Reports

Reports

With the recent trend of going 'cashless', there has been a subsequent rise in the adoption cashless digitalized payment systems. Small businesses, in particular, will serve as a vital growth platform for virtual Point of Sale terminals. This is mainly because they refrain from investing in complex hardware and systems, making virtual terminals an indispensable resource for accepting online payments. Virtual terminals have gained their very own eminence with advancements in mobile applications, and the mounting need to enhance merchant and consumer interactions. Businesses are focusing on adapting to the new digital consumer behavior by replacing traditional payment systems with virtual payment (POS) terminals.

However, with intensified competition in global markets, companies are facing challenges in terms of meeting the rising customer needs for safety and security in processing transactions. Manufacturers have used this restraint to their benefit by integrating data encryption or tokenization into their virtual payment platforms, thereby enhancing security in payment processes. These strides towards a cashless future have compelled TMR analysts to conduct an in-depth analysis of the virtual payment (POS) terminals market. In its new study, TMR highlights the key drivers and changes in consumer behavior that are unlocking growth opportunities in the industry.

The payments industry is a complex space that has been seeing spinning transition, with numerous companies offering advanced payment options to climb up the digital space. Electronic payment terminals existed long before the Internet era, with retailers increasingly adopting solutions from hardware manufacturers such as Ingencio and Hypercom. The landscape of terminal payments completely transformed with the emergence of the internet, as it led to the inundation of new online POS terminals. This technology has seen tremendous evolution from the launch of TWINPOS G Series in 2011 to the development of TWINPOS G5100Li POS models in 2018.

With a ballooning e-Commerce industry and the emergence of multiple payment gateways, the virtual payment (POS) terminals market is anticipated to grow at a promising CAGR of ~ 28%, and reach the mark of ~ US$ 78 Bn by the end of the forecast period.

Key Trends that are Worth Paying Attention To

Not only do digital payment systems offer a speedy shopping experience, but they instill a sense of security among consumers by eliminating the need to enter credit or debit card details over and over again. Moreover, digital wallet companies are increasingly providing digital wallet solutions that are easy to integrate. The e-Commerce sector, in particular, has proven to be the focal point for the growth of digital wallet solutions. Reduction in shopping cart abandonment due to cumbersome purchasing procedures is another reason for the growing consumer inclination towards digital wallets.

With an increase in the number of services offered on mobile devices, there has been a rise in the adoption of Near Field Communication (NFC) services. This service allows the exchange of data between two mobile devices placed within a few centimeters of each other. Numerous retailers such as Macys, Walgreens, and Target have NFC-based payment terminals in place. When an NFC-integrated smartphone is held near this terminal, it automatically deducts the purchase amount from the card tied to the phone. This technology also offers additional security, as it uses a one-time code instead of the credit or debit card number. In lieu of recent credit and debit card breaches, the future of NFC solutions is expected to shine bright.

Merchants are tying loyalty to the use of mobile wallets to drive consumer attention. Loyalty rewards have become the new currency in the space of virtual payment. Rising consumer interest in mobile payments is directly proportional to the value received from using these wallets. In a bid to retain customers, mobile wallet companies such as Google Pay and Amazon are offering loyalty rewards in the form of 'free stuff' and 'discounts' to attract new customers and retain the existing ones.

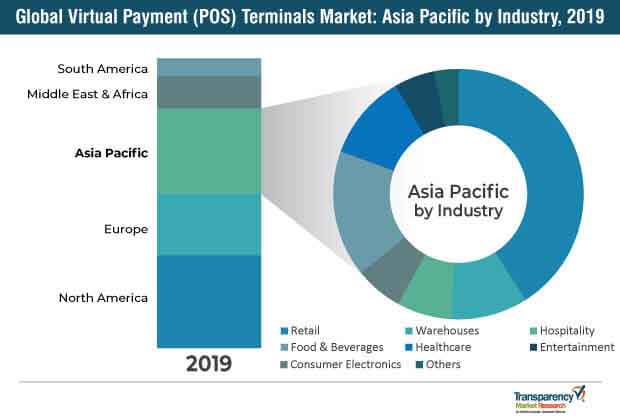

With the rise in digitalization, numerous countries in Asia and South America highly demand virtual payment terminals across end-use sectors. The extensive use of online shopping platforms and advancements in digital systems are key factors driving the use of virtual payment (POS) terminals in developing regions. Moreover, countries such as India and China are shifting towards a robust digital economy, as cashless payment systems take center stage. Asia Pacific alone accounted for ~ 27% of the virtual payment (POS) terminals market share in 2018, and is expected to reach ~ 48% by 2027. South America remains an untapped market, presenting a significant market space for growth, as the competition is low in this region.

The virtual payment (POS) terminals market features a highly fragmented vendor landscape, with a large number of players competing to develop advanced virtual payment (POS) terminals. Competitive rivalry among players is mainly characterized by new alliances and partnerships to enhance their stronghold in the global virtual payment (POS) terminals market.

Apart from this, new product launches and business expansion are the key winning strategies deployed by players in the virtual payment (POS) terminals market. For example, in April 2018, Samsung Electronics America Inc., a subsidiary of Samsung Electronics, announced its plan to relocate its North Texas campus to Legacy Central in Plano, Texas, U.S. Further, in March 2019, PAX Technology partnered with Secure TablePay to introduce a new facility - Pay-at-the-Table Experience - to restaurants across the U.S.

These players have a strong global presence, as they have invested significantly in expanding their virtual payment terminal manufacturing services. Prominent players such as VeriFone Systems Inc. and Fujian Newland Payment Technology Co., Ltd. also have a global presence. However, their market penetration is comparatively lower than the leading players in the virtual payment (POS) terminals market.

Emerging companies in the virtual payment (POS) terminals market include Panasonic Corporation, NCR Corporation, and Squirrel Systems. These companies are strengthening their presence by establishing new facilities and investing heavily in research and development activities to develop advanced software. For instance, in May 2018, Panasonic Corporation launched integrated mobile POS solutions for the Toughpad FZ-G1 rugged tablet and handheld devices for retail and hospitality industries.

Analysts’ Viewpoint of the Virtual Payment (POS) Terminals Market

TMR analysts opine that, the virtual payment (POS) terminals market will show promising growth during the forecast period, due to the high adoption rate of cashless payment systems. The retail industry is expected to present high growth opportunities for the market’s growth, as retail businesses want to provide their customers with a smooth purchase experience. Developing countries such as India and China are expected to be lucrative for the growth of the virtual payment (POS) terminals market because of a rise in the number of people engaged in online shopping, and the digitalization of economies. Market players should focus on untapped markets such as South America, and develop innovative products with advanced security to consolidate their position in the virtual payment (POS) terminals market.

Virtual Payment (POS) Terminals Market in Brief

Some major players operating in the global virtual payment (POS) terminals market and profiled in the report include

Companies are shifting toward product innovation and up-scaling their skills to gain a competitive advantage in the virtual payment (POS) terminals market, apart from maintaining their position in the market.

Virtual Payment (POS) Terminals Market Predicted to 28% CAGR during the Forecast Period.

Virtual Payment (POS) Terminals Market Forecast till 2027

Virtual Payment (POS) Terminals Market include VeriFone Systems Inc. and Fujian Newland Payment Technology Co., Ltd.

North America Highly Lucrative Markets

The Virtual Payment (POS) Terminals Market Would be US$ 78 Bn By 2027

Chapter 1 Preface

1.1 Research Scope

1.2 Market Segmentation

1.3 Research Objectives

1.4 Key Questions Answered

Chapter 2 Assumptions and Research Methodology

2.1 Report Assumptions

2.2 Acronyms Used

2.3 Research Methodology

Chapter 3 Executive Summary

3.1 Virtual Payment (POS) Terminals Market Snapshot

3.1.1 Global Virtual Payment (POS) Terminals Market Size (US$ Bn) Forecast, 2017–2027 and Market Dynamics

3.1.2 CAGR Breakdown

3.1.3 Regional Outline

3.1.4 Regional Abstract

3.1.5 Competition Blueprint

3.1.6 North America Virtual Payment (POS) Terminals Market Abstract

3.1.7 Europe Virtual Payment (POS) Terminals Market Abstract

3.1.8 Asia Pacific Virtual Payment (POS) Terminals Market Abstract

3.1.9 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Abstract

3.1.10 South America Virtual Payment (POS) Terminals Market Abstract

Chapter 4 Market Overview

4.1 Market Taxonomy

4.2 Product Overview

4.3 Introduction

4.3.1 Global Market – Macro Economic Factors

4.3.2 World GDP Indicator – For Top 20 Economies (2018)

4.3.3 Global IT Sector Outlook

4.3.4 Global Virtual Payment (POS) Terminals Market Overview: ICT Spending

4.4 Non-Cash Transaction Analysis

4.5 Pricing Options of Virtual POS System

4.6 Key Industry Developments

4.7 Key Trends Analysis

4.8 Porter’s Analysis

4.9 PESTEL Analysis - Global Virtual Payment (POS) Terminals Market

4.10 Market Dynamics: Drivers and Restraints Snapshot Analysis

4.10.1 Drivers

4.10.2 Restraints

4.10.3 Opportunity

4.10.4 Opportunity Analysis

4.10.5 Impact Analysis of Drivers & Restraints

4.11 Value Chain Analysis

4.12 Global Virtual Payment (POS) Terminals Market Analysis and Forecast, 2017 - 2027

4.13 Market Opportunity Analysis

4.13.1 Virtual Payment (POS) Terminals Market Opportunity Analysis – By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.13.1.1 North America Market Opportunity Analysis – By Country (U.S., Canada and Rest of North America)

4.13.1.2 Europe Market Opportunity Analysis – By Country (Germany, U.K., France and Rest of Europe)

4.13.1.3 Asia Pacific Market Opportunity Analysis – By Country (China, India, Japan and Rest of APAC)

4.13.1.4 MEA Market Opportunity Analysis – By Country (GCC, South Africa and Rest of MEA)

4.13.1.5 South America Market Opportunity Analysis – By Country (Brazil and Rest of South America)

4.14 Global Market Opportunity Analysis

4.14.1 By Solutions

4.14.2 By Industry

4.15 North America Market Opportunity Analysis

4.15.1 By Solutions

4.15.2 By Industry

4.16 Europe Market Opportunity Analysis

4.16.1 By Solutions

4.16.2 By Industry

4.17 Asia Pacific Market Opportunity Analysis

4.17.1 By Solutions

4.17.2 By Industry

4.18 MEA Market Opportunity Analysis

4.18.1 By Solutions

4.18.2 By Industry

4.19 South America Market Opportunity Analysis

4.19.1 By Solutions

4.19.2 By Industry

4.20 Competitive Scenario and Trends

4.20.1 Virtual Payment (POS) Terminals Market Concentration Rate

4.20.2 Mergers & Acquisitions, Expansions

4.21 Market Outlook

Chapter 5 Virtual Payment (POS) Terminals Market Analysis, By Solutions

5.1 Key Segment Analysis

5.2 Overview and Definitions

5.3 Key Findings

5.4 Global Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Solutions

5.5 Global Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, By Solutions

5.5.1 Software Platform

5.5.1.1 Device Based

5.5.1.2 Web Based

5.5.2 Professional Services

Chapter 6 Virtual Payment (POS) Terminals Market Analysis, By Industry

6.1 Key Segment Analysis

6.2 Overview and Definitions

6.3 Key Findings

6.4 Global Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Industry

6.5 Global Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, By Industry

6.5.1 Retail

6.5.2 Warehouse

6.5.3 Hospitality

6.5.4 Consumer Electronics

6.5.5 Food & Beverage

6.5.6 Health Care

6.5.7 Entertainment

6.5.8 Others

Chapter 7 Global Virtual Payment (POS) Terminals Market Analysis, By Region

7.1 Global Regulatory Scenario

7.2 Key Findings

7.3 Global Virtual Payment (POS) Terminals Market Revenue Share Analysis, By Region

7.4 Global Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, By Region

7.4.1 North America

7.4.2 Europe

7.4.3 Asia Pacific

7.4.4 Middle East & Africa

7.4.5 South America

Chapter 8 North America Virtual Payment (POS) Terminals Market Analysis

8.1 Key Trend Analysis

8.2 Regional Dynamics

8.3 North America Virtual Payment (POS) Terminals Market Overview

8.4 North America Virtual Payment (POS) Terminals Market Analysis, by Solutions, 2019 and 2027

8.4.1 Software Platform

8.4.1.1 Device Based

8.4.1.2 Web Based

8.4.2 Professional Services

8.5 North America Virtual Payment (POS) Terminals Market Analysis, by Industry, 2019 and 2027

8.5.1 Retail

8.5.2 Warehouse

8.5.3 Hospitality

8.5.4 Consumer Electronics

8.5.5 Food & Beverage

8.5.6 Health Care

8.5.7 Entertainment

8.5.8 Others

8.6 North America Virtual Payment (POS) Terminals Market Forecast, by Solutions, 2017-2027

8.7 North America Virtual Payment (POS) Terminals Market Forecast, by Industry, 2017-2027

8.8 North America Virtual Payment (POS) Terminals Market Share Analysis, by Country/Sub-region, 2018 & 2027

8.9 North America Virtual Payment (POS) Terminals Market Forecast, by Country/Sub-region

8.9.1 U.S.

8.9.2 Canada

8.9.3 Rest of America

Chapter 9 Europe Virtual Payment (POS) Terminals Market Analysis

9.1 Key Trend Analysis

9.2 Regional Dynamics

9.3 Europe Virtual Payment (POS) Terminals Market Overview

9.4 Europe Virtual Payment (POS) Terminals Market Analysis, by Solutions, 2019 and 2027

9.4.1 Software Platform

9.4.1.1 Device Based

9.4.1.2 Web Based

9.4.2 Professional Services

9.5 Europe Virtual Payment (POS) Terminals Market Analysis, by Industry, 2019 and 2027

9.5.1 Retail

9.5.2 Warehouse

9.5.3 Hospitality

9.5.4 Consumer Electronics

9.5.5 Food & Beverage

9.5.6 Health Care

9.5.7 Entertainment

9.5.8 Others

9.6 Europe Virtual Payment (POS) Terminals Market Forecast, by Solutions, 2017-2027

9.7 Europe Virtual Payment (POS) Terminals Market Forecast, by Industry, 2017-2027

9.8 Europe Virtual Payment (POS) Terminals Market Share Analysis, by Country/Sub-region, 2018 & 2027

9.9 Europe Virtual Payment (POS) Terminals Market Forecast, by Country/Sub-region

9.9.1 Germany

9.9.2 France

9.9.3 U.K.

9.9.4 Rest of Europe

Chapter 10 Asia Pacific Virtual Payment (POS) Terminals Market Analysis

10.1 Key Trend Analysis

10.2 Regional Dynamics

10.3 Asia Pacific Virtual Payment (POS) Terminals Market Overview

10.4 Asia Pacific Virtual Payment (POS) Terminals Market Analysis, by Solutions, 2019 and 2027

10.4.1 Software Platform

10.4.1.1 Device Based

10.4.1.2 Web Based

10.4.2 Professional Services

10.5 Asia Pacific Virtual Payment (POS) Terminals Market Analysis, by Industry, 2019 and 2027

10.5.1 Retail

10.5.2 Warehouse

10.5.3 Hospitality

10.5.4 Consumer Electronics

10.5.5 Food & Beverage

10.5.6 Health Care

10.5.7 Entertainment

10.5.8 Others

10.6 Asia Pacific Virtual Payment (POS) Terminals Market Forecast, by Solutions, 2017-2027

10.7 Asia Pacific Virtual Payment (POS) Terminals Market Forecast, by Industry, 2017-2027

10.8 Asia Pacific Virtual Payment (POS) Terminals Market Share Analysis, by Country/Sub-region, 2018 & 2027

10.9 Asia Pacific Virtual Payment (POS) Terminals Market Forecast, by Country/Sub-region

10.9.1 India

10.9.2 China

10.9.3 Japan

10.9.4 Rest of Asia Pacific

Chapter 11 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Analysis

11.1 Key Trend Analysis

11.2 Regional Dynamics

11.3 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Overview

11.4 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Analysis, by Solutions, 2019 and 2027

11.4.1 Software Platform

11.4.1.1 Device Based

11.4.1.2 Web Based

11.4.2 Professional Services

11.5 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Analysis, byIndustry, 2019 and 2027

11.5.1 Retail

11.5.2 Warehouse

11.5.3 Hospitality

11.5.4 Consumer Electronics

11.5.5 Food & Beverage

11.5.6 Health Care

11.5.7 Entertainment

11.5.8 Others

11.6 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Forecast, by Solutions, 2017-2027

11.7 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Forecast, by Industry, 2017-2027

11.8 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Share Analysis, by Country/Sub-region, 2018 & 2027

11.9 Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Forecast, by Country/Sub-region

11.9.1 GCC

11.9.2 South Africa

11.9.3 Rest of Middle East & Africa (MEA)

Chapter 12 South America Virtual Payment (POS) Terminals Market Analysis

12.1 Key Trend Analysis

12.2 Regional Dynamics

12.3 South America Virtual Payment (POS) Terminals Market Overview

12.4 South America Virtual Payment (POS) Terminals Market Analysis, bySolutions, 2019 and 2027

12.4.1 Software Platform

12.4.1.1 Device Based

12.4.1.2 Web Based

12.4.2 Professional Services

12.5 South America Virtual Payment (POS) Terminals Market Analysis, by Industry, 2019 and 2027

12.5.1 Retail

12.5.2 Warehouse

12.5.3 Hospitality

12.5.4 Consumer Electronics

12.5.5 Food & Beverage

12.5.6 Health Care

12.5.7 Entertainment

12.5.8 Others

12.6 South America Virtual Payment (POS) Terminals Market Forecast, by Solutions, 2017-2027

12.7 South America Virtual Payment (POS) Terminals Market Forecast, by Industry, 2017-2027

12.8 South America Virtual Payment (POS) Terminals Market Share Analysis, by Country/Sub-region, 2018 & 2027

12.9 South America Virtual Payment (POS) Terminals Market Forecast, by Country/Sub-region

12.9.1 Brazil

12.9.2 Rest of South America

Chapter 13 Company Profiles

13.1 Competition Matrix

13.2 Competitive Landscape: Virtual Payment (POS) Terminals Market Positioning of Key Players, 2018

13.3 Cisco Systems, Inc.

13.3.1 Company Details (HQ, Foundation Year, Employee Strength)

13.3.2 Market Presence, By Segment and Geography

13.3.3 Strategic Overview

13.3.4 Key Competitors

13.3.5 Historical Revenue

13.4 Fujian Newland Payment Technology Co., Ltd.

13.4.1 Company Details (HQ, Foundation Year, Employee Strength)

13.4.2 Market Presence, By Segment and Geography

13.4.3 Strategic Overview

13.4.4 Key Competitors

13.5 Ingenico Group

13.5.1 Company Details (HQ, Foundation Year, Employee Strength)

13.5.2 Market Presence, By Segment and Geography

13.5.3 Strategic Overview

13.5.4 Key Competitors

13.5.5 Historical Revenue

13.6 NCR Corporation

13.6.1 Company Details (HQ, Foundation Year, Employee Strength)

13.6.2 Market Presence, By Segment and Geography

13.6.3 Strategic Overview

13.6.4 Key Competitors

13.6.5 Historical Revenue

13.7 NEC Corporation

13.7.1 Company Details (HQ, Foundation Year, Employee Strength)

13.7.2 Market Presence, By Segment and Geography

13.7.3 Strategic Overview

13.7.4 Key Competitors

13.7.5 Historical Revenue

13.8 Panasonic Corporation

13.8.1 Company Details (HQ, Foundation Year, Employee Strength)

13.8.2 Market Presence, By Segment and Geography

13.8.3 Strategic Overview

13.8.4 Key Competitors

13.8.5 Historical Revenue

13.9 PAX Technology

13.9.1 Company Details (HQ, Foundation Year, Employee Strength)

13.9.2 Market Presence, By Segment and Geography

13.9.3 Strategic Overview

13.9.4 Key Competitors

13.10 Samsung Electronics Co., Ltd.

13.10.1 Company Details (HQ, Foundation Year, Employee Strength)

13.10.2 Market Presence, By Segment and Geography

13.10.3 Strategic Overview

13.10.4 Key Competitors

13.10.5 Historical Revenue

13.11 Shenzhen Xinguodu Technology Company Ltd.

13.11.1 Company Details (HQ, Foundation Year, Employee Strength)

13.11.2 Market Presence, By Segment and Geography

13.11.3 Strategic Overview

13.11.4 Key Competitors

13.12 Squirrel Systems

13.12.1 Company Details (HQ, Foundation Year, Employee Strength)

13.12.2 Market Presence, By Segment and Geography

13.12.3 Strategic Overview

13.12.4 Key Competitors

13.13 Toshiba Corporation

13.13.1 Company Details (HQ, Foundation Year, Employee Strength)

13.13.2 Market Presence, By Segment and Geography

13.13.3 Strategic Overview

13.13.4 Key Competitors

13.13.5 Historical Revenue

13.14 VeriFone Systems Inc.

13.14.1 Company Details (HQ, Foundation Year, Employee Strength)

13.14.2 Market Presence, By Segment and Geography

13.14.3 Strategic Overview

13.14.4 Key Competitors

13.14.5 Historical Revenue

List of Tables

1. Executive Summary - Competition Blueprint

2. World GDP Indicator - For Top 20 Economies

3. Pricing Options of Virtual POS

4. PESTEL Analysis - Global Virtual Payment (POS) Terminals Market

5. Value Chain Analysis - Key Participants’ Market Presence (Intensity Map), by Region

6. Competitive Scenario and Trends - Mergers & Acquisitions, Expansions

7. Global Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Solutions, 2017–2027

8. Global Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Region, 2017–2027

9. North America Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Solutions, 2017–2027

10. North America Virtual Payment (POS) Terminals Market Value (US$ Bn) Forecast, by Industry, 2017–2027

11. North America Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Country/Sub-region, 2017-2027

12. Europe Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Solutions, 2017–2027

13. Europe Virtual Payment (POS) Terminals Market Value (US$ Bn) Forecast, by Industry, 2017–2027

14. Europe Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Country/Sub-region, 2017-2027

15. Asia Pacific Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Solutions, 2017–2027

16. Asia Pacific Virtual Payment (POS) Terminals Market Value (US$ Bn) Forecast, by Industry, 2017–2027

17. Asia Pacific Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Country/Sub-region, 2017-2027

18. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Solutions, 2017–2027

19. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Value (US$ Bn) Forecast, by Industry, 2017–2027

20. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Country/Sub-region, 2017-2027

21. South America Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Solutions, 2017–2027

22. South America Virtual Payment (POS) Terminals Market Value (US$ Bn) Forecast, by Industry, 2017–2027

23. South America Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, by Country/Sub-region, 2017-2027

24. Competition Matrix

List of Figures

1. Research Methodology

2. Global Virtual Payment (POS) Terminals Market Size (US$ Bn) Forecast and Y-o-Y Growth (%), 2017–2027

3. North America Virtual Payment (POS) Terminals Market Abstract - Market growth

4. North America Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Solutions, 2018

5. North America Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Industry, 2018

6. North America Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Country/Sub-region, 2018

7. Europe Virtual Payment (POS) Terminals Market Abstract - Market growth

8. Europe Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Solutions, 2018

9. Europe Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Industry, 2018

10. Europe Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Country/Sub-region, 2018

11. Asia Pacific Virtual Payment (POS) Terminals Market Abstract - Market growth

12. Asia Pacific Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Solutions, 2018

13. Asia Pacific Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Industry, 2018

14. Asia Pacific Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Country/Sub-region, 2018

15. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Abstract - Market growth

16. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Solutions, 2018

17. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Industry, 2018

18. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Country/Sub-region, 2018

19. South America Virtual Payment (POS) Terminals Market Abstract - Market growth

20. South America Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Solutions, 2018

21. South America Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Industry, 2018

22. South America Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Country/Sub-region, 2018

23. Gross Domestic Product (GDP) per Capita; Analysis (US$ Tn), By Major Countries, 2012-2017

24. Global ICT Spending (US$ Bn)

25. Number of Global Non-Cash Transactions (Bn), by Region, 2017-2021

26. Porter’s Analysis

27. Retail E-Commerce Sales (US$ Bn)

28. Value Chain Analysis

29. Global Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast, 2017–2027

30. Global Virtual Payment (POS) Terminals Market Attractiveness, by Region, 2018-2027

31. North America Virtual Payment (POS) Terminals Market Attractiveness, by Country/Sub-region, 2018-2027

32. Europe Virtual Payment (POS) Terminals Market Attractiveness, by Country/Sub-region, 2018-2027

33. Asia Pacific Virtual Payment (POS) Terminals Market Attractiveness, by Country/Sub-region, 2018-2027

34. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Attractiveness, by Country/Sub-region, 2018-2027

35. South America Virtual Payment (POS) Terminals Market Attractiveness, by Country/Sub-region, 2018-2027

36. Global Virtual Payment (POS) Terminals Market Attractiveness, by Solutions, 2018-2027

37. Global Virtual Payment (POS) Terminals Market Attractiveness, by Industry, 2018-2027

38. North America Virtual Payment (POS) Terminals Market Attractiveness, by Solutions, 2018-2027

39. North America Virtual Payment (POS) Terminals Market Attractiveness, by Industry, 2018-2027

40. Europe Virtual Payment (POS) Terminals Market Attractiveness, by Solutions, 2018-2027

41. Europe Virtual Payment (POS) Terminals Market Attractiveness, by Industry, 2018-2027

42. Asia Pacific Virtual Payment (POS) Terminals Market Attractiveness, by Solutions, 2018-2027

43. Asia Pacific Virtual Payment (POS) Terminals Market Attractiveness, by Industry, 2018-2027

44. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Attractiveness, by Solutions, 2018-2027

45. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Attractiveness, by Industry, 2018-2027

46. South America Virtual Payment (POS) Terminals Market Attractiveness, by Solutions, 2018-2027

47. South America Virtual Payment (POS) Terminals Market Attractiveness, by Industry, 2018-2027

48. Global Virtual Payment (POS) Terminals Market Revenue Share (%), by Solutions, 2018

49. Global Virtual Payment (POS) Terminals Market Revenue Share (%), by Industry, 2018

50. Global Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Solutions, 2018 and 2027

51. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Software Platform, 2017–2027

52. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Services, 2017–2027

53. Global Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Industry, 2018 and 2027

54. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Retail, 2017–2027

55. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Warehouse, 2017–2027

56. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Hospitality, 2017–2027

57. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Consumer Electronics, 2017–2027

58. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Food & Beverage, 2017–2027

59. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Health Care, 2017–2027

60. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Entertainment, 2017–2027

61. Global Virtual Payment (POS) Terminals Market, Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), by Others, 2017–2027

62. Global Virtual Payment (POS) Terminals Market Revenue Share Analysis, by Region, 2018 and 2027

63. North America Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), 2017–2027

64. North America Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2019)

65. North America Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2027)

66. North America Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2019)

67. North America Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2027)

68. North America Virtual Payment (POS) Terminals Market, Revenue Share Analysis, by Country/Sub-region, 2018 & 2027

69. Europe Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), 2017–2027

70. Europe Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2019)

71. Europe Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2027)

72. Europe Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2019)

73. Europe Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2027)

74. Europe Virtual Payment (POS) Terminals Market, Revenue Share Analysis, by Country/Sub-region, 2018 & 2027

75. Asia Pacific Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), 2017–2027

76. Asia Pacific Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2019)

77. Asia Pacific Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2027)

78. Asia Pacific Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2019)

79. Asia Pacific Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2027)

80. Asia Pacific Virtual Payment (POS) Terminals Market, Revenue Share Analysis, by Country/Sub-region, 2018 & 2027

81. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), 2017–2027

82. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2019)

83. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2027)

84. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2019)

85. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2027)

86. Middle East & Africa (MEA) Virtual Payment (POS) Terminals Market, Revenue Share Analysis, by Country/Sub-region, 2018 & 2027

87. South America Virtual Payment (POS) Terminals Market Revenue (US$ Bn) Forecast and Y-o-Y Growth (%), 2017–2027

88. South America Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2019)

89. South America Virtual Payment (POS) Terminals Market Share Analysis, by Solutions (2027)

90. South America Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2019)

91. South America Virtual Payment (POS) Terminals Market Share Analysis, by Industry (2027)

92. South America Virtual Payment (POS) Terminals Market, Revenue Share Analysis, by Country/Sub-region, 2018 & 2027

93. Competitive Landscape: Virtual Payment (POS) Terminals Market Positioning of Key Players, 2018