Reports

Reports

Market leaders in the global fundus camera market are busy in regulatory clearances, technologically superior products, new product launches, and acquisition & collaboration agreements with other firms. All these efforts expected to drive the growth of the global retinal camera market.

Growing number of market players engaged in the market for fundus cameras and intensified competition among market players to remain competitive in terms of product differentiation and price war are likely to drive the growth of the global market over the forecast period. Conversely, premium pricing of retinal cameras and lack of availability of ophthalmologists in emerging economies are likely to restrain the growth of the global market over the forecast period.

Fundus photographs provide invaluable information regarding the status of the retina and allow early diagnosis and early treatment. Retinal cameras consist of various models such as mydriatic, non-mydriatic, and hybrid, and each of them has its own benefits. Mydriatic cameras require dilatation of the eyes to enhance visualization and non-mydriatic cameras work with fast imaging without dilatation with increased patient comfort.

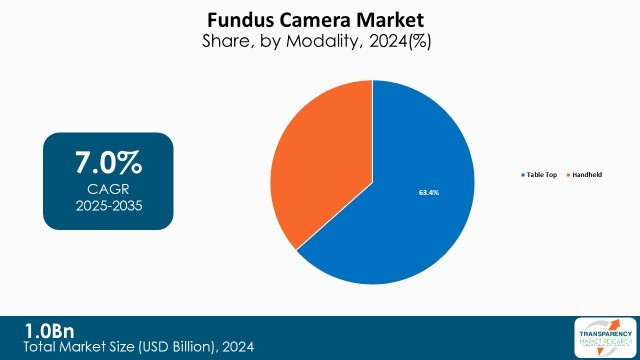

Handheld and table-top types are appropriate for various clinical settings ranging from hospitals to outpatients. The increase in the incidence of chronic diseases along with the necessity to preserve eyesight fuels the demand for fundus cameras.

Coupled with this aspect, technology advancements enhance the performance and efficiency of the machines over time, which are important during routine eye tests and specialist diagnosis. In line with the advancements in the area of ophthalmology, retinal cameras are still a precious asset in the early diagnosis and proper treatment of eye diseases.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Multidisciplinary care and increased patient safety are the major drivers to the fundus camera market, impacting eye care practice patterns profoundly. Retinal cameras provide clear, high-quality images of the retina, which can be an important element of macular degeneration and diabetic retinopathy diagnosis.

Having access to the images in specialties enhances communication and shared decision-making. This means the patient receives a more integrated treatment plan that not only treats their eye health but also their overall health.

In addition, enhanced patient safety is a burning issue in the healthcare setting due to attempts at minimizing error and maximizing care quality. Fundus cameras, through their non-invasive imaging technology, offer safe and effective monitoring of retinal health without invasive procedure.

This emphasis on safety, combined with multi-disciplinary practice, serves to illustrate the increasing role of retinal cameras in modern medical practice. Since healthcare systems all over the world are trying to implement and perform patient-centered methods more comprehensively, the market for fundus cameras is also on the verge of tremendous growth, in line with demand for technology to enhance safety and inter-disciplinarity of care.

The cycle of innovation not only multiplies the number of fundus cameras but also develops niche markets such as hand-held versions to be applied in remote or underserved population. Further advanced functionalities such as better field-of-view images and improved user interfaces, enable practitioners to conduct more detailed exams and make informed treatment choices. The cycle of innovation stimulates more competition among producers to continually improve their products in a bid to capture market share.

Also, the frequent product launch makes individuals conscious and reminds them of retinal health, and hence more healthcare centers adopt such advanced technologies. Being professionals, doctors want to provide the finest of treatments, so the presence of sophisticated fundus cameras becomes the need of the hour.

Hence, the constant flow of innovations and product lines of fundus cameras is an attempt to catch up with the increased needs of patients and medical practitioners to further enhance the quality of eye care services as a whole.

Non-mydriatic fundus cameras provide retinal imaging without pupil dilation, featuring high degrees of patient convenience and comfort. This feature is particularly beneficial in primary care settings, where prompt and precise eye testing must be performed. These cameras enable normal screening to be conducted and offer more convenient access to eye care for more people.

The table top modality type is preferred since it is stable and produces quality images. Their robust parameters make them suitable for application in clinical practice, where detailed examination is needed to monitor various ocular pathologies.

The rising incidence of chronic conditions like diabetes and hypertension also adds to the demand for such sophisticated imaging systems. In addition, the introduction of new technologies like the new digital imaging and connectivity, enhances the efficiency and simplicity of the table top and non-mydriatic ones.

| Attribute | Detail |

|---|---|

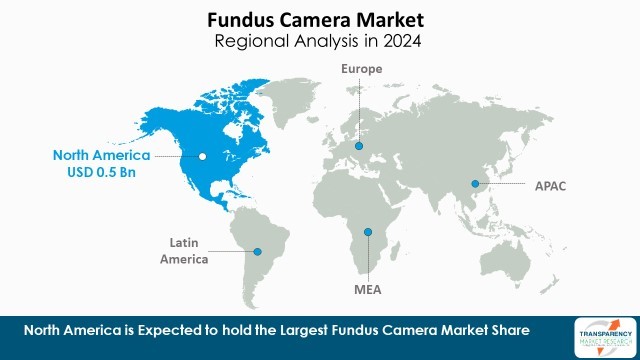

| Leading Region | North America |

North America is leading the market for fundus cameras due to the well-developed healthcare infrastructure of the region, massive investment in medical technology, and access of eye care facilities to everyone. Due to the prevalence of conditions such as hypertension and diabetes, there is an immense demand for eye screening and early detection on a regular basis, which can easily be met through the application of fundus cameras.

Secondly, having market leaders in the medical devices industry promotes competition and innovation resulting in state-of-the-art fundus imaging technology. The introduction of functionality in the form of digital imaging, automated screening, and telemedicine capability has also added to the functionality of fundus cameras to make them a necessity for clinical and out-patient departments.

Overall, North America's pursuit of quality healthcare combined with technological advancements and policy initiatives puts it at the leading edge globally in the market for fundus cameras.

Carl Zeiss Meditec, Inc., Canon, Inc., Kowa Company, Ltd., Optomed Oy, Centervue S.p.A., NIDEK Co.Ltd., Topcon Medical Systems, Inc., S4OPTIK LLC., Shenzhen Thondar Technology Co., Epipole Ltd., Revenio Group Corporation, Haag-Streit Holding AG, Forus Health Pvt. Ltd., Heidelberg Engineering GmbH, and Phelcom Technologies are some of the leading players operating in the fundus camera industry.

Each of these players have been have been profiled in the fundus camera market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

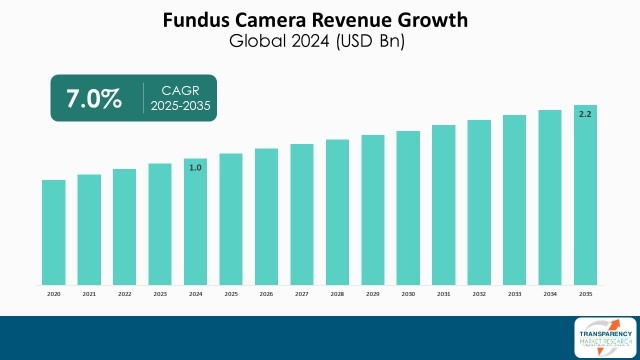

| Size in 2024 | US$ 1.0 Bn |

| Forecast Value in 2035 | US$ 2.2 Bn |

| CAGR | 7.0% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn |

| Fundus Camera Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global fundus camera market was valued at US$ 1.0 Bn in 2024.

The global fundus camera market is projected to cross US$ 2.2 Bn by the end of 2035.

Rise in prevalence of retinal disorders and multidisciplinary engagement and enhanced patient safety.

The CAGR is anticipated to be 7.0% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Carl Zeiss Meditec, Inc., Canon, Inc., Kowa Company, Ltd., Optomed Oy, Centervue S.p.A., NIDEK Co.Ltd., Topcon Medical Systems, Inc., S4OPTIK LLC., Shenzhen Thondar Technology Co., Epipole Ltd., Revenio Group Corporation, Haag-Streit Holding AG, Forus Health Pvt. Ltd., Heidelberg Engineering GmbH, Phelcom Technologies and others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Fundus Camera Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Fundus Camera Market Analysis and Forecast, 2020-2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Overview of Fundus Camera

5.2. Technological Advancements

5.3. PORTER’s Five Forces Analysis

5.4. PESTLE Analysis

5.5. Supply Chain Analysis

5.6. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.7. Brand and Pricing Analysis

5.8. Regulatory Scenario by Key Country/Region

5.9. Go-to-Market Strategy for New Market Entrants

6. Global Fundus Camera Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2020-2035

6.3.1. Mydriatic

6.3.2. Non-mydriatic

6.3.3. Hybrid

6.3.4. Retinopathy of Prematurity (ROP)

6.4. Market Attractiveness Analysis, by Product Type

7. Global Fundus Camera Market Analysis and Forecast, by Modality

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Modality, 2020-2035

7.3.1. Table Top

7.3.2. Handheld

7.4. Market Attractiveness Analysis, by Modality

8. Global Fundus Camera Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020-2035

8.3.1. Hospitals

8.3.2. Ophthalmology Clinics

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Fundus Camera Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020-2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Fundus Camera Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2020-2035

10.2.1. Mydriatic

10.2.2. Non-mydriatic

10.2.3. Hybrid

10.2.4. Retinopathy of Prematurity (ROP)

10.3. Market Value Forecast, by Modality, 2020-2035

10.3.1. Table Top

10.3.2. Handheld

10.4. Market Value Forecast, by End-user, 2020-2035

10.4.1. Hospitals

10.4.2. Ophthalmology Clinics

10.4.3. Others

10.5. Market Value Forecast, by Country, 2020-2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Modality

10.6.3. By End-user

10.6.4. By Country

11. Europe Fundus Camera Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2020-2035

11.2.1. Mydriatic

11.2.2. Non-mydriatic

11.2.3. Hybrid

11.2.4. Retinopathy of Prematurity (ROP)

11.3. Market Value Forecast, by Modality, 2020-2035

11.3.1. Table Top

11.3.2. Handheld

11.4. Market Value Forecast, by End-user, 2020-2035

11.4.1. Hospitals

11.4.2. Ophthalmology Clinics

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020-2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Modality

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Fundus Camera Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2020-2035

12.2.1. Mydriatic

12.2.2. Non-mydriatic

12.2.3. Hybrid

12.2.4. Retinopathy of Prematurity (ROP)

12.3. Market Value Forecast, by Modality, 2020-2035

12.3.1. Table Top

12.3.2. Handheld

12.4. Market Value Forecast, by End-user, 2020-2035

12.4.1. Hospitals

12.4.2. Ophthalmology Clinics

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020-2035

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Modality

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Fundus Camera Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2020-2035

13.2.1. Mydriatic

13.2.2. Non-mydriatic

13.2.3. Hybrid

13.2.4. Retinopathy of Prematurity (ROP)

13.3. Market Value Forecast, by Modality, 2020-2035

13.3.1. Table Top

13.3.2. Handheld

13.4. Market Value Forecast, by End-user, 2020-2035

13.4.1. Hospitals

13.4.2. Ophthalmology Clinics

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020-2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Modality

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Fundus Camera Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2020-2035

14.2.1. Mydriatic

14.2.2. Non-mydriatic

14.2.3. Hybrid

14.2.4. Retinopathy of Prematurity (ROP)

14.3. Market Value Forecast, by Modality, 2020-2035

14.3.1. Table Top

14.3.2. Handheld

14.4. Market Value Forecast, by End-user, 2020-2035

14.4.1. Hospitals

14.4.2. Ophthalmology Clinics

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020-2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Modality

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Carl Zeiss Meditec, Inc.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Canon, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Kowa Company, Ltd.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Optomed Oy

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Centervue S.p.A.

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. NIDEK Co.Ltd.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Topcon Medical Systems, Inc.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. S4OPTIK LLC.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Shenzhen Thondar Technology Co.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Epipole Ltd.

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Revenio Group Corporation

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Haag-Streit Holding AG

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Forus Health Pvt. Ltd.

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Heidelberg Engineering GmbH

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Phelcom Technologies

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

List of Tables

Table 01: Global Fundus Camera Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 02: Global Fundus Camera Market Value (US$ Bn) Forecast, By Modality, 2020-2035

Table 03: Global Fundus Camera Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 04: Global Fundus Camera Market Value (US$ Bn) Forecast, By Region, 2020-2035

Table 05: North America Fundus Camera Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America Fundus Camera Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 07: North America Fundus Camera Market Value (US$ Bn) Forecast, By Modality, 2020-2035

Table 08: North America Fundus Camera Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 09: Europe Fundus Camera Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 10: Europe Fundus Camera Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 11: Europe Fundus Camera Market Value (US$ Bn) Forecast, By Modality, 2020-2035

Table 12: Europe Fundus Camera Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 13: Asia Pacific Fundus Camera Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Asia Pacific Fundus Camera Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 15: Asia Pacific Fundus Camera Market Value (US$ Bn) Forecast, By Modality, 2020-2035

Table 16: Asia Pacific Fundus Camera Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 17: Latin America Fundus Camera Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Latin America Fundus Camera Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 19: Latin America Fundus Camera Market Value (US$ Bn) Forecast, By Modality, 2020-2035

Table 20: Latin America Fundus Camera Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 21: Middle East & Africa Fundus Camera Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Middle East & Africa Fundus Camera Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 23: Middle East & Africa Fundus Camera Market Value (US$ Bn) Forecast, By Modality, 2020-2035

Table 24: Middle East & Africa Fundus Camera Market Value (US$ Bn) Forecast, By End-user, 2020-2035

List of Figures

Figure 01: Global Fundus Camera Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Fundus Camera Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 03: Global Fundus Camera Market Revenue (US$ Bn), by Mydriatic, 2020-2035

Figure 04: Global Fundus Camera Market Revenue (US$ Bn), by Non-mydriatic, 2020-2035

Figure 05: Global Fundus Camera Market Revenue (US$ Bn), by Hybrid, 2020-2035

Figure 06: Global Fundus Camera Market Revenue (US$ Bn), by Retinopathy of Prematurity (ROP), 2020-2035

Figure 07: Global Fundus Camera Market Value Share Analysis, By Modality, 2024 and 2035

Figure 08: Global Fundus Camera Market Attractiveness Analysis, By Modality, 2025-2035

Figure 09: Global Fundus Camera Market Revenue (US$ Bn), by Table Top, 2020-2035

Figure 10: Global Fundus Camera Market Revenue (US$ Bn), by Handheld, 2020-2035

Figure 11: Global Fundus Camera Market Value Share Analysis, By End-user, 2024 and 2035

Figure 12: Global Fundus Camera Market Attractiveness Analysis, By End-user, 2025-2035

Figure 13: Global Fundus Camera Market Revenue (US$ Bn), by Hospitals, 2020-2035

Figure 14: Global Fundus Camera Market Revenue (US$ Bn), by Ophthalmology Clinics, 2020-2035

Figure 15: Global Fundus Camera Market Revenue (US$ Bn), by Others, 2020-2035

Figure 16: Global Fundus Camera Market Value Share Analysis, By Region, 2024 and 2035

Figure 17: Global Fundus Camera Market Attractiveness Analysis, By Region, 2025-2035

Figure 18: North America Fundus Camera Market Value (US$ Bn) Forecast, 2020-2035

Figure 19: North America Fundus Camera Market Value Share Analysis, by Country, 2024 and 2035

Figure 20: North America Fundus Camera Market Attractiveness Analysis, by Country, 2025-2035

Figure 21: North America Fundus Camera Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 22: North America Fundus Camera Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 23: North America Fundus Camera Market Value Share Analysis, By Modality, 2024 and 2035

Figure 24: North America Fundus Camera Market Attractiveness Analysis, By Modality, 2025-2035

Figure 25: North America Fundus Camera Market Value Share Analysis, By End-user, 2024 and 2035

Figure 26: North America Fundus Camera Market Attractiveness Analysis, By End-user, 2025-2035

Figure 27: Europe Fundus Camera Market Value (US$ Bn) Forecast, 2020-2035

Figure 28: Europe Fundus Camera Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 29: Europe Fundus Camera Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 30: Europe Fundus Camera Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 31: Europe Fundus Camera Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 32: Europe Fundus Camera Market Value Share Analysis, By Modality, 2024 and 2035

Figure 33: Europe Fundus Camera Market Attractiveness Analysis, By Modality, 2025-2035

Figure 34: Europe Fundus Camera Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: Europe Fundus Camera Market Attractiveness Analysis, By End-user, 2025-2035

Figure 36: Asia Pacific Fundus Camera Market Value (US$ Bn) Forecast, 2020-2035

Figure 37: Asia Pacific Fundus Camera Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 38: Asia Pacific Fundus Camera Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 39: Asia Pacific Fundus Camera Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 40: Asia Pacific Fundus Camera Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 41: Asia Pacific Fundus Camera Market Value Share Analysis, By Modality, 2024 and 2035

Figure 42: Asia Pacific Fundus Camera Market Attractiveness Analysis, By Modality, 2025-2035

Figure 43: Asia Pacific Fundus Camera Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: Asia Pacific Fundus Camera Market Attractiveness Analysis, By End-user, 2025-2035

Figure 45: Latin America Fundus Camera Market Value (US$ Bn) Forecast, 2020-2035

Figure 46: Latin America Fundus Camera Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 47: Latin America Fundus Camera Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 48: Latin America Fundus Camera Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 49: Latin America Fundus Camera Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 50: Latin America Fundus Camera Market Value Share Analysis, By Modality, 2024 and 2035

Figure 51: Latin America Fundus Camera Market Attractiveness Analysis, By Modality, 2025-2035

Figure 52: Latin America Fundus Camera Market Value Share Analysis, By End-user, 2024 and 2035

Figure 53: Latin America Fundus Camera Market Attractiveness Analysis, By End-user, 2025-2035

Figure 54: Middle East & Africa Fundus Camera Market Value (US$ Bn) Forecast, 2020-2035

Figure 55: Middle East & Africa Fundus Camera Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 56: Middle East & Africa Fundus Camera Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 57: Middle East & Africa Fundus Camera Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 58: Middle East & Africa Fundus Camera Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 59: Middle East & Africa Fundus Camera Market Value Share Analysis, By Modality, 2024 and 2035

Figure 60: Middle East & Africa Fundus Camera Market Attractiveness Analysis, By Modality, 2025-2035

Figure 61: Middle East & Africa Fundus Camera Market Value Share Analysis, By End-user, 2024 and 2035

Figure 62: Middle East & Africa Fundus Camera Market Attractiveness Analysis, By End-user, 2025-2035