Reports

Reports

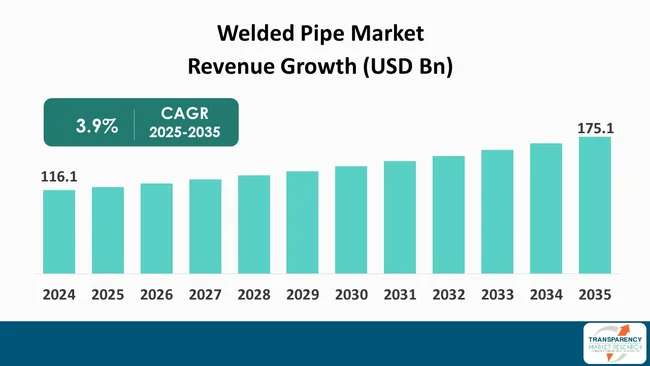

The global welded pipe market size was valued at USD 116.1 Bn in 2024 and is projected to reach USD 175.1 Bn by 2035, expanding at a CAGR of 3.9% from 2025 to 2035. The market growth is driven by the growth of the oil & gas industry, and affordability and cost-effectiveness.

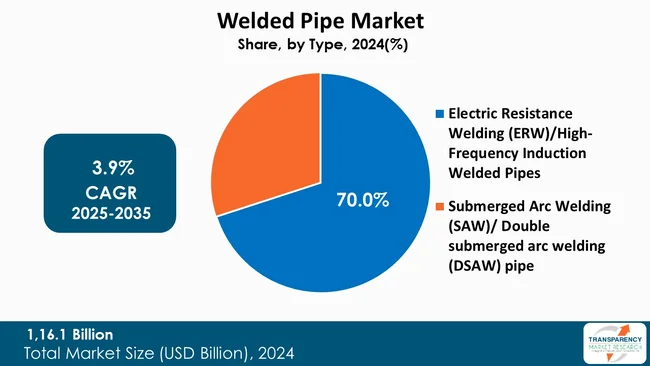

The welded pipe industry is experiencing strong growth due to the development of the oil and gas industry and the affordability of welded pipes in comparison to other seamless pipes. The ERW/High-Frequency Induction Welded Pipes are leading due to their dependability, accuracy in dimensions, and versatility in manufacturing industries e.g. construction, water supply, and automobiles. Their position in the market is further enhanced as large quantities of production are matched with the level of technology they have with regard to the welding processes.

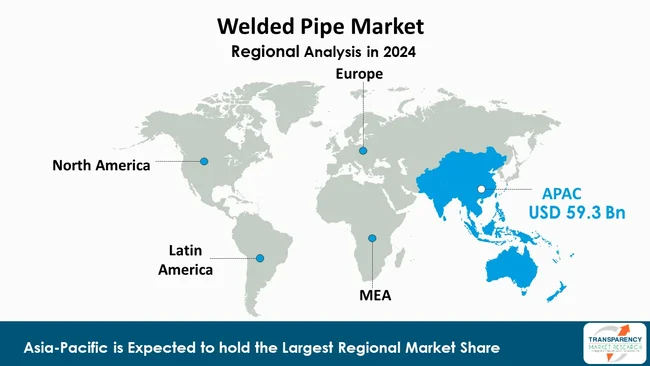

Asia-Pacific region dominates the market due to rapid industrialization, urbanization, and the development of infrastructure in countries such as China and India. The region is experiencing not only high domestic demand but also developing manufacturing capacities with supportive government policies. Major players like Tenaris, ArcelorMittal are also enhancing their services by offering value-added services, strategic acquisitions and technological advancements.

Welded pipe market specializes in production, distribution, and uses of pipes that are manufactured through the process of joining the sheet of steel or any other metal into circular shapes through welding. Welded pipes is unlike seamless pipes where the plates or strips are rolled and welded along the sides. They are thus cheaper to manufacture and come in variety of sizes and thickness.

They find wide application in oil and gas industries, construction sector, water purification, power, and vehicle transportation where fluid and gas transport and structural integrity are needed. Market is influenced by aspects such as the increasing development of infrastructures, the rise of industries, and the developments of the technologies of welding.

Welded pipes are preferred for their durability and uniformity. The types of welded pipes include - electric resistance welded (ERW), longitudinal submerged arc welded (LSAW), and spiral submerged arc welded (SSAW). They are characterized by a high level of corrosion resistance, accuracy in their dimensions, and flexibility in low-pressure and high-pressure applications. As the energy, construction, and water supply market continue to gain momentum, the welded pipe market has grown into a very important segment of the global steel and piping industry.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The oil and gas industry ranks among the biggest users of welded pipes and hence its development is a significant push to the market. According to the U.S. Energy Information Administration (EIA), U.S. natural-gas pipeline projects completed in 2024 increased takeaway capacity by approximately 6.5 billion cubic feet per day (Bcf/d) in producing regions such as the Appalachia, Haynesville, Permian and Eagle Ford basins.

Due to the increasing global energy needs, exploration and production are being done onshore and offshore, which demands pipeline infrastructure necessary to move crude oil, natural gas, and petroleum product.

The welded pipes are in high demand in the construction of long- distance pipelines due to its strength, reliability and cost effectiveness, especially the LSAW and SSAW large-diameter pipes. In addition, the replacement of the old pipeline networks in developed areas promotes the demand for welded pipes further owing to modernization of pipeline networks.

The other applications besides transportation of welded pipes are drilling operations, refinery facilities, and petrochemical facilities where fluid managementand structural reinforcement are necessary. With the increasing investments and quest to explore the other unconventional resources, the demand for welded pipes is increasing. In addition, the rising popularity of LNG (Liquefied Natural Gas) and cross-border pipeline development underscores the significance of welded pipes as an oil and gas supply chain support, which further supports their function as a major expansion driver in the welded pipe market worldwide.

Welded pipes are preferred with a major reason being cost-effectiveness. Welded pipes are less expensive as compared to seamless pipes: welded pipes are made by rolling metal sheets or strips, and welding the edges together instead of forming metal billets through energy-demanding methods such as extrusion or piercing. This manufacturing efficiency enables the manufacturers to sell a welded piping at reduced prices, particularly in large diameters or in long length; hence it becomes an attractive choice in case of a cost conscious project or in situations where enormous infrastructure changes are to be set up.

In addition to production, the welded pipes also cut down on the total project expenditure by easing the transportation, handling and installation of the pipes. They are available in standardized sizes and long lengths, which reduce multiplicity of joints or fittings and can reduce labor and material costs further. Welded pipes have gained much popularity among industries like construction, water supply and oil and gas industries, due to high reliability in their operations.

The Electric Resistance Welding (ERW)/High-Frequency Induction Welded Pipes are leading the welded pipe market with a 70.0% market share, owing to their effectiveness, accuracy, and affordability. They can be manufactured in different diameters and lengths at relatively cheaper costs as opposed to seamless and other forms of welded pipes, which enhances their market position. The popularity of the ERW pipes is also justified by its application in various industries such as oil and gas, water supply, construction, and automobile industries. They are suitable in applications of low to medium pressure, long-distance pipelines and structural purposes.

New technological developments have reinforced the market position of ERW pipes. Due to the automated welding line, non-destructive testing systems (NDT), and upgraded quality control systems, the integrity of the welds has increased, manufacturing defects have decreased, and the consistency in production has improved. Several new innovations in metallurgy have developed new high-strength, corrosion-resistant grades of ERW pipes, allowing application in more challenging environments such as offshore platforms and high salinity locations. Additionally, the sustainability aspect of ERW pipe manufacturing due to lower energy usage and reduced material wastage in comparison to seamless pipes aligns with global efforts toward eco-friendly industrial practices. This combination of cost-effectiveness, reliability, adaptability, and technological evolution ensures the dominance of ERW pipes in the global welded pipe market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia-Pacific leads the welded pipe market with a 51.1% market share due to the high rate of industrialization, urbanization, and infrastructure growth in various economies such as China, India, Japan, and South Korea. Increased energy and water supply systems and constructions have substantially rendered welded pipes to be consumed more in both - governmental and private sectors. China, specifically, is a big manufacturer and customer of welded pipes due to the large-scale oil and gas projects, power plants, and urban infrastructural developments. Similarly, the increasing industrial foundation and the efforts by the government in smart cities and water management systems in India lead to a high demand in the area.

The region has the advantage of large-scale manufacturing and export potential in addition to high demand for large-scale manufacturing and production cost due to the presence of large pipe manufacturers and feasible costs of production. The presence of raw material, development in technology of welding processes, and supportive government policies further boost the growth of the market in the region. The rising industrial operations, investments in infrastructure and low cost production makes Asia-Pacific the dominating region in the world welded pipe market.

Several companies engaged in the welded pipe industry are widening their telehealth services to include mental health support, chronic disease management, and preventive care. This includes offering virtual consultations, therapy sessions, and wellness programs.

AMERICAN Cast Iron Pipe Company, ArcelorMittal, Aurum Alloys & Engineering LLP, BESTAR STEEL CO., LTD, Dixie Southern, Fr. Jacob Söhne GmbH & Co. KG, JFE Steel Corporation, Mega Group of Companies, METINVEST, MORY INDUSTRIES INC., NIPPON STEEL CORPORATION, Nucor Skyline, Special Piping Materials, Steel Tubes India, Tenaris, and Tianjin Wanlei Steel Pipe Co. are some of the leading players operating in the global market.

Each of these players has been profiled in the Welded Pipe market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 116.1 Bn |

| Forecast Value in 2035 | US$ 175.1 Bn |

| CAGR | 3.9 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Tons for Volume |

| Welded Pipe Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global welded pipe market was valued at US$ 116.1 Bn in 2024

The global welded pipe industry is projected to reach at US$ 175.1 Bn by the end of 2035

Growth of the oil & gas industry, and affordability & cost-effectiveness are some of the factors driving the expansion of welded pipe market.

The CAGR is anticipated to be 3.9 % from 2025 to 2035

AMERICAN Cast Iron Pipe Company, ArcelorMittal, Aurum Alloys & Engineering LLP, BESTAR STEEL CO., LTD, Dixie Southern, Fr. Jacob Söhne GmbH & Co. KG, JFE Steel Corporation, Mega Group of Companies, METINVEST, MORY INDUSTRIES INC., NIPPON STEEL CORPORATION, Nucor Skyline, Special Piping Materials, Steel Tubes India, Tenaris, Tianjin Wanlei Steel Pipe Co. and others.

Table 1: Global Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 2: Global Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 3: Global Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 4: Global Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 5: Global Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 6: Global Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 7: Global Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 8: Global Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 9: Global Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 10: Global Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 11: Global Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 12: Global Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Region

Table 13: North America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 14: North America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 15: North America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 16: North America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 17: North America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 18: North America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 19: North America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 20: North America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 21: North America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 22: North America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 23: North America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 24: North America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 25: U.S. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 26: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 27: U.S. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 28: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 29: U.S. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 30: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 31: U.S. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 32: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 33: U.S. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 34: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 35: Canada Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 36: Canada Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 37: Canada Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 38: Canada Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 39: Canada Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 40: Canada Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 41: Canada Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 42: Canada Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 43: Canada Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 44: Canada Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 45: Europe Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 46: Europe Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 47: Europe Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 48: Europe Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 49: Europe Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 50: Europe Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 51: Europe Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 52: Europe Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 53: Europe Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 54: Europe Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 55: Europe Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 56: Europe Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 57: U.K. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 58: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 59: U.K. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 60: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 61: U.K. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 62: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 63: U.K. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 64: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 65: U.K. Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 66: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 67: Germany Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 68: Germany Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 69: Germany Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 70: Germany Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 71: Germany Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 72: Germany Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 73: Germany Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 74: Germany Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 75: Germany Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 76: Germany Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 77: France Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 78: France Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 79: France Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 80: France Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 81: France Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 82: France Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 83: France Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 84: France Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 85: France Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 86: France Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 87: Italy Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 88: Italy Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 89: Italy Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 90: Italy Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 91: Italy Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 92: Italy Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 93: Italy Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 94: Italy Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 95: Italy Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 96: Italy Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 97: Spain Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 98: Spain Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 99: Spain Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 100: Spain Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 101: Spain Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 102: Spain Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 103: Spain Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 104: Spain Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 105: Spain Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 106: Spain Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 107: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 108: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 109: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 110: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 111: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 112: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 113: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 114: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 115: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 116: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 117: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 118: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 119: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 120: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 121: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 122: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 123: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 124: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 125: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 126: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 127: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 128: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 129: China Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 130: China Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 131: China Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 132: China Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 133: China Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 134: China Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 135: China Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 136: China Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 137: China Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 138: China Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 139: India Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 140: India Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 141: India Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 142: India Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 143: India Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 144: India Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 145: India Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 146: India Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 147: India Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 148: India Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 149: Japan Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 150: Japan Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 151: Japan Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 152: Japan Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 153: Japan Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 154: Japan Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 155: Japan Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 156: Japan Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 157: Japan Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 158: Japan Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 159: Australia Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 160: Australia Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 161: Australia Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 162: Australia Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 163: Australia Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 164: Australia Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 165: Australia Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 166: Australia Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 167: Australia Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 168: Australia Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 169: South Korea Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 170: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 171: South Korea Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 172: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 173: South Korea Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 174: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 175: South Korea Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 176: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 177: South Korea Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 178: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 179: ASEAN Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 180: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 181: ASEAN Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 182: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 183: ASEAN Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 184: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 185: ASEAN Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 186: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 187: ASEAN Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 188: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 189: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 190: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 191: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 192: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 193: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 194: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 195: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 196: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 197: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 198: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 199: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 200: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 201: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 202: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 203: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 204: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 205: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 206: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 207: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 208: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 209: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 210: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 211: South Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 212: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 213: South Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 214: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 215: South Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 216: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 217: South Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 218: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 219: South Africa Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 220: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 221: Latin America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 222: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 223: Latin America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 224: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 225: Latin America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 226: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 227: Latin America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 228: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 229: Latin America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 230: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 231: Latin America Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 232: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 233: Brazil Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 234: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 235: Brazil Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 236: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 237: Brazil Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 238: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 239: Brazil Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 240: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 241: Brazil Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 242: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 243: Mexico Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 244: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 245: Mexico Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 246: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 247: Mexico Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 248: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 249: Mexico Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 250: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 251: Mexico Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 252: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 253: Argentina Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 254: Argentina Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Type

Table 255: Argentina Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 256: Argentina Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Material

Table 257: Argentina Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Diameter

Table 258: Argentina Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Diameter

Table 259: Argentina Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 260: Argentina Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By End-use Industry

Table 261: Argentina Welded Pipe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 262: Argentina Welded Pipe Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 2: Global Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 3: Global Welded Pipe Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2025 to 2035

Figure 4: Global Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 5: Global Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 6: Global Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 7: Global Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 8: Global Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 9: Global Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 10: Global Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 11: Global Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 12: Global Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 13: Global Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 14: Global Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 15: Global Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 16: Global Welded Pipe Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 17: Global Welded Pipe Market Volume (Thousand Tons) Projection, By Region 2020 to 2035

Figure 18: Global Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 19: North America Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 20: North America Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 21: North America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 22: North America Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 23: North America Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 24: North America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 25: North America Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 26: North America Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 27: North America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 28: North America Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 29: North America Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 30: North America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 31: North America Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 32: North America Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 33: North America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 34: North America Welded Pipe Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 35: North America Welded Pipe Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 36: North America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 37: U.S. Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 38: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 39: U.S. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 40: U.S. Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 41: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 42: U.S. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 43: U.S. Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 44: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 45: U.S. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 46: U.S. Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 47: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 48: U.S. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 49: U.S. Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 50: U.S. Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 51: U.S. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 52: Canada Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 53: Canada Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 54: Canada Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 55: Canada Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 56: Canada Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 57: Canada Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 58: Canada Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 59: Canada Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 60: Canada Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 61: Canada Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 62: Canada Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 63: Canada Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 64: Canada Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Canada Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 66: Canada Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 68: Europe Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 69: Europe Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 70: Europe Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 71: Europe Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 72: Europe Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 73: Europe Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 74: Europe Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 75: Europe Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 76: Europe Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 77: Europe Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 78: Europe Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 79: Europe Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Europe Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 81: Europe Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Europe Welded Pipe Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 83: Europe Welded Pipe Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 84: Europe Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 85: U.K. Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 86: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 87: U.K. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 88: U.K. Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 89: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 90: U.K. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 91: U.K. Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 92: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 93: U.K. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 94: U.K. Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 95: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 96: U.K. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 97: U.K. Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 98: U.K. Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 99: U.K. Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 100: Germany Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 101: Germany Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 102: Germany Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 103: Germany Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 104: Germany Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 105: Germany Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 106: Germany Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 107: Germany Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 108: Germany Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 109: Germany Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 110: Germany Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 111: Germany Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 112: Germany Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 113: Germany Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 114: Germany Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 115: France Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 116: France Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 117: France Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 118: France Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 119: France Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 120: France Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 121: France Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 122: France Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 123: France Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 124: France Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 125: France Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 126: France Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 127: France Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: France Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 129: France Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: Italy Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 131: Italy Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 132: Italy Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 133: Italy Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 134: Italy Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 135: Italy Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 136: Italy Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 137: Italy Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 138: Italy Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 139: Italy Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 140: Italy Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 141: Italy Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 142: Italy Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 143: Italy Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 144: Italy Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 145: Spain Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 146: Spain Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 147: Spain Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 148: Spain Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 149: Spain Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 150: Spain Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 151: Spain Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 152: Spain Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 153: Spain Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 154: Spain Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 155: Spain Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 156: Spain Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 157: Spain Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 158: Spain Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 159: Spain Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 160: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 161: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 162: The Netherlands Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 163: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 164: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 165: The Netherlands Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 166: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 167: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 168: The Netherlands Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 169: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 170: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 171: The Netherlands Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 172: The Netherlands Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 173: The Netherlands Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 174: The Netherlands Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 175: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 176: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 177: Asia Pacific Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 178: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 179: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 180: Asia Pacific Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 181: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 182: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 183: Asia Pacific Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 184: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 185: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 186: Asia Pacific Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 187: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 189: Asia Pacific Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 190: Asia Pacific Welded Pipe Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 191: Asia Pacific Welded Pipe Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 192: Asia Pacific Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 193: China Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 194: China Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 195: China Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 196: China Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 197: China Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 198: China Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 199: China Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 200: China Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 201: China Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 202: China Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 203: China Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 204: China Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 205: China Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 206: China Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 207: China Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 208: India Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 209: India Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 210: India Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 211: India Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 212: India Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 213: India Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 214: India Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 215: India Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 216: India Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 217: India Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 218: India Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 219: India Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 220: India Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 221: India Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 222: India Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 223: Japan Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 224: Japan Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 225: Japan Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 226: Japan Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 227: Japan Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 228: Japan Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 229: Japan Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 230: Japan Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 231: Japan Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 232: Japan Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 233: Japan Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 234: Japan Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 235: Japan Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 236: Japan Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 237: Japan Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 238: Australia Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 239: Australia Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 240: Australia Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 241: Australia Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 242: Australia Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 243: Australia Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 244: Australia Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 245: Australia Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 246: Australia Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 247: Australia Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 248: Australia Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 249: Australia Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 250: Australia Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 251: Australia Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 252: Australia Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 253: South Korea Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 254: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 255: South Korea Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 256: South Korea Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 257: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 258: South Korea Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 259: South Korea Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 260: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 261: South Korea Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 262: South Korea Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 263: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 264: South Korea Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 265: South Korea Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Korea Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Korea Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: ASEAN Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 269: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 270: ASEAN Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 271: ASEAN Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 272: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 273: ASEAN Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 274: ASEAN Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 275: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 276: ASEAN Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 277: ASEAN Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 278: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 279: ASEAN Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 280: ASEAN Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 281: ASEAN Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 282: ASEAN Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 283: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 284: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 285: Middle East & Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 286: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 287: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 288: Middle East & Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 289: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 290: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 291: Middle East & Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 292: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 293: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 294: Middle East & Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 295: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 296: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 297: Middle East & Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 298: Middle East & Africa Welded Pipe Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 299: Middle East & Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 300: Middle East & Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 301: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 302: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 303: GCC Countries Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 304: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 305: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 306: GCC Countries Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 307: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 308: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 309: GCC Countries Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 310: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 311: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 312: GCC Countries Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 313: GCC Countries Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 314: GCC Countries Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 315: GCC Countries Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 316: South Africa Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 317: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 318: South Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 319: South Africa Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 320: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 321: South Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 322: South Africa Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 323: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 324: South Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 325: South Africa Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 326: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 327: South Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 328: South Africa Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 329: South Africa Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 330: South Africa Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 331: Latin America Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 332: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 333: Latin America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 334: Latin America Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 335: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 336: Latin America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 337: Latin America Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 338: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 339: Latin America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 340: Latin America Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 341: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 342: Latin America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 343: Latin America Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 344: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 345: Latin America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 346: Latin America Welded Pipe Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 347: Latin America Welded Pipe Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 348: Latin America Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 349: Brazil Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 350: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 351: Brazil Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 352: Brazil Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 353: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 354: Brazil Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 355: Brazil Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 356: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 357: Brazil Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 358: Brazil Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 359: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 360: Brazil Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 361: Brazil Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 362: Brazil Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 363: Brazil Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 364: Mexico Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 365: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035

Figure 366: Mexico Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 367: Mexico Welded Pipe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 368: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, By Material 2020 to 2035

Figure 369: Mexico Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 370: Mexico Welded Pipe Market Value (US$ Bn) Projection, By Diameter 2020 to 2035

Figure 371: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, By Diameter 2020 to 2035

Figure 372: Mexico Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Diameter 2025 to 2035

Figure 373: Mexico Welded Pipe Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 374: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, By End-use Industry 2020 to 2035

Figure 375: Mexico Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 376: Mexico Welded Pipe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 377: Mexico Welded Pipe Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 378: Mexico Welded Pipe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 379: Argentina Welded Pipe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 380: Argentina Welded Pipe Market Volume (Thousand Tons) Projection, By Type 2020 to 2035