Reports

Reports

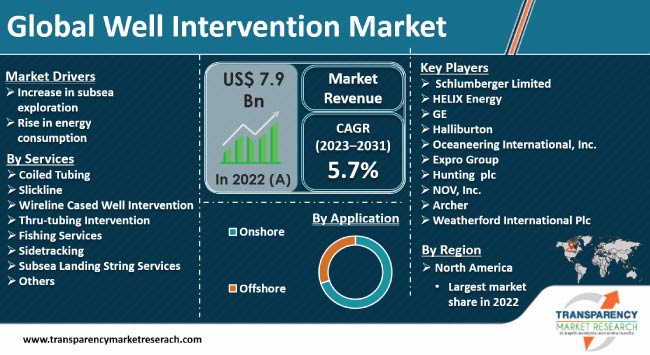

Increase in subsea exploration activities across the globe is a prominent factor that is boosting the well intervention market size. Depletion of oil reserves, high cost of drilling, and general government pressure are compelling the oil & gas sector to gradually shift from onshore oil fields to offshore fields. Well intervention plays a key role in deep-sea exploration; it assists in optimizing production and improving the safety of the entire operation.

Surge in energy consumption is also augmenting well intervention market statistics, as companies are increasingly focusing on discovering novel oil fields and revitalizing aged field wells. Prominent players operating in the well intervention industry are investing significantly in subsurface intervention technologies and reservoir enhancement solutions to reduce costs and improve recovery rates of offshore field wells.

Well intervention is an operation that helps avoid unforeseen issues in oil and gas wells. The process can alter well geometry, assist in well diagnostics, and oversee production management of the well.

Well intervention plays a crucial part in the lifecycle of reservoirs, addressing problems such as oilfield management and reservoir flow. Types of well intervention techniques include pumping, sickline, braided line, coiled tubing, and snubbing.

Well intervention is used to clear debris, safely stop production during storms, rejuvenate production, and carry out secure well abandonment at the end of its economic life. Complexity of large reservoirs can extend from regular maintenance to operational hydraulic fracturing and wellhead control.

Modern intervention solutions offer full-time surveillance, real-time data analytics, and unconventional exploration opportunities. The global well intervention market is expanding at a steady pace, as oil exploration expands to new regions, specifically in the Gulf of Mexico, South China Sea, and the Persian Gulf. Advancements in oilfield remediation and availability of cost-effective well integrity services are also augmenting market progress.

Rise in cost of drilling and dearth of accessible oil reservoirs are prompting the oil and gas sector to shift away from on-field resources toward subsea exploration and production. Subsea oil exploration and production involves extraction of energy resources from beneath the ocean floor.

These activities are usually carried out in deep-sea environments of regions such as the Caspian Sea and North Sea. Subsea exploration is a challenging endeavor and requires understanding of complex ocean geology and ecology.

Current political climate and government regulations are supportive of offshore exploration. Offshore extraction of resources is boosting the image of government agencies and energy companies.

Securing vital resources has become a pivotal geopolitical focus, as petrochemical reserves are dwindling and energy consumption is rising. This is propelling investments in subsea oil exploration. In turn, this is boosting the well intervention market value.

Well intervention also assists in reservoir management and optimization of production and reservation rates. Complete adoption of deep sea oil exploration requires sufficient utilization of well intervention, as companies aim for improved recovery rates from existing and future subsea walls.

Demand for energy is rising significantly across the globe due to the increase in global population, rise in increase toward urban areas, and adoption of new technologies. As per the International Energy Agency, crude oil consumption rose to 99.5 million barrels per day in 2022.

China and the U.S. are the two largest consumers of energy in the world. In December 2023, the U.S. recorded its peak crude oil production statistics, producing more oil than any country in history.

Rapid depletion of accessible oil and gas fields and a gradual shift toward renewable energy are prompting significant investments in discovery of new oilfields and revitalization of aging field wells.

According to a report titled Oil and Gas Exploration: 2022 in Review, exploration efforts of the energy sector discovered lucrative prospects in Namibia, Brazil, Guyana, and Algeria. This new age of exploration and maintenance is set to trigger further investments in the well intervention market.

According to the latest well intervention market analysis, North America held the largest share in 2022. Surge in number of offshore oil and gas projects and enhancement in efficiency owing to the development of new methods for exploration are augmenting the market dynamics of the region.

As per the latest well intervention market forecast, the industry in Asia Pacific is projected to grow at a steady pace from 2023 to 2031. Rise in demand for energy and increase in government efforts in revitalizing old fields are boosting the well intervention industry share of the region.

As per research done by NS Energy, India is likely to account for a third of Asia Pacific’s oil and gas projects by 2025, with a total of 647 new petrochemical projects announced.

According to the recent well intervention market research, prominent manufacturers are investing significantly in the development of advanced well control technologies and subsea well intervention techniques to explore offshore energy opportunities.

They are striving to introduce smarter and safer well intervention solutions to expand their client base. Leading companies are also offering higher flexibility, bespoke engineering, and rapid deployment of high-quality equipment and technology for onshore and offshore projects.

Schlumberger Limited, HELIX Energy, GE, Halliburton, Oceaneering International, Inc., Expro Group, Hunting plc, NOV, Inc., Archer, and Weatherford International Plc are key players operating in the global landscape.

The well intervention market report covers these companies in terms of parameters such as company overview, product portfolio, business strategies, financial overview, and business segments.

| Attributes | Details |

|---|---|

| Market Value in 2022 (Base Year) | US$ 7.9 Bn |

| Market Forecast Value in 2031 | US$ 13.1 Bn |

| Growth Rate (CAGR) | 5.7% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2020 to 2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 7.9 Bn in 2022

It is projected to advance at a CAGR of 5.7% from 2023 to 2031

Increase in subsea exploration and rise in energy consumption

The onshore segment held the largest share in 2022

North America was the leading region in 2022

Schlumberger Limited, HELIX Energy, GE, Halliburton, Oceaneering International, Inc., Expro Group, Hunting plc, NOV Inc., Archer, and Weatherford International Plc

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

2.7. Services Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Price Trend Analysis

5. Global Well Intervention Market Analysis and Forecast, by Type, 2023-2031

5.1. Introduction and Definitions

5.2. Global Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

5.2.1. Light Well

5.2.2. Heavy Well

5.2.3. Medium Well

5.3. Global Well Intervention Market Attractiveness, by Type

6. Global Well Intervention Market Analysis and Forecast, by Services, 2023-2031

6.1. Introduction and Definitions

6.2. Global Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

6.2.1. Coiled Tubing

6.2.2. Slickline

6.2.3. Wireline Cased Well Intervention

6.2.4. Thru-tubing Intervention

6.2.5. Fishing Services

6.2.6. Sidetracking

6.2.7. Subsea Landing String Services

6.2.8. Others

6.3. Global Well Intervention Market Attractiveness, by Services

7. Global Well Intervention Market Analysis and Forecast, by Application, 2023-2031

7.1. Introduction and Definitions

7.2. Global Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

7.2.1. Onshore

7.2.2. Offshore

7.3. Global Well Intervention Market Attractiveness, by Application

8. Global Well Intervention Market Analysis and Forecast, by Region, 2023-2031

8.1. Key Findings

8.2. Global Well Intervention Market Value (US$ Mn) Forecast, by Region, 2023-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global Well Intervention Market Attractiveness, by Region

9. North America Well Intervention Market Analysis and Forecast, 2023-2031

9.1. Key Findings

9.2. North America Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

9.3. North America Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

9.4. North America Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.5. North America Well Intervention Market Value (US$ Mn) Forecast, by Country, 2023-2031

9.5.1. U.S. Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

9.5.2. U.S. Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

9.5.3. U.S. Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.5.4. Canada Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

9.5.5. Canada Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

9.5.6. Canada Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.6. North America Well Intervention Market Attractiveness Analysis

10. Europe Well Intervention Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. Europe Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

10.3. Europe Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

10.4. Europe Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.5. Europe Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

10.5.1. Germany Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

10.5.2. Germany Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

10.5.3. Germany Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.5.4. France Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

10.5.5. France Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

10.5.6. France Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.5.7. U.K. Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

10.5.8. U.K. Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

10.5.9. U.K. Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.5.10. Italy Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

10.5.11. Italy. Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

10.5.12. Italy Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.5.13. Russia & CIS Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

10.5.14. Russia & CIS Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

10.5.15. Russia & CIS Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.5.16. Rest of Europe Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

10.5.17. Rest of Europe Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

10.5.18. Rest of Europe Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.6. Europe Well Intervention Market Attractiveness Analysis

11. Asia Pacific Well Intervention Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Type

11.3. Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

11.4. Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

11.5. Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

11.5.1. China Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

11.5.2. China Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

11.5.3. China Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

11.5.4. Japan Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

11.5.5. Japan Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

11.5.6. Japan Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

11.5.7. India Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

11.5.8. India Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

11.5.9. India Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

11.5.10. ASEAN Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

11.5.11. ASEAN Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

11.5.12. ASEAN Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

11.5.13. Rest of Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

11.5.14. Rest of Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

11.5.15. Rest of Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

11.6. Asia Pacific Well Intervention Market Attractiveness Analysis

12. Latin America Well Intervention Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Latin America Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

12.3. Latin America Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

12.4. Latin America Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

12.5. Latin America Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

12.5.1. Brazil Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.2. Brazil Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

12.5.3. Brazil Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

12.5.4. Mexico Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.5. Mexico Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

12.5.6. Mexico Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

12.5.7. Rest of Latin America Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.8. Rest of Latin America Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

12.5.9. Rest of Latin America Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

12.6. Latin America Well Intervention Market Attractiveness Analysis

13. Middle East & Africa Well Intervention Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

13.3. Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

13.4. Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

13.5. Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.5.1. GCC Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.2. GCC Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

13.5.3. GCC Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

13.5.4. South Africa Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.5. South Africa Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

13.5.6. South Africa Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

13.5.7. Rest of Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.8. Rest of Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

13.5.9. Rest of Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

13.6. Middle East & Africa Well Intervention Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Well Intervention Market Company Share Analysis, 2022

14.2. Company Profile

14.2.1. Schlumberger Limited

14.2.1.1. Company Description

14.2.1.2. Business Overview

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.2. HELIX Energy

14.2.2.1. Company Description

14.2.2.2. Business Overview

14.2.2.3. Financial Overview

14.2.2.4. Strategic Overview

14.2.3. GE

14.2.3.1. Company Description

14.2.3.2. Business Overview

14.2.3.3. Financial Overview

14.2.3.4. Strategic Overview

14.2.4. Halliburton

14.2.4.1. Company Description

14.2.4.2. Business Overview

14.2.4.3. Financial Overview

14.2.4.4. Strategic Overview

14.2.5. Oceaneering International, Inc.

14.2.5.1. Company Description

14.2.5.2. Business Overview

14.2.5.3. Financial Overview

14.2.5.4. Strategic Overview

14.2.6. Expro Group

14.2.6.1. Company Description

14.2.6.2. Business Overview

14.2.6.3. Financial Overview

14.2.6.4. Strategic Overview

14.2.7. Hunting plc

14.2.7.1. Company Description

14.2.7.2. Business Overview

14.2.7.3. Financial Overview

14.2.7.4. Strategic Overview

14.2.8. NOV, Inc.

14.2.8.1. Company Description

14.2.8.2. Business Overview

14.2.8.3. Financial Overview

14.2.8.4. Strategic Overview

14.2.9. Archer

14.2.9.1. Company Description

14.2.9.2. Business Overview

14.2.9.3. Financial Overview

14.2.9.4. Strategic Overview

14.2.10. Weatherford International Plc

14.2.10.1. Company Description

14.2.10.2. Business Overview

14.2.10.3. Financial Overview

14.2.10.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Well Intervention Market Forecast, by Type, 2023-2031

Table 2: Global Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 3: Global Well Intervention Market Forecast, by Services, 2023-2031

Table 4: Global Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 5: Global Well Intervention Market Forecast, by Application, 2023-2031

Table 6: Global Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 7: Global Well Intervention Market Forecast, by Region, 2023-2031

Table 8: Global Well Intervention Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 9: North America Well Intervention Market Forecast, by Type, 2023-2031

Table 10: North America Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 11: North America Well Intervention Market Forecast, by Services, 2023-2031

Table 12: North America Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 13: North America Well Intervention Market Forecast, by Application, 2023-2031

Table 14: North America Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 15: North America Well Intervention Market Forecast, by Country, 2023-2031

Table 16: North America Well Intervention Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 17: U.S. Well Intervention Market Forecast, by Type, 2023-2031

Table 18: U.S. Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 19: U.S. Well Intervention Market Forecast, by Services, 2023-2031

Table 20: U.S. Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 21: U.S. Well Intervention Market Forecast, by Application, 2023-2031

Table 22: U.S. Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 23: Canada Well Intervention Market Forecast, by Type, 2023-2031

Table 24: Canada Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 25: Canada Well Intervention Market Forecast, by Services, 2023-2031

Table 26: Canada Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 27: Canada Well Intervention Market Forecast, by Application, 2023-2031

Table 28: Canada Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 29: Europe Well Intervention Market Forecast, by Type, 2023-2031

Table 30: Europe Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 31: Europe Well Intervention Market Forecast, by Services, 2023-2031

Table 32: Europe Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 33: Europe Well Intervention Market Forecast, by Application, 2023-2031

Table 34: Europe Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 35: Europe Well Intervention Market Forecast, by Country and Sub-region, 2023-2031

Table 36: Europe Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 37: Germany Well Intervention Market Forecast, by Type, 2023-2031

Table 38: Germany Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 39: Germany Well Intervention Market Forecast, by Services, 2023-2031

Table 40: Germany Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 41: Germany Well Intervention Market Forecast, by Application, 2023-2031

Table 42: Germany Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 43: France Well Intervention Market Forecast, by Type, 2023-2031

Table 44: France Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 45: France Well Intervention Market Forecast, by Services, 2023-2031

Table 46: France Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 47: France Well Intervention Market Forecast, by Application, 2023-2031

Table 48: France Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 49: U.K. Well Intervention Market Forecast, by Type, 2023-2031

Table 50: U.K. Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 51: U.K. Well Intervention Market Forecast, by Services, 2023-2031

Table 52: U.K. Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 53: U.K. Well Intervention Market Forecast, by Application, 2023-2031

Table 54: U.K. Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 55: Italy Well Intervention Market Forecast, by Type, 2023-2031

Table 56: Italy Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 57: Italy Well Intervention Market Forecast, by Services, 2023-2031

Table 58: Italy Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 59: Italy Well Intervention Market Forecast, by Application, 2023-2031

Table 60: Italy Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 61: Spain Well Intervention Market Forecast, by Type, 2023-2031

Table 62: Spain Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 63: Spain Well Intervention Market Forecast, by Services, 2023-2031

Table 64: Spain Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 65: Spain Well Intervention Market Forecast, by Application, 2023-2031

Table 66: Spain Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 67: Russia & CIS Well Intervention Market Forecast, by Type, 2023-2031

Table 68: Russia & CIS Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 69: Russia & CIS Well Intervention Market Forecast, by Services, 2023-2031

Table 70: Russia & CIS Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 71: Russia & CIS Well Intervention Market Forecast, by Application, 2023-2031

Table 72: Russia & CIS Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 73: Rest of Europe Well Intervention Market Forecast, by Type, 2023-2031

Table 74: Rest of Europe Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 75: Rest of Europe Well Intervention Market Forecast, by Services, 2023-2031

Table 76: Rest of Europe Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 77: Rest of Europe Well Intervention Market Forecast, by Application, 2023-2031

Table 78: Rest of Europe Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 79: Asia Pacific Well Intervention Market Forecast, by Type, 2023-2031

Table 80: Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 81: Asia Pacific Well Intervention Market Forecast, by Services, 2023-2031

Table 82: Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 83: Asia Pacific Well Intervention Market Forecast, by Application, 2023-2031

Table 84: Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 85: Asia Pacific Well Intervention Market Forecast, by Country and Sub-region, 2023-2031

Table 86: Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 87: China Well Intervention Market Forecast, by Type, 2023-2031

Table 88: China Well Intervention Market Value (US$ Mn) Forecast, by Type 2023-2031

Table 89: China Well Intervention Market Forecast, by Services, 2023-2031

Table 90: China Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 91: China Well Intervention Market Forecast, by Application, 2023-2031

Table 92: China Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 93: Japan Well Intervention Market Forecast, by Type, 2023-2031

Table 94: Japan Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 95: Japan Well Intervention Market Forecast, by Services, 2023-2031

Table 96: Japan Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 97: Japan Well Intervention Market Forecast, by Application, 2023-2031

Table 98: Japan Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 99: India Well Intervention Market Forecast, by Type, 2023-2031

Table 100: India Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 101: India Well Intervention Market Forecast, by Services, 2023-2031

Table 102: India Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 103: India Well Intervention Market Forecast, by Application, 2023-2031

Table 104: India Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 105: India Well Intervention Market Forecast, by Application, 2023-2031

Table 106: India Well Intervention Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 107: ASEAN Well Intervention Market Forecast, by Type, 2023-2031

Table 108: ASEAN Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 109: ASEAN Well Intervention Market Forecast, by Services, 2023-2031

Table 110: ASEAN Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 111: ASEAN Well Intervention Market Forecast, by Application, 2023-2031

Table 112: ASEAN Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 113: Rest of Asia Pacific Well Intervention Market Forecast, by Type, 2023-2031

Table 114: Rest of Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 115: Rest of Asia Pacific Well Intervention Market Forecast, by Services, 2023-2031

Table 116: Rest of Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 117: Rest of Asia Pacific Well Intervention Market Forecast, by Application, 2023-2031

Table 118: Rest of Asia Pacific Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 119: Latin America Well Intervention Market Forecast, by Type, 2023-2031

Table 120: Latin America Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 121: Latin America Well Intervention Market Forecast, by Services, 2023-2031

Table 122: Latin America Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 123: Latin America Well Intervention Market Forecast, by Application, 2023-2031

Table 124: Latin America Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 125: Latin America Well Intervention Market Forecast, by Country and Sub-region, 2023-2031

Table 126: Latin America Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 127: Brazil Well Intervention Market Forecast, by Type, 2023-2031

Table 128: Brazil Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 129: Brazil Well Intervention Market Forecast, by Services, 2023-2031

Table 130: Brazil Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 131: Brazil Well Intervention Market Forecast, by Application, 2023-2031

Table 132: Brazil Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 133: Mexico Well Intervention Market Forecast, by Type, 2023-2031

Table 134: Mexico Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 135: Mexico Well Intervention Market Forecast, by Services, 2023-2031

Table 136: Mexico Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 137: Mexico Well Intervention Market Forecast, by Application, 2023-2031

Table 138: Mexico Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 139: Rest of Latin America Well Intervention Market Forecast, by Type, 2023-2031

Table 140: Rest of Latin America Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 141: Rest of Latin America Well Intervention Market Forecast, by Services, 2023-2031

Table 142: Rest of Latin America Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 143: Rest of Latin America Well Intervention Market Forecast, by Application, 2023-2031

Table 144: Rest of Latin America Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 145: Middle East & Africa Well Intervention Market Forecast, by Type, 2023-2031

Table 146: Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 147: Middle East & Africa Well Intervention Market Forecast, by Services, 2023-2031

Table 148: Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 149: Middle East & Africa Well Intervention Market Forecast, by Application, 2023-2031

Table 150: Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 151: Middle East & Africa Well Intervention Market Forecast, by Country and Sub-region, 2023-2031

Table 152: Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 153: GCC Well Intervention Market Forecast, by Type, 2023-2031

Table 154: GCC Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 155: GCC Well Intervention Market Forecast, by Services, 2023-2031

Table 156: GCC Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 157: GCC Well Intervention Market Forecast, by Application, 2023-2031

Table 158: GCC Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 159: South Africa Well Intervention Market Forecast, by Type, 2023-2031

Table 160: South Africa Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 161: South Africa Well Intervention Market Forecast, by Services, 2023-2031

Table 162: South Africa Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 163: South Africa Well Intervention Market Forecast, by Application, 2023-2031

Table 164: South Africa Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 165: Rest of Middle East & Africa Well Intervention Market Forecast, by Type, 2023-2031

Table 166: Rest of Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 167: Rest of Middle East & Africa Well Intervention Market Forecast, by Services, 2023-2031

Table 168: Rest of Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Services, 2023-2031

Table 169: Rest of Middle East & Africa Well Intervention Market Forecast, by Application, 2023-2031

Table 170: Rest of Middle East & Africa Well Intervention Market Value (US$ Mn) Forecast, by Application, 2023-2031

List of Figures

Figure 1: Global Well Intervention Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 2: Global Well Intervention Market Attractiveness, by Type

Figure 3: Global Well Intervention Market Volume Share Analysis, by Services, 2022, 2025, and 2031

Figure 4: Global Well Intervention Market Attractiveness, by Services

Figure 5: Global Well Intervention Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 6: Global Well Intervention Market Attractiveness, by Application

Figure 7: Global Well Intervention Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Well Intervention Market Attractiveness, by Region

Figure 9: North America Well Intervention Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 10: North America Well Intervention Market Attractiveness, by Type

Figure 11: North America Well Intervention Market Volume Share Analysis, by Services, 2022, 2025, and 2031

Figure 12: North America Well Intervention Market Attractiveness, by Services

Figure 13: North America Well Intervention Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 14: North America Well Intervention Market Attractiveness, by Application

Figure 15: North America Well Intervention Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 16: North America Well Intervention Market Attractiveness, by Country

Figure 17: Europe Well Intervention Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 18: Europe Well Intervention Market Attractiveness, by Type

Figure 19: Europe Well Intervention Market Volume Share Analysis, by Services, 2022, 2025, and 2031

Figure 20: Europe Well Intervention Market Attractiveness, by Services

Figure 21: Europe Well Intervention Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 22: Europe Well Intervention Market Attractiveness, by Application

Figure 23: Europe Well Intervention Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Europe Well Intervention Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Well Intervention Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 26: Asia Pacific Well Intervention Market Attractiveness, by Type

Figure 27: Asia Pacific Well Intervention Market Volume Share Analysis, by Services, 2022, 2025, and 2031

Figure 28: Asia Pacific Well Intervention Market Attractiveness, by Services

Figure 29: Asia Pacific Well Intervention Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 30: Asia Pacific Well Intervention Market Attractiveness, by Application

Figure 31: Asia Pacific Well Intervention Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 32: Asia Pacific Well Intervention Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Well Intervention Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 34: Latin America Well Intervention Market Attractiveness, by Type

Figure 35: Latin America Well Intervention Market Volume Share Analysis, by Services, 2022, 2025, and 2031

Figure 36: Latin America Well Intervention Market Attractiveness, by Services

Figure 37: Latin America Well Intervention Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 38: Latin America Well Intervention Market Attractiveness, by Application

Figure 39: Latin America Well Intervention Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 40: Latin America Well Intervention Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Well Intervention Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 42: Middle East & Africa Well Intervention Market Attractiveness, by Type

Figure 43: Middle East & Africa Well Intervention Market Volume Share Analysis, by Services, 2022, 2025, and 2031

Figure 44: Middle East & Africa Well Intervention Market Attractiveness, by Services

Figure 45: Middle East & Africa Well Intervention Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 46: Middle East & Africa Well Intervention Market Attractiveness, by Application

Figure 47: Middle East & Africa Well Intervention Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 48: Middle East & Africa Well Intervention Market Attractiveness, by Country and Sub-region