Reports

Reports

Analysts’ Viewpoint on Market Scenario

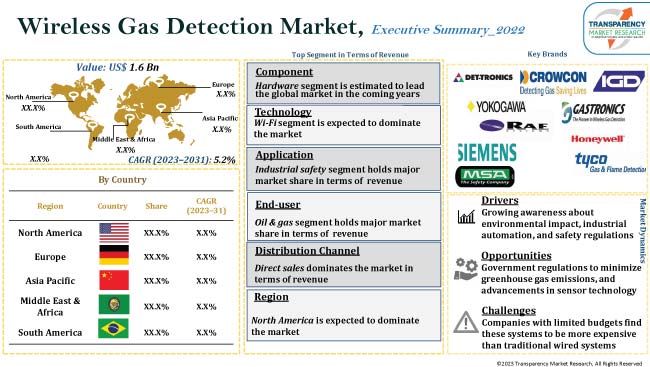

Rise in adoption of wireless technology across various industries is increasing the demand for wireless gas detection systems. This is the key factor contributing to wireless gas detection market growth.

Wireless systems are easy to install and can be integrated with other safety systems to provide a comprehensive safety solution. Furthermore, focus on safety of workers, environmental concerns, and the need for time saving solutions are enhancing the wireless gas detection market value.

Development of advanced technologies in products with additional features such as wireless connectivity, wireless sensors, improved battery life, and advanced analytics are some of the current wireless gas detection market trends.

The wireless gas detection market is highly competitive, with multiple vendors providing a variety of products at various price points.

Wireless gas detection systems use wireless technology to monitor the presence of dangerous gases in the air. These systems typically consist of a network of sensors that are strategically placed throughout a facility or an area where potential gas leaks may occur.

The sensors are designed to detect specific types of gases, such as carbon monoxide, hydrogen sulfide, or methane, and are capable of detecting gas leaks in real time. When a gas leak is detected, the sensor sends a signal wirelessly to a central control panel, which then alerts personnel to the potential danger.

Wireless leak detection systems are often used in industrial facilities, such as oil refineries, chemical plants, and power generation facilities, where gas leaks can be particularly dangerous. They provide an effective way to monitor gas levels and detect leaks quickly, allowing for prompt action to be taken to prevent accidents and protect workers.

Wireless gas detection prevents dangerous industrial accidents by offering great precision, flexibility, and reliability in the detection of gas leakage. The development of wireless communication technologies such as ZigBee, Wi-Fi, and Bluetooth has enabled the creation of more reliable and robust wireless gas detectors, thus offering lucrative market opportunities.

Moreover, these detectors can be monitored remotely, allowing companies to track gas levels and respond to potential hazards in real time, even from off-site locations. Increased adoption of wireless gas detectors in a variety of industries such as oil & gas, mining, chemical, and power is augmenting wireless gas detection market share.

In many countries, government regulations and industry standards require companies to have gas detection systems in place to protect workers and the environment, as these detectors can help prevent gas leaks and toxic fumes from escaping into the environment, thus reducing the risk of pollution and protecting the health of nearby communities.

Additionally, governments across the world are establishing strict rules to control emission rates and setting targets to minimize greenhouse gas emissions, particularly to lower emissions from oil and gas industries. The US Department of Energy announced funding up to US$ 32 Mn in August 2022 for research and development of new monitoring, measurement, and mitigation technologies that will assist in the detection and reduction of methane emissions in the oil and natural gas producing regions of the U.S. These detectors offer an efficient way to comply with these regulations which are expected to drive the wireless gas detection market demand.

The wireless gas detection market segmentation based on application includes industrial safety, national security and military applications, and environmental safety. The industrial safety application segment is expected to dominate the industry during the forecast period. A wide range of safety equipment are installed in most industries as safety is a primary priority.

Industrial chemicals and gases are prone to leaks and spills and thus the incorrect management of these substances may harm workers, as well as manufacturing facilities, and also interrupt production schedules.

Additionally, emergency response, fence line monitoring, leak detection, plant shutdown, and incident response, are various industrial safety applications of wireless gas monitor systems.

Based on end-user, the global wireless gas detection market has been segmented into oil & gas, power, chemical, mining & metals, discrete manufacturing industry, commercial buildings, and others (water & wastewater treatment plants). The oil & gas segment is estimated to lead the global market in the next few years. Different processes involved in oil and gas applications result in the production of toxic gases, which, when accumulated in high concentrations can reduce the oxygen in the air and create a hazardous situation for workers.

Hence, growth in the adoption of wireless gas leak detectors in the oil & gas industry to ensure safety is augmenting the wireless gas detection market development.

According to the latest wireless gas detection market forecast, North America is projected to dominate the global market during the forecast period. The increase in safety concerns within hazardous working environments, and the need for real-time monitoring & response are boosting market statistics in the region.

The industry in North America is highly regulated due to strict government regulations in place to ensure workplace safety. The Occupational Safety and Health Administration (OSHA) requires employers to provide a safe and healthy work environment for their employees, which includes monitoring for hazardous gases and other airborne contaminants. These significant factors are fueling the wireless gas detection industry growth across the region.

The wireless gas detection market is highly fragmented due to the presence of many local and global players. Competition is expected to intensify in the next few years due to the entry of local players. Suppliers and manufacturers are focusing on product development and introducing more efficient products at reasonable prices.

Prominent wireless gas detection manufacturers operating in the market are Detector Electronics Corporation, Crowcon Detection Instruments, Yokogawa Electric Corporation, RAE Systems, International Gas Detectors Ltd., Gastronics Inc., Honeywell International Inc., Siemens AG, Tyco Gas & Flame Detection, MSA Safety Incorporated.

Each of these players has been profiled in the wireless gas detection market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 1.6 Bn |

|

Market Forecast Value in 2031 |

US$ 2.6 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 1.6 Bn in 2022

It is expected to reach US$ 2.6 Bn by 2031

It is estimated to grow at a CAGR of 5.2% from 2023 to 2031

Rapid advancement in technology, government regulations, environmental concerns, and focus on employee safety

Industrial safety is the prominent application segment

North America is expected to be a highly attractive region for vendors

Detector Electronics Corporation, Crowcon Detection Instruments, Yokogawa Electric Corporation, RAE Systems, International Gas Detectors Ltd., Gastronics Inc., Honeywell International Inc., Siemens AG, Tyco Gas & Flame Detection, and MSA Safety Incorporated

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Wireless Gas Detection Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Wireless Gas Detection Market Analysis and Forecast, By Component

6.1. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Component, 2017 - 2031

6.1.1.1. Hardware

6.1.1.2. Software

6.1.1.3. Services

6.2. Incremental Opportunity, By Component

7. Global Wireless Gas Detection Market Analysis and Forecast, By Technology

7.1. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

7.1.1. Wi-Fi

7.1.2. Bluetooth

7.1.3. Cellular

7.1.4. License-Free ISM Brand

7.1.5. Others

7.2. Incremental Opportunity, By Technology

8. Global Wireless Gas Detection Market Analysis and Forecast, By Application

8.1. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

8.1.1. Industrial Safety

8.1.2. National Security and Military Applications

8.1.3. Environmental Safety

8.2. Incremental Opportunity, By Application

9. Global Wireless Gas Detection Market Analysis and Forecast, By End-user

9.1. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

9.1.1. Oil & Gas

9.1.2. Power

9.1.3. Chemical

9.1.4. Mining & Metals

9.1.5. Discrete Manufacturing Industry

9.1.6. Commercial Buildings

9.1.7. Others

9.2. Incremental Opportunity, By End-user

10. Global Wireless Gas Detection Market Analysis and Forecast, By Distribution Channel

10.1. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, By Distribution Channel

11. Global Wireless Gas Detection Market Analysis and Forecast, By Region

11.1. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Wireless Gas Detection Market Analysis and Forecast

12.1. Regional Snapshot

12.2. End-user Trend Analysis

12.2.1. Weighted Average End-user

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Key Supplier Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Component, 2017 - 2031

12.6.1.1. Hardware

12.6.1.2. Software

12.6.1.3. Services

12.7. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

12.7.1. Wi-Fi

12.7.2. Bluetooth

12.7.3. Cellular

12.7.4. License-Free ISM Brand

12.7.5. Others

12.8. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.8.1. Industrial Safety

12.8.2. National Security and Military Applications

12.8.3. Environmental Safety

12.9. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

12.9.1. Oil & Gas

12.9.2. Power

12.9.3. Chemical

12.9.4. Mining & Metals

12.9.5. Discrete Manufacturing Industry

12.9.6. Commercial Buildings

12.9.7. Others

12.10. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.10.1. Direct Sales

12.10.2. Indirect Sales

12.11. Wireless Gas Detection Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2027

12.11.1. U.S.

12.11.2. Canada

12.11.3. Rest of North America

12.12. Incremental Opportunity Analysis

13. Europe Wireless Gas Detection Market Analysis and Forecast

13.1. Regional Snapshot

13.2. End-user Trend Analysis

13.2.1. Weighted Average End-user

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Supplier Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Component, 2017 - 2031

13.6.1.1. Hardware

13.6.1.2. Software

13.6.1.3. Services

13.7. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

13.7.1. Wi-Fi

13.7.2. Bluetooth

13.7.3. Cellular

13.7.4. License-Free ISM Brand

13.7.5. Others

13.8. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.8.1. Industrial Safety

13.8.2. National Security and Military Applications

13.8.3. Environmental Safety

13.9. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

13.9.1. Oil & Gas

13.9.2. Power

13.9.3. Chemical

13.9.4. Mining & Metals

13.9.5. Discrete Manufacturing Industry

13.9.6. Commercial Buildings

13.9.7. Others

13.10. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.10.1. Direct Sales

13.10.2. Indirect Sales

13.11. Wireless Gas Detection Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

13.11.1. U.K.

13.11.2. Germany

13.11.3. France

13.11.4. Rest of Europe

13.12. Incremental Opportunity Analysis

14. Asia Pacific Wireless Gas Detection Market Analysis and Forecast

14.1. Regional Snapshot

14.2. End-user Trend Analysis

14.2.1. Weighted Average End-user

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Key Supplier Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Component, 2017 - 2031

14.6.1.1. Hardware

14.6.1.2. Software

14.6.1.3. Services

14.7. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

14.7.1. Wi-Fi

14.7.2. Bluetooth

14.7.3. Cellular

14.7.4. License-Free ISM Brand

14.7.5. Others

14.8. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.8.1. Industrial Safety

14.8.2. National Security and Military Applications

14.8.3. Environmental Safety

14.9. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

14.9.1. Oil & Gas

14.9.2. Power

14.9.3. Chemical

14.9.4. Mining & Metals

14.9.5. Discrete Manufacturing Industry

14.9.6. Commercial Buildings

14.9.7. Others

14.10. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.10.1. Direct Sales

14.10.2. Indirect Sales

14.11. Wireless Gas Detection Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Wireless Gas Detection Market Analysis and Forecast

15.1. Regional Snapshot

15.2. End-user Trend Analysis

15.2.1. Weighted Average End-user

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Key Supplier Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Component, 2017 - 2031

15.6.1.1. Hardware

15.6.1.2. Software

15.6.1.3. Services

15.7. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

15.7.1. Wi-Fi

15.7.2. Bluetooth

15.7.3. Cellular

15.7.4. License-Free ISM Brand

15.7.5. Others

15.8. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.8.1. Industrial Safety

15.8.2. National Security and Military Applications

15.8.3. Environmental Safety

15.9. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

15.9.1. Oil & Gas

15.9.2. Power

15.9.3. Chemical

15.9.4. Mining & Metals

15.9.5. Discrete Manufacturing Industry

15.9.6. Commercial Buildings

15.9.7. Others

15.10. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.10.1. Direct Sales

15.10.2. Indirect Sales

15.11. Wireless Gas Detection Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

15.11.1. GCC

15.11.2. South Africa

15.11.3. Rest of Middle East & Africa

15.12. Incremental Opportunity Analysis

16. South America Wireless Gas Detection Market Analysis and Forecast

16.1. Regional Snapshot

16.2. End-user Trend Analysis

16.2.1. Weighted Average End-user

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Key Supplier Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Component, 2017 - 2031

16.6.1.1. Hardware

16.6.1.2. Software

16.6.1.3. Services

16.7. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

16.7.1. Wi-Fi

16.7.2. Bluetooth

16.7.3. Cellular

16.7.4. License-Free ISM Brand

16.7.5. Others

16.8. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

16.8.1. Industrial Safety

16.8.2. National Security and Military Applications

16.8.3. Environmental Safety

16.9. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

16.9.1. Oil & Gas

16.9.2. Power

16.9.3. Chemical

16.9.4. Mining & Metals

16.9.5. Discrete Manufacturing Industry

16.9.6. Commercial Buildings

16.9.7. Others

16.10. Wireless Gas Detection Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.10.1. Direct Sales

16.10.2. Indirect Sales

16.11. Wireless Gas Detection Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

16.11.1. Brazil

16.11.2. Rest of South America

16.12. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Share Analysis - 2022 (%)

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. Detector Electronics Corporation

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. Crowcon Detection Instruments

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. Yokogawa Electric Corporation

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. RAE Systems

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. International Gas Detectors Ltd

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Gastronics Inc.

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Honeywell International Inc.

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Siemens AG

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Tyco Gas & Flame Detection

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. MSA Safety Incorporated

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Component

18.1.2. Technology

18.1.3. Application

18.1.4. End-user

18.1.5. Distribution channel

18.1.6. Region

18.2. Understanding the Procurement Process of End-Users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Wireless Gas Detection Market by Component, Thousand Units 2017-2031

Table 2: Global Wireless Gas Detection Market by Component, US$ Bn 2017-2031

Table 3: Global Wireless Gas Detection Market by Technology, Thousand Units 2017-2031

Table 4: Global Wireless Gas Detection Market by Technology, US$ Bn 2017-2031

Table 5: Global Wireless Gas Detection Market by Application, Thousand Units 2017-2031

Table 6: Global Wireless Gas Detection Market by Application, US$ Bn 2017-2031

Table 7: Global Wireless Gas Detection Market by End-user, Thousand Units, 2017-2031

Table 8: Global Wireless Gas Detection Market by End-user, US$ Bn 2017-2031

Table 9: Global Wireless Gas Detection Market by Distribution Channel, Thousand Units, 2017-2031

Table 10: Global Wireless Gas Detection Market by Distribution Channel, US$ Bn 2017-2031

Table 11: Global Wireless Gas Detection Market by Region, Thousand Units, 2017-2031

Table 12: Global Wireless Gas Detection Market by Region, US$ Bn 2017-2031

Table 13: North America Wireless Gas Detection Market by Component, Thousand Units 2017-2031

Table 14: North America Wireless Gas Detection Market by Component, US$ Bn 2017-2031

Table 15: North America Wireless Gas Detection Market by Technology, Thousand Units 2017-2031

Table 16: North America Wireless Gas Detection Market by Technology, US$ Bn 2017-2031

Table 17: North America Wireless Gas Detection Market by Application, Thousand Units 2017-2031

Table 18: North America Wireless Gas Detection Market by Application, US$ Bn 2017-2031

Table 19: North America Wireless Gas Detection Market by End-user, Thousand Units, 2017-2031

Table 20: North America Wireless Gas Detection Market by End-user, US$ Bn 2017-2031

Table 21: North America Wireless Gas Detection Market by Distribution Channel, Thousand Units, 2017-2031

Table 22: North America Wireless Gas Detection Market by Distribution Channel, US$ Bn 2017-2031

Table 23: Europe Wireless Gas Detection Market by Component, Thousand Units 2017-2031

Table 24: Europe Wireless Gas Detection Market by Component, US$ Bn 2017-2031

Table 25: Europe Wireless Gas Detection Market by Technology, Thousand Units 2017-2031

Table 26: Europe Wireless Gas Detection Market by Technology, US$ Bn 2017-2031

Table 27: Europe Wireless Gas Detection Market by Application, Thousand Units, 2017-2031

Table 28: Europe Wireless Gas Detection Market by Application, US$ Bn 2017-2031

Table 29: Europe Wireless Gas Detection Market by End-user, Thousand Units 2017-2031

Table 30: Europe Wireless Gas Detection Market by End-user, US$ Bn 2017-2031

Table 31: Europe Wireless Gas Detection Market by Distribution Channel, Thousand Units, 2017-2031

Table 32: Europe Wireless Gas Detection Market by Distribution Channel, US$ Bn 2017-2031

Table 33: Asia Pacific Wireless Gas Detection Market by Component, Thousand Units 2017-2031

Table 34: Asia Pacific Wireless Gas Detection Market by Component, US$ Bn 2017-2031

Table 35: Asia Pacific Wireless Gas Detection Market by Technology, Thousand Units 2017-2031

Table 36: Asia Pacific Wireless Gas Detection Market by Technology, US$ Bn 2017-2031

Table 37: Asia Pacific Wireless Gas Detection Market by Application, Thousand Units, 2017-2031

Table 38: Asia Pacific Wireless Gas Detection Market by Application, US$ Bn 2017-2031

Table 39: Asia Pacific Wireless Gas Detection Market by End-user, Thousand Units 2017-2031

Table 40: Asia Pacific Wireless Gas Detection Market by End-user, US$ Bn 2017-2031

Table 41: Asia Pacific Wireless Gas Detection Market by Distribution Channel, Thousand Units, 2017-2031

Table 42: Asia Pacific Wireless Gas Detection Market by Distribution Channel, US$ Bn 2017-2031

Table 43: Middle East & Africa Wireless Gas Detection Market by Component, Thousand Units 2017-2031

Table 44: Middle East & Africa Wireless Gas Detection Market by Component, US$ Bn 2017-2031

Table 45: Middle East & Africa Wireless Gas Detection Market by Technology, Thousand Units 2017-2031

Table 46: Middle East & Africa Wireless Gas Detection Market by Technology, US$ Bn 2017-2031

Table 47: Middle East & Africa Wireless Gas Detection Market by Application, Thousand Units, 2017-2031

Table 48: Middle East & Africa Wireless Gas Detection Market by Application, US$ Bn 2017-2031

Table 49: Middle East & Africa Wireless Gas Detection Market by End-user, Thousand Units 2017-2031

Table 50: Middle East & Africa Wireless Gas Detection Market by End-user, US$ Bn 2017-2031

Table 51: Middle East & Africa Wireless Gas Detection Market by Distribution Channel, Thousand Units, 2017-2031

Table 52: Middle East & Africa Wireless Gas Detection Market by Distribution Channel, US$ Bn 2017-2031

Table 53: South America Wireless Gas Detection Market by Component, Thousand Units 2017-2031

Table 54: South America Wireless Gas Detection Market by Component, US$ Bn 2017-2031

Table 55: South America Wireless Gas Detection Market by Technology, Thousand Units 2017-2031

Table 56: South America Wireless Gas Detection Market by Technology, US$ Bn 2017-2031

Table 57: South America Wireless Gas Detection Market by Application, Thousand Units, 2017-2031

Table 58: South America Wireless Gas Detection Market by Application, US$ Bn 2017-2031

Table 59: South America Wireless Gas Detection Market by End-user, Thousand Units 2017-2031

Table 60: South America Wireless Gas Detection Market by End-user, US$ Bn 2017-2031

Table 61: South America Wireless Gas Detection Market by Distribution Channel, Thousand Units, 2017-2031

Table 62: South America Wireless Gas Detection Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global Wireless Gas Detection Market Projections, by Component, Thousand Units, 2017-2031

Figure 2: Global Wireless Gas Detection Market Projections, by Component, US$ Bn 2017-2031

Figure 3: Global Wireless Gas Detection Market, Incremental Opportunity, by Component, US$ Bn 2023-2031

Figure 4: Global Wireless Gas Detection Market Projections, by Technology, Thousand Units, 2017-2031

Figure 5: Global Wireless Gas Detection Market Projections, by Technology, US$ Bn 2017-2031

Figure 6: Global Wireless Gas Detection Market, Incremental Opportunity, by Technology, US$ Bn 2023-2031

Figure 7: Global Wireless Gas Detection Market Projections, by Application, Thousand Units, 2017-2031

Figure 8: Global Wireless Gas Detection Market Projections, by Application, US$ Bn 2017-2031

Figure 9: Global Wireless Gas Detection Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 10: Global Wireless Gas Detection Market Projections, by End-user, Thousand Units, 2017-2031

Figure 11: Global Wireless Gas Detection Market Projections, by End-user, US$ Bn 2017-2031

Figure 12: Global Wireless Gas Detection Market, Incremental Opportunity, by End-user, US$ Bn 2023-2031

Figure 13: Global Wireless Gas Detection Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 14: Global Wireless Gas Detection Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 15: Global Wireless Gas Detection Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 16: Global Wireless Gas Detection Market Projections, by Region, Thousand Units, 2017-2031

Figure 17: Global Wireless Gas Detection Market Projections, by Region, US$ Bn 2017-2031

Figure 18: Global Wireless Gas Detection Market, Incremental Opportunity, by Region, US$ Bn 2023-2031

Figure 19: North America Wireless Gas Detection Market Projections, by Component, Thousand Units, 2017-2031

Figure 20: North America Wireless Gas Detection Market Projections, by Component, US$ Bn 2017-2031

Figure 21: North America Wireless Gas Detection Market, Incremental Opportunity, by Component, US$ Bn 2023-2031

Figure 22: North America Wireless Gas Detection Market Projections, by Technology, Thousand Units, 2017-2031

Figure 23: North America Wireless Gas Detection Market Projections, by Technology, US$ Bn 2017-2031

Figure 24: North America Wireless Gas Detection Market, Incremental Opportunity, by Technology, US$ Bn 2023-2031

Figure 25: North America Wireless Gas Detection Market Projections, by Application, Thousand Units, 2017-2031

Figure 26: North America Wireless Gas Detection Market Projections, by Application, US$ Bn 2017-2031

Figure 27: North America Wireless Gas Detection Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 28: North America Wireless Gas Detection Market Projections, by End-user, Thousand Units, 2017-2031

Figure 29: North America Wireless Gas Detection Market Projections, by End-user, US$ Bn 2017-2031

Figure 30: North America Wireless Gas Detection Market, Incremental Opportunity, by End-user, US$ Bn 2023-2031

Figure 31: North America Wireless Gas Detection Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 32: North America Wireless Gas Detection Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 33: North America Wireless Gas Detection Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 34: Europe Wireless Gas Detection Market Projections, by Component, Thousand Units, 2017-2031

Figure 35: Europe Wireless Gas Detection Market Projections, by Component, US$ Bn 2017-2031

Figure 36: Europe Wireless Gas Detection Market, Incremental Opportunity, by Component, US$ Bn 2023-2031

Figure 37: Europe Wireless Gas Detection Market Projections, by Technology, Thousand Units, 2017-2031

Figure 38: Europe Wireless Gas Detection Market Projections, by Technology, US$ Bn 2017-2031

Figure 39: Europe Wireless Gas Detection Market, Incremental Opportunity, by Technology, US$ Bn 2023-2031

Figure 40: Europe Wireless Gas Detection Market Projections, by Application, Thousand Units, 2017-2031

Figure 41: Europe Wireless Gas Detection Market Projections, by Application, US$ Bn 2017-2031

Figure 42: Europe Wireless Gas Detection Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 43: Europe Wireless Gas Detection Market Projections, by End-user, Thousand Units, 2017-2031

Figure 44: Europe Wireless Gas Detection Market Projections, by End-user, US$ Bn 2017-2031

Figure 45: Europe Wireless Gas Detection Market, Incremental Opportunity, by End-user, US$ Bn 2023-2031

Figure 46: Europe Wireless Gas Detection Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 47: Europe Wireless Gas Detection Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 48: Europe Wireless Gas Detection Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 49: Asia Pacific Wireless Gas Detection Market Projections, by Component, Thousand Units, 2017-2031

Figure 50: Asia Pacific Wireless Gas Detection Market Projections, by Component, US$ Bn 2017-2031

Figure 51: Asia Pacific Wireless Gas Detection Market, Incremental Opportunity, by Component, US$ Bn 2023-2031

Figure 52: Asia Pacific Wireless Gas Detection Market Projections, by Technology, Thousand Units, 2017-2031

Figure 53: Asia Pacific Wireless Gas Detection Market Projections, by Technology, US$ Bn 2017-2031

Figure 54: Asia Pacific Wireless Gas Detection Market, Incremental Opportunity, by Technology, US$ Bn 2023-2031

Figure 55: Asia Pacific Wireless Gas Detection Market Projections, by Application, Thousand Units, 2017-2031

Figure 56: Asia Pacific Wireless Gas Detection Market Projections, by Application, US$ Bn 2017-2031

Figure 57: Asia Pacific Wireless Gas Detection Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 58: Asia Pacific Wireless Gas Detection Market Projections, by End-user, Thousand Units, 2017-2031

Figure 59: Asia Pacific Wireless Gas Detection Market Projections, by End-user, US$ Bn 2017-2031

Figure 60: Asia Pacific Wireless Gas Detection Market, Incremental Opportunity, by End-user, US$ Bn 2023-2031

Figure 61: Asia Pacific Wireless Gas Detection Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 62: Asia Pacific Wireless Gas Detection Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 63: Asia Pacific Wireless Gas Detection Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 64: Middle East & Africa Wireless Gas Detection Market Projections, by Component, Thousand Units, 2017-2031

Figure 65: Middle East & Africa Wireless Gas Detection Market Projections, by Component, US$ Bn 2017-2031

Figure 66: Middle East & Africa Wireless Gas Detection Market, Incremental Opportunity, by Component, US$ Bn 2023-2031

Figure 67: Middle East & Africa Wireless Gas Detection Market Projections, by Technology, Thousand Units, 2017-2031

Figure 68: Middle East & Africa Wireless Gas Detection Market Projections, by Technology, US$ Bn 2017-2031

Figure 69: Middle East & Africa Wireless Gas Detection Market, Incremental Opportunity, by Technology, US$ Bn 2023-2031

Figure 70: Middle East & Africa Wireless Gas Detection Market Projections, by Application, Thousand Units, 2017-2031

Figure 71: Middle East & Africa Wireless Gas Detection Market Projections, by Application, US$ Bn 2017-2031

Figure 72: Middle East & Africa Wireless Gas Detection Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 73: Middle East & Africa Wireless Gas Detection Market Projections, by End-user, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Wireless Gas Detection Market Projections, by End-user, US$ Bn 2017-2031

Figure 75: Middle East & Africa Wireless Gas Detection Market, Incremental Opportunity, by End-user, US$ Bn 2023-2031

Figure 76: Middle East & Africa Wireless Gas Detection Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 77: Middle East & Africa Wireless Gas Detection Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 78: Middle East & Africa Wireless Gas Detection Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 79: South America Wireless Gas Detection Market Projections, by Component, Thousand Units, 2017-2031

Figure 80: South America Wireless Gas Detection Market Projections, by Component, US$ Bn 2017-2031

Figure 81: South America Wireless Gas Detection Market, Incremental Opportunity, by Component, US$ Bn 2023-2031

Figure 82: South America Wireless Gas Detection Market Projections, by Technology, Thousand Units, 2017-2031

Figure 83: South America Wireless Gas Detection Market Projections, by Technology, US$ Bn 2017-2031

Figure 84: South America Wireless Gas Detection Market, Incremental Opportunity, by Technology, US$ Bn 2023-2031

Figure 85: South America Wireless Gas Detection Market Projections, by Application, Thousand Units, 2017-2031

Figure 86: South America Wireless Gas Detection Market Projections, by Application, US$ Bn 2017-2031

Figure 87: South America Wireless Gas Detection Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 88: South America Wireless Gas Detection Market Projections, by End-user, Thousand Units, 2017-2031

Figure 89: South America Wireless Gas Detection Market Projections, by End-user, US$ Bn 2017-2031

Figure 90: South America Wireless Gas Detection Market, Incremental Opportunity, by End-user, US$ Bn 2023-2031

Figure 91: South America Wireless Gas Detection Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 92: South America Wireless Gas Detection Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 93: South America Wireless Gas Detection Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031