Clinical teams at hospitals, HEN (Housing and Essential Needs) providers, and the national NHS (National Health Service) bodies are working closely together to ensure service continuity with minimal disruption during the ongoing coronavirus pandemic. Likewise, companies in the enteral feeding devices market are increasing efforts to ensure a robust supply of tubes, pumps, and administration sets to support the needs of patients.

HEN providers and healthcare professionals are informing caretakers and patients about ways to receive enteral feed supplies and consumables during the COVID-19 pandemic. Suppliers in the enteral feeding devices market are helping caregivers and patients to organize their deliveries and avoid delays in turnaround time. Patients are ensuring complete accurate monthly stock checks.

Request a sample to get extensive insights into the Enteral Feeding Devices Market

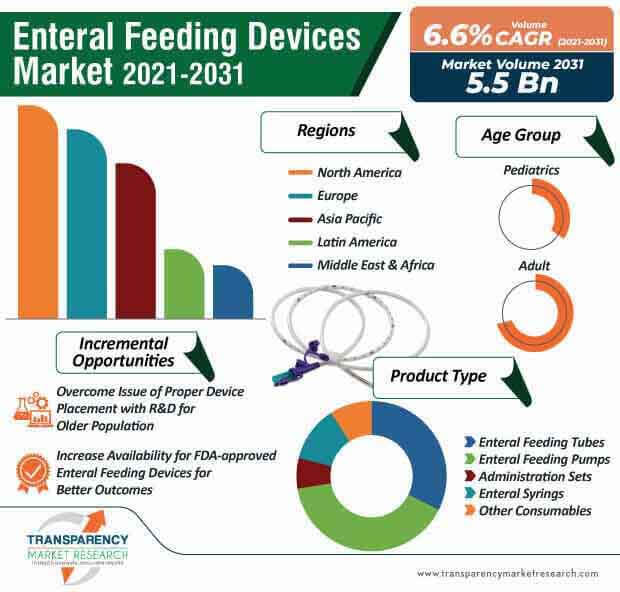

There are many disadvantages that are common with nasogastric tube feeding in the older population. These disadvantages are associated with placement, confirmation of tube placement, and dislodgement. Hence, manufacturers in the enteral feeding devices market are increasing R&D to develop equipment that acts in the best interest of the older population when they lack capacity.

It has been identified that enteral nutrition can significantly reduce the risk of developing pressure ulcers. As such, enteral tube feeding needs to be supported with oral nutrition for reducing the risk of developing pressure ulcers in the older population.

To understand how our report can bring a difference to your business strategy, Ask for a brochure

The enteral feeding devices market is slated to register a CAGR of 6.6% during the forecast period. In order to address the limitations of blind insertions and radiography-based adjuvant methods, Israel-based ENvizion Medical is being publicized for developing an enteral feeding tube that is being recognized by the North American innovation award. Manufacturers in the enteral feeding devices business are taking cues from such innovations to increase the availability of FDA (Food and Drug Administration) approved equipment.

Companies in the global market for enteral feeding devices are increasing their research in systems consisting of electro-mechanical devices with embedded software and enteral feeding tubes. They are increasing efforts to leverage the power of electromagnetic technology where the devices create a personalized body map of patients, thus allowing the medical staff to precisely place the tube in the stomach or small intestine through the oral or mesenteric route.

The enteral feeding devices market is expected to reach US$ 5.5 Bn by 2031. Enteral Access Technologies (E.A.T.) - a medical device company based in Liverpool, has received a CE mark for its DoubleCHEK enteral feeding device, which allows the company to market the patient-centric product in all EU countries.

Despite many complications for med-tech companies trying to export to Europe since Brexit, stakeholders are entering into distribution agreements that are helping to overcome trade barriers and witness increased trade in the sector.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Enteral Feeding Devices Market

Analysts’ Viewpoint

The COVID-19 pandemic has sparked an urgent need for extra enteral feeding supplies and equipment, which has compelled device manufacturers to adapt to the volatile demand sentiments. Since misplacement of feeding tubes can result in serious patient harm, manufacturers in the enteral feeding devices market are developing feeding tubes that help to overcome these issues. Manufacturers are increasing research in enteral feeding devices that use CO2 and pH indicators, coupled with a proprietary valving system to help clinicians place naso/oro gastric tubes safely and quickly in any environment. The electromagnetic tracking technology in enteral feeding tubes are enabling real-time, multi-faceted visualization, and directional guidance to healthcare support staff while inserting the feeding tube.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 2.8 Bn |

|

Market Forecast Value in 2031 |

US$ 5.5 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, parent industry overview, etc. |

|

Competition Landscape |

Company Profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, key financials, etc. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

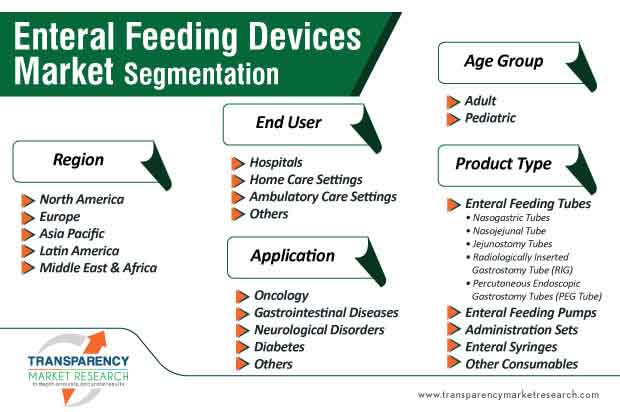

Enteral Feeding Devices Market – Segmentation

| Product Type |

|

| Age Group |

|

| Application |

|

| End-user |

|

| Region |

|

The global market for enteral feeding devices is expected to reach US$ 5.5 Bn by 2031

The global market is slated to register a CAGR of 6.6% during the forecast period 2021-2031

Enteral feeding devices market is driven by rising prevalence of chronic diseases and rise in demand to avoid needle-prick accidents

The enteral feeding pumps segment dominated the global enteral feeding devices market, and the trend is anticipated to continue during the forecast period

Key players operating in the global market for enteral feeding devices are Avanos Medical, Inc., Cardinal Health, Inc., B. Braun Melsungen AG, BD, Boston Scientific Corporation, CONMED Corporation, Medline Industries, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Enteral Feeding Devices Market

4. Market Overview

4.1. Market Dynamics

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.2. Global Enteral Feeding Devices Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Regulatory Scenario, by Region/globally

5.2. Enteral Nutrition - HCPCS Codes

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Enteral Feeding Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value & Volume Forecast, by Product Type, 2017–2031

6.3.1. Enteral Feeding Tubes

6.3.1.1. Nasogastric Tubes

6.3.1.2. Nasojejunal Tube

6.3.1.3. Jejunostomy Tubes

6.3.1.3.1. Percutaneous Endoscopic Jejunostomy (PEJ) Tube

6.3.1.3.2. Radiologically Inserted Jejunostomy (RIJ) Tube

6.3.1.4. Radiologically Inserted Gastrostomy Tube (RIG)

6.3.1.5. Percutaneous Endoscopic Gastrostomy Tubes (PEG Tube)

6.3.2. Enteral Feeding Pumps

6.3.3. Administration Sets

6.3.4. Enteral Syringes

6.3.5. Other Consumables

6.4. Market Attractiveness Analysis, by Product Type

7. Global Enteral Feeding Devices Market Analysis and Forecast, by Age Group

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value & Volume Forecast, by Age Group, 2017–2031

7.3.1. Pediatric

7.3.2. Adult

7.4. Market Attractiveness Analysis, by Age Group

8. Global Enteral Feeding Devices Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Oncology

8.3.2. Gastrointestinal Diseases

8.3.3. Neurological Disorders

8.3.4. Diabetes

8.3.5. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Enteral Feeding Devices Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Home Care Settings

9.3.3. Ambulatory Care Settings

9.4. Market Attractiveness Analysis, by End-user

10. Global Enteral Feeding Devices Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Country/Region

11. North America Enteral Feeding Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast, by Product Type, 2017–2031

11.2.1. Enteral Feeding Tubes

11.2.1.1. Nasogastric Tubes

11.2.1.2. Nasojejunal Tube

11.2.1.3. Jejunostomy Tubes

11.2.1.3.1. Percutaneous Endoscopic Jejunostomy (PEJ) Tube

11.2.1.3.2. Radiologically Inserted Jejunostomy (RIJ) Tube

11.2.1.4. Radiologically Inserted Gastrostomy Tube (RIG)

11.2.1.5. Percutaneous Endoscopic Gastrostomy Tubes (PEG Tube)

11.2.2. Enteral Feeding Pumps

11.2.3. Administration Sets

11.2.4. Enteral Syringes

11.2.5. Other Consumables

11.3. Market Value & Volume Forecast, by Age Group, 2017–2031

11.3.1. Pediatric

11.3.2. Adult

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Oncology

11.4.2. Gastrointestinal Diseases

11.4.3. Neurological Disorders

11.4.4. Diabetes

11.4.5. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Home Care Settings

11.5.3. Ambulatory Care Settings

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Age Group

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Enteral Feeding Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast, by Product Type, 2017–2031

12.2.1. Enteral Feeding Tubes

12.2.1.1. Nasogastric Tubes

12.2.1.2. Nasojejunal Tube

12.2.1.3. Jejunostomy Tubes

12.2.1.3.1. Percutaneous Endoscopic Jejunostomy (PEJ) Tube

12.2.1.3.2. Radiologically Inserted Jejunostomy (RIJ) Tube

12.2.1.4. Radiologically Inserted Gastrostomy Tube (RIG)

12.2.1.5. Percutaneous Endoscopic Gastrostomy Tubes (PEG Tube)

12.2.2. Enteral Feeding Pumps

12.2.3. Administration Sets

12.2.4. Enteral Syringes

12.2.5. Other Consumables

12.3. Market Value & Volume Forecast, by Age Group, 2017–2031

12.3.1. Pediatric

12.3.2. Adult

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Oncology

12.4.2. Gastrointestinal Diseases

12.4.3. Neurological Disorders

12.4.4. Diabetes

12.4.5. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Home Care Settings

12.5.3. Ambulatory Care Settings

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Age Group

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Enteral Feeding Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value & Volume Forecast, by Product Type, 2017–2031

13.2.1. Enteral Feeding Tubes

13.2.1.1. Nasogastric Tubes

13.2.1.2. Nasojejunal Tube

13.2.1.3. Jejunostomy Tubes

13.2.1.3.1. Percutaneous Endoscopic Jejunostomy (PEJ) Tube

13.2.1.3.2. Radiologically Inserted Jejunostomy (RIJ) Tube

13.2.1.4. Radiologically Inserted Gastrostomy Tube (RIG)

13.2.1.5. Percutaneous Endoscopic Gastrostomy Tubes (PEG Tube)

13.2.2. Enteral Feeding Pumps

13.2.3. Administration Sets

13.2.4. Enteral Syringes

13.2.5. Other Consumables

13.3. Market Value & Volume Forecast, by Age Group, 2017–2031

13.3.1. Pediatric

13.3.2. Adult

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Oncology

13.4.2. Gastrointestinal Diseases

13.4.3. Neurological Disorders

13.4.4. Diabetes

13.4.5. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Home Care Settings

13.5.3. Ambulatory Care Settings

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Japan

13.6.2. China

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Age Group

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country

14. Latin America Enteral Feeding Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value & Volume Forecast, by Product Type, 2017–2031

14.2.1. Enteral Feeding Tubes

14.2.1.1. Nasogastric Tubes

14.2.1.2. Nasojejunal Tube

14.2.1.3. Jejunostomy Tubes

14.2.1.3.1. Percutaneous Endoscopic Jejunostomy (PEJ) Tube

14.2.1.3.2. Radiologically Inserted Jejunostomy (RIJ) Tube

14.2.1.4. Radiologically Inserted Gastrostomy Tube (RIG)

14.2.1.5. Percutaneous Endoscopic Gastrostomy Tubes (PEG Tube)

14.2.2. Enteral Feeding Pumps

14.2.3. Administration Sets

14.2.4. Enteral Syringes

14.2.5. Other Consumables

14.3. Market Value & Volume Forecast, by Age Group, 2017–2031

14.3.1. Pediatric

14.3.2. Adult

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Oncology

14.4.2. Gastrointestinal Diseases

14.4.3. Neurological Disorders

14.4.4. Diabetes

14.4.5. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Home Care Settings

14.5.3. Ambulatory Care Settings

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Age Group

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Enteral Feeding Devices Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value & Volume Forecast, by Product Type, 2017–2031

15.2.1. Enteral Feeding Tubes

15.2.1.1. Nasogastric Tubes

15.2.1.2. Nasojejunal Tube

15.2.1.3. Jejunostomy Tubes

15.2.1.3.1. Percutaneous Endoscopic Jejunostomy (PEJ) Tube

15.2.1.3.2. Radiologically Inserted Jejunostomy (RIJ) Tube

15.2.1.4. Radiologically Inserted Gastrostomy Tube (RIG)

15.2.1.5. Percutaneous Endoscopic Gastrostomy Tubes (PEG Tube)

15.2.2. Enteral Feeding Pumps

15.2.3. Administration Sets

15.2.4. Enteral Syringes

15.2.5. Other Consumables

15.3. Market Value & Volume Forecast, by Age Group, 2017–2031

15.3.1. Pediatric

15.3.2. Adult

15.4. Market Value Forecast, by Application, 2017–2031

15.4.1. Oncology

15.4.2. Gastrointestinal Diseases

15.4.3. Neurological Disorders

15.4.4. Diabetes

15.4.5. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospitals

15.5.2. Home Care Settings

15.5.3. Ambulatory Care Settings

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Age Group

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Company Profiles

16.1.1. Avanos Medical, Inc.

16.1.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.1.2. Financial Overview

16.1.1.3. Product Portfolio

16.1.1.4. SWOT Analysis

16.1.1.5. Strategic Overview

16.1.2. Cardinal Health, Inc.

16.1.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.2.2. Financial Overview

16.1.2.3. Product Portfolio

16.1.2.4. SWOT Analysis

16.1.2.5. Strategic Overview

16.1.3. B. Braun Melsungen AG

16.1.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.3.2. Financial Overview

16.1.3.3. Product Portfolio

16.1.3.4. SWOT Analysis

16.1.3.5. Strategic Overview

16.1.4. Hollister Incorporated

16.1.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.4.2. Financial Overview

16.1.4.3. Product Portfolio

16.1.4.4. SWOT Analysis

16.1.4.5. Strategic Overview

16.1.5. Becton, Dickinson and Company

16.1.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.5.2. Financial Overview

16.1.5.3. Product Portfolio

16.1.5.4. SWOT Analysis

16.1.5.5. Strategic Overview

16.1.6. Boston Scientific Corporation

16.1.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.6.2. Financial Overview

16.1.6.3. Product Portfolio

16.1.6.4. SWOT Analysis

16.1.6.5. Strategic Overview

16.1.7. CONMED Corporation

16.1.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.7.2. Financial Overview

16.1.7.3. Product Portfolio

16.1.7.4. SWOT Analysis

16.1.7.5. Strategic Overview

16.1.8. Medline Industries, Inc.

16.1.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.8.2. Financial Overview

16.1.8.3. Product Portfolio

16.1.8.4. SWOT Analysis

16.1.8.5. Strategic Overview

16.1.9. Koninklijke Philips N.V.

16.1.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.9.2. Financial Overview

16.1.9.3. Product Portfolio

16.1.9.4. SWOT Analysis

16.1.9.5. Strategic Overview

16.1.10. Baxter

16.1.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.10.2. Financial Overview

16.1.10.3. Product Portfolio

16.1.10.4. SWOT Analysis

16.1.10.5. Strategic Overview

16.1.11. Other Prominent Players

List of Tables

Table 01: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Enteral Feeding Tubes, 2017–2031

Table 03: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Jejunostomy Tubes, 2017–2031

Table 04: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 05: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 06: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 09: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 10: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Enteral Feeding Tubes, 2017–2031

Table 11: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Jejunostomy Tubes, 2017–2031

Table 12: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 13: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Enteral Feeding Tubes, 2017–2031

Table 18: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Jejunostomy Tubes, 2017–2031

Table 19: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 20: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 21: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 22 Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 23: Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 24: Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Enteral Feeding Tubes, 2017–2031

Table 25: Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Jejunostomy Tubes, 2017–2031

Table 26: Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 27: Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 28: Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 29: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 30: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 31: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Enteral Feeding Tubes, 2017–2031

Table 32: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Jejunostomy Tubes, 2017–2031

Table 33: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 34: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 35: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 36: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 37: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 38: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Enteral Feeding Tubes, 2017–2031

Table 39: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Jejunostomy Tubes, 2017–2031

Table 40: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Age Group, 2017–2031

Table 41: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 42: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Enteral Feeding Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Enteral Feeding Devices Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 03: Global Enteral Feeding Devices Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 04: Global Enteral Feeding Devices Market Value (US$ Mn), by Enteral Feeding Tubes, 2017‒2031

Figure 05: Global Enteral Feeding Devices Market Value (US$ Mn), by Enteral Feeding Pumps, 2017‒2031

Figure 06: Global Enteral Feeding Devices Market Value (US$ Mn), by Administration Sets, 2017‒2031

Figure 07: Global Enteral Feeding Devices Market Value (US$ Mn), by Enteral Syringes, 2017‒2031

Figure 08: Global Enteral Feeding Devices Market Value (US$ Mn), by Other Consumables, 2017‒2031

Figure 09: Global Enteral Feeding Devices Market Value Share Analysis, by Age Group, 2020 and 2031

Figure 10: Global Enteral Feeding Devices Market Attractiveness Analysis, by Age Group, 2021–2031

Figure 11: Global Enteral Feeding Devices Market Value (US$ Mn), by Pediatrics, 2017–2031

Figure 12: Global Enteral Feeding Devices Market Value (US$ Mn), by Adult, 2017–2031

Figure 13: Global Enteral Feeding Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 14: Global Enteral Feeding Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 15: Global Enteral Feeding Devices Market Value (US$ Mn), by Oncology, 2017‒2031

Figure 16: Global Enteral Feeding Devices Market Value (US$ Mn), by Gastrointestinal Diseases, 2017‒2031

Figure 17: Global Enteral Feeding Devices Market Value (US$ Mn), by Neurological Disorders, 2017‒2031

Figure 18: Global Enteral Feeding Devices Market Value (US$ Mn), by Diabetes, 2017‒2031

Figure 19: Global Enteral Feeding Devices Market Value (US$ Mn), by Others, 2017‒2031

Figure 20: Global Enteral Feeding Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 21: Global Enteral Feeding Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 22: Global Enteral Feeding Devices Market Value (US$ Mn), by Hospitals, 2017–2031

Figure 23: Global Enteral Feeding Devices Market Value (US$ Mn), by Home Care Settings, 2017–2031

Figure 24: Global Enteral Feeding Devices Market Value (US$ Mn), by Ambulatory Care Settings, 2017–2031

Figure 25: Global Enteral Feeding Devices Market Value (US$ Mn), by Others, 2017–2031

Figure 26: Global Enteral Feeding Devices Market Value Share Analysis, by Region, 2020 and 2031

Figure 27: Global Enteral Feeding Devices Market Attractiveness Analysis, by Region, 2021–2031

Figure 28: North America Enteral Feeding Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 29: North America Enteral Feeding Devices Market Value Share, by Country, 2020 and 2031

Figure 30: North America Enteral Feeding Devices Market Attractiveness Analysis, by Country, 2021–2031

Figure 31: North America Enteral Feeding Devices Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 32: North America Enteral Feeding Devices Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 33: North America Enteral Feeding Devices Market Value Share Analysis, by Age Group, 2020 and 2031

Figure 34: North America Enteral Feeding Devices Market Attractiveness Analysis, by Age Group, 2021–2031

Figure 35: North America Enteral Feeding Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 36: North America Enteral Feeding Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 37: North America Enteral Feeding Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 38: North America Enteral Feeding Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 39: Europe Enteral Feeding Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 40: Europe Enteral Feeding Devices Market Value Share, by Country/Sub-region, 2020 and 2031

Figure 41: Europe Enteral Feeding Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 42: Europe Enteral Feeding Devices Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 43: Europe Enteral Feeding Devices Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 44: Europe Enteral Feeding Devices Market Value Share Analysis, by Age Group, 2020 and 2031

Figure 45: Europe Enteral Feeding Devices Market Attractiveness Analysis, by Age Group, 2021–2031

Figure 46: Europe Enteral Feeding Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 47: Europe Enteral Feeding Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 48: Europe Enteral Feeding Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 49: Europe Enteral Feeding Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 50: Asia Pacific Enteral Feeding Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 51: Asia Pacific Enteral Feeding Devices Market Value Share, by Country/Sub-region, 2020 and 2031

Figure 52: Asia Pacific Enteral Feeding Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 53: Asia Pacific Enteral Feeding Devices Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 54: Asia Pacific Enteral Feeding Devices Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 55: Asia Pacific Enteral Feeding Devices Market Value Share Analysis, by Age Group, 2020 and 2031

Figure 56: Asia Pacific Enteral Feeding Devices Market Attractiveness Analysis, by Age Group, 2021–2031

Figure 57: Asia Pacific Enteral Feeding Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 58: Asia Pacific Enteral Feeding Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 59: Asia Pacific Enteral Feeding Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 60: Asia Pacific Enteral Feeding Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 61: Latin America Enteral Feeding Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 62: Latin America Enteral Feeding Devices Market Value Share, by Country/Sub-region, 2020 and 2031

Figure 63: Latin America Enteral Feeding Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 64: Latin America Enteral Feeding Devices Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 65: Latin America Enteral Feeding Devices Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 66: Latin America Enteral Feeding Devices Market Value Share Analysis, by Age Group, 2020 and 2031

Figure 67: Latin America Enteral Feeding Devices Market Attractiveness Analysis, by Age Group, 2021–2031

Figure 68: Latin America Enteral Feeding Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 69: Latin America Enteral Feeding Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 70: Latin America Enteral Feeding Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 71: Latin America Enteral Feeding Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 72: Middle East & Africa Enteral Feeding Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 73: Middle East & Africa Enteral Feeding Devices Market Value Share, by Country/Sub-region, 2020 and 2031

Figure 74: Middle East & Africa Enteral Feeding Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 75: Middle East & Africa Enteral Feeding Devices Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 76: Middle East & Africa Enteral Feeding Devices Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 77: Middle East & Africa Enteral Feeding Devices Market Value Share Analysis, by Age Group, 2020 and 2031

Figure 78: Middle East & Africa Enteral Feeding Devices Market Attractiveness Analysis, by Age Group, 2021–2031

Figure 79: Middle East & Africa Enteral Feeding Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 80: Middle East & Africa Enteral Feeding Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 81: Middle East & Africa Enteral Feeding Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 82: Middle East & Africa Enteral Feeding Devices Market Attractiveness Analysis, by End-user, 2021–2031