Reports

Reports

Minimal recycling impact and few trading disruptions are anticipated to affect the U.S. tire recycling downstream products market due to the COVID-19 pandemic. Companies such as Liberty Tire Recycling, LLC are increasing efforts to assure safe collection services and timely pickups as per customer demands. They are implementing CDC and WHO guidelines for facility cleanliness and hygiene.

Companies in the U.S. tire recycling downstream products market are continuously monitoring the coronavirus situation and are adapting to the market’s changing conditions with swift decision-making. Unusual shortfalls in supply chains are likely to stay low for stakeholders in the U.S. Manufacturers are focusing on critical mission projects such as for cement manufacturing, electric utility boilers, and steel production to stay afloat.

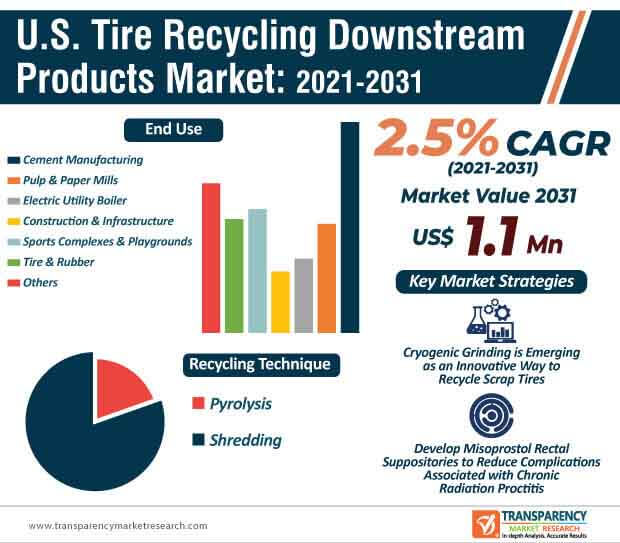

Currently, scrap tire generation is outpacing end market development. As such, the Washington-based U.S. Tire Manufacturers Association (USTMA) released its 2019 Scrap Tire Management Report in mid-October stating that recycling of scrap tires has reached a record low from 2013 when tire recycling was at its peak. This downward trend is hampering the U.S. tire recycling downstream products market, which explains a sluggish CAGR of 2.5% of the market during the forecast period.

Companies in the U.S. tire recycling downstream products market are working with different groups to eliminate stockpiles of scrap tires. They are encouraging state partners to use funds that are collected for scrap tire management to bolster end-use product development.

The U.S. tire recycling downstream products market is estimated to cross the revenue of US$ 1.1 Bn by 2031. BASF SE - a Germany-based multinational chemical company has announced to acquire the ownership stake of Pyrum - a Germany-based firm developing pyrolysis technology for converting waste tires into oil for $18 Mn. Companies in the U.S. tire recycling downstream products market are taking cues from such companies to invest toward the expansion of production capacities.

Manufacturers in the U.S. tire recycling downstream products market are boosting their output capabilities to produce tire-pyrolysis oil, which is used to replace petroleum feedstock in petrochemical crackers. Since waste tire rubber (WTR) management has become a serious problem, manufacturers are using this rubber in polymer matrices and composite materials for industrial use.

Waste tire rubber is being used as a filler for polymer composites and helps to reduce materials costs, whilst suitably modifying WTR to enhance the performance of plastics and rubbers. WTR is being highly publicized as an environment-friendly and low cost modifier of thermoset polymers. Manufacturers in the U.S. tire recycling downstream products market are boosting their R&D muscle to explore possible routes to tailor the performance properties of waste rubber tire systems.

Finding a feasible and cost-effective method for recycling of waste tire rubber is of paramount importance. Hence, manufacturers in the U.S. tire recycling downstream products market are combining WTR with a polymeric material that can flow under certain conditions so that it can be shaped into different products.

Companies in the U.S. tire recycling downstream products market are boosting their production capabilities in playground, landscape, and training course rubber mulch. GroundSmart - a tire recycling company in North America is leveraging revenue opportunities by supplying rubber mulch products for commercial, residential, and military segments. Manufacturers are taking reference from such companies to provide certified rubber mulch products that offer increased playground fall height protection as compared to grass, sand, wood mulch, and the likes.

Rubber mulch is being publicized by manufacturers in the U.S. tire recycling downstream products market for its cost efficiency as compared to landscape wood mulch.

Analysts’ Viewpoint

The collection of scrap passenger light truck tires is estimated to fall due to the onset of the COVID-19 pandemic. This will help companies in the U.S. tire recycling downstream products market to focus on innovating in new material recycling techniques rather than focusing on eliminating large stockpiles. Cryogenic grinding is emerging as one of the innovative ways to recycle scrap tires, which includes the absence of thermal or oxidative destruction of powder, fire, and explosion safety. However, this method requires high consumption of refrigerants in order to obtain rubber powder from scrap tires, with a particle size in millimeters. Hence, companies should capitalize on the advantages of cryogenic grinding, which facilitates efficient separation of metal and textiles from crumb rubber after grinding.

U.S. Tire Recycling Downstream Products Market: Overview

Increase in Volume of Scrap Tires: Key Driver of U.S. Tire Recycling Downstream Products Market

Rise in Demand for Tire Recycling Downstream Products in End-use Industries to Augment U.S. Tire Recycling Downstream Products Market

U.S. Tire Recycling Downstream Products Market: Competition Landscape

U.S. Tire Recycling Downstream Products Market: Key Development

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1.1. Drivers

3.1.1.2. Restraints

3.1.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

4. COVID-19 Impact Analysis

5. Price Trend Analysis

6. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Recycling Technique

6.1. Key Findings and Introduction

6.1.1. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Pyrolysis, 2015–2031

6.1.2. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Shredding, 2015–2031

6.1.2.1. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mechanical, 2015–2031

6.1.2.2. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Cryogenic, 2015–2031

6.1.2.3. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Others, 2015–2031

6.2. U.S. Tire Recycling Downstream Products Market Attractiveness Analysis, by Recycling Technique

7. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Product

7.1. Key Findings and Introduction

7.2. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2015–2031

7.2.1. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Tire-derived Fuel, 2015–2031

7.2.2. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Tire-derived Aggregate, 2015–2031

7.2.3. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Rubber Mulch, 2015–2031

7.2.4. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Steel, 2015–2031

7.2.5. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Rubber Powder, 2015–2031

7.2.6. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Others, 2015–2031

7.3. U.S. Tire Recycling Downstream Products Market Attractiveness Analysis, by Product

8. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by End-use

8.1. Key Findings and Introduction

8.2. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2015–2031

8.2.1. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Cement Manufacturing, 2015–2031

8.2.2. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Pulp & Paper Mills, 2015–2031

8.2.3. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Electric Utility Boiler, 2015–2031

8.2.4. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Construction & Infrastructure, 2015–2031

8.2.5. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Sports Complexes & Playgrounds, 2015–2031

8.2.6. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Tire & Rubber, 2015–2031

8.2.7. U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Others, 2015–2031

8.3. U.S. Tire Recycling Downstream Products Market Attractiveness Analysis, by End-use

9. Competition Landscape

9.1. Competition Matrix

9.2. U.S. Tire Recycling Downstream Products Market Share Analysis, by Company (2019)

9.3. Market Footprint Analysis

9.4. Company Profiles

9.4.1. LIBERTY TIRE RECYCLING

9.4.1.1. Company Details

9.4.1.2. Company Description

9.4.1.3. Business Overview

9.4.1.4. Recent Developments

9.4.2. L & S Tire Company.

9.4.2.1. Company Details

9.4.2.2. Company Description

9.4.2.3. Business Overview

9.4.3. Renelux Group.

9.4.3.1. Company Details

9.4.3.2. Company Description

9.4.3.3. Business Overview

9.4.4. Emanuel Tire, LLC

9.4.4.1. Company Details

9.4.4.2. Company Description

9.4.4.3. Business Overview

9.4.5. Tire Disposal & Recycling

9.4.5.1. Company Details

9.4.5.2. Company Description

9.4.5.3. Business Overview

9.4.6. Globarket

9.4.6.1. Company Details

9.4.6.2. Company Description

9.4.6.3. Business Overview

9.4.7. Lehigh Technologies, Inc

9.4.7.1. Company Details

9.4.7.2. Company Description

9.4.7.3. Business Overview

9.4.8. GENAN Inc.

9.4.8.1. Company Details

9.4.8.2. Company Description

9.4.8.3. Business Overview

9.4.9. Georgia Tire Recovery

9.4.9.1. Company Details

9.4.9.2. Company Description

9.4.9.3. Business Overview

9.4.10. Bridgestone Americas, Inc.

9.4.10.1. Company Details

9.4.10.2. Company Description

9.4.10.3. Business Overview

10. Primary Research – Key Insights

11. Appendix

11.1. Research Methodology and Assumptions

List of Tables

Table 01: U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) Forecast, by Recycling Technique, 2015–2019

Table 02: U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) Forecast, by Recycling Technique, 2020–2031

Table 03: U.S. Tire Recycling Downstream Products Market Value (US$ Mn) Forecast, by Recycling Technique, 2015–2019

Table 04: U.S. Tire Recycling Downstream Products Market Value (US$ Mn) Forecast, by Recycling Technique, 2020–2031

Table 05: U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) Forecast, by Product, 2015–2019

Table 06: U.S. Tire Recycling Downstream Products Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 07: U.S. Tire Recycling Downstream Products Market Value (US$ Mn) Forecast, by Product, 2015–2019

Table 08: U.S. Tire Recycling Downstream Products Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 09: U.S. Tire Recycling Downstream Product Market Volume (Kilo Tons) Forecast, by End-use, 2015–2019

Table 10: U.S. Tire Recycling Downstream Product Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 11: U.S. Tire Recycling Downstream Product Market Value (US$ Mn) Forecast, by End-use, 2015–2019

Table 12: U.S. Tire Recycling Downstream Product Market Value (US$ Mn) Forecast, by End-use, 2020–2031

List of Figures

Figure 01: U.S. Tire Recycling Downstream Products Market Share Analysis, by Recycling Technique

Figure 02: U.S. Tire Recycling Downstream Products Market Attractiveness Analysis, by Recycling Technique

Figure 03: U.S. Tire Recycling Downstream Products Market Share Analysis, by Product

Figure 04: U.S. Tire Recycling Downstream Products Market Attractiveness Analysis, by Product

Figure 05: U.S. Tire Recycling Downstream Products Market Share Analysis, by End-use

Figure 06: U.S. Tire Recycling Downstream Products Market Attractiveness Analysis, by End-use