Reports

Reports

Analysts’ Viewpoint

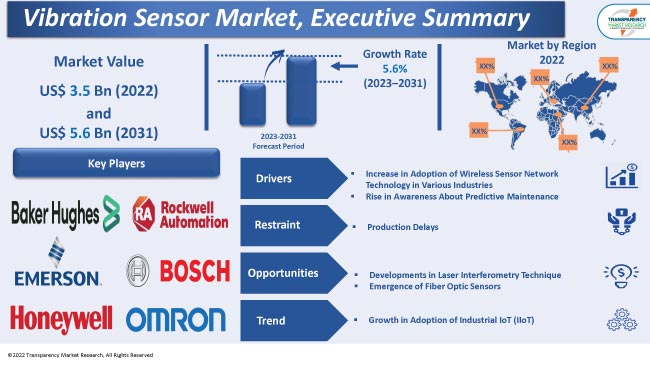

Increase in usage of predictive maintenance tools in industries such as oil and gas, aerospace and defense, and automotive and transportation is driving the global vibration sensor market size. Vibration sensors play a vital role in improving asset performance in these industries. Demand for vibration sensors is rising steadily in various applications, as industrial vibration sensors help predict the need for maintenance and repair of rotating equipment and machines such as compressors, steam turbines, and pumps and connected lines.

Key vibration sensor manufacturers are focusing on the development of new technologies to manufacture next generation sensors such as wireless vibration transmitters and vibration transducers. Leading players are also emphasizing on following the latest vibration sensor market trends to broaden their revenue streams.

Vibration sensor is device that is used to measure the amount of vibration in a machine or a piece of equipment. It enables the maintenance team to obtain insights regarding equipment failure. This allows the maintenance team to prevent the need of major repairs.

Various types of vibration sensors available in the market are MEMS sensors, piezoresistive sensors, and piezoelectric sensors. Each of these sensors has its own advantages and disadvantages.

Automation is a taking over manual work in most of the industries. Of late, IoT-based wireless vibration sensors are being used in equipment health tracking. These sensors help inform the maintenance team about the need for equipment repair. This is anticipated to boost the demand for wireless vibrometers in the near future.

Advancements in computer technology, electronic technology, and industrial processes has led to the emergence of a variety of vibration sensors. These technologies have enabled the development of large-scale systems for real-time monitoring.

Wireless sensor network technology is increasingly being adopted in various applications where machine monitoring is a priority. Wireless sensor network architecture is suitable for the monitoring of vibration of an aircraft. It helps improve flight safety by monitoring vibration intensity across all structure components of an aircraft. Furthermore, it sends this information to the cockpit computer so that it may react before any component reaches resonance.

Leading companies operating in the market are engaged in developing innovative wireless vibration sensors. In 2022, Sensoteq designed and developed a wireless vibration sensor, which features the proprietary wireless technology, a replaceable battery design, and fault detection capacity within a compact 25mm footprint. It can be mounted on virtually any piece of rotating equipment in any industry. Others players are also striving to develop wireless vibration sensors. This is anticipated to augment market progress in the near future.

Predictive maintenance has gained traction in the manufacturing sector due to its various benefits such as decrease or elimination of unscheduled machine time, reduction of maintenance cost, and increase in production capacity and equipment lifespan.

Predictive maintenance offers many advantages to industries. It helps reduce the manufacturing hours through lesser downtime, minimize the time required for asset management, and lower the cost of spare parts through maximization of the life of existing assets. Thus, predictive maintenance enables to lower maintenance costs by 30%.

Various companies are focusing on adopting the predictive maintenance strategy to understand how and why asset failure occurs and detect the warning signs of potential losses. Thus, rise in awareness about the importance of predictive maintenance is augmenting market statistics.

According to the vibration sensor market analysis, the accelerometers type segment held major share of 58.3% in 2022. The segment is likely to maintain its dominance during the forecast period due to the increase in usage of vibration monitoring data in various sectors such as oil and gas and semiconductors and electronics.

Accelerometers are suitable for a wide band of frequencies, ranging from low to high. They are widely employed in the process industry and the aerospace and defense sector owing to their benefits such as low cost, small size, and high power efficiency.

In terms of end-use industry, the global vibration sensor market has been divided into oil and gas, aerospace and defense, automotive and transportation, semiconductor and electronics, process, healthcare, and others.

The process end-use segment held significant share of 29.34% in 2022. It is likely to expand at a CAGR of 6.4% during the forecast period. Growth of the segment can be ascribed to large-scale adoption of vibration sensors in measurement of vibration levels of process and production machinery.

Asia Pacific accounted for prominent vibration sensor market share (31.87%) in 2022. This can be ascribed to the presence of a large number of industries in the region. Rise in awareness about predictive maintenance in various sectors is also augmenting market expansion in Asia Pacific.

North America is also anticipated to record significant expansion of vibration sensor market during the forecast period owing to the rise in adoption of vibration sensors for industrial applications in the region. For instance, demand for vibration sensors is high in the aerospace and defense sector in North America.

The global landscape is highly fragmented, with the presence of a large number of players. Most of the leading companies are focusing on expansion of product portfolios and mergers and acquisitions to increase their vibration sensor market share.

Baker Hughes Company, Dytran Instruments, Inc., Emerson Electric Co, Honeywell International Inc., National Instruments Corp, NXP Semiconductors, Omron Corp, PCB Piezotronics, Inc., Robert Bosch, Rockwell Automation Inc., TE Connectivity, and Wilcoxon Sensing Technologies are prominent companies operating in the market.

The vibration sensor market report summarizes these leading players based on features such as financial overview, product portfolio, business strategies, company overview, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 3.5 Bn |

|

Market Forecast Value in 2031 |

US$ 5.6 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 3.5 Bn in 2022.

The CAGR is expected to be 5.6% from 2023 to 2031.

Increase in adoption of wireless sensor network technology in various industries and rise in awareness about predictive maintenance.

The accelerometers type segment accounted for major share of 58.3% in 2022.

The process end-use industry segment held significant share of 29.3% in 2022.

Asia Pacific is a highly attractive region for vendors.

The market size of China was US$ 486.2 Mn in 2022.

Baker Hughes Company, Dytran Instruments, Inc, Emerson Electric Co, Honeywell International Inc, National Instruments Corp, NXP Semiconductors, Omron Corp, PCB Piezotronics, Inc, Robert Bosch, Rockwell Automation Inc, TE Connectivity, and Wilcoxon Sensing Technologies.

1. Preface

1.1. Market Introduction

1.2. Market and Segment Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Vibration Sensor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Sensors Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Industrial Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Vibration Sensor Market Analysis, By Type

5.1. Vibration Sensor Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

5.1.1. Accelerometers

5.1.1.1. Piezoelectric

5.1.1.2. Piezoresistive

5.1.1.3. Capacitive MEMS

5.1.2. Proximity Probes

5.1.3. Laser Displacement Sensors

5.1.4. Velocity Sensors

5.1.5. Others

5.2. Market Attractiveness Analysis, By Type

6. Vibration Sensor Market Analysis, By Material

6.1. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Material, 2017–2031

6.1.1. Piezoelectric Ceramics

6.1.2. Quartz

6.2. Market Attractiveness Analysis, By Material

7. Vibration Sensor Market Analysis, By Measuring Range

7.1. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Measuring Range, 2017–2031

7.1.1. Upto 5g

7.1.2. 5g – 20g

7.1.3. Above 20g

7.2. Market Attractiveness Analysis, By Measuring Range

8. Vibration Sensor Market Analysis, By End-use Industry

8.1. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

8.1.1. Oil and Gas

8.1.2. Aerospace and Defense

8.1.3. Automotive and Transportation

8.1.4. Semiconductors and Electronics

8.1.5. Process

8.1.6. Healthcare

8.1.7. Others

8.2. Market Attractiveness Analysis, By End-use Industry

9. Vibration Sensor Market Analysis and Forecast, By Region

9.1. Vibration Sensor Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Vibration Sensor Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Vibration Sensor Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

10.3.1. Accelerometers

10.3.1.1. Piezoelectric

10.3.1.2. Piezoresistive

10.3.1.3. Capacitive MEMS

10.3.2. Proximity Probes

10.3.3. Laser Displacement Sensors

10.3.4. Velocity Sensors

10.3.5. Others

10.4. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Material, 2017–2031

10.4.1. Piezoelectric Ceramics

10.4.2. Quartz

10.5. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Measuring Range, 2017–2031

10.5.1. Upto 5g

10.5.2. 5g – 20g

10.5.3. Above 20g

10.6. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

10.6.1. Oil and Gas

10.6.2. Aerospace and Defense

10.6.3. Automotive and Transportation

10.6.4. Semiconductors and Electronics

10.6.5. Process

10.6.6. Healthcare

10.6.7. Others

10.7. Vibration Sensor Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Type

10.8.2. By Material

10.8.3. By Measuring Range

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Vibration Sensor Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Vibration Sensor Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

11.3.1. Accelerometers

11.3.1.1. Piezoelectric

11.3.1.2. Piezoresistive

11.3.1.3. Capacitive MEMS

11.3.2. Proximity Probes

11.3.3. Laser Displacement Sensors

11.3.4. Velocity Sensors

11.3.5. Others

11.4. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Material, 2017–2031

11.4.1. Piezoelectric Ceramics

11.4.2. Quartz

11.5. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Measuring Range, 2017–2031

11.5.1. Upto 5g

11.5.2. 5g – 20g

11.5.3. Above 20g

11.6. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.6.1. Oil and Gas

11.6.2. Aerospace and Defense

11.6.3. Automotive and Transportation

11.6.4. Semiconductors and Electronics

11.6.5. Process

11.6.6. Healthcare

11.6.7. Others

11.7. Vibration Sensor Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. The U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Type

11.8.2. By Material

11.8.3. By Measuring Range

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific Vibration Sensor Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Vibration Sensor Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

12.3.1. Accelerometers

12.3.1.1. Piezoelectric

12.3.1.2. Piezoresistive

12.3.1.3. Capacitive MEMS

12.3.2. Proximity Probes

12.3.3. Laser Displacement Sensors

12.3.4. Velocity Sensors

12.3.5. Others

12.4. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Material, 2017–2031

12.4.1. Piezoelectric Ceramics

12.4.2. Quartz

12.5. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Measuring Range, 2017–2031

12.5.1. Upto 5g

12.5.2. 5g – 20g

12.5.3. Above 20g

12.6. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.6.1. Oil and Gas

12.6.2. Aerospace and Defense

12.6.3. Automotive and Transportation

12.6.4. Semiconductors and Electronics

12.6.5. Process

12.6.6. Healthcare

12.6.7. Others

12.7. Vibration Sensor Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Material

12.8.3. By Measuring Range

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa Vibration Sensor Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Vibration Sensor Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

13.3.1. Accelerometers

13.3.1.1. Piezoelectric

13.3.1.2. Piezoresistive

13.3.1.3. Capacitive MEMS

13.3.2. Proximity Probes

13.3.3. Laser Displacement Sensors

13.3.4. Velocity Sensors

13.3.5. Others

13.4. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Material, 2017–2031

13.4.1. Piezoelectric Ceramics

13.4.2. Quartz

13.5. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Measuring Range, 2017–2031

13.5.1. Upto 5g

13.5.2. 5g – 20g

13.5.3. Above 20g

13.6. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.6.1. Oil and Gas

13.6.2. Aerospace and Defense

13.6.3. Automotive and Transportation

13.6.4. Semiconductors and Electronics

13.6.5. Process

13.6.6. Healthcare

13.6.7. Others

13.7. Vibration Sensor Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of the Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Material

13.8.3. By Measuring Range

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Vibration Sensor Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Vibration Sensor Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

14.3.1. Accelerometers

14.3.1.1. Piezoelectric

14.3.1.2. Piezoresistive

14.3.1.3. Capacitive MEMS

14.3.2. Proximity Probes

14.3.3. Laser Displacement Sensors

14.3.4. Velocity Sensors

14.3.5. Others

14.4. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Material, 2017–2031

14.4.1. Piezoelectric Ceramics

14.4.2. Quartz

14.5. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By Measuring Range, 2017–2031

14.5.1. Upto 5g

14.5.2. 5g – 20g

14.5.3. Above 20g

14.6. Vibration Sensor Market Value (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

14.6.1. Oil and Gas

14.6.2. Aerospace and Defense

14.6.3. Automotive and Transportation

14.6.4. Semiconductors and Electronics

14.6.5. Process

14.6.6. Healthcare

14.6.7. Others

14.7. Vibration Sensor Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Material

14.8.3. By Measuring Range

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Vibration Sensor Market Competition Matrix - a Dashboard View

15.1.1. Global Vibration Sensor Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Baker Hughes Company

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Dytran Instruments, Inc.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Emerson Electric Co

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Honeywell International Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. National Instruments Corp

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. NXP Semiconductors

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Omron Corp.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. PCB Piezotronics, Inc.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Robert Bosch

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Rockwell Automation Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. TE Connectivity

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Wilcoxon Sensing Technologies

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Vibration Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 2: Global Vibration Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 3: Global Vibration Sensor Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 4: Global Vibration Sensor Market Value (US$ Mn) & Forecast, by Measuring Range, 2017‒2031

Table 5: Global Vibration Sensor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 6: Global Vibration Sensor Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 7: Global Vibration Sensor Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 8: North America Vibration Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 9: North America Vibration Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 10: North America Vibration Sensor Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 11: North America Vibration Sensor Market Value (US$ Mn) & Forecast, by Measuring Range, 2017‒2031

Table 12: North America Vibration Sensor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 13: North America Vibration Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 14: North America Vibration Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 15: Europe Vibration Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 16: Europe Vibration Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 17: Europe Vibration Sensor Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 18: Europe Vibration Sensor Market Value (US$ Mn) & Forecast, by Measuring Range, 2017‒2031

Table 19: Europe Vibration Sensor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 20: Europe Vibration Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Europe Vibration Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 22: Asia Pacific Vibration Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 23: Asia Pacific Vibration Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 24: Asia Pacific Vibration Sensor Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 25: Asia Pacific Vibration Sensor Market Value (US$ Mn) & Forecast, by Measuring Range, 2017‒2031

Table 26: Asia Pacific Vibration Sensor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 27: Asia Pacific Vibration Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 28: Asia Pacific Vibration Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 29: Middle East & Africa Vibration Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 30: Middle East & Africa Vibration Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 31: Middle East & Africa Vibration Sensor Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 32: Middle East & Africa Vibration Sensor Market Value (US$ Mn) & Forecast, by Measuring Range, 2017‒2031

Table 33: Middle East & Africa Vibration Sensor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 34: Middle East & Africa Vibration Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 35: Middle East & Africa Vibration Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 36: South America Vibration Sensor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 37: South America Vibration Sensor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 38: South America Vibration Sensor Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 39: South America Vibration Sensor Market Value (US$ Mn) & Forecast, by Measuring Range, 2017‒2031

Table 40: South America Vibration Sensor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 41: South America Vibration Sensor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 42: South America Vibration Sensor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Vibration Sensor

Figure 02: Porter Five Forces Analysis - Global Vibration Sensor

Figure 03: Technology Road Map - Global Vibration Sensor

Figure 04: Global Vibration Sensor Market, Value (US$ Mn), 2017-2031

Figure 05: Global Vibration Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Vibration Sensor Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Vibration Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 08: Global Vibration Sensor Market Share Analysis, by Type, 2023 and 2031

Figure 09: Global Vibration Sensor Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 10: Global Vibration Sensor Market, Incremental Opportunity, by Material, 2023‒2031

Figure 11: Global Vibration Sensor Market Share Analysis, by Material, 2023 and 2031

Figure 12: Global Vibration Sensor Market Projections by Measuring Range, Value (US$ Mn), 2017‒2031

Figure 13: Global Vibration Sensor Market, Incremental Opportunity, by Measuring Range, 2023‒2031

Figure 14: Global Vibration Sensor Market Share Analysis, by Measuring Range, 2023 and 2031

Figure 15: Global Vibration Sensor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 16: Global Vibration Sensor Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 17: Global Vibration Sensor Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 18: Global Vibration Sensor Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 19: Global Vibration Sensor Market, Incremental Opportunity, by Region, 2023‒2031

Figure 20: Global Vibration Sensor Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America Vibration Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 22: North America Vibration Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 23: North America Vibration Sensor Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 24: North America Vibration Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 25: North America Vibration Sensor Market Share Analysis, by Type, 2023 and 2031

Figure 26: North America Vibration Sensor Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 27: North America Vibration Sensor Market, Incremental Opportunity, by Material, 2023‒2031

Figure 28: North America Vibration Sensor Market Share Analysis, by Material, 2023 and 2031

Figure 29: North America Vibration Sensor Market Projections by Measuring Range (US$ Mn), 2017‒2031

Figure 30: North America Vibration Sensor Market, Incremental Opportunity, by Measuring Range, 2023‒2031

Figure 31: North America Vibration Sensor Market Share Analysis, by Measuring Range, 2023 and 2031

Figure 32: North America Vibration Sensor Market Projections by End-use Industry Value (US$ Mn), 2017‒2031

Figure 33: North America Vibration Sensor Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 34: North America Vibration Sensor Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 35: North America Vibration Sensor Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 36: North America Vibration Sensor Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 37: North America Vibration Sensor Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 38: Europe Vibration Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 39: Europe Vibration Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 40: Europe Vibration Sensor Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 41: Europe Vibration Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 42: Europe Vibration Sensor Market Share Analysis, by Type, 2023 and 2031

Figure 43: Europe Vibration Sensor Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 44: Europe Vibration Sensor Market, Incremental Opportunity, by Material, 2023‒2031

Figure 45: Europe Vibration Sensor Market Share Analysis, by Material, 2023 and 2031

Figure 46: Europe Vibration Sensor Market Projections by Measuring Range, Value (US$ Mn), 2017‒2031

Figure 47: Europe Vibration Sensor Market, Incremental Opportunity, by Measuring Range, 2023‒2031

Figure 48: Europe Vibration Sensor Market Share Analysis, by Measuring Range, 2023 and 2031

Figure 49: Europe Vibration Sensor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 50: Europe Vibration Sensor Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 51: Europe Vibration Sensor Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 52: Europe Vibration Sensor Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 53: Europe Vibration Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 54: Europe Vibration Sensor Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 55: Asia Pacific Vibration Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 56: Asia Pacific Vibration Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 57: Asia Pacific Vibration Sensor Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific Vibration Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 59: Asia Pacific Vibration Sensor Market Share Analysis, by Type, 2023 and 2031

Figure 60: Asia Pacific Vibration Sensor Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 61: Asia Pacific Vibration Sensor Market, Incremental Opportunity, by Material, 2023‒2031

Figure 62: Asia Pacific Vibration Sensor Market Share Analysis, by Material, 2023 and 2031

Figure 63: Asia Pacific Vibration Sensor Market Projections by Measuring Range, Value (US$ Mn), 2017‒2031

Figure 64: Asia Pacific Vibration Sensor Market, Incremental Opportunity, by Measuring Range, 2023‒2031

Figure 65: Asia Pacific Vibration Sensor Market Share Analysis, by Measuring Range, 2023 and 2031

Figure 66: Asia Pacific Vibration Sensor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 67: Asia Pacific Vibration Sensor Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 68: Asia Pacific Vibration Sensor Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 69: Asia Pacific Vibration Sensor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 70: Asia Pacific Vibration Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 71: Asia Pacific Vibration Sensor Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 72: MEA Vibration Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 73: MEA Vibration Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 74: MEA Vibration Sensor Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 75: MEA Vibration Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 76: MEA Vibration Sensor Market Share Analysis, by Type, 2023 and 2031

Figure 77: MEA Vibration Sensor Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 78: MEA Vibration Sensor Market, Incremental Opportunity, by Material, 2023‒2031

Figure 79: MEA Vibration Sensor Market Share Analysis, by Material, 2023 and 2031

Figure 80: MEA Vibration Sensor Market Projections by Measuring Range, Value (US$ Mn), 2017‒2031

Figure 81: MEA Vibration Sensor Market, Incremental Opportunity, by Measuring Range, 2023‒2031

Figure 82: MEA Vibration Sensor Market Share Analysis, by Measuring Range, 2023 and 2031

Figure 83: MEA Vibration Sensor Market Projections by End-use Industry Value (US$ Mn), 2017‒2031

Figure 84: MEA Vibration Sensor Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 85: MEA Vibration Sensor Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 86: MEA Vibration Sensor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 87: MEA Vibration Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 88: MEA Vibration Sensor Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 89: South America Vibration Sensor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 90: South America Vibration Sensor Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 91: South America Vibration Sensor Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 92: South America Vibration Sensor Market, Incremental Opportunity, by Type, 2023‒2031

Figure 93: South America Vibration Sensor Market Share Analysis, by Type, 2023 and 2031

Figure 94: South America Vibration Sensor Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 95: South America Vibration Sensor Market, Incremental Opportunity, by Material, 2023‒2031

Figure 96: South America Vibration Sensor Market Share Analysis, by Material, 2023 and 2031

Figure 97: South America Vibration Sensor Market Projections by Measuring Range, Value (US$ Mn), 2017‒2031

Figure 98: South America Vibration Sensor Market, Incremental Opportunity, by Measuring Range, 2023‒2031

Figure 99: South America Vibration Sensor Market Share Analysis, by Measuring Range, 2023 and 2031

Figure 100: South America Vibration Sensor Market Projections by End-use Industry Value (US$ Mn), 2017‒2031

Figure 101: South America Vibration Sensor Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 102: South America Vibration Sensor Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 103: South America Vibration Sensor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 104: South America Vibration Sensor Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 105: South America Vibration Sensor Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 106: Global Vibration Sensor Market Competition

Figure 107: Global Vibration Sensor Market Company Share Analysis