Reports

Reports

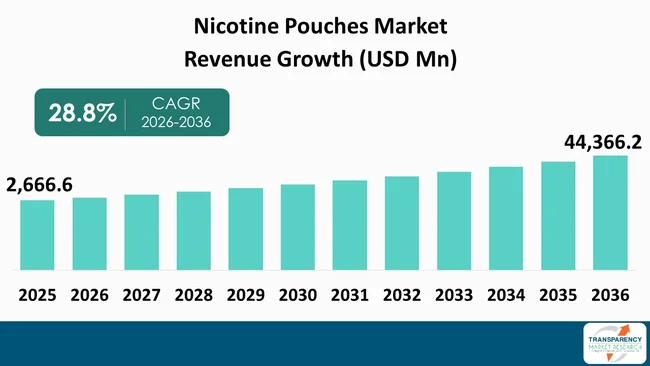

The U.S. nicotine pouches market size was valued at US$ 2,666.6 Mn in 2025 and is projected to reach US$ 44,366.2 Mn by 2036, expanding at a CAGR of 28.8% from 2026 to 2036. The market growth is driven by increasing consumer preference for discreet & odorless nicotine products, and shift toward smoke-free & harm reduction alternatives.

Nicotine pouches represent one of the fastest-growing product categories within the broader tobacco and nicotine ecosystem in the United States. Although these products serve as smoke-free and spitless oral nicotine options their increasing popularity demonstrates changing consumer preferences. In other words, users now prefer these products over combustible cigarettes and vaping devices.

The 2022 Federal survey data shows that 2.9% of the U.S. adults have used nicotine pouches while 0.4% currently use them, which shows that adults have achieved both - awareness and usage of these products but their actual usage remains low.

The segment has drawn regulatory and public health interest as it shows increasing use amongst the youth even though usage as adults remains low. The federal survey data shows that 1.8% of middle and high school students used nicotine products in 2024, which raises concerns about new nicotine initiation paths that do not involve conventional smoking.

Users can consume nicotine through nicotine pouches that serve as discrete oral products devoid of tobacco and deliver nicotine through a pouch that users place between their upper lip and gums. Nicotine pouches function as smokeless tobacco alternatives as they contain nicotine from tobacco and synthetic sources while users do not need to burn the product or breathe it in.

Adults looking for smoking and vaping alternatives find these products appealing as they produce no smoke and users need not spit. The characteristics of these products have driven both - retail channel growth and product development of various flavor and nicotine strength options.

The regulatory framework in the United States classifies nicotine pouches as tobacco products that the Food and Drug Administration (FDA) regulates according to the Family Smoking Prevention and Tobacco Control Act. The law requires manufacturers to secure premarket authorizations for their products, which enables proper evaluation of safety and manufacturing standards together with public health implications.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The U.S. nicotine pouches market experiences a fundamental transformation as consumers request for products that enable them to consume nicotine without displaying any signs of their usage. Consumers increasingly favor products that are devoid of visible smoke, ash, and tobacco smell, which allows them to use products without interruption during social and professional interactions.

Among the U.S. young adult ever-users, 26.1% reported odorlessness as a key adoption factor, while 29.3% highlighted discretion as the primary motivator.

The appeal of nicotine pouches is growing in smoke-free locations as they provide better accessibility than conventional alternatives. CDC data shows that 2.9% of U.S. adults have ever used nicotine pouches while 0.4% were current users, which indicates that mainstream adoption of the product has started to grow. Younger adults and transitioning smokers show the strongest inclination toward these formats due to their usability in restricted settings. The functional advantage of these products in workplaces and public spaces has become the primary factor driving customer demand.

The need for hidden nicotine products has increased owing to existing workplace’s smoking regulations, which restrict existing smoking areas. Smoke-free products that produce no smoke or ash or odor have gained value as smoking bans have been incorporated throughout the world. The driver gets stronger as people now understand product innovation including new flavor profiles, strength options, and delivery methods. The trend is expected to sustain long-term segment growth as manufacturers align more closely with discreet consumption behavior.

The U.S. nicotine pouches market experiences substantial growth as consumers increasingly prefer smoke-free nicotine alternatives that public health initiatives use to achieve harm reduction goals.

Nicotine pouches establish themselves as a contemporary discreet product that provides users with less harmful effects as they do not require smoke or spit or tobacco as their main components. Pouches deliver nicotine through a clean and odorless method that users can consume without needing to inhale as it eliminates secondhand smoke, thereby making it suitable for use in smoke-free areas like workplaces and public transit systems and homes. The harm reduction narrative has gained traction as both - consumers and certain public health organizations together with regulatory agencies now acknowledge how nicotine pouches assist smokers in their journey to quit smoking.

The U.S. nicotine pouches market faces its biggest challenge due to increasing regulatory surveillance that the Food and Drug Administration together with the other government agencies maintains. Nicotine pouches serve as a smokeless and tobacco-free product but need to follow regulations which control nicotine use especially for underage users.

The authorities are considering bans or severe restrictions on flavored variants as they know that flavors drive consumer preferences, which will result in the major market growth impacts. The ongoing debates about synthetic nicotine classification versus tobacco-derived nicotine classification create manufacturing uncertainty for producers.

The growing shift toward synthetic nicotine presents a significant opportunity in the U.S. nicotine pouches market. Synthetic nicotine that scientists create in laboratories through chemical processes provides manufacturers with an option to promote their products as completely tobacco-free. This distinction is valuable as regulatory agencies like the FDA continue to impose stricter rules on tobacco-derived products which include potential flavor bans and higher taxation. Companies can use synthetic nicotine to market their products as cleaner options while they reduce their need to follow strict regulations that apply to tobacco-based nicotine products.

Health-minded customers are driving the demand for synthetic nicotine as they want products that deliver pure nicotine without the harmful substances found in tobacco leaves. Synthetic nicotine gives brands better options for product development as it enables them to create products with steady nicotine concentrations, which results in superior product performance. The market transformation corresponds to market trends, which stress the need for new ideas and product uniqueness.

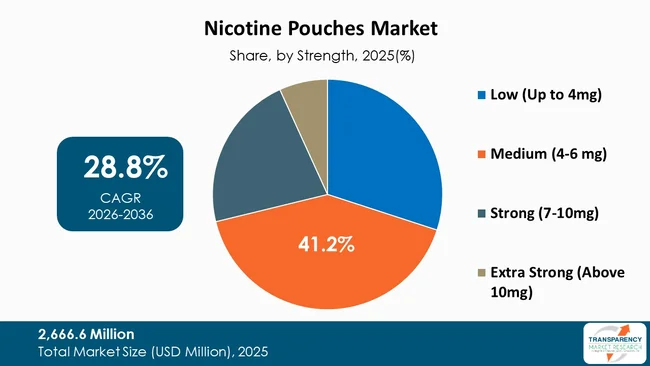

The Medium (4-6 mg) segment of the U.S. nicotine pouches market holds 41.2% market share, which demonstrates that consumers prefer this nicotine strength as it provides them with both - satisfaction and better control for their everyday consumption needs. The segment draws two groups of users who want to experience continuous nicotine effects through moderate-strength products instead of using high-strength items.

The present situation shows how businesses develop their products and their market distribution methods. Businesses create product collections that match particular customer preferences while medium-strength products become standard components of retail displays.

Altria Group, Inc., Black Buffalo Inc., British American Tobacco p.l.c., DHOLAKIA TOBACCO PVT. LTD, Enorama Pharma Inc., Imperial Brands Plc, JT International SA, LUCY GOODS, Philip Morris International Inc., Sesh Products, Smokey Mountain Chew, Inc., Swisher, Turning Point Brands, Twinroll, ZEO Universe and others are some of the leading manufacturers operating in the U.S. nicotine pouches market.

Each of these companies has been profiled in the U.S. nicotine pouches market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 2,666.6 Mn |

| Market Forecast Value in 2036 | US$ 44,366.2 Mn |

| Growth Rate (CAGR 2026 to 2036) | 28.8% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2023 |

| Quantitative Units | US$ Mn for Value and Million Cans for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Country Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The U.S. nicotine pouches market was valued at US$ 2,666.6 Mn in 2025

The U.S. nicotine pouches industry is projected to reach at US$ 44,366.2 Mn by the end of 2036

Increasing consumer preference for discreet & odorless nicotine products, and shift toward smoke-free & harm reduction alternatives, are some of the driving factors for this market

The CAGR is anticipated to be 28.8% from 2026 to 2036

Altria Group, Inc., Black Buffalo Inc., British American Tobacco p.l.c., DHOLAKIA TOBACCO PVT. LTD, Enorama Pharma Inc., Imperial Brands Plc, JT International SA, LUCY GOODS, Philip Morris International Inc., Sesh Products, Smokey Mountain Chew, Inc., Swisher, Turning Point Brands, Twinroll, ZEO Universe, and other key players.

Table 01: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Type 2021 to 2036

Table 02: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2021 to 2036

Table 03: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Strength 2021 to 2036

Table 04: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2021 to 2036

Table 05: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Category 2021 to 2036

Table 06: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2021 to 2036

Table 07: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Consumer Group 2021 to 2036

Table 08: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2021 to 2036

Table 09: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Table 10: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2021 to 2036

Figure 01: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Type 2021 to 2036

Figure 02: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2021 to 2036

Figure 03: U.S. Nicotine Pouches Market Incremental Opportunities (US$ Mn) Forecast, By Type 2026 to 2036

Figure 04: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Strength 2021 to 2036

Figure 05: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2021 to 2036

Figure 06: U.S. Nicotine Pouches Market Incremental Opportunities (US$ Mn) Forecast, By Strength 2026 to 2036

Figure 07: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Category 2021 to 2036

Figure 08: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2021 to 2036

Figure 09: U.S. Nicotine Pouches Market Incremental Opportunities (US$ Mn) Forecast, By Category 2026 to 2036

Figure 10: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Consumer Group 2021 to 2036

Figure 11: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2021 to 2036

Figure 12: U.S. Nicotine Pouches Market Incremental Opportunities (US$ Mn) Forecast, By Consumer Group 2026 to 2036

Figure 13: U.S. Nicotine Pouches Market Value (US$ Mn) Projection, By Distribution Channel 2021 to 2036

Figure 14: U.S. Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2021 to 2036

Figure 15: U.S. Nicotine Pouches Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2026 to 2036