Reports

Reports

Analysts’ Viewpoint

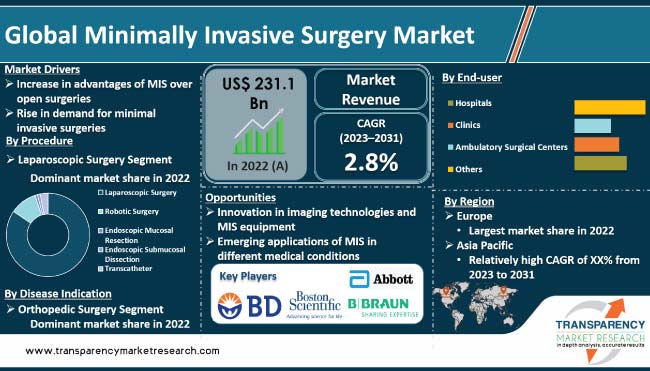

Significant benefits, such as quick recovery and reduced inpatient hospital cost, across a broad range of surgical disciplines is driving the global minimally invasive surgery market. Scientific innovations and technological advancements in surgery have enabled the development of new minimally invasive procedures. Increase in popularity of robotic surgery due to precision and limited human intervention is another factor propelling market development. Furthermore, increase in preference for endoscopic surgeries, such as endoscopic mucosal resection and endoscopic submucosal dissection in gastrointestinal cancer treatment, is likely to bolster market expansion.

Development of new materials, such as memory metals, for the manufacturing of equipment to make heat activated scissors or forceps offers lucrative opportunities to market players. Manufacturers are focusing on developing advanced surgical robots with enhanced precision and control in order to increase market share.

Minimally invasive surgery (MIS), also known as minimally invasive procedure, refers to a surgical technique that is performed using small incisions or natural body openings instead of larger incisions required in traditional open surgeries. The goal of minimally invasive surgery is to minimize trauma to the body, reduce post-operative pain, accelerate recovery, and improve cosmetic outcomes.

Specialized surgical instruments and laparoscopes are used in a minimally invasive surgery. Laparoscope is a long, thin tube with a camera and light source attached to it, which allows a surgeon to visualize the surgical site on a monitor. Other surgical instruments are inserted through small incisions or ports, enabling the surgeon to perform the necessary procedures.

Robotic procedures represent the latest development in minimally invasive procedures, providing surgeons with precision devices that employ the same small incisions as conventional laparoscopy. A key difference is that the robotic systems can offer broader visualization of the operative field and precision control of minimally invasive surgery devices.

Less surgical pain, faster functional recovery, and shorter hospital stay are the major advantages of minimally invasive surgery (MIS) over open surgery.

Minimally invasive procedures are also associated with significantly less blood loss, lower analgesic consumption, faster time to first flatus, soft diet, and shorter postoperative hospital stay compared to open surgery. Awareness about the benefits of minimally invasive surgeries is increasing among patients.

Surgery is the only known treatment option for gastric cancer. Benefits of MIS procedure has encouraged octogenarians and older patients who face high operative morbidity and mortality to undergo surgery rather than strictly conservative treatment.

Usage of surgical robots in performing complex procedures is a significant factor bolstering global minimally invasive surgery market size. Surgical robots, such as the da Vinci Surgical System, have revolutionized the field of surgery by providing enhanced precision, dexterity, and control to surgeons during minimally invasive procedures.

Technological improvements, such as more efficient motors, compact & light materials, power back-up & sophisticated controls, and safety mechanisms, have led to development of cost-effective versions of surgical robots.

High precision of robot-assisted surgery helps in accurate implant positioning and reduces the risk of injury to adjacent tissues. Patients also benefit from less bleeding and post-operative pain, and fewer hospital readmissions.

Robots are also becoming increasingly important in the field of minimally invasive surgery due to the growing complexity of procedures to treat difficult diseases. With 38% of treatments involving thyroid cancer and 27.8% involving prostate cancer, respectively, robotic surgery is preferred for these procedures.

Thus, robotic surgery, which is gaining popularity among surgeons, is an efficient and secure way to treat thyroid and prostate cancer.

According to Cleveland Clinic, on average, around 35% of all colorectal surgeries in Atlanta, the U.S. have been performed robotically for the past two to three years.

In terms of procedure, the laparoscopic surgery segment dominated the global market in 2022, and the trend is expected to continue during the forecast period. This can be ascribed to higher rate of adoption of laparoscopy procedures to help diagnose different medical conditions that arise within the abdomen or pelvis.

According to Cleveland Clinic, more than 15 million laparoscopic procedures are performed globally every year. The number is expected to increase by 1% in the next five years. According to OECD, around 24,305 laparoscopic hysterectomy and 110,848 laparoscopic cholecystectomy surgeries have been performed in France.

Advanced laparoscopy devices are also used to perform surgical procedures such as removal of a diseased or damaged organ or a tissue sample for further testing (biopsy). Substantially low maintenance cost of laparoscopic handheld minimally invasive surgery devices and rise in technological innovations in handheld instruments are likely to augment the laparoscopic surgery segment during the forecast period.

Based on indication, the orthopedic surgery segment accounted for the largest global minimally invasive surgery market share in 2022. The trend is likely to continue during the forecast period.

An estimated 28.3 million orthopedic procedures were performed globally in 2022. The number is expected to increase during the forecast period. Therefore, high number of cases of orthopedic disorders, such as fracture of bones, bone cancer, is propelling demand for minimally invasive surgery across the globe.

In terms of end-user, the hospitals segment accounted for leading share of the global minimally invasive surgery market in 2022.

Rise in number of operating rooms in hospitals in developing countries, increase in patient preference for hospitals due to favorable reimbursement, availability to advanced minimally invasive surgery devices, and ability to perform different types of minimally invasive surgeries are expected to drive the hospitals segment during the forecast period. According to American Hospital Associations, the U.S. had more than 6,129 hospitals in 2022.

Europe accounted for the largest share of the global minimally invasive surgery market in 2022. The trend is projected to continue during the forecast period due to increase in the geriatric population in the region.

The market in Europe is driven by rise in prevalence of chronic diseases, focus on improving patient’s quality of life, and increase in healthcare expenditure. Increase in geriatric population is another key factor propelling demand for minimally invasive surgical instruments in the region. According to Eurostat, around 21.1%, one-fifth of the EU population, was aged 65 and over in 2022.

Asia Pacific is likely to be the fastest growing market for minimally invasive surgery during the forecast period. The market in the region is anticipated to expand at a high CAGR from 2022 to 2031 due to large patient base in countries such as India and China and rise in awareness about MIS surgical procedure.

The global minimally invasive surgery market is fragmented, with the presence of large number of leading players. Manufactures of MIS devices are investing significantly in research & development, primarily to develop innovative new surgical devices. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the key players in the global minimally invasive surgery market.

Key players operating in the global market are Abbott Laboratories, B. Braun Melsungen AG, Becton, Dickinson and Company, Boston Scientific Corporation, CONMED Corporation, Johnson & Johnson Services, Inc., Medtronic plc, Smith & Nephew plc, Stryker Corporation, and Zimmer Biomet.

Key hospitals that have been also profiled in the report include Apollo Hospitals Enterprise Limited, Huntington Hospital, Johns Hopkins Hospital, Massachusetts General Hospital, Rutland Medical Center, Saint Michael's Hospital, Singapore General Hospital, The Ottawa Hospital, University of Pittsburgh Medical Center, and Washington Hospital Healthcare System.

The minimally invasive surgery market report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 231.1 Bn |

|

Forecast (Value) in 2031 |

US$ 301.1 Bn |

|

Growth Rate (CAGR) |

2.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Example: Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 231.1 Bn in 2022

It is projected to reach more than US$ 301.1 Bn by 2031

The business is anticipated to expand at a CAGR of 2.8% from 2023 to 2031

Increase in advantages of MIS over open surgeries and rise in demand for minimal invasive surgeries are likely to drive the market.

Europe is projected to account for major market share during the forecast period

Abbott Laboratories, B. Braun Melsungen AG, Becton, Dickinson and Company, Boston Scientific Corporation, CONMED Corporation, Johnson & Johnson Services, Inc., Medtronic plc, Smith & Nephew plc, Stryker Corporation, and Zimmer Biomet are the prominent players in the market. Key hospitals that have been also profiled in the report include Apollo Hospitals Enterprise Limited, Huntington Hospital, Johns Hopkins Hospital, Massachusetts General Hospital, Rutland Medical Center

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Minimally Invasive Surgery Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics, by Region

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

5. Key Insights

5.1. Overview of reimbursement scenario for MIS surgeries by Region

5.1.1. Reimbursement Trends

5.2. Overview of pricing of MIS products

5.3. Data related to percentage of MIS adoption as compared to total procedures

5.4. Comparison between MIS and Open Surgery (Volume, by Region)

5.5. Information related MIS Training

5.5.1. MIS Training Gap

5.5.2. Verbatim about Training

5.6. Number of surgeons in each medical specialty and how many of them use MIS today (as per best-efforts basis)

5.7. List of procedures that can be done by MIS for each specialty

5.8. Cost of Surgery in Different Countries

5.9. Major Hospitals, by Region/Country

5.10. COVID-19 Impact Analysis

6. Global Minimally Invasive Surgery Market Analysis and Forecast, by Procedure

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Minimally Invasive Surgery Market Value & Volume Forecast, by Procedure, 2017-2031

6.3.1. Laparoscopic Surgery

6.3.1.1. Orthopedic Surgery

6.3.1.2. Thoracic Surgery

6.3.1.3. Urology Surgery

6.3.1.4. Gynecology Surgery

6.3.1.5. Vascular Surgery

6.3.1.6. General Surgery

6.3.1.7. Cancer Surgery

6.3.1.8. Breast Surgery

6.3.1.9. Ear, Nose, and Throat Surgery

6.3.1.10. Bariatric Surgery

6.3.2. Robotic Surgery

6.3.2.1. Orthopedic Surgery

6.3.2.2. Cardiac Surgery

6.3.2.3. Thoracic Surgery

6.3.2.4. Urology Surgery

6.3.2.5. Gynecology Surgery

6.3.2.6. Vascular Surgery

6.3.2.7. General Surgery

6.3.2.8. Cancer Surgery

6.3.2.9. Breast Surgery

6.3.2.10. Ear, Nose, and Throat Surgery

6.3.2.11. Bariatric Surgery

6.3.2.12. Cosmetic/Plastic Surgery

6.3.2.13. Neurosurgery

6.3.3. Endoscopic Mucosal Resection

6.3.4. Endoscopic Submucosal Dissection

6.3.5. Transcatheter

6.3.5.1. Cardiac Surgery

6.3.5.2. Vascular Surgery

6.3.5.3. Cancer Surgery

6.3.5.4. Bariatric Surgery

6.4. Global Minimally Invasive Surgery Market Attractiveness, by Procedure

7. Global Minimally Invasive Surgery Market Analysis and Forecast, by Disease Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Minimally Invasive Surgery Market Value & Volume Forecast, by Disease Indication, 2017-2031

7.3.1. Orthopedic Surgery

7.3.1.1. Knee

7.3.1.2. Spine

7.3.1.3. Shoulder

7.3.1.4. Others

7.3.2. Cardiac Surgery

7.3.2.1. Mitral Valve

7.3.2.2. Aortic Valve

7.3.2.3. Structural Heart Disease

7.3.2.4. Tricuspid Valve

7.3.2.5. Others

7.3.3. General Surgery

7.3.3.1. Gastrointestinal Surgery

7.3.3.2. Hepatobiliary Pancreatic Surgery

7.3.4. Urology Surgery

7.3.5. Thoracic Surgery

7.3.6. Gynecology Surgery

7.3.7. Vascular Surgery

7.3.8. Cancer Surgery

7.3.9. Breast Surgery

7.3.10. Ear, Nose, and Throat Surgery

7.3.11. Bariatric Surgery

7.3.12. Cosmetic/Plastic Surgery

7.3.13. Neurosurgery

7.4. Global Minimally Invasive Surgery Market Attractiveness, by Disease Indication

8. Global Minimally Invasive Surgery Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Minimally Invasive Surgery Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.1.1. Orthopedic Surgery

8.3.1.2. Cardiac Surgery

8.3.1.3. Thoracic Surgery

8.3.1.4. Urology Surgery

8.3.1.5. Gynecology Surgery

8.3.1.6. Vascular Surgery

8.3.1.7. General Surgery

8.3.1.8. Cancer Surgery

8.3.1.9. Breast Surgery

8.3.1.10. Ear, Nose, and Throat Surgery

8.3.1.11. Bariatric Surgery

8.3.1.12. Cosmetic/Plastic Surgery

8.3.1.13. Neurosurgery

8.3.2. Clinics

8.3.2.1. Orthopedic Surgery

8.3.2.2. Cardiac Surgery

8.3.2.3. Thoracic Surgery

8.3.2.4. Urology Surgery

8.3.2.5. Gynecology Surgery

8.3.2.6. Vascular Surgery

8.3.2.7. General Surgery

8.3.2.8. Cancer Surgery

8.3.2.9. Breast Surgery

8.3.2.10. Ear, Nose, and Throat Surgery

8.3.2.11. Bariatric Surgery

8.3.2.12. Cosmetic/Plastic Surgery

8.3.2.13. Neurosurgery

8.3.3. Ambulatory Surgical Centers

8.3.3.1. Orthopedic Surgery

8.3.3.2. Cardiac Surgery

8.3.3.3. Thoracic Surgery

8.3.3.4. Urology Surgery

8.3.3.5. Gynecology Surgery

8.3.3.6. Vascular Surgery

8.3.3.7. General Surgery

8.3.3.8. Cancer Surgery

8.3.3.9. Breast Surgery

8.3.3.10. Ear, Nose, and Throat Surgery

8.3.3.11. Bariatric Surgery

8.3.3.12. Cosmetic/Plastic Surgery

8.3.3.13. Neurosurgery

8.3.4. Others

8.3.4.1. Orthopedic Surgery

8.3.4.2. Cardiac Surgery

8.3.4.3. Thoracic Surgery

8.3.4.4. Urology Surgery

8.3.4.5. Gynecology Surgery

8.3.4.6. Vascular Surgery

8.3.4.7. General Surgery

8.3.4.8. Cancer Surgery

8.3.4.9. Breast Surgery

8.3.4.10. Ear, Nose, and Throat Surgery

8.3.4.11. Bariatric Surgery

8.3.4.12. Cosmetic/Plastic Surgery

8.3.4.13. Neurosurgery

8.4. Global Minimally Invasive Surgery Market Attractiveness, by End-user

9. Global Minimally Invasive Surgery Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Minimally Invasive Surgery Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Minimally Invasive Surgery Market Attractiveness, by Region

10. North America Minimally Invasive Surgery Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Minimally Invasive Surgery Market Value & Volume Forecast, by Procedure, 2017-2031

10.2.1. Laparoscopic Surgery

10.2.1.1. Orthopedic Surgery

10.2.1.2. Thoracic Surgery

10.2.1.3. Urology Surgery

10.2.1.4. Gynecology Surgery

10.2.1.5. Vascular Surgery

10.2.1.6. General Surgery

10.2.1.7. Cancer Surgery

10.2.1.8. Breast Surgery

10.2.1.9. Ear, Nose, and Throat Surgery

10.2.1.10. Bariatric Surgery

10.2.2. Robotic Surgery

10.2.2.1. Orthopedic Surgery

10.2.2.2. Cardiac Surgery

10.2.2.3. Thoracic Surgery

10.2.2.4. Urology Surgery

10.2.2.5. Gynecology Surgery

10.2.2.6. Vascular Surgery

10.2.2.7. General Surgery

10.2.2.8. Cancer Surgery

10.2.2.9. Breast Surgery

10.2.2.10. Ear, Nose, and Throat Surgery

10.2.2.11. Bariatric Surgery

10.2.2.12. Cosmetic/Plastic Surgery

10.2.2.13. Neurosurgery

10.2.3. Endoscopic Mucosal Resection

10.2.4. Endoscopic Submucosal Dissection

10.2.5. Transcatheter

10.2.5.1. Cardiac Surgery

10.2.5.2. Vascular Surgery

10.2.5.3. Cancer Surgery

10.2.5.4. Bariatric Surgery

10.3. North America Minimally Invasive Surgery Market Value & Volume Forecast, by Disease Indication, 2017-2031

10.3.1. Orthopedic Surgery

10.3.1.1. Knee

10.3.1.2. Spine

10.3.1.3. Shoulder

10.3.1.4. Others

10.3.2. Cardiac Surgery

10.3.2.1. Mitral Valve

10.3.2.2. Aortic Valve

10.3.2.3. Structural Heart Disease

10.3.2.4. Tricuspid Valve

10.3.2.5. Others

10.3.3. General Surgery

10.3.3.1. Gastrointestinal Surgery

10.3.3.2. Hepatobiliary Pancreatic Surgery

10.3.4. Urology Surgery

10.3.5. Thoracic Surgery

10.3.6. Gynecology Surgery

10.3.7. Vascular Surgery

10.3.8. Cancer Surgery

10.3.9. Breast Surgery

10.3.10. Ear, Nose, and Throat Surgery

10.3.11. Bariatric Surgery

10.3.12. Cosmetic/Plastic Surgery

10.3.13. Neurosurgery

10.4. North America Minimally Invasive Surgery Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.1.1. Orthopedic Surgery

10.4.1.2. Cardiac Surgery

10.4.1.3. Thoracic Surgery

10.4.1.4. Urology Surgery

10.4.1.5. Gynecology Surgery

10.4.1.6. Vascular Surgery

10.4.1.7. General Surgery

10.4.1.8. Cancer Surgery

10.4.1.9. Breast Surgery

10.4.1.10. Ear, Nose, and Throat Surgery

10.4.1.11. Bariatric Surgery

10.4.1.12. Cosmetic/Plastic Surgery

10.4.1.13. Neurosurgery

10.4.2. Clinics

10.4.2.1. Orthopedic Surgery

10.4.2.2. Cardiac Surgery

10.4.2.3. Thoracic Surgery

10.4.2.4. Urology Surgery

10.4.2.5. Gynecology Surgery

10.4.2.6. Vascular Surgery

10.4.2.7. General Surgery

10.4.2.8. Cancer Surgery

10.4.2.9. Breast Surgery

10.4.2.10. Ear, Nose, and Throat Surgery

10.4.2.11. Bariatric Surgery

10.4.2.12. Cosmetic/Plastic Surgery

10.4.2.13. Neurosurgery

10.4.3. Ambulatory Surgical Centers

10.4.3.1. Orthopedic Surgery

10.4.3.2. Cardiac Surgery

10.4.3.3. Thoracic Surgery

10.4.3.4. Urology Surgery

10.4.3.5. Gynecology Surgery

10.4.3.6. Vascular Surgery

10.4.3.7. General Surgery

10.4.3.8. Cancer Surgery

10.4.3.9. Breast Surgery

10.4.3.10. Ear, Nose, and Throat Surgery

10.4.3.11. Bariatric Surgery

10.4.3.12. Cosmetic/Plastic Surgery

10.4.3.13. Neurosurgery

10.4.4. Others

10.4.4.1. Orthopedic Surgery

10.4.4.2. Cardiac Surgery

10.4.4.3. Thoracic Surgery

10.4.4.4. Urology Surgery

10.4.4.5. Gynecology Surgery

10.4.4.6. Vascular Surgery

10.4.4.7. General Surgery

10.4.4.8. Cancer Surgery

10.4.4.9. Breast Surgery

10.4.4.10. Ear, Nose, and Throat Surgery

10.4.4.11. Bariatric Surgery

10.4.4.12. Cosmetic/Plastic Surgery

10.4.4.13. Neurosurgery

10.5. North America Minimally Invasive Surgery Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. North America Minimally Invasive Surgery Market Attractiveness Analysis

10.6.1. By Procedure

10.6.2. By Disease Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Minimally Invasive Surgery Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Minimally Invasive Surgery Market Value & Volume Forecast, by Procedure, 2017-2031

11.2.1. Laparoscopic Surgery

11.2.1.1. Orthopedic Surgery

11.2.1.2. Thoracic Surgery

11.2.1.3. Urology Surgery

11.2.1.4. Gynecology Surgery

11.2.1.5. Vascular Surgery

11.2.1.6. General Surgery

11.2.1.7. Cancer Surgery

11.2.1.8. Breast Surgery

11.2.1.9. Ear, Nose, and Throat Surgery

11.2.1.10. Bariatric Surgery

11.2.2. Robotic Surgery

11.2.2.1. Orthopedic Surgery

11.2.2.2. Cardiac Surgery

11.2.2.3. Thoracic Surgery

11.2.2.4. Urology Surgery

11.2.2.5. Gynecology Surgery

11.2.2.6. Vascular Surgery

11.2.2.7. General Surgery

11.2.2.8. Cancer Surgery

11.2.2.9. Breast Surgery

11.2.2.10. Ear, Nose, and Throat Surgery

11.2.2.11. Bariatric Surgery

11.2.2.12. Cosmetic/Plastic Surgery

11.2.2.13. Neurosurgery

11.2.3. Endoscopic Mucosal Resection

11.2.4. Endoscopic Submucosal Dissection

11.2.5. Transcatheter

11.2.5.1. Cardiac Surgery

11.2.5.2. Vascular Surgery

11.2.5.3. Cancer Surgery

11.2.5.4. Bariatric Surgery

11.3. Europe Minimally Invasive Surgery Market Value & Volume Forecast, by Disease Indication, 2017-2031

11.3.1. Orthopedic Surgery

11.3.1.1. Knee

11.3.1.2. Spine

11.3.1.3. Shoulder

11.3.1.4. Others

11.3.2. Cardiac Surgery

11.3.2.1. Mitral Valve

11.3.2.2. Aortic Valve

11.3.2.3. Structural Heart Disease

11.3.2.4. Tricuspid Valve

11.3.2.5. Others

11.3.3. General Surgery

11.3.3.1. Gastrointestinal Surgery

11.3.3.2. Hepatobiliary Pancreatic Surgery

11.3.4. Urology Surgery

11.3.5. Thoracic Surgery

11.3.6. Gynecology Surgery

11.3.7. Vascular Surgery

11.3.8. Cancer Surgery

11.3.9. Breast Surgery

11.3.10. Ear, Nose, and Throat Surgery

11.3.11. Bariatric Surgery

11.3.12. Cosmetic/Plastic Surgery

11.3.13. Neurosurgery

11.4. Europe Minimally Invasive Surgery Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.1.1. Orthopedic Surgery

11.4.1.2. Cardiac Surgery

11.4.1.3. Thoracic Surgery

11.4.1.4. Urology Surgery

11.4.1.5. Gynecology Surgery

11.4.1.6. Vascular Surgery

11.4.1.7. General Surgery

11.4.1.8. Cancer Surgery

11.4.1.9. Breast Surgery

11.4.1.10. Ear, Nose, and Throat Surgery

11.4.1.11. Bariatric Surgery

11.4.1.12. Cosmetic/Plastic Surgery

11.4.1.13. Neurosurgery

11.4.2. Clinics

11.4.2.1. Orthopedic Surgery

11.4.2.2. Cardiac Surgery

11.4.2.3. Thoracic Surgery

11.4.2.4. Urology Surgery

11.4.2.5. Gynecology Surgery

11.4.2.6. Vascular Surgery

11.4.2.7. General Surgery

11.4.2.8. Cancer Surgery

11.4.2.9. Breast Surgery

11.4.2.10. Ear, Nose, and Throat Surgery

11.4.2.11. Bariatric Surgery

11.4.2.12. Cosmetic/Plastic Surgery

11.4.2.13. Neurosurgery

11.4.3. Ambulatory Surgical Centers

11.4.3.1. Orthopedic Surgery

11.4.3.2. Cardiac Surgery

11.4.3.3. Thoracic Surgery

11.4.3.4. Urology Surgery

11.4.3.5. Gynecology Surgery

11.4.3.6. Vascular Surgery

11.4.3.7. General Surgery

11.4.3.8. Cancer Surgery

11.4.3.9. Breast Surgery

11.4.3.10. Ear, Nose, and Throat Surgery

11.4.3.11. Bariatric Surgery

11.4.3.12. Cosmetic/Plastic Surgery

11.4.3.13. Neurosurgery

11.4.4. Others

11.4.4.1. Orthopedic Surgery

11.4.4.2. Cardiac Surgery

11.4.4.3. Thoracic Surgery

11.4.4.4. Urology Surgery

11.4.4.5. Gynecology Surgery

11.4.4.6. Vascular Surgery

11.4.4.7. General Surgery

11.4.4.8. Cancer Surgery

11.4.4.9. Breast Surgery

11.4.4.10. Ear, Nose, and Throat Surgery

11.4.4.11. Bariatric Surgery

11.4.4.12. Cosmetic/Plastic Surgery

11.4.4.13. Neurosurgery

11.5. Europe Minimally Invasive Surgery Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Europe Minimally Invasive Surgery Market Attractiveness Analysis

11.6.1. By Procedure

11.6.2. By Disease Indication

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Minimally Invasive Surgery Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Minimally Invasive Surgery Market Value & Volume Forecast, by Procedure, 2017-2031

12.2.1. Laparoscopic Surgery

12.2.1.1. Orthopedic Surgery

12.2.1.2. Thoracic Surgery

12.2.1.3. Urology Surgery

12.2.1.4. Gynecology Surgery

12.2.1.5. Vascular Surgery

12.2.1.6. General Surgery

12.2.1.7. Cancer Surgery

12.2.1.8. Breast Surgery

12.2.1.9. Ear, Nose, and Throat Surgery

12.2.1.10. Bariatric Surgery

12.2.2. Robotic Surgery

12.2.2.1. Orthopedic Surgery

12.2.2.2. Cardiac Surgery

12.2.2.3. Thoracic Surgery

12.2.2.4. Urology Surgery

12.2.2.5. Gynecology Surgery

12.2.2.6. Vascular Surgery

12.2.2.7. General Surgery

12.2.2.8. Cancer Surgery

12.2.2.9. Breast Surgery

12.2.2.10. Ear, Nose, and Throat Surgery

12.2.2.11. Bariatric Surgery

12.2.2.12. Cosmetic/Plastic Surgery

12.2.2.13. Neurosurgery

12.2.3. Endoscopic Mucosal Resection

12.2.4. Endoscopic Submucosal Dissection

12.2.5. Transcatheter

12.2.5.1. Cardiac Surgery

12.2.5.2. Vascular Surgery

12.2.5.3. Cancer Surgery

12.2.5.4. Bariatric Surgery

12.3. Asia Pacific Minimally Invasive Surgery Market Value & Volume Forecast, by Disease Indication, 2017-2031

12.3.1. Orthopedic Surgery

12.3.1.1. Knee

12.3.1.2. Spine

12.3.1.3. Shoulder

12.3.1.4. Others

12.3.2. Cardiac Surgery

12.3.2.1. Mitral Valve

12.3.2.2. Aortic Valve

12.3.2.3. Structural Heart Disease

12.3.2.4. Tricuspid Valve

12.3.2.5. Others

12.3.3. General Surgery

12.3.3.1. Gastrointestinal Surgery

12.3.3.2. Hepatobiliary Pancreatic Surgery

12.3.4. Urology Surgery

12.3.5. Thoracic Surgery

12.3.6. Gynecology Surgery

12.3.7. Vascular Surgery

12.3.8. Cancer Surgery

12.3.9. Breast Surgery

12.3.10. Ear, Nose, and Throat Surgery

12.3.11. Bariatric Surgery

12.3.12. Cosmetic/Plastic Surgery

12.3.13. Neurosurgery

12.4. Asia Pacific Minimally Invasive Surgery Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.1.1. Orthopedic Surgery

12.4.1.2. Cardiac Surgery

12.4.1.3. Thoracic Surgery

12.4.1.4. Urology Surgery

12.4.1.5. Gynecology Surgery

12.4.1.6. Vascular Surgery

12.4.1.7. General Surgery

12.4.1.8. Cancer Surgery

12.4.1.9. Breast Surgery

12.4.1.10. Ear, Nose, and Throat Surgery

12.4.1.11. Bariatric Surgery

12.4.1.12. Cosmetic/Plastic Surgery

12.4.1.13. Neurosurgery

12.4.2. Clinics

12.4.2.1. Orthopedic Surgery

12.4.2.2. Cardiac Surgery

12.4.2.3. Thoracic Surgery

12.4.2.4. Urology Surgery

12.4.2.5. Gynecology Surgery

12.4.2.6. Vascular Surgery

12.4.2.7. General Surgery

12.4.2.8. Cancer Surgery

12.4.2.9. Breast Surgery

12.4.2.10. Ear, Nose, and Throat Surgery

12.4.2.11. Bariatric Surgery

12.4.2.12. Cosmetic/Plastic Surgery

12.4.2.13. Neurosurgery

12.4.3. Ambulatory Surgical Centers

12.4.3.1. Orthopedic Surgery

12.4.3.2. Cardiac Surgery

12.4.3.3. Thoracic Surgery

12.4.3.4. Urology Surgery

12.4.3.5. Gynecology Surgery

12.4.3.6. Vascular Surgery

12.4.3.7. General Surgery

12.4.3.8. Cancer Surgery

12.4.3.9. Breast Surgery

12.4.3.10. Ear, Nose, and Throat Surgery

12.4.3.11. Bariatric Surgery

12.4.3.12. Cosmetic/Plastic Surgery

12.4.3.13. Neurosurgery

12.4.4. Others

12.4.4.1. Orthopedic Surgery

12.4.4.2. Cardiac Surgery

12.4.4.3. Thoracic Surgery

12.4.4.4. Urology Surgery

12.4.4.5. Gynecology Surgery

12.4.4.6. Vascular Surgery

12.4.4.7. General Surgery

12.4.4.8. Cancer Surgery

12.4.4.9. Breast Surgery

12.4.4.10. Ear, Nose, and Throat Surgery

12.4.4.11. Bariatric Surgery

12.4.4.12. Cosmetic/Plastic Surgery

12.4.4.13. Neurosurgery

12.5. Asia Pacific Minimally Invasive Surgery Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Minimally Invasive Surgery Market Attractiveness Analysis

12.6.1. By Procedure

12.6.2. By Disease Indication

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Minimally Invasive Surgery Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Minimally Invasive Surgery Market Value & Volume Forecast, by Procedure, 2017-2031

13.2.1. Laparoscopic Surgery

13.2.1.1. Orthopedic Surgery

13.2.1.2. Thoracic Surgery

13.2.1.3. Urology Surgery

13.2.1.4. Gynecology Surgery

13.2.1.5. Vascular Surgery

13.2.1.6. General Surgery

13.2.1.7. Cancer Surgery

13.2.1.8. Breast Surgery

13.2.1.9. Ear, Nose, and Throat Surgery

13.2.1.10. Bariatric Surgery

13.2.2. Robotic Surgery

13.2.2.1. Orthopedic Surgery

13.2.2.2. Cardiac Surgery

13.2.2.3. Thoracic Surgery

13.2.2.4. Urology Surgery

13.2.2.5. Gynecology Surgery

13.2.2.6. Vascular Surgery

13.2.2.7. General Surgery

13.2.2.8. Cancer Surgery

13.2.2.9. Breast Surgery

13.2.2.10. Ear, Nose, and Throat Surgery

13.2.2.11. Bariatric Surgery

13.2.2.12. Cosmetic/Plastic Surgery

13.2.2.13. Neurosurgery

13.2.3. Endoscopic Mucosal Resection

13.2.4. Endoscopic Submucosal Dissection

13.2.5. Transcatheter

13.2.5.1. Cardiac Surgery

13.2.5.2. Vascular Surgery

13.2.5.3. Cancer Surgery

13.2.5.4. Bariatric Surgery

13.3. Latin America Minimally Invasive Surgery Market Value & Volume Forecast, by Disease Indication, 2017-2031

13.3.1. Orthopedic Surgery

13.3.1.1. Knee

13.3.1.2. Spine

13.3.1.3. Shoulder

13.3.1.4. Others

13.3.2. Cardiac Surgery

13.3.2.1. Mitral Valve

13.3.2.2. Aortic Valve

13.3.2.3. Structural Heart Disease

13.3.2.4. Tricuspid Valve

13.3.2.5. Others

13.3.3. General Surgery

13.3.3.1. Gastrointestinal Surgery

13.3.3.2. Hepatobiliary Pancreatic Surgery

13.3.4. Urology Surgery

13.3.5. Thoracic Surgery

13.3.6. Gynecology Surgery

13.3.7. Vascular Surgery

13.3.8. Cancer Surgery

13.3.9. Breast Surgery

13.3.10. Ear, Nose, and Throat Surgery

13.3.11. Bariatric Surgery

13.3.12. Cosmetic/Plastic Surgery

13.3.13. Neurosurgery

13.4. Latin America Minimally Invasive Surgery Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.1.1. Orthopedic Surgery

13.4.1.2. Cardiac Surgery

13.4.1.3. Thoracic Surgery

13.4.1.4. Urology Surgery

13.4.1.5. Gynecology Surgery

13.4.1.6. Vascular Surgery

13.4.1.7. General Surgery

13.4.1.8. Cancer Surgery

13.4.1.9. Breast Surgery

13.4.1.10. Ear, Nose, and Throat Surgery

13.4.1.11. Bariatric Surgery

13.4.1.12. Cosmetic/Plastic Surgery

13.4.1.13. Neurosurgery

13.4.2. Clinics

13.4.2.1. Orthopedic Surgery

13.4.2.2. Cardiac Surgery

13.4.2.3. Thoracic Surgery

13.4.2.4. Urology Surgery

13.4.2.5. Gynecology Surgery

13.4.2.6. Vascular Surgery

13.4.2.7. General Surgery

13.4.2.8. Cancer Surgery

13.4.2.9. Breast Surgery

13.4.2.10. Ear, Nose, and Throat Surgery

13.4.2.11. Bariatric Surgery

13.4.2.12. Cosmetic/Plastic Surgery

13.4.2.13. Neurosurgery

13.4.3. Ambulatory Surgical Centers

13.4.3.1. Orthopedic Surgery

13.4.3.2. Cardiac Surgery

13.4.3.3. Thoracic Surgery

13.4.3.4. Urology Surgery

13.4.3.5. Gynecology Surgery

13.4.3.6. Vascular Surgery

13.4.3.7. General Surgery

13.4.3.8. Cancer Surgery

13.4.3.9. Breast Surgery

13.4.3.10. Ear, Nose, and Throat Surgery

13.4.3.11. Bariatric Surgery

13.4.3.12. Cosmetic/Plastic Surgery

13.4.3.13. Neurosurgery

13.4.4. Others

13.4.4.1. Orthopedic Surgery

13.4.4.2. Cardiac Surgery

13.4.4.3. Thoracic Surgery

13.4.4.4. Urology Surgery

13.4.4.5. Gynecology Surgery

13.4.4.6. Vascular Surgery

13.4.4.7. General Surgery

13.4.4.8. Cancer Surgery

13.4.4.9. Breast Surgery

13.4.4.10. Ear, Nose, and Throat Surgery

13.4.4.11. Bariatric Surgery

13.4.4.12. Cosmetic/Plastic Surgery

13.4.4.13. Neurosurgery

13.5. Latin America Minimally Invasive Surgery Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Minimally Invasive Surgery Market Attractiveness Analysis

13.6.1. By Procedure

13.6.2. By Disease Indication

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Minimally Invasive Surgery Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Minimally Invasive Surgery Market Value & Volume Forecast, by Procedure, 2017-2031

14.2.1. Laparoscopic Surgery

14.2.1.1. Orthopedic Surgery

14.2.1.2. Thoracic Surgery

14.2.1.3. Urology Surgery

14.2.1.4. Gynecology Surgery

14.2.1.5. Vascular Surgery

14.2.1.6. General Surgery

14.2.1.7. Cancer Surgery

14.2.1.8. Breast Surgery

14.2.1.9. Ear, Nose, and Throat Surgery

14.2.1.10. Bariatric Surgery

14.2.2. Robotic Surgery

14.2.2.1. Orthopedic Surgery

14.2.2.2. Cardiac Surgery

14.2.2.3. Thoracic Surgery

14.2.2.4. Urology Surgery

14.2.2.5. Gynecology Surgery

14.2.2.6. Vascular Surgery

14.2.2.7. General Surgery

14.2.2.8. Cancer Surgery

14.2.2.9. Breast Surgery

14.2.2.10. Ear, Nose, and Throat Surgery

14.2.2.11. Bariatric Surgery

14.2.2.12. Cosmetic/Plastic Surgery

14.2.2.13. Neurosurgery

14.2.3. Endoscopic Mucosal Resection

14.2.4. Endoscopic Submucosal Dissection

14.2.5. Transcatheter

14.2.5.1. Cardiac Surgery

14.2.5.2. Vascular Surgery

14.2.5.3. Cancer Surgery

14.2.5.4. Bariatric Surgery

14.3. Middle East & Africa Minimally Invasive Surgery Market Value & Volume Forecast, by Disease Indication, 2017-2031

14.3.1. Orthopedic Surgery

14.3.1.1. Knee

14.3.1.2. Spine

14.3.1.3. Shoulder

14.3.1.4. Others

14.3.2. Cardiac Surgery

14.3.2.1. Mitral Valve

14.3.2.2. Aortic Valve

14.3.2.3. Structural Heart Disease

14.3.2.4. Tricuspid Valve

14.3.2.5. Others

14.3.3. General Surgery

14.3.3.1. Gastrointestinal Surgery

14.3.3.2. Hepatobiliary Pancreatic Surgery

14.3.4. Urology Surgery

14.3.5. Thoracic Surgery

14.3.6. Gynecology Surgery

14.3.7. Vascular Surgery

14.3.8. Cancer Surgery

14.3.9. Breast Surgery

14.3.10. Ear, Nose, and Throat Surgery

14.3.11. Bariatric Surgery

14.3.12. Cosmetic/Plastic Surgery

14.3.13. Neurosurgery

14.4. Middle East & Africa Minimally Invasive Surgery Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.1.1. Orthopedic Surgery

14.4.1.2. Cardiac Surgery

14.4.1.3. Thoracic Surgery

14.4.1.4. Urology Surgery

14.4.1.5. Gynecology Surgery

14.4.1.6. Vascular Surgery

14.4.1.7. General Surgery

14.4.1.8. Cancer Surgery

14.4.1.9. Breast Surgery

14.4.1.10. Ear, Nose, and Throat Surgery

14.4.1.11. Bariatric Surgery

14.4.1.12. Cosmetic/Plastic Surgery

14.4.1.13. Neurosurgery

14.4.2. Clinics

14.4.2.1. Orthopedic Surgery

14.4.2.2. Cardiac Surgery

14.4.2.3. Thoracic Surgery

14.4.2.4. Urology Surgery

14.4.2.5. Gynecology Surgery

14.4.2.6. Vascular Surgery

14.4.2.7. General Surgery

14.4.2.8. Cancer Surgery

14.4.2.9. Breast Surgery

14.4.2.10. Ear, Nose, and Throat Surgery

14.4.2.11. Bariatric Surgery

14.4.2.12. Cosmetic/Plastic Surgery

14.4.2.13. Neurosurgery

14.4.3. Ambulatory Surgical Centers

14.4.3.1. Orthopedic Surgery

14.4.3.2. Cardiac Surgery

14.4.3.3. Thoracic Surgery

14.4.3.4. Urology Surgery

14.4.3.5. Gynecology Surgery

14.4.3.6. Vascular Surgery

14.4.3.7. General Surgery

14.4.3.8. Cancer Surgery

14.4.3.9. Breast Surgery

14.4.3.10. Ear, Nose, and Throat Surgery

14.4.3.11. Bariatric Surgery

14.4.3.12. Cosmetic/Plastic Surgery

14.4.3.13. Neurosurgery

14.4.4. Others

14.4.4.1. Orthopedic Surgery

14.4.4.2. Cardiac Surgery

14.4.4.3. Thoracic Surgery

14.4.4.4. Urology Surgery

14.4.4.5. Gynecology Surgery

14.4.4.6. Vascular Surgery

14.4.4.7. General Surgery

14.4.4.8. Cancer Surgery

14.4.4.9. Breast Surgery

14.4.4.10. Ear, Nose, and Throat Surgery

14.4.4.11. Bariatric Surgery

14.4.4.12. Cosmetic/Plastic Surgery

14.4.4.13. Neurosurgery

14.5. Middle East & Africa Minimally Invasive Surgery Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Minimally Invasive Surgery Market Attractiveness Analysis

14.6.1. By Procedure

14.6.2. By Disease Indication

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Company Profiles (Hospitals)

15.2.1. Apollo Hospitals Enterprise Limited

15.2.1.1. Services Portfolio

15.2.1.2. SWOT Analysis

15.2.1.3. Strategic Overview

15.2.2. Huntington Hospital

15.2.2.1. Services Portfolio

15.2.2.2. SWOT Analysis

15.2.2.3. Strategic Overview

15.2.3. Johns Hopkins Hospital

15.2.3.1. Services Portfolio

15.2.3.2. SWOT Analysis

15.2.3.3. Strategic Overview

15.2.4. Massachusetts General Hospital

15.2.4.1. Services Portfolio

15.2.4.2. SWOT Analysis

15.2.4.3. Strategic Overview

15.2.5. Rutland Medical Center

15.2.5.1. Services Portfolio

15.2.5.2. SWOT Analysis

15.2.5.3. Strategic Overview

15.2.6. Saint Michael's Hospital

15.2.6.1. Services Portfolio

15.2.6.2. SWOT Analysis

15.2.6.3. Strategic Overview

15.2.7. Singapore General Hospital

15.2.7.1. Services Portfolio

15.2.7.2. SWOT Analysis

15.2.7.3. Strategic Overview

15.2.8. The Ottawa Hospital

15.2.8.1. Services Portfolio

15.2.8.2. SWOT Analysis

15.2.8.3. Strategic Overview

15.2.9. University of Pittsburgh Medical Center

15.2.9.1. Services Portfolio

15.2.9.2. SWOT Analysis

15.2.9.3. Strategic Overview

15.2.10. Washington Hospital Healthcare System

15.2.10.1. Services Portfolio

15.2.10.2. SWOT Analysis

15.2.10.3. Strategic Overview

15.3. Company Profiles (Instrument Providers)

15.3.1. Abbott Laboratories

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. B. Braun Melsungen AG

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Becton, Dickinson and Company

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Boston Scientific Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. CONMED Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Johnson & Johnson Services, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Medtronic plc

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Smith & Nephew plc

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Stryker Corporation

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Zimmer Biomet

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017-2031

Table 02: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Procedure, 2017-2031

Table 03: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 04: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery, 2017-2031

Table 05: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 06: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 07: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery, 2017-2031

Table 08: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 09: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 10: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery, 2017-2031

Table 11: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 12: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 13: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 14: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery, 2017-2031

Table 15: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 16: Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 17: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 18: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 19: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 20: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 21: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 22: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 23: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery, 2017-2031

Table 24: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery, 2017-2031

Table 25: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 26: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 27: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 28: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 29: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 30: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 31: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 32: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 33: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 34: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 35: Global Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Region, 2017-2031

Table 36: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 37: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017-2031

Table 38: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Procedure, 2017-2031

Table 39: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 40: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery, 2017-2031

Table 41: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 42: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 43: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery, 2017-2031

Table 44: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 45: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 46: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery, 2017-2031

Table 47: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 48: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 49: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 50: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery, 2017-2031

Table 51: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 52: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 53: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 54: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 55: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 56: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 57: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 58: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 59: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery , 2017-2031

Table 60: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery , 2017-2031

Table 61: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 62: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 63: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 64: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 65: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 66: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 67: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 68: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 69: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 70: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 71: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017-2031

Table 72: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Procedure, 2017-2031

Table 73: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 74: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Orthopedic Surgery, 2017-2031

Table 75: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 76: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 77: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Orthopedic Surgery, 2017-2031

Table 78: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 79: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 80: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 81: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 82: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 83: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 84: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 85: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 86: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 87: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 88: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 89: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 90: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 91: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 92: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 93: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery , 2017-2031

Table 94: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery , 2017-2031

Table 95: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 96: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 97: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 98: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 99: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 100: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 101: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 102: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 103: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 104: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 105: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017-2031

Table 106: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Procedure, 2017-2031

Table 107: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 108: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Orthopedic Surgery, 2017-2031

Table 109: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 110: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 111: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Orthopedic Surgery, 2017-2031

Table 112: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 113: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 114: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 115: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 116: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 117: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 118: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 119: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 120: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 121: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 122: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 123: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 124: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 125: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 126: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 127: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 128: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 129: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery, 2017-2031

Table 130: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery, 2017-2031

Table 131: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 132: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 133: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 134: Asia Pacific Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 135: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 136: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 137: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 138: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 139: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 140: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 141: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 142: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 143: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 144: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 145: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017-2031

Table 146: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Procedure, 2017-2031

Table 147: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 148: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Orthopedic Surgery, 2017-2031

Table 149: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 150: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 151: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Orthopedic Surgery, 2017-2031

Table 152: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 153: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 154: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 155: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 156: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 157: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 158: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 159: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 160: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 161: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 162: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 163: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 164: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 165: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 167: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 168: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 169: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 170: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery , 2017-2031

Table 171: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery , 2017-2031

Table 172: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 173: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 174: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 175: Latin America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 176: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 177: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 178: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 179: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 180: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 181: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 182: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 183: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 184: Latin America Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 185: Middle East and Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 186: Middle East And Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017-2031

Table 187: Middle East And Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Procedure, 2017-2031

Table 188: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 189: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by Orthopedic Surgery, 2017-2031 1

Table 190: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 191: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Disease Indication, 2017-2031

Table 192: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by Cardiac Surgery, 2017-2031

Table 193: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Laparoscopic Surgery, by General Surgery, 2017-2031

Table 194: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 196: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 197: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 198: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 199: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Disease Indication, 2017-2031

Table 200: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Orthopedic Surgery, 2017-2031

Table 201: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by Cardiac Surgery, 2017-2031

Table 202: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Robotic Surgery, by General Surgery, 2017-2031

Table 203: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 204: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 205: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Disease Indication, 2017-2031

Table 206: Middle East & Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast for Transcatheter, by Cardiac Surgery, 2017-2031

Table 207: Middle East And Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 208: Middle East and Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Disease Indication, 2017-2031

Table 209: Middle East And Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 210: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Disease Indication, 2017-2031

Table 211: Middle East And Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Orthopedic Surgery , 2017-2031

Table 212: Middle East And Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Orthopedic Surgery , 2017-2031

Table 213: Middle East And Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Cardiac Surgery, 2017-2031

Table 214: Middle East And Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by Cardiac Surgery, 2017-2031

Table 215: Middle East and Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by General Surgery, 2017-2031

Table 216: Middle East And Africa Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast, by General Surgery, 2017-2031

Table 217: Middle East And Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 218: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 219: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Hospitals, by Disease Indication, 2017-2031

Table 220: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 221: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Clinics, by Disease Indication, 2017-2031

Table 222: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 223: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Ambulatory Surgical Centers, by Disease Indication, 2017-2031

Table 224: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

Table 225: Middle East & Africa Minimally Invasive Surgery Market Value (US$ Mn) Forecast for Others, by Disease Indication, 2017-2031

List of Figures

Figure 01: Global Minimally Invasive Surgery Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Minimally Invasive Surgery Market Value Share, by Procedure (2022)

Figure 03: Global Minimally Invasive Surgery Market Value Share, by Disease Indication (2022)

Figure 04: Global Minimally Invasive Surgery Market Value Share, by End-user (2022)

Figure 05: Global Minimally Invasive Surgery Market Value Share, by Region (2022)

Figure 06: Global Minimally Invasive Surgery Market, by Procedure, 2022 and 2031

Figure 07: Global Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2023-2031

Figure 08: Global Minimally Invasive Surgery Market (US$ Mn), by Laparoscopic Surgery, 2017-2031

Figure 09: Global Minimally Invasive Surgery Market (US$ Mn), by Robotic Surgery, 2017-2031

Figure 10: Global Minimally Invasive Surgery Market (US$ Mn), by Endoscopic Mucosal Resection, 2017-2031

Figure 11: Global Minimally Invasive Surgery Market (US$ Mn), by Endoscopic Submucosal Dissection, 2017-2031

Figure 12: Global Minimally Invasive Surgery Market (US$ Mn), by Transcatheter, 2017-2031

Figure 13: Global Minimally Invasive Surgery Market, by Disease Indication, 2022 and 2031

Figure 14: Global Minimally Invasive Surgery Market Attractiveness Analysis, by Disease Indication, 2023-2031

Figure 15: Global Minimally Invasive Surgery Market (US$ Mn), by Orthopedic Surgery, 2017-2031

Figure 16: Global Minimally Invasive Surgery Market (US$ Mn), by Cardiac Surgery, 2017-2031

Figure 17: Global Minimally Invasive Surgery Market (US$ Mn), by General Surgery, 2017-2031

Figure 18: Global Minimally Invasive Surgery Market (US$ Mn), Urology Surgery, 2017-2031

Figure 19: Global Minimally Invasive Surgery Market (US$ Mn), by Thoracic Surgery, 2017-2031

Figure 20: Global Minimally Invasive Surgery Market (US$ Mn), by Gynecology Surgery, 2017-2031

Figure 21: Global Minimally Invasive Surgery Market (US$ Mn), by Vascular Surgery, 2017-2031

Figure 22: Global Minimally Invasive Surgery Market (US$ Mn), by Cancer Surgery, 2017-2031

Figure 23: Global Minimally Invasive Surgery Market (US$ Mn), by Breast Surgery, 2017-2031

Figure 24: Global Minimally Invasive Surgery Market (US$ Mn), by Ear, Nose and Throat Surgery, 2017-2031

Figure 25: Global Minimally Invasive Surgery Market (US$ Mn), by Bariatric Surgery, 2017-2031

Figure 26: Global Minimally Invasive Surgery Market (US$ Mn), by Cosmetic/Plastic Surgery, 2017-2031

Figure 27: Global Minimally Invasive Surgery Market (US$ Mn), by Neurosurgery, 2017-2031

Figure 28: Global Minimally Invasive Surgery Market (US$ Mn), by Others, 2017-2031

Figure 29: Global Minimally Invasive Surgery Market, by End-user, 2022 and 2031

Figure 30: Global Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2023-2031

Figure 31: Global Minimally Invasive Surgery Market (US$ Mn), by Hospitals, 2017-2031

Figure 32: Global Minimally Invasive Surgery Market (US$ Mn), by Clinics 2017-2031

Figure 33: Global Minimally Invasive Surgery Market (US$ Mn), by Ambulatory Surgical Centers, 2017-2031

Figure 34: Global Minimally Invasive Surgery Market (US$ Mn), by Others, 2017-2031

Figure 35: Global Minimally Invasive Surgery Market Value Share Analysis, by Region, 2022 and 2031

Figure 36: Global Minimally Invasive Surgery Market Attractiveness Analysis, by Region, 2023-2031

Figure 37: North America Minimally Invasive Surgery Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 38: North America Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 39: North America Minimally Invasive Surgery Market Value Share Analysis, by Country, 2022 and 2031

Figure 40: North America Minimally Invasive Surgery Market Attractiveness Analysis, by Country, 2023-2031

Figure 41: North America Minimally Invasive Surgery Market, by Procedure, 2022 and 2031

Figure 42: North America Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2023-2031

Figure 43: North America Minimally Invasive Surgery Market, by Disease Indication, 2022 and 2031

Figure 44: North America Minimally Invasive Surgery Market Attractiveness Analysis, by Disease Indication , 2023-2031

Figure 45: North America Minimally Invasive Surgery Market, by End-user, 2022 and 2031

Figure 46: North America Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2023-2031

Figure 47: Europe Minimally Invasive Surgery Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 48: Europe Minimally Invasive Surgery Market Volume (Mn Procedures) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 49: Europe Minimally Invasive Surgery Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 50: Europe Minimally Invasive Surgery Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 51: Global Minimally Invasive Surgery Market, by Procedure, 2022 and 2031

Figure 52: Europe Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2023-2031

Figure 53: Europe Minimally Invasive Surgery Market, by Disease Indication , 2022 and 2031

Figure 54: Europe Minimally Invasive Surgery Market Attractiveness Analysis, by Disease Indication , 2023-2031

Figure 55: Europe Minimally Invasive Surgery Market, by End-user, 2022 and 2031

Figure 56: Europe Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2023-2031

Figure 57: Asia Pacific Minimally Invasive Surgery Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031