Reports

Reports

Rising health awareness and demand for harm reduction alternatives and product innovation and flavor variety driving consumer adoption is driving the nicotine pouches market growth. Nicotine pouches offer a discreet, odorless, and combustion-free method of nicotine consumption, making them a preferred choice for health-conscious consumers and those seeking to reduce or quit smoking.

By addressing the health, social, and regulatory concerns associated with combustible tobacco, nicotine pouches have emerged as a key component in the global shift toward harm-reduction nicotine products.

Moreover, ongoing developments such as synthetic nicotine formulations, flavor diversification, and recyclable packaging are also fueling market expansion, as consumers demand cleaner, customizable, and sustainable nicotine delivery systems. These advancements are particularly appealing to younger adults, are drawn to products that align with wellness trends and modern lifestyles.

In line with the latest nicotine pouches market trends prominent key players are investing in product innovation, brand differentiation, and geographic expansion. Major companies are developing new flavors, nicotine strength variations, and eco-friendly packaging formats to cater to the evolving preferences of a broader consumer base.

Nicotine pouches are tobacco-free, smokeless oral nicotine products that supply nicotine without the harm of smoking or the consumption of conventional tobacco. They are tiny, discreet pouches most commonly placed between the lip and gum, and they are a blend of nicotine (tobacco-derived or synthetic), plant fiber, sweeteners, and flavoring components.

Unlike snus, which contains ground tobacco, nicotine pouches offer a cleaner alternative as they are entirely free of tobacco leaf. Over the last few years, nicotine pouches have become very popular in the global markets at a very fast rate among smokers seeking lower-risk products and users looking to quit traditional tobacco products.

The surge in demand can be attributed to the growing awareness of the health risks associated with combustible tobacco, a shift in consumer preference towards harm-reduction products, and increasing availability of flavored, easy-to-use nicotine pouches.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The global shift toward healthier lifestyles is fundamentally transforming consumer behavior across the tobacco and nicotine sectors. With growing awareness of the health risks associated with smoking, there is a notable rise in demand for safer alternatives that offer reduced exposure to harmful substances. Among these, nicotine pouches have emerged as a leading solution, offering a smokeless, discreet, and socially acceptable method of nicotine intake.

A major growth driver for the nicotine pouch market is the increasing consumer focus on harm reduction. Health-conscious individuals particularly younger adults are seeking alternatives that align with their wellness-oriented lifestyles. Prioritizing convenience, hygiene, and long-term health, this demographic is actively transitioning away from combustible tobacco toward products perceived as lower risk, such as nicotine pouches.

Government-led health campaigns and regulatory actions have also played a role in shifting public opinion. Heavy excise duties on cigarettes, plain packaging laws, bans on smoking in public, and forceful stop-smoking campaigns have all reduced the appeal of traditional tobacco products.

While these interventions were intended to restrict the spread of smoking, they have had the outcome of opening a market niche now filled by reduced-risk products like nicotine pouches. In some countries, health authorities have cautiously come to acknowledge the nicotine pouches as the lesser risk, even if full endorsement is still in the balance.

In view of public health measures, it is recognized that while nicotine itself is not harmless, nearly all the harm arising from smoking is because of combustion. The resulting shift in perception about nicotine has allowed for a more favorable view of alternatives such as pouches, which is useful as a stepping-stone towards cessation or long-term harm reduction paths.

For instance, in July 2024, Philip Morris International announced a $600 million investment to build a new manufacturing facility in Colorado to meet rising demand for Zyn nicotine pouches. This strategic move underscores the expanding consumer base and growing institutional confidence in nicotine pouches as a safer, scalable alternative in the evolving nicotine landscape.

One of the key drivers behind the rapid growth of the nicotine pouches market is the continuous wave of product innovation particularly in formulation, flavoring, packaging, and delivery mechanisms. As the market matures, top brands are emphasizing innovation not just as a differentiator but also as a fundamental strategy to acquire and retain consumers.

The presence of a broad variety of tastes, coupled with enhanced user experience and ease of use of the product, has contributed to nicotine pouches being uplifted from niche products to mainstream consumer items. These innovations have helped shift nicotine pouches from a niche product category to a mainstream consumer offering.

A significant contributor to this transition is the growing variety of flavors available. Unlike traditional tobacco products, which typically offer limited flavor profiles (such as tobacco or menthol), nicotine pouches are now available in a broad and expanding range of flavors. Popular choices include mint, coffee, citrus, berry, and cinnamon, along with more unique offerings like tropical fruit, cola, licorice, and even exotic blends.

This diverse selection enhances user satisfaction by catering to individual taste preferences and delivering a more enjoyable and customized experience. For example, in April 2024, Scandinavian Tobacco Group launched its new XQS nicotine pouch line, which introduced flavors such as Tropical, Blueberry Mint, Cool Ice, and Arctic Freeze all designed with recyclable packaging. This move not only reflected the company’s commitment to environmental sustainability but also addressed consumer demand for exciting, flavorful alternatives.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

According to the latest nicotine pouches market analysis, North America held the largest share in 2024 driven by the growing demand for safer and less harmful alternatives to traditional tobacco products. In the United States in particular, rising health consciousness among adult smokers has significantly contributed to the adoption of nicotine pouches as a harm-reduction tool or smoking cessation aid.

The surge in popularity of brands such as Zyn, Velo, and On! is attributed to several key factors, including increased public awareness about the health risks associated with smoking, evolving consumer preferences, and the convenience of smoke-free, discreet nicotine products. These brands have effectively positioned themselves as modern, accessible alternatives for nicotine delivery.

Additionally, government-endorsed support for harm reduction strategies has reinforced this market dominance. While not all regulatory agencies fully endorse nicotine pouches, the broader recognition of their lower-risk profile compared to combustible tobacco has contributed to their acceptance and growth across the region.

Altria, Black Buffalo, British American Tobacco, DHOLAKIA TOBACCO PVT. LTD, Enorama Pharma AB, FRE Pouch, GN Tobacco, Habit Factory, Imperial Brands plc, Japan Tobacco International (JTI), Mac Baren Tobacco Company A/S, Philip Morris Products SA, Swisher International, Inc (Rogue Holdings, LLC), Turning Point Brands, Twinroll and others are some of the leading manufacturers operating in the global nicotine pouches market.

Each of these companies has been profiled in the nicotine pouches market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

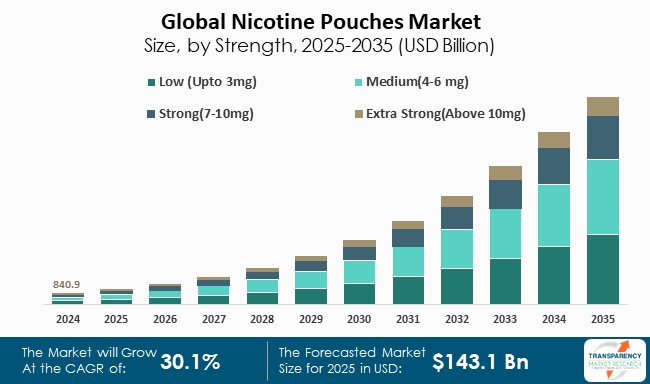

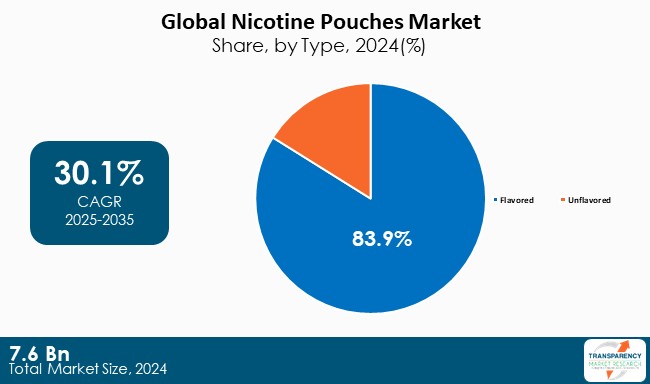

| Market Size Value in 2024 (Base Year) | US$ 7.6 Bn |

| Market Forecast Value in 2035 | US$ 143.1 Bn |

| Growth Rate (CAGR 2025 to 2035) | 30.1% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value and Million Cans for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Region Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 5.4 Bn in 2023

It is expected to reach US$ 119.2 Bn by 2034

Rise in awareness of the harmful effect of tobacco products and convenience of use

The flavored segment contributes the largest share

North America is booming as consumers are mainly transitioning to smokeless nicotine alternatives due to health concerns

British American Tobacco (VELLO), Swedish Match (ZYN), Skruf, Nordic Spirit, Rogue, 77 Nicotine Pouches, Genmist, Stockholm White, NIIN, and Triumph Chew

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.2.3. Packaging Trends

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. PESTEL Analysis

5.7. Raw Material Analysis

5.8. Standards & Regulations

5.9. Snus Pearl Technologies

5.10. Packaging Material Analysis (Nonwoven)

5.10.1. Manufacturing Technologies

5.10.2. Sustainability

5.10.3. Raw Materials

5.11. Global Nicotine Pouches Market Analysis and Forecast, 2020 - 2035

5.11.1. Market Value Projections (USD Mn)

5.11.2. Market Volume Projections (Million Cans)

6. Global Nicotine Pouches Market Analysis and Forecast, by Type

6.1. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Type, 2020 - 2035

6.1.1. Flavored

6.1.1.1. Cinnamon

6.1.1.2. Coffee

6.1.1.3. Mint

6.1.1.4. Citrus

6.1.1.5. Others (Apple, Peppermint etc.)

6.1.2. Unflavored

6.2. Incremental Opportunity Analysis, by Type

7. Global Nicotine Pouches Market Analysis and Forecast, by Category

7.1. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Category, 2020 - 2035

7.1.1. Tobacco-derived

7.1.2. Synthetic

7.2. Incremental Opportunity Analysis, by Category

8. Global Nicotine Pouches Market Analysis and Forecast, by Strength

8.1. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Strength, 2020 - 2035

8.1.1. Low (Up to 3mg)

8.1.2. Medium(4-6 mg)

8.1.3. Strong(7-10mg)

8.1.4. Extra Strong(Above 10mg)

8.2. Incremental Opportunity Analysis, by Strength

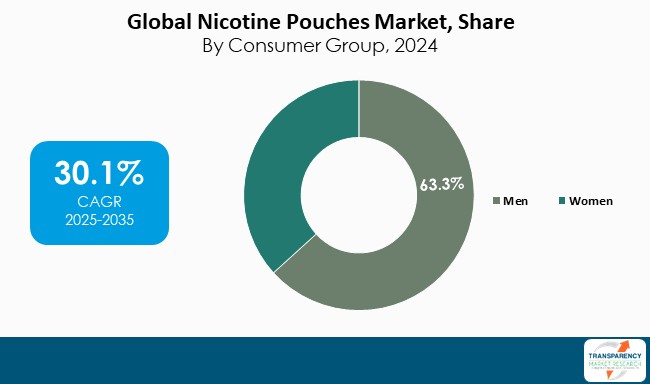

9. Global Nicotine Pouches Market Analysis and Forecast, by Consumer Group

9.1. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Consumer Group, 2020 - 2035

9.1.1. Men

9.1.2. Women

9.2. Incremental Opportunity Analysis, by Consumer Group

10. Global Nicotine Pouches Market Analysis and Forecast, by Composition

10.1. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Composition, 2020 - 2035

10.1.1. Nicotine Powder-Containing

10.1.2. Tobacco-Containing

10.2. Incremental Opportunity Analysis, by Composition

11. Global Nicotine Pouches Market Analysis and Forecast, by Distribution Channel

11.1. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Distribution Channel, 2020 - 2035

11.1.1. Online

11.1.1.1. Company Owned Websites

11.1.1.2. E-Commerce Websites

11.1.2. Offline

11.1.2.1. Hypermarkets/Supermarkets

11.1.2.2. Drug Stores

11.1.2.3. Other Retail Stores

11.2. Incremental Opportunity Analysis, by Distribution Channel

12. Global Nicotine Pouches Market Analysis and Forecast, by Region

12.1. Global Nicotine Pouches Market Size (US$ Bn and Million Cans), By Region, 2020 - 2035

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity Analysis, by Region

13. North America Nicotine Pouches Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Demographic Overview

13.3. Market Share Analysis (%)

13.4. Consumer Buying Behavior Analysis

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Pricing Analysis

13.6.1. Weighted Average Selling Price (USD)

13.7. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Type, 2020 - 2035

13.7.1. Flavored

13.7.1.1. Cinnamon

13.7.1.2. Coffee

13.7.1.3. Mint

13.7.1.4. Citrus

13.7.1.5. Others (Apple, Peppermint etc.)

13.7.2. Unflavored

13.8. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Category, 2020 - 2035

13.8.1. Tobacco-derived

13.8.2. Synthetic

13.9. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Strength, 2020 - 2035

13.9.1. Low (Up to 3mg)

13.9.2. Medium(4-6 mg)

13.9.3. Strong(7-10mg)

13.9.4. Extra Strong(Above 10mg)

13.10. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Consumer Group, 2020 - 2035

13.10.1. Men

13.10.2. Women

13.11. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Composition, 2020 - 2035

13.11.1. Nicotine Powder-Containing

13.11.2. Tobacco-Containing

13.12. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Distribution Channel, 2020 - 2035

13.12.1. Online

13.12.1.1. Company Owned Websites

13.12.1.2. E-Commerce Websites

13.12.2. Offline

13.12.2.1. Hypermarkets/Supermarkets

13.12.2.2. Drug Stores

13.12.2.3. Other Retail Stores

13.13. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Country, 2020 - 2035

13.13.1. The U.S.

13.13.2. Canada

13.13.3. Rest of North America

13.14. Incremental Opportunity Analysis

14. Europe Nicotine Pouches Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Demographic Overview

14.3. Market Share Analysis (%)

14.4. Consumer Buying Behavior Analysis

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Pricing Analysis

14.6.1. Weighted Average Selling Price (USD)

14.7. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Type, 2020 - 2035

14.7.1. Flavored

14.7.1.1. Cinnamon

14.7.1.2. Coffee

14.7.1.3. Mint

14.7.1.4. Citrus

14.7.1.5. Others (Apple, Peppermint etc.)

14.7.2. Unflavored

14.8. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Category, 2020 - 2035

14.8.1. Tobacco-derived

14.8.2. Synthetic

14.9. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Strength, 2020 - 2035

14.9.1. Low (Up to 3mg)

14.9.2. Medium(4-6 mg)

14.9.3. Strong(7-10mg)

14.9.4. Extra Strong(Above 10mg)

14.10. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Consumer Group, 2020 - 2035

14.10.1. Men

14.10.2. Women

14.11. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Composition, 2020 - 2035

14.11.1. Nicotine Powder-Containing

14.11.2. Tobacco-Containing

14.12. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Distribution Channel, 2020 - 2035

14.12.1. Online

14.12.1.1. Company Owned Websites

14.12.1.2. E-Commerce Websites

14.12.2. Offline

14.12.2.1. Hypermarkets/Supermarkets

14.12.2.2. Drug Stores

14.12.2.3. Other Retail Stores

14.13. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Country, 2020 - 2035

14.13.1. Sweden

14.13.2. Norway

14.13.3. U.K.

14.13.4. Denmark

14.13.5. Switzerland

14.13.6. Rest of Europe

14.14. Incremental Opportunity Analysis

15. Asia Pacific Nicotine Pouches Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Demographic Overview

15.3. Market Share Analysis (%)

15.4. Consumer Buying Behavior Analysis

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Pricing Analysis

15.6.1. Weighted Average Selling Price (USD)

15.7. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Type, 2020 - 2035

15.7.1. Flavored

15.7.1.1. Cinnamon

15.7.1.2. Coffee

15.7.1.3. Mint

15.7.1.4. Citrus

15.7.1.5. Others (Apple, Peppermint etc.)

15.7.2. Unflavored

15.8. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Category, 2020 - 2035

15.8.1. Tobacco-derived

15.8.2. Synthetic

15.9. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Strength, 2020 - 2035

15.9.1. Low (Up to 3mg)

15.9.2. Medium(4-6 mg)

15.9.3. Strong(7-10mg)

15.9.4. Extra Strong(Above 10mg)

15.10. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Consumer Group, 2020 - 2035

15.10.1. Men

15.10.2. Women

15.11. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Composition, 2020 - 2035

15.11.1. Nicotine Powder-Containing

15.11.2. Tobacco-Containing

15.12. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Distribution Channel, 2020 - 2035

15.12.1. Online

15.12.1.1. Company Owned Websites

15.12.1.2. E-Commerce Websites

15.12.2. Offline

15.12.2.1. Hypermarkets/Supermarkets

15.12.2.2. Drug Stores

15.12.2.3. Other Retail Stores

15.13. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Country, 2020 - 2035

15.13.1. Japan

15.13.2. Pakistan

15.13.3. South Korea

15.13.4. Philippines

15.13.5. Indonesia

15.13.6. Rest of Asia Pacific

15.14. Incremental Opportunity Analysis

16. Middle East & Africa Nicotine Pouches Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Demographic Overview

16.3. Market Share Analysis (%)

16.4. Consumer Buying Behavior Analysis

16.5. Key Trends Analysis

16.5.1. Demand Side Analysis

16.5.2. Supply Side Analysis

16.6. Pricing Analysis

16.6.1. Weighted Average Selling Price (USD)

16.7. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Type, 2020 - 2035

16.7.1. Flavored

16.7.1.1. Cinnamon

16.7.1.2. Coffee

16.7.1.3. Mint

16.7.1.4. Citrus

16.7.1.5. Others (Apple, Peppermint etc.)

16.7.2. Unflavored

16.8. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Category, 2020 - 2035

16.8.1. Tobacco-derived

16.8.2. Synthetic

16.9. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Strength, 2020 - 2035

16.9.1. Low (Up to 3mg)

16.9.2. Medium(4-6 mg)

16.9.3. Strong(7-10mg)

16.9.4. Extra Strong(Above 10mg)

16.10. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Consumer Group, 2020 - 2035

16.10.1. Men

16.10.2. Women

16.11. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Composition, 2020 - 2035

16.11.1. Nicotine Powder-Containing

16.11.2. Tobacco-Containing

16.12. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Distribution Channel, 2020 - 2035

16.12.1. Online

16.12.1.1. Company Owned Websites

16.12.1.2. E-Commerce Websites

16.12.2. Offline

16.12.2.1. Hypermarkets/Supermarkets

16.12.2.2. Drug Stores

16.12.2.3. Other Retail Stores

16.13. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Country, 2020 - 2035

16.13.1. UAE

16.13.2. Qatar

16.13.3. South Africa

16.13.4. Kenya

16.13.5. Rest of Middle East & Africa

16.14. Incremental Opportunity Analysis

17. South America Nicotine Pouches Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Demographic Overview

17.3. Market Share Analysis (%)

17.4. Consumer Buying Behavior Analysis

17.5. Key Trends Analysis

17.5.1. Demand Side Analysis

17.5.2. Supply Side Analysis

17.6. Pricing Analysis

17.6.1. Weighted Average Selling Price (USD)

17.7. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Type, 2020 - 2035

17.7.1. Flavored

17.7.1.1. Cinnamon

17.7.1.2. Coffee

17.7.1.3. Mint

17.7.1.4. Citrus

17.7.1.5. Others (Apple, Peppermint etc.)

17.7.2. Unflavored

17.8. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Category, 2020 - 2035

17.8.1. Tobacco-derived

17.8.2. Synthetic

17.9. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Strength, 2020 - 2035

17.9.1. Low (Up to 3mg)

17.9.2. Medium(4-6 mg)

17.9.3. Strong(7-10mg)

17.9.4. Extra Strong(Above 10mg)

17.10. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Consumer Group, 2020 - 2035

17.10.1. Men

17.10.2. Women

17.11. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Composition, 2020 - 2035

17.11.1. Nicotine Powder-Containing

17.11.2. Tobacco-Containing

17.12. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Distribution Channel, 2020 - 2035

17.12.1. Online

17.12.1.1. Company Owned Websites

17.12.1.2. E-Commerce Websites

17.12.2. Offline

17.12.2.1. Hypermarkets/Supermarkets

17.12.2.2. Drug Stores

17.12.2.3. Other Retail Stores

17.13. Nicotine Pouches Market Size (US$ Bn and Million Cans), By Country, 2020 - 2035

17.13.1. Brazil

17.13.2. Argentina

17.13.3. Rest of South America

17.14. Incremental Opportunity Analysis

18. Competition Landscape of Nicotine Pouches Manufacturers

18.1. Market Player – Competition Dashboard

18.2. Market Share Analysis (%), 2024

18.3. Company Profiles

18.3.1. Altria

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Product Portfolio

18.3.1.4. Key Financials

18.3.1.5. Strategy & Business Overview

18.3.2. Black Buffalo Inc.

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Product Portfolio

18.3.2.4. Key Financials

18.3.2.5. Strategy & Business Overview

18.3.3. British American Tobacco

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Product Portfolio

18.3.3.4. Key Financials

18.3.3.5. Strategy & Business Overview

18.3.4. DHOLAKIA TOBACCO PVT. LTD

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Product Portfolio

18.3.4.4. Key Financials

18.3.4.5. Strategy & Business Overview

18.3.5. Enorama Pharma AB

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Product Portfolio

18.3.5.4. Key Financials

18.3.5.5. Strategy & Business Overview

18.3.6. FRE Pouch

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Product Portfolio

18.3.6.4. Key Financials

18.3.6.5. Strategy & Business Overview

18.3.7. GN Tobacco

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Product Portfolio

18.3.7.4. Key Financials

18.3.7.5. Strategy & Business Overview

18.3.8. Habit Factory

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Product Portfolio

18.3.8.4. Key Financials

18.3.8.5. Strategy & Business Overview

18.3.9. Imperial Brands plc

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Product Portfolio

18.3.9.4. Key Financials

18.3.9.5. Strategy & Business Overview

18.3.10. Japan Tobacco International (JTI)

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Product Portfolio

18.3.10.4. Key Financials

18.3.10.5. Strategy & Business Overview

18.3.11. Mac Baren Tobacco Company A/S

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Product Portfolio

18.3.11.4. Key Financials

18.3.11.5. Strategy & Business Overview

18.3.12. Philip Morris Products SA

18.3.12.1. Company Overview

18.3.12.2. Sales Area/Geographical Presence

18.3.12.3. Product Portfolio

18.3.12.4. Key Financials

18.3.12.5. Strategy & Business Overview

18.3.13. Swisher International, Inc. (Rogue Holdings, LLC)

18.3.13.1. Company Overview

18.3.13.2. Sales Area/Geographical Presence

18.3.13.3. Product Portfolio

18.3.13.4. Key Financials

18.3.13.5. Strategy & Business Overview

18.3.14. Turning Point Brands

18.3.14.1. Company Overview

18.3.14.2. Sales Area/Geographical Presence

18.3.14.3. Product Portfolio

18.3.14.4. Key Financials

18.3.14.5. Strategy & Business Overview

18.3.15. Twinroll

18.3.15.1. Company Overview

18.3.15.2. Sales Area/Geographical Presence

18.3.15.3. Product Portfolio

18.3.15.4. Key Financials

18.3.15.5. Strategy & Business Overview

18.3.16. Other Key Players

18.3.16.1. Company Overview

18.3.16.2. Sales Area/Geographical Presence

18.3.16.3. Product Portfolio

18.3.16.4. Key Financials

18.3.16.5. Strategy & Business Overview

19. Go To Market Strategy

List of Tables

Table 1: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 2: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Table 3: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Table 4: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Table 5: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Table 6: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Table 7: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 8: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Table 9: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Table 10: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Table 11: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 12: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Table 13: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 14: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Region 2020 to 2035

Table 15: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 16: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Table 17: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Table 18: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Table 19: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Table 20: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Table 21: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 22: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Table 23: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Table 24: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Table 25: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 26: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Table 27: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 28: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Table 29: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 30: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Table 31: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Table 32: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Table 33: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Table 34: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Table 35: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 36: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Table 37: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Table 38: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Table 39: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 40: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Table 41: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 42: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Table 43: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 44: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Table 45: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Table 46: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Table 47: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Table 48: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Table 49: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 50: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Table 51: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Table 52: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Table 53: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 54: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Table 55: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 56: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Table 57: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 58: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Table 59: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Table 60: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Table 61: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Table 62: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Table 63: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 64: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Table 65: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Table 66: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Table 67: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 68: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Table 69: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 70: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Table 71: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 72: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Table 73: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Table 74: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Table 75: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Table 76: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Table 77: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 78: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Table 79: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Table 80: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Table 81: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 82: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Table 83: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 84: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

List of Figures

Figure 1: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 2: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Figure 3: Global Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Type 2025 to 2035

Figure 4: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Figure 5: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Figure 6: Global Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Strength 2025 to 2035

Figure 7: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 8: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Figure 9: Global Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Consumer Group 2025 to 2035

Figure 10: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 11: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Figure 12: Global Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 13: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Figure 14: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Figure 15: Global Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Composition 2025 to 2035

Figure 16: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 17: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Figure 18: Global Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 19: Global Nicotine Pouches Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 20: Global Nicotine Pouches Market Volume (Million Cans) Projection, By Region 2020 to 2035

Figure 21: Global Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Region 2025 to 2035

Figure 22: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 23: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Figure 24: North America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Type 2025 to 2035

Figure 25: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Figure 26: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Figure 27: North America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Strength 2025 to 2035

Figure 28: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 29: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Figure 30: North America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Consumer Group 2025 to 2035

Figure 31: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 32: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Figure 33: North America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 34: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Figure 35: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Figure 36: North America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Composition 2025 to 2035

Figure 37: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 38: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Figure 39: North America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 40: North America Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 41: North America Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Figure 42: North America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 43: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 44: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Figure 45: Europe Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Type 2025 to 2035

Figure 46: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Figure 47: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Figure 48: Europe Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Strength 2025 to 2035

Figure 49: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 50: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Figure 51: Europe Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Consumer Group 2025 to 2035

Figure 52: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 53: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Figure 54: Europe Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 55: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Figure 56: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Figure 57: Europe Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Composition 2025 to 2035

Figure 58: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 59: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Figure 60: Europe Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 61: Europe Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 62: Europe Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Figure 63: Europe Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 64: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 65: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Figure 66: Asia Pacific Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Type 2025 to 2035

Figure 67: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Figure 68: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Figure 69: Asia Pacific Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Strength 2025 to 2035

Figure 70: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 71: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Figure 72: Asia Pacific Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Consumer Group 2025 to 2035

Figure 73: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 74: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Figure 75: Asia Pacific Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 76: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Figure 77: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Figure 78: Asia Pacific Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Composition 2025 to 2035

Figure 79: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Figure 81: Asia Pacific Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 82: Asia Pacific Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 83: Asia Pacific Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Figure 84: Asia Pacific Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 85: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 86: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Figure 87: Middle East & Africa Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Type 2025 to 2035

Figure 88: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Figure 89: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Figure 90: Middle East & Africa Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Strength 2025 to 2035

Figure 91: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 92: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Figure 93: Middle East & Africa Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Consumer Group 2025 to 2035

Figure 94: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 95: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Figure 96: Middle East & Africa Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 97: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Figure 98: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Figure 99: Middle East & Africa Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Composition 2025 to 2035

Figure 100: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 101: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Figure 102: Middle East & Africa Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 103: Middle East & Africa Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 104: Middle East & Africa Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Figure 105: Middle East & Africa Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 106: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 107: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Type 2020 to 2035

Figure 108: South America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Type 2025 to 2035

Figure 109: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Strength 2020 to 2035

Figure 110: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Strength 2020 to 2035

Figure 111: South America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Strength 2025 to 2035

Figure 112: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 113: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Consumer Group 2020 to 2035

Figure 114: South America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Consumer Group 2025 to 2035

Figure 115: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 116: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Category 2020 to 2035

Figure 117: South America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 118: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Composition 2020 to 2035

Figure 119: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Composition 2020 to 2035

Figure 120: South America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Composition 2025 to 2035

Figure 121: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 122: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Distribution Channel 2020 to 2035

Figure 123: South America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 124: South America Nicotine Pouches Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 125: South America Nicotine Pouches Market Volume (Million Cans) Projection, By Country 2020 to 2035

Figure 126: South America Nicotine Pouches Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035