Reports

Reports

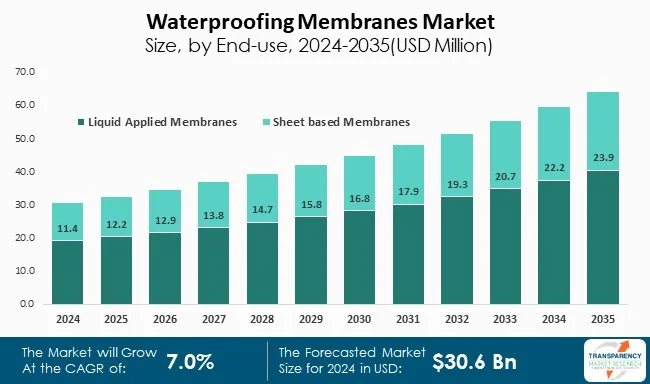

The global waterproofing membranes market is witnessing a strong growth, which is due to the growth of infrastructure, urban expansion, and increasing interest in construction sector. At the moment, emerging economies are investing in both government agencies and private companies in commercial and housing projects, which, in turn, increases the demand for advanced waterproofing systems.

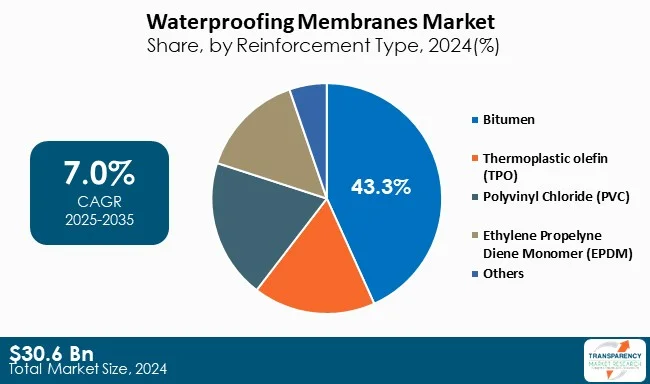

Bituminous membranes continue to hold the largest market share due to their cost-efficiency and easy installation, while polymer reflected and fluid membranes get traction due to their better performance and environmentally-friendly properties.

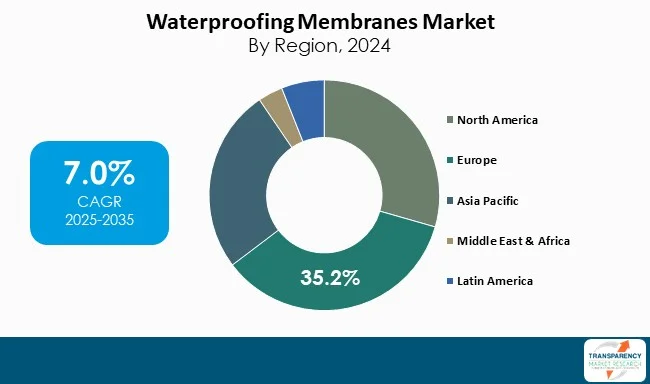

Green building certification and strict environmental regulations in the market lead to solvent -free, low VOC, and recycled membrane products. In addition, increase in climate -related events such as floods and severe rainfall motivate stakeholders to seek stronger waterproofing solutions, especially exposed to floods in coastal areas. Over the upcoming years, the waterproofing membranes industry is expected to witness a stable CAGR, with the Asia Pacific experiencing remarkable expansion followed by North America and Europe for great infrastructure and urban housing needs.

Strategic partnerships, innovation in product offerings, and long -term performance will be central to competitive advantage. Large players are also investing in technologies to monitor the application and future maintenance, indicating a change to technology-based and high value services. As a result, the waterproofing membrane market is set to develop a more integrated value chain as a preferential stability.

Waterproofing membranes comprising materials such as bituminous, PVC, TPO, in addition to liquid-applied and spray-on membranes, are engineered to improve structural sturdiness, safety, and durability.

As urbanization expands, investments in smart town initiatives upward thrust, and there is an expanded emphasis on weather-resilient production, the demand for progressive waterproofing solutions is rising. Additionally, regulatory restrain for sustainable and green construction methods are majorly impacting the waterproofing membranes market demand.

| Attribute | Detail |

|---|---|

| Waterproofing Membranes Market Drivers |

|

The global waterproofing membranes market is experienced by rapid urbanization and infrastructure development in areas such as the Asia Pacific, Middle East, and Latin America. Emerging economies such as India, China, Indonesia, and Brazil attract investments in commercial, housing, and industrial infrastructure to accommodate the expansion of the urban population. Civil engineering projects, including metro & railway systems, highways, residential cloud scrapers and industrial complexes, require reliable and efficient waterproofing systems for long -term performances.

Waterproofing membrane plays an important role in stopping water/moisture from entering buildings, causing structural decay, erosion of reinforcement, and damage to the interior. The demand for high quality waterproofing has increased dramatically, focusing from both - governments and private sectors on growing construction sector.

In addition, infrastructure projects across Asia and Africa have encouraged the use of more sustainable building materials by using building-operate-transfer (Bot) and Public-Private Partnership (PPP) Framework, which has become a standard component in waterproofing membrane design specifications. Increase in infrastructure initiative not only increases the demand for waterproofing, but also promotes local innovation and production.

As urban areas proceed, the need for strong, energy-efficient, and climate-flexible infrastructure will continue to continue the waterproof membrane area. The industry utilizes this development by increasing regional appearance, by creating strategic partnerships and building cost-effective, environmentally-friendly solutions that correspond to local climate and government requirements.

Construction regulations such as International Building Code (IBC), National Building Code (NBC), and LEED (Leadership in Energy and Environmental Design) and BREEEAM (Building Research Installation Environmental Assessment METHOD) such as energy efficiency systems, Special Controls, Special Contracts, Special Contracts. I exist. Compliance with these rules helps prevent water infiltration, mold growth, and subsequent indoor air quality and insulation performance.

In addition, when the global construction industry moves toward durable and environmentally-friendly practice, the specification of the waterproofing membrane increases due to focus on building's efficiency. Liquid membrane, synthetic polymer membrane (such as TPO and EPDM), and self-learning membranes provide better sealing, insulation and environmental flexibility than traditional materials. These technologies facilitate the integration of green roof systems.

Governments in both - Europe and North America encourage and implement taxes for environmentally-friendly construction practices, which has motivated builders and contractors to choose the membrane that meets both - waterproofing and environmental norms.

Bitumen is one of the top materials in the waterproofing membrane industry, which is due to its stability, cost-effectiveness, and proven better performance under different climatic conditions. It is widely used in both - residential and commercial construction for applications such as roofs, basements and bridges. Bituminous offers the membrane, whether it is torch-layer or self-catering, excellent adhesion, flexibility and resistance, to water and chemicals. Their installed track entries and direct installations make them a favorite option between developers and contractors.

While polymer-based alternatives have emerged, bitumen remains prominent, especially in contexts where costs are an important factor, especially in large-scale infrastructure projects in Asia-Pacific, the Middle East, and Latin American regions.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Europe dominates the global waterproofing membranes market, which is inspired by strict building rules, advanced construction techniques, and a significant focus on stability. Economies such as Germany, United Kingdom, and France call for energy-efficient and environmentally-friendly production solutions that use high-performance waterproofing systems. Along with the instructions from the EU regarding water management and energy savings, renewal of old infrastructure and compliance also increases demand.

North America occupies the second largest market share, supported by continuous investment in housing and commercial construction, especially in the U.S. and Canada. Awareness of structural problems related to moisture in the region and increasing use of fluid and polymer -powered membranes are increasing awareness, due to their excellent shelf life and easy use. In waterproofing technologies, more climate flexibility and progress are estimated to further strengthen the North American market.

In waterproofing membranes market, BASF SE, Sika AG, Pidilite Industries, and Dow Inc. are the major companies, which emphasize innovation, stability and strategic development. These companies are dedicated to creating environmentally-friendly high-performance membranes designed to meet the requirements for modern construction. Companies such as Carlisle, GAF and Living prioritize roof solutions, while Solmax and Cumper systems are categorized as geo-synthetic technologies. A general trend includes strategic mergers, investment in research and development and expansion in new markets. Increasing demand for improvement of green buildings and infrastructure is to encourage companies to offer integrated waterproofing systems that provide greater durability, fast installation, and low environmental effects.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 30.6 Bn |

| Market Forecast Value in 2035 | US$ 64.4 Bn |

| Growth Rate (CAGR) | 7.0% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value & Mn Sq. Meters for Volume |

| Market Analysis | It includes cross-segment analysis at the Europe as well as Country level. Furthermore, the qualitative analysis includes drivers, restraints, Fabric Reinforcements Market for Liquid-applied Roofing opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Material

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 30.6 Bn in 2024

The waterproofing membranes industry is expected to grow at a CAGR of 7.0% from 2025 to 2035

Rapid urbanization and infrastructure development in emerging economies and stringent building codes and sustainability standards

Bitumen is prominent reinforcement type segment and its value is anticipated to grow at a CAGR of 7.9% during the forecast period

Europe was the most lucrative region in 2024

BASF SE, Pidilite Industries Ltd., Carlisle Coatings & Waterproofing, Fosroc International Ltd, Dow Inc., SIKA AG, GAF Materials Corporation, Kemper System America, Inc., Solmax, Paul Bauder GmbH & Co. KG are the major players in the waterproofing membranes market

Table 1 Global Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 2 Global Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 3 Global Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 4 Global Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 5 Global Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 6 Global Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 7 Global Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Region, 2020 to 2035

Table 8 Global Waterproofing Membranes Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 10 North America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 11 North America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 12 North America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 13 North America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 14 North America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15 North America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Country, 2020 to 2035

Table 16 North America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 USA Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 18 USA Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 19 USA Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 20 USA Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 21 USA Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 22 USA Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 23 Canada Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 24 Canada Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 25 Canada Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 26 Canada Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 27 Canada Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 28 Canada Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 29 Europe Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 30 Europe Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 31 Europe Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 32 Europe Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 33 Europe Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 34 Europe Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35 Europe Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Waterproofing Membranes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 38 Germany Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 39 Germany Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 40 Germany Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 41 Germany Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 42 Germany Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 France Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 44 France Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 45 France Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 46 France Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 47 France Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 48 France Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 49 UK Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 50 UK Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 51 UK Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 52 UK Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 53 UK Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 54 UK Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55 Italy Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 56 Italy Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 57 Italy Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 58 Italy Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 59 Italy Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 60 Italy Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 Spain Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 62 Spain Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 63 Spain Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 64 Spain Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 65 Spain Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 66 Spain Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 67 Russia & CIS Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 68 Russia & CIS Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 69 Russia & CIS Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 70 Russia & CIS Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 71 Russia & CIS Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 72 Russia & CIS Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 73 Rest of Europe Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 74 Rest of Europe Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 75 Rest of Europe Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 76 Rest of Europe Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 77 Rest of Europe Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 78 Rest of Europe Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 79 Asia Pacific Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 80 Asia Pacific Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 81 Asia Pacific Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 82 Asia Pacific Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 83 Asia Pacific Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 84 Asia Pacific Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 Asia Pacific Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Waterproofing Membranes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 88 China Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material 2020 to 2035

Table 89 China Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 90 China Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 91 China Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 92 China Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Japan Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 94 Japan Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 95 Japan Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 96 Japan Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 97 Japan Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 98 Japan Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 99 India Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 100 India Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 101 India Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 102 India Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 103 India Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 104 India Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 India Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 106 India Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 107 ASEAN Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 108 ASEAN Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 109 ASEAN Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 110 ASEAN Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 111 ASEAN Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 112 ASEAN Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 113 Rest of Asia Pacific Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 114 Rest of Asia Pacific Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 115 Rest of Asia Pacific Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 116 Rest of Asia Pacific Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 117 Rest of Asia Pacific Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 118 Rest of Asia Pacific Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 119 Latin America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 120 Latin America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 121 Latin America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 122 Latin America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 123 Latin America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 124 Latin America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Latin America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 128 Brazil Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 129 Brazil Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 130 Brazil Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 131 Brazil Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 132 Brazil Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 133 Mexico Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 134 Mexico Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 135 Mexico Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 136 Mexico Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 137 Mexico Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 138 Mexico Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 139 Rest of Latin America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 140 Rest of Latin America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 141 Rest of Latin America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 142 Rest of Latin America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 143 Rest of Latin America Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 144 Rest of Latin America Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 145 Middle East & Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 146 Middle East & Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 147 Middle East & Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 148 Middle East & Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 149 Middle East & Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 150 Middle East & Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 151 Middle East & Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 154 GCC Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 155 GCC Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 156 GCC Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 157 GCC Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 158 GCC Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 159 South Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 160 South Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 161 South Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 162 South Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 163 South Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 164 South Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 165 Rest of Middle East & Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Material, 2020 to 2035

Table 166 Rest of Middle East & Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 167 Rest of Middle East & Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Type, 2020 to 2035

Table 168 Rest of Middle East & Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 169 Rest of Middle East & Africa Waterproofing Membranes Market Volume (Mn Sq. Meters) Forecast, by Application, 2020 to 2035

Table 170 Rest of Middle East & Africa Waterproofing Membranes Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Figure 1 Global Waterproofing Membranes Market Volume Share Analysis, by Material, 2024, 2027, and 2035

Figure 2 Global Waterproofing Membranes Market Attractiveness, by Material

Figure 3 Global Waterproofing Membranes Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 4 Global Waterproofing Membranes Market Attractiveness, by Type

Figure 5 Global Waterproofing Membranes Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 6 Global Waterproofing Membranes Market Attractiveness, by Application

Figure 7 Global Waterproofing Membranes Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global Waterproofing Membranes Market Attractiveness, by Region

Figure 9 North America Waterproofing Membranes Market Volume Share Analysis, by Material, 2024, 2027, and 2035

Figure 10 North America Waterproofing Membranes Market Attractiveness, by Material

Figure 11 North America Waterproofing Membranes Market Attractiveness, by Material

Figure 12 North America Waterproofing Membranes Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 13 North America Waterproofing Membranes Market Attractiveness, by Type

Figure 14 North America Waterproofing Membranes Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 15 North America Waterproofing Membranes Market Attractiveness, by Application

Figure 16 North America Waterproofing Membranes Market Attractiveness, by Country and Sub-region

Figure 17 Europe Waterproofing Membranes Market Volume Share Analysis, by Material, 2024, 2027, and 2035

Figure 18 Europe Waterproofing Membranes Market Attractiveness, by Material

Figure 19 Europe Waterproofing Membranes Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 20 Europe Waterproofing Membranes Market Attractiveness, by Type

Figure 21 Europe Waterproofing Membranes Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 22 Europe Waterproofing Membranes Market Attractiveness, by Application

Figure 23 Europe Waterproofing Membranes Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe Waterproofing Membranes Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Waterproofing Membranes Market Volume Share Analysis, by Material, 2024, 2027, and 2035

Figure 26 Asia Pacific Waterproofing Membranes Market Attractiveness, by Material

Figure 27 Asia Pacific Waterproofing Membranes Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 28 Asia Pacific Waterproofing Membranes Market Attractiveness, by Type

Figure 29 Asia Pacific Waterproofing Membranes Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 30 Asia Pacific Waterproofing Membranes Market Attractiveness, by Application

Figure 31 Asia Pacific Waterproofing Membranes Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific Waterproofing Membranes Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Waterproofing Membranes Market Volume Share Analysis, by Material, 2024, 2027, and 2035

Figure 34 Latin America Waterproofing Membranes Market Attractiveness, by Material

Figure 35 Latin America Waterproofing Membranes Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 36 Latin America Waterproofing Membranes Market Attractiveness, by Type

Figure 37 Latin America Waterproofing Membranes Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 38 Latin America Waterproofing Membranes Market Attractiveness, by Application

Figure 39 Latin America Waterproofing Membranes Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America Waterproofing Membranes Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Waterproofing Membranes Market Volume Share Analysis, by Material, 2024, 2027, and 2035

Figure 42 Middle East & Africa Waterproofing Membranes Market Attractiveness, by Material

Figure 43 Middle East & Africa Waterproofing Membranes Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 44 Middle East & Africa Waterproofing Membranes Market Attractiveness, by Type

Figure 45 Middle East & Africa Waterproofing Membranes Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 46 Middle East & Africa Waterproofing Membranes Market Attractiveness, by Application

Figure 47 Middle East & Africa Waterproofing Membranes Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa Waterproofing Membranes Market Attractiveness, by Country and Sub-region