Reports

Reports

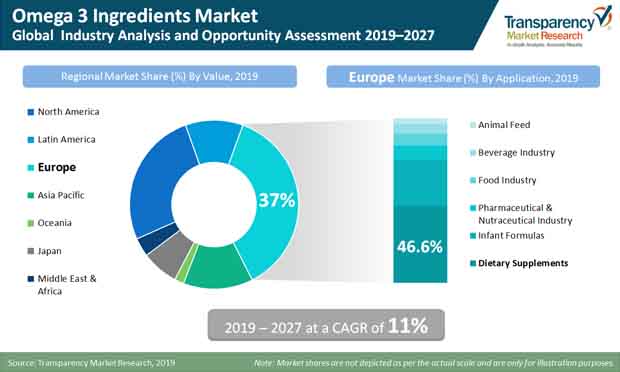

Future shines bright for the omega 3 industry, after the EPA and DHA made first cut in obtaining the regulatory approval. TMR’s research finds that the demand for omega 3 foods is surging at an unprecedented pace, having garnered significant consumer appeal since 2014, and global sales of omega 3 ingredients were upward of US$ 4,500 Mn in 2018. Growing consumer inclination towards improving their immunity and overall wellbeing continues to be a broader influential aspect, however, slower regulatory approval is expected to stymie growth to a significant extent.

The paradigm shift towards healthy food consumption, driven by rising chronic disease prevalence led by poor dietary habits. These technology-induced ingredients continue to gain popularity as effective food quality enhancers, thereby attracting the widening health-conscious demographic.

A slew of aspects including the emergence of new combination products, and the newfound appreciation of scientific evidence for omega 3 ingredients among consumers and healthcare professionals, has meant that the prebiotic ingredients market will witness sheer proliferation in the upcoming years. Although development and sales of omega 3 ingredients positioned specifically for dietary supplements lag behind variants such as amino acids, studies that back benefits of fatty acids for athletes are likely to advocate adoption. The study finds that demand for Eicosapentaenoic acid (EPA) and Docosahexaenoic acid (DHA) remains strong in omega 3 oil and seafood industry.

Omega 3 ingredients are becoming an indispensable part of the dietary supplements pyramid. While the growing consumer awareness continues to reap profits in the omega 3 ingredients market, suppliers are formulating strategies that highlight the preventive role of polyunsaturated fatty acids (PUFAs) in thwarting prevalence of chronic diseases. Numerous government initiatives to promote adequate intake of omega 3 ingredients are complementing the marketing efforts of stakeholders in the omega 3 ingredients market.

The focus of suppliers on maintaining a steady product supply continues to be a recuperative influencer of demand-side trends in the omega 3 ingredients market. The fish oil derived omega 3 ingredients continue to govern sales in the landscape – accounting for 90% sales approximately according to our research. Whereas, plant-derived omega 3 ingredients are likely to take the center stage abreast remarkable growth in the vegan trend, which consequentially propels the demand for vegan supplements.

Studies have attested the effectiveness of fish oil in alleviating symptoms of ADHD in children while improving their cognitive skills. Additionally, the two most popular omega 3 ingredients, namely, Eicosapentaenoic acid (EPA) and Docosahexaenoic acid (DHA) sourced from fish oil are linked with improving cognitive functions in infants and aging demographic alike. Such favorable researches continue to trigger higher adoption of omega 3 ingredients among the rapidly-growing health-conscious consumers.

Consumers in developed markets have already embraced the health & wellness trends, and relevant consumption practices have been on an upsurge recently. As awareness of health benefits of omega 3 ingredients picks pace, such as consumption of PUFAs in regular diet, prospects of the omega 3 ingredients market in these economies remain bullish. Economic vigor of consumers backed by their willingness to spend more on health supplements, coupled with the advocacy of evident benefits associated with fish oil-derived omega 3 ingredients among leading regional regulators, continue to favor sales of omega 3 ingredients in these regions.

Global omega 3 ingredients market is primarily characterized by essence of a large number of multinational and regional companies. Multinational players with their extensive product portfolios hold significant share in the omega 3 ingredients market, while they aim in reaping profits by targeting of the large pool of health-conscious consumers in Europe and North America. The leverage of innovative technologies, such as PureMax, to strip impurities in oil and ensure the provision of quality products to consumers, remain key growth strategies of the omega 3 ingredients industry leaders.

The companies operating in the omega 3 ingredients market, as profiled in the study, include Marine Ingredients, LLC., Omega Protein Corporation, Copeinca ASA, Cargill Incorporated, GC Rieber Oils AS, POLARIS Nutritional Lipids, Croda International plc, Luhua Biomarine (Shandong) Co., Ltd, Koninklijke DSM N.V., Denomega Nutritional Oils, and NU-MEGA Ingredients Pty Ltd. (Clover Corporation).

Omega 3 Ingredients Market is estimated to rise at a CAGR of 11% during forecast period

Europe and North America are more attractive for vendors in the Omega 3 Ingredients Market

Continued research for the potential health benefits of omega 3 ingredients in the growth and development of toddlers is promising for the growth of omega 3 ingredients market.

The companies operating in the omega 3 ingredients market, as profiled in the study, include Marine Ingredients, LLC., Omega Protein Corporation, Copeinca ASA, Cargill Incorporated, GC Rieber Oils AS, POLARIS Nutritional Lipids, Croda International plc, Luhua Biomarine (Shandong) Co., Ltd, Koninklijke DSM N.V., Denomega Nutritional Oils, and NU-MEGA Ingredients Pty Ltd. (Clover Corporation).

The forecast period considered for the Omega 3 Ingredients Market is 2019-2027

1. Global Omega 3 Ingredients Market - Executive Summary

1.1. Global Omega 3 Ingredients Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Trends

3.1. Key Trends Impacting the Market

3.1.1. Marketers Reach Out to Millennial

3.1.2. Leveraging New Health Claims (by Brand Owners and Nutraceutical Supplement Manufacturers)

3.2. Desirable Health Claims by Manufacturers and Brand Owners

3.3. Shortened M&A Activity

3.4. Heightened Product Launch Frequency

4. Product Innovation / Development Trends

4.1. Cultural Customization to Target Specific Population and Ethnic Group

4.2. Creating New Delivery Mechanisms

4.3. Indication Specific / Targeted Supplement Formulation

4.4. Shift Toward Natural Ingredients

4.5. Preferential Inclination towards Non-Modified Functional Ingredients

4.6. Transformed Packaging to Suit Customer Orientation

4.7. Brand Differentiation through Packaging

5. Market Background and Associated Industry Indicators

5.1. Transformed Nutraceuticals Market (Industry Proposition Then and Now)

5.2. Varying Definition and Regulation for Omega 3 Supplement across the Globe

5.3. Rising Cost of Healthcare and Role of Omega 3 Supplements

5.4. Preventive Healthcare is Getting Traction then Treatment

5.5. Consumer Out of Pocket Healthcare Expenditure

5.6. Per Capita Health Food and Supplement Spending

5.7. Nutraceutical Supplement Spending (as a percentage of total Health Food and Supplement Spending)

5.8. Convergence of Food and Pharmaceuticals

5.9. Nutraceutical Supplement and Omega 3 Product Hotspot - Pipeline Analysis

5.10. Macro-Economic Factors - Relevance & Impact

5.10.1. Healthcare Sector GVA and Growth

5.10.2. Retail Sector GVA and Growth

5.10.3. Per Capita Disposable Income

5.10.4. Organized Retail Penetration

5.10.5. Middle Income Population Group

5.10.6. Global GDP Growth Outlook

5.11. Forecast Factors - Relevance & Impact

5.11.1. Top Companies Historical Growth

5.11.2. Target Incidence Occurrence Rate

5.11.3. Functional Food Industry Growth

5.11.4. Out of Pocket Healthcare Expenditure Trend

6. Market Dynamics

6.1. Drivers

6.1.1. Affluence of Working Population

6.1.2. Changing Lifestyle and Dietary Pattern

6.1.3. Increased Awareness

6.1.4. Omni-Channel Product Offering by Brand Owners

6.1.5. Ageing Population

6.2. Restraints and Market Risks

6.2.1. Slower Regulatory Approval for Health Claims

6.2.2. Cluttered Market Behavior

6.2.3. High Associated Cost of Product Development

6.3. Opportunity Analysis

6.3.1. Total Addressable Opportunity

6.3.2. Innovation Hub and Test Markets

7. Policy and Regulatory Landscape

7.1. Dietary Supplement Health and Education Act (DSHEA)

7.2. Federal Food & Cosmetics Act

7.3. Europe Food & Safety Authority

7.4. State Food and Drug Administration (SFDA)

7.5. Foods for Specified Health Uses

7.6. FSSAI

7.7. Food Packaging Claims

7.8. Labeling and Claims

8. Risk & Opportunities Market Tendencies & Latest Buzz

8.1. Intrinsic Opportunities

8.1.1. Technology enhancements

8.1.2. In operational excellence

8.2. Extrinsic Opportunities

8.2.1. Partnerships with key food & beverages giants

8.2.2. Licensing opportunities

8.2.3. In clusters, countries and regions

8.3. Associated Risks

8.3.1. Pertaining to regulatory framework and approvals

8.3.2. Related to standards and certifications

8.3.3. Change in consumer preferences

8.3.4. Threat of alternatives

9. Key Success Factors

9.1. Leveraging Personalized Healthcare Delivery

9.2. Powerful Portfolio of Formulation and Brands

9.3. Nuanced Marketing Campaigns

9.4. Exploiting Economies of Scale

9.5. Establishing Flexible Supply Chain to Optimize on Miracle Ingredients

9.6. Working in Close Vicinity of Policy Formulators

9.7. Strategic Promotional Activity

10. Supply Chain Analysis

10.1. Profitability and Gross Margin Analysis By Competition

10.2. List of Active Participants- By Region

10.2.1. Raw Material Suppliers

10.2.2. Key Manufacturers

10.2.3. Key Distributor/Retailers

10.2.4. Operating Margins

11. Global Omega 3 Ingredients Market Pricing Analysis

11.1. Price Point Assessment by Product Type

11.2. Regional Average Pricing Analysis

11.2.1. North America

11.2.2. Latin America

11.2.3. Europe

11.2.4. Asia Pacific Ex. Japan (APEJ)

11.2.5. Japan

11.2.6. Oceania

11.2.7. Middle East and Africa

11.3. Price Forecast till 2027

11.4. Factors Influencing Pricing

12. Global Omega 3 Ingredients Market Analysis and Forecast

12.1. Market Size Analysis (2014-2018) and Forecast (2019-2027)

12.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

12.1.2. Absolute $ Opportunity

12.2. Global Omega 3 Ingredients Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

12.2.1. Forecast Factors and Relevance of Impact

12.2.2. Regional Omega 3 Ingredients Market Business Performance Summary

13. Global Omega 3 Ingredients Market Analysis By Product Type

13.1. Introduction

13.1.1. Y-o-Y Growth Comparison By Product Type

13.1.2. Basis Point Share (BPS) Analysis By Product Type

13.2. Omega 3 Ingredients Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2027) By Product Type

13.2.1. Alpha-Linolenic Acid (ALA)

13.2.2. Eicosapentaenoic Acid (EPA)

13.2.3. Docosahexaneoic Acid (DHA)

13.3. Market Attractiveness Analysis By Product Type

14. Global Omega 3 Ingredients Market Analysis By Source

14.1. Introduction

14.1.1. Y-o-Y Growth Comparison By Source

14.1.2. Basis Point Share (BPS) Analysis By Source

14.2. Omega 3 Ingredients Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2027) By Source

14.2.1. Plant

14.2.1.1. Corn Oils

14.2.1.2. Safflower Oil

14.2.1.3. Sunflower Oil

14.2.1.4. Soybean Oil

14.2.1.5. Canola Oil

14.2.1.6. Flax Seed

14.2.1.7. Chia Seed

14.2.1.8. Nuts and Seeds

14.2.1.9. Others

14.2.2. Animal

14.2.2.1. Meat

14.2.2.2. Eggs

14.2.2.3. Dairy

14.2.2.4. Fish Oil

14.3. Market Attractiveness Analysis By Source

15. Global Omega 3 Ingredients Market Analysis By Application

15.1. Introduction

15.1.1. Y-o-Y Growth Comparison By Application

15.1.2. Basis Point Share (BPS) Analysis By Application

15.2. Omega 3 Ingredients Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2027) By Application

15.2.1. Food and beverage

15.2.1.1. Food Industry

15.2.1.1.1. Dairy & dessert

15.2.1.1.2. Bakery & Confectionary

15.2.1.1.3. Savory Snacks

15.2.1.1.4. Breakfast Cereals

15.2.1.1.5. Others

15.2.1.2. Beverage industry

15.2.1.2.1. Functional Drinks

15.2.1.2.2. Juices

15.2.1.2.3. Others

15.2.2. Pharmaceutical and Nutraceutical industry

15.2.3. Infant Formula

15.2.4. Animal Feed

15.3. Market Attractiveness Analysis By Application

16. Global Omega 3 Ingredients Market Analysis and Forecast, By Region

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Region

16.1.2. Y-o-Y Growth Projections By Region

16.2. Omega 3 Ingredients Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2027) Analysis By Region

16.2.1. North America

16.2.2. Europe

16.2.3. APEJ

16.2.4. Japan

16.2.5. Oceania

16.2.6. Latin America

16.2.7. Middle East and Africa

16.3. Market Attractiveness Analysis By Region

17. North America Omega 3 Ingredients Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.2. Omega 3 Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2027)

17.2.1. Market Attractiveness By Country

17.2.1.1. U.S.

17.2.1.2. Canada

17.2.2. By Product Type

17.2.3. By Source

17.2.4. By Application

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By Product Type

17.3.3. By Source

17.3.4. By Application

17.4. Drivers and Restraints: Impact Analysis

18. Latin America Omega 3 Ingredients Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Omega 3 Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2027)

18.2.1. By Country

18.2.1.1. Brazil

18.2.1.2. Mexico

18.2.1.3. Chile

18.2.1.4. Peru

18.2.1.5. Argentina

18.2.1.6. Rest of Latin America

18.2.2. By Product Type

18.2.3. By Source

18.2.4. By Application

18.3. Market Attractiveness Analysis

18.3.1. By Product Type

18.3.2. By Source

18.3.3. By Application

18.4. Drivers and Restraints: Impact Analysis

19. Europe Omega 3 Ingredients Market Analysis and Forecast

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.1.3. Key Regulations

19.2. Omega 3 Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2027)

19.2.1. By Country

19.2.1.1. EU-4 (Germany, France, Italy, Spain)

19.2.1.2. U.K.

19.2.1.3. BENELUX

19.2.1.4. Nordic

19.2.1.5. Russia

19.2.1.6. Poland

19.2.1.7. Rest of Europe

19.2.2. By Product Type

19.2.3. By Source

19.2.4. By Application

19.3. Market Attractiveness Analysis

19.3.1. By Product Type

19.3.2. By Source

19.3.3. By Application

19.4. Drivers and Restraints: Impact Analysis

20. APEJ Omega 3 Ingredients Market Analysis and Forecast

20.1. Introduction

20.1.1. Basis Point Share (BPS) Analysis By Country

20.1.2. Y-o-Y Growth Projections By Country

20.1.3. Key Regulations

20.2. Omega 3 Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2027)

20.2.1. By Country

20.2.1.1. China

20.2.1.2. India

20.2.1.3. South Korea

20.2.1.4. ASEAN

20.2.2. By Product Type

20.2.3. By Source

20.2.4. By Application

20.3. Market Attractiveness Analysis

20.3.1. By Product Type

20.3.2. By Source

20.3.3. By Application

20.4. Drivers and Restraints: Impact Analysis

21. Japan Omega 3 Ingredients Market Analysis and Forecast

21.1. Introduction

21.1.1. Basis Point Share (BPS) Analysis By Country

21.1.2. Y-o-Y Growth Projections By Country

21.1.3. Key Regulations

21.2. Omega 3 Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2027)

21.2.1. By Product Type

21.2.2. By Source

21.2.3. By Application

21.3. Market Attractiveness Analysis

21.3.1. By Product Type

21.3.2. By Source

21.3.3. By Application

21.4. Drivers and Restraints: Impact Analysis

22. Oceania Omega 3 Ingredients Market Analysis and Forecast

22.1. Introduction

22.1.1. Basis Point Share (BPS) Analysis By Country

22.1.2. Y-o-Y Growth Projections By Country

22.1.3. Key Regulations

22.2. Omega 3 Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2027)

22.2.1. By Product Type

22.2.2. By Source

22.2.3. By Application

22.3. Market Attractiveness Analysis

22.3.1. By Product Type

22.3.2. By Source

22.3.3. By Application

22.4. Drivers and Restraints: Impact Analysis

23. Middle East and Africa (MEA) Omega 3 Ingredients Market Analysis and Forecast

23.1. Introduction

23.1.1. Basis Point Share (BPS) Analysis By Country

23.1.2. Y-o-Y Growth Projections By Country

23.1.3. Key Regulations

23.2. Omega 3 Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2027)

23.2.1. By Country

23.2.1.1. GCC Countries

23.2.1.2. South Africa

23.2.1.3. North Africa

23.2.1.4. Rest of MEA

23.2.2. By Product Type

23.2.3. By Source

23.2.4. By Application

23.3. Market Attractiveness Analysis

23.3.1. By Product Type

23.3.2. By Source

23.3.3. By Application

23.4. Drivers and Restraints: Impact Analysis

24. Global Omega 3 Supplements Market Outlook

24.1. Global Omega 3 Supplements Market Analysis and Forecast

24.1.1. Market Size Analysis (2014-2018) and Forecast (2019-2027)

24.1.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

24.1.1.2. Absolute $ Opportunity

24.1.2. Global Omega 3 Supplements Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

24.1.2.1. Forecast Factors and Relevance of Impact

24.1.2.2. Regional Omega 3 Supplements Market Business Performance Summary

24.2. Global Omega 3 Supplements Market Analysis By Product Type

24.2.1. Introduction

24.2.1.1. Y-o-Y Growth Comparison By Form Type

24.2.1.2. Basis Point Share (BPS) Analysis By Form Type

24.2.2. Omega 3 Supplements Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2027) By Form Type

24.2.2.1. Powder

24.2.2.2. Capsules

24.2.2.3. Others

24.2.3. Market Attractiveness Analysis By Form Type

24.3. Global Omega 3 Supplements Market Analysis By Distribution Channel

24.3.1. Introduction

24.3.1.1. Y-o-Y Growth Comparison By Distribution Channel

24.3.1.2. Basis Point Share (BPS) Analysis By Distribution Channel

24.3.2. Omega 3 Supplements Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2027) By Distribution Channel

24.3.2.1. Modern Trade

24.3.2.2. Convenience Store

24.3.2.3. Departmental Store

24.3.2.4. Drug Store

24.3.2.5. Online Stores

24.3.2.6. Other Sales Channel

24.3.3. Market Attractiveness Analysis By Distribution Channel

24.4. Global Omega 3 Supplements Market Analysis By Price Range

24.4.1. Introduction

24.4.1.1. Y-o-Y Growth Comparison By Price Range

24.4.1.2. Basis Point Share (BPS) Analysis By Price Range

24.4.2. Omega 3 Supplements Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2027) By Price Range

24.4.2.1. Below $10

24.4.2.2. $10 - $20

24.4.2.3. $20 - $50

24.4.2.4. $50 - $100

24.4.2.5. $250 - $500

24.4.2.6. $500 - $750

24.4.3. Market Attractiveness Analysis By Price Range

25. Competition Assessment

25.1. Global Omega 3 Ingredients Market Competition - a Dashboard View

25.2. Global Omega 3 Ingredients Market Structure Analysis

25.3. Global Omega 3 Ingredients Market Company Share Analysis

25.3.1. For Tier 1 Market Players, 2018

25.3.2. Company Market Share Analysis of Top 10 Players, By Region

25.4. Key Participants Market Presence (Intensity Mapping) by Region

26. Brand Assessment

26.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

26.2. Omega 3 Ingredients Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

26.3. Brand Strategy

27. Competition Deep-dive

27.1. Omega 3 Ingedient Companies

27.1.1. Croda International plc

27.1.2. BIOPROCESS ALGAE, LLC

27.1.3. Omega Protein Corporation

27.1.4. Pelagia AS (Epax Norway AS)

27.1.5. GC Rieber Oils AS

27.1.6. Pharma Marine AS

27.1.7. Copeinca ASA

27.1.8. Arista Industries Inc

27.1.9. NU-MEGA Ingredients Pty Ltd. (Clover Corporation)

27.1.10. Marine Ingredients, LLC.

27.1.11. Luhua Biomarine (Shandong) Co., Ltd

27.1.12. POLARIS Nutritional Lipids

27.1.13. Algaecytes

27.1.14. Qualitas Health

27.1.15. Barleans Organic Oils

27.1.16. Denomega Nutritional Oils

27.1.17. Qponics Limited

27.1.18. Cellana Inc.

27.1.19. Koninklijke DSM N.V.

27.1.20. Cargill Incorporated

27.1.21. Others (On Request)

27.2. Omega 3 Supplement Companies

27.2.1. QuattroMega Inc. (WHC)

27.2.2. Viva Naturals Inc.

27.2.3. Innovix Pharma Inc.

27.2.4. NutriGold Inc.

27.2.5. Omax Health, Inc.

27.2.6. Sancilio & Company, Inc.

27.2.7. Innovix Pharma Inc.

27.2.8. Nordic Naturals, Inc.

27.2.9. Life & Food Inc.

27.2.10. NOW Health Group, Inc.

27.2.11. DTI GmbH

27.2.12. Axis Labs, Inc.

27.2.13. General Nutrition Centers, Inc.

27.2.14. RB LLC.

27.2.15. Twinlab Corp.

27.2.16. Solgar Inc.

27.2.17. Carlson Laboratories, Inc.

27.2.18. Met-Rx Substrate Technology, Inc. Optimum Nutrition, Inc.

27.2.19. Others (On Request

27.3. Key Brands

27.3.1. Spring Valley

27.3.2. Nature's Bounty

27.3.3. Nature Made

27.3.4. MegaRed

27.3.5. Alfa

27.3.6. Carlson Labs

27.3.7. Sundown Naturals

27.3.8. L'il Critters

27.3.9. Vitafusion

27.3.10. Equate

27.3.11. NutriFlair

27.3.12. Great HealthWorks

27.3.13. TheraTears

27.3.14. Best Naturals

27.3.15. ChildLife

27.3.16. Nordic Naturals

27.3.17. Source Naturals

27.3.18. Others (On Request

27.4. Key Inclusions In Company Profiles

27.4.1. Overview

27.4.2. Product Portfolio

27.4.3. Sales Footprint

27.4.4. Channel Footprint

27.4.4.1. Distributors List

27.4.4.2. Sales Channel (Clients)

27.4.5. Strategy Overview

27.4.5.1. Marketing Strategy

27.4.5.2. Culture Strategy

27.4.5.3. Channel Strategy

27.4.6. SWOT Analysis

27.4.7. Financial Analysis

27.4.8. Revenue Share

27.4.8.1. By Product Type

27.4.8.2. By Region

27.4.9. Key Clients

27.4.10. Analyst Comments

28. Recommendation- Critical Success Factors

29. Research Methodology, Assumptions & Acronyms Used

List of Tables

Table 1: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Region, 2014-2027

Table 2: Global Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Region, 2014-2027

Table 3: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredients, 2014-2027

Table 4: Global Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Ingredients, 2014-2027

Table 5: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 6: Global Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 7: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 8: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 9: Global Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 10: Global Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 11: North America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 12: North America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 13: North America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by End User, 2014-2027

Table 14: North America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by End User, 2014-2027

Table 15: North America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 16: North America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 17: North America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 18: North America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 19: North America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 20: North America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 21: Europe Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 22: Europe Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 23: Europe Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredients, 2014-2027

Table 24: Europe Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Ingredients, 2014-2027

Table 25: Europe Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 26: Europe Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 27: Europe Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 28: Europe Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 29: Europe Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 30: Europe Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 31: Latin America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 32: Latin America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 33: Latin America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredients, 2014-2027

Table 34: Latin America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Ingredients, 2014-2027

Table 35: Latin America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 36: Latin America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 37: Latin America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 38: Latin America Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 39: Latin America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 40: Latin America Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 41: Asia Pacific Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 42: Asia Pacific Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 43: Asia Pacific Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredients, 2014-2027

Table 44: Asia Pacific Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Ingredients, 2014-2027

Table 45: Asia Pacific Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 46: Asia Pacific Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 47: Asia Pacific Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 48: Asia Pacific Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 49: Asia Pacific Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 50: Asia Pacific Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 51: Oceania Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredients, 2014-2027

Table 52: Oceania Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Ingredients, 2014-2027

Table 53: Oceania Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 54: Oceania Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 55: Oceania Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 56: Oceania Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 57: Oceania Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 58: Oceania Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 59: Japan Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredients, 2014-2027

Table 60: Japan Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Ingredients, 2014-2027

Table 61: Japan Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 62: Japan Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 63: Japan Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 64: Japan Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 65: Japan Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 66: Japan Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 67: MEA Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 68: MEA Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 69: MEA Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Ingredients, 2014-2027

Table 70: MEA Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Ingredients, 2014-2027

Table 71: MEA Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Source, 2014-2027

Table 72: MEA Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Source, 2014-2027

Table 73: MEA Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 74: MEA Omega 3 Ingredients Market Value (US$ Mn) Analysis and Forecast by Application, 2014-2027

Table 75: MEA Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

Table 76: MEA Omega 3 Ingredients Market Volume (MT) Analysis and Forecast by Application, 2014-2027

List of Figures:

Figure 1: Global Omega 3 Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2019–2027

Figure 2: Global Omega 3 Ingredients Market Absolute $ Opportunity (US$ Mn), 2019–2027

Figure 3: Global Omega 3 Ingredients Market Share (%) & BPS Analysis by Region, 2019 & 2027

Figure 4: Global Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Region, 2019-2027

Figure 5: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis & Forecast by Region, 2019–2027

Figure 6: Global Omega 3 Ingredients Market Attractiveness Index by Region, 2019-2027

Figure 7: Global Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 8: Global Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 9: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis & Forecast by Ingredients, 2019–2027

Figure 10: Global Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 11: Global Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 12: Global Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 13: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis & Forecast by Source, 2019–2027

Figure 14: Global Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 15: Global Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 16: Global Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 17: Global Omega 3 Ingredients Market Value (US$ Mn) Analysis & Forecast by Application, 2019–2027

Figure 18: Global Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027

Figure 19: North America Omega 3 Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 20: North America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 21: North America Omega 3 Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 22: North America Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 23: North America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 24: North America Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 25: North America Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 26: North America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 27: North America Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 28: North America Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 29: North America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 30: North America Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027

Figure 31: Europe Omega 3 Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 32: Europe Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 33: Europe Omega 3 Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 34: Europe Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 35: Europe Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 36: Europe Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 37: Europe Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 38: Europe Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 39: Europe Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 40: Europe Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 41: Europe Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 42: Europe Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027

Figure 43: Latin America Omega 3 Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 44: Latin America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 45: Latin America Omega 3 Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 46: Latin America Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 47: Latin America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 48: Latin America Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 49: Latin America Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 50: Latin America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 51: Latin America Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 52: Latin America Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 53: Latin America Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 54: Latin America Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027

Figure 55: Asia Pacific Omega 3 Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 56: Asia Pacific Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 57: Asia Pacific Omega 3 Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 58: Asia Pacific Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 59: Asia Pacific Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 60: Asia Pacific Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 61: Asia Pacific Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 62: Asia Pacific Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 63: Asia Pacific Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 64: Asia Pacific Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 65: Asia Pacific Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 66: Asia Pacific Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027

Figure 67: Oceania Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 68: Oceania Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 69: Oceania Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 70: Oceania Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 71: Oceania Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 72: Oceania Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 73: Oceania Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 74: Oceania Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 75: Oceania Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027

Figure 76: Japan Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 77: Japan Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 78: Japan Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 79: Japan Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 80: Japan Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 81: Japan Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 82: Japan Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 83: Japan Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 84: Japan Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027

Figure 85: MEA Omega 3 Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 86: MEA Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 87: MEA Omega 3 Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 88: MEA Omega 3 Ingredients Market Share (%) & BPS Analysis by Ingredients, 2019 & 2027

Figure 89: MEA Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Ingredients, 2019-2027

Figure 90: MEA Omega 3 Ingredients Market Attractiveness Index by Ingredients, 2019-2027

Figure 91: MEA Omega 3 Ingredients Market Share (%) & BPS Analysis by Source, 2019 & 2027

Figure 92: MEA Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Source, 2019-2027

Figure 93: MEA Omega 3 Ingredients Market Attractiveness Index by Source, 2019-2027

Figure 94: MEA Omega 3 Ingredients Market Share (%) & BPS Analysis by Application, 2019 & 2027

Figure 95: MEA Omega 3 Ingredients Market Y-o-Y Growth Rate (%) by Application, 2019-2027

Figure 96: MEA Omega 3 Ingredients Market Attractiveness Index by Application, 2019-2027