Reports

Reports

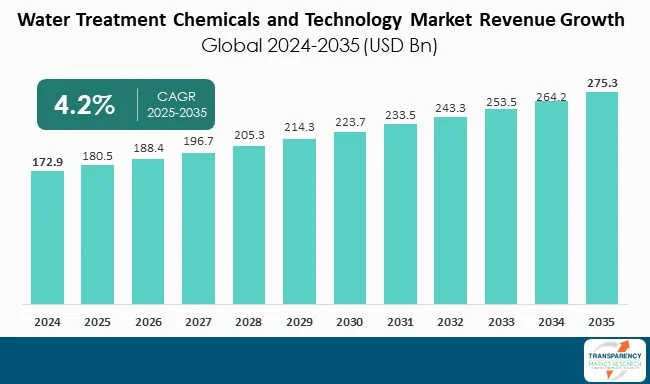

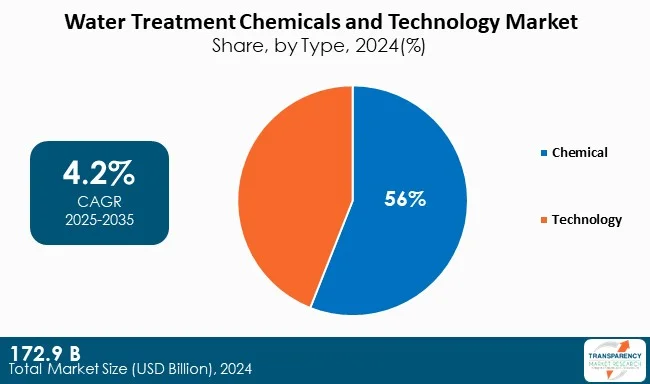

The water treatment chemicals and technology market is anticipated to witness a CAGR of 4.2 % during the forecast period due to increase in water scarcity and rise in demand for clean water from various end-use sectors. Various countries are investing significantly in providing potable water to the urban and rural population, which require water treatment solutions.

Strict environmental regulations and industrial compliance mandates are forcing various industries to adopt water treatment chemicals and technologies for water treatment. Industries face fines if they do not meet the required percentage of waste water treatment before discharge. Some of the water treatment chemicals that help in optimizing water quality include biocides, corrosion inhibitors, coagulants, disinfectants, flocculants, and scale inhibitors, among others.

Reverse osmosis, UV disinfection, ion exchange, membrane filtration technologies are being implemented around the world for water treatment and desalination. Raw water treatment is gaining significance in commercial, industrial, and municipal sectors. Asia Pacific leads this market, as populous countries such as India and China are investing significantly in developing infrastructure for waste water treatment.

The water treatment chemicals and technologies solutions help provide clean and safe water for industrial, municipal, and commercial purposes and aid in meeting regulatory criteria and sustainability goals. Water treatment chemicals include coagulants, flocculants, corrosion inhibitors, scale inhibitors, biocides, and disinfectants, which are critical to improve the quality of water, protect facilities and infrastructure, and improve productivity value.

Additionally, new technologies such as membrane filtration, ion exchange, UV disinfection, and data monitoring and management systems are transforming the sector in ways that will allow water treatment companies to trustably, automatically, and sustainably provide clean and safe water more cost-effectively. Water treatment is evolving and companies are rethinking how to treat water with an urgent response regarding increasing water scarcity, climate change action, environmental regulation, and the need for more resource-efficient businesses.

| Attribute | Detail |

|---|---|

| Water Treatment Chemicals and Technology Market Drivers |

|

The continued growth in the water treatment chemicals and technologies sector is primarily driven by the ongoing global issue of water scarcity and the increasing safe/clear water demand in the municipal, industrial, and agricultural sectors. According to the United Nations, global demand for water is projected to exceed supplies by 40% by 2030, meaning the need for advanced treatment solutions cannot come soon enough.

Industrial operations are continuing to face increased pressure to reduce operational consumption, recycle wastewater, and adhere to more stringent drinking water quality standards, and industrial manufacturing operations account for almost 20% of global water withdrawals for freshwater.

Municipal utilities across the globe are spending billions of dollars to implement advanced infrastructure such as membrane filtration and point-of-use disinfection applications to anticipate and respond to accelerating urban demand for water (expected to exceed a global urban population of 68.0% by 2050). In India, approximately 192 million households will see the rollout of water treatment projects through the Government of India's Jal Jeevan Mission, and yet this offers a wealth of opportunity for chemical and technology suppliers alike.

Regulations are established worldwide to require higher levels of pollutant removal and a sustainable approach to wastewater, leading to an increased amount of available advanced treatment chemicals and technologies.

The U.S. Environmental Protection Agency (EPA) Clean Water Act regulates over 65 toxic pollutants, which require that industrial facilities add to the treatment roster coagulants, flocculants, corrosion inhibitors, and disinfectants. Likewise, the EU Urban Wastewater Treatment Directive mandates municipal wastewater treatment to function with 90-95% pollutant removal efficiency, promoting the use of membrane filtration, reverse osmosis, and UV disinfection technologies.

The consequences of non-compliance with regulations, especially within high-impact sectors, can add up quickly. Non-compliance can lead to penalties assessed for millions of dollars each year in the oil and gas segments, food and beverage and in chemical manufacturing. Relationships have been developed between the requirement to control water use and to manage the treatment of water as a financial instrument. The Water Ten Plan in China is one example, controlling the treatment of nearly 70% of industrial wastewater prior to discharge, generating increased demand for the use of water treatment chemicals, such as biocides and scale inhibitors, and to adopt zero-liquid discharge (ZLD) systems.

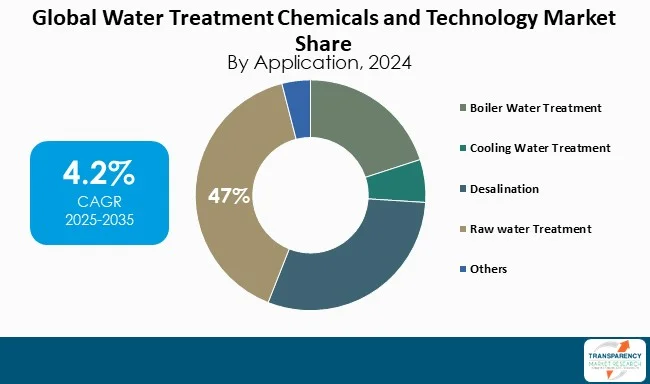

Raw water treatment is the largest application segment within the global water treatment chemicals and technology market as it is where water treatment begins in every industrial, municipal, and commercial application. Although benefits are derived in each sector, water must be treated before using it in power generation, food and beverage, pharmaceutical applications, or for municipalities to distribute.

At the raw water treatment stage, water must be treated to remove suspended solids, microorganisms, dissolved salts, chemicals, and the other impurities. As water treatment is performed prior to the benefit being derived, treating raw water enables desirable water quality, thereby preventing expensive downstream equipment failings, such as scaling, corrosion, and fouling.

Within the power generation and manufacturing sectors, where significant volumes of water will be used, companies routinely use coagulants, flocculants, disinfectants, and a variety of filtering techniques and technologies while in use. Furthermore, regulations require there to be clean, safe water for human consumption and industrial uses. As efficiencies, compliance, and sustainability become more important within the industry, raw water treatment will always be the essential starting point in the water treatment chemicals and technology value chain.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific is the leading region in the Global Market |

The Asia-Pacific region continues to be the leader as the region industrializes and urbanizes rapidly with an increased demand for water from municipal sources. Countries like China and India, the two most populated countries in the world, are also making billions of dollars’ allocations toward anaerobic and aerobic wastewater treatment, sewage treatment, and wastewater treatment plants.

China has launched the Water Ten Plan for 70% industrial waste treatment by 2020, which creates a strong demand for coagulants, flocculants, and membrane technologies to treat industrial wastewater. Singapore's NEWater program is also heavily utilizing membrane/disinfection technologies to supply 40% of its water needs. ABA has also noted Australia's feature on Desalination Projects, which relies heavily on antiscalants, biocides, and reverse osmosis technologies such as the Sydney Desalination plant for 250,000m³/day, in order to maintain operations at times of drought and shortage.

The North America’s market has a significant size with strong backing from strict environmental regulations such as the U.S. EPA’s Clean Water Act that regulates more than 65 toxic pollutants. Also, North America’s strong industrial base in oil & gas, power generation, and food processing drives the adoption of advanced treatment technologies and specialty chemicals. The Europe’s market is driven by stringent and evolving EU directives such as the Urban Wastewater Treatment Directive that mandates 90–95% pollutant removal efficiency, thereby making Europe a center for advanced and sustainable water treatment solutions.

Ecolab is a global leader in the area of water treatment chemicals and solutions, providing advanced formulations that enhance efficiencies, safety, and sustainability in its product offerings across a variety of sectors around the world. Ecolab supplies scale inhibitors, corrosion inhibitors, disinfectants, and smart monitoring tools that help reduce water usage, providing value & meeting regulatory requirements in the sectors of food and beverage, healthcare, energy and manufacturing.

Veolia Water Technologies is a major player in the global water treatment market, supplying integrated solutions with advanced technology and specialty chemicals for municipal and industrial applications. Veolia Water Technologies is specializing in desalination, wastewater reuse, and zero-liquid discharge technologies, and is actively providing marketplace solutions to the world’s greatest water scarcity and sustainability challenges. While leveraging innovation and new technologies like membrane processing and digital monitoring (e.g. cloud-connected water monitoring and smart treatment chemicals), Veolia is helping clients maintain compliance with increasing regulatory currency, while keeping a keen focus on managing operational excellence and environmental stewardship.

AkzoNobel, Dow Water & Process Solutions, BASF SE, Emerson, Ashland Hercules, GE Tech, KSB Corporation, Grundfos, Kirloskar Ebara, Pentair, KITZ Corp, Flowserve Corporation, Ecolab, SUEZ Water Technologies & Solutions, Kemira, Kurita Water Industries Ltd, Solenis, Ion Exchange India Ltd, SNF Group, Ion Exchange India Ltd., SNF Group, BWA Water Additives, and DuPont Water Solutions are some other players in the water treatment chemicals and technology market.

Each of these players has been profiled in the global water treatment chemicals and technology market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 172.9 Bn |

| Market Forecast Value in 2035 | US$ 275.3 Bn |

| Growth Rate (CAGR) | 4.2% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Water Treatment Chemicals and Technology market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The water treatment chemicals and technology market was valued at US$ 172.9 Bn in 2024

The water treatment chemicals and technology industry is expected to grow at a CAGR of 4.2% from 2025 to 2035

Rising global water scarcity and growing demand for clean water and stringent environmental regulations and industrial compliance requirements

Raw water treatment was the largest application segment

Asia Pacific was the most lucrative region in 2024

Ecolab, Veolia Water Technologies, AkzoNobel, Dow Water & Process Solutions, BASF SE, Emerson, Ashland Hercules, GE Tech, KSB Corporation, Grundfos, Kirloskar Ebara, Pentair, KITZ Corp, Flowserve Corporation, Ecolab, SUEZ Water Technologies & Solutions, Kemira, Kurita Water Industries Ltd, Solenis, Ion Exchange India Ltd, SNF Group, Ion Exchange India Ltd, SNF Group, BWA Water Additives, and DuPont Water Solutions Corporation are the major players in the water treatment chemicals and technology

Table 1 Global Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 2 Global Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 3 Global Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use, 2020 to 2035

Table 4 Global Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 5 North America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 6 North America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 7 North America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use, 2020 to 2035

Table 8 North America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 9 U.S. Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 10 U.S. Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 11 U.S. Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use, 2020 to 2035

Table 12 Canada Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 13 Canada Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14 Canada Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 15 Europe Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 16 Europe Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 17 Europe Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 18 Europe Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 19 Germany Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 20 Germany Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 Germany Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 22 France Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 23 France Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 24 France Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 25 U.K. Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 26 U.K. Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 U.K. Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 28 Italy Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 29 Italy Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 30 Italy Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 31 Spain Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 32 Spain Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 Spain Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 34 Russia & CIS Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 35 Russia & CIS Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 36 Russia & CIS Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 37 Rest of Europe Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 38 Rest of Europe Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39 Rest of Europe Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 40 Asia Pacific Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 41 Asia Pacific Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 42 Asia Pacific Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 43 Asia Pacific Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 44 China Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 45 China Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 46 China Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 47 Japan Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 48 Japan Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 49 Japan Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 50 India Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 51 India Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 52 India Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 53 ASEAN Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 54 ASEAN Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55 ASEAN Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 56 Rest of Asia Pacific Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 57 Rest of Asia Pacific Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 58 Rest of Asia Pacific Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 59 Latin America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 60 Latin America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 Latin America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 62 Latin America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 63 Brazil Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 64 Brazil Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Brazil Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 66 Mexico Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 67 Mexico Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68 Mexico Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 69 Rest of Latin America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 70 Rest of Latin America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 71 Rest of Latin America Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 72 Middle East & Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 73 Middle East & Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 74 Middle East & Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 75 Middle East & Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 76 GCC Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 77 GCC Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 78 GCC Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 79 South Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 80 South Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 81 South Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Table 82 Rest of Middle East & Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 83 Rest of Middle East & Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 84 Rest of Middle East & Africa Water Treatment Chemicals and Technology Market Value (US$ Bn) Forecast, by End-Use 2020 to 2035

Figure 1 Global Water Treatment Chemicals and Technology Market Value Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global Water Treatment Chemicals and Technology Market Attractiveness, by Type

Figure 3 Global Water Treatment Chemicals and Technology Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 Global Water Treatment Chemicals and Technology Market Attractiveness, by Application

Figure 5 Global Water Treatment Chemicals and Technology Market Value Share Analysis, by End-Use, 2024, 2028, and 2035

Figure 6 Global Water Treatment Chemicals and Technology Market Attractiveness, by End-Use

Figure 7 Global Water Treatment Chemicals and Technology Market Value Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Water Treatment Chemicals and Technology Market Attractiveness, by Region

Figure 9 North America Water Treatment Chemicals and Technology Market Value Share Analysis, by Type, 2024, 2028, and 2035

Figure 10 North America Water Treatment Chemicals and Technology Market Attractiveness, by Type

Figure 11 North America Water Treatment Chemicals and Technology Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 12 North America Water Treatment Chemicals and Technology Market Attractiveness, by Application

Figure 13 North America Water Treatment Chemicals and Technology Market Value Share Analysis, by End-Use, 2024, 2028, and 2035

Figure 14 North America Water Treatment Chemicals and Technology Market Attractiveness, by End-Use

Figure 15 North America Water Treatment Chemicals and Technology Market Attractiveness, by Country and Sub-region

Figure 16 Europe Water Treatment Chemicals and Technology Market Value Share Analysis, by Type, 2024, 2028, and 2035

Figure 17 Europe Water Treatment Chemicals and Technology Market Attractiveness, by Type

Figure 18 Europe Water Treatment Chemicals and Technology Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 19 Europe Water Treatment Chemicals and Technology Market Attractiveness, by Application

Figure 20 Europe Water Treatment Chemicals and Technology Market Value Share Analysis, by End-Use, 2024, 2028, and 2035

Figure 21 Europe Water Treatment Chemicals and Technology Market Attractiveness, by End-Use

Figure 22 Europe Water Treatment Chemicals and Technology Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 23 Europe Water Treatment Chemicals and Technology Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Water Treatment Chemicals and Technology Market Value Share Analysis, by Type, 2024, 2028, and 2035

Figure 25 Asia Pacific Water Treatment Chemicals and Technology Market Attractiveness, by Type

Figure 26 Asia Pacific Water Treatment Chemicals and Technology Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 27 Asia Pacific Water Treatment Chemicals and Technology Market Attractiveness, by Application

Figure 28 Asia Pacific Water Treatment Chemicals and Technology Market Value Share Analysis, by End-Use, 2024, 2028, and 2035

Figure 29 Asia Pacific Water Treatment Chemicals and Technology Market Attractiveness, by End-Use

Figure 30 Asia Pacific Water Treatment Chemicals and Technology Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 31 Asia Pacific Water Treatment Chemicals and Technology Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Water Treatment Chemicals and Technology Market Value Share Analysis, by Type, 2024, 2028, and 2035

Figure 33 Latin America Water Treatment Chemicals and Technology Market Attractiveness, by Type

Figure 34 Latin America Water Treatment Chemicals and Technology Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 35 Latin America Water Treatment Chemicals and Technology Market Attractiveness, by Application

Figure 36 Latin America Water Treatment Chemicals and Technology Market Value Share Analysis, by End-Use, 2024, 2028, and 2035

Figure 37 Latin America Water Treatment Chemicals and Technology Market Attractiveness, by End-Use

Figure 38 Latin America Water Treatment Chemicals and Technology Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Latin America Water Treatment Chemicals and Technology Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Water Treatment Chemicals and Technology Market Value Share Analysis, by Type, 2024, 2028, and 2035

Figure 41 Middle East & Africa Water Treatment Chemicals and Technology Market Attractiveness, by Type

Figure 42 Middle East & Africa Water Treatment Chemicals and Technology Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 43 Middle East & Africa Water Treatment Chemicals and Technology Market Attractiveness, by Application

Figure 44 Middle East & Africa Water Treatment Chemicals and Technology Market Value Share Analysis, by End-Use, 2024, 2028, and 2035

Figure 45 Middle East & Africa Water Treatment Chemicals and Technology Market Attractiveness, by End-Use

Figure 46 Middle East & Africa Water Treatment Chemicals and Technology Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Middle East & Africa Water Treatment Chemicals and Technology Market Attractiveness, by Country and Sub-region