Reports

Reports

On-Site Hydrogen Generator Market: Snapshot

Steam methane changing is the most prudent approach to deliver hydrogen. It includes two essential responses: the changing response and the water gas move response. In the improving response, petroleum gas is blended in with steam and is warmed at exceptionally high temperatures to create carbon monoxide and hydrogen. So as to create extra hydrogen, carbon monoxide from the transforming response interfaces with steam in the water gas move reactor. Normally used feedstocks in steam reformers are petroleum gas and naphtha. Steam reformers are portioned dependent on the sort, for example, pre-reformers, essential reformers, minimized reformers, and auxiliary reformers. This as a result helps the global on-site hydrogen generators market to witness an exponential growth in coming years.

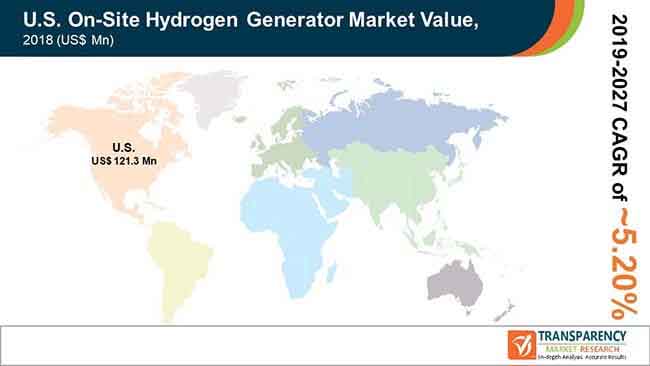

The vast reserves of natural gas and its availability in absolute abundance is expected to boost the adoption of on-site hydrogen generators across the U.S. region. Transparency Market Research observes, several end-users industries are demanding on-site hydrogen as they provide a cost-efficient option along with safety and security by making the operations free of hydrogen storage, cylinder handling, and routine hydrogen delivery. With this strong backing, the opportunity in the U.S. on-site hydrogen generator market is expected to be US$ 191.4 Mn by 2027 from US$ 121.3 Mn in 2018, surging at a steady pace of 5.2% between 2019 and 2027.

The stringent environmental regulatory framework that is aimed at reducing carbon footprint is expected to boost the demand for hydrogen in making petrochemicals, fertilizers, and as an important energy carrier. The demand for hydrogen will also be felt amongst the specialty chemical manufacturers and refiners for meeting the production levels of cleaner products. All of these factors are expected to propel the installations of on-site hydrogen generators across the U.S.

The rise of the on-site hydrogen generator market in the U.S. will also be driven by the need for reducing the dependency on conventional sources of energy and adopting cleaner fuel sources. The decreasing quality of crude oil will also be responsible for the emergence of this market in the near future. The increasing usage of hydrogen in various industrial applications will also provide a massive boost to the overall market.

The on-site hydrogen generators based on non-alkaline technology held a leading share of 67% in the overall market in 2018. This is mainly due to the technology on which the non-alkaline on-site hydrogen generators are based upon, which enables them to deliver reliable, portable, purer, and cost-effective hydrogen production. However, the alkaline on-site hydrogen generator is anticipated to grow at a significant pace during the forecast period.

The non-alkaline on-site hydrogen generators are known to use steam reforming technology and proton exchange membrane (PEM) electrolysis. These generators are especially being preferred for applications such as reducing gas chromatography, metals, and annealing as they need pure hydrogen, which is achievable through PEM electrolysis.

The on-site hydrogen generators that have a flow rate of <100Nm3/h are leading the market due to their remarkable efficiency and compactness. These generators are competing with generators that have a flow rate of 100-2,000Nm3/h. In the near future, hydrogen generators that have a range of 100-2,000Nm3/h will emerge as leading generators due to their increasing adoption in various industrial verticals.

Some of the important players operating in the U.S. on-site hydrogen generator market are

The competition in the overall market in quite cutthroat due to the existence of just a few players. In the coming years, companies will try to enter new markets with strategic alliances to meet the hydrogen needs of the remote areas. Furthermore, the trajectory of this market will also be decided by the strategies adopted by these players such as optimum usage of resources and production capacity.

Global US On-Site Hydrogen Generator Market: Recent Developments

1. Executive Summary: US On-Site Hydrogen Generator Market

2. Market Overview

2.1. Market Segmentation

2.2. Market Definitions

2.3. Market Trends

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.7. Regulatory Landscape

3. US On-Site Hydrogen Generator Market Analysis and Forecast, by Category

3.1. Key Findings

3.2. Market Definitions

3.3. US On-Site Hydrogen Generator Market Volume (Units) & Value (US$ Mn), by Category, 2018–2027

3.3.1. Alkaline

3.3.2. Non Alkaline (Proton Exchange Membrane)

3.4. US On-Site Hydrogen Generator Market Attractiveness Analysis, by Category

4. US On-Site Hydrogen Generator Market Analysis and Forecast, by Flow Rate

4.1. Key Findings

4.2. US On-Site Hydrogen Generator Market Volume (Units) & Value (US$ Mn), by Flow Rate, 2018–2027

4.2.1. <100Nm3/h

4.2.2. 100-2,000Nm3/h

4.2.3. >2,000Nm3/h

4.3. US On-Site Hydrogen Generator Market Attractiveness Analysis, by Flow Rate

5. Competition Landscape

5.1. Competition Matrix, by Key Players

5.2. US On-Site Hydrogen Generator Market Share Analysis, by Company, 2018

5.3. Product Mapping

5.4. Company Profiles

5.4.1. Air Liquide

5.4.1.1. Company overview

5.4.1.2. Product portfolio

5.4.1.3. Financial overview

5.4.1.4. Business strategy

5.4.1.5. Recent developments

5.4.2. Air Products and Chemicals, Inc.

5.4.2.1. Company overview

5.4.2.2. Product portfolio

5.4.2.3. Financial overview

5.4.2.4. Business strategy

5.4.2.5. Recent developments

5.4.3. Praxair Technology, Inc.

5.4.3.1. Company overview

5.4.3.2. Product portfolio

5.4.3.3. Financial overview

5.4.3.4. Business strategy

5.4.3.5. Recent developments

5.4.4. Proton OnSite, Inc.

5.4.4.1. Company overview

5.4.4.2. Product portfolio

5.4.5. Hy9 Corporation

5.4.5.1. Company overview

5.4.5.2. Product portfolio

5.4.6. Hydrogenics

5.4.6.1. Company overview

5.4.6.2. Product portfolio

5.4.6.3. Financial overview

5.4.6.4. Business strategy

5.4.6.5. Recent developments

5.4.7. Nuvera Fuel Cells, Inc.

5.4.7.1. Company overview

5.4.7.2. Product portfolio

5.4.8. Linde AG

5.4.8.1. Company overview

5.4.8.2. Product portfolio

5.4.8.3. Financial overview

5.4.8.4. Business strategy

5.4.8.5. Recent developments

6. Primary Research - Key Insights

7. Appendix

7.1. Research Methodology and Assumptions

List of Figures

Figure 1. U.S. On-Site Hydrogen Generator Market, Estimates and Forecast, by Category, 2018–2027 (Units)

Figure 2. U.S. On-Site Hydrogen Generator Market, Estimates and Forecast, by Flow Rate, 2018–2027 (Units)

Figure 3. Cost Comparison by Feedstock (US$/kg)

Figure 4. Hydrogen Purity(%) & Cooling Efficiency (KW) (US$/day)

Figure 5. Hydrogen Production Cost (US$/GJ), by Type

Figure 6. Energy-related Carbon Dioxide Emissions (MMTPA) in U.S. by Year

Figure 7. U.S. On-Site Hydrogen Generator Market, Company Market Share (%) (2018)

Figure 8. U.S. On-Site Hydrogen Generator, Market Share by Category Segment, 2018

Figure 9. U.S. On-Site Hydrogen Generator, Market Share by Category Segment, 2027

Figure 10. U.S. On-Site Hydrogen Generator Market, Category Segment, By Volume, 2018–2027 (Units)

Figure 11. U.S. On-Site Hydrogen Generator Market, Category Segment, By Revenue, 2018–2027 (US$ Mn)

Figure 12. U.S. On-Site Hydrogen Generator Market, Alkaline, By Volume, 2018–2027 (Units)

Figure 13. U.S. On-Site Hydrogen Generator Market, Alkaline, By Revenue, 2018–2027 (US$ Mn)

Figure 14. U.S. On-Site Hydrogen Generator Market, Non Alkaline, By Volume, 2018–2027 (Units)

Figure 15. U.S. On-Site Hydrogen Generator Market, Non Alkaline, By Revenue, 2018–2027 (US$ Mn)

Figure 16. U.S. On-Site Hydrogen Generator, Market Share by Flow Rate Segment, 2018

Figure 17. U.S. On-Site Hydrogen Generator, Market Share by Flow Rate Segment, 2027

Figure 18. U.S. On-Site Hydrogen Generator Market, Flow Rate Segment, By Volume, 2018–2027 (Units)

Figure 19. U.S. On-Site Hydrogen Generator Market, Flow Rate Segment, By Revenue, 2018–2027 (US$ Mn)

Figure 20. U.S. On-Site Hydrogen Generator Market, <100Nm3/h, By Volume, 2018–2027 (Units)

Figure 21. U.S. On-Site Hydrogen Generator Market, <100Nm3/h, By Revenue, 2018–2027 (US$ Mn)

Figure 22. U.S. On-Site Hydrogen Generator Market, 100-2,000Nm3/h, By Volume, 2018–2027 (Units)

Figure 23. U.S. On-Site Hydrogen Generator Market, 100-2,000Nm3/h, By Revenue, 2018–2027 (US$ Mn)

Figure 24. U.S. On-Site Hydrogen Generator Market, >2,000Nm3/h, By Volume, 2018–2027 (Units)

Figure 25. U.S. On-Site Hydrogen Generator Market, >2,000Nm3/h, By Revenue, 2018–2027 (US$ Mn)

Figure 26. Air Liquide Revenue, By Business Segment, US$ Mn (2018)

Figure 27. Air Liquide Revenue, By Region, US$ Mn (2018)

Figure 28. Air Products and Chemicals, Inc. Revenue, By Business Segment, US$ Mn (2018)

Figure 29. Air Products and Chemicals, Inc. Revenue, By Region, US$ Mn (2018)

Figure 30. Praxair Technology, Inc. Revenue, By Business Segment, US$ Mn (2018)

Figure 31. Praxair Technology, Inc. Revenue, By Region, US$ Mn (2018)

Figure 32. Hydrogenics Revenue, By Business Segment, US$ Mn (2018)

Figure 33. Linde AG Revenue, By Business Segment, US$ Mn (2018)

Figure 34. Linde AG Revenue, By Region, US$ Mn (2018)