer low air loss mattresses. Companies in the pressure relief devices market are increasing their research efforts to develop healthcare mattresses with tiny holes in air cells, which allows cool air to pass through, whilst managing the microclimate heat and moisture.

On the other hand, manufacturers in the pressure relief devices market are increasing their production capabilities to produce alternating pressure air mattresses for patients who suffer from pressure ulcers and bed sores. The uptake for alternating pressure air mattresses is surging as a result of its advantageous attributes of improving blood flow and healing process in patients. Moreover, the inflation and deflation process of alternating pressure air mattresses help to alleviate pain at pressure points, whilst preventing skin breakdown.

Cutting edge, smart therapeutic beds are generating value-grab opportunities for companies in the pressure relief devices market. Since life-altering health events result in exorbitant costs for individuals, healthcare providers are offering comprehensive solutions to patients, which involve pressure relief devices and other therapeutic solutions. Smart therapeutic beds prevent pressure injury and continuously monitor the heart rate and respiratory activities of patients. Value-added features in smart therapeutic beds are benefitting patients with mobility issues, since these beds can even detect incontinence.

On the other hand, alternating overlay mattresses and low air loss mattresses are being highly publicized in the pressure relief devices market. Low air loss mattress overlay systems are revolutionizing the overlay market, owing to their advantages of optimal care and comfort. These overlay systems are being made from high-grade material to provide efficient skin protection.

Expanding operations in future? To get the perfect launch ask for a custom report

Analysts’ Viewpoint

Companies in the pressure relief devices market are tapping opportunities in disposable mattresses used in COVID-19 care centers and isolation wards. They are innovating in alternating pressure overly systems powered with alternating pressure cycles. However, manufacturers need to adhere to stringent safety standards such as integrating safety base and cell-on-cell designs in air mattresses. Manufacturers should comply with safety requirements in pressure relief devices such as introducing firm perimeters in mattresses to prevent incidence of rollout falls. Low air loss mattresses and air fluidized therapeutic beds are generating incremental opportunities for pressure relief devices manufacturers, owing to their popularity among patients with moisture-related ailments.

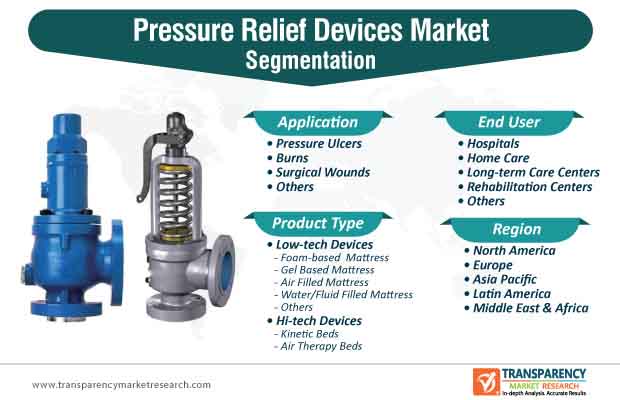

Pressure Relief Devices Market – Segmentation

|

Product Type |

Low-tech Devices

Hi-tech Devices

|

|

Application |

|

|

End User |

|

|

Region |

|

Pressure relief devices market to reach valuation of US$ 4.54 Bn by 2030

Pressure relief devices market is driven by rise in geriatric & obese populations and increase in incidence of chronic diseases

North America dominated the global pressure relief devices market and the trend is expected to continue during the forecast period

The end-use segments in pressure relief devices market are hospitals, home care, long term care centers, rehabilitation centers

Key players in the global pressure relief devices market are Stryker Corporation, Hill-Rom Holdings, Inc., Invacare Corporation, Arjo, 3M

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pressure Relief Devices Market

4. Market Overview

4.1. Definition

4.2. Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Pressure Relief Devices Market Value (US$ Mn) Forecast, 2018–2030

4.5. Global Pressure Relief Devices Market Outlook

5. Key Insights

5.1. Key Mergers and Acquisitions

5.2. Technological Advancements

5.3. Pricing Analysis

5.4. Reimbursement Scenario for Key Countries

5.5. Major Distributors Analysis by Region

5.6. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Pressure Relief Devices Market Analysis and Forecast, by Product Type

6.1. Introduction

6.2. Global Pressure Relief Devices Market Value Share (%) Analysis, by Product Type

6.3. Global Pressure Relief Devices Market Value Forecast, by Product Type, 2018–2030

6.4. Global Pressure Relief Devices Market Volume Forecast, by Product Type, 2018–2030

6.4.1. Low-tech Devices

6.4.1.1. Foam-based Mattress

6.4.1.2. Gel Filled Mattress

6.4.1.3. Air Filled Mattress

6.4.1.4. Water/Fluid Filled Mattress

6.4.1.5. Others

6.4.2. Hi-tech Devices

6.4.2.1. Kinetic Beds

6.4.2.2. Air Therapy Beds

6.5. Global Pressure Relief Devices Market Attractiveness Analysis, by Product Type

7. Global Pressure Relief Devices Market Analysis and Forecast, by Application

7.1. Introduction

7.2. Global Pressure Relief Devices Market Value Share (%) Analysis, by Application

7.3. Global Pressure Relief Devices Market Value Forecast, by Application, 2018–2030

7.3.1. Pressure Ulcers

7.3.2. Burns

7.3.3. Surgical Wounds

7.3.4. Others

7.4. Global Pressure Relief Devices Market Attractiveness Analysis, by Application

8. Global Pressure Relief Devices Market Analysis and Forecast, by End-user

8.1. Introduction

8.2. Global Pressure Relief Devices Market Value Share (%) Analysis, by End-user

8.3. Global Pressure Relief Devices Market Value Forecast, by End-user, 2018–2030

8.3.1. Hospitals

8.3.2. Home Care

8.3.3. Long-term Centers

8.3.4. Rehabilitation Centers

8.3.5. Others

8.4. Global Pressure Relief Devices Market Attractiveness Analysis, by End-user

9. Global Pressure Relief Devices Market Analysis and Forecast, by Region

9.1. Regional Outlook

9.2. Introduction

9.3. Global Pressure Relief Devices Market Value Forecast, by Region

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East & Africa

9.4. Global Pressure Relief Devices Market Attractiveness Analysis, by Region

10. North America Pressure Relief Devices Market Analysis and Forecast

10.1. Key Findings

10.2. North America Pressure Relief Devices Market Value and Volume Forecast, by Product Type, 2018–2030

10.2.1. Low-tech Devices

10.2.1.1. Foam-based Mattress

10.2.1.2. Gel Filled Mattress

10.2.1.3. Air Filled Mattress

10.2.1.4. Water/Fluid Filled Mattress

10.2.1.5. Others

10.2.2. Hi-tech Devices

10.2.2.1. Kinetic Beds

10.2.2.2. Air Therapy Beds

10.3. North America Pressure Relief Devices Market Value Forecast, by Application, 2018–2030

10.3.1. Pressure Ulcers

10.3.2. Burns

10.3.3. Surgical Wounds

10.3.4. Others

10.4. North America Pressure Relief Devices Market Value Forecast, by End-user, 2018–2030

10.4.1. Hospitals

10.4.2. Homecare

10.4.3. Long Term Centers

10.4.4. Rehabilitation Centers

10.4.5. Others

10.5. North America Pressure Relief Devices Market Value Forecast, by Country, 2018–2030

10.5.1. U.S.

10.5.2. Canada

10.6. North America Pressure Relief Devices Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Pressure Relief Devices Market Analysis and Forecast

11.1. Key Findings

11.2. Europe Pressure Relief Devices Market Value and Volume Forecast, by Product Type, 2018–2030

11.2.1. Low-tech Devices

11.2.1.1. Foam-based Mattress

11.2.1.2. Gel Filled Mattress

11.2.1.3. Air Filled Mattress

11.2.1.4. Water/Fluid Filled Mattress

11.2.1.5. Others

11.2.2. Hi-tech Devices

11.2.2.1. Kinetic Beds

11.2.2.2. Air Therapy Beds

11.3. Europe Pressure Relief Devices Market Value Forecast, by Application, 2018–2030

11.3.1. Pressure Ulcers

11.3.2. Burns

11.3.3. Surgical Wounds

11.3.4. Others

11.4. Europe Pressure Relief Devices Market Value Forecast, by End-user, 2018–2030

11.4.1. Hospitals

11.4.2. Homecare

11.4.3. Long Term Centers

11.4.4. Rehabilitation Centers

11.4.5. Others

11.5. Europe Pressure Relief Devices Market Value Forecast, by Country/Sub-region, 2018–2030

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Europe Pressure Relief Devices Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Pressure Relief Devices Market Analysis and Forecast

12.1. Key Findings

12.2. Asia Pacific Pressure Relief Devices Market Value and Volume Forecast, by Product Type, 2018–2030

12.2.1. Low-tech Devices

12.2.1.1. Foam-based Mattress

12.2.1.2. Gel Filled Mattress

12.2.1.3. Air Filled Mattress

12.2.1.4. Water/Fluid Filled Mattress

12.2.1.5. Others

12.2.2. Hi-tech Devices

12.2.2.1. Kinetic Beds

12.2.2.2. Air Therapy Beds

12.3. Asia Pacific Pressure Relief Devices Market Value Forecast, by Application, 2018–2030

12.3.1. Pressure Ulcers

12.3.2. Burns

12.3.3. Surgical Wounds

12.3.4. Others

12.4. Asia Pacific Pressure Relief Devices Market Value Forecast, by End-user, 2018–2030

12.4.1. Hospitals

12.4.2. Homecare

12.4.3. Long Term Centers

12.4.4. Rehabilitation Centers

12.4.5. Others

12.5. Asia Pacific Pressure Relief Devices Market Value Forecast, by Country/Sub-region, 2018–2030

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Pressure Relief Devices Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Pressure Relief Devices Market Analysis and Forecast

13.1. Key Findings

13.2. Latin America Pressure Relief Devices Market Value and Volume Forecast, by Product Type, 2018–2030

13.2.1. Low-tech Devices

13.2.1.1. Foam-based Mattress

13.2.1.2. Gel Filled Mattress

13.2.1.3. Air Filled Mattress

13.2.1.4. Water/Fluid Filled Mattress

13.2.1.5. Others

13.2.2. Hi-tech Devices

13.2.2.1. Kinetic Beds

13.2.2.2. Air Therapy Beds

13.3. Latin Pressure Relief Devices Market Value Forecast, by Application, 2018–2030

13.3.1. Pressure Ulcers

13.3.2. Burns

13.3.3. Surgical Wounds

13.3.4. Others

13.4. Latin America Pressure Relief Devices Market Value Forecast, by End-user, 2018–2030

13.4.1. Hospitals

13.4.2. Homecare

13.4.3. Long Term Centers

13.4.4. Rehabilitation Centers

13.4.5. Others

13.5. Latin America Pressure Relief Devices Market Value Forecast, by Country/Sub-region, 2018–2030

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Pressure Relief Devices Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Pressure Relief Devices Market Analysis and Forecast

14.1. Key Findings

14.2. Middle East & Africa Pressure Relief Devices Market Value and Volume Forecast, by Product Type, 2018–2030

14.2.1. Low-tech Devices

14.2.1.1. Foam-based Mattress

14.2.1.2. Gel Filled Mattress

14.2.1.3. Air Filled Mattress

14.2.1.4. Water/Fluid Filled Mattress

14.2.1.5. Others

14.2.2. Hi-tech Devices

14.2.2.1. Kinetic Beds

14.2.2.2. Air Therapy Beds

14.3. Middle East & Africa Pressure Relief Devices Market Value Forecast, by Application, 2018–2030

14.3.1. Pressure Ulcers

14.3.2. Burns

14.3.3. Surgical Wounds

14.3.4. Others

14.4. Middle East & Africa Pressure Relief Devices Market Value Forecast, by End-user, 2018–2030

14.4.1. Hospitals

14.4.2. Homecare

14.4.3. Long Term Centers

14.4.4. Rehabilitation Centers

14.4.5. Others

14.5. Middle East & Africa Pressure Relief Devices Market Value Forecast, by Country/Sub-region, 2018–2030

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Pressure Relief Devices Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2019

15.3. Company Profiles

15.3.1. Stryker Corporation

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. Hill-Rom Holdings, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Strategic Overview

15.3.2.5. SWOT Analysis

15.3.3. Invacare Corporation

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. Arjo

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Strategic Overview

15.3.4.5. SWOT Analysis

15.3.5. 3M

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Paramount Bed Co., Ltd.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. 5 Minds Mobility

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Strategic Overview

15.3.7.5. SWOT Analysis

15.3.8. Rober Limited

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Strategic Overview

15.3.8.5. SWOT Analysis

15.3.9. Thomashilfen.us.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

List of Tables

Table 01: Global Pressure Relief Devices Market Size (US$ Mn) Forecast, by Product, 2018–2030

Table 02: Global Pressure Relief Devices Market Volume (Units) Forecast, by Product, 2018–2030

Table 03: Global Pressure Relief Devices Market Size (US$ Mn) Forecast, by Low-tech Devices, 2018–2030

Table 04: Global Pressure Relief Devices Market Volume (Units) Forecast, by Low-tech Devices, 2018–2030

Table 05: Global Pressure Relief Devices Market Size (US$ Mn) Forecast, by Hi-tech Devices, 2018–2030

Table 06: Global Pressure Relief Devices Market Volume (Units) Forecast, by Hi-tech Devices, 2018–2030

Table 07: Global Pressure Relief Devices Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 08: Global Pressure Relief Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 09: Global Pressure Relief Devices Market Value (US$ Mn) Forecast, by Region , 2018–2030

Table 10: North America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 11: North America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 12: North America Pressure Relief Devices Market Volume (Units) Forecast, by Product, 2018–2030

Table 13: North America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Low-tech Devices, 2018–2030

Table 14: North America Pressure Relief Devices Market Volume (Units) Forecast, by Low-tech Devices, 2018–2030

Table 15: North America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Hi-tech Devices, 2018–2030

Table 16: North America Pressure Relief Devices Market Volume (Units) Forecast, by Hi-tech Devices, 2018–2030

Table 17: North America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 18: North America Pressure Relief Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 19: Europe Pressure Relief Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 20: Europe Pressure Relief Devices Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 21: Europe Pressure Relief Devices Market Volume (Units) Forecast, by Product, 2018–2030

Table 22: Europe Pressure Relief Devices Market Value (US$ Mn) Forecast, by Low-tech Devices, 2018–2030

Table 23: Europe Pressure Relief Devices Market Volume (Units) Forecast, by Low-tech Devices, 2018–2030

Table 24: Europe Pressure Relief Devices Market Value (US$ Mn) Forecast, by Hi-tech Devices, 2018–2030

Table 25: Europe Pressure Relief Devices Market Volume (Units) Forecast, by Hi-tech Devices, 2018–2030

Table 26: Europe Pressure Relief Devices Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 27: Europe Pressure Relief Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 28: Asia Pacific Pressure Relief Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 29: Asia Pacific Pressure Relief Devices Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 30: Asia Pacific Pressure Relief Devices Market Volume (Units) Forecast, by Product, 2018–2030

Table 31: Asia Pacific Pressure Relief Devices Market Value (US$ Mn) Forecast, by Low-tech Devices, 2018–2030

Table 32: Asia Pacific Pressure Relief Devices Market Volume (Units) Forecast, by Low-tech Devices, 2018–2030

Table 33: Asia Pacific Pressure Relief Devices Market Value (US$ Mn) Forecast, by Hi-tech Devices, 2018–2030

Table 34: Asia Pacific Pressure Relief Devices Market Volume (Units) Forecast, by Hi-tech Devices, 2018–2030

Table 35: Asia Pacific Pressure Relief Devices Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 36: Asia Pacific Pressure Relief Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 37: Latin America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 38: Latin America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 39: Latin America Pressure Relief Devices Market Volume (Units) Forecast, by Product, 2018–2030

Table 40: Latin America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Low-tech Devices, 2018–2030

Table 41: Latin America Pressure Relief Devices Market Volume (Units) Forecast, by Low-tech Devices, 2018–2030

Table 42: Latin America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Hi-tech Devices, 2018–2030

Table 43: Latin America Pressure Relief Devices Market Volume (Units) Forecast, by Hi-tech Devices, 2018–2030

Table 44: Latin America Pressure Relief Devices Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 45: Latin America Pressure Relief Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 46: Middle East & Africa Pressure Relief Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 47: Middle East & Africa Pressure Relief Devices Market Value (US$ Mn) Forecast, by Product, 2018–2030

Table 48: Middle East & Africa Pressure Relief Devices Market Volume (Units) Forecast, by Product, 2018–2030

Table 49: Middle East & Africa Pressure Relief Devices Market Value (US$ Mn) Forecast, by Low-tech Devices, 2018–2030

Table 50: Middle East & Africa Pressure Relief Devices Market Volume (Units) Forecast, by Low-tech Devices, 2018–2030

Table 51: Middle East & Africa Pressure Relief Devices Market Value (US$ Mn) Forecast, by Hi-tech Devices, 2018–2030

Table 52: Middle East & Africa Pressure Relief Devices Market Volume (Units) Forecast, by Hi-tech Devices, 2018–2030

Table 53: Middle East & Africa Pressure Relief Devices Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 54: Middle East & Africa Pressure Relief Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2030

List of Figures

Figure 01: Global Pressure Relief Devices Market Value (US$ Mn) Forecast, 2018–2030

Figure 02: Global Pressure Relief Devices Market Value Share (%), by Product, 2019

Figure 03: Global Pressure Relief Devices Market Value Share (%), by Application, 2019

Figure 04: Global Pressure Relief Devices Market Value Share (%), by End-user, 2019

Figure 05: Global Pressure Relief Devices Market Value Share (%), by Region, 2019

Figure 06: Global Pressure Relief Devices Market Value Share (%) Analysis, by Product, 2019 and 2030

Figure 07: Global Pressure Relief Devices Market Attractiveness Analysis, by Product, 2020–2030

Figure 08: Global Pressure Relief Devices Market Revenue (US$ Mn), by Low-tech Devices, 2018–2030

Figure 09: Global Pressure Relief Devices Market Revenue (US$ Mn), by Hi-tech Devices, 2018–2030

Figure 10: Global Pressure Relief Devices Market Value Share (%) Analysis, by Application, 2019 and 2030

Figure 11: Global Pressure Relief Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 12: Global Pressure Relief Devices Market Revenue (US$ Mn), by Pressure Ulcers, 2018–2030

Figure 13: Global Pressure Relief Devices Market Revenue (US$ Mn), by Burns, 2018–2030

Figure 14: Global Pressure Relief Devices Market Revenue (US$ Mn), by Surgical Wounds, 2018–2030

Figure 15: Global Pressure Relief Devices Market Revenue (US$ Mn), by Others, 2018–2030

Figure 16: Global Pressure Relief Devices Market Value Share (%) Analysis, by End-user, 2019 and 2030

Figure 17: Global Pressure Relief Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 18: Global Pressure Relief Devices Market Revenue (US$ Mn), by Hospitals, 2018–2030

Figure 19: Global Pressure Relief Devices Market Revenue (US$ Mn), by Home Care, 2018–2030

Figure 20: Global Pressure Relief Devices Market Revenue (US$ Mn), by Long-term Care Centers, 2018–2030

Figure 21: Global Pressure Relief Devices Market Revenue (US$ Mn), by Rehabilitation Centers, 2018–2030

Figure 22: Global Pressure Relief Devices Market Revenue (US$ Mn), by Others, 2018–2030

Figure 23: Global Pressure Relief Devices Market Value Share (%) Analysis, by Region, 2019 and 2030

Figure 24: Global Pressure Relief Devices Market Attractiveness Analysis, by Region, 2020–2030

Figure 25: North America Pressure Relief Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 26: North America Pressure Relief Devices Market Value Share (%), by Country/Sub-region, 2019–2030

Figure 27: North America Pressure Relief Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2030

Figure 28: North America Pressure Relief Devices Market Value Share (%) Analysis, by Product, 2019 and 2030

Figure 29: North America Pressure Relief Device Market Attractiveness Analysis, by Product, 2019–2030

Figure 30: North America Pressure Relief Devices Market Value Share (%) (%) Analysis, by Application, 2019 and 2030

Figure 31: North America Pressure Relief Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 32: North America Pressure Relief Devices Market Value Share (%) (%) Analysis, by End-user, 2019 and 2030

Figure 33: North America Pressure Relief Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 34: Europe Pressure Relief Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 35: Europe Pressure Relief Devices Market Value Share (%), by Country/Sub-region, 2019–2030

Figure 36: Europe Pressure Relief Devices Market Attractiveness, by Country/Sub-region, 2019–2030

Figure 37: Europe Pressure Relief Devices Market Value Share (%) Analysis, by Product, 2019 and 2030

Figure 38: Europe Pressure Relief Devices Market Attractiveness Analysis, by Product, 2019–2030

Figure 39: Europe Pressure Relief Devices Market Value Share (%) (%) Analysis, by Application, 2019 and 2030

Figure 40: Europe Pressure Relief Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 41: Europe Pressure Relief Devices Market Value Share (%) (%) Analysis, by End-user, 2019 and 2030

Figure 42: Europe Pressure Relief Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 43: Asia Pacific Pressure Relief Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 44: Asia Pacific Pressure Relief Devices Market Value Share (%) Analysis, by Country/Sub-region, 2019–2030

Figure 45: Asia Pacific Pressure Relief Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2030

Figure 46: Asia Pacific Pressure Relief Devices Market Value Share (%) Analysis, by Product, 2019 and 2030

Figure 47: Asia-Pacific Pressure Relief Devices Market Attractiveness Analysis, by Product, 2019–2030

Figure 48: Asia Pacific Pressure Relief Devices Market Value Share (%) (%)Analysis, by Application, 2019 and 2030

Figure 49: Asia Pacific Pressure Relief Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 50: Asia Pacific Pressure Relief Devices Market Value Share (%) (%)Analysis, by End-user, 2019 and 2030

Figure 51: Asia Pacific Pressure Relief Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 52: Latin America Pressure Relief Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 53: Latin America Pressure Relief Devices Market Value Share (%) Analysis, by Country/Sub-region, 2019–2030

Figure 54: Latin America Pressure Relief Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2030

Figure 55: Latin America Pressure Relief Devices Market Value Share (%) Analysis , by Product, 2019 and 2030

Figure 56: Latin America Pressure Relief Devices Market Attractiveness Analysis, by Product, 2019–2030

Figure 57: Latin America Pressure Relief Devices Market Value Share (%) (%) Analysis, by Application, 2019 and 2030

Figure 58: Latin America Pressure Relief Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 59: Latin America Pressure Relief Devices Market Value Share (%) (%) Analysis, by End-user, 2019 and 2030

Figure 60: Latin America Pressure Relief Devices Market Attractiveness Analysis, by End-user, 2020–2030

Figure 61: Middle East & Africa Pressure Relief Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 62: Middle East & Africa Pressure Relief Devices Market Value Share (%) Analysis, by Country/Sub-region, 2019–2030

Figure 63: Middle East & Africa Pressure Relief Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2030

Figure 64: Middle East & Africa Pressure Relief Devices Market Value Share (%) Analysis, by Product, 2019 and 2030

Figure 65: Middle East & Africa Pressure Relief Devices Market Attractiveness Analysis, by Product, 2019–2030

Figure 66: Middle East & Africa Pressure Relief Devices Market Value Share (%) (%)Analysis, by Application, 2019 and 2030

Figure 67: Middle East & Africa Pressure Relief Devices Market Attractiveness Analysis, by Application, 2020–2030

Figure 68: Middle East & Africa Pressure Relief Devices Market Value Share (%) (%) Analysis, by End-user, 2019 and 2030

Figure 69: Middle East & Africa Pressure Relief Devices Market Attractiveness Analysis, by End-user, 2020–2030