Analysts’ Viewpoint on Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Scenario

Switchgear refers to an amalgamation of electrical switching devices whose function is to switch, control, regulate, isolate, and protect electrical circuits and equipment. Products in the switchgear ambit include switches, circuit breakers, switch fuse units, contractors, HRC fuses, offload isolators, and earth leakage circuit breakers. Demand for low and medium voltage switchgear is expected to increase consistently in Asia Pacific owing to industrial development, rise in expenditure by governments on boosting infrastructure development, and addition of power capacity by key players. Rapid expansion and modernization of power generation plants across different parts of Asia Pacific in order to cater to the rising demand for electricity is anticipated to propel the adoption rate of switchgears in various power generation plants.

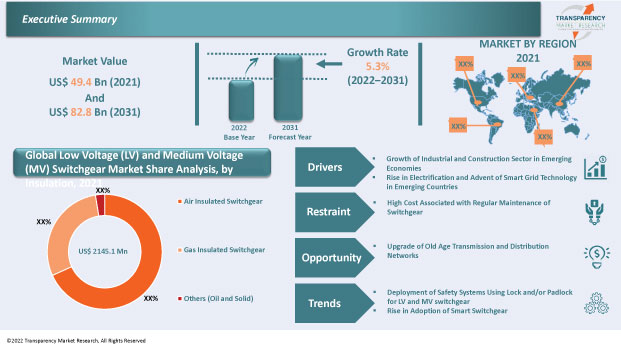

Rise in concerns about emission of CO2 of old transmission and distribution networks has triggered the demand for the installation of new medium voltage switchgear assembly. Low and medium voltage switchgears are directly linked to reliability of the supply of electricity. Advancements in features of SF6 switchgear, such as low noise level during operation, long maintenance intervals, excellent interrupting performance, environment compatibility, and small space requirement, are propelling the low and medium voltage switchgear market. The upgrade of aging transmission and distribution infrastructure is further anticipated to fuel the market. Around 65 gigawatts of onshore wind turbines are expected to reach end-of-design-life in Europe by 2028. The upgrade of equipment in order to extend their lifespan is estimated to drive the market for low and medium voltage switchgear. New regulations to reduce or limit power blackouts and strengthen power distribution networks are creating opportunities for manufacturers of the power sector equipment. Growth in usage of the equipment to make smarter decisions by providing real-time data is a major factor driving the global market.

Request a sample to get extensive insights into the Low Voltage (LV) and Medium Voltage (MV) Switchgear Market

Lack of electrification in various countries across the world has been inhibiting the use of switchgear and other advanced equipment, which require electricity. Grid electrification and adoption is high among rural households; electric grid has become the primary source of electricity and lighting. This is boosting the demand for low voltage and medium voltage switchgear. As of 2018, the electrification rate stood at less than 75% in rural areas in various countries in Asia such as Myanmar, Pakistan, North Korea, and Bangladesh. It was less than 50% in several countries in Africa. Initiatives taken by the governments of China, Sri Lanka, and India to achieve 100% rural electrification are also anticipated to propel the demand for low and medium voltage switchgear in the next few years. Increase in electrification and adoption of smart grid technology across different parts of the world is likely to augment the demand for low and medium voltage switchgear from 2022 to 2031.

In terms of insulation, the global low voltage (LV) and medium voltage (MV) switchgear market has been split into air insulated switchgear, gas insulated switchgear, and others (oil and solid). The air insulated switchgear segment held major share of 68.24% in 2021. It is likely to maintain the status quo and expand at a growth rate of 5.6% during the forecast period. In this type of switchgear, the air is utilized as the primary dielectric from phase to ground or for phase to phase insulation technology. These switchgears are extensively employed in areas where weather conditions, space, seismic occurrences, and environmental concerns are generally not an issue such as favourable offsite terrain and rural areas. Air insulation offers several advantages such as easy installation, remote monitoring and control, reliable switching of SF6 gas, and ease of transport and storage. Thus, manufacturers are increasingly focusing on the development of air insulated low and medium voltage switchgears. For Instance, MITSUBISHI ELECTRIC provides a variety of medium/low voltage products to ensure the safe and reliable operation of modern power network. The company is also focusing on offering the society a clean environment (sf6-free) and energy-efficient low lifecycle cost solutions.

Request a custom report on Low Voltage (LV) and Medium Voltage (MV) Switchgear Market

Based on installation, the global low voltage (LV) and medium voltage (MV) switchgear market has been bifurcated into indoor and outdoor. The indoor low and medium voltage switchgear segment held a share of 65.20% in 2021. Furthermore, the segment is expected to register a CAGR of 5.6% during the forecast period. Indoor switchgear is preferred for voltages below 40kV. The pieces of equipment in the system are packed together in an earthed metal case, i.e., most of the low and medium voltage switchgear are indoor installed. Outdoor type switchgear is used for voltages above 66kV. Equipment used by the system such as transformers, switches, and circuit breakers requires a considerably large surface area and wide electrical clearance between conductors at such high magnitude of voltages. This type of installation is not cost-effective.

Asia Pacific held a prominent share of 39.12% of the global low voltage (LV) and medium voltage (MV) switchgear market in 2021. Asia Pacific and North America are major hubs of research and development activities in the field of technology and new product development. Lucrative presence of low voltage switchgear and medium voltage switchgear manufacturers is driving the market in these regions. North America held 26.36% share of the global market in 2021 due to the presence of several prominent manufacturing corporations that offer electrification components for various industries. China dominated the market in Asia Pacific in 2021 due to the increase in power grid construction in the country. Government initiatives in renewable energy is also boosting the LV and MV switchgear market in the country. For instance, in December 2020, Hitachi ABB Power Grids introduced a 72.5 kV high-voltage hybrid switchgear for offshore wind – Plug and Switch System (PASS) M00 – Wind. The hybrid switchgear would be installed at China’s first 66-kilovolt offshore wind farm, Huadian Yuhuan Phase 1, to optimize the energy landscape in the Yangtze River Delta. This has boosted the adoption LV switchgears and MV switchgears in the country.

The global low voltage (LV) and medium voltage (MV) switchgear market is consolidated with the presence of established players who have stronghold on the global market for LV and MV switchgear. Majority of medium and low voltage switchgear companies are spending significantly on comprehensive research & development activities, primarily to develop environment-friendly products. Most of the low voltage switchgear manufacturers can choose their suppliers from a large number of raw interface suppliers worldwide. Large numbers of raw material suppliers are available across the globe. Sometimes, clients also provide a raw interface to meet their requirements. Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by key players. ABB, CG Power & Industrial Solutions Ltd., Eaton Corporation plc., Efacec, Fuji Electric Co., Ltd., General Electric, Hyosung Heavy Industries, Powell Industries Inc., Siemens AG, Schneider Electric SE, Mitsubishi Electric Corporation, BHEL, and Regal Rexnord Corporation are the prominent entities operating in the market.

Each of these players has been profiled in the low voltage (LV) and medium voltage (MV) switchgear market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 49.4 Bn |

|

Market Forecast Value in 2031 |

US$ 82.8 Bn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The low voltage (LV) and medium voltage (MV) switchgear market stood at US$ 49.4 Bn in 2021.

The low voltage (LV) and medium voltage (MV) switchgear market is expected to grow at a CAGR of 5.3% by 2031.

The low voltage (LV) and medium voltage (MV) switchgear market would reach US$ 82.8 Bn in 2031.

Prominent players operating in the low voltage (LV) and medium voltage (MV) switchgear market include ABB, Schneider Electric SE, Siemens AG, General Electric, Eaton Corporation plc, Mitsubishi Electric Corporation, Powell Industries Inc., Fuji Electric Co., Ltd., BHEL, Hyosung Heavy Industries, Regal Rexnord Corporation, CG Power & Industrial Solutions Ltd., and Efacec.

The U.S. accounted for 19.54% of share of the low voltage (LV) and medium voltage (MV) switchgear market in 2021.

Based on type, the air insulated segment held 68.24% share of the low voltage (LV) and medium voltage (MV) switchgear market in 2021.

Deployment of safety systems using lock and/or padlock for LV and MV switchgear and rising adoption of smart switchgear are key factors driving the market.

Asia Pacific is a more lucrative region of the global low voltage (LV) and medium voltage (MV) switchgear market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Switchgear Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis, by Voltage Range

5.1. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Voltage Range, 2017–2031

5.1.1. Less than 1kV

5.1.2. 1kV – 5kV

5.1.3. 6kV – 15kV

5.1.4. 17kV – 27kV

5.1.5. 28kV – 40kV

5.2. Market Attractiveness Analysis, by Voltage Range

6. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis, by Components

6.1. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Components, 2017–2031

6.1.1. Circuit Breaker

6.1.2. Relays

6.1.3. Bus Bars and Switches

6.1.4. Others (Enclosure, Isolators, Fuses)

6.2. Market Attractiveness Analysis, by Components

7. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis, by Insulation

7.1. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Insulation, 2017–2031

7.1.1. Air Insulated Switchgear

7.1.2. Gas Insulated Switchgear

7.1.3. Others (Oil and Solid)Others (Enclosure, Isolators, Fuses)

7.2. Market Attractiveness Analysis, by Insulation

8. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis, by Installation

8.1. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by Installation, 2017–2031

8.1.1. Indoor

8.1.2. Outdoor

8.2. Market Attractiveness Analysis, by Installation

9. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis, by End-use Industry

9.1. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.1.1. Automotive

9.1.2. IT and Telecommunication

9.1.3. Energy & Utility

9.1.4. Metals & Mining

9.1.5. Food & Beverage

9.1.6. Chemicals

9.1.7. Oil & Gas

9.1.8. Building & Construction

9.1.9. Others (Water & Waste Water, Textile, etc.)

9.2. Market Attractiveness Analysis, by End-use Industry

10. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis and Forecast, by Region

10.1. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, by Region

11. North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis and Forecast

11.1. Market Snapshot

11.2. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Voltage Range, 2017–2031

11.2.1. Less than 1kV

11.2.2. 1kV – 5kV

11.2.3. 6kV – 15kV

11.2.4. 17kV – 27kV

11.2.5. 28kV – 40kV

11.3. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Components, 2017–2031

11.3.1. Circuit Breaker

11.3.2. Relays

11.3.3. Bus Bars and Switches

11.3.4. Others (Enclosure, Isolators, Fuses)

11.4. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Insulation, 2017–2031

11.4.1. Air Insulated Switchgear

11.4.2. Gas Insulated Switchgear

11.4.3. Others (Oil and Solid)Others (Enclosure, Isolators, Fuses)

11.5. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by Installation, 2017–2031

11.5.1. Indoor

11.5.2. Outdoor

11.6. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.6.1. Automotive

11.6.2. IT and Telecommunication

11.6.3. Energy & Utility

11.6.4. Metals & Mining

11.6.5. Food & Beverage

11.6.6. Chemicals

11.6.7. Oil & Gas

11.6.8. Building & Construction

11.6.9. Others (Water & Waste Water, Textile, etc.)

11.7. Low Voltage (LV) and Medium Voltage (MV) Switchgear Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country/Sub-region and Sub-region, 2017–2031

11.7.1. The U.S.

11.7.2. Canada

11.7.3. Rest of North America

11.8. Market Attractiveness Analysis

11.8.1. By Voltage Range

11.8.2. By Components

11.8.3. By Insulation

11.8.4. By Installation

11.8.5. By End-use Industry

11.8.6. By Country/Sub-region/Sub-region

12. Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis and Forecast

12.1. Market Snapshot

12.2. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Voltage Range, 2017–2031

12.2.1. Less than 1kV

12.2.2. 1kV – 5kV

12.2.3. 6kV – 15kV

12.2.4. 17kV – 27kV

12.2.5. 28kV – 40kV

12.3. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Components, 2017–2031

12.3.1. Circuit Breaker

12.3.2. Relays

12.3.3. Bus Bars and Switches

12.3.4. Others (Enclosure, Isolators, Fuses)

12.4. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Insulation, 2017–2031

12.4.1. Air Insulated Switchgear

12.4.2. Gas Insulated Switchgear

12.4.3. Others (Oil and Solid)Others (Enclosure, Isolators, Fuses)

12.5. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by Installation, 2017–2031

12.5.1. Indoor

12.5.2. Outdoor

12.6. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.6.1. Automotive

12.6.2. IT and Telecommunication

12.6.3. Energy & Utility

12.6.4. Metals & Mining

12.6.5. Food & Beverage

12.6.6. Chemicals

12.6.7. Oil & Gas

12.6.8. Building & Construction

12.6.9. Others (Water & Waste Water, Textile, etc.)

12.7. Low Voltage (LV) and Medium Voltage (MV) Switchgear Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country/Sub-region and Sub-region, 2017–2031

12.7.1. The U.K.

12.7.2. Germany

12.7.3. France

12.7.4. Rest of Europe

12.8. Market Attractiveness Analysis

12.8.1. By Voltage Range

12.8.2. By Components

12.8.3. By Insulation

12.8.4. By Installation

12.8.5. By End-use Industry

12.8.6. By Country/Sub-region/Sub-region

13. Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis and Forecast

13.1. Market Snapshot

13.2. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Voltage Range, 2017–2031

13.2.1. Less than 1kV

13.2.2. 1kV – 5kV

13.2.3. 6kV – 15kV

13.2.4. 17kV – 27kV

13.2.5. 28kV – 40kV

13.3. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Components, 2017–2031

13.3.1. Circuit Breaker

13.3.2. Relays

13.3.3. Bus Bars and Switches

13.3.4. Others (Enclosure, Isolators, Fuses)

13.4. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Insulation, 2017–2031

13.4.1. Air Insulated Switchgear

13.4.2. Gas Insulated Switchgear

13.4.3. Others (Oil and Solid)Others (Enclosure, Isolators, Fuses)

13.5. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by Installation, 2017–2031

13.5.1. Indoor

13.5.2. Outdoor

13.6. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.6.1. Automotive

13.6.2. IT and Telecommunication

13.6.3. Energy & Utility

13.6.4. Metals & Mining

13.6.5. Food & Beverage

13.6.6. Chemicals

13.6.7. Oil & Gas

13.6.8. Building & Construction

13.6.9. Others (Water & Waste Water, Textile, etc.)

13.7. Low Voltage (LV) and Medium Voltage (MV) Switchgear Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country/Sub-region and Sub-region, 2017–2031

13.7.1. China

13.7.2. India

13.7.3. Japan

13.7.4. South Korea

13.7.5. ASEAN

13.7.6. Rest of Asia Pacific

13.8. Market Attractiveness Analysis

13.8.1. By Voltage Range

13.8.2. By Components

13.8.3. By Insulation

13.8.4. By Installation

13.8.5. By End-use Industry

13.8.6. By Country/Sub-region/Sub-region

14. Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis and Forecast

14.1. Market Snapshot

14.2. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Voltage Range, 2017–2031

14.2.1. Less than 1kV

14.2.2. 1kV – 5kV

14.2.3. 6kV – 15kV

14.2.4. 17kV – 27kV

14.2.5. 28kV – 40kV

14.3. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Components, 2017–2031

14.3.1. Circuit Breaker

14.3.2. Relays

14.3.3. Bus Bars and Switches

14.3.4. Others (Enclosure, Isolators, Fuses)

14.4. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Insulation, 2017–2031

14.4.1. Air Insulated Switchgear

14.4.2. Gas Insulated Switchgear

14.4.3. Others (Oil and Solid)Others (Enclosure, Isolators, Fuses)

14.5. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by Installation, 2017–2031

14.5.1. Indoor

14.5.2. Outdoor

14.6. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

14.6.1. Automotive

14.6.2. IT and Telecommunication

14.6.3. Energy & Utility

14.6.4. Metals & Mining

14.6.5. Food & Beverage

14.6.6. Chemicals

14.6.7. Oil & Gas

14.6.8. Building & Construction

14.6.9. Others (Water & Waste Water, Textile, etc.)

14.7. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country/Sub-region and Sub-region, 2017–2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. Rest of Middle East and Africa

14.8. Market Attractiveness Analysis

14.8.1. By Voltage Range

14.8.2. By Components

14.8.3. By Insulation

14.8.4. By Installation

14.8.5. By End-use Industry

14.8.6. By Country/Sub-region/Sub-region

15. South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Analysis and Forecast

15.1. Market Snapshot

15.2. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Voltage Range, 2017–2031

15.2.1. Less than 1kV

15.2.2. 1kV – 5kV

15.2.3. 6kV – 15kV

15.2.4. 17kV – 27kV

15.2.5. 28kV – 40kV

15.3. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Components, 2017–2031

15.3.1. Circuit Breaker

15.3.2. Relays

15.3.3. Bus Bars and Switches

15.3.4. Others (Enclosure, Isolators, Fuses)

15.4. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Insulation, 2017–2031

15.4.1. Air Insulated Switchgear

15.4.2. Gas Insulated Switchgear

15.4.3. Others (Oil and Solid)Others (Enclosure, Isolators, Fuses)

15.5. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by Installation, 2017–2031

15.5.1. Indoor

15.5.2. Outdoor

15.6. Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

15.6.1. Automotive

15.6.2. IT and Telecommunication

15.6.3. Energy & Utility

15.6.4. Metals & Mining

15.6.5. Food & Beverage

15.6.6. Chemicals

15.6.7. Oil & Gas

15.6.8. Building & Construction

15.6.9. Others (Water & Waste Water, Textile, etc.)

15.7. Low Voltage (LV) and Medium Voltage (MV) Switchgear Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country/Sub-region and Sub-region, 2017–2031

15.7.1. Brazil

15.7.2. Rest of South America

15.8. Market Attractiveness Analysis

15.8.1. By Voltage Range

15.8.2. By Components

15.8.3. By Insulation

15.8.4. By Installation

15.8.5. By End-use Industry

15.8.6. By Country/Sub-region/Sub-region

16. Competition Assessment

16.1. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Competition Matrix - a Dashboard View

16.1.1. Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. ABB

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. CG Power & Industrial Solutions Ltd.

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Eaton Corporation plc.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Efacec

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Fuji Electric Co., Ltd.

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. General Electric

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. Hyosung Heavy Industries

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Powell Industries Inc.

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Siemens AG

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Schneider Electric SE

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Mitsubishi Electric Corporation

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. BHEL

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. Regal Rexnord Corporation

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Voltage Range

18.1.2. By Components

18.1.3. By Insulation

18.1.4. By Installation

18.1.5. By End-use Industry

18.1.6. By Region

List of Tables

Table 01: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Value (US$ Mn), 2017‒2031

Table 02: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Volume (Thousand Units), 2017‒2031

Table 03: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Value (US$ Mn), 2017‒2031

Table 04: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Volume (Thousand Units), 2017‒2031

Table 05: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Value (US$ Mn), 2017‒2031

Table 06: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Volume (Thousand Units), 2017‒2031

Table 07: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Value (US$ Mn), 2017‒2031

Table 08: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 09: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 10: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Region, Volume (Thousand Units), 2017‒2031

Table 11: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Value (US$ Mn), 2017‒2031

Table 12: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Volume (Thousand Units), 2017‒2031

Table 13: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Value (US$ Mn), 2017‒2031

Table 14: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Volume (Thousand Units), 2017‒2031

Table 15: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Value (US$ Mn), 2017‒2031

Table 16: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Volume (Thousand Units), 2017‒2031

Table 17: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Value (US$ Mn), 2017‒2031

Table 18: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 19: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country/Sub-region, Value (US$ Mn), 2017‒2031

Table 20: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country/Sub-region, Volume (Thousand Units), 2017‒2031

Table 21: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Value (US$ Mn), 2017‒2031

Table 22: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Volume (Thousand Units), 2017‒2031

Table 23: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Value (US$ Mn), 2017‒2031

Table 24: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Volume (Thousand Units), 2017‒2031

Table 25: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Value (US$ Mn), 2017‒2031

Table 26: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Volume (Thousand Units), 2017‒2031

Table 27: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Value (US$ Mn), 2017‒2031

Table 28: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 29: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Table 30: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Volume (Thousand Units), 2017‒2031

Table 31: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Value (US$ Mn), 2017‒2031

Table 32: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Volume (Thousand Units), 2017‒2031

Table 33: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Value (US$ Mn), 2017‒2031

Table 34: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Volume (Thousand Units), 2017‒2031

Table 35: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Value (US$ Mn), 2017‒2031

Table 36: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Volume (Thousand Units), 2017‒2031

Table 37: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Value (US$ Mn), 2017‒2031

Table 38: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 39: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Table 40: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Volume (Thousand Units), 2017‒2031

Table 41: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Value (US$ Mn), 2017‒2031

Table 42: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Volume (Mn Units), 2017‒2031

Table 43: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Value (US$ Mn), 2017‒2031

Table 44: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Volume (Mn Units), 2017‒2031

Table 45: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Value (US$ Mn), 2017‒2031

Table 46: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Volume (Mn Units), 2017‒2031

Table 47: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Value (US$ Mn), 2017‒2031

Table 48: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 49: Middle East & Africa (MEA) Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Table 50: Middle East & Africa (MEA) Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Volume (Mn Units), 2017‒2031

Table 51: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Value (US$ Mn), 2017‒2031

Table 52: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Volume (Mn Units), 2017‒2031

Table 53: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Value (US$ Mn), 2017‒2031

Table 54: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Volume (Mn Units), 2017‒2031

Table 55: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Value (US$ Mn), 2017‒2031

Table 56: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Volume (Mn Units), 2017‒2031

Table 57: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Value (US$ Mn), 2017‒2031

Table 58: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 59: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Volume (Mn Units), 2017‒2031

Table 60: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Volume (Mn Units), 2017‒2031

List of Figures

Figure 01: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 02: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 03: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market, Value (US$ Mn), 2017‒2031

Figure 04: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Revenue (US$ Mn), 2017‒2031

Figure 05: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Voltage Range, Value (US$ Mn), 2022‒2031

Figure 06: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 07: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Revenue (US$ Mn), 2017‒2031

Figure 08: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Components, Value (US$ Mn), 2022‒2031

Figure 09: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Components, 2022 and 2031

Figure 10: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Revenue (US$ Mn), 2017‒2031

Figure 11: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Insulation, Value (US$ Mn), 2022‒2031

Figure 12: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Insulation, 2022 and 2031

Figure 13: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Revenue (US$ Mn), 2017‒2031

Figure 14: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Installation, Value (US$ Mn), 2022‒2031

Figure 15: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Installation, 2022 and 2031

Figure 16: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 17: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 18: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 19: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Region, Revenue (US$ Mn), 2017‒2031

Figure 20: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Region, Value (US$ Mn), 2022‒2031

Figure 21: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Region, 2022 and 2031

Figure 22: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Value (US$ Mn ), 2017‒2031

Figure 23: Global Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 24: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market, Value (US$ Mn), 2017‒2031

Figure 25: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Revenue (US$ Mn), 2017‒2031

Figure 26: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Voltage Range, Value (US$ Mn), 2022‒2031

Figure 27: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 28: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Revenue (US$ Mn), 2017‒2031

Figure 29: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Components, Value (US$ Mn), 2022‒2031

Figure 30: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Components, 2022 and 2031

Figure 31: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Revenue (US$ Mn), 2017‒2031

Figure 32: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Insulation, Value (US$ Mn), 2022‒2031

Figure 33: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Insulation, 2022 and 2031

Figure 34: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Revenue (US$ Mn), 2017‒2031

Figure 35: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Installation, Value (US$ Mn), 2022‒2031

Figure 36: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Installation, 2022 and 2031

Figure 37: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 38: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 39: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 40: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 41: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Country, Value (US$ Mn), 2022‒2031

Figure 42: North America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Country, 2022 and 2031

Figure 43: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Value (US$ Mn ), 2017‒2031

Figure 44: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 45: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market, Value (US$ Mn), 2017‒2031

Figure 46: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Revenue (US$ Mn), 2017‒2031

Figure 47: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Voltage Range, Value (US$ Mn), 2022‒2031

Figure 48: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 49: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Revenue (US$ Mn), 2017‒2031

Figure 50: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Components, Value (US$ Mn), 2022‒2031

Figure 51: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Components, 2022 and 2031

Figure 52: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Revenue (US$ Mn), 2017‒2031

Figure 53: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Insulation, Value (US$ Mn), 2022‒2031

Figure 54: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Insulation, 2022 and 2031

Figure 55: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Revenue (US$ Mn), 2017‒2031

Figure 56: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Installation, Value (US$ Mn), 2022‒2031

Figure 57: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Installation, 2022 and 2031

Figure 58: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 59: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 60: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 61: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 62: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 63: Europe Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 64: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Value (US$ Mn ), 2017‒2031

Figure 65: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 66: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market, Value (US$ Mn), 2017‒2031

Figure 67: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Revenue (US$ Mn), 2017‒2031

Figure 68: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Voltage Range, Value (US$ Mn), 2022‒2031

Figure 69: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 70: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Revenue (US$ Mn), 2017‒2031

Figure 71: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Components, Value (US$ Mn), 2022‒2031

Figure 72: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Components, 2022 and 2031

Figure 73: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Revenue (US$ Mn), 2017‒2031

Figure 74: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Insulation, Value (US$ Mn), 2022‒2031

Figure 75: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Insulation, 2022 and 2031

Figure 76: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Revenue (US$ Mn), 2017‒2031

Figure 77: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Installation, Value (US$ Mn), 2022‒2031

Figure 78: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Installation, 2022 and 2031

Figure 79: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 80: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 81: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 82: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 83: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 84: Asia Pacific Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 85: Middle East and Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Value (US$ Mn ), 2017‒2031

Figure 86: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 87: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market, Value (US$ Mn), 2017‒2031

Figure 88: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Revenue (US$ Mn), 2017‒2031

Figure 89: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Voltage Range, Value (US$ Mn), 2022‒2031

Figure 90: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 91: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Revenue (US$ Mn), 2017‒2031

Figure 92: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Components, Value (US$ Mn), 2022‒2031

Figure 93: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Components, 2022 and 2031

Figure 94: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Revenue (US$ Mn), 2017‒2031

Figure 95: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Insulation, Value (US$ Mn), 2022‒2031

Figure 96: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Insulation, 2022 and 2031

Figure 97: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Revenue (US$ Mn), 2017‒2031

Figure 98: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Installation, Value (US$ Mn), 2022‒2031

Figure 99: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Installation, 2022 and 2031

Figure 100: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 101: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 102: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 103: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 104: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 105: Middle East & Africa Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 106: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Value (US$ Mn ), 2017‒2031

Figure 107: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 108: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market, Value (US$ Mn), 2017‒2031

Figure 109: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Voltage Range, Revenue (US$ Mn), 2017‒2031

Figure 110: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Voltage Range, Value (US$ Mn), 2022‒2031

Figure 111: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 112: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Components, Revenue (US$ Mn), 2017‒2031

Figure 113: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Components, Value (US$ Mn), 2022‒2031

Figure 114: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Components, 2022 and 2031

Figure 115: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Insulation, Revenue (US$ Mn), 2017‒2031

Figure 116: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Insulation, Value (US$ Mn), 2022‒2031

Figure 117: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Insulation, 2022 and 2031

Figure 118: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Installation, Revenue (US$ Mn), 2017‒2031

Figure 119: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Installation, Value (US$ Mn), 2022‒2031

Figure 120: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Installation, 2022 and 2031

Figure 121: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 122: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 123: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 124: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 125: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 126: South America Low Voltage (LV) and Medium Voltage (MV) Switchgear Market Share Analysis, by Country and Sub-region, 2022 and 2031