Ever since the first laser was developed nearly 60 years ago, laser technologies have evolved at a rapid pace. Due to technological advancements and emphasis on the discovery of innovative laser concepts, at present, lasers are extensively used across a host of industrial sectors. Developments in laser technologies over the past few decades have played an imperative role in revolutionizing the modern-day healthcare sector. Medical laser systems are increasingly being used across hospitals and specialized clinics around the world in an array of medical applications, including dermatology, cancer therapy, cardiovascular treatment, ophthalmology, and dentistry. This is expected to drive the medical laser systems market.

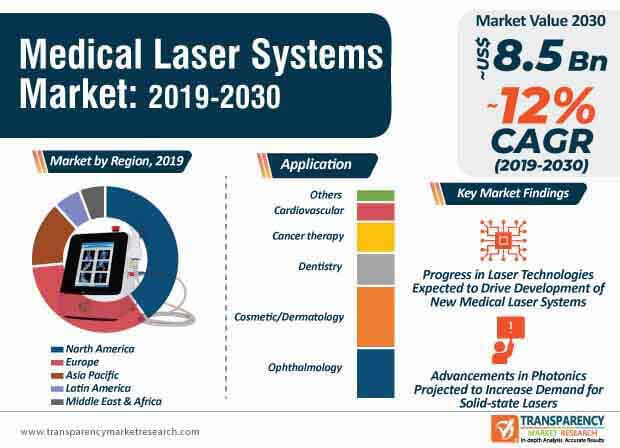

While the science behind light remains the same, technologies and innovative laser concepts have matured at a rapid pace due to which, different types of lasers have entered the fray. Some of the most recent advancements within the laser field include the onset of new types of lasers such as holmium-doped laser, full silicon laser, and flying microlaser, among others. Advancements in photonics coupled with the surge in research and development activities have played a key role in increasing the adoption of medical laser systems over the past decade and the trend is likely to continue during the forecast period. At the back of these factors, the global medical laser systems market is on course to reach a market value of ~US$ 8.5 Bn the end of 2030.

To know the scope of our report Get a Sample on Medical Laser Systems Market

Over the past few years, research institutes and the healthcare sector have extensively focused on exploring the potential benefits of new laser technologies in medical applications. The progress made by photonics in recent years has played a key role in the development of new lasers. Among different types of lasers, fiber lasers, a variant of the solid-state laser, have gained a considerable amount of popularity. The adoption of fiber lasers has consistently grown over the past few decades due to optimum physical characteristics of the waveguide structure of the fiber.

Get a glimpse of the in-depth analysis through our Report Brochure

Although fiber lasers are used across a broad spectrum of research and industrial applications, the demand from the medical field is on the rise. The adoption of fiber lasers in the medical field has shifted gears due to which, fiber lasers have emerged as one of the most promising tools that are likely to modernize the medical sector. The growing demand for painless and non-invasive medical treatments is another factor that is expected to propel the demand for medical laser systems in the forthcoming decade. Recent progress in cancer diagnosis using advanced laser technologies is another major factor that is likely to provide an impetus to the growth of the medical laser systems market.

Researchers around the world are increasingly focused on the development of photoacoustic imaging techniques, wherein living materials are thoroughly examined using laser light. At present, medical experts are increasingly exploring potential applications of photoacoustic imaging in the medical field.

The onset of the novel COVID-19 pandemic is expected to provide a new window of opportunity for players operating in the current medical laser systems market. Although the demand for a few types of non-essential laser treatments is likely to witness a slight decline, the adoption of medical laser systems for COVID-19 diagnostics is likely to grow. At present, COVID-19 diagnostics involves a swab test that typically takes several hours. However, researchers are exploring the potential applications of lasers to speed up COVID-19 diagnostics. A group of scientists from different universities in the U.S. is collaborating with each other to develop a diagnostic tool to identify different viruses using laser beams.

At present, considerable efforts are being made to streamline the screening process and make it more efficient. Medical laser systems have the potential to provide solutions to address these challenges. For instance, in May 2020, QuantLase Imaging Lab announced that the organization has successfully developed cutting-edge laser equipment that is likely to enable large-scale testing and mass screenings. Stakeholders operating in the current medical laser systems market landscape are expected to improvise, invest in research, and develop new solutions to capitalize on the looming opportunities.

Expanding operations in future? To get the perfect launch ask for a custom report

Analysts’ Viewpoint

The global medical laser systems market is expected to grow at an impressive CAGR of ~12% during the forecast period. The market growth is largely driven by advancements in laser technology, strides taken by photonics in the past decade, a growing number of research activities, and collaborations between medical and research institutes. The soaring demand for solid-state lasers will provide a boost to the prospects of the medical laser systems market during the forecast period despite treading through uncertain times during the COVID-19 pandemic.

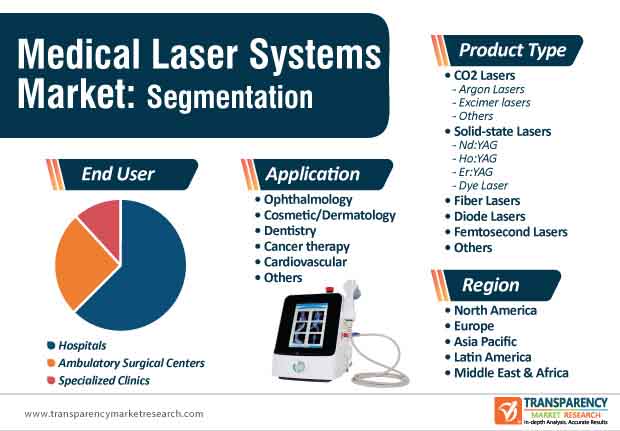

Medical Laser Systems Market – Segmentation

|

Product Type |

|

|

Application |

|

|

End User |

|

|

Region |

|

Medical laser systems market to reach valuation of US$ 8.5 Bn by 2030

Medical laser systems market is driven by rise in prevalence of chronic diseases, high unmet needs in terms of disease epidemiology

North America accounted for a major share of the global medical laser systems market

The solid-state lasers segment dominated the global medical laser systems market

Key players operating in the global medical laser systems market include LASOS Lasertechnik GmbH, Fujikura Ltd., Modu-Laser, Zeiss, BIOLASE, Inc., Alcon

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Laser Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Laser Systems Market Analysis and Forecast, 2018–2030

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with Key countries

5.2. Regulatory Scenario by Region/globally

5.3. Technological Advancements

6. Global Medical Laser Systems Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Medical Laser Systems Market Value Forecast, by Product Type, 2018–2030

6.3.1. Gas Lasers

6.3.1.1. CO2 Lasers

6.3.1.2. Argon Lasers

6.3.1.3. Excimer Lasers

6.3.1.4. Others

6.3.2. Solid-state Lasers

6.3.2.1. Nd:YAG

6.3.2.2. Ho:YAG

6.3.2.3. Er:YAG

6.3.2.4. Dye Lasers

6.3.3. Fiber Lasers

6.3.4. Diode Lasers

6.3.5. Femtosecond Lasers

6.3.6. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Medical Laser Systems Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Medical Laser Systems Market Value Forecast, by Application, 2018–2030

7.3.1. Ophthalmology

7.3.2. Cosmetic/Dermatology

7.3.3. Dentistry

7.3.4. Cancer therapy

7.3.5. Cardiovascular

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Medical Laser Systems Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Medical Laser Systems Market Value Forecast, by End-user, 2018–2030

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Medical Laser Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Medical Laser Systems Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Medical Laser Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Medical Laser Systems Market Value Forecast, by Product Type, 2018–2030

10.2.1. Gas Lasers

10.2.1.1. CO2 Lasers

10.2.1.2. Argon Lasers

10.2.1.3. Excimer Lasers

10.2.1.4. Others

10.2.2. Solid-state Lasers

10.2.2.1. Nd:YAG

10.2.2.2. Ho:YAG

10.2.2.3. Er:YAG

10.2.2.4. Dye Lasers

10.2.3. Fiber Lasers

10.2.4. Diode Lasers

10.2.5. Femtosecond Lasers

10.2.6. Others

10.3. North America Medical Laser Systems Market Value Forecast, by Application, 2018–2030

10.3.1. Ophthalmology

10.3.2. Cosmetic/Dermatology

10.3.3. Dentistry

10.3.4. Cancer therapy

10.3.5. Cardiovascular

10.3.6. Others

10.4. North America Medical Laser Systems Market Value Forecast, by End-user, 2018–2030

10.4.1. Hospitals

10.4.2. Diagnostic Centers

10.4.3. Others

10.5. North America Medical Laser Systems Market Value Forecast, by Country, 2018–2030

10.5.1. U.S.

10.5.2. Canada

10.6. North America Medical Laser Systems Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Medical Laser Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Medical Laser Systems Market Value Forecast, by Product Type, 2018–2030

11.2.1. Gas Lasers

11.2.1.1. CO2 Lasers

11.2.1.2. Argon Lasers

11.2.1.3. Excimer Lasers

11.2.1.4. Others

11.2.2. Solid-state Lasers

11.2.2.1. Nd:YAG

11.2.2.2. Ho:YAG

11.2.2.3. Er:YAG

11.2.2.4. Dye Lasers

11.2.3. Fiber Lasers

11.2.4. Diode Lasers

11.2.5. Femtosecond Lasers

11.2.6. Others

11.3. Europe Medical Laser Systems Market Value Forecast, by Application, 2018–2030

11.3.1. Ophthalmology

11.3.2. Cosmetic/Dermatology

11.3.3. Dentistry

11.3.4. Cancer therapy

11.3.5. Cardiovascular

11.3.6. Others

11.4. Europe Medical Laser Systems Market Value Forecast, by End-user, 2018–2030

11.4.1. Hospitals

11.4.2. Diagnostic Centers

11.4.3. Others

11.5. Europe Medical Laser Systems Market Value Forecast, by Country/Sub-region, 2018–2030

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Medical Laser Systems Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Medical Laser Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Medical Laser Systems Market Value Forecast, by Product Type, 2018–2030

12.2.1. Gas Lasers

12.2.1.1. CO2 Lasers

12.2.1.2. Argon Laser

12.2.1.3. Excimer Lasers

12.2.1.4. Others

12.2.2. Solid-state Lasers

12.2.2.1. Nd:YAG

12.2.2.2. Ho:YAG

12.2.2.3. Er:YAG

12.2.2.4. Dye Lasers

12.2.3. Fiber Lasers

12.2.4. Diode Lasers

12.2.5. Femtosecond Lasers

12.2.6. Others

12.3. Asia Pacific Medical Laser Systems Market Value Forecast, by Application, 2018–2030

12.3.1. Ophthalmology

12.3.2. Cosmetic/Dermatology

12.3.3. Dentistry

12.3.4. Cancer therapy

12.3.5. Cardiovascular

12.3.6. Others

12.4. Asia Pacific Medical Laser Systems Market Value Forecast, by End-user, 2018–2030

12.4.1. Hospitals

12.4.2. Diagnostic Centers

12.4.3. Others

12.5. Asia Pacific Medical Laser Systems Market Value Forecast, by Country/Sub-region, 2018–2030

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Medical Laser Systems Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Medical Laser Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Medical Laser Systems Market Value Forecast, by Product Type, 2018–2030

13.2.1. Gas Lasers

13.2.1.1. CO2 Lasers

13.2.1.2. Argon Lasers

13.2.1.3. Excimer Lasers

13.2.1.4. Others

13.2.2. Solid-state Lasers

13.2.2.1. Nd:YAG

13.2.2.2. Ho:YAG

13.2.2.3. Er:YAG

13.2.2.4. Dye Lasers

13.2.3. Fiber Lasers

13.2.4. Diode Lasers

13.2.5. Femtosecond Lasers

13.2.6. Others

13.3. Latin America Medical Laser Systems Market Value Forecast, by Application, 2018–2030

13.3.1. Ophthalmology

13.3.2. Cosmetic/Dermatology

13.3.3. Dentistry

13.3.4. Cancer therapy

13.3.5. Cardiovascular

13.3.6. Others

13.4. Latin America Medical Laser Systems Market Value Forecast, by End-user, 2018–2030

13.4.1. Hospitals

13.4.2. Diagnostic Centers

13.4.3. Others

13.5. Latin America Medical Laser Systems Market Value Forecast, by Country/Sub-region, 2018–2030

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Medical Laser Systems Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Medical Laser Systems Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Medical Laser Systems Market Value Forecast, by Product Type, 2018–2030

14.2.1. Gas Lasers

14.2.1.1. CO2 Lasers

14.2.1.2. Argon Lasers

14.2.1.3. Excimer Lasers

14.2.1.4. Others

14.2.2. Solid-state Lasers

14.2.2.1. Nd:YAG

14.2.2.2. Ho:YAG

14.2.2.3. Er:YAG

14.2.2.4. Dye Lasers

14.2.3. Fiber Lasers

14.2.4. Diode Lasers

14.2.5. Femtosecond Lasers

14.2.6. Others

14.3. Middle East & Africa Medical Laser Systems Market Value Forecast, by Application, 2018–2030

14.3.1. Ophthalmology

14.3.2. Cosmetic/Dermatology

14.3.3. Dentistry

14.3.4. Cancer therapy

14.3.5. Cardiovascular

14.3.6. Others

14.4. Middle East & Africa Medical Laser Systems Market Value Forecast, by End-user, 2018–2030

14.4.1. Hospitals

14.4.2. Diagnostic Centers

14.4.3. Others

14.5. Middle East & Africa Medical Laser Systems Market Value Forecast, by Country/Sub-region, 2018–2030

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Medical Laser Systems Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competitive Landscape

15.1. Market Player - Competition Matrix (by Tier and Size of companies)

15.2. Company Profiles

15.2.1. LASOS Lasertechnik GmbH

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Product Portfolio

15.2.1.3. Strategic Overview

15.2.1.4. SWOT Analysis

15.2.2. Fujikura Ltd.

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Product Portfolio

15.2.2.3. Strategic Overview

15.2.2.4. SWOT Analysis

15.2.3. Modu-Laser

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Product Portfolio

15.2.3.3. Strategic Overview

15.2.3.4. SWOT Analysis

15.2.4. Zeiss

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Financial Overview

15.2.4.3. Product Portfolio

15.2.4.4. Strategic Overview

15.2.4.5. SWOT Analysis

15.2.5. BIOLASE, Inc.

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Financial Overview

15.2.5.3. Product Portfolio

15.2.5.4. Strategic Overview

15.2.5.5. SWOT Analysis

15.2.6. Alcon

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Financial Overview

15.2.6.3. Product Portfolio

15.2.6.4. Strategic Overview

15.2.6.5. SWOT Analysis

15.2.7. IRIDEX Corporation

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Financial Overview

15.2.7.3. Product Portfolio

15.2.7.4. Strategic Overview

15.2.7.5. SWOT Analysis

15.2.8. CANDELA CORPORATION

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Product Portfolio

15.2.8.3. Strategic Overview

15.2.8.4. SWOT Analysis

15.2.9. Lumenis

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Product Portfolio

15.2.9.3. Strategic Overview

15.2.9.4. SWOT Analysis

15.2.10. Bausch & Lomb Incorporated or its affiliates

15.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2. Financial Overview

15.2.10.3. Product Portfolio

15.2.10.4. Strategic Overview

15.2.10.5. SWOT Analysis

List of Tables

Table 01: Global Medical Laser Systems Market Value (US$ Mn) Forecast, by Product Type, 2020–2030

Table 02: Global Medical Laser Systems Market Value (US$ Mn) Forecast, by Gas Lasers, 2020–2030

Table 03: Global Medical Laser Systems Market Value (US$ Mn) Forecast, by Solid-state Lasers, 2020–2030

Table 04: Global Medical Laser Systems Market Value (US$ Mn) Forecast, by Application, 2020–2030

Table 05: Global Medical Laser Systems Market Value (US$ Mn) Forecast, by End-user, 2020–2030

Table 06: Global Medical Laser Systems Market Value (US$ Mn) Forecast, by Region, 2020–2030

Table 07: North America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Country, 2018–2030

Table 08: North America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 09: North America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Gas Lasers, 2018–2030

Table 10: North America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Solid-state Lasers, 2018–2030

Table 11: North America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 12: North America Medical Lasers Systems Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 13: Europe Medical Lasers Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 14: Europe Medical Lasers Systems Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 15: Europe Medical Lasers Systems Market Value (US$ Mn) Forecast, by Gas Lasers, 2018–2030

Table 16: Europe Medical Lasers Systems Market Value (US$ Mn) Forecast, by Solid-state Lasers, 2018–2030

Table 17: Europe Medical Lasers Systems Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 18: Europe Medical Lasers Systems Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 19: Asia Pacific Medical Lasers Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 20: Asia Pacific Medical Lasers Systems Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 21: Asia Pacific Medical Lasers Systems Market Value (US$ Mn) Forecast, by Gas Lasers, 2018–2030

Table 22: Asia Pacific Medical Lasers Systems Market Value (US$ Mn) Forecast, by Solid-state Lasers, 2018–2030

Table 23: Asia Pacific Medical Lasers Systems Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 24: Asia Pacific Medical Lasers Systems Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 25: Latin America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 26: Latin America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 27: Latin America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Gas Lasers, 2018–2030

Table 28: Latin America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Solid-state Lasers, 2018–2030

Table 29: Latin America Medical Lasers Systems Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 30: Latin America Medical Lasers Systems Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 31: Middle East & Africa Medical Lasers Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 32: Middle East & Africa Medical Lasers Systems Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 33: Middle East & Africa Medical Lasers Systems Market Value (US$ Mn) Forecast, by Gas Lasers, 2018–2030

Table 34: Middle East & Africa Medical Lasers Systems Market Value (US$ Mn) Forecast, by Solid-state Lasers, 2018–2030

Table 35: Middle East & Africa Medical Lasers Systems Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 36: Middle East & Africa Medical Lasers Systems Market Value (US$ Mn) Forecast, by End-user, 2018–2030

List of Figures

Figure 01: Global Medical Laser Systems Market Snapshot

Figure 02: Global Medical Laser Systems Market Snapshot

Figure 03: Global Medical Laser Systems Market Value (US$ Mn), by Region, 2018 and 2027

Figure 04: Global Medical Laser Systems Market Value (US$ Mn) and Y-o-Y (%) Forecast, 2018–2030

Figure 05: Global Medical Laser Systems Market Value Share, by Product Type, 2019

Figure 06: Global Medical Laser Systems Market Value Share, by Application, 2019

Figure 07: Global Medical Laser Systems Market Value Share, by End-user, 2019

Figure 08: Global Medical Laser Systems Market Value Share, by Region, 2019

Figure 09: Key Industry Developments - Medical Lasers Systems Market

Figure 10: Global Medical Laser Systems Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 11: Global Medical Laser Systems Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 12: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Gas lasers, 2020–2030

Figure 13: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Solid-state Lasers, 2020–2030

Figure 14: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Fiber Lasers, 2020–2030

Figure 15: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diode Lasers, 2020–2030

Figure 16: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Language Processing Disorder, 2020–2030

Figure 17: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2020–2030

Figure 18: Global Medical Laser Systems Market Value Share Analysis, by Application, 2019 and 2030

Figure 19: Global Medical Laser Systems Market Attractiveness Analysis, by Application, 2020–2030

Figure 20: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ophthalmology, 2020–2030

Figure 21: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cosmetic/Dermatology, 2020–2030

Figure 22: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Dentistry, 2020–2030

Figure 23: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cancer Therapy, 2020–2030

Figure 24: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cardiovascular, 2020–2030

Figure 25: Global Medical Laser Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2020–2030

Figure 26: Global Medical Laser Systems Market Value Share Analysis, by End-user, 2019 and 2030

Figure 27: Global Medical Laser Systems Market Attractiveness Analysis, by End-user, 2020–2030

Figure 28: Global Medical Laser Systems Market Revenue (US$ Mn ) and Y-o-Y Growth (%), by Hospitals, 2020–2030

Figure 29: Global Medical Laser Systems Market Revenue (US$ Mn ) and Y-o-Y Growth (%), by Ambulatory Surgical Centers, 2020–2030

Figure 30: Global Medical Laser Systems Market Revenue (US$ Mn ) and Y-o-Y Growth (%), by Specialized Clinics, 2020–2030

Figure 31: Medical Laser Systems Market – Regional Outlook

Figure 32: Global Medical Laser Systems Market Value Share Analysis, by Region, 2019 and 2030

Figure 33: Global Medical Laser Systems Market Attractiveness Analysis, by Region, 2020–2030

Figure 34: North America Medical Lasers Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 35: North America Medical Lasers Systems Market Value Share Analysis, by Country, 2019 and 2030

Figure 36: North America Medical Lasers Systems Market Attractiveness Analysis, by Country, 2020–2030

Figure 37: North America Medical Lasers Systems Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 38: North America Medical Lasers Systems Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 39: North America Medical Lasers Systems Market Value Share Analysis, by Application, 2019 and 2030

Figure 40: North America Medical Lasers Systems Market Attractiveness Analysis, by Application, 2020–2030

Figure 41: North America Medical Lasers Systems Market Value Share Analysis, by End-user, 2019 and 2030

Figure 42: North America Medical Lasers Systems Market Attractiveness Analysis, by End-user, 2020–2030

Figure 43: Europe Medical Lasers Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 44: Europe Medical Lasers Systems Market Value Share Analysis, by Country, 2019 and 2030

Figure 45: Europe Medical Lasers Systems Market Attractiveness Analysis, by Country, 2020–2030

Figure 46: Europe Medical Lasers Systems Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 47: Europe Medical Lasers Systems Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 48: Europe Medical Lasers Systems Market Value Share Analysis, by Application, 2019 and 2030

Figure 49: Europe Medical Lasers Systems Market Attractiveness Analysis, by Application, 2020–2030

Figure 50: Europe Medical Lasers Systems Market Value Share Analysis, by End-user, 2019 and 2030

Figure 51: Europe Medical Lasers Systems Market Attractiveness Analysis, by End-user, 2020–2030

Figure 52: Asia Pacific Medical Lasers Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 53: Asia Pacific Medical Lasers Systems Market Value Share Analysis, by Country, 2019 and 2030

Figure 54: Asia Pacific Medical Lasers Systems Market Attractiveness Analysis, by Country, 2020–2030

Figure 55: Asia Pacific Medical Lasers Systems Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 56: Asia Pacific Medical Lasers Systems Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 57: Asia Pacific Medical Lasers Systems Market Value Share Analysis, by Application, 2019 and 2030

Figure 58: Asia Pacific Medical Lasers Systems Market Attractiveness Analysis, by Application, 2020–2030

Figure 59: Asia Pacific Medical Lasers Systems Market Value Share Analysis, by End-user, 2019 and 2030

Figure 60: Asia Pacific Medical Lasers Systems Market Attractiveness Analysis, by End-user, 2020–2030

Figure 61: Latin America Medical Lasers Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 62: Latin America Medical Lasers Systems Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 63: Latin America Medical Lasers Systems Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 64: Latin America Medical Lasers Systems Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 65: Latin America Medical Lasers Systems Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 66: Latin America Medical Lasers Systems Market Value Share Analysis, by Application, 2019 and 2030

Figure 67: Latin America Medical Lasers Systems Market Attractiveness Analysis, by Application, 2020–2030

Figure 68: Latin America Medical Lasers Systems Market Value Share Analysis, by End-user, 2019 and 2030

Figure 69: Latin America Medical Lasers Systems Market Attractiveness Analysis, by End-user, 2020–2030

Figure 70: Middle East & Africa Medical Lasers Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 71: Middle East & Africa Medical Lasers Systems Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 72: Middle East & Africa Medical Lasers Systems Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 73: Middle East & Africa Medical Lasers Systems Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 74: Middle East & Africa Medical Lasers Systems Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 75: Middle East & Africa Medical Lasers Systems Market Value Share Analysis, by Application, 2019 and 2030

Figure 76: Middle East & Africa Medical Lasers Systems Market Attractiveness Analysis, by Application, 2020–2030

Figure 77: Middle East & Africa Medical Lasers Systems Market Value Share Analysis, by End-user, 2019 and 2030

Figure 78: Middle East & Africa Medical Lasers Systems Market Attractiveness Analysis, by End-user, 2020–2030