Reports

Reports

Analysts’ Viewpoint

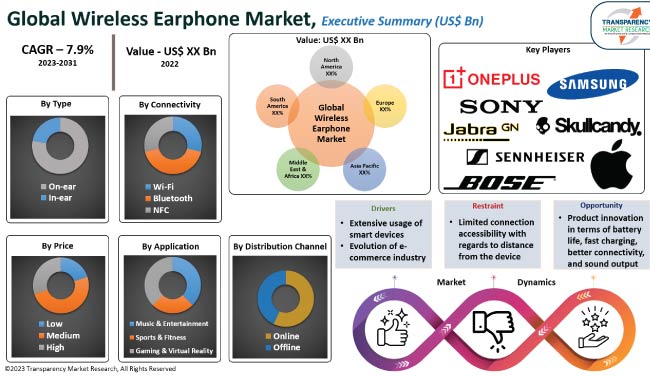

Extensive usage of smart devices and evolution of the e-commerce industry are the key factors driving the wireless earphone industry growth.

Earphones that are both cost-effective and comfortable for outdoor activities such as swimming and running are in high demand. Wireless earphone market development is ensured by manufacturers who are developing wireless earbuds with long battery life and short charging times.

Wireless earphone manufacturers are benefiting from lucrative market opportunities as a result of technological advancements. Wireless earphone market trends include the introduction of waterproof earphones, improvement in connectivity, and active noise cancellation. The wireless earphone market value is rising as a result of additional developments such as easy connectivity and quick charging by wireless charging cases.

Earphones that interface with a gadget, such as a smartphone, wireless audio devices, TV, gaming control center, PC, or other electronic gadgets, without utilizing a wire or link are referred to as wireless earphones. Depending on the device, wireless headphones transmit audio signals through radio or IR (infrared) signals.

Wireless earbuds are widely used to listen to music and play video games. Wireless headphones are available in various varieties and shapes. Wireless earbuds with noise cancellation feature are popular among video gamers due to their ability to effectively hear sound while playing video games.

The Bluetooth earbuds technology in earphones also contributes to a long product lifespan along with enhanced comfort and functionality. Wireless earbuds ensure regular head movement, and calls can be conveniently replied by simply touching one of the earbuds. A smart battery case charges the wireless earphones even when not in use. This feature significantly extends the battery life of these earphones.

Increase in usage of smart devices is contributing to the expansion of the global wireless earphone market. Growth in usage of smart technology and rise in preference for wireless devices are expected to drive the wireless earphone market demand during the forecast period.

Demand for wireless earphones heavily depends on the adoption of smart devices such as smartphones, smart televisions, and other smart accessories. The World Population Review estimated that 327 million Americans used mobile services in 2021. The Asia Pacific region's economic recovery and digital and green transformation depends on mobile networks.

Some users have multiple smartphone lines for various reasons, such as one for individual use and one for business use. Nearly 1.6 billion Chinese people owned smartphones in 2022. As per the Ministry of Information & Broadcasting, India has over 1.2 billion cell phone users and 600 million smartphone users. Additionally, with the very low data rates in the region, rise in smartphone usage resulted in users consuming high amount of information and entertainment via smartphones.

Product innovation and technological advancements, such as better sound output, battery life, wireless charging, appearance, connectivity, and portability, are additionally augmenting the wireless earphone market development.

E-commerce is more common in use now than ever before. Expansion of the e-commerce sector worldwide is anticipated to drive the wireless earphone market growth during the forecast period.

As global retail sale continues to grow, the retail market share is estimated to expand as well. By 2023, online retail deals are likely to be valued at US$ 6.17 Trn, with web-based business sites representing 22.3% of all retail deals. With 52.1% of all retail e-commerce sales worldwide and just over US$ 2 Trn in total online sales in 2021, China is likely to dominate the global e-commerce market. Additionally, it has 824.5 million digital purchasers worldwide, or 38.5% of all purchasers.

The e-commerce market in the U.S. surpassed US$ 875 Bn in 2022, slightly crossing China's market. With retail e-commerce sales of 4.8%, the U.K. is the third largest e-commerce market after China and the U.S. The electronics segment is expected to grow from 38% to 45% of global retail sales in the near future, making it the most active category of e-commerce activity.

The market grows as a result of an increase in the number of online portals. It is thus anticipated that the expanding online e-commerce market would continuously boost the global wireless earphone industry.

According to the latest market analysis, the in-ear wireless earphones type is expected to account for major market share in the near future.

In-ear wireless earphones have completely redefined the way consumers use earphones. The device is easy to carry in the pocket during outdoor activities, ensures performance of multiple tasks, and has wireless charging feature. The segment's expansion is being driven by the growing usage of in-ear wireless earphones for entertainment and professional purposes.

Customers are likely to experience more technological advancements in in-ear wireless earphones in the near future. The segment is estimated to expand rapidly owing to the rising demand for voice assistance and control.

Asia Pacific is estimated to dominate and hold major wireless earphone market share during the forecast period, attributed to the rising smartphone penetration rate in countries such as China and India, which, is likely to fuel the demand for wireless earphones among the population in the region. The middle-class population of the region is becoming more aware of the variety of electronic devices and accessories that are available, thus fueling market expansion.

The wireless earphone market size in North America is anticipated to significantly expand during the forecast period. In developing nations such as the U.S. and Canada, shift in customer preference toward technology-driven premium products is leading to the regional market progress. Rise in sale of smart devices such as smartphones and tablets is also expected to drive the demand for outdoor music, which in turn would promote the usage of wireless earphones.

The business model of prominent manufacturers includes investments in R&D, product expansions, and mergers & acquisitions. Market analysis suggests product development as a major marketing strategy adopted by top wireless earphone market players. The market is highly competitive, with the presence of various global and regional players.

Apple Inc., Bose Corporation, Jabra, Noise, OnePlus, Plantronics, Inc. Samsung Electronics Co, Ltd, Sennheiser Electronic, Skullcandy Inc., and SONY Corporation are the prominent entities profiled in the wireless earphone market report.

Each of these players has been profiled in the wireless earphone market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 8.9 Bn |

|

Market Forecast Value in 2031 |

US$ 18.2 Bn |

|

Growth Rate (CAGR) |

7.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 8.9 Bn in 2022

It is projected to grow at a CAGR of 7.9% from 2023 to 2031

Extensive usage of smart devices, and evolution of the e-commerce industry

The in-ear type segment accounted for a significant share in 2022

Asia Pacific is a lucrative region for manufacturers

Apple Inc. Bose Corporation, Jabra, Noise, OnePlus, Plantronics, Inc. Samsung Electronics Co, Ltd, Sennheiser Electronic, Skullcandy Inc., and Sony Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Wireless Earphone Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Wireless Earphone Market Analysis and Forecast, By Type

6.1. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. On-ear

6.1.2. In-ear

6.2. Incremental Opportunity, By Type

7. Global Wireless Earphone Market Analysis and Forecast, By Connectivity

7.1. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Connectivity, 2017 - 2031

7.1.1. Wi-Fi

7.1.2. Bluetooth

7.1.3. NFC

7.2. Incremental Opportunity, By Connectivity

8. Global Wireless Earphone Market Analysis and Forecast, By Price

8.1. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

8.1.1. Low

8.1.2. Medium

8.1.3. High

8.2. Incremental Opportunity, By Price

9. Global Wireless Earphone Market Analysis and Forecast, By Application

9.1. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

9.1.1. Music & Entertainment

9.1.2. Sports & Fitness

9.1.3. Gaming & Virtual Reality

9.2. Incremental Opportunity, By Application

10. Global Wireless Earphone Market Analysis and Forecast, By Distribution Channel

10.1. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company-owned Websites

10.1.2. Offline

10.1.2.1. Hypermarkets/Supermarkets

10.1.2.2. Specialty Stores

10.1.2.3. Others

10.2. Incremental Opportunity, By Distribution Channel

11. Global Wireless Earphone Market Analysis and Forecast, By Region

11.1. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Wireless Earphone Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Type,2017 - 2031

12.5.1. On-ear

12.5.2. In-ear

12.6. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Connectivity, 2017 - 2031

12.6.1. Wi-Fi

12.6.2. Bluetooth

12.6.3. NFC

12.7. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

12.7.1. Low

12.7.2. Medium

12.7.3. High

12.8. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.8.1. Music & Entertainment

12.8.2. Sports & Fitness

12.8.3. Gaming & Virtual Reality

12.9. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. E-commerce Websites

12.9.1.2. Company-owned Websites

12.9.2. Offline

12.9.2.1. Hypermarkets/Supermarkets

12.9.2.2. Specialty Stores

12.9.2.3. Others

12.10. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Country/sub-region, 2017 - 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Wireless Earphone Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Type,2017 - 2031

13.5.1. On-ear

13.5.2. In-ear

13.6. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Connectivity, 2017 - 2031

13.6.1. Wi-Fi

13.6.2. Bluetooth

13.6.3. NFC

13.7. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

13.7.1. Low

13.7.2. Medium

13.7.3. High

13.8. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.8.1. Music & Entertainment

13.8.2. Sports & Fitness

13.8.3. Gaming & Virtual Reality

13.9. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.9.1. Online

13.9.1.1. E-commerce Websites

13.9.1.2. Company-owned Websites

13.9.2. Offline

13.9.2.1. Hypermarkets/Supermarkets

13.9.2.2. Specialty Stores

13.9.2.3. Others

13.10. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Country/sub-region, 2017 - 2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Wireless Earphone Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Key Trends Analysis

14.3.1. Demand Side

14.3.2. Supplier Side

14.4. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

14.4.1. On-ear

14.4.2. In-ear

14.5. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Connectivity, 2017 - 2031

14.5.1. Wi-Fi

14.5.2. Bluetooth

14.5.3. NFC

14.6. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

14.6.1. Low

14.6.2. Medium

14.6.3. High

14.7. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.7.1. Music & Entertainment

14.7.2. Sports & Fitness

14.7.3. Gaming & Virtual Reality

14.8. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.8.1. Online

14.8.1.1. E-commerce Websites

14.8.1.2. Company-owned Websites

14.8.2. Offline

14.8.2.1. Hypermarkets/Supermarkets

14.8.2.2. Specialty Stores

14.8.2.3. Others

14.9. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Country/sub-region, 2017 - 2031

14.9.1. India

14.9.2. China

14.9.3. Japan

14.9.4. Rest of Asia Pacific

14.10. Incremental Opportunity Analysis

15. Middle East & Africa Wireless Earphone Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

15.5.1. On-ear

15.5.2. In-ear

15.6. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Connectivity, 2017 - 2031

15.6.1. Wi-Fi

15.6.2. Bluetooth

15.6.3. NFC

15.7. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

15.7.1. Low

15.7.2. Medium

15.7.3. High

15.8. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.8.1. Music & Entertainment

15.8.2. Sports & Fitness

15.8.3. Gaming & Virtual Reality

15.9. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.9.1. Online

15.9.1.1. E-commerce Websites

15.9.1.2. Company-owned Websites

15.9.2. Offline

15.9.2.1. Hypermarkets/Supermarkets

15.9.2.2. Specialty Stores

15.9.2.3. Others

15.10. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Country/sub-region, 2017 - 2031

15.10.1. GCC

15.10.2. Rest of MEA

15.11. Incremental Opportunity Analysis

16. South America Wireless Earphone Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Brand Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Price

16.4. Key Trends Analysis

16.4.1. Demand Side

16.4.2. Supplier Side

16.5. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

16.5.1. On-ear

16.5.2. In-ear

16.6. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Connectivity, 2017 - 2031

16.6.1. Wi-Fi

16.6.2. Bluetooth

16.6.3. NFC

16.7. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

16.7.1. Low

16.7.2. Medium

16.7.3. High

16.8. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

16.8.1. Music & Entertainment

16.8.2. Sports & Fitness

16.8.3. Gaming & Virtual Reality

16.9. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.9.1. Online

16.9.1.1. E-commerce Websites

16.9.1.2. Company-owned Websites

16.9.2. Offline

16.9.2.1. Hypermarkets/Supermarkets

16.9.2.2. Specialty Stores

16.9.2.3. Others

16.10. Wireless Earphone Market Size (US$ Bn and Thousand Units) Forecast, By Country/sub-region, 2017 - 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Share Analysis (%), by Company, (2022)

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. Apple Inc.

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. Bose Corporation

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. Jabra

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Noise

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. OnePlus

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Plantronics, Inc.

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Samsung Electronics Co, Ltd

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Sennheiser Electronic

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Skullcandy Inc.

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. SONY Corporation

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. By Type

18.1.2. By Connectivity

18.1.3. By Price

18.1.4. By Application

18.1.5. By Distribution Channel

18.1.6. By Region

18.2. Prevailing Market Risks

18.3. Understanding the Buying Process of Customers

18.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Table 4: Global Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Table 5: Global Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Table 6: Global Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Table 7: Global Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Table 8: Global Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Table 9: Global Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 10: Global Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 11: Global Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Table 12: Global Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Table 13: North America Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Table 14: North America Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Table 15: North America Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Table 16: North America Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Table 17: North America Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Table 18: North America Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Table 19: North America Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Table 20: North America Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Table 21: North America Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 22: North America Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: North America Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Table 24: North America Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Table 25: Europe Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Table 26: Europe Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Table 27: Europe Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Table 28: Europe Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Table 29: Europe Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Table 30: Europe Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Table 31: Europe Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Table 32: Europe Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Table 33: Europe Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 34: Europe Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 35: Europe Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Table 36: Europe Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Table 37: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Table 38: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Table 39: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Table 40: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Table 41: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Table 42: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Table 43: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Table 44: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Table 45: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 46: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Table 48: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Table 49: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Table 50: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Table 51: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Table 52: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Table 53: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Table 54: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Table 55: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Table 56: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Table 57: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Table 60: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Table 61: South America Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Table 62: South America Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Table 63: South America Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Table 64: South America Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Table 65: South America Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Table 66: South America Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Table 67: South America Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Table 68: South America Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Table 69: South America Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 70: South America Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 71: South America Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Table 72: South America Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Figure 5: Global Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Figure 6: Global Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Connectivity, 2023-2031

Figure 7: Global Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Figure 8: Global Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Figure 9: Global Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Price, 2023-2031

Figure 10: Global Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Figure 11: Global Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Figure 12: Global Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 13: Global Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 14: Global Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 15: Global Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 16: Global Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Figure 17: Global Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Figure 18: Global Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 19: North America Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Figure 20: North America Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Figure 21: North America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 22: North America Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Figure 23: North America Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Figure 24: North America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Connectivity, 2023-2031

Figure 25: North America Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Figure 26: North America Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Figure 27: North America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Price, 2023-2031

Figure 28: North America Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Figure 29: North America Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Figure 30: North America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 31: North America Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 32: North America Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: North America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 34: North America Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Figure 35: North America Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Figure 36: North America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Europe Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Figure 38: Europe Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Figure 39: Europe Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 40: Europe Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Figure 41: Europe Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Figure 42: Europe Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Connectivity, 2023-2031

Figure 43: Europe Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Figure 44: Europe Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Figure 45: Europe Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Price, 2023-2031

Figure 46: Europe Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Figure 47: Europe Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Figure 48: Europe Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 49: Europe Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 50: Europe Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 51: Europe Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 52: Europe Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Figure 53: Europe Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Figure 54: Europe Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 55: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Figure 56: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Figure 57: Asia Pacific Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 58: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Figure 59: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Figure 60: Asia Pacific Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Connectivity, 2023-2031

Figure 61: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Figure 62: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Figure 63: Asia Pacific Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Price, 2023-2031

Figure 64: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Figure 65: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Figure 66: Asia Pacific Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 67: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 68: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: Asia Pacific Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 70: Asia Pacific Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Figure 71: Asia Pacific Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Figure 72: Asia Pacific Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 73: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Figure 74: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Figure 75: Middle East & Africa Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 76: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Figure 77: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Figure 78: Middle East & Africa Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Connectivity, 2023-2031

Figure 79: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Figure 80: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Figure 81: Middle East & Africa Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Price, 2023-2031

Figure 82: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Figure 83: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Figure 84: Middle East & Africa Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 85: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: Middle East & Africa Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: Middle East & Africa Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Figure 89: Middle East & Africa Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Figure 90: Middle East & Africa Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 91: South America Wireless Earphone Market Value (US$ Bn), by Type, 2017-2031

Figure 92: South America Wireless Earphone Market Volume (Thousand Units), by Type 2017-2031

Figure 93: South America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 94: South America Wireless Earphone Market Value (US$ Bn), by Connectivity, 2017-2031

Figure 95: South America Wireless Earphone Market Volume (Thousand Units), by Connectivity 2017-2031

Figure 96: South America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Connectivity, 2023-2031

Figure 97: South America Wireless Earphone Market Value (US$ Bn), by Price, 2017-2031

Figure 98: South America Wireless Earphone Market Volume (Thousand Units), by Price 2017-2031

Figure 99: South America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Price, 2023-2031

Figure 100: South America Wireless Earphone Market Value (US$ Bn), by Application, 2017-2031

Figure 101: South America Wireless Earphone Market Volume (Thousand Units), by Application 2017-2031

Figure 102: South America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 103: South America Wireless Earphone Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 104: South America Wireless Earphone Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 105: South America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 106: South America Wireless Earphone Market Value (US$ Bn), by Region, 2017-2031

Figure 107: South America Wireless Earphone Market Volume (Thousand Units), by Region 2017-2031

Figure 108: South America Wireless Earphone Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031