Reports

Reports

Analysts’ Viewpoint

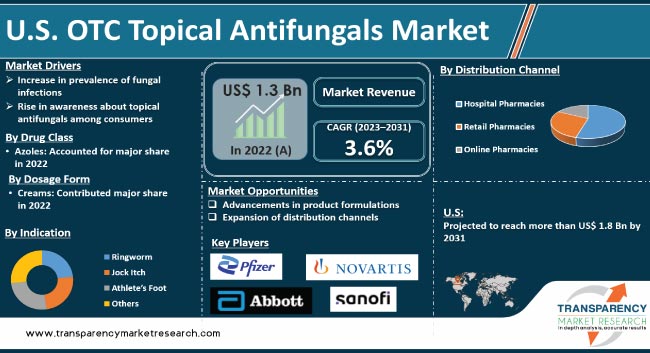

Increase in prevalence of fungal infections and rise in awareness about topical antifungals among consumers are fueling U.S. OTC topical antifungals industry growth. Surge in geriatric population is contributing to increase in demand for OTC topical antifungal medications. Furthermore, rise in focus of U.S. manufacturers on R&D to create new and advanced antifungal products is expected to propel market growth in the near future.

Companies in the U.S. are undergoing strategic alliances to strengthen their market share. Advancements in product formulations and expansion of distribution channels are estimated to create value-grab U.S. OTC topical antifungals market opportunities for industry participants.

OTC topical antifungals are over-the-counter medications that are used to treat fungal infections on the skin. This includes creams, lotions, powders, sprays, and other topical formulations that contain antifungal agents. Clotrimazole is an effective OTC topical antifungal agent commonly used to treat athlete's foot, jock itch, and ringworm. Miconazole is used to cure infections caused by different types of fungi. Terbinafine is an antifungal medication that is available in cream, gel, and spray forms. Similarly, tolnaftate and undecylenic acid are also the key medications used to treat fungal infection in the U.S.

Fungal infections are caused by various types of fungi and could occur on skin, nails, or hair. These infections are a common health problem across the world and can range from mild to severe. Prevalence of fungal infections has increased in the U.S. in the past few years due to several factors including environmental conditions and poor hygiene.

Fungi thrive in warm and humid environments, and usage of communal facilities such as swimming pools, locker rooms, and saunas can increase the risk of infection. Poor hygiene, particularly in tropical and subtropical regions, could also contribute to the spread of fungal infections in the U.S.

Ringworm is a common fungal illness that affects the skin, scalp, and nails. Ringworm is a prevalent skin ailment in the country, affecting 10% to 20% of the population at some time in their lives. Ringworm affects youngsters more than adults. It is prevalent across the country. The southeastern U.S. has a greater incidence of tinea capitis (ringworm of the scalp) than other locations.

Increase in prevalence of vaginal candidiasis is also contributing to market expansion. It is the second most severe vaginal infection in the U.S., after bacterial vaginal infections. Annually, about 1.4 million people are taking consultations for vaginal candidiasis in the U.S.

Over-the-counter (OTC) products are conveniently used to cure fungal infections in patients. In the past, patients had to schedule appointments and pay for the OTC medications out-of-pocket. However, with the availability of OTC antifungal products, consumers can now easily purchase these medications at their local pharmacy or online without a prescription.

Increase in awareness among consumers about the symptoms and treatment options for fungal infections is creating growth opportunities for market players. As more people become informed about the signs of fungal infections, they are more likely to seek out and purchase OTC antifungal products on their own. This is particularly true for minor infections such as athlete's foot or ringworm that can be easily treated with OTC products.

Based on drug class, the azoles segment is likely to account for major share of the market in the U.S. in the near future. Azole-based OTC topical antifungal products are widely available in various formulations, including creams, ointments, sprays, and powders. These can be purchased at retail stores, pharmacies, and online retailers, making them easily accessible to consumers. Hence, demand for azole antifungals is projected to increase in the next few years.

In terms of indication, the ringworm indication segment accounted for major share of the market in the U.S. in 2022. Ringworm is a common condition that affects people of all ages and backgrounds. According to the Centers for Disease Control and Prevention (CDC), an estimated 20.0% of the U.S. population would experience a fungal skin infection including ringworm at some point in their lives. High prevalence of the condition drives demand for effective topical antifungal drugs.

Based on dosage form, the creams segment accounted for major share of the market in 2022. Creams are one of the most commonly used forms for topical antifungals. These are easy to apply and are absorbed quickly into the skin. Topical antifungal creams are ideal for treating skin conditions caused by fungal infections such as athlete's foot and ringworm. Creams can be spread evenly over the affected area. These do not require any special applicator and can be applied using clean hands.

In terms of distribution channel, the retail pharmacies segment is expected to account for major market share during the forecast period. Increase in availability of OTC topical antifungals in retail pharmacies is contributing to market progress. Retail pharmacies are preferred by consumers to purchase these medications over hospital pharmacies and online pharmacies.

As per the latest U.S. OTC topical antifungals market forecast, the industry in the country is likely to expand at a high CAGR from 2023 to 2031. The U.S. OTC topical antifungals market size is anticipated to increase in the near future, owing to early adoption of latest technologies and presence of key industry players in the country. Moreover, rise in awareness about OTC topical antifungals among consumers and rapid growth in healthcare sector are expected to propel market dynamics in the country.

Rise in the geriatric population is another factor contributing to the U.S. OTC topical antifungals market growth. According to one survey, 54.1 million adults, or 16.3% of the population, in the U.S. were seniors (aged 65 or older) in 2022.

The industry is consolidated, with the presence of a small number of large companies that control majority of the U.S. OTC topical antifungals market share. According to the latest U.S. OTC topical antifungals market research report, majority of the companies are making significant investment in research and development.

As per U.S. OTC topical antifungals market trends, companies are focusing on product portfolio expansion and mergers & acquisitions to increase presence and revenue. Leading players in the U.S. OTC topical antifungals market are Novartis AG, Merck KGaA, Dr. Reddy’s Laboratories Ltd., Pfizer, Inc., Abbott Laboratories, Bayer AG, Sanofi, and Crown.

Each of these players has been profiled in U.S. OTC topical antifungals market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 1.3 Bn |

|

Forecast (Value) in 2031 |

More than US$ 1.8 Bn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment level analysis as well as country level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 1.3 Bn in 2022

It is anticipated to reach more than US$ 1.8 Bn by 2031

The CAGR is expected to be 3.6% from 2023 to 2031

Increase in prevalence of fungal infections and rise in awareness about topical antifungals among consumers are driving the market

Novartis AG, Merck KGaA, Dr Reddy’s Laboratories Ltd., Pfizer, Inc., Abbott Laboratories, Bayer AG, Sanofi, and Crown

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. U.S. OTC Topical Antifungals Market Forecast

4.4. U.S. OTC Topical Antifungals Market Outlook

5. Market Outlook

5.1. Porter’s Five Force Analysis

5.2. Pricing Analysis

5.3. Disease Prevalence & Incidence Rate

5.4. Overview and Application of OTC Products

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact

6. U.S. OTC Topical Antifungals Market Analysis and Forecasts, By Drug Class

6.1. Introduction

6.2. U.S. OTC Topical Antifungals Market Value Share Analysis, by Drug Class

6.3. U.S. OTC Topical Antifungals Market Forecast, by Drug Class

6.3.1. Azoles

6.3.1.1. Clotrimazole

6.3.1.2. Miconazole

6.3.1.3. Fluconazole

6.3.1.4. Ketokonazole

6.3.1.5. Others

6.3.2. Allylamine

6.3.2.1. Terbinafine

6.3.2.2. Butenafine

6.3.2.3. Others

6.3.3. Tolnaftate

6.3.4. Undecylenic Acid

6.3.5. Others

6.4. U.S. OTC Topical Antifungals Market Analysis, by Drug Class

6.5. U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Drug Class

7. U.S. OTC Topical Antifungals Market Analysis and Forecasts, By Indication

7.1. Introduction

7.2. U.S. OTC Topical Antifungals Market Value Share Analysis, by Indication

7.3. U.S. OTC Topical Antifungals Market Forecast, by Indication

7.3.1. Ringworm

7.3.2. Jock Itch

7.3.3. Athlete’s Foot

7.3.4. Others

7.4. U.S. OTC Topical Antifungals Market Analysis, by Indication

7.5. U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Indication

8. U.S. OTC Topical Antifungals Market Analysis and Forecasts, By Dosage Form

8.1. Introduction

8.2. U.S. OTC Topical Antifungals Market Value Share Analysis, by Dosage Form

8.3. U.S. OTC Topical Antifungals Market Forecast, by Dosage Form

8.3.1. Creams

8.3.2. Gels

8.3.3. Ointments

8.3.4. Others

8.4. U.S. OTC Topical Antifungals Market Analysis, by Dosage Form

8.5. U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Dosage Form

9. U.S. OTC Topical Antifungals Market Analysis and Forecasts, By Distribution Channel

9.1. Introduction

9.2. U.S. OTC Topical Antifungals Market Value Share Analysis, by Distribution Channel

9.3. U.S. OTC Topical Antifungals Market Forecast, by Distribution Channel

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. U.S. OTC Topical Antifungals Market Analysis, by Distribution Channel

9.5. U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Distribution Channel

10. Competition Landscape

10.1. Market Player – Competition Matrix (By Tier and Size of Companies)

10.2. Market Share Analysis, by Company (2022)

10.3. Company Profiles

10.3.1. Novartis AG

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. SWOT Analysis

10.3.1.4. Strategic Overview

10.3.2. Merck KGaA

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. SWOT Analysis

10.3.2.4. Strategic Overview

10.3.3. Dr Reddy’s Laboratories Ltd.

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. SWOT Analysis

10.3.3.4. Strategic Overview

10.3.4. Pfizer, Inc.

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. SWOT Analysis

10.3.4.4. Strategic Overview

10.3.5. Abbott Laboratories

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. SWOT Analysis

10.3.5.4. Strategic Overview

10.3.6. Bayer AG

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. SWOT Analysis

10.3.6.4. Strategic Overview

10.3.7. Sanofi

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. SWOT Analysis

10.3.7.4. Strategic Overview

10.3.8. Crown

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. SWOT Analysis

10.3.8.4. Strategic Overview

List of Tables

Table 01: U.S. OTC Topical Antifungals Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 02: U.S. OTC Topical Antifungals Market Size (US$ Mn) Forecast, by Azole, 2017–2031

Table 03: U.S. OTC Topical Antifungals Market Size (US$ Mn) Forecast, by Allylamine, 2017–2031

Table 04: U.S. OTC Topical Antifungals Market Volume (Units in Thousand) Forecast, by Drug Class, 2017–2031

Table 05: U.S. OTC Topical Antifungals Market Volume (Units in Thousand) Forecast, by Azole, 2017–2031

Table 06: U.S. OTC Topical Antifungals Market Volume (Units in Thousand) Forecast, by Allylamine, 2017–2031

Table 07: U.S. OTC Topical Antifungals Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 08: U.S. OTC Topical Antifungals Market Size (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 09: U.S. OTC Topical Antifungals Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: U.S. OTC Topical Antifungals Market Value (US$ Bn) Forecast, 2017–2031

Figure 02: U.S. OTC Topical Antifungals Market Value Share, by Drug Class, 2022

Figure 03: U.S. OTC Topical Antifungals Market Value Share, by Indication, 2022

Figure 04: U.S. OTC Topical Antifungals Market Value Share, by Dosage Form, 2022

Figure 05: U.S. OTC Topical Antifungals Market Value Share, by Region, 2022

Figure 06: U.S. OTC Topical Antifungals Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 07: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Azole, 2017–2031

Figure 08: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Allylamine, 2017–2031

Figure 09: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Tolnaftate, 2017–2031

Figure 10: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Undecylenic Acid, 2017–2031

Figure 11: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Others, 2017–2031

Figure 12: U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 13: U.S. OTC Topical Antifungals Market Value Share Analysis, by Indication, 2022 and 2031

Figure 14: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Ringworm, 2017–2031

Figure 15: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Undecylenic Acid, 2017–2031

Figure 16: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Athlete’s Foot, 2017–2031

Figure 17: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Others, 2017–2031

Figure 18: U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Indication, 2023–2031

Figure 19: U.S. OTC Topical Antifungals Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 20: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Creams, 2017–2031

Figure 21: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Gels, 2017–2031

Figure 22: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Ointment, 2017–2031

Figure 23: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Others, 2017–2031

Figure 24: U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Indication, 2023–2031

Figure 25: U.S. OTC Topical Antifungals Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 26: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 27: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 28: U.S. OTC Topical Antifungals Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031

Figure 29: U.S. OTC Topical Antifungals Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 30: Global OTC Topical Antifungals Market Share, by Company, 2022