Within the past couple of decades, the healthcare sector has witnessed advancements and innovations. Research and development activities continue to bring to the fore new medications, therapies, and treatments. However, despite these advancements, unmet clinical requirements to treat degenerative conditions and orthopedic injuries continue to pose a major challenge for healthcare systems across the world. Advancements in bio implant engineering have paved the way for several biological alternatives that are aimed at retaining, modifying, and restoring the functionalities of different organs. Moreover, rapid progress in the material technology has enabled the deployment of an array of materials for implant applications.

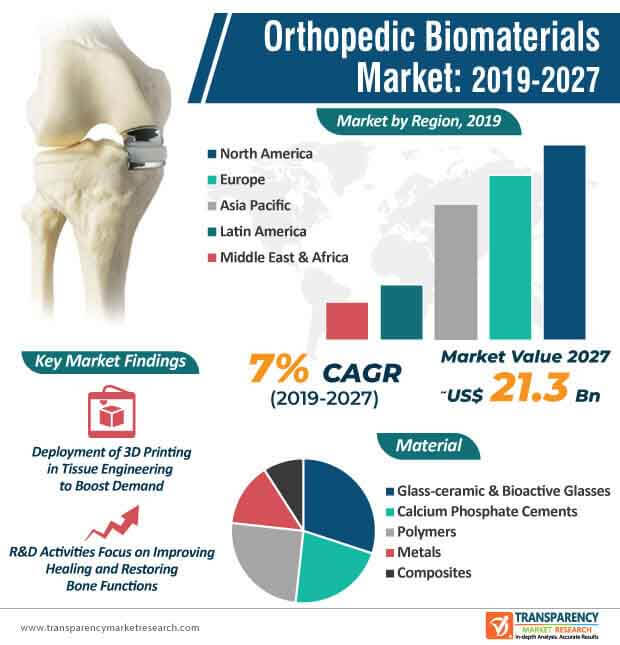

Orthopedic biomaterials are increasingly being used for joint replacements, ortho biologics, spine implants, and bio-resorbable tissue fixation, among others. The demand for orthopedic biomaterials is expected to witness considerable growth during the forecast period (2019-2027), due to a range of factors. Some of the leading factors that are expected to steer the global orthopedic biomaterials market past US$ 21.3 Bn mark include exponential rise in aging population, shift toward nanophase materials from conventional materials, and growing adoption of 3D printed orthopedic implants. Stakeholders in the current orthopedic biomaterials market landscape are likely to focus on improving designs of nanophase materials to improve reliability and functionalities of implants.

To know the scope of our report Get a Sample on Orthopedic Biomaterials Market

Advancement in the 3D printing technology is expected to create a strong impact on the orthopedic biomaterials market during the forecast period, as stakeholders continue to explore its potential for tissue engineering. 3D printed implants, smart biomaterials, and porous structures are some of the trends one can expect within the orthopedic biomaterials market during the forecast period. These advancements in the orthopedic biomaterial market are anticipated to play a key role in the development of implants with improved functionalities. Although the commercialization of these orthopedic biomaterials was a major challenge for a considerable time period, at present, the adoption of orthopedic biomaterials is on the rise. Furthermore, due to drawbacks of conventional orthopedic biomaterials, including quality, implant life, and cost of the treatment, demand for advanced orthopedic biomaterials is projected to grow at a healthy pace during the assessment period, thus driving the orthopedic biomaterials market.

Get a glimpse of the in-depth analysis through our Report Brochure

At present, the application of 3D printing within the tissue engineering and regenerative medicine field are bound by the choice of biomaterials, and research and development activities are expected to change the narrative in the coming years. Research and development activities are paving the way for new biomaterials that can be utilized in 3D printing techniques. The advent of 3D printing is expected to significantly boost the demand for orthopedic biomaterials, owing to the advantages associated with fabricating scaffolds. Some of the major benefits offered by 3D printing in the orthopedic biomaterial market include improved capability to develop complex geometries, co-culture of numerous cells, and most importantly integrate growth factors. At present, composites, polymers, and ceramics are some of the orthopedic biomaterials that are increasingly being used in biomaterial 3D printing.

In the past few years, there have been significant innovations in the regenerative medicines space due to the benefits of biomaterials. At present, biomaterial-based tissue engineering strategies are offering promising results due to which the demand for such ‘smart’ biomaterials is expected to witness substantial growth. Staggering developments as far as stem-cell-based techniques are concerned to have gradually opened the door for new and effective solutions to treat a range of diseases. In the current scenario, owing to the progress in nanotechnology, both natural as well as artificial biomaterials can be deployed to produce 3D scaffolds. Stakeholders in the current orthopedic biomaterials market are seeking solutions to improve the integration of implants made from orthopedic biomaterials. Research and development activities are focusing on finding new techniques wherein orthopedic biomaterials can be used to enhance healing and restoring different physiological functions of the bone. Modern-day bone tissue engineering techniques have largely benefitted from the use of biomaterials to create 3D biodegradable and porous bioactive scaffolds.

Expanding operations in future? To get the perfect launch ask for a custom report

Analysts’ Viewpoint

The global orthopedic biomaterials market is expected to grow at a healthy CAGR of ~7% during the forecast period. The market growth can be largely attributed to the ascending demand for orthopedic implants, surge in the number of sports-related injuries, noteworthy advancements in technology, and growth in the number of research and development activities. Moreover, advancements in nanotechnology coupled with progress in the 3D printing space are expected to increase the demand for orthopedic biomaterials for tissue engineering. Despite facing a few hurdles while commercializing orthopedic biomaterials, since then the demand has moved in an upward trajectory. Research & development activities will play an imperative role in improving the functionalities of orthopedic biomaterials, which in turn will drive the orthopedic biomaterials market.

Orthopedic Biomaterials Market: Overview

Orthopedic Biomaterials Market: Drivers

Market Segmentation: Orthopedic Biomaterials Market

Regional Overview: Orthopedic Biomaterials Market

Major Players

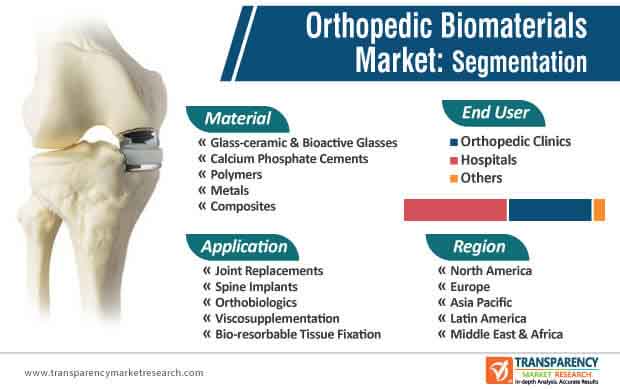

Orthopedic Biomaterials Market – Segmentation

|

Material |

Glass-ceramic & Bioactive Glasses Calcium Phosphate Cements Polymers Composites |

|

Application |

Joint Replacements Spine Implants Orthobiologics Bio-resorbable Tissue Fixation |

|

End User |

Hospitals Orthopedic Clinics Others |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

The global orthopedic biomaterials market was worth US$ 11.3 Bn and is projected to reach a value of US$ 21.3 Bn by the end of 2027

Orthopedic biomaterials market is anticipated to grow at a CAGR of 7% during the forecast period

North America and Western Europe accounted for a major share of the global orthopedic biomaterials market

Orthopedic biomaterials market is driven by rise in percentage of population requiring orthopedic implants; increase in incidence rate of injuries related to accidents, sports, and adventure; surge in adoption of technologically advanced products; and rise in government initiatives to address unmet medical needs

Key players in the global orthopedic biomaterials market include Zimmer Biomet Holdings, Inc., Stryker, DePuy Synthes (Johnson & Johnson), Smith & Nephew plc, Medtronic, DJO Global, Inc., Arthrex, Inc., NuVasive, Inc., and Globus Medical, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Orthopedic Biomaterials Market

4. Market Overview

4.1. Introduction

4.1.1. Orthopedic Biomaterials Market Introduction

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Orthopedic Biomaterials Market Analysis and Forecasts, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Price Comparison Analysis

5.2. Key Potential Customers

5.3. Key Success Factors of Three Players

5.4. Key Industry Developments (Mergers & Acquisitions, Funding, Business Expansion, etc.)

5.5. Technological Advancements

5.6. Regulatory Scenario by Regional/Global

6. Global Orthopedic Biomaterials Market Analysis and Forecasts, by Material

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Material, 2017–2027

6.3.1. Glass-ceramic & Bioactive Glasses

6.3.2. Calcium Phosphate Cements

6.3.3. Polymers

6.3.4. Metals

6.3.5. Composites

6.4. Market Attractiveness, by Material

7. Global Orthopedic Biomaterials Market Analysis and Forecasts, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2027

7.3.1. Joint Replacements

7.3.2. Spine Implants

7.3.3. Orthobiologics

7.3.4. Viscosupplementation

7.3.5. Bio-resorbable Tissue Fixation

7.4. Market Attractiveness, by Application

8. Global Orthopedic Biomaterials Market Analysis and Forecasts, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2027

8.3.1. Hospitals

8.3.2. Orthopedic Clinics

8.3.3. Others

8.4. Market Attractiveness, by End-user

9. Global Orthopedic Biomaterials Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Orthopedic Biomaterials Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Material, 2017–2027

10.2.1. Glass-ceramic & Bioactive Glasses

10.2.2. Calcium Phosphate Cements

10.2.3. Polymers

10.2.4. Metals

10.2.5. Composites

10.3. Market Value Forecast, by Application, 2017–2027

10.3.1. Joint Replacements

10.3.2. Spine Implants

10.3.3. Orthobiologics

10.3.4. Viscosupplementation

10.3.5. Bio-resorbable Tissue Fixation

10.4. Market Value Forecast, by End-user, 2017–2027

10.4.1. Hospitals

10.4.2. Orthopedic Clinics

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Material

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Orthopedic Biomaterials Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Material, 2017–2027

11.2.1. Glass-ceramic & Bioactive Glasses

11.2.2. Calcium Phosphate Cements

11.2.3. Polymers

11.2.4. Metals

11.2.5. Composites

11.3. Market Value Forecast, by Application, 2017–2027

11.3.1. Joint Replacements

11.3.2. Spine Implants

11.3.3. Orthobiologics

11.3.4. Viscosupplementation

11.3.5. Bio-resorbable Tissue Fixation

11.4. Market Value Forecast, by End-user, 2017–2027

11.4.1. Hospitals

11.4.2. Orthopedic Clinics

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Material

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Orthopedic Biomaterials Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Material, 2017–2027

12.2.1. Glass-ceramic & Bioactive Glasses

12.2.2. Calcium Phosphate Cements

12.2.3. Polymers

12.2.4. Metals

12.2.5. Composites

12.3. Market Value Forecast, by Application, 2017–2027

12.3.1. Joint Replacements

12.3.2. Spine Implants

12.3.3. Orthobiologics

12.3.4. Viscosupplementation

12.3.5. Bio-resorbable Tissue Fixation

12.4. Market Value Forecast, by End-user, 2017–2027

12.4.1. Hospitals

12.4.2. Orthopedic Clinics

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Material

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Orthopedic Biomaterials Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Material, 2017–2027

13.2.1. Glass-ceramic & Bioactive Glasses

13.2.2. Calcium Phosphate Cements

13.2.3. Polymers

13.2.4. Metals

13.2.5. Composites

13.3. Market Value Forecast, by Application, 2017–2027

13.3.1. Joint Replacements

13.3.2. Spine Implants

13.3.3. Orthobiologics

13.3.4. Viscosupplementation

13.3.5. Bio-resorbable Tissue Fixation

13.4. Market Value Forecast, by End-user, 2017–2027

13.4.1. Hospitals

13.4.2. Orthopedic Clinics

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Material

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Orthopedic Biomaterials Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Material, 2017–2027

14.2.1. Glass-ceramic & Bioactive Glasses

14.2.2. Calcium Phosphate Cements

14.2.3. Polymers

14.2.4. Metals

14.2.5. Composites

14.3. Market Value Forecast, by Application, 2017–2027

14.3.1. Joint Replacements

14.3.2. Spine Implants

14.3.3. Orthobiologics

14.3.4. Viscosupplementation

14.3.5. Bio-resorbable Tissue Fixation

14.4. Market Value Forecast, by End-user, 2017–2027

14.4.1. Hospitals

14.4.2. Orthopedic Clinics

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Material

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Share Analysis, by Company (2018)

15.2. Company Profiles

15.2.1. Zimmer Biomet Holdings, Inc.

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Growth Strategies

15.2.1.3. SWOT Analysis

15.2.2. Stryker

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Growth Strategies

15.2.2.3. SWOT Analysis

15.2.3. DePuy Synthes (Johnson & Johnson)

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Growth Strategies

15.2.3.3. SWOT Analysis

15.2.4. Smith & Nephew plc

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Growth Strategies

15.2.4.3. SWOT Analysis

15.2.5. Medtronic

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Growth Strategies

15.2.5.3. SWOT Analysis

15.2.6. DJO Global, Inc.

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Growth Strategies

15.2.6.3. SWOT Analysis

15.2.7. Arthrex, Inc.

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Growth Strategies

15.2.7.3. SWOT Analysis

15.2.8. NuVasive, Inc.

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Growth Strategies

15.2.8.3. SWOT Analysis

15.2.9. Globus Medical, Inc.

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Growth Strategies

15.2.9.3. SWOT Analysis

List of Tables

Table 01: Price Comparison Analysis: Spine Surgery in Region/Countries (US$ Thousand)

Table 02: Key Industry Acquisitions in Global Orthopedic Biomaterials Market, 2016–2018 (1/3)

Table 03: Key Industry Acquisitions in Global Orthopedic Biomaterials Market, 2016–2018 (2/3)

Table 04: Key Industry Acquisitions in Global Orthopedic Biomaterials Market, 2016–2018 (3/3)

Table 05: Medical Device Classification as per U.S. FDA

Table 06: Supplements for Pre-market Approval, by Type of Supplements, 1986–1997

Table 07: Global Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Material, 2017–2027

Table 08: Global Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 09: Global Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 10: Global Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 11: North America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 12: North America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Material, 2017–2027

Table 13: North America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 14: North America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 15: Europe Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Europe Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Material, 2017–2027

Table 17: Europe Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 18: Europe Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 19: Asia Pacific Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 20: Asia Pacific Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Material, 2017–2027

Table 21: Asia Pacific Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 22: Asia Pacific Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 23: Latin America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Latin America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Material, 2017–2027

Table 25: Latin America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 26: Latin America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 27: Middle East & Africa Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 28: Middle East & Africa Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Material, 2017–2027

Table 29: Middle East & Africa Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 30: Middle East & Africa Orthopedic Biomaterials Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Orthopedic Biomaterials Market Snapshot

Figure 02: Global Orthopedic Biomaterials Market Value Share, by Material, 2018 and 2027

Figure 03: Global Orthopedic Biomaterials Market Attractiveness, by Material, 2018

Figure 04: Global Orthopedic Biomaterials Market Value(US$ Mn) and Y-o-Y Growth (%), by Glass-ceramic & Bioactive Glasses, 2017–2027

Figure 05: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Calcium Phosphate Cements, 2017–2027

Figure 06: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Polymers, 2017–2027

Figure 07: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Metals, 2017–2027

Figure 08: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Composites, 2017–2027

Figure 09: Global Orthopedic Biomaterials Market Value Share Analysis, by Application, 2018 and 2027

Figure 10: Global Orthopedic Biomaterials Market Attractiveness Analysis, by Application, 2018

Figure 11: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Joint Replacements, 2017–2027

Figure 12: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Spine Implants, 2017-2027

Figure 13: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Orthobiologics,2017–2027

Figure 14: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Viscosupplementation, 2017- 2027

Figure 15: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Bio-resorbable Tissue Fixation, 2017–2027

Figure 16: Global Orthopedic Biomaterials Market Value Share Analysis, by End-user, 2018 and 2027

Figure 17: Global Orthopedic Biomaterials Market Attractiveness Analysis, by End-user, 2018

Figure 18: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 19: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Orthopedic Clinics, 2017–2027

Figure 20: Global Orthopedic Biomaterials Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 21: Global Orthopedic Biomaterials Market Value Share Analysis, by Region, 2018 and 2027

Figure 22: Global Orthopedic Biomaterials Market Attractiveness Analysis, by Region, 2018

Figure 23: North America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, 2017–2027

Figure 24: North America Orthopedic Biomaterials Market Attractiveness Analysis, by Country, 2018

Figure 25: North America Orthopedic Biomaterials Market Value Share Analysis, by Country, 2018 and 2027

Figure 26: North America Orthopedic Biomaterials Market Value Share, by Material, 2018 and 2027

Figure 27: North America Orthopedic Biomaterials Market Attractiveness, by Material, 2018

Figure 28: North America Orthopedic Biomaterials Market Value Share Analysis, by Application, 2018 and 2027

Figure 29: North America Orthopedic Biomaterials Market Attractiveness Analysis, by Application, 2018

Figure 30: North America Orthopedic Biomaterials Market Value Share Analysis, by End-user, 2018 and 2027

Figure 31: North America Orthopedic Biomaterials Market Attractiveness Analysis, by End-user, 2018

Figure 32: Europe Orthopedic Biomaterials Market Value (US$ Mn) Forecast, 2017–2027

Figure 33: Europe Orthopedic Biomaterials Market Attractiveness, by Country/Sub-region, 2018

Figure 34: Europe Orthopedic Biomaterials Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 35: Europe Orthopedic Biomaterials Market Value Share, by Material, 2018 and 2027

Figure 36: Europe Orthopedic Biomaterials Market Attractiveness, by Material, 2018

Figure 37: Europe Orthopedic Biomaterials Market Value Share Analysis, by Application, 2018 and 2027

Figure 38: Europe Orthopedic Biomaterials Market Attractiveness Analysis, by Application, 2018

Figure 39: Europe Orthopedic Biomaterials Market Value Share Analysis, by End-user, 2018 and 2027

Figure 40: Europe Orthopedic Biomaterials Market Attractiveness Analysis, by End-user, 2018

Figure 41: Asia Pacific Orthopedic Biomaterials Market Value (US$ Mn) Forecast, 2017–2027

Figure 42: Asia Pacific Orthopedic Biomaterials Market Attractiveness Analysis, by Country/Sub-region, 2018

Figure 43: Asia Pacific Orthopedic Biomaterials Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 44: Asia Pacific Orthopedic Biomaterials Market Value Share, by Material, 2018 and 2027

Figure 45: Asia Pacific Orthopedic Biomaterials Market Attractiveness, by Material, 2018

Figure 46: Asia Pacific Orthopedic Biomaterials Market Value Share Analysis, by Application, 2018 and 2027

Figure 47: Asia Pacific Orthopedic Biomaterials Market Attractiveness Analysis, by Application, 2018

Figure 48: Asia Pacific Orthopedic Biomaterials Market Value Share Analysis, by End-user, 2018 and 2027

Figure 49: Asia Pacific Orthopedic Biomaterials Market Attractiveness Analysis, by End-user, 2018

Figure 50: Latin America Orthopedic Biomaterials Market Value (US$ Mn) Forecast, 2017–2027

Figure 51: Latin America Orthopedic Biomaterials Market Attractiveness, by Country/Sub-region, 2018

Figure 52: Latin America Orthopedic Biomaterials Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 53: Latin America Orthopedic Biomaterials Market Value Share, by Material, 2018 and 2027

Figure 54: Latin America Orthopedic Biomaterials Market Attractiveness, by Material, 2018

Figure 55: Latin America Orthopedic Biomaterials Market Value Share Analysis, by Application, 2018 and 2027

Figure 56: Latin America Orthopedic Biomaterials Market Attractiveness Analysis, by Application, 2018

Figure 57: Latin America Orthopedic Biomaterials Market Value Share Analysis, by End-user, 2018 and 2027

Figure 58: Latin America Orthopedic Biomaterials Market Attractiveness Analysis, by End-user, 2018

Figure 59: Middle East & Africa Orthopedic Biomaterials Market Value (US$ Mn) Forecast, 2017–2027

Figure 60: Middle East & Africa Orthopedic Biomaterials Market Attractiveness, by Country/Sub-region, 2018

Figure 61: Middle East & Africa Orthopedic Biomaterials Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 62: Middle East & Africa Orthopedic Biomaterials Market Value Share, by Material, 2018 and 2027

Figure 63: Middle East & Africa Orthopedic Biomaterials Market Attractiveness, by Material, 2018

Figure 64: Middle East & Africa Orthopedic Biomaterials Market Value Share Analysis, by Application, 2018 and 2027

Figure 65: Middle East & Africa Orthopedic Biomaterials Market Attractiveness Analysis, by Application, 2018

Figure 66: Middle East & Africa Orthopedic Biomaterials Market Value Share Analysis, by End-user, 2018 and 2027

Figure 67: Middle East & Africa Orthopedic Biomaterials Market Attractiveness Analysis, by End-user, 2018

Figure 68: Global Orthopedic Biomaterials Market Share, by Company, 2018

Figure 69: Zimmer Biomet Holdings, Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2018

Figure 70: Zimmer Biomet Holdings, Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 71: Zimmer Biomet Holdings, Inc. Breakdown of Net Sales (%), by Business Segment, 2018

Figure 72: Stryker Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 73: Stryker Breakdown of Net Sales (%), by Region, 2018

Figure 74: Stryker Breakdown of Net Sales (%), by Business Segment, 2018

Figure 75: Johnson & Johnson Orthopedics Franchise of Medical Devices Business Segment Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 76: Johnson & Johnson Breakdown of Net Sales (%), by Region, 2018

Figure 77: Johnson & Johnson Breakdown of Net Sales (%), by Orthopedics Franchise of Medical Devices Business Segment, 2018

Figure 78: Smith & Nephew plc Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 79: Smith & Nephew plc Breakdown of Net Sales (%), by Region, 2018

Figure 80: Smith & Nephew plc Breakdown of Net Sales (%), by Orthopedics Business Segment, 2018

Figure 81: Medtronic Spine Business Segment Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 82: Medtronic Restorative Therapies Group Breakdown of Net Sales (%), by Region, 2018

Figure 83: Medtronic Breakdown of Net Sales (%), by Orthopedics Business Segment, 2018

Figure 84: DJO Global, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 85: DJO Global, Inc. Breakdown of Net Sales (%), by Region, 2017

Figure 86: DJO Global, Inc. Breakdown of Net Sales (%), by Orthopedics Business Segment, 2017

Figure 87: NuVasive, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 88: NuVasive, Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 89: NuVasive, Inc. Breakdown of Net Sales (%), by Business Segment, 2018

Figure 90: Globus Medical, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 91: Globus Medical, Inc. Breakdown of Net Sales (%), by Region, 2017

Figure 92: Globus Medical, Inc. Breakdown of Net Sales (%), by Business Segment, 2017