Reports

Reports

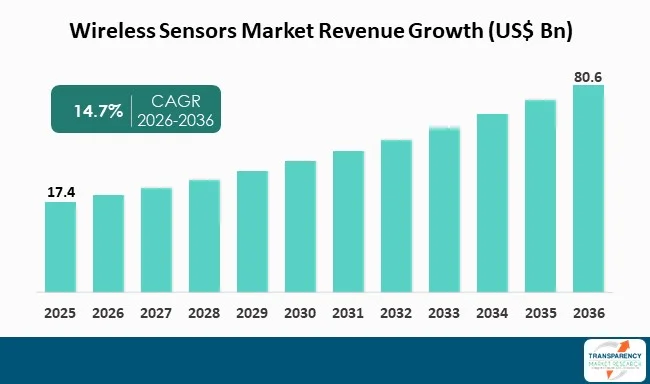

The global wireless sensors market was valued at US$ 17.4 Bn in 2025 and is projected to reach US$ 80.6 Bn by 2036, expanding at a CAGR of 14.7% from 2026 to 2036. The market growth is primarily driven by the rapid expansion of IoT ecosystems, rising industrial automation & industry 4.0, and growing demand for smart infrastructure.

The wireless sensors market is expanding rapidly as industries are increasingly adopting data-driven and connected operational paradigms. The integration of IoT, edge analytics, cloud, and low-power wireless communication technologies has enabled the transformation of traditional sensing systems into autonomous and intelligent systems that can monitor and make decisions in real-time. Enterprises in the manufacturing, healthcare, energy, transportation, and smart infrastructure sectors are increasingly adopting wireless sensing solutions for simplifying cabling, improving scalability, and enabling remote and predictive operations.

The market is moving from simple data acquisition to intelligent sensing systems that combine digital twins, AI-driven analytics, and condition-based maintenance solutions. Enterprises are incorporating intelligence into sensors through edge processing technology, which facilitates lower latency, faster decision-making, and reduced data transmission expenses.

Furthermore, the increasing emphasis on battery life extension, energy efficiency, and ultra-low-power wireless communication technologies such as LPWAN and Bluetooth Low Energy (BLE) is enabling widespread adoption in both - outdoor and indoor settings.

The key players are also shifting their focus to platform-based solutions, which integrate connectivity modules, sensors, software analytics, and managed services. Collaborations among semiconductor firms, sensor makers, and cloud service providers are also altering the competitive landscape. With the ongoing digital transformation in several sectors, wireless sensors are turning out to be the building blocks of smart cities, smart factories, and intelligent industrial automation systems.

Wireless sensor market is made up of sensing devices that measure physical, chemical or environmental data and provide it wirelessly to central system for monitoring, analyzing, and controlling processes. Wireless sensors provide ability to replace wired sensor systems through the use of Wi-Fi, Bluetooth, ZigBee, cellular networks, and LPWAN (low-power wide area network) to provide wireless communications.

Wireless sensors are used in environmental monitoring, industrial process monitoring, asset tracking, smart buildings, healthcare monitoring, and infrastructure management.

Wireless sensors have become essential components of the Internet of Things (IoT) ecosystem as an outcome of the increasing need for remote access, real-time information, r and automated control. The ability of wireless sensors to operate in extreme, remote and fluctuating conditions make them exceptionally well-suited for today's industrial and infrastructure settings, thus replacing traditional wired sensors.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the primary drivers to the wireless sensors industry is the rapid growth of industrial automation and Industry 4.0 technologies globally. There are numerous manufacturers implementing connected sensors in their manufacturing surroundings and therefore monitoring equipment performance, production processes, and environmental data in real time. By employing constantly monitoring devices, wireless sensors support predictive maintenance by measuring temperature, vibration, pressure etc., thus helping to reduce unplanned downtime and maintenance expense rates.

Wireless sensor networks used in smart manufacturing facilities assist with the provision of operational visibility, thereby maximizing resource efficiency and improving the quality of products. By integrating together wireless sensors, industrial IoT platforms, programmable logic controllers (PLCs), and manufacturing execution systems (MES), manufacturers can ensure the seamless transfer of data for different stages of production processes throughout their facilities. The ability to deploy wireless sensors on an ad-hoc basis makes it easier for manufacturers to relocate or modify their plant layouts without the prohibitive constraints associated with hard-wired connections.

Due to the increased employment of robotics, autonomous systems, and digital twins across many industries, there has been enhanced demand for scalable and dependable wireless sensing technologies. There is especially an increased requirement for this type of technology in discrete manufacturing, process manufacturing and the automotive manufacturing industries because they all rely heavily on real-time continuous sensing and adaptable control in order to effectively operate their facilities.

The increased emphasis on the establishment of smart infrastructure is also a significant factor leading to the rising use of wireless sensors. Examples of smart infrastructure include smart grid systems, intelligent transport systems, and smart buildings (all applications depend greatly on wireless sensor technology for collecting, analyzing, and processing data in real-time). Other uses include providing efficient management of energy consumption, monitoring of structural health, and managing traffic and environmental conditions.

Wireless sensor technology has experienced rapid growth in terms of use within automated building systems. They are now widely used to control HVAC systems, manage lighting, detect occupancy, and secure buildings. In addition to using these sensors in building systems, smart cities will use wireless sensor networks to monitor air quality, noise pollution, and waste systems, along with water distribution systems. The ease of installation and reduced cost associated with deploying wireless sensor systems due to their lack of required complex wiring has greatly influenced the speed at which new infrastructure projects can be completed.

Government programs promoting the development of sustainable, energy-efficient, and smart infrastructure encourage increased investment levels in wireless sensor technology. As urban populations grow and cities begin implementing data-driven government approaches, wireless sensors will be vital enabler elements for creating intelligent infrastructure systems.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

The convergence of artificial intelligence and edge analytics with wireless sensors is a major growth area for the market. By integrating AI algorithms into wireless sensor nodes or edge gateways, the organizations can process data at the local level, which facilitates quicker decision-making and does away with the need for cloud processing. This is especially important for applications that require low latency.

AI-enabled wireless sensors facilitate sophisticated applications such as predictive maintenance, pattern recognition, anomaly detection, and adaptive control. In a manufacturing setting, AI-enabled wireless sensors are capable of detecting the early warning signs of equipment failure, optimizing machine performance, and initiating corrective measures automatically. In healthcare and infrastructure, the AI-enabled wireless sensors facilitate continuous monitoring and real-time notifications, thereby improving efficiency and safety.

The increasing emergence of edge AI chipsets, low-power processors, and wireless modules is making intelligent sensing more mainstream and affordable. As organizations become more data-driven, the need for AI-enabled wireless sensors is expected to unlock new revenue streams and applications across numerous industries.

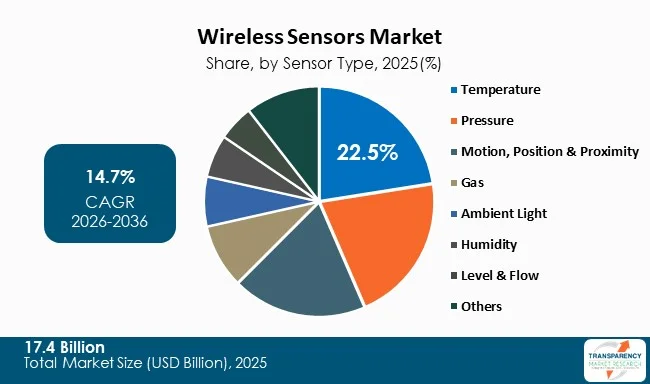

The wireless sensors market is basically dominated by the temperature sensor type, accounting for a revenue share of 22.5% in 2025. The main reason behind the dominance of the temperature sensor type in the global market is the extensive use of temperature sensing in various industrial applications such as healthcare, building automation, environmental monitoring.

Wireless temperature sensors are broadly used in manufacturing facilities for the monitoring of furnaces, equipment, and storage conditions. In smart buildings, wireless temperature sensors are used for HVAC optimization and energy management. The healthcare industry also uses wireless temperature sensors for cold chain management, patient monitoring, and pharmaceutical storage.

Improvements in precision, size, and battery life of sensors have further increased the use of wireless temperature sensors.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The industries in North America have been quick to adopt wireless sensing technology for improving operational efficiency, minimizing downtime, and facilitating predictive maintenance. The widespread adoption of smart grids, smart factories, and intelligent transportation systems in the United States and Canada has contributed largely to the growth of the market.

The convergence of cloud infrastructure, edge computing, and AI analytics with wireless sensor networks has further cemented North America’s position in the market.

Key players operating in the wireless sensors market are investing in technological advancements, innovation, and strategic partnerships. They emphasize on expanding product portfolios and improving clarity, thereby ascertaining sustained growth and leadership in the evolving industry.

Honeywell International Inc., STMicroelectronics, TE Connectivity Ltd., Siemens AG, Texas Instruments Incorporated, Emerson Electric Co., ABB Ltd., NXP Semiconductors, Schneider Electric SE, Analog Devices, Inc., Intel Corporation, Cisco Systems, Inc., Advantech Co., Ltd., Yokogawa Electric Corporation, and Multi-Tech Systems, Inc. are the key players operating in the wireless sensors market.

Each of these players have been profiled in the wireless sensors market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 17.4 Bn |

| Forecast Value in 2036 | US$ 80.6 Bn |

| CAGR | 14.7% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2025 |

| Quantitative Units | US$ Bn |

| Wireless Sensors Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Sensor Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The wireless sensors market was valued at US$ 17.4 Bn in 2025

The wireless sensors market is projected to reach US$ 80.6 Bn by the end of 2036

Rapid Expansion of IoT Ecosystems, Rising Industrial Automation & Industry 4.0, and Growing Demand for Smart Infrastructure are some of the driving factors of Wireless sensors market.

The CAGR is anticipated to be 14.7% from 2026 to 2036

North America is expected to account for the largest share

Honeywell International Inc., STMicroelectronics, TE Connectivity Ltd., Siemens AG, Texas Instruments Incorporated, Emerson Electric Co., ABB Ltd., NXP Semiconductors, Schneider Electric SE, Analog Devices, Inc., Intel Corporation, Cisco Systems, Inc., Advantech Co., Ltd., Yokogawa Electric Corporation, and Multi-Tech Systems, Inc. among others.

Table 01: Global Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 02: Global Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 03: Global Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 04: Global Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 05: Global Wireless Sensors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 06: North America Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 07: North America Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 08: North America Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 09: North America Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 10: North America Wireless Sensors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 11: U.S. Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 12: U.S. Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 13: U.S. Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 14: U.S. Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 15: Canada Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 16: Canada Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 17: Canada Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 18: Canada Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 19: Europe Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 20: Europe Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 21: Europe Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 22: Europe Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 23: Europe Wireless Sensors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 24: Germany Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 25: Germany Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 26: Germany Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 27: Germany Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 28: U.K. Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 29: U.K. Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 30: U.K. Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 31: U.K. Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 32: France Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 33: France Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 34: France Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 35: France Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 36: Italy Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 37: Italy Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 38: Italy Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 39: Italy Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 40: Spain Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 41: Spain Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 42: Spain Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 43: Spain Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 44: Switzerland Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 45: Switzerland Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 46: Switzerland Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 47: Switzerland Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 48: The Netherlands Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 49: The Netherlands Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 50: The Netherlands Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 51: The Netherlands Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 52: Rest of Europe Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 53: Rest of Europe Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 54: Rest of Europe Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 55: Rest of Europe Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 56: Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 57: Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 58: Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 59: Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 60: Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 61: China Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 62: China Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 63: China Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 64: China Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 65: Japan Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 66: Japan Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 67: Japan Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 68: Japan Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 69: India Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 70: India Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 71: India Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 72: India Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 73: South Korea Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 74: South Korea Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 75: South Korea Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 76: South Korea Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 77: Australia and New Zealand Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 78: Australia and New Zealand Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 79: Australia and New Zealand Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 80: Australia and New Zealand Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 81: Rest of Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 82: Rest of Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 83: Rest of Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 84: Rest of Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 85: Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 86: Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 87: Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 88: Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 89: Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 90: Brazil Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 91: Brazil Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 92: Brazil Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 93: Brazil Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 94: Mexico Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 95: Mexico Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 96: Mexico Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 97: Mexico Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 98: Argentina Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 99: Argentina Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 100: Argentina Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 101: Argentina Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 102: Rest of Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 103: Rest of Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 104: Rest of Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 105: Rest of Latin America Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 106: Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 107: Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 108: Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 109: Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 110: Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 111: GCC Countries Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 112: GCC Countries Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 113: GCC Countries Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 114: GCC Countries Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 115: South Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 116: South Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 117: South Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 118: South Africa Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Table 119: Rest of Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Sensor Type, 2021 to 2036

Table 120: Rest of Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Connectivity, 2021 to 2036

Table 121: Rest of Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 122: Rest of Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, by End-User Industry, 2021 to 2036

Figure 01: Global Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 03: Global Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 04: Global Wireless Sensors Market Revenue (US$ Bn), by Temperature, 2021 to 2036

Figure 05: Global Wireless Sensors Market Revenue (US$ Bn), by Pressure, 2021 to 2036

Figure 06: Global Wireless Sensors Market Revenue (US$ Bn), by Motion, Position & Proximity, 2021 to 2036

Figure 07: Global Wireless Sensors Market Revenue (US$ Bn), by Gas, 2021 to 2036

Figure 08: Global Wireless Sensors Market Revenue (US$ Bn), by Ambient Light, 2021 to 2036

Figure 09: Global Wireless Sensors Market Revenue (US$ Bn), by Humidity, 2021 to 2036

Figure 10: Global Wireless Sensors Market Revenue (US$ Bn), by Level & Flow, 2021 to 2036

Figure 11: Global Wireless Sensors Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 12: Global Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 13: Global Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 14: Global Wireless Sensors Market Revenue (US$ Bn), by Wi-Fi, 2021 to 2036

Figure 15: Global Wireless Sensors Market Revenue (US$ Bn), by Bluetooth, 2021 to 2036

Figure 16: Global Wireless Sensors Market Revenue (US$ Bn), by ZigBee, 2021 to 2036

Figure 17: Global Wireless Sensors Market Revenue (US$ Bn), by Cellular, 2021 to 2036

Figure 18: Global Wireless Sensors Market Revenue (US$ Bn), by LPWAN, 2021 to 2036

Figure 19: Global Wireless Sensors Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 20: Global Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 21: Global Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 22: Global Wireless Sensors Market Revenue (US$ Bn), by Industrial monitoring, 2021 to 2036

Figure 23: Global Wireless Sensors Market Revenue (US$ Bn), by Environmental monitoring, 2021 to 2036

Figure 24: Global Wireless Sensors Market Revenue (US$ Bn), by Building automation, 2021 to 2036

Figure 25: Global Wireless Sensors Market Revenue (US$ Bn), by Asset tracking, 2021 to 2036

Figure 26: Global Wireless Sensors Market Revenue (US$ Bn), by Security & surveillance, 2021 to 2036

Figure 27: Global Wireless Sensors Market Revenue (US$ Bn), by Patient monitoring, 2021 to 2036

Figure 28: Global Wireless Sensors Market Revenue (US$ Bn), by Machine health monitoring, 2021 to 2036

Figure 29: Global Wireless Sensors Market Revenue (US$ Bn), by Smart metering, 2021 to 2036

Figure 30: Global Wireless Sensors Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 31: Global Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 32: Global Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 33: Global Wireless Sensors Market Revenue (US$ Bn), by Manufacturing, 2021 to 2036

Figure 34: Global Wireless Sensors Market Revenue (US$ Bn), by Automotive & Transportation, 2021 to 2036

Figure 35: Global Wireless Sensors Market Revenue (US$ Bn), by Energy & Utility, 2021 to 2036

Figure 36: Global Wireless Sensors Market Revenue (US$ Bn), by Healthcare, 2021 to 2036

Figure 37: Global Wireless Sensors Market Revenue (US$ Bn), by Consumer Electronics, 2021 to 2036

Figure 38: Global Wireless Sensors Market Revenue (US$ Bn), by IT & Telecommunication, 2021 to 2036

Figure 39: Global Wireless Sensors Market Revenue (US$ Bn), by Oil & Gas, 2021 to 2036

Figure 40: Global Wireless Sensors Market Revenue (US$ Bn), by Aerospace & Defense, 2021 to 2036

Figure 41: Global Wireless Sensors Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 42: Global Wireless Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 43: Global Wireless Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 44: North America Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 45: North America Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 46: North America Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 47: North America Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 48: North America Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 49: North America Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 50: North America Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 51: North America Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 52: North America Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 53: North America Wireless Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 54: North America Wireless Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 55: U.S. Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 56: U.S. Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 57: U.S. Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 58: U.S. Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 59: U.S. Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 60: U.S. Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 61: U.S. Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 62: U.S. Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 63: U.S. Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 64: Canada Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 65: Canada Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 66: Canada Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 67: Canada Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 68: Canada Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 69: Canada Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 70: Canada Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 71: Canada Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 72: Canada Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 73: Europe Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 74: Europe Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 75: Europe Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 76: Europe Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 77: Europe Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 78: Europe Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 79: Europe Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 80: Europe Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 81: Europe Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 82: Europe Wireless Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 83: Europe Wireless Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 84: Germany Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 85: Germany Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 86: Germany Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 87: Germany Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 88: Germany Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 89: Germany Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 90: Germany Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 91: Germany Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 92: Germany Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 93: U.K. Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 94: U.K. Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 95: U.K. Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 96: U.K. Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 97: U.K. Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 98: U.K. Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 99: U.K. Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 100: U.K. Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 101: U.K. Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 102: France Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 103: France Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 104: France Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 105: France Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 106: France Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 107: France Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 108: France Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 109: France Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 110: France Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 111: Italy Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 112: Italy Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 113: Italy Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 114: Italy Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 115: Italy Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 116: Italy Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 117: Italy Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 118: Italy Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 119: Italy Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 120: Spain Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 121: Spain Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 122: Spain Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 123: Spain Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 124: Spain Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 125: Spain Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 126: Spain Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 127: Spain Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 128: Spain Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 129: Switzerland Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 130: Switzerland Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 131: Switzerland Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 132: Switzerland Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 133: Switzerland Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 134: Switzerland Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 135: Switzerland Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 136: Switzerland Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 137: Switzerland Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 138: The Netherlands Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 139: The Netherlands Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 140: The Netherlands Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 141: The Netherlands Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 142: The Netherlands Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 143: The Netherlands Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 144: The Netherlands Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 145: The Netherlands Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 146: The Netherlands Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 147: Rest of Europe Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 148: Rest of Europe Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 149: Rest of Europe Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 150: Rest of Europe Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 151: Rest of Europe Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 152: Rest of Europe Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 153: Rest of Europe Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 154: Rest of Europe Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 155: Rest of Europe Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 156: Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 157: Asia Pacific Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 158: Asia Pacific Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 159: Asia Pacific Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 160: Asia Pacific Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 161: Asia Pacific Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 162: Asia Pacific Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 163: Asia Pacific Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 164: Asia Pacific Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 165: Asia Pacific Wireless Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 166: Asia Pacific Wireless Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 167: China Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 168: China Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 169: China Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 170: China Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 171: China Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 172: China Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 173: China Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 174: China Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 175: China Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 176: Japan Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 177: Japan Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 178: Japan Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 179: Japan Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 180: Japan Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 181: Japan Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 182: Japan Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 183: Japan Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 184: Japan Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 185: India Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 186: India Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 187: India Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 188: India Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 189: India Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 190: India Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 191: India Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 192: India Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 193: India Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 194: South Korea Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 195: South Korea Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 196: South Korea Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 197: South Korea Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 198: South Korea Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 199: South Korea Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 200: South Korea Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 201: South Korea Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 202: South Korea Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 203: Australia and New Zealand Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 204: Australia and New Zealand Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 205: Australia and New Zealand Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 206: Australia and New Zealand Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 207: Australia and New Zealand Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 208: Australia and New Zealand Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 209: Australia and New Zealand Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 210: Australia and New Zealand Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 211: Australia and New Zealand Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 212: Rest of Asia Pacific Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 213: Rest of Asia Pacific Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 214: Rest of Asia Pacific Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 215: Rest of Asia Pacific Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 216: Rest of Asia Pacific Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 217: Rest of Asia Pacific Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 218: Rest of Asia Pacific Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 219: Rest of Asia Pacific Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 220: Rest of Asia Pacific Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 221: Latin America Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 222: Latin America Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 223: Latin America Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 224: Latin America Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 225: Latin America Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 226: Latin America Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 227: Latin America Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 228: Latin America Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 229: Latin America Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 230: Latin America Wireless Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 231: Latin America Wireless Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 232: Brazil Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 233: Brazil Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 234: Brazil Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 235: Brazil Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 236: Brazil Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 237: Brazil Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 238: Brazil Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 239: Brazil Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 240: Brazil Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 241: Mexico Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 242: Mexico Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 243: Mexico Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 244: Mexico Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 245: Mexico Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 246: Mexico Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 247: Mexico Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 248: Mexico Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 249: Mexico Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 250: Argentina Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 251: Argentina Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 252: Argentina Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 253: Argentina Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 254: Argentina Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 255: Argentina Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 256: Argentina Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 257: Argentina Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 258: Argentina Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 259: Rest of Latin America Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 260: Rest of Latin America Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 261: Rest of Latin America Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 262: Rest of Latin America Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 263: Rest of Latin America Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 264: Rest of Latin America Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 265: Rest of Latin America Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 266: Rest of Latin America Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 267: Rest of Latin America Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 268: Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 269: Middle East and Africa Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 270: Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 271: Middle East and Africa Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 272: Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 273: Middle East and Africa Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 274: Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 275: Middle East and Africa Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 276: Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 277: Middle East and Africa Wireless Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 278: Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 279: GCC Countries Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 280: GCC Countries Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 281: GCC Countries Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 282: GCC Countries Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 283: GCC Countries Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 284: GCC Countries Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 285: GCC Countries Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 286: GCC Countries Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 287: GCC Countries Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 288: South Africa Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 289: South Africa Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 290: South Africa Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 291: South Africa Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 292: South Africa Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 293: South Africa Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 294: South Africa Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 295: South Africa Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 296: South Africa Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036

Figure 297: Rest of Middle East and Africa Wireless Sensors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 298: Rest of Middle East and Africa Wireless Sensors Market Value Share Analysis, by Sensor Type, 2025 and 2036

Figure 299: Rest of Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by Sensor Type, 2026 to 2036

Figure 300: Rest of Middle East and Africa Wireless Sensors Market Value Share Analysis, by Connectivity, 2025 and 2036

Figure 301: Rest of Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by Connectivity, 2026 to 2036

Figure 302: Rest of Middle East and Africa Wireless Sensors Market Value Share Analysis, by Application, 2025 and 2036

Figure 303: Rest of Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 304: Rest of Middle East and Africa Wireless Sensors Market Value Share Analysis, by End-User Industry, 2025 and 2036

Figure 305: Rest of Middle East and Africa Wireless Sensors Market Attractiveness Analysis, by End-User Industry, 2026 to 2036