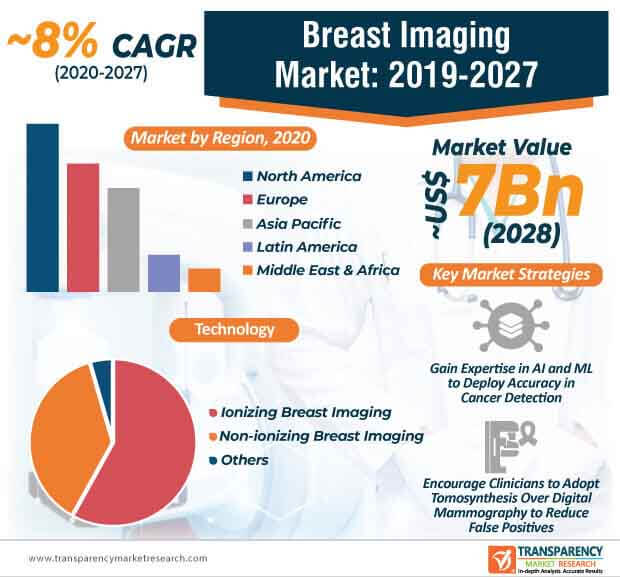

AI (Artificial Intelligence) and ML (Machine Learning) are virtually penetrating almost all industries, including healthcare. These technologies are generating incremental opportunities for companies in the breast imaging market. The alarming rate of women in the U.S. that may be susceptible to breast cancer during their lifetime has led to the adoption of AI and ML to improve patient quality of life. The market in the U.S., one of the major economies of North America, is anticipated to generate the highest revenue and is predicted for exponential growth. There is a growing need for early detection and increased awareness among patients in the market for breast imaging.

Early detection of lesions with the help of AI and ML has helped to improve clinical numbers. This phenomena is being further leveraged with advanced screening mammography, whereas this technique is gaining global recognition as one of the most effective methods for detecting early breast cancer. This explains why ionizing breast imaging dictates the highest revenue among all technologies in the breast imaging market.

To know the scope of our report Get a Sample on Breast Imaging Market

Early cancer detection has become one of the important prerequisites for most women worldwide. Hence, healthcare companies are gaining expertise in digital breast imaging to improve cancer diagnosis. Such advancements are boosting the revenue of breast imaging market, which is estimated to be valued at ~US$ 7 Bn by the end of 2028. On the other hand, clinicians are building their credibility by gaining efficacy in FDA-approved technologies for breast imaging. Such technologies are supporting a wide range of clinical research studies and the development of innovative products related to breast cancer.

Get a glimpse of the in-depth analysis through our Report Brochure

Apart from innovations in the breast imaging market, clinicians are creating an awareness about radiologist-patient communication as the key to offer a more patient-centric atmosphere in hospitals and clinics. Thus, along with innovations in breast imaging, healthcare providers need to understand that patients are more willing to interact with their radiologist, while being educated about their individual circumstances.

Advantages offered by tomosynthesis are anticipated to outperform the offerings of digital mammography. However, in the current scenario, the rapidly evolving COVID-19 (Coronavirus) has forced stakeholders to cancel and reschedule important conferences associated with breast imaging. For instance, the 2020 Society of Breast Imaging/American College of Radiology (SBI/ACR) annual symposium has been cancelled and rescheduled for April 8 - April 11, 2021, in Savannah, Georgia, U.S. Such unwelcome pandemics are slowing down the pace of innovations in the breast imaging market. Hence, healthcare companies are taking cues from previous and ongoing research materials available at their disposal.

Newly published studies are offering important insights to technology companies that are shifting their focus to digital breast tomosynthesis (DBT) from digital mammography (DM). Thus, the breast imaging market is continuously growing due to largely consolidated players dominating ~45%-50% of the market share in 2018. The DBT is being highly publicized for effective breast imaging in order to reduce the incidences of false positives.

Expanding operations in future? To get the perfect launch ask for a custom report

Analysts’ Viewpoint

The analysts of Transparency Market Research (TMR) anticipate that improved radiologist-patient communication is building the credibility of hospitals and clinics, thus making breast imaging widely accepted in developing economies of Asia Pacific. The breast imaging market is undergoing transformation with the introduction of AI and ML in early detection of lesions.

Moreover, DBT is gaining popularity over DM as a powerful tool for breast cancer screening. However, the volume of published data on DBT is limited to only first round of screening, thus creating ambiguity about the performance of the DBT over prolonged periods of time. Hence, companies should increase their efficacy in five-year research studies and more to create the availability of enough clinical data about DBT in order to establish its widespread application.

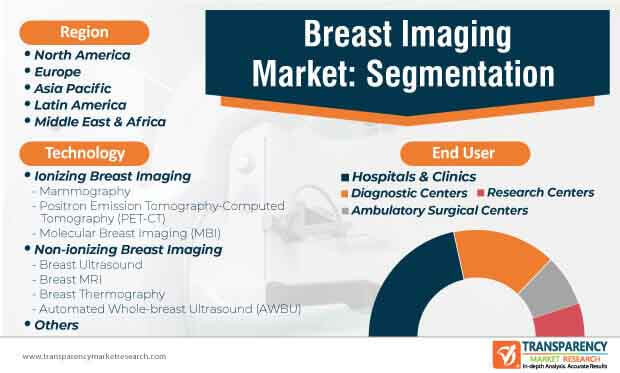

Breast Imaging Market - Segmentation

TMR’s study on the global breast imaging market includes information divided into: technology, end user, and region. Changing industry trends and other crucial market dynamics associated with these segments of the global breast imaging market are discussed in detail.

|

Technology |

Nonionizing Breast Imaging

|

|

End User |

|

|

Region |

|

Breast imaging market is estimated to be valued at US$ 7 Bn by the end of 2028

Breast imaging market is projected to expand at a CAGR of 8% from 2020 to 2028

Breast imaging market is driven by growing preference for mammography screening

North America accounted for a major share of the global breast imaging market and the trend is anticipated to continue during the forecast period

Key players in the global breast imaging market include GE Healthcare, Koninklijke Philips N.V., Hologic, Inc., Siemens Healthineers, Fujifilm Holding Corporation

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Breast Imaging Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Market Dynamics

4.4. Drivers and Restraints Snapshot Analysis

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunities

4.5. Global Breast Imaging Market Revenue Projection

4.6. Global Breast Imaging Market Outlook

5. Market Outlook

5.1. Breast Cancer Incidence and Mortality Rate, by Region in 2018

5.2. Global Risk of Breast Cancer

5.3. Top Three Players Operating in the Market Space

6. Global Breast Imaging Market Analysis, by Technology

6.1. Introduction

6.2. Global Breast Imaging Market Value Share and Attractiveness Analysis, by Technology

6.3. Global Breast Imaging Market Forecast, by Technology

6.3.1. Ionizing Breast Imaging

6.3.1.1. Mammography

6.3.1.1.1. Analog Mammography

6.3.1.1.2. Digital Mammography

6.3.1.2. Positron Emission Tomography-Computed Tomography (PET-CT)

6.3.1.3. Molecular Breast Imaging (MBI)

6.3.2. Non-ionizing Breast Imaging

6.3.2.1. Breast Ultrasound

6.3.2.2. Breast MRI

6.3.2.3. Breast Thermography

6.3.2.4. Automated Whole-breast Ultrasound (AWBU)

6.3.3. Others

6.4. Global Breast Imaging Market Analysis, by Technology

7. Global Breast Imaging Market Analysis, by End-user

7.1. Introduction

7.2. Global Breast Imaging Market Value Share and Attractiveness Analysis, by End-user

7.3. Global Breast Imaging Market Forecast, by End-user

7.3.1. Hospitals & Clinics

7.3.2. Diagnostic Centers

7.3.3. Ambulatory Surgical Centers

7.3.4. Research Centers

7.4. Global Breast Imaging Market Analysis, by End-user

8. Global Breast Imaging Market Analysis, by Region

8.1. Global Breast Imaging Market Scenario, by Country

8.2. Global Breast Imaging Market Value Share and Attractiveness Analysis, by Region

8.3. Global Breast Imaging Market Forecast, by Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

9. North America Breast Imaging Market Analysis

9.1. Key Findings

9.2. North America Breast Imaging Market Overview

9.3. North America Breast Imaging Market Value Share and Attractiveness Analysis, by Country

9.4. North America Breast Imaging Market Forecast, by Country

9.4.1. U.S.

9.4.2. Canada

9.5. North America Breast Imaging Market Value Share and Attractiveness Analysis, by Technology

9.6. North America Breast Imaging Market Forecast, by Technology

9.6.1. Ionizing Breast Imaging

9.6.1.1. Mammography

9.6.1.1.1. Analog Mammography

9.6.1.1.2. Digital Mammography

9.6.1.2. Positron Emission Tomography-Computed Tomography (PET-CT)

9.6.1.3. Molecular Breast Imaging (MBI)

9.6.2. Non-ionizing Breast Imaging

9.6.2.1. Breast Ultrasound

9.6.2.2. Breast MRI

9.6.2.3. Breast Thermography

9.6.2.4. Automated Whole-breast Ultrasound (AWBU)

9.6.3. Others

9.7. North America Breast Imaging Market Value Share and Attractiveness Analysis, by End-user

9.8. North America Breast Imaging Market Forecast, by End-user

9.8.1. Hospitals & Clinics

9.8.2. Diagnostic Centers

9.8.3. Ambulatory Surgical Centers

9.8.4. Research Centers

10. Europe Breast Imaging Market Analysis

10.1. Key Findings

10.2. Europe Breast Imaging Market Overview

10.3. Europe Breast Imaging Market Value Share and Attractiveness Analysis, by Country/Sub-region

10.4. Europe Breast Imaging Market Forecast, by Country/Sub-region

10.4.1. Germany

10.4.2. France

10.4.3. Italy

10.4.4. Spain

10.4.5. U.K.

10.4.6. Rest of Europe

10.5. Europe Breast Imaging Market Value Share and Attractiveness Analysis, by Technology

10.6. Europe Breast Imaging Market Forecast, by Technology

10.6.1. Ionizing Breast Imaging

10.6.1.1. Mammography

10.6.1.1.1. Analog Mammography

10.6.1.1.2. Digital Mammography

10.6.1.2. Positron Emission Tomography-Computed Tomography (PET-CT)

10.6.1.3. Molecular Breast Imaging (MBI)

10.6.2. Non-ionizing Breast Imaging

10.6.2.1. Breast Ultrasound

10.6.2.2. Breast MRI

10.6.2.3. Breast Thermography

10.6.2.4. Automated Whole-breast Ultrasound (AWBU)

10.6.3. Others

10.7. Europe Breast Imaging Market Value Share and Attractiveness Analysis, by End-user

10.8. Europe Breast Imaging Market Forecast, by End-user

10.8.1. Hospitals & Clinics

10.8.2. Diagnostic Centers

10.8.3. Ambulatory Surgical Centers

10.8.4. Research Centers

11. Asia Pacific Breast Imaging Market Analysis

11.1. Key Findings

11.2. Asia Pacific Breast Imaging Market Overview

11.3. Asia Pacific Breast Imaging Market Value Share and Attractiveness Analysis, by Country/Sub-region

11.4. Asia Pacific Breast Imaging Market Forecast, by Country/Sub-region

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Breast Imaging Market Value Share and Attractiveness Analysis, by Technology

11.6. Asia Pacific Breast Imaging Market Forecast, by Technology

11.6.1. Ionizing Breast Imaging

11.6.1.1. Mammography

11.6.1.1.1. Analog Mammography

11.6.1.1.2. Digital Mammography

11.6.1.2. Positron Emission Tomography-Computed Tomography (PET-CT)

11.6.1.3. Molecular Breast Imaging (MBI)

11.6.2. Non-ionizing Breast Imaging

11.6.2.1. Breast Ultrasound

11.6.2.2. Breast MRI

11.6.2.3. Breast Thermography

11.6.2.4. Automated Whole-breast Ultrasound (AWBU)

11.6.3. Others

11.7. Asia Pacific Breast Imaging Market Value Share and Attractiveness Analysis, by End-user

11.8. Asia Pacific Breast Imaging Market Forecast, by End-user

11.8.1. Hospitals & Clinics

11.8.2. Diagnostic Centers

11.8.3. Ambulatory Surgical Centers

11.8.4. Research Centers

12. Latin America Breast Imaging Market Analysis

12.1. Key Findings

12.2. Latin America Breast Imaging Market Overview

12.3. Latin America Breast Imaging Market Value Share and Attractiveness Analysis, by Country/Sub-region

12.4. Latin America Breast Imaging Market Forecast, by Country/Sub-region

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Breast Imaging Market Value Share and Attractiveness Analysis, by Technology

12.6. Latin America Breast Imaging Market Forecast, by Technology

12.6.1. Ionizing Breast Imaging

12.6.1.1. Mammography

12.6.1.1.1. Analog Mammography

12.6.1.1.2. Digital Mammography

12.6.1.2. Positron Emission Tomography-Computed Tomography (PET-CT)

12.6.1.3. Molecular Breast Imaging (MBI)

12.6.2. Non-ionizing Breast Imaging

12.6.2.1. Breast Ultrasound

12.6.2.2. Breast MRI

12.6.2.3. Breast Thermography

12.6.2.4. Automated Whole-breast Ultrasound (AWBU)

12.6.3. Others

12.7. Latin America Breast Imaging Market Value Share and Attractiveness Analysis, by End-user

12.8. Latin America Breast Imaging Market Forecast, by End-user

12.8.1. Hospitals & Clinics

12.8.2. Diagnostic Centers

12.8.3. Ambulatory Surgical Centers

12.8.4. Research Centers

13. Middle East & Africa Breast Imaging Market Analysis

13.1. Key Findings

13.2. Middle East & Africa Breast Imaging Market Overview

13.3. Middle East & Africa Breast Imaging Market Value Share and Attractiveness Analysis, by Country/Sub-region

13.4. Middle East & Africa Breast Imaging Market Forecast, by Country/Sub-region

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Middle East & Africa Breast Imaging Market Value Share and Attractiveness Analysis, by Technology

13.6. Middle East & Africa Breast Imaging Market Forecast, by Technology

13.6.1. Ionizing Breast Imaging

13.6.1.1. Mammography

13.6.1.1.1. Analog Mammography

13.6.1.1.2. Digital Mammography

13.6.1.2. Positron Emission Tomography-Computed Tomography (PET-CT)

13.6.1.3. Molecular Breast Imaging (MBI)

13.6.2. Non-ionizing Breast Imaging

13.6.2.1. Breast Ultrasound

13.6.2.2. Breast MRI

13.6.2.3. Breast Thermography

13.6.2.4. Automated Whole-breast Ultrasound (AWBU)

13.6.3. Others

13.7. Middle East & Africa Breast Imaging Market Value Share and Attractiveness Analysis, by End-user

13.8. Middle East & Africa Breast Imaging Market Forecast, by End-user

13.8.1. Hospitals & Clinics

13.8.2. Diagnostic Centers

13.8.3. Ambulatory Surgical Centers

13.8.4. Research Centers

14. Competition Analysis

14.1. Global Breast Imaging Market Share Analysis, by Company (2018)

14.2. Competition Matrix

14.3. Company Profile

14.3.1. GE Healthcare (General Electric Company)

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Koninklijke Philips N.V.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Hologic, Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Siemens Healthineers (Siemens AG)

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Fujifilm Holding Corporation

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Canon Medical Systems Corporation (Canon Inc.)

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Aurora Imaging Technologies, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Dilon Technologies, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Leica Biosystems Nussloch GmbH (Danaher)

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

List of Tables

Table 01: Global Risk of Breast Cancer

Table 02: Global Breast Imaging Market Value (US$ Mn) Forecast, by Technology, 2018–2028

Table 03: Global Breast Imaging Market Value (US$ Mn) Forecast, by Ionizing Breast Imaging, 2018–2028

Table 04: Global Breast Imaging Market Value (US$ Mn) Forecast, by Mammography, 2018–2028

Table 05: Global Breast Imaging Market Value (US$ Mn) Forecast, by Non-ionizing Breast Imaging, 2018–2028

Table 06: Global Breast Imaging Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 07: Global Breast Imaging Market Value (US$ Mn) Forecast, by Region, 2018–2028

Table 08: North America Breast Imaging Market Value (US$ Mn) Forecast, by Country, 2018–2028

Table 09: North America Breast Imaging Market Value (US$ Mn) Forecast, by Technology, 2018–2028

Table 10: North America Breast Imaging Market Value (US$ Mn) Forecast, by Ionizing Breast Imaging, 2018–2028

Table 11: North America Breast Imaging Market Value (US$ Mn) Forecast, by Mammography, 2018–2028

Table 12: North America Breast Imaging Market Value (US$ Mn) Forecast, by Non-ionizing Breast Imaging, 2018–2028

Table 13: North America Breast Imaging Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 14: Europe Breast Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 15: Europe Breast Imaging Market Value (US$ Mn) Forecast, by Technology, 2018–2028

Table 16: Europe Breast Imaging Market Value (US$ Mn) Forecast, by Ionizing Breast Imaging, 2018–2028

Table 17: Europe Breast Imaging Market Value (US$ Mn) Forecast, by Mammography, 2018–2028

Table 18: Europe Breast Imaging Market Value (US$ Mn) Forecast, by Non-ionizing Breast Imaging, 2018–2028

Table 19: Europe Breast Imaging Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 20: Asia Pacific Breast Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 21: Asia Pacific Breast Imaging Market Value (US$ Mn) Forecast, by Technology, 2018–2028

Table 22: Asia Pacific Breast Imaging Market Value (US$ Mn) Forecast, by Ionizing Breast Imaging, 2018–2028

Table 23: Asia Pacific Breast Imaging Market Value (US$ Mn) Forecast, by Mammography, 2018–2028

Table 24: Asia Pacific Breast Imaging Market Value (US$ Mn) Forecast, by Non-ionizing Breast Imaging, 2018–2028

Table 25: Asia Pacific Breast Imaging Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 26: Latin America Breast Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 27: Latin America Breast Imaging Market Value (US$ Mn) Forecast, by Technology, 2018–2028

Table 28: Latin America Breast Imaging Market Value (US$ Mn) Forecast, by Ionizing Breast Imaging, 2018–2028

Table 29: Latin America Breast Imaging Market Value (US$ Mn) Forecast, by Mammography, 2018–2028

Table 30: Latin America Breast Imaging Market Value (US$ Mn) Forecast, by Non-ionizing Breast Imaging, 2018–2028

Table 31: Latin America Breast Imaging Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table 32: Middle East & Africa Breast Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 33: Middle East & Africa Breast Imaging Market Value (US$ Mn) Forecast, by Technology, 2018–2028

Table 34: Middle East & Africa Breast Imaging Market Value (US$ Mn) Forecast, by Ionizing Breast Imaging, 2018–2028

Table 35: Middle East & Africa Breast Imaging Market Value (US$ Mn) Forecast, by Mammography, 2018–2028

Table 36: Middle East & Africa Breast Imaging Market Value (US$ Mn) Forecast, by Non-ionizing Breast Imaging, 2018–2028

Table 37: Middle East & Africa Breast Imaging Market Value (US$ Mn) Forecast, by End-user, 2018–2028

List of Figures

Figure 01: Global Breast Imaging Market Value (US$ Mn) and Distribution (%), by Region, 2019 and 2028

Figure 02: Global Breast Imaging Market Size (US$ Mn) and Forecast, 2020–2028

Figure 03: Global Breast Imaging Market Value Share (%), by Technology, 2019

Figure 04: Global Breast Imaging Market Value Share (%), by Region, 2019

Figure 05: Global Breast Imaging Market Value Share (%), by End-user, 2019

Figure 06: Global Breast Imaging Market Value Share Analysis, by Technology, 2019 and 2028

Figure 07: Global Breast Imaging Market Attractiveness, by Technology, 2020–2028

Figure 08: Global Breast Imaging Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ionizing Breast Imaging, 2018–2028

Figure 09: Global Breast Imaging Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Non-ionizing Breast Imaging, 2018–2028

Figure 10: Global Breast Imaging Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018–2028

Figure 11: Global Breast Imaging Market Value Share, by End-user, 2019 and 2028

Figure 12: Global Breast Imaging Market Attractiveness, by End-user, 2020–2028

Figure 13: Global Breast Imaging Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals & Clinics, 2018–2028

Figure 14: Global Breast Imaging Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diagnostic Centers, 2018–2028

Figure 15: Global Breast Imaging Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgical Centers, 2018–2028

Figure 16: Global Breast Imaging Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Research Centers, 2018–2028

Figure 17: Global Breast Imaging Market Value Share, by Region, 2019 and 2028

Figure 18: Global Breast Imaging Market Attractiveness, by Region, 2020–2028

Figure 19: North America Breast Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 20: North America Breast Imaging Market Value Share Analysis, by Country, 2019 and 2028

Figure 21: North America Breast Imaging Market Attractiveness, by Country, 2020–2028

Figure 22: North America Breast Imaging Market Value Share Analysis, by Technology, 2019 and 2028

Figure 23: North America Breast Imaging Market Attractiveness, by Technology, 2020–2028

Figure 24: North America Breast Imaging Market Value Share, by End-user, 2019 and 2028

Figure 25: North America Breast Imaging Market Attractiveness, by End-user, 2020–2028

Figure 26: Europe Breast Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 27: Europe Breast Imaging Market Value Share Analysis, by Countries/Sub-region, 2019 and 2028

Figure 28: Europe Breast Imaging Market Attractiveness, by Countries/Sub-region, 2020–2028

Figure 29: Europe Breast Imaging Market Value Share Analysis, by Technology, 2019 and 2028

Figure 30: Europe Breast Imaging Market Attractiveness, by Technology, 2020–2028

Figure 31: Europe Breast Imaging Market Value Share, by End-user, 2019 and 2028

Figure 32: Europe Breast Imaging Market Attractiveness, by End-user, 2020–2028

Figure 33: Asia Pacific Breast Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 34: Asia Pacific Breast Imaging Market Value Share Analysis, by Countries/Sub-region, 2019 and 2028

Figure 35: Asia Pacific Breast Imaging Market Attractiveness, by Countries/Sub-region, 2020–2028

Figure 36: Asia Pacific Breast Imaging Market Value Share Analysis, by Technology, 2019 and 2028

Figure 37: Asia Pacific Breast Imaging Market Attractiveness, by Technology, 2020–2028

Figure 38: Asia Pacific Breast Imaging Market Value Share, by End-user, 2019 and 2028

Figure 39: Asia Pacific Breast Imaging Market Attractiveness, by End-user, 2020–2028

Figure 40: Latin America Breast Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 41: Latin America Breast Imaging Market Value Share Analysis, by Countries/Sub-region, 2019 and 2028

Figure 42: Latin America Breast Imaging Market Attractiveness, by Countries/Sub-region, 2020–2028

Figure 43: Latin America Breast Imaging Market Value Share Analysis, by Technology, 2019 and 2028

Figure 44: Latin America Breast Imaging Market Attractiveness, by Technology, 2020–2028

Figure 45: Latin America Breast Imaging Market Value Share, by End-user, 2019 and 2028

Figure 46: Latin America Breast Imaging Market Attractiveness, by End-user, 2020–2028

Figure 47: Middle East & Africa Breast Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 48: Middle East & Africa Breast Imaging Market Value Share Analysis, by Countries/Sub-region, 2019 and 2028

Figure 49: Middle East & Africa Breast Imaging Market Attractiveness, by Countries/Sub-region, 2020–2028

Figure 50: Middle East & Africa Breast Imaging Market Value Share Analysis, by Technology, 2019 and 2028

Figure 51: Middle East & Africa Breast Imaging Market Attractiveness, by Technology, 2020–2028

Figure 52: Middle East & Africa Breast Imaging Market Value Share, by End-user, 2019 and 2028

Figure 53: Middle East & Africa Breast Imaging Market Attractiveness, by End-user, 2020–2028

Figure 54: Global Breast Imaging Market Share, by Company, 2018

Figure 55: GE Healthcare Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 56: GE Healthcare Breakdown of Net Sales (%), by Region, 2018

Figure 57: GE Healthcare Breakdown of Net Sales (%), by Business Segment, 2018

Figure 58: Koninklijke Philips N.V. Revenue (US$ Mn) and Y-o-Y Growth (%),

Figure 59: Koninklijke Philips N.V., Breakdown of Net Sales (%), by Region, 2018

Figure 60: Koninklijke Philips N.V., Breakdown of Net Sales (%), by Business Segment, 2018

Figure 61: Hologic, Inc., Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2019

Figure 62: Hologic Inc., Breakdown of Net Sales (%), by Region, 2019

Figure 63: Hologic, Inc., Breakdown of Net Sales (%), by Business Segment, 2019

Figure 64: Siemens Healthineers Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2018

Figure 65: Siemens Healthineers Diagnostics Business Segment, Breakdown of Net Sales (%), by Region, 2018

Figure 66: Siemens Healthineers Diagnostics Business Segment, Breakdown of Net Sales (%), by Business Segment, 2018

Figure 67: Fujifilm Holding Corporation Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2018

Figure 68: Fujifilm Holding Corporation Breakdown of Net Sales (%), by Segment, 2018-2019

Figure 69: CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.) Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 70: CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.) – Medical Systems Business Segment Breakdown of Net Sales (%), by Region, 2018

Figure 71: CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.) Breakdown of Net Sales (%), by Business Segment, 2018

Figure 72: Danaher (Diagnostics) Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2019

Figure 73: Danaher (Diagnostics) Breakdown of Net Sales, by Region, 2019