Reports

Reports

The emergence of mosquito-borne diseases has triggered a demand for mosquito repellent candles across Europe, states the latest research report of Transparency Market Research. The growing possibility of malaria and dengue due to the constant inflow of travelers is expected to drive the demand for mosquito repellent candles across Europe during the forecast period. Furthermore, the benefits of these candles over other types of repellents such as liquids, coils, and ointments, have become their unique selling points, helping them carve a niche in the overall market. Candles do not emit harmful smoke or do not lead of dirt such as coils. Thus they are being preferred over conventional methods of repelling mosquitoes.

According to Transparency Market Research, the opportunity in the Europe mosquito repellent candle market is expected to be worth US$2.0 bn by the end of 2021 as compared to US$1.3 bn in 2014. During the forecast years of 2015 and 2021, the overall market is expected to expand at a CAGR of 6.0%. This market will also gain momentum from the recent outbreak of Zika virus, which has urged governments across Europe to take serious measures to prevent an epidemic.

France Leads Overall Market with Increasing Inflow of Tourists

Geographically, the Europe mosquito repellent candles market is segmented into countries such as France, Italy, Spain, Portugal, Hungary, and Rest of Europe. Of these France is anticipated to emerge as the leader, with the segment poised to progress at a CAGR of 6.30% between 2015 and 2021. Climate change is expected to a major reason for excessive breeding of mosquitoes in the near future, which is likely to increase the risk of mosquito-borne diseases in the near future. As this trend continues, it will bolster the demand for mosquito repellent candles market in France.

Warm climate and a progressive rise in the number of tourists with each passing year has made France susceptible to mosquito-borne diseases. Its relatively vast territory as compared to other countries in the region has also contributed towards its rising stake in the overall market. Analysts state that the improving economic conditions in France will also fuel the demand for mosquito repellent candles, with citronella being the most popular choice of product amongst the rest.

Citronella Candles to be the Popularly Sold Product Type

The various raw materials used for making mosquito repellent candles are citronella oil, andiroba oil, eucalyptus oil, and basil oil. Over the period of next six odd years, citronella oil will be the predominantly used oil as it is inherently a mosquito repellent. The abundance of lemongrass, the source of citronella, will also cater to the ongoing demand for citronella-based mosquito repellent candles in the near future. Furthermore, citronella candles are marginally cheaper than the other types of candles, a fact that has been boosting the demand for these candles over the past few years. The shifting consumer preference for citronella candles over other types of mosquito repellent candles is also likely to work in favor of this product segment.

Some of the leading manufacturers of mosquito repellent candles across Europe are Gies-Kerzen GmbH, Bite Lite LLC , Yankee Candle Company, Diversam Comaral, Guangzhou Tiger Head Battery Group, and Coghlan’s Ltd. Manufacturers are trying to develop products that are completely natural to overcome restraints such as exposure to lead and carbon as candles burn. Product innovation such as conceal candles that will act as inhibitor instead of repellents will also prove critical in gaining a leading share in the overall market.

Rising Incidence of Insect-Borne Diseases and Disorders to Propel the Growth Opportunities across the Europe Insect Repellent Market

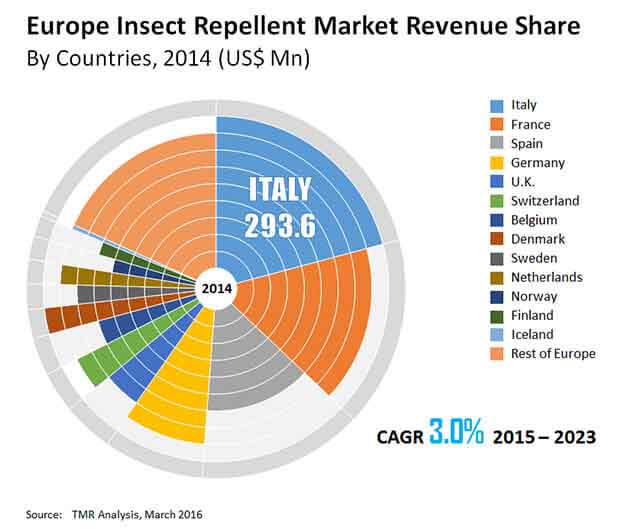

The growing prevalence of diseases occurring due to mosquitoes has grown manifold over the years. The demand for personal hygiene and home care products has increased considerably over the years in Europe. The growing prevalence of insect-borne diseases across Europe and the rising awareness about controlling the same will bring promising growth opportunities for the Europe insect repellent market during the assessment period of 2015-2023.

Insect repellent market in europe is expected to reach US$1.82 bn by 2023

Insect repellent market in europe is expected to expand at a CAGR of 3.0% from 2015 to 2023

Insect repellent market in Europe is primarily driven by increasing concerns about insect-borne diseases and existence of strong distribution networks in the continent

France accounted for a major share of the europe insect repellent market

Key players in the insect repellent market in Europe are Avon Products Inc. (U.S.), S.C. Johnson & Son, Inc. (U.S.), 3M Corporation (U.S.), E.I. DuPont de Nemours and Company (U.S.), BASF S.E (Germany) and Omega Pharma (Belgium)

Chapter 1 Preface

1.1 Report description

1.2 Research scope

1.3 Research methodology

Chapter 2 Executive Summary

Chapter 3 Insect Repellent Market Overview

3.1 Introduction

3.2 Key trends analysis

3.3 Market dynamics

3.3.1 Market drivers

3.3.1.1 Growing concerns about insect-borne diseases in Europe

3.3.1.2 Extensive distribution network

3.3.2 Market Restraints

3.3.2.1 Strict government regulations

3.3.3 Market opportunities

3.3.3.1 Usage of natural products

3.4 Europe insect repellent market: Market attractiveness analysis

3.5 Europe insect repellent market: Company market share analysis

3.5.1 Market share by insect repellent market key vendors, 2014 (Value %)

Chapter 4 Europe Insect Repellent Market: By Product Type

4.1 Overview

4.1.1 Europe Insect Repellent Market Revenue Share (%), by Product Type, 2014 and 2023

4.2 Body worn insect repellent

4.2.1 Europe Body Worn Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2 Oils and cream

4.2.2.1 Europe Oils and Cream Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.2 Plant based insect repellent

4.2.2.2.1 Europe Plant Based Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.2.2 Citronella

4.2.2.2.2.1 Europe Citronella Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.2.3 Geraniol

4.2.2.2.3.1 Europe Geraniol Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.2.4 Oil of lemon eucalyptus

4.2.2.2.4.1 Europe Oil of Lemon Eucalyptus Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.3 Synthetic based insect repellent

4.2.2.3.1 Europe Synthetic Based Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.3.2 DEET

4.2.2.3.2.1 Europe DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.3.3 Picaridin

4.2.2.3.3.1 Europe Picaridin Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.2.3.4 Permethrin

4.2.2.3.4.1 Europe Permethrin Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.3 Apparel

4.2.3.1 Europe Apparel Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.4 Stickers and patches

4.2.4.1 Europe Stickers and Patches Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.5 Aerosol

4.2.5.1 Europe Aerosol Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.5.2 DEET

4.2.5.2.1 Europe DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.2.5.3 Non DEET

4.2.5.3.1 Europe Non DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.3 Non body worn insect repellent

4.3.1 Europe Non Body Worn Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.3.2 Coils, mats and sheets

4.3.2.1 Europe Coils, Mats and Sheets Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.3.3 Aerosol

4.3.3.1 Europe Aerosol Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.3.3.2 DEET

4.3.3.2.1 Europe DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.3.3.3 Non DEET

4.3.3.3.1 Europe Non DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

4.3.4 Liquid vaporizer

4.3.4.1 Europe Liquid Vaporizer Market Revenue and Forecast, 2014 – 2023 (USD Million)

Chapter 5 Europe Insect Repellent Market: By Countries

5.1 Overview

5.1.1 Europe Insect Repellent Market Revenue Share (%), By Countries, 2014 and 2023

5.2 U.K.

5.2.1 U.K. Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.3 Germany

5.3.1 Germany Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.4 Italy

5.4.1 Italy Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.5 France

5.5.1 France Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.6 Spain

5.6.1 Spain Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.7 Belgium

5.7.1 Belgium Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.8 Switzerland

5.8.1 Switzerland Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.9 Netherlands

5.9.1 Netherlands Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.10 Denmark

5.10.1 Denmark Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.11 Norway

5.11.1 Norway Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.12 Sweden

5.12.1 Sweden Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.13 Finland

5.13.1 Finland Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.14 Iceland

5.14.1 Iceland Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

5.15 Rest of Europe

5.15.1 Rest of Europe Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

Chapter 6 Company Profiles

6.1 Avon Products Inc.

6.2 S.C.Johnson & Son, Inc.

6.3 3M Corporation

6.4 E.I. DuPont de Nemours and Company

6.5 BASF S.E.

6.6 Omega Pharma

List of Tables

TABLE 1 Europe Insect Repellent Market Snapshot (Revenue), 2014 and 2023

TABLE 2 Drivers for Europe insect repellent market: impact analysis

TABLE 3 Restraints for Europe insect repellent market

List of Figures

FIG. 1 Market Segmentation Insect Repellent Market

FIG. 2 Europe Insect Repellent Market: Market Attractiveness Analysis, By Product Type

FIG. 3 Market share by Insect Repellent Market Key Vendors, 2014 (Value %)

FIG. 4 Europe Insect Repellent Market Revenue Share (%), by Product Type, 2014 and 2023

FIG. 5 Europe Body Worn Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 6 Europe Oils and Cream Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 7 Europe Plant Based Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 8 Europe Citronella Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 9 Europe Geraniol Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 10 Europe Oil of Lemon Eucalyptus Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 11 Europe Synthetic Based Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 12 Europe DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 13 Europe Picaridin Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 14 Europe Permethrin Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 15 Europe Apparel Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 16 Europe Stickers and Patches Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 17 Europe Aerosol Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 18 Europe DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 19 Europe Non DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 20 Europe Non Body Worn Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 21 Europe Coils, Mats and Sheets Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 22 Europe Aerosol Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 23 Europe DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 24 Europe Non DEET Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 25 Europe Liquid Vaporizer Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 26 Europe Insect Repellent Market Revenue Share (%), By Countries, 2014 and 2023

FIG. 27 U.K. Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 28 Germany Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 29 Italy Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 30 France Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 31 Spain Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 32 Belgium Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 33 Switzerland Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 34 Netherlands Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 35 Denmark Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 36 Norway Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 37 Sweden Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 38 Finland Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 39 Iceland Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)

FIG. 40 Rest of Europe Insect Repellent Market Revenue and Forecast, 2014 – 2023 (USD Million)