Reports

Reports

Analysts’ Viewpoint

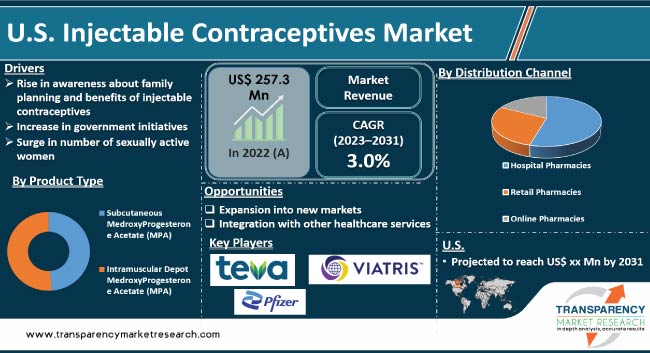

Increase in awareness about family planning and benefits of injectable contraceptives among women and healthcare providers is a key U.S. injectable contraceptives market driver. Rise in number of sexually active women and surge in incidence of unwanted pregnancies are propelling U.S. injectable contraceptives market value. Furthermore, convenience and effectiveness of injectable contraceptives is likely to bolster market expansion during the forecast period

Research & development of new and advanced injectable contraceptive products is expected to offer lucrative opportunities to market players. Manufacturers are focusing on expansion into new markets and collaboration with other healthcare services in order to increase market share and revenue.

Injectable contraceptive is a form of birth control administered via injection. It typically contains synthetic hormones that prevent pregnancy by stopping ovulation, thickening cervical mucus to prevent sperm from entering the uterus, and thinning the uterine lining to make implantation less likely.

There are two types of injectable contraceptives: Depo-Provera injection, which contains a synthetic progestin hormone called medroxyprogesterone acetate, and norethisterone enanthate injection, which also contains a synthetic progestin hormone.

The Depo-Provera injection is typically given every 12 weeks, while the norethisterone enanthate injection is given every eight weeks. Injectable contraceptives are highly effective in preventing pregnancy, with a failure rate of less than 1% when used correctly.

Depo-Provera injection is the most commonly used injectable contraceptive in the U.S. It is available by prescription and can be administered by a healthcare provider in a clinic or an office setting.

Both women and healthcare providers are increasingly acknowledging the significance of family planning as a means of achieving reproductive health and well-being. Women are becoming more informed about the variety of contraceptive options at their disposal, including injectable contraceptives, and are seeking advice from healthcare providers to make informed decisions about their reproductive health.

Healthcare providers are also playing a pivotal role in spreading awareness about the advantages of injectable contraceptives. They are educating patients about the efficacy of injectable contraceptives in preventing unintended pregnancies, as well as the convenience of long-acting contraceptives in managing family planning. Additionally, healthcare providers are offering guidance on the appropriate usage of injectable contraceptives, as well as the potential side effects and risks associated with their use.

According to the Centers for Disease Control and Prevention, in the U.S., women receive injections of the hormone progestin in either their buttocks or arm every three months from their doctor. However, only around 2.3% of women in the U.S. utilize injectable contraceptives, as per the Kaiser Family Foundation (KFF).

These factors are driving U.S. injectable contraceptives market size.

The U.S. Government has started several initiatives to increase access to injectable contraceptives, which are a highly effective form of birth control that can last for several months with a single injection.

The government has started various programs to spread awareness about reproductive and sexual health, especially among teenagers and young women, and provides grants to prevent unplanned pregnancies. For instance, the Office of Population Affairs Teen Pregnancy Prevention (TPP) Program provides funding to diverse organizations working to prevent teen pregnancies across the U.S. Such proactive steps are expected to increase the adoption of LARCs among women, thus, propelling U.S. injectable contraceptives market growth.

The U.S. Government has implemented several healthcare initiatives, including the Affordable Care Act (ACA), Medicare, and Medicaid. The ACA, also known as Obamacare, was enacted in 2010 and aimed to increase access to affordable healthcare by expanding Medicaid coverage, creating health insurance marketplaces, and requiring insurance plans to cover certain essential health benefits.

Other government healthcare initiatives include the National Institutes of Health (NIH), which funds medical research, and the Centers for Disease Control and Prevention (CDC), which works to prevent and control disease outbreaks. These factors are likely to augment U.S. injectable contraceptives market share.

Based on product type, the U.S. injectable contraceptives market segmentation includes subcutaneous medroxyprogesterone acetate (MPA) and intramuscular depot medroxyprogesterone acetate (MPA). The subcutaneous medroxyprogesterone acetate (MPA) segment held major market share in 2022.

The self-injection of subcutaneous MPA probably improves continuation of contraceptive use as it provides slow and better absorption of hormone than intramuscular depot medroxyprogesterone acetate (DMPA).

DMPA, an intramuscular injection of 17-acetoxy-6-methyl progestin used for long-term contraception, is an aqueous solution of the hormone. Since the progestin is released gradually from the muscle, this extremely potent injectable version of MPA provides action for longer duration.

In terms of distribution channel, the retail pharmacies segment dominated the market in the U.S. in 2022. Availability of injectable contraceptives at retail pharmacies varies on the basis of country. In the U.S., injectable contraceptives are available without a prescription from the healthcare provider.

Retail pharmacies are preferred to hospital pharmacies and online pharmacies in the U.S. However, access to injectable contraceptives in hospital pharmacies can be beneficial for women who need immediate access to contraception after giving birth or undergoing a medical procedure.

As per the U.S. injectable contraceptives market forecast, the market in the country is likely to expand at a high CAGR from 2023 to 2031. Early adoption of latest technologies and presence of key industry players are propelling U.S. injectable contraceptives industry growth.

Increase in awareness about family planning and benefits of injectable contraceptives among women and healthcare providers, surge in government initiatives, and rise in number of sexually active women are the key drivers of the market in the country.

The market in the U.S. is consolidated, with the presence of a small number of large companies. Majority of the companies are making significant investments in research & development, primarily to develop cost-efficient products. Expansion of product portfolio and mergers & acquisitions are the strategies adopted by the key players. Leading U.S. injectable contraceptives market players are Viatris Inc. (Mylan N.V.), Pfizer, Inc., and Teva Pharmaceutical Industries Ltd.

Each of these players has been profiled in U.S. injectable contraceptives market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|---|---|

|

Size in 2022 |

US$ 257.3 Mn |

|

Forecast (Value) in 2031 |

US$ 339.6 Mn |

|

Growth Rate (CAGR) |

3.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis related to the U.S. market. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Country Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 257.3 Mn in 2022

It is projected to reach more than US$ 339.6 Mn by 2031

The market is anticipated to grow at a CAGR of 3.0% from 2023 to 2031

Rise in awareness about family planning & benefits of injectable contraceptives among women and healthcare providers, increase in government initiatives, and rise in number of sexually active women are driving the market in the country

Viatris, Inc. (Mylan N.V.), Pfizer, Inc., and Teva Pharmaceutical Industries Ltd. are the prominent players in the industry

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: U.S. Injectable Contraceptives Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. U.S. Injectable Contraceptives Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Pipeline Analysis

5.2. Overview of Contraceptive Usage, Mechanism of Action, Advantages, etc.

5.3. COVID-19 Pandemic Impact on the Industry

6. U.S. Injectable Contraceptives Market Analysis and Forecast, By Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Subcutaneous MedroxyProgesterone Acetate (MPA)

6.3.2. Intramuscular Depot MedroxyProgesterone Acetate (MPA)

6.4. Market Attractiveness Analysis, by Product Type

7. U.S. Injectable Contraceptives Market Analysis and Forecast, By Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, By Distribution Channel, 2017-2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Pharmacies

7.4. Market Attractiveness Analysis, By Distribution Channel

8. Competition Landscape

8.1. Market Player - Competition Matrix (by tier and size of companies)

8.2. Market Share Analysis, By Company (2022)

8.3. Company Profiles

8.3.1. Viatris, Inc. (Mylan N.V.)

8.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.1.2. Product Portfolio

8.3.1.3. Financial Overview

8.3.1.4. SWOT Analysis

8.3.1.5. Strategic Overview

8.3.2. Pfizer, Inc.

8.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.2.2. Product Portfolio

8.3.2.3. Financial Overview

8.3.2.4. SWOT Analysis

8.3.2.5. Strategic Overview

8.3.3. Teva Pharmaceutical Industries Ltd

8.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.3.2. Product Portfolio

8.3.3.3. Financial Overview

8.3.3.4. SWOT Analysis

8.3.3.5. Strategic Overview

List of Tables

Table 01: U.S. Injectable Contraceptives Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: U.S. Injectable Contraceptives Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: U.S. Injectable Contraceptives Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: U.S. Injectable Contraceptives Market Value Share, by Product Type, 2022

Figure 03: U.S. Injectable Contraceptives Market Value Share, by Distribution Channel, 2022

Figure 04: U.S. Injectable Contraceptives Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 05: U.S. Injectable Contraceptives Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 06: U.S. Injectable Contraceptives Market (US$ Mn), by Subcutaneous MedroxyProgesterone Acetate (MPA), 2017-2031

Figure 07: U.S. Injectable Contraceptives Market (US$ Mn), by Intramuscular Depot MedroxyProgesterone Acetate (MPA), 2017-2031

Figure 08: U.S. Injectable Contraceptives Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 09: U.S. Injectable Contraceptives Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 10: U.S. Injectable Contraceptives Market (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 11: U.S. Injectable Contraceptives Market (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 12: U.S. Injectable Contraceptives Market (US$ Mn), by Online Pharmacies, 2017-2031

Figure 13: U.S. Injectable Contraceptives Market Share Analysis, by Company, 2022