Reports

Reports

Vehicle aftermarket services have been defined as an essential service by security and government authorities during the coronavirus crisis. There is an increased demand for working and functioning vehicles to take workers to hospitals and supply stores. This has led to the concept of automatic vehicle inspection to eliminate the need to physically inspect cars, which helps to limit the spread of COVID-19. Such opportunities are creating business avenues for companies in the vehicle occupancy detection system market.

Individuals in charge of a car fleet manufacturing business or a worker on a country’s border inspecting cars for threats, such applications have drawn increased emphasis on companies in the vehicle occupancy detection system market providing automatic inspection products.

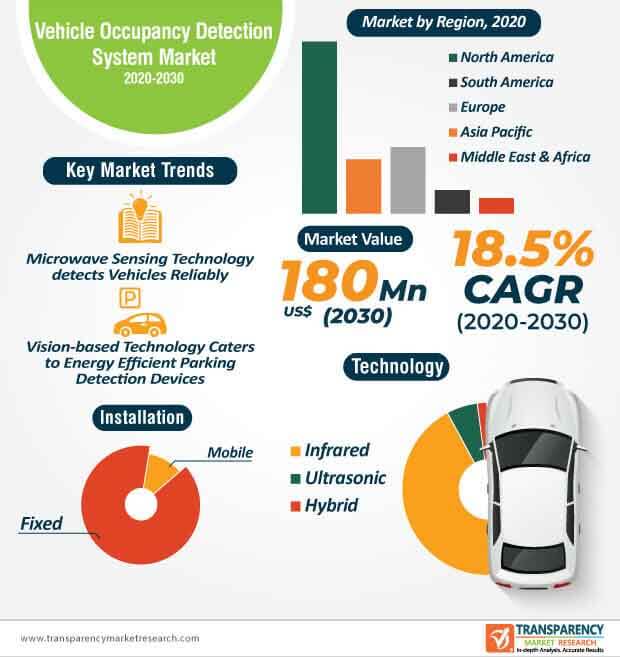

A robust city infrastructure is vital for ensuring economic, social, and physical welfare of citizens. However, government authorities are facing considerable challenges in urban planning, especially pertaining to the finding of empty parking spaces on roadsides. Hence, companies in the vehicle occupancy detection system market are capitalizing on this opportunity to increase the availability of fixed and mobile installation products. As such, fixed installation products are estimated to dictate a higher revenue share compared to mobile installation products during the forecast period.

The vision-based technology is gaining prominence in urban planning and smart city concepts. Companies in the vehicle occupancy detection system market are developing devices that automatically maintain brightness during night conditions as soon as a car is detected on a street that requires parking.

Stakeholders in the vehicle occupancy detection system market are innovating in the sensor technology to establish efficient ways in car counting applications. OPTEX— a manufacturer of high performance sensing technologies is gaining recognition for its vehicle sensor, which uses the microwave sensing technology to detect vehicles reliably. As such, the infrared technology is predicted to hold the lion’s share in terms of revenue in the vehicle occupancy detection system market.

Manufacturers are increasing the availability of devices that can be customized with various range settings. They are developing products that can be used at open retail parks and for monitoring traffic in high street applications.

Radar-based occupant alert systems are storming the vehicle occupancy detection system market. Hyundai Mobis— a public South Korean car parts company, has developed a new radar-based rear occupant alert system that prevents children from being stuck in back seats. Manufacturers are unlocking growth opportunities in the U.S. vehicle occupancy detection system market, as the U.S. child safety and accident prevention organization has become aware about children dying due to heart stroke in locked cars every year.

Since vehicle owners have become aware about various safety features in cars, the popularity of radar-based occupant alert systems is contributing toward market expansion. This has compelled many governments to make modifications in their regulations to ensure the safety of their citizens.

As Elon Musk’s driverless car series Tesla is gaining importance for reducing fatal road accidents, similarly, vehicle occupancy detection systems are being deployed to ensure road and driver safety. The vehicle occupancy detection system market is estimated to surpass the revenue of US$ 180 Mn by the end of 2030, as driver monitoring systems are being highly publicized for their contribution toward road safety for both, passenger cars and commercial trucks. This has led to innovations in driver facing camera that detect a driver’s state of alertness.

The U.S. National Transportation Safety Board (NTSB) has recommended the use of camera-based driver monitoring systems to facilitate emotion detection and deliver the convergence of occupant and driver monitoring.

Analysts’ Viewpoint

The coronavirus pandemic has facilitated safe car inspections for detection of foreign objects and anomalies to give alerts about possible threats with the help of vehicle occupancy detection systems. The vehicle occupancy detection system market is expected to register an astonishing CAGR of 18.5% during the forecast period. However, manufacturers need to overcome challenges in smart city and urban planning initiatives pertaining to parking space detection. Hence, companies should increase their R&D in the vision-based technology to increase the availability of energy efficient parking detection devices. Since North America is projected to dominate the highest revenue share among all regions in the market, manufacturers should unlock revenue opportunities in the U.S., since government organizations are taking cognizance of road accidents.

1. Global Vehicle Occupancy Detection System Market - Executive Summary

1.1.Global Vehicle Occupancy Detection System Market Country Analysis

1.2.Competition Blueprint

1.3.Application Time Line Mapping

1.4.TMR Analysis and Recommendations

2. Market Overview

2.1.Market Introduction

2.2.Market Definition

2.3.Market Taxonomy

3. Market Dynamics

3.1.Macroeconomic Factors

3.2.Drivers

3.2.1.Economic Drivers

3.2.2.Supply Side Drivers

3.2.3.Demand Side Drivers

3.3.Market Restraints

3.4.Market Trends

3.5.Trend Analysis- Impact on Time Line (2020-2030)

3.6.Key Regulations By Regions

4. Associated Industry and Key Indicator Assessment

4.1.Parent Industry Overview

4.2.Supply Chain Analysis

4.2.1.Profitability and Gross Margin Analysis By Competition

4.2.2.List of Active Participants- By Region

4.2.2.1. Raw Material Suppliers

4.2.2.2. Key Manufacturers

4.2.2.3. Integrators

4.2.2.4. Key Distributor/Retailers

4.3.Porter’s Five Forces Analysis

4.4.Technology Roadmap

5. Global Vehicle Occupancy Detection System Market Analysis and Forecast

5.1.Market Size Analysis (2018-2019) and Forecast (2020-2030)

5.1.1.Market Value (US$ Mn) and Y-o-Y Growth

5.2.Global Vehicle Occupancy Detection System Market Scenario Forecast (Optimistic, Likely, and Conservative Market Conditions)

5.2.1.Forecast Factors and Relevance of Impact

5.2.2.Regional Vehicle Occupancy Detection System Market Business Performance Summary

6. Global Vehicle Occupancy Detection System Market Analysis By Installation

6.1.Introduction

6.1.1.Y-o-Y Growth Comparison By Installation

6.2.Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Installation, 2018 - 2030

6.2.1.Fixed

6.2.2.Mobile

6.3.Market Attractiveness Analysis By Installation

7. Global Vehicle Occupancy Detection System Market Analysis By Technology

7.1.Introduction

7.1.1.Y-o-Y Growth Comparison By Technology

7.2.Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Technology, 2018 - 2030

7.2.1.Infrared

7.2.2.Ultrasonic

7.2.3.Hybrid

7.3.Market Attractiveness Analysis By Technology

8. Global Vehicle Occupancy Detection System Market Analysis and Forecast, By Region

8.1.Introduction

8.1.1.Basis Point Share (BPS) Analysis By Region

8.2.Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Region, 2018 - 2030

8.2.1.North America

8.2.2.Europe

8.2.3.Asia Pacific

8.2.4.Middle East & Africa

8.2.5.South America

8.3.Market Attractiveness Analysis By Region

9. North America Vehicle Occupancy Detection System Market Analysis and Forecast

9.1.Introduction

9.2.Drivers and Restraints: Impact Analysis

9.3.Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Installation, 2018 - 2030

9.3.1.Fixed

9.3.2.Mobile

9.4.Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Technology, 2018 - 2030

9.4.1.Infrared

9.4.2.Ultrasonic

9.4.3.Hybrid

9.5.Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Country, 2018 - 2030

9.5.1.U.S.

9.5.2.Canada

9.5.3.Mexico

9.6.Market Attractiveness Analysis

9.6.1.Installation

9.6.2.Technology

9.6.3.Country

10. Europe Vehicle Occupancy Detection System Market Analysis and Forecast

10.1. Introduction

10.2. Drivers and Restraints: Impact Analysis

10.3. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Installation, 2018 - 2030

10.3.1.Fixed

10.3.2.Mobile

10.4. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Technology, 2018 - 2030

10.4.1.Infrared

10.4.2.Ultrasonic

10.4.3.Hybrid

10.5. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

10.5.1.U.K.

10.5.2.Germany

10.5.3.France

10.5.4.Italy

10.5.5.Russia

10.5.6.Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1.Installation

10.6.2.Technology

10.6.3.Country

11. Asia Pacific Vehicle Occupancy Detection System Market Analysis and Forecast

11.1. Introduction

11.2. Drivers and Restraints: Impact Analysis

11.3. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Installation, 2018 - 2030

11.3.1.Fixed

11.3.2.Mobile

11.4. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Technology, 2018 - 2030

11.4.1.Infrared

11.4.2.Ultrasonic

11.4.3.Hybrid

11.5. Vehicle Occupancy Detection System Market Size (US$ Mn) & Forecast, By Country & Sub-region, 2018 - 2030

11.5.1.China

11.5.2.India

11.5.3.Japan

11.5.4.South Korea

11.5.5.ASEAN

11.5.6.Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1.Installation

11.6.2.Technology

11.6.3.Country

12. Middle East & Africa (MEA) Vehicle Occupancy Detection System Market Analysis and Forecast

12.1. Introduction

12.2. Drivers and Restraints: Impact Analysis

12.3. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Installation, 2018 - 2030

12.3.1.Fixed

12.3.2.Mobile

12.4. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Technology, 2018 - 2030

12.4.1.Infrared

12.4.2.Ultrasonic

12.4.3.Hybrid

12.5. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

12.5.1.GCC

12.5.2.South Africa

12.5.3.North Africa

12.5.4.Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1.Installation

12.6.2.Technology

12.6.3.Country

13. South America Vehicle Occupancy Detection System Market Analysis and Forecast

13.1. Introduction

13.2. Drivers and Restraints: Impact Analysis

13.3. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Installation, 2018 - 2030

13.3.1.Fixed

13.3.2.Mobile

13.4. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Technology, 2018 - 2030

13.4.1.Infrared

13.4.2.Ultrasonic

13.4.3.Hybrid

13.5. Vehicle Occupancy Detection System Market Size (US$ Mn) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

13.5.1.Brazil

13.5.2.Argentina

13.5.3.Rest of South America

13.6. Market Attractiveness Analysis

13.6.1.Installation

13.6.2.Technology

13.6.3.Country

14. Competition Assessment

14.1. Global Vehicle Occupancy Detection System Market Competition - a Dashboard View

14.2. Global Vehicle Occupancy Detection System Market Structure Analysis

14.3. Global Vehicle Occupancy Detection System Market Company Share Analysis, by Value and Volume (2019)

14.4. Key Participants Market Presence (Intensity Mapping) by Region

15. Competition Deep-dive (Manufacturers/Suppliers)

15.1. Conduent Inc.

15.1.1.Overview

15.1.2.Product Portfolio

15.1.3.Sales Footprint

15.1.4.Channel Footprint

15.1.4.1. Distributors List

15.1.5.Strategy Overview

15.1.5.1. Marketing Strategy

15.1.5.2. Culture Strategy

15.1.5.3. Channel Strategy

15.1.6.SWOT Analysis

15.1.7.Financial Analysis

15.1.8.Revenue Share

15.1.8.1. By Region

15.1.9.Key Clients

15.1.10.Analyst Comments

15.2. Fortran Traffic System Limited

15.2.1.Overview

15.2.2.Product Portfolio

15.2.3.Sales Footprint

15.2.4.Channel Footprint

15.2.4.1. Distributors List

15.2.5.Strategy Overview

15.2.5.1 Marketing Strategy

15.2.5.2. Culture Strategy

15.2.5.3. Channel Strategy

15.2.6.SWOT Analysis

15.2.7.Financial Analysis

15.2.8.Revenue Share

15.2.8.1. By Region

15.2.9.Key Clients

15.2.10.Analyst Comments

15.3. Indra Sistemas, S.A

15.3.1.Overview

15.3.2.Product Portfolio

15.3.3.Sales Footprint

15.3.4.Channel Footprint

15.3.4.1. Distributors List

15.3.5.Strategy Overview

15.3.5.1. Marketing Strategy

15.3.5.2. Culture Strategy

15.3.5.3. Channel Strategy

15.3.6.SWOT Analysis

15.3.7.Financial Analysis

15.3.8.Revenue Share

15.3.8.1. By Region

15.3.9.Key Clients

15.3.10.Analyst Comments

15.4. Invision AI

15.4.1.Overview

15.4.2.Product Portfolio

15.4.3.Sales Footprint

15.4.4.Channel Footprint

15.4.4.1. Distributors List

15.4.5.Strategy Overview

15.4.5.1. Marketing Strategy

15.4.5.2. Culture Strategy

15.4.5.3. Channel Strategy

15.4.6.SWOT Analysis

15.4.7.Financial Analysis

15.4.8.Revenue Share

15.4.8.1. By Region

15.4.9.Key Clients

15.4.10.Analyst Comments

15.5. NEC Corporation of America

15.5.1.Overview

15.5.2.Product Portfolio

15.5.3.Sales Footprint

15.5.4.Channel Footprint

15.5.4.1. Distributors List

15.5.5.Strategy Overview

15.5.5.1. Marketing Strategy

15.5.5.2. Culture Strategy

15.5.5.3. Channel Strategy

15.5.6.SWOT Analysis

15.5.7.Financial Analysis

15.5.8.Revenue Share

15.5.8.1. By Region

15.5.9.Key Clients

15.5.10.Analyst Comments

15.6. Siemens

15.6.1.Overview

15.6.2.Product Portfolio

15.6.3.Sales Footprint

15.6.4.Channel Footprint

15.6.4.1. Distributors List

15.6.5.Strategy Overview

15.6.5.1. Marketing Strategy

15.6.5.2. Culture Strategy

15.6.5.3. Channel Strategy

15.6.6.SWOT Analysis

15.6.7.Financial Analysis

15.6.8.Revenue Share

15.6.8.1. By Region

15.6.9.Key Clients

15.6.10.Analyst Comments

15.7. TransCore

15.7.1.Overview

15.7.2.Product Portfolio

15.7.3.Sales Footprint

15.7.4.Channel Footprint

15.7.4.1. Distributors List

15.7.5.Strategy Overview

15.7.5.1. Marketing Strategy

15.7.5.2. Culture Strategy

15.7.5.3. Channel Strategy

15.7.6.SWOT Analysis

15.7.7.Financial Analysis

15.7.8.Revenue Share

15.7.8.1. By Region

15.7.9.Key Clients

15.7.10.Analyst Comments

15.8. Xerox Corporation

15.8.1.Overview

15.8.2.Product Portfolio

15.8.3.Sales Footprint

15.8.4.Channel Footprint

1.8.4.1. Distributors List

15.8.5.Strategy Overview

15.8.5.1. Marketing Strategy

15.8.5.2. Culture Strategy

15.8.5.3. Channel Strategy

15.8.6.SWOT Analysis

15.8.7.Financial Analysis

15.8.8.Revenue Share

15.8.8.1. By Region

15.8.9.Key Clients

15.8.10.Analyst Comments

15.9. Others (On additional request)

16.Recommendation- Critical Success Factors

17.Research Methodology

18.Assumptions & Acronyms Used

List of Tables

Table 01: Global Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Installation, 2018–2030

Table 02: Global Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Technology, 2018–2030

Table 03: Global Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Region, 2018–2030

Table 04: North America Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Installation, 2018–2030

Table 05: North America Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Technology, 2018–2030

Table 06: Global Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Country, 2018–2030

Table 07: Europe Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Installation, 2018–2030

Table 08: Europe Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Technology, 2018–2030

Table 09: Europe Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Country, 2018–2030

Table 10: Asia Pacific Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Installation, 2018–2030

Table 11: Asia Pacific Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Technology, 2018–2030

Table 12: Asia Pacific Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Country, 2018–2030

Table 13: Middle East & Africa Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Installation, 2018–2030

Table 14: Middle East & Africa Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Technology, 2018–2030

Table 15: Middle East & Africa Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Country, 2018–2030

Table 16: South America Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Installation, 2018–2030

Table 17: South America Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Technology, 2018–2030

Table 18: South America Vehicle Occupancy Detection System Market Revenue (US$ Mn), by Country, 2018–2030

List of Figures

Figure 01: Global Vehicle Occupancy Detection System Market Value (USD Mn) Forecast, 2020–2030

Figure 02: Global Vehicle Occupancy Detection System Market Revenue Projection and Y-o-Y Growth, 2018–2030 (US$ Mn and %)

Figure 03: Global Vehicle Occupancy Detection System Market, by Fixed

Figure 04: Global Vehicle Occupancy Detection System Market, by Mobile

Figure 05: Global Vehicle Occupancy Detection System Market Comparison Matrix, by Installation

Figure 06: Global Vehicle Occupancy Detection System Market Attractiveness Analysis, by Installation

Figure 07: Global Vehicle Occupancy Detection System Market, by Infrared

Figure 08: Global Vehicle Occupancy Detection System Market, by Ultrasonic

Figure 09: Global Vehicle Occupancy Detection System Market, by Hybrid

Figure 10: Global Vehicle Occupancy Detection System Market Comparison Matrix, by Technology

Figure 11: Global Vehicle Occupancy Detection System Market Attractiveness Analysis, by Technology

Figure 12: Global Vehicle Occupancy Detection System Market Value Share Analysis, by Region (2020E)

Figure 13: Global Vehicle Occupancy Detection System Market Value Share Analysis, by Region (2030F)

Figure 14: Global Vehicle Occupancy Detection System Market Attractiveness Analysis, by Region

Figure 15: North America Vehicle Occupancy Detection System Market Revenue Projection and Y-o-Y Growth, 2018–2030 (US$ Mn and %)

Figure 16: North America Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2020)

Figure 17: North America Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2030)

Figure 18: North America Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2020)

Figure 19: North America Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2030)

Figure 20: North America Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2020)

Figure 21: North America Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2030)

Figure 22: North America Vehicle Occupancy Detection System Market Attractiveness Analysis, by Installation

Figure 23: North America Vehicle Occupancy Detection System Market Attractiveness Analysis, by Technology

Figure 24: North America Vehicle Occupancy Detection System Market Attractiveness Analysis, by Country

Figure 25: Europe Vehicle Occupancy Detection System Market Revenue Projection and Y-o-Y Growth, 2018–2030 (US$ Mn and %)

Figure 26: Europe Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2020)

Figure 27: Europe Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2030)

Figure 28: Europe Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2020)

Figure 29: Europe Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2030)

Figure 30: Europe Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2020)

Figure 31: Europe Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2030)

Figure 32: Europe Vehicle Occupancy Detection System Market Attractiveness Analysis, by Installation

Figure 33: Europe Vehicle Occupancy Detection System Market Attractiveness Analysis, by Technology

Figure 34: Europe Vehicle Occupancy Detection System Market Attractiveness Analysis, by Country

Figure 35: Asia Pacific Vehicle Occupancy Detection System Market Revenue Projection and Y-o-Y Growth, 2018–2030 (US$ Mn and %)

Figure 36: Asia Pacific Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2020)

Figure 37: Asia Pacific Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2030)

Figure 38: Asia Pacific Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2020)

Figure 39: Asia Pacific Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2030)

Figure 40: Asia Pacific Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2020)

Figure 41: Asia Pacific Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2030)

Figure 42: Asia Pacific Vehicle Occupancy Detection System Market Attractiveness Analysis, by Installation

Figure 43: Asia Pacific Vehicle Occupancy Detection System Market Attractiveness Analysis, by Technology

Figure 44: Asia Pacific Vehicle Occupancy Detection System Market Attractiveness Analysis, by Country

Figure 45: Middle East & Africa Vehicle Occupancy Detection System Market Revenue Projection and Y-o-Y Growth, 2018–2030 (US$ Mn and %)

Figure 46: Middle East & Africa Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2020)

Figure 47: Middle East & Africa Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2030)

Figure 48: Middle East & Africa Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2020)

Figure 49: Middle East & Africa Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2030)

Figure 50: Middle East & Africa Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2020)

Figure 51: Middle East & Africa Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2030)

Figure 52: Middle East & Africa Vehicle Occupancy Detection System Market Attractiveness Analysis, by Installation

Figure 53: Middle East & Africa Vehicle Occupancy Detection System Market Attractiveness Analysis, by Technology

Figure 54: Middle East & Africa Vehicle Occupancy Detection System Market Attractiveness Analysis, by Country

Figure 55: South America Vehicle Occupancy Detection System Market Revenue Projection and Y-o-Y Growth, 2018–2030 (US$ Mn and %)

Figure 56: South America Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2020)

Figure 57: South America Vehicle Occupancy Detection System Market Value Share Analysis, by Installation (2030)

Figure 58: South America Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2020)

Figure 59: South America Vehicle Occupancy Detection System Market Value Share Analysis, by Technology (2030)

Figure 60: South America Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2020)

Figure 61: South America Vehicle Occupancy Detection System Market Value Share Analysis, by Country (2030)

Figure 62: South America Vehicle Occupancy Detection System Market Attractiveness Analysis, by Installation

Figure 63: South America Vehicle Occupancy Detection System Market Attractiveness Analysis, by Technology

Figure 64: South America Vehicle Occupancy Detection System Market Attractiveness Analysis, by Country

Figure 65: Global Vehicle Occupancy Detection System Market Share Analysis, by Company (2019)